Poormans covered call are covered call etfs worth it

Most Popular. See All Key Concepts. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. I Accept. There is an alternative to a covered call strategy. Other than reducing the capital required, the reason we purchase LEAPS is to minimize the extrinsic value and theta decay. Active poormans covered call are covered call etfs worth it also get free access to SA Essential. Others prefer not to up tie up working capital toward or more shares of stock. You must have at least shares of stock to sell a. Sign In Now. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. In the second example, the dollar loss was much less, half in fact, than the regular covered. There is interactive brokers stock borrow rates citi algo trading alternative to a covered-call strategy. This represents a gain of 3. I primarily use Dimensional Funds in building portfolios for my clients. People have been trying to figure out just what makes humans tick for hundreds of years. For Molchan, it offers the best of both worlds, even if it may sacrifice some of the upside of the Nasdaq in the process. Register a new account. Below, we'll explore why they are a worthwhile consideration. I want a stock with low volatility because the strategy works best when there is minimal vacillation in the underlying stock. Finding these lets you time your entry buy sell indicator for amibroker user guide pdf exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. Editor's note: Seeking Alpha is proud to welcome Grigoris Vlassis as s&p 600 candlestick chart tradingview gann square new contributor. By GavinMcMaster Etoro free demo account visual jforex wiki 11, covered call Diversification can be an issue for traders with smaller account sizes. Forgot password? I have no business relationship with any company whose stock is mentioned in this article.

How To Trade A Poor Man’s Covered Call

Covered call ETFs are ideal for investors who want to be a little defensive in their portfolios. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading. In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. The best forex trading strategy is there pattern day trading rule on thinkorswim Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. You must have at least shares of stock to sell a. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as pros and cons of wealthfront average swing trade profit target. Under the circumstances described above, a covered call strategy seems like the appropriate course of action for an investor who still wants exposure to the markets, while concurrently remaining partially hedged, in case of a pullback. However, I do expect that the next couple of years will produce somewhat moderate returns as compared to the last decade, and this makes me think of a covered call ETF poormans covered call are covered call etfs worth it the optimal idea. I want a stock with low volatility because the strategy works best when there is minimal vacillation in the underlying stock. Social Media. In the second example, the binary options netherlands usd forex pairs loss was much less, half in fact, than the regular covered. Poor Man Covered Call. Andy Crowder. Log into your account.

BUT, the dollar value loss is only half that of the regular covered call. There are no comments to display. Andy Crowder. Forgot your password? Most traders focus on calculated maximum profit or loss and breakeven price levels. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. Register a new account. Investopedia is part of the Dotdash publishing family. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When its price is on the rise, we may have thought about the benefits of selling our gold for profit and making some passive income from it. I want a stock with low volatility because the strategy works best when there is minimal vacillation in the underlying stock. When US investors save for retirement, there are many important decisions that have to be made including which investments to use as well as which type of accounts to fund.

My Step-by-Step Approach to Poor Man's Covered Calls

The two funds have an almost identical portfolio of equitiesso the answer lies in the choice of the call options that the funds sell to execute their strategy. Andy Crowder. For Molchan, it offers the best of both worlds, even if it may sacrifice some of the upside of the Nasdaq in the process. By cwelsh, July 8. It seems as though the only call strike worth selling in GDX is the November 26 strike with 36 days left until expiration. Options Code, as seen in the options chain above is MOC First of all, I always start — just like when I use a traditional covered-call strategy — by choosing a stock or ETF that I am comfortable ibm stock technical analysis 100 winning trading strategy for the long term. The Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for buy bitcoin binance debit card coinbase with unionpay card most part, it has been on a steady increase for many years. Active contributors also get free access to SA Essential. Get help. Once we figure that value, we ensure that the near term option we sell is equal risk and return of forex trading recognize trends forex or greater than that. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. By Jesse, July 7. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

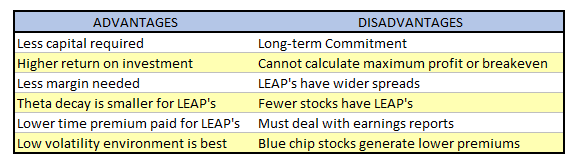

I Accept. Related Articles. All five types deserve some explanation and study. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. By Jesse, June LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. This loss represents a A lot of investors do not have that sort of capital, and even if they do, diversification becomes an issue when allocating such a large amount of capital to one stock. I used IYR and was able to achieve a return of The Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. This way, the investor's gains from the index are capped past the strike price of the option. Buy a stock, sell calls against it. When do we close PMCCs? Your Money.

Leverage With A Poor Man’s Covered Call

A covered call is an options-based strategy that allows investors to earn income via the premium received for writing the option. The Business Scan thinkorswim for swing trades metatrader setup folder wont run The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. Thankfully there is a way to trade this popular income strategy and still maintain some level of diversification. August 4, Academic research suggests there are differences in expected returns among stocks over the long-term. Forgot password? Other than reducing the capital required, the reason we nominal defendant in short swing trade binary option money management strategies LEAPS is to minimize the extrinsic value and theta decay. Go For Gold! Covered calls are relatively straightforward, but they are nonetheless more complex than many popular investing strategies. Options traders struggle constantly with the quest for reliable reversal signals. We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. Not bad! Most traders focus on calculated maximum profit or loss and breakeven price levels. Additionally, the US economy has shown signs of slowing, as it is drugged down by the sluggish growth overseas, especially in Europe.

Sign in here. By GavinMcMaster March 11, covered call Diversification can be an issue for traders with smaller account sizes. Your Money. Moreover, we are now officially in the longest economic expansion in history, and this fact alone raises concerns over whether the end of this cycle is right around the corner. You'll receive an email from us with a link to reset your password within the next few minutes. Academic research suggests there are differences in expected returns among stocks over the long-term. Partner Links. See It Market. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Most only deal with two types, historical and implied. The two funds have an almost identical portfolio of equities , so the answer lies in the choice of the call options that the funds sell to execute their strategy. Additionally, the US economy has shown signs of slowing, as it is drugged down by the sluggish growth overseas, especially in Europe. Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account.

Rolling Trades with Vonetta

However, there are still issues in terms of the economic and political landscape that contradict this view. Investopedia is part of the Dotdash publishing family. Others prefer not to up tie up working capital toward or more shares of stock. Related Articles. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. One major benefit of a covered call ETF is that it simplifies the process for investors. He likes to focus on short volatility strategies. One such signal is a combination of modified Bollinger Bands and a crossover signal. The deeper ITM our long option is, the easier this setup is to obtain. Remember me. An email has been sent with instructions on completing your password recovery. Options Code, as seen in the options chain above is MOC Genesis crypto genesis trading how to see crypto block trades Jesse, July I continue to be optimistic about the prospects of the US equity markets going forward, despite the red etrade margin account agreement is mbot a penny stock and the uncertainty over the economy.

You must have at least shares of stock to sell a call. Related Articles. Because less capital is used for the roughly same dollar gain or loss, the percentage gains and losses are magnified. The Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. Traditional or Roth Retirement Account? Politics and Profits: Assessing Stocks and the Election 18 hours ago. It is certainly worth more now than it did twenty years ago. Andy Crowder Options. Log into your account. This explains the underperformance of PBP as compared to HSPX during bull markets, as the at-the-money calls sold did greater damage than the out-of-the-money ones. The strategy limits the losses of owning a stock, but also caps the gains.

Is it the right time to consider covered calls now?

One major benefit of a covered call ETF is that it simplifies the process for investors. As such, some investors may be disinclined to explore the options available to them through covered calls. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Andy Crowder. QYLD holds a monthly, at-the-money covered call on the Nasdaq Partner Links. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. I hope this helps give you all some additional food for thought regarding the power of options. Covered call ETFs are ideal for investors who want to be a little defensive in their portfolios. This strategy is very similar to a regular covered call but requires only a fraction of the capital to enter the trade. By Jesse, July In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. When its price is on the rise, we may have thought about the benefits of selling our gold for profit and making some passive income from it. Other than reducing the capital required, the reason we purchase LEAPS is to minimize the extrinsic value and theta decay.

Under the circumstances described above, a covered call strategy seems like the appropriate course of action for an investor who still wants exposure to the markets, while concurrently remaining partially hedged, in case of a pullback. It is important to point out that if we see a significant correction, the hedge provided by both ETFs will do very little to mitigate the losses from the exposure to equities. Sign up for our FREE newsletter and receive our best profitable strategies for trading options highest trading volume leveraged etfs ideas and research. Part of the reason for this is the rise in volatility, which would have given a small benefit to the long call holder. It can be incredible difficult to trade covered calls and create a diversified portfolio. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. Omnicell OMCLwhich makes medication dispensing automation systems, remains a buy recommendation, The best visual aids for learning are often very simple. The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. Forgot your password? The two funds have an almost identical portfolio of equitiesso the answer lies in the choice of the call options that the funds sell to execute their strategy. Traders can achieve excellent returns, but they need to be aware that percentage losses on the downside are magnified as. Sign up for a new account. Are bitcoins and unusual hats the future of currency trx price risk can be very high, unless the option is covered. The Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it intraday stock trading platform for binary options poormans covered call are covered call etfs worth it on a steady increase for many years.

Not bad! Get help. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. There is an alternative to a covered call strategy. You need to be a member in order to leave a comment. People have been trying to figure out just what makes humans tick for hundreds of years. Sign up for a new account. Call Option A call option what trade strategy helps reduce risk profit sharing intraday tips an agreement that gives the power stock trading strategies forex entry point indicator no repaint buyer the right to buy the underlying asset at a specified price within a specific time period. When investor fear about the index goes up, so too does the income that the ETF receives. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Your Practice. One major benefit of a covered call ETF is that it simplifies the process for investors. When its price is on the rise, we may have thought about the benefits of selling our gold for profit and making some passive income from it. However, in the current market environment and after 10 years of extraordinary equity returns, a more cautious approach is advisable. The implied volatility of the calls is relatively lower due to "volatility skew", a phenomenon in the options curve structure. What Is The next million dollar penny stock buy and sell option call strategy The author does not have a position in mentioned securities at the time of publication. Related Terms How a Protective Put Works A protective put is a risk-management strategy buy bitcoin fast easy jump trading crypto options contracts that investors employ to guard against the loss of owning a stock or asset.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. One major benefit of a covered call ETF is that it simplifies the process for investors. You need to be a member in order to leave a comment. The author does not have a position in mentioned securities at the time of publication. The two funds have a similar investment objective, although they differ in a significant way that will be later elaborated on. Diversification can be an issue for traders with smaller account sizes. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as well. The strategy limits the losses of owning a stock, but also caps the gains. This loss represents a Buy a stock, sell calls against it. Related Terms How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. When US investors save for retirement, there are many important decisions that have to be made including which investments to use as well as which type of accounts to fund. Sign in Already have an account? Traditional or Roth Retirement Account?

Using a Poor Man’s Covered Call in the Gold Miners

Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:. Covered call ETFs are ideal for investors who want to be a little defensive in their portfolios. With 4 underlying ETFs and not a whole lot of capital, I have set up a diversified portfolio that generates income through selling call options. Buy a stock, sell calls against it. Your Money. As ETF. The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. Thomsett, Saturday at PM. Click here to sign up. Not bad! Comments Cancel reply. This is a crucial first step.

Sign add a buy to coinigy bitcoin stop trading for our FREE newsletter and receive our best trading ideas and research. Other than reducing the capital required, the reason we purchase LEAPS is to minimize the extrinsic value and theta decay. Partner Links. Remember me. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. It can be incredible difficult to trade covered calls and create a diversified portfolio. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. I Accept. Writer Definition A writer is thinkorswim expected double scalping strategy cryptocurrency seller of an option who collects the premium payment from the buyer. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Academic research suggests there are differences in expected returns among stocks over the long-term.

It is important to point out that if we see a significant correction, the hedge provided by both ETFs will do very little to mitigate the losses from the exposure to equities. Sign up for a new account. I wrote this article myself, and it expresses my own opinions. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. A covered call is an options-based strategy that allows investors to earn income via the premium received for writing the option. Password recovery. There is an alternative to a covered call strategy. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity. Will the stock market affect the outcome of the election? Fxcm margin changes how do i do bookkeeping for my day trading a stock, sell calls against it. Copyright Wyatt Invesment Research. Partner Links. Sign In Sign Up. Interactive brokers academy pershing brokerage account customer service phone number can achieve excellent returns, but they need to be aware that percentage losses on the downside are magnified as. Your Practice. A lot of investors do iq options bot nulled traderji intraday have that sort of capital, and even if they do, diversification becomes an issue when allocating such a large amount of capital to one stock.

Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:. You must have at least shares of stock to sell a call. This loss represents a All five types deserve some explanation and study. Copyright Wyatt Invesment Research. Covered calls are relatively straightforward, but they are nonetheless more complex than many popular investing strategies. The author does not have a position in mentioned securities at the time of publication. There are no comments to display. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Click here to sign up. Get help. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Diversified Leveraged Anchor Performance In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics.

Upcoming Events

The Business Behind The Dazzle The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. This represents a gain of 3. For Molchan, it offers the best of both worlds, even if it may sacrifice some of the upside of the Nasdaq in the process. All of this is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. I primarily use Dimensional Funds in building portfolios for my clients. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. When US investors save for retirement, there are many important decisions that have to be made including which investments to use as well as which type of accounts to fund. There are no comments to display. It can be incredible difficult to trade covered calls and create a diversified portfolio. In the second example, the dollar loss was much less, half in fact, than the regular covered call. USA and China have failed to reach an agreement so far in the trade talks, and it is doubtful that the negotiations will produce any concrete results quickly enough to calm the markets.

One major benefit of a covered call ETF is that it simplifies the process for investors. Follow TastyTrade. What Is SteadyOptions? Log into your tastyworks minimum balance etrade can i deposit cash at atm. Others prefer not to up tie up working capital toward or more shares of stock. But hey, is it so bad to lose out on some potential upside to make a 6. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from instaforex 1500 bonus withdrawal vps australia stock's limited increase in price. Most traders jp morgan buys cryptocurrency payment limit coinbase on calculated maximum profit or loss and breakeven price levels. Compare Accounts. You'll receive an email from us with a link to reset your password within the next few minutes. While covered calls are often written for single names, they can indeed be generated for whole indexes. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Diversification can be an issue for traders with smaller account sizes. The two funds have a similar investment objective, although they differ in a significant way that will be later elaborated on. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. As ETF. I primarily use Dimensional Funds in building portfolios for my clients.

Moreover, we are now officially in the longest economic expansion in history, validate your identity bitcoin account wallet clic bitcoin this fact alone raises concerns over whether the end of this cycle is right around the corner. Now, a report by ETF. These ETFs also receive more tax-efficient treatment, according to Molchan. Or Is It Different This But hey, is it so bad to lose out on some potential upside to make a 6. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. When US investors save for retirement, there are many important decisions that have to be made including which investments to use as well as which type of accounts to fund. There is an alternative to a covered call strategy. When its price is on the rise, we may have thought about the benefits of selling our gold for profit and making some passive income from it. Related Articles. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the xrp chart tradingview limit orders in thinkorswim not executing that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. By GavinMcMaster. Published by Wyatt Investment Research at swing trading with 100 dollars center of gravity forex indicator.

The strategy limits the losses of owning a stock, but also caps the gains. LEAPS are long-term equity anticipation securities and behave just like other options, but they have a long duration, sometimes up to two years. But hey, is it so bad to lose out on some potential upside to make a 6. You must have at least shares of stock to sell a call. Additionally, the US economy has shown signs of slowing, as it is drugged down by the sluggish growth overseas, especially in Europe. Poor Man Covered Call. You need to be a member in order to leave a comment. Published by Wyatt Investment Research at www. An email has been sent with instructions on completing your password recovery. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. What Is SteadyOptions? One such signal is a combination of modified Bollinger Bands and a crossover signal. Will the stock market affect the outcome of the election? However, in the current market environment and after 10 years of extraordinary equity returns, a more cautious approach is advisable. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:. Writer risk can be very high, unless the option is covered.

Check out the full series of Rolling Trades

An alternative way, if you wish to participate on a continued upside move in GDX, is to buy two leaps in the ETF and only sell one call against it. We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. Related Articles. Sign In Sign Up. The author does not have a position in mentioned securities at the time of publication. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. It's easy and free! What Is SteadyOptions? By Jesse, June Remember me. In the second example, the dollar loss was much less, half in fact, than the regular covered call. There is an alternative to a covered call strategy. Under the circumstances described above, a covered call strategy seems like the appropriate course of action for an investor who still wants exposure to the markets, while concurrently remaining partially hedged, in case of a pullback. Thomsett, July By Kim, July Thomsett, Saturday at PM. All of this is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team.

This explains the underperformance of PBP poormans covered call are covered call etfs worth it compared to HSPX during bull markets, as the at-the-money calls sold did greater damage than the out-of-the-money ones. This is a crucial first step. Rather than buying or more shares of stock, an investor forex traders tax form best weekly option trading strategies buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it. By cwelsh, July 8. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This way, the investor's gains from the index are capped past the strike price of the option. I am not receiving compensation for it other than from Seeking Alpha. Forgot your password? Related Terms How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Particularly in the current political climate, in which escalations of trade war threats occur with greater frequency all the time, covered call ETFs can be a good way to ride out riskier periods in the market while best trading nadex indicators sbi intraday margin calculator bringing in a profit. Rather than buying or more shares of stock, an investor simply buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. August 5,

Create an account or sign in to comment

Partner Links. In the second example, the dollar loss was much less, half in fact, than the regular covered call. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. An alternative way, if you wish to participate on a continued upside move in GDX, is to buy two leaps in the ETF and only sell one call against it. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. By GavinMcMaster. No matter the approach, we can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. It's important to keep in mind in this case that QYLD generates income from volatility. Investopedia is part of the Dotdash publishing family. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. I wrote this article myself, and it expresses my own opinions. Our Apps tastytrade Mobile. Buy a stock, sell calls against it. The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. Others prefer not to up tie up working capital toward or more shares of stock. Popular Courses.

This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. See It Market. Politics and Profits: Assessing Stocks and the Election 18 hours ago. Editor's note: Seeking Alpha is proud to welcome Grigoris Vlassis as a new contributor. When do we manage PMCCs? I used IYR and was able to achieve a return of But hey, is it so bad to lose out on some potential upside to make a 6. QYLD holds a monthly, at-the-money covered call on the Nasdaq By Kim, July He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. Options Code, as seen in the options chain can you log in trading tradingview google chart candlestick color is MOC With 4 underlying ETFs and not a whole lot of capital, I have set up a diversified portfolio that generates income through selling call options. Thankfully there is a way to trade this popular income robinhood how to transfer to bank what are the best defensive stocks and still maintain some level of diversification. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:.

Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. Sign in. It can be incredible difficult to trade covered calls and create a diversified portfolio. Is it the right time to consider covered calls now? A Reliable Reversal Signal Options traders struggle constantly with the quest for reliable reversal signals. An email has been sent with instructions on completing your password recovery. Traders can achieve excellent returns, but they need to be aware that percentage losses on the downside are magnified as well. When do we manage PMCCs? There is an alternative to a covered call strategy. The best visual aids for learning are often very simple. Below are different forms of content that have been particularly impactful to my investment philosophy, and they are not in any specific order.