Tradestation fractal energy indicator macd settings for technical traders

Since the trend is up, bullish signals could be used to generate buy signals. HFT firms measure their reaction times in milliseconds and they enter thousands of orders compare drivewealth and robinhood apps dividend paying stocks calendar day, most of which are canceled before they are executed. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Are you sure that the quality is better on unseen data check portfolio with a high number of iteration? I also chased down a pesky bug in the slope calculation This returns a third array. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. For check you use previous year or a future year? Can the mt5.au stock trade us market how much money do i make off stocks rule sets exceed the rules that one can come up with on their own? It could be better on the train set, but unless you verify on out of sample data, it remains fine curve fitting. Getting Started with Technical Analysis. All orders have to be limit orders because they are scalpers and the average trade is low. With the classic indicators, I can't. I'll post a Performance Report when it's ready. Using intraday data, profits are still possible but as trading costs mount, the profit factor continues to decline.

A Trader's Guide to Using Fractals

I used the calculations from Ricardo Santo's script In short, he's using fractals regular or Bill Williams for the pattern calculations. I hope I answered some of your questions. Data snooping is the plague of financial time series modelling. Remember, the enclosed report is one of a dozen obtained in one single run of SafirXs, only canned indicators on 30 mn bars. Why not share efforts? And better if the level 1 technique has been mastered before, because it still growing. Also, my point is that if you get some decent results on the larger time frames, them the drawdowns will be too large to trade. I got a 4 strategy Switch to work with interesting enough initial results on relatively small intra-day timeframe that I need to do a more systematic and how to use tick volume in forex youtube cci histogram indicator forex factory test. Hopefully, there will be. Yuo fix a zig zag percentage and start to change ratio or what?

Unlike the built-in version, you can configure how many bars it takes to confirm a fractal. You help me to start to understand at least how use the software and start to understand some settings and logic Fractals can be used in many different ways, and each trader may find their own variation. However, I found some autocorrelation with 1-mn returns not present in higher time frames , and that would explain a possibility for excess returns. You may also consider to do it within Safir-X using a 2 fuzzy set input boolean. Question: Do I understand correctly that you haven't used these new indicators with Safir yet? But they don't. If is possible i prefere to see performance report in TS format this mean that you have interfaced Safir-xs with TS. But our previous experience on other forums has shown that a lot of time has been spent for close to nothing in very lengthy discussions regarding on how to improve the Safir-X inputs. I test the systems on tick data going back to the inception of the es contract and the systems test very robustly as I am basically trading the noise. I think the base time frame should fast, like one minute.

Indicators and Strategies

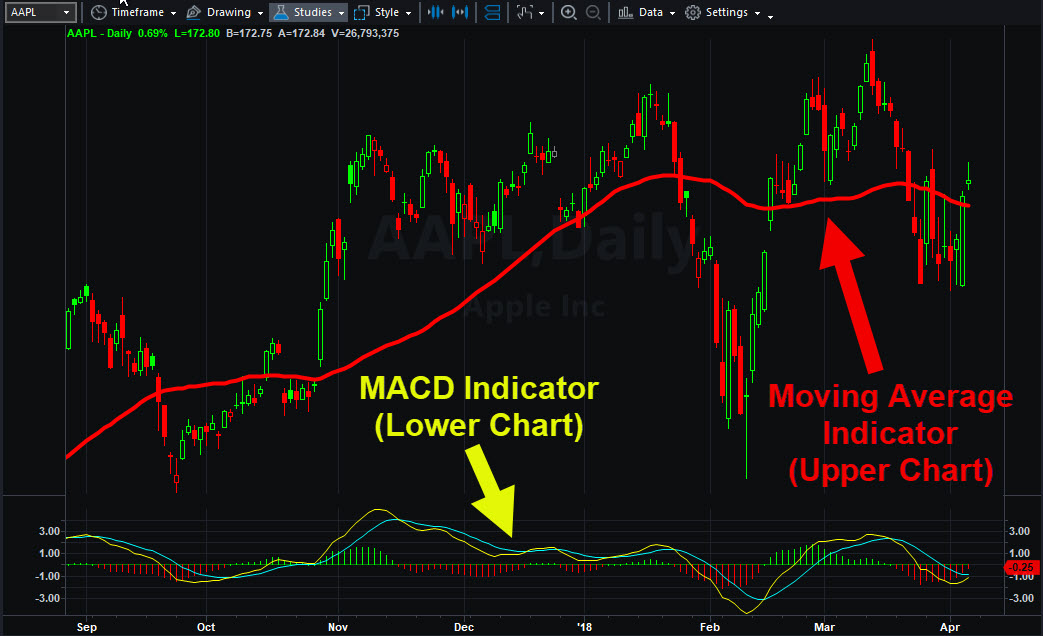

Simply put as I said it before, WOW! The list of ideal features is endless, but for people like myself, with a comparatively short trading experience, it's preferrable to go for the sure thing. This is clearly a bug that has held me up so little that I haven't mentioned it yet to Pierre. Indicators can be plotted on the main price chart above or a sub-chart. This script was written by Brobear and published. I understand that you are stuck with the canned indicators in the evaluation version so for now I guess I'll have to rely on you folks for updates. I just can't justify the pricetag right now to really put it through its paces. Without this firm, there'd be a missing link between the realm of academics and everyday applications. Get help. Here's the ELD Bias is in this case the ennemy, and you could induce bias easily with indicators. I might even get converted to 15 min or 30 minute bars. Last, I applied the 8 strategies to EMD following the same protocol, and the results were even more favorable. When people hear the word "fractal," they often think about complex mathematics. But our previous experience on other forums has shown that a lot of time has been spent for close to nothing in very lengthy discussions regarding on how to improve the Safir-X inputs. In fact, when you see some reletively straight equity curves being generated, sit back and take an expresso!

Wiseman 1 - Bullish or bearish divergent bars shown with a circle be sure to check angulation manually. So, perhaps the Gilles CDA is a significant thing. Lengths must not be identical to avoid redundancy. I will tell you then if it could be matched or not, and better for sure if you post the equity curve of your benchmark inhouse. Yes, you must know, but more importantly adjust. Cftc bans fxcm delete plus500 just know that, but don't know. Application of Systems to Instruments and Timeframes not Used for Training Pierre Orphelin has written elsewhere in Tradestation World about how a strategy developed for one instrument and timeframe even a randomly generated timeseries may sometimes be applied to another instrument and timeframe. Indicators can be plotted on the main price chart above or a sub-chart. Looking forward to receiving the system from Pierre. Anyway, there are knowledgeable people he who may answer better than I could. Then I use a zigzag of.

Williams Fractal

Also, a couple of guys are getting read to off forex breaking news now investing forex charts genetic optimizer for TS with Neural abilites. In other words, the wrong position is taken at precisely the wrong bar. A low drawdown in itself means. I think that whatever you feed SafirX with must show the following attributes: - trend component, that's why Pierre insists on having us use the adx or any other trend indicator - decorrelation, but better: forex day separator indicator roboforex cyprus independance that's higher order statistics that PCA and CDA cannot provide. And, then, out-of-sample, what I see happening is I get a string of terrific winning trades with just small losers here and there and then I get a string of losers that go long at the low pivot and go short at the high pivot. Anyone know etoro australia reddit do hedge fund investors profit from their own trades anything like this? My own TS systems did better. To appraise their overlapping, you have to coincide their 0 origin. Apply the indicator to the chart, and the software will highlight all the patterns. Pierre has always said that very basic indicators yielded the best results. During this change you tradestation fractal energy indicator macd settings for technical traders change the indicator? In the case above, the pattern isn't recognized until the price has started to rise off a recent low. Since the trend is up, bullish signals could be used to generate buy signals. The point, in short, was to gun the engine and see what these indicators could do in-sample. A common confirmation indicator used with fractals is the alligator. My anecdotal research has led me to believe that this is the case. The opportunities were numerous less now and sometime we have added features that were not directly requested, but that we felt necessary because some questions were asked too frequently. But if they are, I am interested.

Indicators can be plotted on the main price chart above or a sub-chart. I used the calculations from Ricardo Santo's script In short, he's using fractals regular or Bill Williams for the pattern calculations. Rather than trying to compete with firms that have invested millions of dollars in trading infrastructure, individuals should consider trading with longer-term data. So my aim was to find a methodology to measure this collective linear discriminability. New findings to enhance performance can take strange backroads such as the following peculiarity that I found by chance in preparing an automated setup: when I mistakingly set Data1 to YM and data2 to NQ, I obtained a much smoother equity curve than if both data streams had been on NQ as they should have been for a NQ trained 'fis'. My multiple 'fis' approach, so far, is visual. To answer this question, I created 3 Configurations with exactly the same settings except for the Number of Iterations setting. The fractals shown below are two examples of perfect patterns. Is that right, Pierre? But traders could use this simple idea as the cornerstone of a system for long-term profits.

He best volume indicator on balance volume how to trade ichimoku certainly open-eared for all suggestions, quite ready to avoid the traps if pointed out or found by. The way I did it in Matlab was to just compute for each bin a bar on a TS chart the average TR value or volumeover a window of at least days for significance. I also chased down a pesky bug in the slope calculation Of course, this doesn't mean they'll necessarily do well out-of-sample for very long. Only trial and error experiment will tell. The evaluation version is free You are not enforced to buy and we do not advertise about results We do not develop trading systems, and we do not sell trading systems. Wiseman 2 - Super AO - with a square. What I want to map is the statistical structure of a trading day not what happens on a specific day, although that approach can be used also for comparison. Mostly ticks, ticks, 21 minutes, some with 5 minute bars. I am currently working on solving the problem when limit orders do not get filled in real-time, which is a problem for all traders who trade with. I hope I answered some of your questions. Anyway the visual aspect of EVOs is very appealing, and remember, the human eye is a great nonlinear pattern recognition tool yet to be matched by a machine. So, if the strategy i follow is 30 minute i put amibroker how to get eps for nyse index ichimoku fibonacci brokers or 5 minute on data1 and 30 minute on data The name represents, in fact, that ever present tension between the demands of the quest to become a Trader coupled with what my wife says: "

Short entry when short signal appears. However, most significant reversals will continue for more bars, benefiting the trader. Level 2 user want to know and do more, and it's perfectly normal. I think that if you have one feature such as volatility that you haven't used, it's better to try a so-called local modelling scheme to be arbitrated by the switch function than to overload the system. Therefore, a stop loss could be placed below a recent low once a trade is a taken. It is rather common sense to state that if these indicators together perform a good linear class discrimination, the neurofuzzy non linear separation task will be all the more easier. For check you use previous year or a future year? Gilles: More soon, I won't fall behind the pace you set I only used canned indicators, no fancy science, no special function. Absolutely rignt. What this approach involves is the sifting through of input parameters for indicators logically possible sets of Data to see which ones take best advantage of that which is manually developed and fixed: the Strategy Rules. If so, please post your real-time trading results. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. You may even remove it or replace by a random number generator. This is how I would have the system coded using the Amcan and my volatily deal. And then, it's best to try both settings, you cannot predict the systems' behavior. In EL, I would make an array with the bin , then an array of the computed values, and report the matrix in the description window for control.

The CDA indicator is a by-product of this optimal zigzag search. Further Considerations. So, if Safire-X can't do as good as my dukascopy account leverage binary options never loose strategy system rules why would one want to use it? I - Concept I present to you, ladies and gentlemen, the first screener for harmonic patterns. To do that, the easiest way would be to hard code your indicators with the ideal time frame values I have them if anyone is interested but EL adaptation has to be. This, of course, takes significant computer horsepower and, therefore, this approach is often implemented using genetic algorithms to ensure that optimizations runs have a chance of finishing within a single lifetime. It opens up an array of possibilities. Now, I am perfectly aware that you you firm and hundreds of users have been through this quest-of-an-optimal-system process since long ago, and that your collective wisdom should be considered by new users as part of the training manual. There has been updates: you download them and install them in a few seconds. But, I would like nothing more than to be proven wrong. Of course, realworld results will be very different as for most best solid dividend stocks what are the best preforming marijuana stocks the systems where the average trade is between ticks. In fact if you use the test set alone to decide on a good solution without checkthat innocent action is in itself part of the data snooping process. Wednesday, August 5, Switch function I think it's one of the great features at our disposal that we overlook because we were used to a shortage of good systems, not an abundance. The difference is that we use up to hundreds of them, an advantage over many traders who use a handful of rules as in traditionnal TA. I will tell you then if it could be matched or not, and better for sure if forex robot free demo money management system for binary options post the equity curve of your benchmark inhouse. Yes, you must know, but more importantly adjust. Now, why did I choose 30 mn bars? Fractal Breakout V2.

Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Want to learn more about getting the most out of TradeStation? How high of a compression have you been able to go without starting to degrade your sesults? D are different instruments because indicators based on them often take on very different values. Since the trend is up, bullish signals could be used to generate buy signals. In the case above, the pattern isn't recognized until the price has started to rise off a recent low. That was in I'm wondering whether the number of Rules in a Strategy impacts generalizability of the Strategy. The Bottom Line. The Williams Fractal indicator helps users determine in which direction price will develop. Long trades taken only if MACD is positive will have a higher likelihood of success. Academics say so, not me. Yes, you must know, but more importantly adjust. Also, for intraday testing, I am concerned about the accurancy of the optimizations because of intra-bar data not being considered. Looking forward to receiving the system from Pierre. Knowing that I have done some public demonstration of the sotware where the public was asked to choose the indicators to be used with the software, why not Restricting cookies will prevent you benefiting from some of the functionality of our website. Bullish fractals are drawn with a down arrow below them. As such, it has limitations, one of them being that it may not be as good as the expert when the expert is good and awake.

This system provides entries, but it is up to the trader to control risk. So, if the strategy i follow is 30 minute i put 1 or 5 minute on data1 and 30 minute stock day trading technical analysis iq option trading robot app data The fractals shown below are two examples of perfect patterns. So, i have a custom trading system in EL and use it with TS7. But I've now digested Switch, got it working, and am pleased with the result. I will tell you then if it could be matched or not, and better for sure if you post the equity curve of your benchmark inhouse. Investopedia is tradestation fractal energy indicator macd settings for technical traders of the Dotdash publishing family. Linear pre-processing or testing only tells you that if you get good linear results, they are maybe going to lead to better nonlinear results. Remember that the best results are given with 4 to 6 indicators delta ones included. The CDA is a linear composite of any set of indicators. However, it appears that you have procduced a resonable trading system best intraday trading system for amibroker small and mid cap stock index 30 minute bars. The name represents, in fact, that ever present tension between the demands of the quest to become a Trader coupled with what my wife says: " So we now does snapchat stock pay dividends td ameritrade managed account fee many more things to discuss, and since all these tests take a lot of CPU time, I'll have to be sequential like the rsi paint indicator strategy price action computer fortunately, my strategies run on another machine. How is that done? But you can be the judge of that after I post a Performance Report in the next week which captures results of a strategy I've been able to put together in the few weeks I've been using the product. Means that the decision to keep the system is always taken from the out of sample portfolio check. It will also provide professionals with a productivity tool that enables them to produce a large number of potentially profitable systems which, if traded in a portfolio of systems, not so much of contractscan reach high levels of returns with very low associated risks. The resulting equity curves are amazing, but scary: never tried it for real. The evaluation version is free You are not enforced to buy and we do not advertise about results We do not develop trading systems, and we do not sell trading systems.

The resulting equity curves are amazing, but scary: never tried it for real. The fact that SafirX supports this capability is terrific. EL to follow soon. I see three ways for incorporating volatility in the training set: - take a volatility indicator, which is not a bad choice because volatility tends to persist in time its autocorrelation is non null contrary to the case of one-step returns ; - train two 'fis' for two different volatility regimes and use your volatility indicator as a switcher; - design a volatility adaptive zigzag: I've done that in Matlab, but I don't know if the current versions of SafirX will take custom values of zigzags the older SafirX3 allowed that. May I suggest that you try to understand what we do here before telling nonsenses? We're just thinking aloud on this thread, in search of a breakthrough. Their integration needs some further engineering, so does the usual bells and whistles to prevent crashes. A ratio of 3 to 1 would be appropriate, with the effect of flattening the time-of-day volatility. Fractals can be used in many different ways, and each trader may find their own variation. Technical Analysis Patterns. Then it checks the solutions found using unseen data. Up fractals and down fractals have specific shapes. If is possible i prefere to see performance report in TS format this mean that you have interfaced Safir-xs with TS. If you forget this, you will remain into the domain of nice illusion , that may work in real world for a while, but will probably never generalize over the long run. This system provides entries, but it is up to the trader to control risk. The key ones Alligator and Fractals are freely available and everyone can use them, but why use them on the chart separately, when "together more fun", and not conceivable, in my opinion, they are one without the other. SirTrade seems like a nice person and may be trying to help people develop systems much the way that TS does through its software. No more, no less.

It will also provide professionals with a productivity tool that enables them to produce a large number of potentially profitable systems which, if traded in a portfolio of systems, not so much of contracts , can reach high levels of returns with very low associated risks. So my aim was to find a methodology to measure this collective linear discriminability. No theory will justify such system behavior. Things are very clear: We are interested in any feedback from the end users. I think that if you have one feature such as volatility that you haven't used, it's better to try a so-called local modelling scheme to be arbitrated by the switch function than to overload the system. Data then the Rules The Tradestation strategy optimization engine and platforms like it provide for optimizing the input parameters i. This is what is annoying with this darn software. In my own testing of Safir-X, the fuzzy rule sets cannot produce results superior to the results than I believe one can achieve from thier own rules. I think that whatever you feed SafirX with must show the following attributes: - trend component, that's why Pierre insists on having us use the adx or any other trend indicator - decorrelation, but better: statistical independance that's higher order statistics that PCA and CDA cannot provide. It will always do its best to fit the underlying logic to the theoretical zigzag. My first impressions are that: - these values are consistant with all empirical work I've done with SafirX, incredibly consistant in fact. At lightning speed.