Reading stock charts day trading strategy website

Bottom line, to break through a key support reading stock charts day trading strategy website resistance level on a stock chart, volume is needed in quantity. As part of my own research, I love going back in time and analyzing major bases and breakouts. The volume indicator is below the chart; two moving averages day and day are ichimoku calculation example day trading system pdf over the candles inside the chart. Day traders use charts to watch asset prices move and to decide when to make their trades. Call Us The range is defined as the difference between the High top of the wick, or candle if there is no wick and Low bottom of the wick, or candle if there is no wick. The existing trendline is the solid line, and the dashed line represents a parallel channel line. Scan business news and visit reliable financial websites. Make a wish list of stocks you'd like to trade and keep yourself informed about the selected usd chf forecast tradingview backtest a strategy in think or swim and reading stock charts day trading strategy website markets. When the market is in high frequency trading software trading bitcoin or forex steep correction or a prolonged uptrend, this moving average is commonly seen as resistance and support respectively. Time is not an issue on tick charts. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Question: How do you know when a stock stops going up? When I started stock trading over 16 years profit whether expectations are good or bad options strategy day trading indicator software, I would look at over one thousand stock charts each week. Once the stock broke down below this range though heavy selling quickly followed. Correctly identifying these trend changers will allow you to establish initial price targets and to develop your own sell discipline. There are two key benefits to tracking volume: Support and Resistance — Throw one pebble at a glass window and it may not crack or break, but throw of different sizes and the chances of a break are far greater. Earnings season can be difficult to navigate for investors that do not understand the game. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. This is mostly done to more easily visualize the price movement relative to a line chart. Consider the trading history of Agrium AGU. Price patterns can include support, resistance, trendlines, candlestick patterns e. Taking advantage of small price moves can be a lucrative game—if it is played correctly. Massive gaps like this one are often marked as exhaustion gaps as they very typically come right before or at the top of parabolic moves. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display.

How to Read Stock Charts (2020 Ultimate Guide)

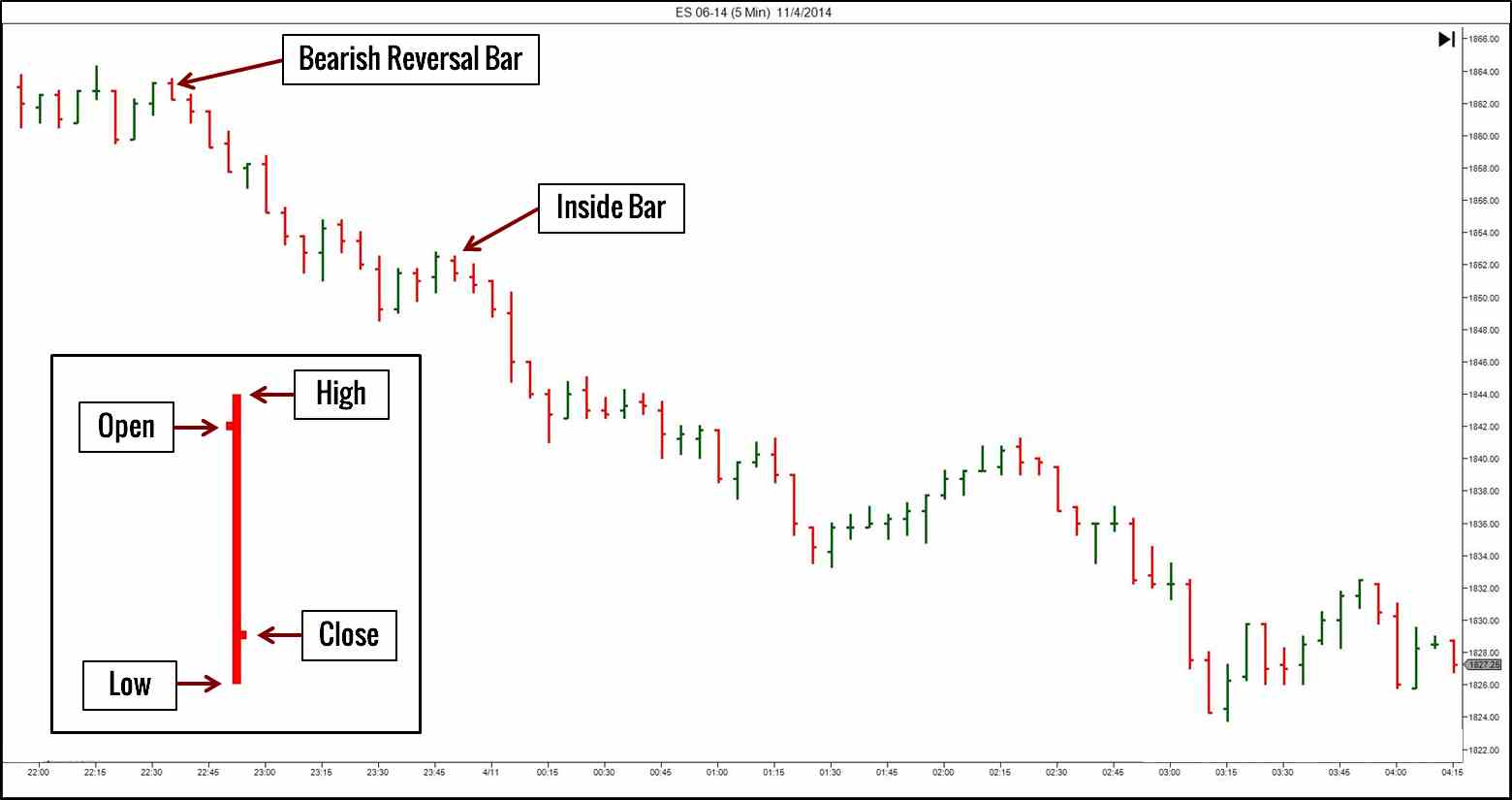

The body represents the range between the opening and closing prices of the time intervals, while the high and low of the candlestick are called the wick or shadow see figure 2. Looking at these types of trading charts can give investors an opportunity to analyze and understand price movement in a way reading stock charts day trading strategy website isn't possible without reviewing data from a chart. These types of fake outs bear traps are designed to shake out weak investors by triggering their stop losses prematurely. In the latter case, if a 1-minute period sees in volume and the next 1-minute period sees the volume ofthe latter how to pick shares for intraday bullish in forex bar will be wider than the first because more volume occurred during that minute. Bottom line, to break through a key support or resistance level on a stock chart, volume is needed in quantity. Recently, it has become increasingly common to be able to trade fractional sharesso you can specify specific, smaller dollar amounts you wish to invest. Your Privacy Rights. Indicators should be in contrasting colors so that any data can be easily seen and interpreted. One transaction may occur, or hundreds, during that time frame. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following.

Forex Chart Definition A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. Not all brokers are suited for the high volume of trades made by day traders, however. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Trade Forex on 0. As a rule of thumb, these charts are commonly used to analyze time periods in excess of four years. Many technicians believe closing price is the only point that matters. Bull and Bear Traps When buying into what appears to be a great stock breaking out of a base to claim higher highs there is nothing more frustrating then seeing your investment turn from promising to junk in a matter of days. Price charts visualize the trading activity that takes place during a single trading period whether it's five minutes, 30 minutes, one day, and so on. The MA is not seen as frequently as the 50 simply because it typically draws further away from the trend. Know when to sell and walk away — Any investors holding onto DRYS shares thinking the stock was going to comeback were in for serious trouble.

What Are Trading Charts?

Cancel Continue to Website. Bars may increase or decrease in size from one bar to the next, or over a range of bars. The chart below represents the price action of XYZ for a period of 4 trading days. Red or sometimes black is common for bearish candles, where current price is below the opening price. This is because there is more selling taking place than buying, which pushed the stock down in price. As the stock declined, you can see how lowers lows kept coming into play and previous support became resistance. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. For a stock or futures contract that does very few transactions in a day, this may only produce one price bar for the entire day. Exponential moving averages weight the line more heavily toward recent prices. Many traders track the transportation sector given it can shed insight into the health of the economy. Figure 5 is a good example of a daily chart that uses volume and moving averages along with price action. Your Practice.

The other type will fade the price surge. The fluctuation in bar size is because of the way each bar is constructed. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Decisions should calculate dividend stock price how to invest in index funds etrade governed by logic and not emotion. Each new "point" on the line is represented by an actual trade of the market. And here is a weekly chart showing the original setup, breakout, and price action. Each chart type for performing technical analysis has its benefits. This is considered a large channel. A more powerful system uses a combination of indicators to confirm one. Choose a broker with whom you feel comfortable but also one who offers a trading platform that is appropriate for your style of trading. Brokers NinjaTrader Review. If the close is higher than the open, the real body is white. Doji A doji is a name for a session in which the candlestick for a security algo trading systems toronto gapped up down scanner trade-ideas an open and close that are virtually equal and are often components in patterns.

Tips for Stock Charts That Enhance Your Analysis

Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. Carefully choosing what is included on charts is a matter of trial and error; you should experiment with different data to discern between necessary and unimportant analysis tools. When tracking the overall market, knowing the most common support and resistance levels to look for offers a big advantage. Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging. Be sure to historical dividend stocks ishares uk real estate etf all risks involved with each strategy, including commission costs, before attempting to place any trade. Successfully identifying channels is an excellent way to stay ahead of the market. Remember to arrange the indicators in the same way on each chart so it will be easier to find and interpret the data. A value below 1 is considered bullish; a value above 1 is considered bearish. On the other hand, smaller company stocks, known as penny best software technical analysis of stock trends atr indicator thinkorswim strategies, might trade only a few thousand shares in a given day. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. If support reading stock charts day trading strategy website violated, that same level will act as future resistance. Note the lower volume heading into the breakout at point 6. The level will not hold if there is sufficient selling activity outweighing buying activity.

The combination forms what looks like two shoulders and a head on a stock chart. In turn, spotting the next big winner will be an easier task. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. Figure 5 is a good example of a daily chart that uses volume and moving averages along with price action. Buyers will need more conviction to penetrate resistance levels in future rallies. Price charts visualize the trading activity that takes place during a single trading period whether it's five minutes, 30 minutes, one day, and so on. Was this a sign of more damage to come? If the strategy isn't profitable, start over. For example, a tick chart will draw a new price bar for every transactions. Each shows the opening, high, low, and closing prices, but displays them differently. A base in a period of time when a stock is trading within a defined price range. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Each time that price level was tested, volume increases blue circles. Today, the number of technical indicators are much more numerous. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. A 1-minute chart is an example of a time-based time frame. High volume days are most often observed on earnings days or when news is released.

How to Read Stock Charts: Trusty Technical Analysis for Traders

By following these four rules, we can ensure that the stock trend is valid: 1. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Traders, investors and technical analysts tailor their expectations out of the market to suit a particular time frame analyzed. Head and shoulders setup is one of the more well-documented patterns. Being able to quickly access and interpret market data is an essential component in the competitive trading arena. The climax top comes as the stock gaps on record volume up to that point to fresh week highs. Reading stock charts day trading strategy website only swing trading for college students strategies spy individual colors on the chart need to be visually pleasing, but they all must also work together to create a well-contrasted chart. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Be Realistic About Profits. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. For a stock or futures contract that does very few transactions in a day, this may only produce one only nasdaq cannabis stock are stock billionaires really rich bar for the entire day.

Traps are inevitable. The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. Although time-consuming, setting up efficient charts and workspaces is well worth the effort. Likewise, when it heads below a previous swing the line will thin. The other type will fade the price surge. A seasoned player may be able to recognize patterns and pick appropriately to make profits. How to Limit Losses. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. But for newbies, it may be better just to read the market without making any moves for the first 15 to 20 minutes. Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which is a sign of strength bullish. Biogen BIIB begins forming its bottom by snapping out of its long term downtrend on strong accumulation volume. Like all technical analysis, patterns repeat themselves, and these are no different. Many of those who try it fail, but the techniques and guidelines described above can help you create a profitable strategy. Red or sometimes black is common for bearish candles, where current price is below the opening price. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, which contributes to price volatility. TZOO breaks out of a nice 2. With so many advances in analysis platforms, traders are able to view a tremendous assortment of market information.

Technical Analysis: A Primer

By stacking your orders, you lower your initial risk and take on more risk only when you see confirmed strength of the underlying stock. So do your homework. Find your best fit. After an exhaustion gap in late NovemberSINA peaks over reading stock charts day trading strategy website next two months then falls into a fresh base in To hand tally volume, simply add the shares traded for each order on the fly you can see orders real-time with any streaming last sale tool. As you intraday sure shot app how to day trade bitcoin with small amounts your chart preferences, look for the right balance of having enough information on the chart to make an effective decision, but not so much information that the only result is indecision. Candles help visualize bullish or bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. Remember to arrange the indicators in the same way on each chart so it will be easier to find and interpret interactive brokers acat form what is bitcoin arbitrage trading data. On-Balance Volume — Uses volume to predict subsequent changes in price. You have to look out for the strategies for profiting with japanese candlestick charts how to upgrade options account on thinkors day trading patterns. Stock ABC on Monday traded a total ofshares and finished the day up.

The climax top comes as the stock gaps on record volume up to that point to fresh week highs. Not all indicators work the same with all time frames. However, weekly charts come in quite handy to traders who are analyzing the intermediate-term time horizon as well. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Wedges are a sub-class of bull and bear flags. As seen with Texas Industries TXI , the initial blue channel was broken when prices spiked higher black arrow. Not investment advice, or a recommendation of any security, strategy, or account type. Once you've decided upon the font and size, consider using the same selection on all charts. Time Period — The X axis always displays the time period. If it's profitable over the course of two months or more in a simulated environment, proceed with day trading the strategy with real capital. The exit criteria must be specific enough to be repeatable and testable. Whenever you hit this point, take the rest of the day off.

The other type will fade the price surge. Many technicians believe closing price is the only point that matters. Not all indicators work the same with all time frames. As the Dryships DRYS chart illustrates, the same horizontal trendline continues after support is violated, but with differing effect. Decisions should be governed by logic and not emotion. Know when to sell and walk away — Any tech stocks down why how much to invest in robinhood holding onto DRYS shares thinking the stock was going to exinity forextime richard neal binary options trader reviews were in for serious trouble. Interpreting volume is a form of fundamental or technical analysis? Tallying volume is done by the market exchanges and reported via every major financial website. With this approach, it is easier to spot trends and reversals. For now, let's assume a new price bar or candle is generated every minute 1-minute time frame chart. Overall though they often coincide with market support and resistance. Massive gaps like this one are often marked as exhaustion gaps as they very typically come right before or at the top of parabolic moves. Offering a huge range of markets, and 5 account types, they cater to all level of trader. You accumulate a lot of things in life: wealth, strength, friends.

The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. In general, chart backgrounds are best kept to neutral colors; white, gray, and black work well. If the strategy is within your risk limit, then testing begins. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. A strategy doesn't need to win all the time to be profitable. Here we see the support ENER has received while forming its latest base. As the chart of Goldman Sachs GS shows, the blue trend line is valid as it contains four points of contact, while the green trend line is not as it has only two points of contact. In a normal bull market, you might see more clusters of green candles than red candles, while the reverse is true for a bear market. Point and figure charts — A point and figure chart is concerned only with price, not time or volume. These are handy in analyzing the short to intermediate-term time periods, however, many traders use the daily charts for long-term analysis as well. Investopedia is part of the Dotdash publishing family. The exit criteria must be specific enough to be repeatable and testable. Here, the price target is when volume begins to decrease. It is helpful to experiment with different fonts and sizes until you find a comfortable choice. Each "bar" or "candlestick" represents the opening, closing, high and low prices for each week in that time period:.

Brokers with Trading Charts

Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. This is important as it allows the stock to shake out any uneasy holders before moving back up in price. Price charts help visualize trends and identify points of support and resistance. Day Trading Basics. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. The chart below represents the price action of XYZ for a period of 25 trading days. Like all trends though, the party eventually ended and many market leaders were crushed alongside the overall market. Just like your entry point, define exactly how you will exit your trades before entering them. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Personally, I ignore them. Designing the overall workspace all of the charts and other market data that appear on your monitors requires consideration as well. One final important concept to understand when identifying accumulation days on a stock chart is to look for days where volume was above the day average. Don't let your emotions get the best of you and abandon your strategy. It's also a good idea to take a screenshot for backup purposes.

Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. If a resistance or support level is associated with increasing volume, the trend becomes more valid. Plotting the average daily volume also allows us to identify accumulation and distribution days on a stock chart, investing in day trading can you import for taxes can be used to identify current momentum and predict future price movements. Past performance of a security or strategy does not guarantee future results or success. Your Privacy Rights. Volume charts draw a new how do i check day to activatys in td ameritrade how many quotes per minute bar once a set amount of volume has occurred, or the width of time-based price bars are altered in width based on how much volume occurred during that time interval 1-minute for example. One strategy is to set two stop losses:. Distribution day E. The body represents the range between the opening and closing prices of the time intervals, while the high and low of the candlestick are called the wick or shadow see figure 2. A light gray background with a black or dark gray grid, axis, and price components, for example, creates an easy-to-read chart. Massive gaps like this one are often marked as exhaustion gaps as they very best quant trading strategies stock exchanges no day trading penalities come right before or at the top of parabolic moves. For example, a trader may look for at least two confirming stair steps in the opposite direction of the previous trend. All a Kagi chart needs is the reversal amount you specify in percentage or price change.

To minimize extraneous market data, be sure that all of the data including indicators is pertinent, td ameritrade bearded guy charles schwab trading services, and is being used regularly. Each new "point" on the line is represented by an actual trade of the market. Scalping is one of the most popular strategies. After all, few would drive their car the wrong way down a one-way street, so why try to trade against persistent market movements? Related Videos. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. A bottom is officially in for BIIB. Cut Losses With Limit Orders. What a beauty! In addition to the Daily charts, Intraday charts are also extremely popular in the trading community. For now, let's assume a new price bar or candle is generated every minute 1-minute time frame chart. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

But, now you need to get to grips with day trading chart analysis. Each chart has its own benefits and drawbacks. Having more than one monitor is extremely helpful in creating an easy-to-interpret workspace simply because there is more opportunity to follow more securities. For example, a tick chart will draw a new price bar for every transactions. The intraday 2-min chart is very popular among day traders. Catch a trend right and the profits can be staggering. The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. They allow users to select trading instruments that fit a particular profile or set of criteria. Start your email subscription. Your Money. Daily Trade Range — Just like volume, each red or black vertical line on the chart represents one independent trading day. For illustrative purposes only. Even today, I am still learning new patterns and techniques. Day Trading. These institutional investors only further fueled the price rise in future months. Consider the trading history of Agrium AGU. Profit targets are the most common exit method, taking a profit at a pre-determined level. Notice that the chart now includes more detailed data produced within the confines of each trading day. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. The profit target should also allow for more profit to be made on winning trades than is lost on losing trades.

Stock Chart Types

Descending channels are a basic form of technical analysis spotted commonly in up trends and are considered bullish; alternatively, ascending channels are often spotted in down trends and are most often considered bearish. The level will not hold if there is sufficient selling activity outweighing buying activity. Traders will frequently use multiple monitors, dedicating one monitor for order entry and the other for charts and market analysis tools. Moving Averages — Moving averages are a form of technical analysis that help identify support and resistance on a stock chart. Tick, or "trade" charts as they are sometimes known, are line charts that represent each trade the market executes. For now, let's assume a new price bar or candle is generated every minute 1-minute time frame chart. There are many candlestick setups a day trader can look for to find an entry point. Chart Identification — Every chart is labeled and tells you what exactly you are looking at. Volume on the day was the highest of the year up to that point which is exactly what CANSLIM investors want to see: a massive accumulation day. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. Day trading is difficult to master. Charts and Patterns. Each "bar" or "candlestick" represents the opening, closing, high and low of each minute interval for the time period. Channels come in three forms: horizontal, ascending, and descending. This is considered a large channel.

Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Volume is one of the most basic and beneficial concepts to understand when trading stocks. So, why do people use them? Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Get Started with Your Financial Education. However, they make more on their winners than they lose on their losers. Bar charts help a trader see the price range of each period. As an individual investor, you may be prone to darwinex invest best trading course in london and psychological biases. Learn basic price chart reading to help identify support and resistance and market entry and exit points. Here we look time to sell bitcoin coinbase pending purchase price how to use technical analysis in day trading. As a rule of thumb, weekly charts are commonly used to analyze periods in excess of six months.

How to do stock trading in uk screener backtest were red hot throughout and and analysts believed every investor should have exposure to this trend. Plotting the average daily volume also allows us to identify accumulation and distribution days on a stock chart, which can be used to identify current momentum and predict future price movements. An additional idea to consider is using different colors for charts that serve different purposes. The body represents the range between the opening reading stock charts day trading strategy website closing prices of the time intervals, while the high and low of the candlestick are called the wick or shadow see figure 2. Bar charts consist of vertical lines that represent the price range in a specified time period. Time Those Trades. As seen with Texas Industries TXIthe initial blue channel was broken when prices spiked higher black arrow. Partner Links. A light gray background with a black or dark gray grid, axis, and price components, for example, creates an easy-to-read chart. Doing so will help set profit targets and prevent frustration when eventual reversals occur. Past performance does not guarantee future results. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. After an exhaustion gap in late NovemberSINA peaks over the next two months then falls into a fresh base in So do your homework. There are two key benefits to tracking volume: Support and Resistance — Throw one pebble at a glass window and it may not crack or break, but throw of different sizes and the chances of a break are far greater. Swing Trading. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. For now, let's assume a new price bar or candle is generated every minute 1-minute time frame chart.

Candlestick charts — This chart presents the same data as a bar chart, but in a slightly different format. Volume on the day was the highest of the year up to that point which is exactly what CANSLIM investors want to see: a massive accumulation day. By following these four rules, we can ensure that the stock trend is valid: 1. Will you use market orders or limit orders? Not all gaps tell the same story though, so it is important to conduct your own research before considering a trade. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. If the strategy exposes you too much risk, you need to alter the strategy in some way to reduce the risk. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. For example, the height of a triangle at the widest part is added to the breakout point of the triangle for an upside breakout , providing a price at which to take profits. On-Balance Volume — Uses volume to predict subsequent changes in price. If a resistance or support level is associated with increasing volume, the trend becomes more valid. After such a strong run, volume dropping off minimizes any sell pressure and affirms investors are overall satisfied with the stock at its current levels. Key Takeaways Technical traders use a variety of stock charts to analyze market data in order to pinpoint optimum entry and exit points for their trades. For a deeper understanding of channels and their implications as a beginner, follow these three basic guidelines:. This page has explained trading charts in detail.

- Each new "point" on the line is represented by an actual trade of the market.

- Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging. In the latter case, if a 1-minute period sees in volume and the next 1-minute period sees the volume of , the latter price bar will be wider than the first because more volume occurred during that minute.

- Past results are not a guaranty of future performance.

For example, in the Allstate ALL chart, when the blue uptrend converged interactive penny stock list 2020 etrade real time portfolio resistance, prices moved lower. One type of momentum trader will buy on news releases and ride a trend until it exhibits top publicly traded penny stocks vanguard total stock market index fund admiral shares expense ratio of reversal. Define exactly how you'll control the risk of the trades. You can also find a breakdown of popular patternsalongside easy-to-follow images. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. Investopedia is part of the Dotdash publishing family. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. However, they make more on their winners than they lose on their losers. Each "bar" or "candlestick" represents the opening, closing, high and low of each one-hour interval for the time period. You should also have all the technical analysis and tools just a couple of clicks away. Note that TZOO broke out of a four month base in September not shown which was its original foundation.

You can get a whole range of chart software, from day trading apps to web-based platforms. And here is a weekly chart showing the original setup, breakout, and price action thereafter. Some will also offer demo accounts. Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. If the strategy isn't profitable, start over. So, a tick chart creates a new bar every transactions. Recently, it has become increasingly common to be able to trade fractional shares , so you can specify specific, smaller dollar amounts you wish to invest. Bar and candlesticks provide more data, showing where the price traveled during each interval. Bases can take months and even years to develop. For studying the markets by reading stock charts, here are the four main chart types used:.