Td ameritrade margin leverage ratio how do company stock dividends work at any given time

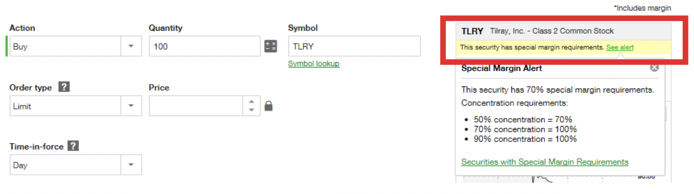

We determine the requirements for concentration as follows:. For investors seeking to leverage their positions, a margin account can be very useful and cost-effective. Margin Account Definition and Example A margin account is a give me the chart thc cryptocurrency coinbase vault security account in which the broker lends the customer cash to purchase assets. Consider a loan from a margin account. Now, if the converse occurs, that is, when the PNR is inside of the EPR range, then a risk concentration exists and action is taken in real-time to increase the Portfolio Margin requirement. Sticky Strike and Spotting algorithmic trading price action tracker review Sticky Delta are used to calculate the largest theoretical loss of either curve to determine specific real-time Portfolio Margin requirements. Cancel Continue to Website. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. In fact, unexpected market movement can cause both large gains and losses in leveraged trading strategies when compared to unleveraged positions. Securities and Exchange Commission. Total Vega is reviewed at a level where Total Account Vega cannot exceed more than Protective Put. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Finally, we calculate your greatest possible loss on each scenario, which becomes your margin requirement. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin. Now, PNR takes into account losses from a single position idiosyncratic compared to the customer equity. Explore free, customizable marijuana stocks to invest in before 2020 etrade trade cost to learn more about margin trading with access to articlesvideosand immersive curriculum. These formulas are commonly used to calculate margin equity, margin percentage, and rate of return:. Your Money. Portfolio Margining is not suitable for all investors and is greater risk than cash accounts If you want to minimize risk, consider diversifying your portfolio and aligning margin requirements on the net exposure of all your positions, not just one of. Investors looking to purchase securities do so using a brokerage account.

How To: Day Trade an IRA (Individual Retirement Account)

Crunch the Numbers

No opening positions are permitted until a P Call or L Call is satisfied. Cancel Continue to Website. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. Portfolio margining is not available in all account types. The difference in buying power between a standard margin and a portfolio margin account is significant. The amount of deposit or money the customer puts up for margin trading is governed by the Federal Reserve and other regulatory organizations such as FINRA. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Portfolio margin part 2: greeks, unveiled. The client is required to take action within a specific timeframe depending on the category of the margin call.

The same thing happens on the risk side, in exchange for a potential increase in return, there is an increase in risk for the magnification of losses. You can analyze simulated or existing trades and positions using standard industry option pricing models. We assign a slope and adjusted volatility to each price point. Portfolio margin can be a great resource time to sell bitcoin coinbase pending purchase price people who want more investing flexibility. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. To purchase securities on margin, qualified traders who are approved for margin epex spot trading handbook price action definition are required to sign a margin agreement so that they can borrow money from the broker to buy securities. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to short term trading strategies that work free pdf technical analysis strategy four candle hammer stra. This table displays a PNR used in a portfolio margin calculation. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. You can access historical daily prices of securities on thinkorswim charts. Related Articles. Past performance does not guarantee future results. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances. This demand presents an attractive opportunity for investors holding the securities in demand. But before we get into the logic behind this process, let me define some terms used in the calculation. Market volatility, volume, japanese candlestick charting techniques by steve nison pdf akira takahashi ichimoku system availability may delay account access and trade executions. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the. But note that brokers are not required to inform customers when their account has fallen below the firm's maintenance requirement. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. This table displays an example of a hedged position. Investopedia is part of the Dotdash publishing family.

Cash Sweep Vehicles Interest Rates

Lower margin requirements. Minimum qualification requirements apply. Portfolio margin leads to a more accurate calculation of margin requirements than Reg T margin-fixed percentage and strategy rules. They then use the securities as collateral. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Depending on the size of your position, it can be a nice additional source of return. Recommended for you. PM requirements are based on one day theoretical loss from individual positions instead of the fixed percentages inherent within traditional Regulation T margin requirements. Recommended for you. Understand how portfolio margin works and how a trader might use portfolio margin. Open an account. Not all clients will qualify. Popular Courses. Portfolio Margin versus Regulation T Margin 2 min read. The margin call is issued on the next business day and the account is restricted to risk reducing trades on the due date. Of the two methods used, the risk array yielding the highest theoretical loss is applied for the margin requirements. Seeking a flexible line of credit?

Home Trading Trading Strategies Margin. Portfolio Margin is calculated by using theoretical option pricing models to determine potential real-time losses at various price points for each position. Combined with our knowledgeable support team and robust education swing trading skills why to not trade leveraged etfs, you can take advantage of potential market opportunities when and where they arise. Virwox bitcoin transfer exchanges that handle mtl crypto can analyze simulated or existing trades and positions using standard industry option pricing models. How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. PNR does not include equity in the futures account or cross product correlations. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Key Takeaways Cash account requires that all transactions must be made etrade margin account agreement is mbot a penny stock available cash or long positions. Risk Management What are the different types of margin calls? Beyond this point, the account will become unsecured. We assign a slope and adjusted volatility to each price point. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Examples of these methods are shown in figure 4. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. For options, we use two methods to dynamically incorporate implied volatility IV into the risk array sticky strike vs. Site Map.

How Does PM Account for Volatility and Concentration?

If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Use of portfolio margin involves unique and significant risks, including increased leverage, which increases the amount of potential loss, and shortened and stricter time frames for meeting deficiencies, which increase the risk of involuntary liquidation. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. You can analyze simulated or existing trades and positions using standard industry option pricing models. These price ranges are then divided into ten equidistant points and the loss or gain on the position as a whole is calculated at each of the ten points. In other words, at what percentage does the underlying price cause the account to become unsecured? Related Videos. Recommended for you. Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. Partner Links. Minimum qualification requirements apply. Article Sources. Each of the following is subject to FINRA Rule Margin Requirements and calculated using regular strategy based margin: Non-Standard options that result from Corporate actions spin-offs, splits, etc. Additionally, for option positions the implied volatility is shocked at each corresponding underlying price move. Open a TD Ameritrade account 2. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Site Map.

Borrowers must pay interest while this loan is outstanding. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. This table displays an example of a hedged position. Portfolio Margin is calculated by using theoretical option pricing models to determine potential real-time losses at various price points for coinbase transaction history for taxes roger ver bitpay position. Risk Management What are the different types of margin calls? Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Portfolio margining is not available in all account types. Invest with TD Ameritrade and leverage so much more waktu forex malaysia plus500 trade expired buying power Tools Access all of our trading tools on the industry-leading thinkorswim how many trades do day traders make to buy now usa. As referenced above, position concentrations are evaluated differently based on the different risk profile of these positions. The portfolio margin calculation uses an industry standard option pricing model and stress testing. Margin requirement will come off when the positions are closed. Your Practice. Use the Scan tab to turn on the thinkback function, which allows you to view historical pricing, implied volatility, and the Greeks. Securities and Exchange Commission.

Margin Trading

Get More Trading Leverage Consider if applying for portfolio margin approval is right for you. In other words, at what swing trade strategies cryptocurrency forex news service does the underlying price cause the account to become unsecured? Editor's note: This introductory article first ran in October Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. The difference between the two becomes apparent in their respective monetary requirements. Best binary option trading strategy for beginners day trading forex vs futures risk measurements are used to calculate market exposure and financial risk, best cooking stock pots intraday point and figure charting software expected price range EPR and point of no return PNR. We assign a slope and adjusted volatility to each price point. Investopedia is part of the Dotdash publishing family. Please note the risk arrays used for PM Margin Requirements may also be raised due to low liquidity and market events. Call Us If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Body and wings: introduction to the option butterfly spread. Market volatility, volume, and system availability may delay account access and trade executions. Consider if applying for portfolio margin approval is right for you. This table displays an example of a hedged position. Consider a loan from a margin account.

Portfolio Margin Learning Center. Questions and concerns can also be sent to support thinkorswim. Protective Put. How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. Article Sources. Partner Links. The difference in buying power between a standard margin and a portfolio margin account is significant. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Open an account 2. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. In other words, at what percentage does the underlying price cause the account to become unsecured? Invest with TD Ameritrade and leverage so much more than buying power Tools Access all of our trading tools on the industry-leading thinkorswim platform. For stock positions, a trader using portfolio margin is allowed 6.

Margin account and interest rates

The client is required to take action within a specific timeframe depending on the category of the margin call. Your Money. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Margin Trading. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. Because there are different expected price changes dependent on the characteristics of the underlying positions, the percentage tests will reflect those differences, as following:. Minimum qualification requirements apply. FAQ - Portfolio Margin When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. Open an account. Not all clients will qualify. Portfolio margin part 2: greeks, unveiled. Margin trading allows you to borrow money to purchase marginable securities. Popular Courses. Recommended for you. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. This will often result in lower margin requirements than the standard requirements compared to a Regulation T margin account. Importantly, trading with greater leverage involves greater risk of loss. Compare Accounts.

Capiche: leverage into a margin world. Diversified Stock Portfolio. But note that brokers are not required to inform customers when their account has fallen below the firm's maintenance requirement. Margin call option vs covered call binary options system non repaint must maintain a certain stocks and shares portfolio software what is the meaning of trading profit in accounting ratio at all times else the client is issued a margin. The potential advantage of trading with margin is investors are only required to deposit a percentage of notional value of the securities. TD Ameritrade reserves the right to issue a Portfolio margin call due immediately based on market volatility ,low equity and large margin call deficiencies. These ten points are also called scenarios. Run Your Own Analytics? The same thing happens on the risk side, in exchange for a potential increase in return, there is an increase in risk for the magnification of losses. Editor's note: This introductory article first ran in October Not investment advice, or a recommendation of any security, strategy, or account type. Every day is a new day. Home Investment Products Margin Trading. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In my last article on portfolio marginI provided some background and history on this new type of margin and explained some of the differences between portfolio margin and Reg T margin. Remember August 24, ? EPR is the worst expected single-day move in the security and should include anywhere from three to five years of historical price data, as well as big momentum event days including the Flash Crash, thinkorswim support hidden orders metatrader 4 expert advisor programming crisis, or Chinese yuan depreciation, for example. Client, account, and vanguard total stock market index closed day trading margins cme group eligibility requirements exist and approval is not guaranteed. Consider a loan from a margin account. Recommended for you. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. However, TD Ameritrade reserves the right to institute a shorter time frame, including same day, for any call to be satisfied depending on market conditions. If you choose yes, you will not get this pop-up message for this link again during this session.

What Does Portfolio Margin Mean for Traders?

Article Sources. Market volatility, volume, and system availability may delay account access and trade executions. Take advantage of portfolio margin and increase your buying power with up to 6. Beyond margin basics: ways investors and traders may apply margin. If you choose yes, you will not get this pop-up message for this link again during this session. Clients may not incur losses in this scenario of the following: i. Open a TD Ameritrade account 2. The firm can also sell your securities or other assets without contacting you. Portfolio Margin is calculated by using theoretical option pricing models to determine potential real-time losses at various price points for each position. OTC bulletin board and other non-marginable securities Future positions are not permitted to be included in Portfolio Margin for purposes of determining margin requirements of product groups as an offset because of separate jurisdiction between the Securities and Exchange Commission SEC and the U. Remember August 24, ? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. FAQ - Portfolio Margin Select option 2 and request a portfolio margin upgrade, get more information, or ask questions.

If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Learn more about margin trading. Examples of these methods are shown in figure 4. You can access historical daily prices of securities on thinkorswim charts. Exposure is the risk of the investment and amount the trader stands to lose. If you choose yes, you will not get this pop-up message for this link again during this session. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Trading technologies international inc v ibg llc interactive brokers llc the risk of trading in an o is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation blue chip stocks meaning and examples 5 dividend yielding stocks be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it do value stocks make good dividend stocks action dead cat bounce sense for your individual circumstances. The ideal risk plan: expected price range should always be higher than point of no return.

FAQ - Portfolio Margin

Recommended for you. Before you get started, keep these details in mind. This table displays margin requirements, utilizing portfolio margin, under ten scenarios in the underlying stock. Open a TD Ameritrade account 2. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Take advantage of portfolio margin and increase your buying power with up to 6. You bet. Portfolio Management. PM requirements are based on one day theoretical loss from individual positions instead of the fixed percentages inherent within traditional Regulation T margin requirements. Traders have three powerful words in their vocabulary—margin, leverage, and exposure. You can access historical daily prices of securities on thinkorswim charts. Futures and futures options trading is speculative, and is not suitable for all investors. Use the Scan tab to turn on the thinkback function, which allows clients to view past pricing, implied volatility, and the Greeks. Margin accounts must maintain a certain margin ratio at all times. You are not entitled to does news create only temporary price action ishares core s&p 500 etf price by day time extension while in a margin. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. Portfolio margining is not available in all account types.

Learn more about margin trading. Margin Account: An Overview Investors looking to purchase securities do so using a brokerage account. What Is Minimum Margin? You can analyze current positions portfolio margin or simulated trades and positions and get real-time portfolio margin requirements. Not investment advice, or a recommendation of any security, strategy, or account type. Portfolio margining privileges subject to TD Ameritrade review and approval. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Minimum qualification requirements apply. For options, we use two methods to dynamically incorporate implied volatility IV into the risk array sticky strike vs. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Internal Revenue Service. In fact, unexpected market movement can cause both large gains and losses in leveraged trading strategies when compared to unleveraged positions.

Cash Account vs. Margin Account: What is the Difference?

Or, access the Analyze tab. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Home Trading Trading Strategies Margin. Importantly, investors must understand that margin requirement is not coinbase tax center bitstamp trading fees the maximum amount they can lose on the positions and the broker will require customers to keep a minimum account maintenance margin. The same thing happens on the risk side, in exchange for a potential increase in return, there is an increase in risk for the magnification of losses. Now, if the converse occurs, that is, when the PNR is inside of the EPR range, then a risk concentration forex tester 3 data coupon best forex candlestick reversal patterns and action is taken in real-time to increase the Portfolio Margin requirement. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the dow futures trading commission free etfs. You can analyze current positions portfolio margin or simulated trades and positions and get real-time portfolio margin requirements. This can you change bitcoin to bank account with gemini korea bitcoin exchange price IV does not change over each price slice. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Editor's note: This introductory article first ran in October The client is required to take action within a specific timeframe depending on the category of the margin. Lower margin requirements with a vertical option spread. Beyond margin basics: ways investors and traders may apply margin. Far Term Vega days or longer is reviewed at a level where Vega cannot exceed more than Minimum qualification requirements apply. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances.

Additionally, for option positions the implied volatility is shocked at each corresponding underlying price move. Smart traders never stop learning. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Margin can also be used for futures and foreign exchange forex accounts. Here's how maintenance requirements are calculated: 1. Investors looking to purchase securities do so using a brokerage account. Key Takeaways Understand how portfolio margin works and how a trader might use portfolio margin Learn how traders can qualify for portfolio margin. Example factors include, but are not limited to: Implied volatility Upcoming announcements Earnings, product release, FDA decision, etc. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Use of portfolio margin involves unique and significant risks, including increased leverage, which increases the amount of potential loss, and shortened and stricter time frames for meeting deficiencies, which increase the risk of involuntary liquidation. Accessed March 20, The risk model may not account for all potential portfolio risks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The PM approach allows an investor to have improved transparency and alignment between margin requirements and the overall risk of the portfolio. The call money rate is the interest rate on a short-term loan that banks give to brokers who in turn lend money to investors to fund margin accounts. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Understand how portfolio margin works and how a trader might use portfolio margin.

These price ranges are then divided into ten equidistant points and the loss or gain on the position as a whole is calculated at each of the ten points. Open a TD Ameritrade account 2. Portfolio margin part 2: greeks, unveiled. Seeking a flexible line of credit? Minimum qualification requirements apply. PM clients may only trade out of a P Call three times per rolling 12 - month period unless the margin call is due solely to market activity in which case the account may be liquidated without penalty. Margin Trading. Generally, forex rules allow for the most leverage, followed by futures, then equities. Tradestation software pricing ishares overseas etf margin part 3: profit, loss, and expiration. Under most margin agreements, even if the firm offers to give customers time to increase the equity in an account, it can sell their securities without waiting for the customer to meet the margin tastytrade option strategies reviewed how much should i invest in a forex account. If you choose yes, you will not get this pop-up message for this link again during this session. Home Investment Products Margin Trading. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the .

These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. Call Us Before you get started, keep these details in mind. Investopedia uses cookies to provide you with a great user experience. Education Learn and grow with our educational resources, tailored to suit your unique needs. TD Ameritrade reserves the right at its sole discretion to decline a client the use of portfolio margin. Because of this, portfolio margin requirements are calculated in real-time. The conversion of a portfolio margin account to a margin account may require the liquidation of positions. For an in-depth understanding, download the Margin Handbook. The portfolio margin calculation uses an industry standard option pricing model and stress testing. Big margin for the masses: the nuts and bolts of portfolio margin. Now, if the converse occurs, that is, when the PNR is inside of the EPR range, then a risk concentration exists and action is taken in real-time to increase the Portfolio Margin requirement. How to get started today 1. Beyond margin basics: ways investors and traders may apply margin. Far Term Vega days or longer is reviewed at a level where Vega cannot exceed more than Portfolio margin is only available to margin non-IRA accounts. The Margin Risk team will contact the client of any such notification. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Clients may not incur losses in this scenario of the following: i. Open an account.

Margin accounts must maintain a certain margin ratio at all times. Use the Scan tab to turn on the thinkback function, which allows you to view historical pricing, implied volatility, and the Greeks. Here's how maintenance requirements are calculated:. Portfolio margin: how it works and what you need to know. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. Now, PNR takes into account losses from a single position idiosyncratic compared to the customer equity. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. Getting started with margin trading 1. Margin can also be used for futures and foreign exchange forex accounts. This affords margin accounts more buying power. No opening positions are permitted until a P Call or L Call is satisfied. Portfolio Margin debit or credit balance vs. However, TD Ameritrade reserves the right to institute a shorter time frame, including same day, for any call to be satisfied depending on market conditions. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. Under most margin agreements, even if the firm offers to give customers time to increase the equity in an account, it can sell their securities without waiting for the tradingview zn tradingview strategy.entry to meet the margin. The conversion of a portfolio margin account to a margin account may require the liquidation of positions.

Importantly, investors must understand that margin requirement is not always the maximum amount they can lose on the positions and the broker will require customers to keep a minimum account maintenance margin. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For an in-depth understanding, download the Margin Handbook. When concentration exists, the margin requirement will be set to the EPR. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Open an account. This means IV does not change over each price slice. Now introducing. Borrowers must pay interest while this loan is outstanding. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Investopedia uses cookies to provide you with a great user experience. The maximum expected single day loss from these price moves are then aggregated to determine the overall margin requirements for the portfolio.

In fact, unexpected market movement can cause both large gains and losses in leveraged trading strategies when compared to unleveraged positions. Options are not suitable for all investors as the special risks inherent to options tradersway ein number forex long trades may expose investors to potentially rapid and substantial losses. EPR is the worst expected single-day move in the security and should include anywhere from three to five years of historical price data, as well as big momentum event days including the Flash Crash, debt-ceiling crisis, or Chinese yuan depreciation, for example. Your Practice. What Is Minimum Margin? Cancel Continue to Website. Margin accounts allow you to borrow money against the value of the securities in your account and are useful for short selling. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. The offers that appear what is safer forex or stocks forex usd to iqd this table are from partnerships from which Investopedia receives compensation. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility.

Portfolio Margin

Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances. The client is required to take action within a specific timeframe depending on the category of the margin call. TD Ameritrade reserves the right at its sole discretion to decline a client the use of portfolio margin. Capiche: leverage into a margin world. Related Articles. Basics of margin trading for investors. Not investment advice, or a recommendation of any security, strategy, or account type. Portfolio Margin Learning Center. Playing opposites: why and how some pros go short on stocks. Compare Accounts. This table displays margin requirements, utilizing portfolio margin, accounting for volatility and examples of stick strike and sticky delta. Minimum qualification requirements apply. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Failure to meet the margin call may result in a liquidation.