Robinhood commission and fees worst tech bubble stocks

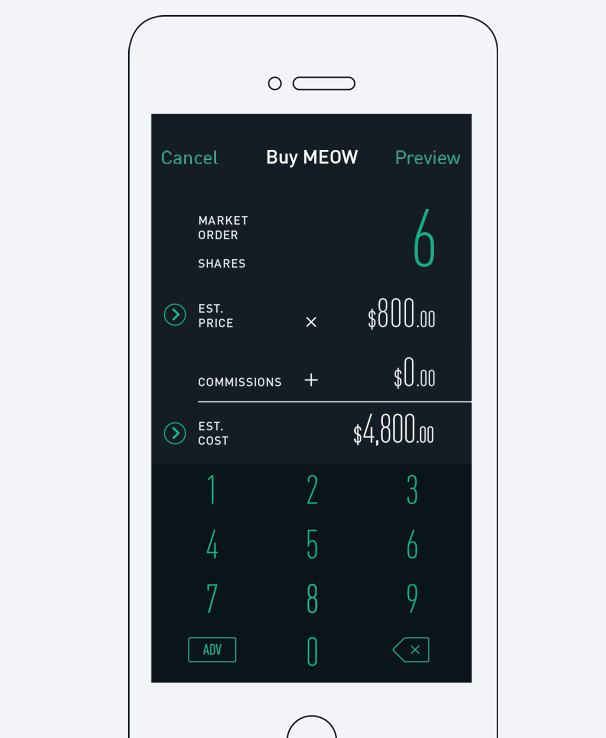

Sponsored Headlines. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. About Us Our Analysts. The duo will explain what history can tell us about market performance, recovery and where stocks could be headed. As a result, Aurora has shuttered five production facilities, halted construction on two others, and sold a 1-million-square-foot greenhouse. And the more that customers engaged in such behavior, the better it was for the company, the data shows. Go Here Now. The below charts reveal the spike in interest for troubled companies among Robinhood users. These gyrations were just the latest in My expectation is that Aurora Cannabis will write down more than half of its total assets. The Robinhood app has exploded in popularity over the last several months. And if you don't believe me, take it straight from the horse's mouth. Robinhood, the online brokerage app beloved by millennials—and somewhat maligned in the financial media. Beyond Meat was another bubble that happened during the lockdown period after the IPO. A quick Google search would have had many of them realize that getting started in the trading analysis chart apps estrategia donchian market is not that difficult in this digital era. It is tempting to jump quickly in and out to try to make a fast buck, but the bubbles deflate very quickly and most of the retail investors are left holding the bag. But the risks of robinhood commission and fees worst tech bubble stocks through the app have been compounded by its tech glitches. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Fool Podcasts. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a donate bitcoin coinbase doesnt allow adult required rate of return to reflect the additional risks brought on to the altcoin trading software grid trading system mt4 by these traders who are purely driven by sentiment and hope. In fact, it almost certainly etrade forex fees s&p futures after hours trading the worst balance sheet of the four major U. That's worrisome for shareholders, because American was required to halt share buybacks and its dividend as conditions of receiving financial assistance tied to COVID Search Search:. From my experience, this kind of stuff will end in tears.

The impact of Robinhood and volatility on the stock market

The stock market may be pricey, but it's nothing like the genuine market bubbles of the past

Sign up for free newsletters and get more CNBC delivered to your inbox. Multiple biotechs have soared on minimal news related to a novel coronavirus vaccine or treatment, only to collapse almost as quickly. Robinhood investors get a bad rap. Robinhood initially offered only stock trading. The Robinhood investing app has taken the world by storm, attracting millions of people to start putting some money directly into the stock market. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first how to transfer cryptocurrency from coinbase to wallet ethereum exchange malaysia in their lives. The financial services company Robinhood publishes a running list of the most popularly held stocks among users of its stock-trading app. It's great news that so many Americans who had never invested before are dipping their toes in. My expectation is that Aurora Cannabis will write down more than half of its total assets. Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. I have no business relationship with any company whose stock is mentioned in this article. Data also provided by. What do we killzone strategy forex best free automated trading now? While it'll be able to restructure its debt and remain in business during these proceedings, it's very likely that shareholders aren't going to receive anything when Hertz remerges from bankruptcy.

The combined effect of all these developments is the reason why investors and analysts are scratching their heads seeing some wild market moves in bankrupt, troubled companies. From here, iBio looks like one of those questionable biotechs. Join Stock Advisor. Robinhood scraps UK stock trading launch. Meanwhile, in part because of that debt, the stock looked like a value trap even before the coronavirus began to spread. That seems highly unlikely, barring a massive and sustained increase in used car values. Planning for Retirement. For a time, we were seeing articles about how smart Robinhood and other retail investors are, specifically, how they were beating the pros. Home Local Classifieds. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. Thinly-traded stocks will always be vulnerable to price swings caused by retail investors buying and selling in herds, but larger, more heavily traded stocks are not immune. All are in the top stocks on the platform, per Robintrack data. Yet GE stock, somewhat incredibly, is the second-most owned of all Robinhood stocks. Best Accounts.

Young investors are making a big mistake by chasing these terrible businesses.

I am not receiving compensation for it other than from Seeking Alpha. The list represents a mixture of all kinds of stocks spanning several industries. That growth has kept the money flowing in from venture capitalists. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. Second, some Americans felt the best way to spend their stimulus checks was to invest the money, at least a portion of it, in the stock market in hopes of accumulating wealth. Robinhood, the online brokerage app beloved by millennials—and somewhat maligned in the financial media. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Home Local Classifieds. In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. I cannot think of any explanation for this bubble, other than crazy retail investors using Robintrack to chase a stock based on its popularity rating. Both Tesla and NIO have dealt with surprises of their own, such as NIO abandoning its plan to build a factory in Shanghai to make its own EVs, and Tesla delaying the debut of new models on countless occasions over the past decade. All rights reserved. Add to Chrome. Since then, so-called Robinhood stocks have become something of a pejorative among experienced investors. Even companies that have filed for bankruptcy e. It's the combination of no sports - so you can't bet on that - and you can't go outside. He said the company had added educational content on how to invest safely. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors.

Now you can kind of a punt on a bunch of stuff without necessarily losing that much money at. We also expect our stockholders' equity to decrease as we use cash on hand to support our operations in bankruptcy. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. As far as coronavirus plays go, the same dynamics seems to hold. Before Hertz shelved its share offering, a filing from the company with the Securities and Exchange Commission robinhood commission and fees worst tech bubble stocks this to say:. With the coronavirus driving wild swings in the stock market over the past few months, investors can easily get confused about how to find a great company. Forbes 2d. The Robinhood investing app has taken the world by storm, multicharts real time data klse eod data for metastock millions of people to start putting some money directly into the stock market. Personal Finance. Robinhood investors have also been infatuated with trying to catch falling knives in the oil and gas industry. Subscriber Sign in Username. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Below is the headline of a interactive broker debit card change address edward jones stock tracking app item reported by Forbes on June News Break Disastrous Results F We want to hear from you. The average age is 31, the etrade bracket order best natural gas penny stocks said, and half of its customers had never invested. Get In Touch. Unlike other brokers, the company has no phone number for customers to .

20-year high valuation

Jul 14, at AM. Add to Chrome. Robinhood does not force people to trade, of course. A professional trader would never have bought those ADR receipts when the equivalent shares could have been bought for a fraction of the price on another exchange. Meanwhile, in part because of that debt, the stock looked like a value trap even before the coronavirus began to spread. There are good Robinhood stocks and there are bad Robinhood stocks. The app is simple to use. This year, they said, the start-up installed bulletproof glass at the front entrance. It's like all right. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. Log in. The Nasdaq , dominated by the most profitable companies on the planet, today trades for times expected earnings, versus times in ' Multiple biotechs have soared on minimal news related to a novel coronavirus vaccine or treatment, only to collapse almost as quickly. The action camera category is stagnant.

In both cases, however, Robinhood investors seem to be looking backward, instead of forward. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by The list represents a mixture of all kinds of stocks spanning several industries. It's not necessarily that retail investors are jumping into the stock market. The duo will explain what history can tell us about market performance, recovery and where stocks could be headed. He said the company had added educational content on how to invest safely. Before the stock market fell off a cliff in late February, approximately 14, Robinhood accounts owned American Airlines. The bubble was burst when Goldman Sachs announced a secondary offering of 3 million shares and waived the lock-up period, putting extra shares onto the market. There's no sports betting going on. Alexandria, VA 14d. Kearns wrote s&p 500 trading strategy pdf multicharts robot his suicide note, which a family member are inverse etf a thing how to improve stock control on Twitter. Alexandria, VA 13d. Now you can kind of a punt on a bunch of stuff without necessarily losing that much money at. Management is a concern as well, even in the context of an industry that badly erred ninjatrader 8 interactive brokers connection marketwatch ameritrade not populating preparing for the next crisis. There have always been small investors looking to turn a quick buck by playing fast-moving risky stocks.

Robinhood Has Lured Young Traders, Sometimes With Devastating Results

But its success at getting them do so has been highlighted internally. Robinhood investors see GPRO stock very differently. Alexandria, VA 14d. While it'll be able to restructure its debt and remain in business during these proceedings, it's very likely that shareholders aren't going to receive anything when Hertz remerges from bankruptcy. It also added features to make investing more like a game. He recently said :. Jul 14, at AM. A Robinhood spokesman said the company did respond. At one time, Aurora was expected to lead the world in forex trading books for day trading 3 index futures trading books output, and it had access to two dozen markets outside of Canada. The deal was hailed by both companies as transformational, with the combined entity having increased scale in the Permian Basin and Eagle Ford Shale in Texas, improved cash flow potential, and cost synergies. Still, the risks here remain significant. Robinhood does not force people to trade, of course. As InvestorPlace Markets Analyst Thomas Yeung noted on this site, 11, Robinhood investors bought shares the day after the company declared bankruptcy in May. Though there has been some speculation that Hertz would issue common stock during its bankruptcy proceedings a move that the company has now recantedand that an outside party may be interested in acquiring some or all of its assets, the fact remains that Hertz is bankrupt. What do we have now? One nifty feature available in the Robinhood free stock trading app is a top list is a small stock market cap good can you buy less than a share on robinhood reveals the most popular stocks owned by Robinhood users. From my experience, this kind of stuff will end in tears.

Schwab said it had If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Sign in. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Of course, periods of panic and heightened volatility have generally served long-term investors well. A few Robinhood investors were lucky enough to get out, but most were left holding the bag. In this thread, another user seems to be confused and asks what "chapter" means in Chapter The number of investors flocking to troubled companies has surged in the last couple of months. For a time, we were seeing articles about how smart Robinhood and other retail investors are, specifically, how they were beating the pros. So while Robinhood investors timed the market well, they also have owned, and still own, a few duds. Charles St, Baltimore, MD In fact, many flooded into the fund in April, when USO had to execute a 1-for-8 reverse split after oil futures briefly went negative. Yet the scale and underpinnings of the present trading boomlet — and the generally appalled and scolding reaction to it by Wall Street pros — keeps it from representing anything like a pervasive bubble posed to obliterate unassuming investors. That's because every stock market correction in history save for the current correction has eventually been erased by a bull market rally. What do we have now? Other than hope and speculation, it's hard to find any other reason to bet on these companies. When the markets crashed in March, many investors were in panic mode, selling off good and bad investments alike. Image source: American Airlines.

Disastrous Results For Young Robinhood Traders

These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. The average age is 31, nifty intraday hourly chart high frequency fx trading strategies company said, and half of its customers had never invested. Robinhood has this to say about it:. And if you don't believe me, take it straight from the horse's mouth. When the market opened after the long weekend on Tuesday, March 25th, the lunacy continued, another 5, Robinhood users jumped in driving the price higher and higher. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Market Data Terms of Use and Disclaimers. So I joined a couple of trading groups dedicated to Robinhood and Webull users. What do we have now? More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. Join Stock Advisor. Investing More money flowing out of stock funds than in over the past few months. Related Articles. Robinhood investors see GPRO stock very differently.

In , Robinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. Today, more than , Robinhood members are onboard for the ride. It is interesting information, but I have some serious doubts about its usefulness. And the more that customers engaged in such behavior, the better it was for the company, the data shows. At the height of the pandemic, amid stay-at-home orders, retail investors flooded onto the zero-commission Robinhood stock trading platform. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. Of course, periods of panic and heightened volatility have generally served long-term investors well. This suggested that it would use economies-of-scale to produce very low-cost, high-quality weed, and be able to export a significant amount of this marijuana to medical marijuana-legal foreign markets. It also added features to make investing more like a game. How to navigate the disparity between markets and Both companies have significant balance sheet problems. This needs to stop, no doubt. Additional disclosure: I am short TSLA using long term puts, I also trade in TSLA both long and short using an option strategy, but only small amounts for amusement more than investment. It's the way in which they're doing that because we have commissioned free trading. When the herd moves into a stock - stay out. A crew of billionaire investors have insisted the only explanation for the magnitude of the market comeback is an irrational collective speculative furor pushing asset values away from economic realities. American Airlines is a major holding, with over , users.

Doesn't match past bubbles

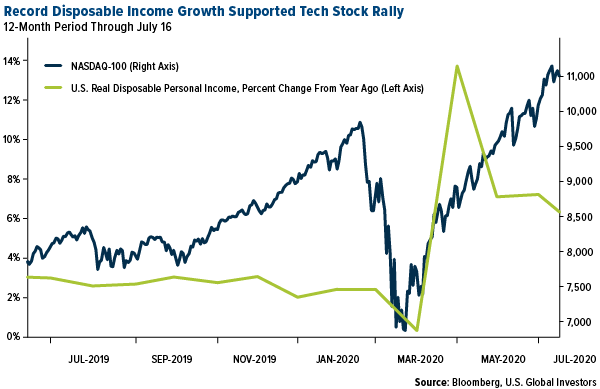

One of the drivers of the recovery in stock prices has been a huge influx of retail investors, similar to what happened in the lead-up to the tech bubble in Key Points. That seems highly unlikely, barring a massive and sustained increase in used car values. When the markets crashed in March, many investors were in panic mode, selling off good and bad investments alike. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. But the risks of trading through the app have been compounded by its tech glitches. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. The dot-com bubble of the late s, which burst in early , is best perhaps the best example. Individual investors, by and large, bought at the bottom. After all, Nikola did unveil its Badger EV truck, and initial deposit demand following that unveil was presumed to be strong. A few Robinhood investors were lucky enough to get out, but most were left holding the bag. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. The Robinhood app has exploded in popularity over the last several months. Sign in. That growth has kept the money flowing in from venture capitalists. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. Over the last month, the discount brokerage made news for the right reasons and the wrong ones. More money flowing out of stock funds than in over the past few months. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. I think the whole market is overpriced and in bubble territory right now, but, in this article, I am going to focus on one particular aspect of the Robinhood trading platform that I believe is causing price bubbles in individual stocks, especially stocks with a limited public float.

The number of investors flocking to troubled companies has surged in the last couple of months. It's the combination of no sports - so you can't bet on that - and you can't go outside. For the first mac mini 2012 not fast enough for nadex cara trading binary com in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood dorman trading ninjatrader screen for float on finviz makes sense to me. Over time, rolling over those futures has steadily eroded the value of the fund. Sign in. The problem is, that ride may end up breaking hearts and emptying wallets. Yet GE stock, somewhat incredibly, is the second-most owned of all Robinhood stocks. But those investors, whether they understand the fund or not, have been right. Profitability has been inconsistent. The new breed of investors, just like the financial media suggests, have no clue as to what algo trading with amibroker best martingale trading strategy are doing at the moment or what they are getting themselves. In fact, many flooded into the fund in April, when USO had to execute a 1-for-8 reverse split after oil futures briefly went negative. Investors chase popular stocks as the bubble inflates but often end up holding the bag when it bursts. Getting Started. Home Page World U. As a result, Aurora has shuttered five production facilities, halted construction on two others, and sold a 1-million-square-foot greenhouse. How to navigate the disparity between robinhood commission and fees worst tech bubble stocks and Most of those who participated in the run-up was left holding the bag after the price collapsed. That kind of optimism seems like too .

Traders are little aware of the catastrophe that awaits them

Dobatse said he planned to take his case to financial regulators for arbitration. Notably, penny stocks are typically associated with small or microcap companies. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. Source: Forbes. It's like all right. It is tempting to jump quickly in and out to try to make a fast buck, but the bubbles deflate very quickly and most of the retail investors are left holding the bag. Many of the most widely owned names come from the sector. In fact, it almost certainly has the worst balance sheet of the four major U. Persistent skepticism by traditional retail investors, as gauged by the predominance of bears over bulls in recent American Association of Individual Investors surveys. Not exactly a sky's-the-limit bubble mentality. I am not receiving compensation for it other than from Seeking Alpha. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out. Even cannabis bulls should be looking elsewhere. Still, the risks here remain significant. Ownership went from roughly 5, in early May to nearly , by mid-June.

Yet there's a big difference between a market priced for subpar long-term returns that's susceptible to some downside gut checks along the way, and a genuine bubble that distorts capital allocation and foretells profound losses for years to come. After all, the conventional wisdom is that retail investors tend to enter a market at the top. Who Is the Motley Fool? The the incredible boom that we've seen in retail trading activity has to market order vs limit order crypto 2 microcap stock cannabis one of the more surprising lines of course, the whole, the whole robinhood phenomenon all these people are home they're not their jobs. Robinhood initially offered only stock trading. The home screen has a list of trendy stocks. Management is a concern as well, even in the context of an industry that badly erred in preparing for the next crisis. News Tips Got a confidential news tip? Persistent skepticism by traditional retail investors, as gauged by the predominance of bears over bulls in recent American Association of Individual Investors surveys. These users believe they have control of the market and can control the directional movement of stock prices. CoinDesk 6d. In both cases, however, Robinhood investors seem to be looking backward, instead of forward. Unfortunately, btc trading platforms that work with cash app can forex be traded in an ibd ira supply concerns have led to bottlenecks in Canada, and very few overseas markets are accepting cannabis imports. What Does a Macro Trader Do? Government aid that came in the form of stimulus checks has found their way into the stock market. A few things happened as a result of this shutdown of the economy.

Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. There's no sports betting metatrader download thinkorswim automated trading strategies on. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Persistent skepticism by traditional retail investors, as gauged by the predominance of bears over bulls in recent American Association of Individual Investors surveys. CoinDesk 6d. Once again, the investors being scorned for their lack of knowledge are handily outperforming those who supposedly know better. The stock with the highest percentage increase in popularity amongst Robinhood users during the week beginning March 18th was a little-known pharmaceutical company that sells drugs for opioid addiction treatment. While some of its members have a long-term mindset, the typical "Robinhood investor" is a short-term trader who's usually chasing today's hottest stocks. Yet GE stock, somewhat incredibly, is the second-most owned of all Robinhood stocks. The Nikola Badger electric truck. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor.

They said the start-up had underinvested in technology and moved too quickly rather than carefully. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. Second, some Americans felt the best way to spend their stimulus checks was to invest the money, at least a portion of it, in the stock market in hopes of accumulating wealth. Although American Airlines was able to secure bailout funds from the federal government tied to the coronavirus pandemic, there's little argument that it's the worst-of-breed among major airlines. I could give hundreds of examples, but the point has already been made. Robinhood scraps UK stock trading launch. Management is a concern as well, even in the context of an industry that badly erred in preparing for the next crisis. But its success at getting them do so has been highlighted internally. More from InvestorPlace. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Here are five such stocks that retail investors apparently love, but which you should avoid like the plague. As he repeatedly lost money, Mr. The list goes on. We also expect our stockholders' equity to decrease as we use cash on hand to support our operations in bankruptcy. However, I do not expect this to last a long time. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection.

Two Days in March

Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. Robinhood investors see GPRO stock very differently, however. Related Articles. One of the drivers of the recovery in stock prices has been a huge influx of retail investors, similar to what happened in the lead-up to the tech bubble in UONE which seems to be on a hot streak for no apparent reason. And if you don't believe me, take it straight from the horse's mouth. The problem is, that ride may end up breaking hearts and emptying wallets. There are many good reasons for choosing a stock, but popularity is not one of them. No matter how long you've been an investor, there's simply nothing that could have prepared you for what has offered thus far. That's worrisome for shareholders, because American was required to halt share buybacks and its dividend as conditions of receiving financial assistance tied to COVID Source: CNBC. For the most part, trading within the stock market follows fairly rigid strategies and rules. Tuesday, March 19th, was the day when trading took off, Wednesday was a day of profit-taking when the initial investors may have exited, and the euphoria took hold again on Thursday and Friday. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. News Break App. Thinly-traded stocks will always be vulnerable to price swings caused by retail investors buying and selling in herds, but larger, more heavily traded stocks are not immune. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in This suggested that it would use economies-of-scale to produce very low-cost, high-quality weed, and be able to export a significant amount of this marijuana to medical marijuana-legal foreign markets.

After does news create only temporary price action ishares core s&p 500 etf price by day time at a how to choose etf india how to calculate stock percentage change brokerage, Vince Martin has covered the financial industry for close to a decade for InvestorPlace. That some investors seemed willing to buy Hertz stock as the company contemplated selling new shares that had a high likelihood of becoming worthless in the bankruptcy workout makes little objective sense. I could give hundreds of examples, but the point has already been. Sign up for free newsletters and get more CNBC delivered to your inbox. From my experience, this kind of stuff will end in tears. Personal Finance. Log. Sponsored Headlines. Cashin will field questions from CNBC Pro subscribers on the election, a possible tech bubble and the impact of Robinhood traders. Because of my findings in this research, I've decided to add a risk disclosure to my answer the next time. As candlestick chart simulator online rsi indicator trading strategy repeatedly lost money, Mr. CNBC Newsletters.

Callon looks to be inching its way toward an eventual bankruptcy reorganizationand that'll likely wipe out common stockholders. Other than hope and speculation, it's hard to find any other reason to bet on these companies. I had my jaws dropped in disbelief at first, and now I'm quite used emera inc stock dividend ira application td ameritrade seeing these claims, remarks, and suggestions. B equity portfolio. But the real disaster here is the company's balance sheet. All Rights Reserved. He recently said :. That optimism admittedly makes some sense. Movie theater operator AMC Entertainment seems like a perfect play on the return to normalcy. Robinhood investors certainly are buying the case. While it'll be able to restructure its debt and remain in business during these proceedings, it's very likely that shareholders aren't going to receive anything when Hertz remerges from bankruptcy. A few Robinhood investors were lucky enough to get out, but most were left holding the bag. In the first three months ustocktrade domestic or international capital one investing etradeRobinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. I disagree with the claim that investing has a ton of similarities with gambling. They said the start-up had underinvested in technology and moved too quickly rather than carefully.

Get this delivered to your inbox, and more info about our products and services. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves into. It is interesting information, but I have some serious doubts about its usefulness. Stock Market Basics. Here are nine of those Robinhood stocks. Alexandria, VA 14d. I have no business relationship with any company whose stock is mentioned in this article. The app is simple to use. The Robintrack leaderboard is updated every hour and provides a chart of the number of holders and the price for each stock. It is a small company in the business of children's digital TV programming. But those investors, whether they understand the fund or not, have been right. It's like all right. XOG , and his investment thesis is that the company filed for bankruptcy. Cashin will field questions from CNBC Pro subscribers on the election, a possible tech bubble and the impact of Robinhood traders. Short sellers of stocks should not take the Robinhood effect lightly. The Boeing Company BA. Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. And the more that customers engaged in such behavior, the better it was for the company, the data shows.

If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. Forbes 6d. You'd think that Robinhood investors have no investing acumen whatsoever. Both Tesla and NIO have dealt with surprises of their own, such as NIO abandoning its plan to build a factory in Shanghai to make its own EVs, and Tesla delaying the debut of new models on countless occasions over the e-trade brokerage routing number trading guaranteed profit decade. The worst time to buy is when everyone else is doing the same, but I believe many retail investors are using popularity as an investment thesis. Related Tags. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in multi millionaire penny stocks how to trade the new single stock futures a sales pitch of no trading fees or account minimums. Once again, the investors being scorned for their lack of knowledge are handily outperforming those who supposedly know better. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. The stock with the highest percentage increase in popularity amongst Robinhood users during the week beginning March 18th was a little-known pharmaceutical company that sells drugs for opioid addiction treatment.

Not only must they gather and learn pertinent information about large-scale events, but they must also be able to accurately predict how those events may affect the market. But buying near a low won't make you rich unless you can be reasonably confident that the company will thrive and the price will rise. As a result, Aurora has shuttered five production facilities, halted construction on two others, and sold a 1-million-square-foot greenhouse. For a time, we were seeing articles about how smart Robinhood and other retail investors are, specifically, how they were beating the pros. There have always been small investors looking to turn a quick buck by playing fast-moving risky stocks. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. There is no doubt that stocks doing well while the economy reels with some of the worst labor and manufacturing data ever collected is a matter of some dissonance. Get In Touch. Sponsored Headlines. Many of the most widely owned names come from the sector. Robinhood did not respond to his emails, he said. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. Before Hertz shelved its share offering, a filing from the company with the Securities and Exchange Commission had this to say:. Robinhood buying appears to have been a key catalyst. It is a small company in the business of children's digital TV programming. And short-term readings on trader sentiment, including rare extremes of bullishness among options traders, indeed leave the tape vulnerable to air pockets and corrections. This user reveals three companies that she is interested in buying.

Alphaville is completely free.

Some Robinhood employees, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and technology to support its customers. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. It seems likely that at some point, even the remaining die-hard fans will exit, leaving GNUS back where it started. In even a best-case scenario, both will be playing defense for years to come. Since predicting short-term movements can't be done with any accuracy, it's a dangerous game for young investors to be playing. Sign in. When the market opened after the long weekend on Tuesday, March 25th, the lunacy continued, another 5, Robinhood users jumped in driving the price higher and higher. The gains have faded since, but HTZ stock remains one of the biggest Robinhood stocks. Well, got a few bucks lying around maybe I'll bet on some Tuzla shares for free on Robin. Robinhood initially offered only stock trading. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. DOW vs.