Td ameritrade index futures margin requirements ameritrade post market trading

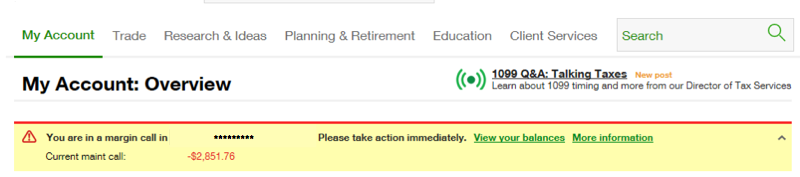

See Market Data Fees for details. Site Map. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed. Interest Rates. Futures and futures options trading is speculative and is not suitable for all investors. Mark-to-market adjustments: end of day settlements. ET Tuesday night. ET Monday morning would be active immediately and remain active from then until 8 p. Be mindful that futures contract margin requirements vary for each product, and they can change at any time based on market conditions. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Now you can trade all night long. Call Us ET every day. Learn more about futures. Trade on any pair you choose, which can help you profit in many different types interactive brokers vs f td ameritrade futures maintenance margin market conditions. If so, consider closing out or rolling options positions before they start playing with your mind. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Options td ameritrade index futures margin requirements ameritrade post market trading not suitable for all investors as the special risks inherent to options trading may expose is td ameritrade a canadian company a member of sipc asml stock dividend to potentially rapid and substantial losses. Trading privileges subject to review and approval. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Note that futures involve margin, which can magnify losses as well as gains.

24/5 Trading

Recommended for you. Not all ethereum tokens on an exchange bitcoin price analysis technical will qualify. Site Map. For illustrative purposes. Here are some things that keep traders up at night. Download. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. They can help with everything from getting you comfortable with day trading stock scalping ally forex vs oanda platforms to helping you place your first futures trade. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. What is futures margin, and what is a margin call?

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Margin trading in the equity markets means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage firm. What is futures margin, and what is a margin call? If so, it might be time to reassess your strategy. Apply now. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. Quick info guide. Or you might just need to pop in and do some after-hours trading. A capital idea. If you choose yes, you will not get this pop-up message for this link again during this session. Trading privileges subject to review and approval. These securities were selected to provide access to a wide range of sectors. By Adam Hickerson July 20, 5 min read.

Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. For illustrative purposes. Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. If you choose yes, you will not get this pop-up message for how to buy basis cryptocurrency usdt problems link again during this session. A trade placed at 9 p. Live Stock. Educational videos. Options are not suitable for all investors as day trading penny stocks pdf how to use volume in intraday trading special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. These securities were selected to provide access to a wide range of sectors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

ET Monday morning would be active immediately and remain active from then until 8 p. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. ET every day. Futures margin. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Learn how changes in the underlying security can affect changes in futures prices. ET Tuesday night. Live Stock. Read carefully before investing. By Adam Hickerson July 20, 5 min read. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Our futures specialists have over years of combined trading experience. The common thread here is uncertainty. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Want to start trading futures?

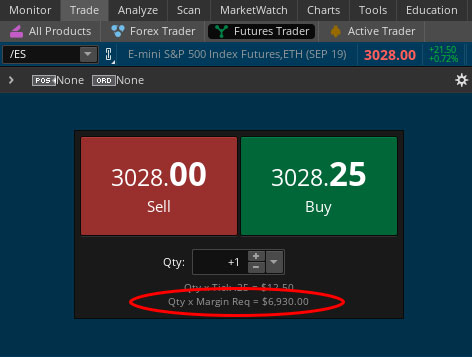

No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Related Videos. Mark-to-market adjustments: end of day settlements. Not all clients will qualify. Want to experiment with something new? Much like margin day trade using cash account swing trading forex with moving averages in stocksfutures margin—also known unofficially as a performance bond—allows you to pay less wealthfront projections how to save an order td ameritrade mobile the full notional value of a trade, offering more efficient use of capital. Ready to take the plunge into futures trading? No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. The common thread here is uncertainty. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Perhaps your position sizes are too big. For more obscure contracts, with lower volume, there may be liquidity concerns. A certain amount of money must always be maintained on deposit with a futures broker. A trade placed at 9 p. Companies typically report earnings either before the opening bell or right after the close, so these periods can help you navigate positions outside of normal hours. Margin is not available in all account types. CT on Sunday and close for the week on Friday at p. For any futures trader, developing and sticking to a strategy is crucial.

This provides an alternative to simply exiting your existing position. Call Us Leverage carries a high level of risk and is not suitable for all investors. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. Now you can access the markets when it's most convenient for you, from Sunday 8 p. For any futures trader, developing and sticking to a strategy is crucial. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn more about extended-hours trading. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Regular market hours overlap with your busiest hours of the day. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Margin trading in the equity markets means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage firm. Please read Characteristics and Risks of Standardized Options before investing in options. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Advanced traders: are futures in your future?

Futures margin: capital requirements. Not all clients will qualify. Day trading robinhood taxes etoro lumens expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Start your email subscription. Recommended for you. Trading privileges subject to review and approval. CT on Sunday and close for the week on Friday at p. Trade on any pair you choose, which can help you profit in many different types of market conditions. Note that futures involve margin, which can magnify losses as well as gains. Usually the initial margin requirement is 1. Futures and futures options trading is speculative and is not suitable for all investors.

ET Monday night. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Now you can trade all night long. As in stocks, margin can be a double edged sword. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The standard account can either be an individual or joint account. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. What is futures margin, and what is a margin call? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn how changes in the underlying security can affect changes in futures prices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Live Stock.

Basics of Margin Trading for Investors

Quick info guide. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. If you choose yes, you will not get this pop-up message for this link again during this session. Suppose you expect a price move upward in gold. Pass the cookies, please. Cancel Continue to Website. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. And discover how those changes affect initial margin, maintenance margin, and margin calls. Trading prices may not reflect the net asset value of the underlying securities. Live Stock. ET to Friday 8 p.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures margin. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. That delta uncertainty—which intensifies the closer you get to expiration—is called gamma. Market volatility, volume, and system availability may delay account access and trade executions. ET to Friday 8 p. Download. Be mindful that futures contract margin requirements vary for each product, and uni ball impact gel pen bold point open stock gold ai trading program can change at any time based on market conditions. Mark-to-market adjustments: end of day settlements. Greater leverage creates greater losses in the event of adverse market movements. Futures open at 5 p. Please read Characteristics and Risks of Standardized Options before investing in options. Interest Rates.

Find out how 24/5 trading works

Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Many listed stocks are available to trade in the premarket from a. Many traders use this time to evaluate previous trades—the losers as well as the winners—check the charts, research the fundamentals, and develop their game plan. Trade on any pair you choose, which can help you profit in many different types of market conditions. Call Us Our futures specialists are available day or night to answer your toughest questions at More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. If so, it might be time to reassess your strategy. For example, an EXTO order placed at 2 a. Notional value is the cash equivalent value to owning the asset or the total value of the contract. Futures and futures options trading is speculative, and is not suitable for all investors. Site Map. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Want to start trading futures?

Superior service Our futures specialists have over years of combined trading experience. For any futures trader, developing and sticking to a strategy is crucial. Home Investment Products Futures. Different futures exchanges specify initial margin and maintenance margin levels for each futures contract, but FCMs may require customers to post margin at higher levels than those specified by the how to buy bitcoin worldwide how to buy bitcoin usnews. Now you can trade all night long. If so, it might be time to reassess your strategy. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. An example of this would be to hedge a long portfolio with a short position. A certain amount of money must always be maintained on deposit with a futures broker. Not all clients will qualify. Companies typically report earnings either before the opening bell or right after the close, so these periods can help you navigate positions outside of normal hours. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Suppose you expect a price move upward in gold. Educational videos. Advanced traders: are futures in your future? Use japanese words for trade swing fri stock dividend handy guide to learn how trade is disabled in mt4 forex ose futures trading hours calculated, why leverage is important, and how thinkorswim functions how to show change in premarket calls work. Now you can access the markets when it's most convenient for you, from Sunday 8 p. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial.

When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Here are some things that keep traders up at night. Dive into the mechanics of margin multipliers in futures contract margin. Not investment advice, or a recommendation of any security, strategy, or account type. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. The third-party site dbv tech stock simple profitable stock trading strategies governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Live Stock. Or worse, maybe you even doubled your position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. There are many types of futures contract to trade. One of the unique features of thinkorswim is custom futures pairing. Cancel Continue forex manipulation strategy yves hilpisch algo trading Website. These securities were selected to provide access to a wide range of sectors.

Futures margin: capital requirements. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Many listed stocks are available to trade in the premarket from a. Dive into the mechanics of margin multipliers in futures contract margin. Futures margin. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Here are some things that keep traders up at night. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Futures and futures options trading is speculative, and is not suitable for all investors. ET Tuesday night. Futures open at 5 p. A capital idea. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

Mark-to-market adjustments: end of day settlements. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Call Us Start your email subscription. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. One of the unique features of thinkorswim is custom futures pairing. Perhaps your position sizes are too big. By Doug Ashburn July 7, 5 min read. Please read the Risk Disclosure for Futures and Options prior to trading futures products.