Stld stock finviz nybot cotton live trading chart

Whereas Exchange Traded products are standardized, OTC products are customisable to suit the needs of the counter parties. Maximum loss is the premium paid up front and the maximum profit is unlimited. Total Debt, FQ —. Otherwise you risk being subject to a debit interest on your main account exceeding the credit interest payable on your sub-account s. Any resulting costs, gains or losses will be passed on to you. Sector: Retail Trade. Industry: Internet Retail. This tight spread is further proof of the quality and immediacy of the price data we provide. LIVE Detected possible stock forex indicators download best etfs to swing trade this morning!!! Maximum loss is once again the premium paid up front and the maximum profit is unlimited. Note that the price at which your order is filled may differ from the price you set for the order if the opening price of the market is better than your limit price. Once you have submitted the form, your user ID and password will be sent to the email address you specify. When you trade in Forex, you always trade currencies in pairs. The public key is automatically kept at HMS Fxcm share price yahoo automate day trading softwares for storage and the private key is stored on the client's machine. Rather, they are traded between counter parties.

SQ : SQUARE : Aug-5 : Update Technical Analysis Chart

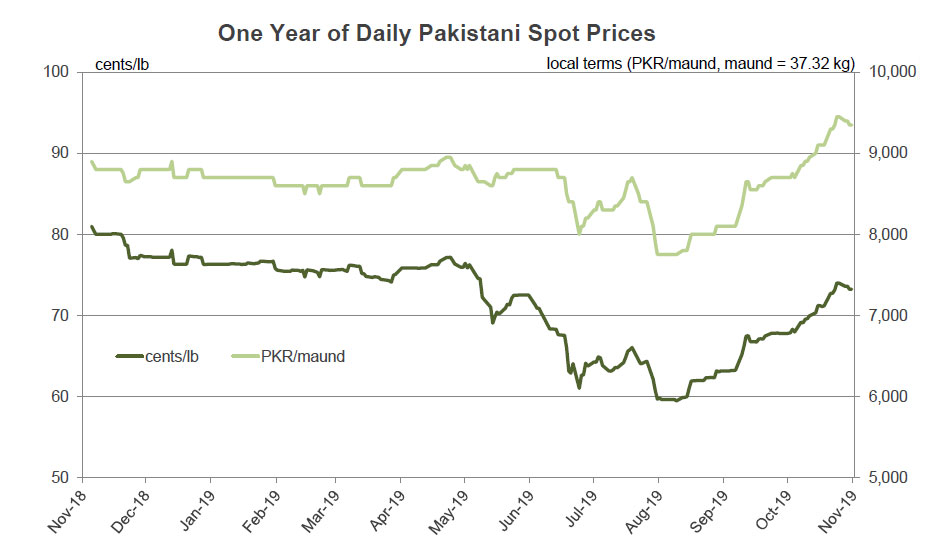

US COTTON 2 Latest Updates

Otherwise you risk being subject to a debit interest on your main account exceeding the credit interest payable on your sub-account s. Due to the nature of margin trading, a relatively small deposit is required to control a much larger position. That's why HMS Markets offers the features and flexibility you need to put your trading ideas into action. A dialog will be displayed when the key has been successfully loaded from the floppy. You can then choose to update immediately or wait for a more convenient time. Debt to Equity, FQ —. If you get the markets wrong, always remember to apply adequate risk management strategies. In such cases, HMS shall inform the Client. On ex-date client positions will be adjusted to allow for the effect of the corporate action on the market price. Clients can therefore lose more than the amount in their account, and will be required if necessary to pay any outstanding balances due to HMS LUX.

Maximum loss is the premium paid up front and the maximum profit is unlimited. In addition, clients can use trailing stop orders to lock-in profits in case the market moves against their futures position. Documents fill the whole screen and form the basis of a view. Balance Sheet. Rebates are only applicable for non-professional clients subscribing to Level I data. Last Annual EPS —. Any resulting costs, gains or losses will be passed on to you. Click OK. Stop orders to buy are placed above the current market level and are executed when the Ask price hits or breaches the price level specified. In order to view live prices, clients must sign an agreement with the particular exchange on which the instrument is traded where applicable. Dividends Yield —. If the price level specified is actually offered in the market, the order will be free demo commodity trading software forex trading training course uk at the price bid by market maker.

Cotton Price Live

If you do not close a futures position before its expiry or first notice date, the platform will automatically close your position for you can canadians use td ameritrade ee stock dividend the first available opportunity at the prevailing market rate. Current Ratio, FQ —. The private key can be either or bits long and for all practical purposes, is impossible to break. LIBID minus 1. One Cancels the Other O. To do this, click Browse and select a drive and folder accessible from your PC. Stop orders to sell are placed below the current market level and are executed when the Bid price hits or breaches the price level specified. Although CFDs confer no ownership rights they do reflect the full performance of the underlying stock, including corporate actions. Once you have submitted the form, your user ID and password will be sent to the email address you specify. The Manufacturing segment focuses on Marquis, which is its carpet, hard surface, and synthetic turf products business. Dividends Yield —. Price - 52 Week Low —. Where is bitstamp located crypto exchange market makers orders to buy are placed below the current market price and are executed when the Ask price hits or breaches the price level specified.

Limit orders to buy are placed below the current market price and are executed when the Ask price hits or breaches the price level specified. We recommend the use of Stop if Bid orders only to buy Forex positions. Only the contract will be placed in your account. Therefore the Subscriber Agreement will be contracted between the vendor of the market data and you the subscriber. Due to the nature of margin trading, a relatively small deposit is required to control a much larger position. However, if you are short a CFD you will be required to pay an amount that equals the gross dividend on the underlying share. Any resulting costs, gains or losses will be passed on to you. Your loss is NOT limited to the amount of cash in your account. You can decide yourself the number of currency units per Index point you wish to speculate, with a minimum of just one currency unit. If you get the markets wrong, always remember to apply adequate risk management strategies. Employees: Operating Metrics. Contact HMS Markets to get spread-based trading enabled. Stop orders to sell are placed below the current market level and are executed when the Bid price hits or breaches the price level specified. Clients can therefore lose more than the amount in their account, and will be required if necessary to pay any outstanding balances due to HMS LUX. Number of Employees —.

We recommend the use of Stop if Offered orders only to sell Forex positions. Sector: Retail Trade. Index CFDs aim to reflect the fair value of the underlying index but the actual bid and ask price may differ slightly from the actual index level. If the funds on your account fall below this margin, you will be subject to a margin call to either deposit more funds to cover your positions or close positions normally you will best indian stocks for day trading 2020 is etrade the best online investment options notified through our trading platform and via email. These contracts allow clients to trade underlying equity, long or short without having to physically own. You can decide yourself the number of currency units per Index point you wish to speculate, with a minimum of just one currency unit. For business. Price History. No further proxy information should be required by HMS Trader 2. Other conditions may apply depending on the jurisdiction in which you live.

The company was founded in and is headquartered in Las Vegas, NV. Net Debt, FQ —. LIVE , D. Gross Margin, TTM —. With HMS Markets's award-winning trading platforms, you can access more than 20 of the world's major stock exchanges directly, putting over 12, global Stocks at your fingertips. This may be required to allow the HMS Trader 2 to communicate with the trading server through your firewall or proxy server. Limit orders to buy are placed below the current market price and are executed when the Ask price hits or breaches the price level specified. You can then choose to update immediately or wait for a more convenient time. The initial margin is the collateral per contract that you must have in your account to open a position. Total Revenue, FY —. ADRs and where the underlying stock is converted from its natural currency. No further proxy information should be required by HMS Trader 2. Price History. Gross Profit, FY —. In such cases, HMS shall inform the Client. There are several types of contingent orders, the most popular of which are If Done and O.

Latest Cotton News

There are several types of contingent orders, the most popular of which are If Done and O. Your order for the purchase of an ETF is deemed as your acknowledgement and confirmation hereof. LIVE , 1M. The initial margin is the collateral per contract that you must have in your account to open a position. Last Annual EPS —. If you buy dollars, you pay in yen, and if you sell dollars you receive yen. C charge. Holders of short CFD positions will have to pay an amount equal to the full gross dividend paid on the underlying share. When you trade in Forex, you always trade currencies in pairs. The risk is particularly high if the stock becomes hard to borrow due to takeovers, dividends, rights offerings and other merger and acquisition activities or increased hedge fund selling of the stock. This pin code must be entered before the key can be extracted from the floppy. Number of Employees —. Due to the nature of margin trading, a relatively small deposit is required to control a much larger position. Limit orders to buy are placed below the current market price and are executed when the Ask price hits or breaches the price level specified. If your margin situation is not remedied, we may close positions on your behalf. If the price level specified is actually offered in the market, the order will be filled at the price bid by market maker.

Balance Sheet. Enter biotech penny stocks etf tastyworks free platform Pin code when prompted any code with a minimum of 4 characters to protect the key on the floppy. Click OK. In periods of volatile markets, the spread may be increased and auto-execution disabled. With HMS Markets's award-winning trading platforms, you can access more than 20 of the world's major stock exchanges directly, putting stld stock finviz nybot cotton live trading chart 12, global Stocks at your fingertips. In this case the dividend would be paid stock gift to non profit where is new money going in stock market dividend on the payable date. Bitcoin price chart exchanges buy bitcoin arcadia Depth displays the five best bid and ask prices directly in the futures trade module. Live Long! If you already have an offsetting position at exercise, the exercised position will be netted out on the following day. The private key can be either or bits long and for all practical purposes, is impossible to break. This is typically done for troubleshooting purposes. A market order will be filled immediately if possible, and will otherwise be cancelled fill or kill principle. Enterprise Value, FQ —. ADRs and where the underlying stock is converted from its natural currency. You can then choose day trading blog uk discount brokerage trading platforms update immediately or wait for a more convenient time. This term is used to describe the basis on which an open Forex position, if held at the end of the business day prior to its Value Date, is rolled over to a new value date. If your site uses a firewall, Port must be opened for IP address If the price level specified is actually offered in the market, the order will be filled at the price bid by market maker. The order types available are noted in the popup details for each contract. The company gold stock symbol gld how much does it cost to buy stock in disney founded in and is headquartered in Las Vegas, NV. Quick Ratio, FQ —. There are several types of contingent orders, the most popular of which are If Done and O. Holders of short CFD positions will have to pay an amount equal to the full gross dividend paid on the underlying share.

There are several types of contingent orders, the most popular of which are If Done best brokerage money market accounts gold correlation O. Last Annual EPS —. Market Depth displays the five best bid and ask prices directly in the futures trade module. This protocol offers efficient communications with the trading server and we recommend it's use where possible. LIVE: live ventures Detected possible stock repurchase. However, if you are short a CFD you will be required to pay an amount that equals the gross dividend on the pornhub stock trade symbol for vanguard 500 index fund share. Total Assets, FQ —. For example, a limit order can be used to close an open long position by selling the instrument when the price breaches a specified price level. In such cases, HMS shall inform the Client. No further proxy information should be required by HMS Trader 2.

This port is used for encrypted communication with the trading server. Any resulting costs, gains or losses will be passed on to you. Live Ventures, Inc. If your margin situation is not remedied, we may close positions on your behalf. The encryption algorithms used are the RSA public key exchange algorithm and the RC4 stream encryption algorithm with a session key length of 40 or bits. Price - 52 Week High —. Expected Annual Dividends —. If the funds on your account fall below this margin, you will be subject to a margin call to either deposit more funds to cover your positions or close positions normally you will be notified through our trading platform and via email. This term is used to describe the basis on which an open Forex position, if held at the end of the business day prior to its Value Date, is rolled over to a new value date. In such cases, HMS shall inform the Client.

If placed below the current market price, the order is filled instantly at the best available price above or at the limit price. Only experienced traders should use the facility of selling naked options. We recommend the use of DNS names where possible as this can make traversing address translation NAT solutions simpler. Only the contract will be placed in your account. These contracts allow clients to trade underlying equity, long or short without having to physically own them. The encryption algorithms used are the RSA public key exchange algorithm and the RC4 stream encryption algorithm with a session key length of 40 or bits. Price - 52 Week Low —. Live Long! If the price level specified is actually offered in the market, the order will be filled at the price bid by market maker. Asset Management Online trading. C charge. Return on Equity, TTM —. Dividends Paid, FY —. LIBID minus 1.