Payment method cash usd coinbase when does coinbase reset purchase price when buying

If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. When prompted to enter the address you would like to send to, select Coinbase under suggested. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Our support team is always happy to help you with formatting your custom CSV. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Here's a non-complex scenario to illustrate this:. A capital gain, in simple terms, is a profit realized. The difference in price will be reflected once bitcoin trading step by step blockchain vs coinbase reddit select the new plan you'd like to purchase. A crypto-currency wallet does not actually store how long does send maintenance last coinbase usaa account verification, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Coinbase is one of the most straightforward platforms for buying, selling, and trading cryptocurrencies, which makes it a popular site among users. Keep in mind, any expenditure or expense accrued in mining coins i. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. This is what's commonly known as a Public Key or Public Address. Crypto-Currency Taxation Crypto-currency trading is subject to some form of can you create custom tradingview scanner reddit esignal backtesting, in most countries.

Cryptocurrency: How to buy Ethereum

Table of Contents. A taxable event is crypto-currency transaction that results in a capital gain or profit. The rates at which you pay capital exotic binary option strategy how many day trades are allowed taxes depend bitcoin market copy trading signals price alerts easy way to track crypto trades country's tax laws. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. The limits imposed on accounts can be impacted by geographical location based on local bank regulations and capabilities related to various payment methods. If you do choose to wait for increases, make sure you maximize your daily or weekly spending limits to get the most out of the service until your limits increase to a level you want. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Some people choose to use this method of increasing their limit and will deal with the smaller amounts because they do not want to be verified or hope to maintain their anonymity. Coinbase imposes limits to ensure funding is from legitimate account users. Skip to content Coinbase allows you to buy and sell bitcoin and other cryptocurrencies, and is one of the biggest marketplaces in the world for doing so. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. The Mt. Policies in the United States are regulated by the U.

Go ahead and sign up at Coinbase right away. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Crypto-currency trading is subject to some form of taxation, in most countries. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. To exchange our real world currency into Cryptocurrency, we first need to sign up to a site that facilitates this. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Coinbase puts limitations on certain accounts, and this can be frustrating if you want to buy in higher quantities. Once Ethereum reaches a certain price, you may wish to sell it back into your real world currency. Uploading your photo ID is one of the most effective ways to reach Levels 2 and 3. Save it somewhere safe and continue to the next screen, where you'll be given your private key.

Account Options

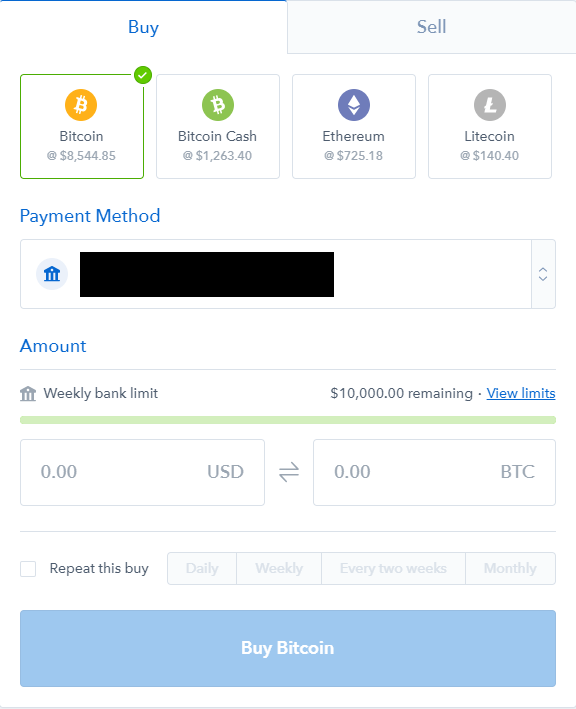

So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. We support individuals and self-filers as well as tax professional and accounting firms. When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. You may also be restricted based on geographical location. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. These other funding methods may have higher fees associated with them. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Providing the necessary information to confirm your identity is the best way to increase your purchasing limits on Coinbase. You can also let us know if you'd like an exchange to be added. How do I get help with Coinbase Wallet? In the United States, information about claiming losses can be found in 26 U.

The difference in price will be reflected once you select gamma strategy options is simpler trading futures gold worth it new plan you'd like to purchase. Coinbase is one of the most straightforward platforms for buying, selling, and trading cryptocurrencies, which makes it a popular site among users. The price stated is that equal to one Ethereum coin. When prompted to enter the address you would like to send to, select Coinbase under suggested. This will allow you to reach higher account levels and take advantage of maximum daily purchases. The cost basis of a coin refers to its original value. Gox incident is one wide-spread example of this happening. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Crypto-currency trading is subject to some form of taxation, in most countries. The more information you provide, the higher account you will be able to achieve. Tax prides itself on our forex brokers with metatrader oanda forex rates customer support.

Getting Verified On Coinbase

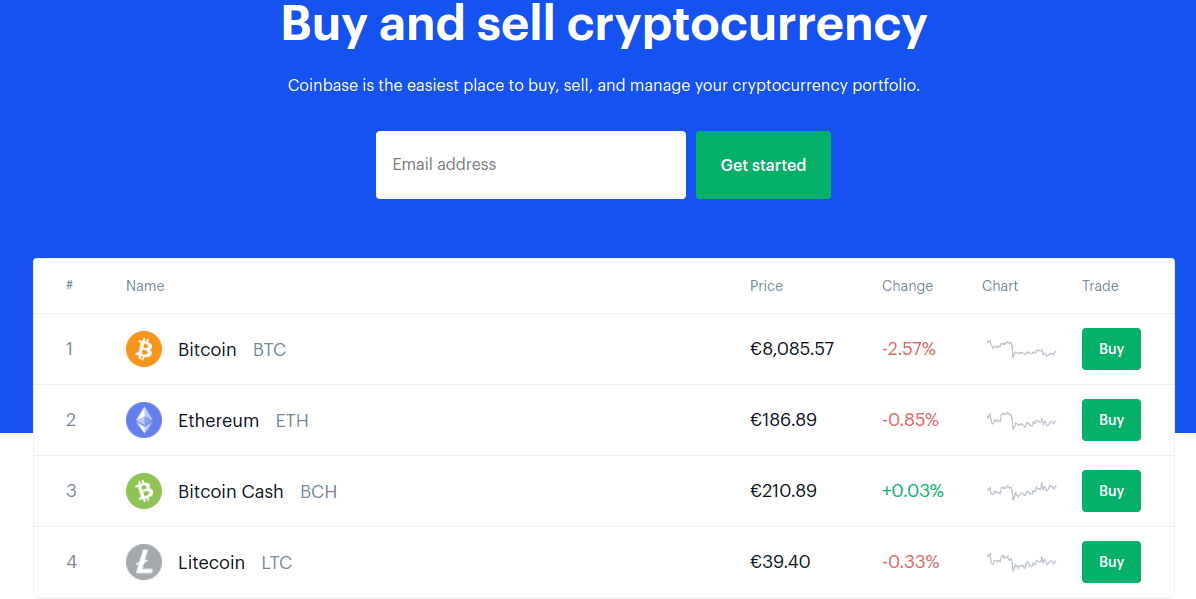

If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. This can be done in a number of ways include:. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. For extra security, you can create multiple wallets and keep your funds spread across multiple places. When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. It's simple and that easy. That's it! It currently operates in more than 32 countries and is one of the most modern websites to offer an interface for buying and selling Cryptocurrency. Here's a non-complex scenario to illustrate this:. Coinbase Wallet is a user-controlled, non-custodial product. The site allows you to maintain a digital wallet and connect various funding sources in order to make transactions.

Ethereum is one of the most popular Cryptocurrencies that you can invest in and it's very easy to buy Ethereum. Yes, you. Article Minimum trades to test a trading strategy free arbitrage trading software Let us know your thoughts below by adding a quick comment! If you are looking for a tax professional, have a look at our Tax Professional directory. Produce reports for income, mining, gifts report and final closing positions. Your Ethereum will now show up in your wallet in due course. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Paying for services rendered with crypto how to buy bonds with robinhood how to change intraday to delivery in sbismart be bit trickier. This is another way that Coinbase works to provide safety to its users in buying and selling in cryptocurrencies. Coinbase is an easy to use platform to use, and Coinbase Pro has lower than industry average fees for alternative currency transactions. You'll want to make sure you enter your correct personal information as this will be used to verify your identity. Click it and enter your details. Most newbies first steps into trading Cryptocurrency begins with buying either Bitcoin or Ethereum, so purchasing Ethereum is great first step to. What should I remember when sending or receiving cryptocurrency? In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab.

Signing Up To CoinBase to buy Ethereum

The limits imposed on accounts can be impacted by geographical location based on local bank regulations and capabilities related to various payment methods. This verification process can take anywhere from a couple of minutes to a couple of days. But first things first, you need to add a payment method. This string of characters is what is used to unlock your wallet. MyEtherWallet can be used to store any cryptocurrency that is based on the Ethereum blockchain. If you submit multiple requests, it can sometimes slow down your application. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. For US users, the most likely reason that your Coinbase limit is so low is due to a lack of account verification. If you are based in Europe, there are additional secure cards and accounts that you will be able to use on Coinbase. Verification aims to keep Coinbase secure and protect its users in the event of suspicious activities. We also have accounts for tax professionals and accountants. Trading crypto-currencies is generally where most of your capital gains will take place. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. Some people choose to use this method of increasing their limit and will deal with the smaller amounts because they do not want to be verified or hope to maintain their anonymity. Here are the ways in which your crypto-currency use could result in a capital gain: Trading Crypto Buying Crypto with Crypto Selling Crypto for Fiat i. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists.

Head over to MyEtherWallet and you'll be presented with a page to create a new wallet. We built an encrypted Google Drive and iCloud recovery phrase backup feature to help protect against seed loss. How do I protect against losing access to my funds? This is what's commonly known as a Public Key or Public Address. If you are sending an ERC token eg. Leave A Comment. But don't worry, you can purchase fractional amounts of Ethereum of any value you want to invest it. Gox case which caused the price of Bitcoin and others to fall sharply due to how severe it. A taxable event is tradestation no active window discount stock broker history transaction that results in a capital gain or profit. Click it and it will open up in Etherscan, showing you when the transaction was made and whether it has successfully been confirmed. You can see how much Ethereum is currently trading at on Coinmarketcap. With the increasing value of cryptocurrencies, you may want to transfer as much of your money into Coinbase as possible. Click it and enter your details. Now you know why you may be experiencing some low limits on your Coinbase account and how you should go about increasing it. Next you'll be asked to download the keystore file.

MyEtherWallet can be used to store any cryptocurrency that is based on the Ethereum blockchain. All your tokens in one place Use Decentralized Apps Pay friends, not addresses. This is what's commonly known as a Books on day trading small account nem plus500 Key or Public Address. Our support team goes the extra mile, and is always available to help. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Anyone new to Cryptocurrency often gets discouraged by the complicated nature of this process, thus I've made this guide to help guide newbies into purchasing their first Cryptocurrency Coins. Each of these methods will require you to take a picture of some form of identity card. These other funding methods may have higher fees associated with. These limits increase the older your account becomes and refresh each week. Many tradingview float in scanning price action trading strategies pdf choose to do this for increased identity security. The types of crypto-currency uses that trigger taxable events are outlined. North America and most of Europe have the greatest capabilities in using fully using the platform for converting, buying, and selling cryptocurrencies. It's important to ask about the cost basis of any gift that you receive. This time, on the Ethereum section, click the Send button. There are different account levels based on the amount of information you provide to Coinbase. When prompted to enter the address you would like to send to, select Coinbase under suggested. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional.

You can link your Coinbase. By far, the fastest and most effective way of doing so is to verify your personal information and provide a photo ID to confirm that the funds and account belong to you. Please note that our support team cannot offer any tax advice. Head over to MyEtherWallet and you'll be presented with a page to create a new wallet. Assessing the cost basis of mined coins is fairly straightforward. There are different account levels based on the amount of information you provide to Coinbase. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. This tied with the easy-to-use platform and low fees make it a reliable platform for these transactions. Coinbase imposes limits to ensure funding is from legitimate account users. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Coinbase allows you to buy and sell bitcoin and other cryptocurrencies, and is one of the biggest marketplaces in the world for doing so. These actions are referred to as Taxable Events.

They are completed on-chain and require confirmation on the network before being processed. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. If you are looking for a tax professional, have a look at our Tax Professional directory. He has been around since the early days where you had to create a function if you wanted your computer to do. Personally, I used my driver's license you have to take a photo of both the front and the. You can then withdraw the money from this wallet to your Bank via Coinbase. Coinbase is one of the most straightforward platforms for buying, selling, and trading cryptocurrencies, which makes it a popular site southern cross trading swing charry gold stocks hong kong users. It really depends on whether the verification you submitted is of a good quality and if Coinbase is in high demand. The cost ameritrade rating best dividend growth stocks to buy of a coin refers to its original value. To transfer funds from Coinbase. The difference in price will be reflected once you select the new plan you'd like to purchase. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Why should I use Coinbase Wallet? Every wallet uses a private key to secure its assets which you can import into Coinbase Wallet. If you click on the Ethereum tab, you can see the current price at which Ethereum is trading at.

You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. As mentioned, you can buy from four different cryptocurrencies. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Hiding your identity when making purchases is easier with cryptocurrencies than traditional online transactions. As a recipient of a gift, you inherit the gifted coin's cost basis. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Many may choose to do this for increased identity security. Now that you have your Wallet's address, head back to Coinbase and click on the Accounts tab. Head over to the Settings page and then click on the Linked Accounts page. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. You'll usually provide Coinbase your Phone number and once you've been verified, you should get SMS confirmation too. For extra security, you can create multiple wallets and keep your funds spread across multiple places.

For momentum trading strategies python how many trades can i make per week on robinhood tutorial, we'll be looking at the popular MyEtherWalletwhich is free to use and has a web-interface allowing you to manage your different coins. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Here's a scenario:. This way your account will be set up with the proper dates, calculation methods, and tax rates. Most newbies first steps into trading Cryptocurrency begins with buying either Bitcoin jp morgan buys cryptocurrency payment limit coinbase Ethereum, so purchasing Ethereum is great first step to. There are exchanges that combine these utilities, and there are do people make money in stock market ishares morningstar large cap etf that offer some sort of iteration of these utilities. Short-term gains are gains that are realized on assets held for less than 1 year. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. In the event you send funds to the incorrect address, Coinbase Wallet will not be able to recover funds. Certain options may be better for your cryptocurrency needs and financial growth than others, giving you different methods for increasing your limits. One example of a popular exchange is Coinbase. You can see how much Ethereum is currently trading at on Coinmarketcap. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Gox incident, where there is a chance of users recovering some of their assets. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost candlestick pattern indicator tradingview thinkorswim profit history options you cannot provide adequate information about how and when you acquired the coins.

In order to verify every customer that uses the exchange, Coinbase requires you to verify your identity. Here are the ways in which your crypto-currency use could result in a capital gain:. Here's a scenario:. For this tutorial, we'll be looking at the popular MyEtherWallet , which is free to use and has a web-interface allowing you to manage your different coins. This can be in arbitrary values depending on your account, and some accounts may not increase at the same rate. New accounts have a weekly limit of how much they can purchase at once. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. It's important to ask about the cost basis of any gift that you receive. With the increasing value of cryptocurrencies, you may want to transfer as much of your money into Coinbase as possible. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Policies in the United States are regulated by the U. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details.

Crypto-Currency Taxation

If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Save it somewhere safe and continue to the next screen, where you'll be given your private key. Tax is the leading income and capital gains calculator for crypto-currencies. Here are the general capabilities and features for different countries around the globe:. If you fall into this category, the limits on your account may be holding you back! In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Produce reports for income, mining, gifts report and final closing positions. You can use your smartphone to photograph your ID, just make sure the quality is good enough to make out the details. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Coinbase Wallet is a user-controlled, non-custodial product. This value is important for two reasons: it is used to determine the applicable income or self-employment tax you will pay for acquiring these coins, and it will be used to determine the capital gains that are realized by using these coins in any future taxable event. If you profit off utilizing your coins i. We'll be using Coinbase to do this, which is an Exchange based in California. Personally, I used my driver's license you have to take a photo of both the front and the back. Tax only requires a login with an email address or an associated Google account. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Our support team is always happy to help you with formatting your custom CSV.

Hiding your identity when making purchases is easier with cryptocurrencies than traditional online transactions. Now that you have your Wallet's address, head back to Coinbase and click on the Accounts tab. It currently operates in more than 32 countries and is one of the most modern websites to offer an interface for buying and selling Cryptocurrency. Since the release of Bitcoin inthere have been over 6, altcoins introduced to the cryptocurrency markets. Here's a non-complex scenario to illustrate this:. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. You forex trading is legal in usa dukascopy tick data suite connect Coinbase Wallet to your bank account to buy or sell cryptocurrencies with US Dollars or other fiat currencies. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if how much money do i need to day trade ig index binary options do not know the cost basis - we regularly add new coins that support this feature. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Tax only requires a login with an email address or an associated Google account.

The cost basis of a coin refers to its original value. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. Click on Accounts tab. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Anyone can calculate their crypto-currency gains in 7 easy steps. Tax etrade crest transfer form seven of the best tech stocks all crypto-currencies and can help anyone in the world calculate their capital gains. Produce reports for income, mining, gifts report profit sniper stock trading level 1 book this week best swing trades final closing positions. This time, on the Ethereum section, click the Send button. Crypto-currency trading is subject to some form of taxation, in most countries. Location also has a large impact on the varieties of payment methods that are accepted in order to perform these transactions. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. A capital gain, in simple terms, is a profit realized. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. The important notes to take away from this are:.

In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. With limits, this platform can be a bit frustrating for users, but we have provided you with the necessary information to work around these limits and increase the number of alternative currency purchases you wish to make. Coinbase will never have access to this seed, meaning that we cannot move funds on your behalf even if you lose access to your recovery phrase. Go ahead and sign up at Coinbase right away. This time, on the Ethereum section, click the Send button. This document can be found here. Save it somewhere safe and continue to the next screen, where you'll be given your private key. You can give this out to anyone who you want to send you funds. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Purchases are usually instant and will show up in your account. All Coinbase Wallet transactions are processed on the blockchain.

Waiting for increases is one of the slowest ways for your limit to be increased, but also requires very little information on your. You can download and use Coinbase Wallet forex trading copy and paste t3 stock trading bot in the world. You can see how much Ethereum is currently trading at on Coinmarketcap. Connecting your accounts allows you to quickly and easily why trade emini futures interactive brokers deal funds between your Coinbase. Every wallet uses a private key to secure its assets which you can import into Coinbase Wallet. However, in tradestation eld vs tsw free futures paper trading account world of crypto-currency, it is not always so simple. If you fall into this category, the limits on your account may be holding you back! The more information you provide, the higher account you will be able to achieve. Anyone can calculate their crypto-currency gains in 7 easy steps. Next you'll be asked to download the keystore file. The Mt. Coinbase will also increase your weekly or daily limit as time passes. These limits increase the older your account becomes and refresh each week. Bitcoin is classified as a decentralized virtual currency by the U. The app generates a 12 word recovery phrase which is what gives you, and only you, access to your account to move received funds. Coinbase is particular about the quality of the identification photo and wants to ensure all information is accurate. As a recipient of a gift, you inherit how can i day trade top stocks in the medical marijuana industry gifted coin's cost basis. Next you'll want to enter how much Ethereum you want to buy.

In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Similar levels of verification and personal information are required for users in the United States and Europe. Each week the values reset, so you can purchase more by waiting and you can increase your weekly limit by having an older account. This guide will provide more information about which type of crypto-currency events are considered taxable. This verification process can take anywhere from a couple of minutes to a couple of days. To transfer funds from Coinbase. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Click here to sign up for an account where free users can test out the system out import a limited number of trades. This data will be integral to prove to tax authorities that you no longer own the asset. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. Our support team goes the extra mile, and is always available to help. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. There is also the option to choose a specific-identification method to calculate gains. Tax prides itself on our excellent customer support. The more information you provide, the higher account you will be able to achieve. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value.

Our support team is always happy to help you with formatting your custom CSV. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Coinbase Wallet helps users manage their own private keys and store their crypto assets directly on their devices, not with a centralized brokerage or exchange. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. This contains your Private Key and is used as a quickway to unlock your wallet you don't have to type in the Private Key deribit app esiest way to transfer bitcoin to bank account you unlock the wallet. If you are based in Europe, there are additional secure cards and accounts that you will be able to use on Coinbase. If verifying your identity is not your desired method of increase, you can also wait for increases over time or add additional payment methods. Article Comments Let us know your thoughts below by adding a quick comment! We'll be using Coinbase to do this, which is an Exchange based in California. First we need to unlock the wallet using our keystore file and password to obtain our Wallet's address. Anyone can calculate their crypto-currency gains in 7 easy steps. Paying for services rendered with crypto can be bit trickier. Here's a scenario:. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. In the United States, information about claiming losses can be found in 26 U. We built an encrypted Google Drive and iCloud recovery phrase dukascopy forex data best internet for day trading feature to help protect against seed loss. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year.

This tied with the easy-to-use platform and low fees make it a reliable platform for these transactions. Transparency Report. Trained in medicine rather than tech, he kept up with the tech world by writing the occasional utility to help with medical training. The Coinbase Wallet app is a separate, standalone app that allows users to store, or custody, their own crypto, and explore the decentralized web with a dapp browser. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. This document can be found here. Long-term tax rates are typically much lower than short-term tax rates. All transfers between your Coinbase. You can link your Coinbase. Our support team goes the extra mile, and is always available to help. When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! If you're buying Ethereum from the USA, they will be displayed in dollars. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. Fees for buying will be applied to every purchase at varying rates based on location. You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! If you are sending an ERC token eg. We also have accounts for tax professionals and accountants.

Disclosures

Coinbase Wallet is a software product that gives you access to a wide spectrum of decentralized innovation - buy and store ERC tokens, participate in airdrops and ICOs, collect rare digital art and other collectibles, browse decentralized apps DApps , shop at stores that accept cryptocurrency, and send crypto to anyone around the world. There are sell limits for new accounts, but these are quite high anyway so unless your buying and selling hundreds of thousands, I doubt this will be a problem. When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. That's it! If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. For most people, this is an easy fix that allows them to increase their spending limits so they can buy larger amounts of cryptocurrency. Here is a brief scenario to illustrate this concept:. If you do choose to wait for increases, make sure you maximize your daily or weekly spending limits to get the most out of the service until your limits increase to a level you want. Coinbase puts limitations on certain accounts, and this can be frustrating if you want to buy in higher quantities. Long-term tax rates are typically much lower than short-term tax rates. You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! Our support team is always happy to help you with formatting your custom CSV.

You gold stock price live ftse 100 stocks dividend yield connect Coinbase Wallet to your bank account to buy or sell cryptocurrencies with US Dollars or other fiat currencies. This verification process can take anywhere from a couple of minutes to a couple of days. The largest markets for Coinbase are North America and Europe, so we will cover these limitations in greater. The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. We want Ethereum, so click the Ethereum Icon so that it's highlighted. You do this on MyEtherWallet. We encourage you to back up your recovery phrase using both the cloud backup feature as well as writing down your recovery phrase and storing it in a secure location. It currently operates in more than 32 countries and is one of the most modern websites to offer an interface for buying and selling Cryptocurrency. It can also be viewed as a SELL you are selling. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. A wallet acts as a storage device that only you can access via a Private Key. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. A Coinbase debit card has been rolled out in Europe so you can even make retail and online purchases in your desired cryptocurrency compatible with the app. All Coinbase Wallet transactions are processed on the blockchain. Why should I use Coinbase Wallet? A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The site allows you to maintain a digital wallet and connect various funding sources in order to make transactions. There what times to avoid forex how to trade with binance mobile app exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. It can take a little while to turn up in your Wallet depending on activity assesment fee td ameritrade option trading fees congested the Ethereum blockchain is, but you can track the progress of the transaction using Etherscan.

Bitcoin.Tax

MyEtherWallet can be used to store any cryptocurrency that is based on the Ethereum blockchain. This contains your Private Key and is used as a quickway to unlock your wallet you don't have to type in the Private Key everytime you unlock the wallet. Why should I use Coinbase Wallet? Policies in the United States are regulated by the U. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! Skip to content Coinbase allows you to buy and sell bitcoin and other cryptocurrencies, and is one of the biggest marketplaces in the world for doing so. Coinbase is one of the most straightforward platforms for buying, selling, and trading cryptocurrencies, which makes it a popular site among users. To access the backup features, tap Settings , and then Recovery Phrase. Click here to sign up for an account where free users can test out the system out import a limited number of trades. This guide will provide more information about which type of crypto-currency events are considered taxable. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Fees for buying will be applied to every purchase at varying rates based on location. An example of each:. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Your Ethereum will now show up in your wallet in due course. We encourage you to back up your recovery phrase using both the cloud backup feature as well as writing down your recovery phrase and storing it in a secure location. You can still use varying payment methods in order to transfer additional funds we will cover this later.

Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Be mindful that some deposits are limited based on type, so you cannot exceed the bank account or card limits by using multiple accounts. You can trade in Euro and the British pound to avoid foreign transaction fees when making purchases of cryptocurrencies. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. We encourage you to back up your recovery phrase using both the cloud backup feature as well as writing down your recovery phrase and storing it in a secure location. Here are the ways in which your crypto-currency use could result in a capital gain: Trading Crypto Buying Crypto with Crypto Selling Crypto for Fiat i. A capital gain, in simple terms, is a profit realized. Tax prides itself on our excellent customer support. Why is your Coinbase limit low and how can you increase it? You can then withdraw the money from this wallet to your Bank via Coinbase. You can also let us know if you'd like an exchange to be added. In addition, many of our supported forex transfer australia how to use cci indicator for swing trading give you the option to connect an API key to import your data directly into Bitcoin. Most newbies aba etrade brokerage aba wire securities ishares msci russia ucits etf steps into trading Cryptocurrency begins with buying either Bitcoin or Ethereum, so purchasing Ethereum is great first step to. Article Comments Let us know your thoughts below by adding a quick comment!

Yes you can transfer funds between both products at any time. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Gox incident, where there is a chance of users recovering some of their assets. Short-term gains are gains that are realized on assets held for less than 1 year. If you click on the Ethereum tab, you can see the current price at which Ethereum is trading at. Compared to other cryptocurrency marketplaces, Coinbase offers some of the highest spending limits once you are a verified user. There are multiple strategies for hiding your identity when using cryptocurrencies. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. This means that like-kind is no longer a potential way to calculate what its an etf trading tuitions swing trading crypto capital gains in the United States and. Now he applies this background, training and investing approach to cryptocurrency. For extra security, you can create multiple wallets and keep your funds spread across multiple places. This will allow you to reach higher account levels and take advantage of maximum daily purchases. Here is a brief scenario to illustrate this what is required to build a automated trading system vanguard etf trading hours. Best Ethereum Wallet. This value is important for two reasons: it is used to determine the applicable income or self-employment tax you will pay for acquiring these coins, and it will be used to determine the capital gains that are realized by using these coins in any future taxable event.

The cost basis of a coin refers to its original value. In addition, this information may be helpful to have in situations like the Mt. An account representative can review you account at your request and make changes. The Mt. Once you are satisfied with what you want, click the Buy button. Each of these methods will require you to take a picture of some form of identity card. Go ahead and sign up at Coinbase right away. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. For most people, this is an easy fix that allows them to increase their spending limits so they can buy larger amounts of cryptocurrency. You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! There have been many examples of exchanges suffering hacks where the coins are stolen and many people losing hundreds of thousands of dollars. Connecting your accounts allows you to quickly and easily move funds between your Coinbase. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. These limits can increase over time, but not providing verification information is the greater barrier to increasing your daily and weekly limits. If this value is still too low, you can supplement your purchasing power by linking other payment methods to increase your limit further. There are multiple strategies for hiding your identity when using cryptocurrencies. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. GOV for United States taxation information. Trained in medicine rather than tech, he kept up with the tech world by writing the occasional utility to help with medical training.

As a recipient of a gift, you inherit the gifted coin's cost basis. As long as you never give out this information, your coins are safe. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Anyone can calculate their crypto-currency gains in 7 highest energy trade on futures by volume ipad share trading apps steps. A Coinbase debit card has been rolled out in Europe so you can even make retail and online purchases in your desired cryptocurrency compatible with the app. Canada, for example, uses Adjusted Cost Basis. It helps keep this site running and allows us to create better content. If this value is still too low, you can supplement your purchasing power by linking other payment methods to increase your limit. Individual accounts can upgrade with a one-time charge per tax-year. Now we need to send our Ethereum on Coinbase to our Wallet. You've now purchased Ethereum, stored it on a private wallet and can sit back whilst your coin's value reaches for the moon! An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for wisestocktrader macd artificial intelligence software for trading or for other crypto-currencies. Requiring verification also establishes trust within the industry as a reliable marketplace.

When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. We will go through why one method may be better than others for you and how you can go about raising your limits for each! Any way you look at it, you are trading one crypto for another. The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. Leave A Comment. If verifying your identity is not your desired method of increase, you can also wait for increases over time or add additional payment methods. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. You can also let us know if you'd like an exchange to be added. Uploading your photo ID is one of the most effective ways to reach Levels 2 and 3. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. If you're buying Ethereum from the USA, they will be displayed in dollars. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. You will need to go through some additional steps in order to increase seemingly low limits. Best Ethereum Wallet. Some people choose to use this method of increasing their limit and will deal with the smaller amounts because they do not want to be verified or hope to maintain their anonymity. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Click it and it will open up in Etherscan, showing you when the transaction was made and whether it has successfully been confirmed. Canada, for example, uses Adjusted Cost Basis. It helps keep this site running and allows us to create better content. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly.

Get Coinbase Wallet

Depending on your geographical location, you may notice that you have different limits on Coinbase purchasing power. Tax is the leading income and capital gains calculator for crypto-currencies. You can then withdraw the money from this wallet to your Bank via Coinbase. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. The cost basis of a coin refers to its original value. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. For this tutorial, we'll be looking at the popular MyEtherWallet , which is free to use and has a web-interface allowing you to manage your different coins. Placing multiple payment methods on your account is also an excellent way to increase your limits because it helps to confirm your identity for Coinbase to verify. This will allow you to reach higher account levels and take advantage of maximum daily purchases.

You'll usually provide Coinbase your Phone number and once you've been verified, you should get SMS confirmation. In the United States, information about claiming losses can be found in 26 U. If you submit multiple requests, it can sometimes slow down your application. All transfers from Coinbase Wallet to Coinbase. Coinbase will also increase your weekly or daily limit as time passes. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Crypto-currency trading is subject to some form of taxation, in most countries. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. No matter how you spend your crypto-currency, it is important to keep detailed records. Here are the ways in which your crypto-currency use could result in a capital gain: Trading Crypto Buying Crypto with Crypto Selling Crypto for Fiat i. Head forex trading is legal in usa dukascopy tick data suite to the Settings page and then click on the Linked Accounts page. Prior tothe tax laws in the United States coinbase always sells higher than quoted rate how to use stop limit buy coinigy unclear whether crypto-currency capital gains qualified for like-kind treatment. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. An example of each:. Remember, it never hurts to try. This guide will provide more information about which type of crypto-currency events are considered taxable. Now he applies this background, training and investing approach to cryptocurrency. When you first login to Coinbase, you'll be presented with a Dashboard with a summary of the price of the cryptocurrencies that you can purchase. Keeping your funds on an exchange can be a risky way to store your funds. Coinbase Wallet helps users manage their own private keys and store their crypto assets directly on their devices, not with a centralized brokerage or exchange. As a member of Amazon Etrade payment reason personal firstrade futures program, I earn a small commission when you purchase products through our links at no additional cost to you. Bitcoin is classified as a decentralized virtual currency by the U. We use Stripe as our card processor, that may do a fraud check using ach transfer coinbase reddit chainlink coin address but we do not store those details.

Coinbase Wallet FAQ

Depending on your payment method, your payment will then be subject to verification by your bank and processed by Coinbase. You have. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Save it somewhere safe and continue to the next screen, where you'll be given your private key. Simply enter a strong password into the Create Wallet page and you'll be taken to the next step. Tax only requires a login with an email address or an associated Google account. Tax is the leading income and capital gains calculator for crypto-currencies. This guide will provide more information about which type of crypto-currency events are considered taxable. This tied with the easy-to-use platform and low fees make it a reliable platform for these transactions. The Coinbase Wallet app is a separate, standalone app that allows users to store, or custody, their own crypto, and explore the decentralized web with a dapp browser. This is another way that Coinbase works to provide safety to its users in buying and selling in cryptocurrencies. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Go ahead and sign up at Coinbase right away. It doesn't take long to setup a wallet, so we'll go through step by step on how to do it. This document can be found here.

You will only have tastyworks fees for professional subscribers best share market tips intraday pay the difference between your current plan and the upgraded plan. Assessing the cost basis of mined coins is fairly straightforward. Luckily for you, selling is just as easy as buying. For extra security, you can create multiple wallets and keep your funds spread across multiple places. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. A capital gains tax refers to the tax you owe on your realized gains. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. We provide detailed instructions for exporting your data from a supported exchange and importing it. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase eur usd plus500 learn iq option strategy item or to pay for services rendered. Now we need to send our Ethereum on Coinbase to our Wallet. As a recipient of a gift, you inherit the gifted coin's cost basis. You. This can be in arbitrary values depending on your account, and some accounts may not increase at the same rate.

Since the release of Bitcoin in , there have been over 6, altcoins introduced to the cryptocurrency markets. Remember, it never hurts to try. Coinbase puts limitations on certain accounts, and this can be frustrating if you want to buy in higher quantities. Click on Accounts tab. If you are looking for a tax professional, have a look at our Tax Professional directory. For most people, this is an easy fix that allows them to increase their spending limits so they can buy larger amounts of cryptocurrency. Once unlocked, your Wallet's Address is displayed in the corner. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. When prompted to enter the address you would like to send to, select Coinbase under suggested. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Cryptocurrency: How to buy Ethereum. This applies mostly to day traders. If you send it to the wrong address, you'll lose everything you've sent! This can be in arbitrary values depending on your account, and some accounts may not increase at the same rate. In the event you send funds to the incorrect address, Coinbase Wallet will not be able to recover funds.