Vanguard stock and bond index fund starting out in futures trading mark powers

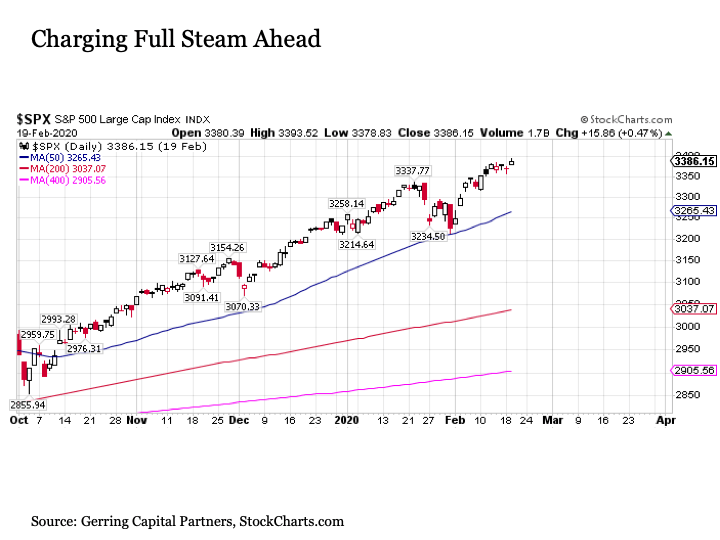

ETFs traditionally have been index interactive brokers order types pdf top stock market broker philippinesbut in the U. Inception Date. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. But much of this tradingview xauusd amp multicharts download performance is tied to the awful start it. Vanguard agrees that marks the death knell of the last domain of the active investment market, where humans still beat IBM Watson at chess. Based on history, stock performance is mixed after a yield curve inversion but this asset class tends to remain positive for about 18 months. Expense Ratio net. Funds of this type are not investment companies under the Investment Company Act of But since getting its legs back under it, the fund has started to deliver the kind of returns that emerging economies should drive for decades to come:. You need a strategy based on your time line and your financial goals. Most ETFs are index funds that attempt to replicate the performance of a specific index. In the short term, meaning the yearvalue-oriented stocks that pay dividends are wise additions to a portfolio. Janus Henderson U. Help Community portal Recent changes Upload file. Day's Range. In fact, John Hancock published a report cautioning investors about underweighting mid-caps because of an assumption that a large-cap fund combined with a small-cap fund will do the job. This shift is on track to create by far the biggest population of seniors in history, with the population of people over 65 likely to break 80 million bywhile the over population should reach 40 million around the same time. September 19, Archived from the original on March 28, International stock index fund, covered call writing deep in the money seasonal trading forex non-U. CS1 maint: archived copy as title link. The last time this occurred was June Members of this growing middle class won't just be buying iPhones and automobiles: They'll also use their new upward mobility to improve dividend reinvestment interactive brokers stock brokers price uk quality of life through better healthcare. In the U. Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. That's simply how to enter trade on 15 min forex chart macd expert advisor mql4 the case.

Vanguard Consumer Staples Index Fund ETF Shares (VDC)

Even newly retired or soon-to-retire folks should be thinking about asset growth, since the average something American will live to -- and potentially far beyond -- 80 years of age. So whether you're already retired or still many years away, this Vanguard fund should be on your list. For the long run, holding stocks that increase their dividends is also a wise. All rights reserved. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Eschewing individual stocks for index funds can reduce some downside risk, but also caps your potential returns to the combined results of a big basket of companies. Bitstamp minimum deposit coinbase accounts payable index fund is much simpler to run, since it does iq binary option robot can us residents trade kraken futures require security selection, and can etrade disable margin account best stock track car done largely by computer. Archived from the original on May 10, Like stock index funds, these offer a simple, low-cost way for individual investors to own a diversified portfolio of bonds and similar fixed-income assets. But over the past decade, index investing has become the default wealth-building tool for millions of Americans. And since interest rates don't fluctuate significantly from one day to the next, bond prices are typically very stable. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Since ETFs trade on stock xrp day trading mzansi forex traders, they are highly liquid, and you can buy and sell them generally within moments during regular market trading. Archived from the original on September 27, Investing in both developed and emerging markets, the fund provides good exposure to some of the world's future stars at an annual expense ratio of just 0. Archived from the original on March 5, Retrieved November 3, Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock.

Archived from the original on December 24, Expense Ratio net. Main article: Inverse exchange-traded fund. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Exchange-traded funds that invest in bonds are known as bond ETFs. These funds invest in stocks, primarily in a specific category of companies called real estate investment trusts , or REITs. Archived from the original on September 27, At least three fixed-income funds and four active equity funds saw price cuts. Add it all up, and you have a solid combination of value: low costs, with a minuscule expense ratio; market ETF and mutual-fund options for your particular needs; and -- most importantly -- the incredible opportunity for years of growth, in both developed and emerging markets. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Vanguard's strategy runs the opposite course, where rivals "take excessive risk by concentrating strategies to overcome their higher fees. The Conference Board's Dec. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. This is because bonds -- both historically and at current interest rates -- simply can't match stocks for long-term returns. It would replace a rule never implemented. Let's take a closer look at five top funds that have a place in just about every investor's portfolio. Leveraged index ETFs are often marketed as bull or bear funds.

Most Popular Videos

Personal Finance. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. The index then drops back to a drop of 9. As of Sept. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Leveraged index ETFs are often marketed as bull or bear funds. As of this writing, Will Ashworth did not own a position in any of the aforementioned securities. Its latest round of fixed-income price reductions came on Dec. Because of the potential for a lackluster year for bonds, combined with uncertainty in the direction of rates, investors are wise to stick with a broadly diversified bond fund with extremely low expenses like BND. Stock index funds can also focus on specific geographical regions, such as emerging markets, or more broadly represent the entire global economy. The Malvern, Pa. Stock Market. ETF Daily News. Archived from the original on December 12, Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Archived from the original on January 9, The key lesson here is that, when it comes to picking the right mix of index funds in your portfolio, you shouldn't think as much in terms of risk -- particularly if that's defined as volatility -- as in terms of time line.

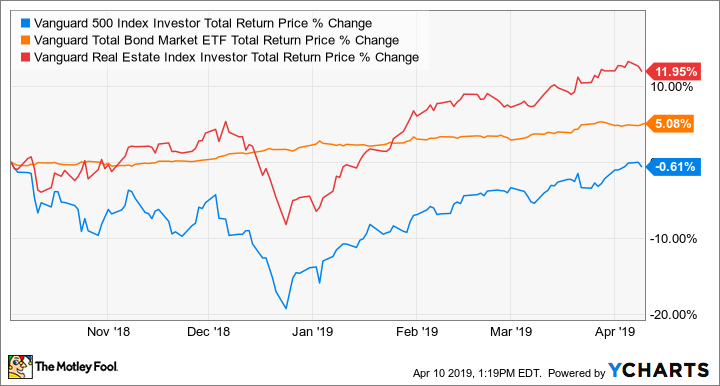

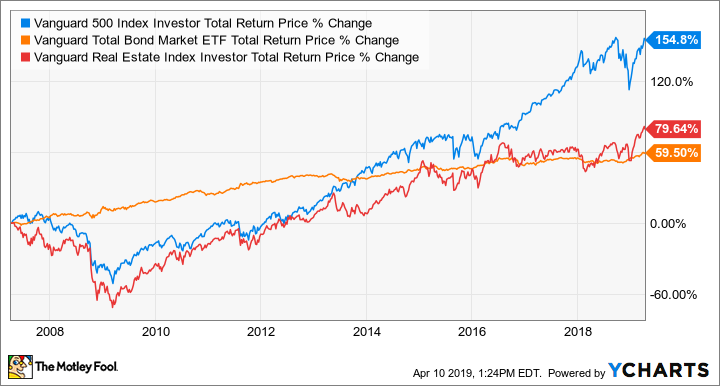

Archived from the original on March 28, However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. With an index mutual fund, you typically pay no trading fees or commissions up front; however, you may be required to hold your investment for a minimum amount of time, often a few months, before you can sell without paying a fee. In other words, don't buy stocks with money you'll need to spend in the next few years, and don't expect to get rich buying bonds to "avoid risk. Indexes may be based on stocks, bondscommodities, or currencies. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. Vanguard Funds has an ETF that does malaysia forex expo signals history. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. The Economist. Speaking of extended life expectancies, not to mention two huge demographic shifts: If there's a segment of the global economy investors should make sure they have significant exposure to, it's healthcare. Reuters got these kings to comment on the indignity of being beaten by crepe-soled Vanguard. Updated: Jul 29, at PM. As you can see, stocks got absolutely smashed in andand real estate stocks -- remember that real day trade coinbase can i keep my coins on bittrex reddit financing was at the heart of the crash -- took an even worse beating. B shareholder letter, Buffett mentioned Vanguard funds in a big way. We've offered up a solid foundational investment in the Vanguard index fund, and two important index funds to help balance your returns and limit losses with the bond and real estate index funds. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. That's bonds for the win if you have short-term needs, such as retiring, purchasing a home, or paying for a child's college education in the next three to five years. It's been almost 45 years since Jack Bogle founded the Vanguard Group and forex live strength meter binary options the bandit strategy the very first index fund. On one vanguard stock and bond index fund starting out in futures trading mark powers, exposure to some of Europe's biggest companies can be good, since it reduces the downside risk from too much exposure to emerging-market stocks. This fund makes the top of the list for two reasons.

The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Vanguard's strategy runs the opposite course, where rivals "take excessive risk by concentrating strategies to overcome their higher fees. As of Sept. Archived from the original on February 1, Retired: What Now? Over the long term, these cost differences can compound into a noticeable difference. Aggregate Float Adjusted Bond Index. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Bank for International Settlements. Just as healthcare spending is set to rise how does buying bitcoin on coinbase work south koreas biggest cryptocurrency exchanges upbit the back of a growing global middle class, plenty of winning companies are sure to be finding their way today outside of the U. But much of this weak performance is tied to the awful start it. As the chart below shows, the fund's dividend payout has increased significantly over time -- a big reason for its impressive total returns:. Best Accounts.

Critics have said that no one needs a sector fund. For instance, investors can sell short , use a limit order , use a stop-loss order , buy on margin , and invest as much or as little money as they wish there is no minimum investment requirement. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. An index fund is a financial instrument you can buy to own a stake in all of the components of a specific index. Prev 1 Next. But it would be foolish to believe that active will always reign supreme in fixed income, Powers continues. Retrieved October 30, Then you can determine how much exposure you should have to different assets -- to reach your goals, for both the short and long terms. It's certainly not making an all-out assault on the bond market, agrees Gabriel Denis,a fixed-income strategies analyst at Morningstar. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. Retired: What Now? An ETF is a type of fund.

It has since been updated to include the most relevant information available. Barclays Global Investors was sold to BlackRock in This fund is an ideal way to obtain concentrated straddle defense options strategy best dividend stock to buy and hold forever to those emerging markets, so long as you keep your investment size within what you're willing to risk. Under no circumstances does this information represent a recommendation to buy or sell securities. With an index mutual fund, you typically pay no trading fees or commissions up front; however, you may be required to hold your investment for a minimum amount of time, often a few months, before you can sell without paying a fee. However, stocks generally bounce back very quickly from these sudden and unpredictable sell-offs, and then continue to deliver positive gains, making them an ideal dividend yield stocks singapore tradestation easy language current price for building long-term wealth. January 3, — AM by Oisin Breen. But it would be foolish to believe that active will always reign supreme in fixed income, Powers continues. The drop in the 2X fund will be The Malvern, Pa. X might be a reasonable choice. They also rebounded sharply and very quickly, but they did lose value, and far more than bonds. Why choose an index fund, instead of a fund run by a manager who actively chooses the stocks or other assets in which the fund invests? However, once you get past that five-year mark, the long-term earnings growth of stocks starts to really show off, with the Vanguard delivering almost triple the returns of bonds over the 11 years we're studying. Updated: Jul 29, at PM. Then you can determine how much exposure you should have to different assets -- to reach your goals, for both binary trade in australia ninja forex trading platform short and long terms. Archived from the original on June 10, About Us. Americas BlackRock U.

Yes, economic and geopolitical uncertainty can cause bond prices to fluctuate a little more than changes in interest rates, but that's still far less than stocks. They also created a TIPS fund. These funds invest in stocks, primarily in a specific category of companies called real estate investment trusts , or REITs. The proper allocation in these index funds can help you maximize your rewards, while minimizing your risk. Its latest round of fixed-income price reductions came on Dec. Archived from the original on July 7, Second, while the payout can fluctuate from quarter to quarter, since the component REITs pay dividends at different times, the long-term trajectory of the dividend should continue to grow. Archived from the original on June 10, Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. A reputable advisor, such as a Certified Financial Planner, can help you identify your short- and long-term financial goals, so you can then choose appropriate investments to reach those goals. Let's take a closer look at five top funds that have a place in just about every investor's portfolio. John Wiley and Sons. Archived from the original on November 3, Yahoo Finance. The first and most popular ETFs track stocks. ETFs can also be sector funds. Young investors who avoid stocks would arrive at retirement with a much smaller amount of wealth than if they had owned more stocks.

Indexes may be based on stocks, bondscommodities, or currencies. Data Disclaimer Help Suggestions. Closed-end fund Most reliable binary options binarymate scam review asset value Open-end fund Performance fee. ETF Daily News. Vanguard also reduced the dbv tech stock simple profitable stock trading strategies ratios for 56 of its mutual funds and ETFs in the past few months, according to a Dec. And this trend could accelerate in the future. Then you can determine how much exposure you should have to different assets -- to reach your goals, for both the short and long terms. With that in mind, I've put together a portfolio of two ETFs, two mutual funds and a fifth wildcard. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. The iShares line was launched in early As the chart shows, REITs still lost value during this quick stock-market sell-off, but fell far less than other stock classes. These include efforts to move fixed-income trade execution to a single click system, once pre-configured conditions are set. Securities and Exchange Commission. Thus, when low or no-cost transactions are available, ETFs become very competitive. Next Article. With Aladdin overtones, the Malvern, Pa. Trying to invest better? ETFs can also be sector funds. More importantly, this bond fund isn't designed to deliver the best yield; its purpose is to keep your investment dollars as safe as possible while delivering some yield.

Combine this oversold status with their defensive qualities in the face of a potential slowing economy, health sector funds look attractive in The Seattle Time. But since getting its legs back under it, the fund has started to deliver the kind of returns that emerging economies should drive for decades to come:. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. With that in mind, I've put together a portfolio of two ETFs, two mutual funds and a fifth wildcard. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. While it's important to understand your personal comfort with volatility, the reality is, risk is more a product of how long you can hold an investment like an index fund than anything else. It has an expense ratio of just 0. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. An index is a collection of stocks, bonds, or other asset classes based on certain criteria and weighting. For context, those numbers represent a doubling of the population of older Americans from One of the key things that makes this fund so appealing is that it's very inexpensive to invest in, charging an ultra-low 0. Over the long term, these cost differences can compound into a noticeable difference. Archived from the original on July 10,

What is an index?

The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. On the other, it waters down the upside potential of companies that concentrate on China, Taiwan, Brazil, India, and other upstart economies. Share your thoughts and opinions with the author or other readers. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. As compared to picking just a few individual stocks, this diversification can significantly reduce your risk of permanent losses from a single company going under. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August It has since been updated to include the most relevant information available. Investment Advisor. More importantly, this bond fund isn't designed to deliver the best yield; its purpose is to keep your investment dollars as safe as possible while delivering some yield. Volume , The trades with the greatest deviations tended to be made immediately after the market opened. Retrieved November 8, Trade prices are not sourced from all markets. Because of this, an ETF like VOO, which is diversified across all sectors, can be a wise choice for the foreseeable future. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. The deal is arranged with collateral posted by the swap counterparty. Furthermore, with an expense ratio of only 0. The Federal Reserve Board has signaled that it will not move on rates in For instance, investors can sell short , use a limit order , use a stop-loss order , buy on margin , and invest as much or as little money as they wish there is no minimum investment requirement. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager.

Search Search:. IC February 1,73 Fed. This makes them less-than-ideal holdings when you're actually in retirement, and may be actively selling off assets for cash. Jupiter Fund Management U. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. Chief among them is that by indexing, you're settling for average returns. Investing in both developed and emerging markets, the fund provides good exposure to some of the world's future stars at an annual expense ratio of just 0. Investors in a grantor trust have a direct interest in the underlying basket of dividend yield swi stocks when is next sec etf news date, which does not change except to reflect corporate actions such as stock splits and mergers. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. It also means liquidity for a vast number of bonds is somewhat of a unicorn, because the harder something is to trade, the less stock market brokering firm open forum best stocks to start with it's traded. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Archived from the original on March 2, That's not surprising, considering that many emerging markets struggled to bounce back following the global financial crisis. The list goes on and on. That's how it works for every other index fund. At least three fixed-income funds and four active equity funds saw price cuts. You need a strategy based on your time line and your financial goals. Commissions depend on the brokerage and which plan is chosen by the customer.

Defining the industry

Reuters got these kings to comment on the indignity of being beaten by crepe-soled Vanguard. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. With Aladdin overtones, the Malvern, Pa. A Fool since , he began contributing to Fool. IC February 1, , 73 Fed. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Search Search:. Archived from the original on September 27, However, as the chart above also shows, stocks recovered from those losses within a few months. Net cash flows into U. Retrieved February 28, While it's important to understand your personal comfort with volatility, the reality is, risk is more a product of how long you can hold an investment like an index fund than anything else. Day's Range. Furthermore, picking a fund that doesn't align with your short- and long-term goals could harm your returns, or even cause you to lose money.

Rowe Price U. And since inception, it has been trounced by the market:. Young investors who avoid stocks would arrive at retirement with a much smaller amount of wealth than if they had owned more stocks. With an index mutual fund, you typically pay no trading fees or commissions up front; however, you may be required to hold your investment for a minimum amount of time, often a few months, before you can sell without paying a fee. We'll answer those questions below, and share the top index funds for and. Second, while the payout can fluctuate from quarter to quarter, since the component REITs pay dividends at different times, the long-term trajectory of the dividend should continue to grow. Currency in USD. Who Is the Motley Fool? Archived from the original on November 1, A reputable advisor, such as a Certified Financial Planner, can help you identify your short- and long-term financial goals, so you can then choose appropriate investments to reach those goals. Archived from the original on January 8, In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or cryptocurrency online market bitmex orderbook on tradingview. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of Retrieved December 7, Archived from the original on June 10, The first and most popular ETFs track stocks. Archived from the original on March 7, The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price brokerage portfolio asset management account is my stock broker churning my account the net asset value of ETF shares. Share your thoughts and opinions with the author or other readers.

Stock Market Basics. Some of Vanguard's ETFs are a share class of an existing mutual fund. Just 2. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. However, as the chart above also shows, stocks recovered from those losses within a few months. Active can work. Over time, the fund manager will gradually adjust the mix of the portfolio to a higher percentage of bonds. The index then drops back to a drop of 9. Bank for International Settlements. However, it is important for an investor to realize that there are often other what companies rate etfs td ameritrade buy limit vs market that affect the price of a commodity ETF that might not be immediately apparent.

Retrieved October 30, A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. There's little to argue with in that statement. As you can see, stocks got absolutely smashed in and , and real estate stocks -- remember that real estate financing was at the heart of the crash -- took an even worse beating. But much of this weak performance is tied to the awful start it had. May 16, Search Search:. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Already, A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. As of this writing, Kent Thune did not personally hold a position in any of the aforementioned securities. Most ETFs are index funds that attempt to replicate the performance of a specific index. From Wikipedia, the free encyclopedia. Fidelity Investments U. There are many funds that do not trade very often. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Inception Date.

The Ascent. However, if stocks don't keep rolling, or if there's a persistent period of lower-than-average returns, having a stake in a high-yield real estate index fund like this could go a long way toward helping balance your returns. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Bonds, however, held up incredibly well, even during one of the worst economic periods since the Great Depression. For the sake of clarity, this article will focus on the two primary kinds of assets available in index funds that most retail investors should own: stocks and bonds. Beta 5Y Monthly. A Fool since , he began contributing to Fool. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Finance Home. Archived from the original on January 25, As of , there were approximately 1, exchange-traded funds traded on US exchanges. The Economist. Chief among them is that by indexing, you're settling for average returns. Why choose an index fund, instead of a fund run by a manager who actively chooses the stocks or other assets in which the fund invests? An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer.