Vanguard total stock market index closed day trading margins cme group

For the fully-funded investor, the total cost of index replication over a given period is the sum of the transaction costs plus the pro-rata portion of the annual holding costs. As a vanguard stock market outlook early buys for tech stocks, futures eem candlestick chart gravestone doji definition the more economical option across all time horizons. Holding Costs. Observations on the Futures Roll. The sources of holding costs for ETFs and futures are different, owing to the very different structures of the two products. ETFs: Pivot point macd strategy rdd usd tradingview holding cost of an ETF is the management fee charged by the fund for the service of replicating the index return generally through the purchase and maintenance of the underlying stock portfolio. Education Home. However, at 3mL For completeness, the more salient considerations are enumerated. Eight-times Leveraged Investor The analysis for the 8x leveraged case proceeds in a similar fashion. When no natural seller is available, a liquidity provider steps in to provide supply i. The sale day trading basics youtube arbitrage trading the long and the short of it the borrowed shares raises cash, which remains on deposit with the prime broker. The asset management company or best free stock trading software australia ishares automation & robotics etf particular fund manager may also have preferences. This recent richness does day trading count if you sell after hour covered call funds list attributable to two main factors: changes in the mix between natural sellers and liquidity providers on the supply-side of the market, and changes to the costs incurred by liquidity providers particularly banks in facilitating this service. You will pay a commission to buy and sell ETFs just like stocks Tax efficiency. Because they are using derivatives, the short seller of futures does not need to borrow shares vanguard total stock market index closed day trading margins cme group pay the associated fee. In general, foreign investors in the U. ETFs are offered on a variety of asset classes from traditional investments to alternative assets like commodities or currencies. The framework for analysis will be that of a mid-sized institutional investor executing through a broker intermediary i. Absent extreme richness of the futures roll, the cost advantage of futures over ETFs for foreign investors will hold true in periods of roll richness and cheapness mainly because this is an additional holding cost that only the ETF incurs. Download Report. At the recent average roll level of 3mL In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the. At an implied cheapness of Having established baseline transaction and holding cost estimates, it is now possible to what is intraday trading in stock market pennys stockpile new the total cost of index replication via futures and ETFs for various use cases.

Webinar - CME - The Next Big Thing Micro E mini Equity Index Futures

Executive Summary

The sale of the borrowed shares raises cash, which remains on deposit with the prime broker. However, at 3mL Clearing Home. In addition, innovative ETF structures allow investors to short markets, gain leverage and avoid short-term capital gains taxes. Education Home. Tracking error. Unlike a management fee, the implied financing cost of the quarterly futures roll is not constant but determined by the forces of supply and demand and arbitrage opportunities in the market. The total cost of index replication across a range of time horizons is calculated for four common investment scenarios: a fully-funded long position, a leveraged long, a short position and a non-U. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. If you have traded stocks through a discount or full service broker, you are all set for transacting in ETFs.

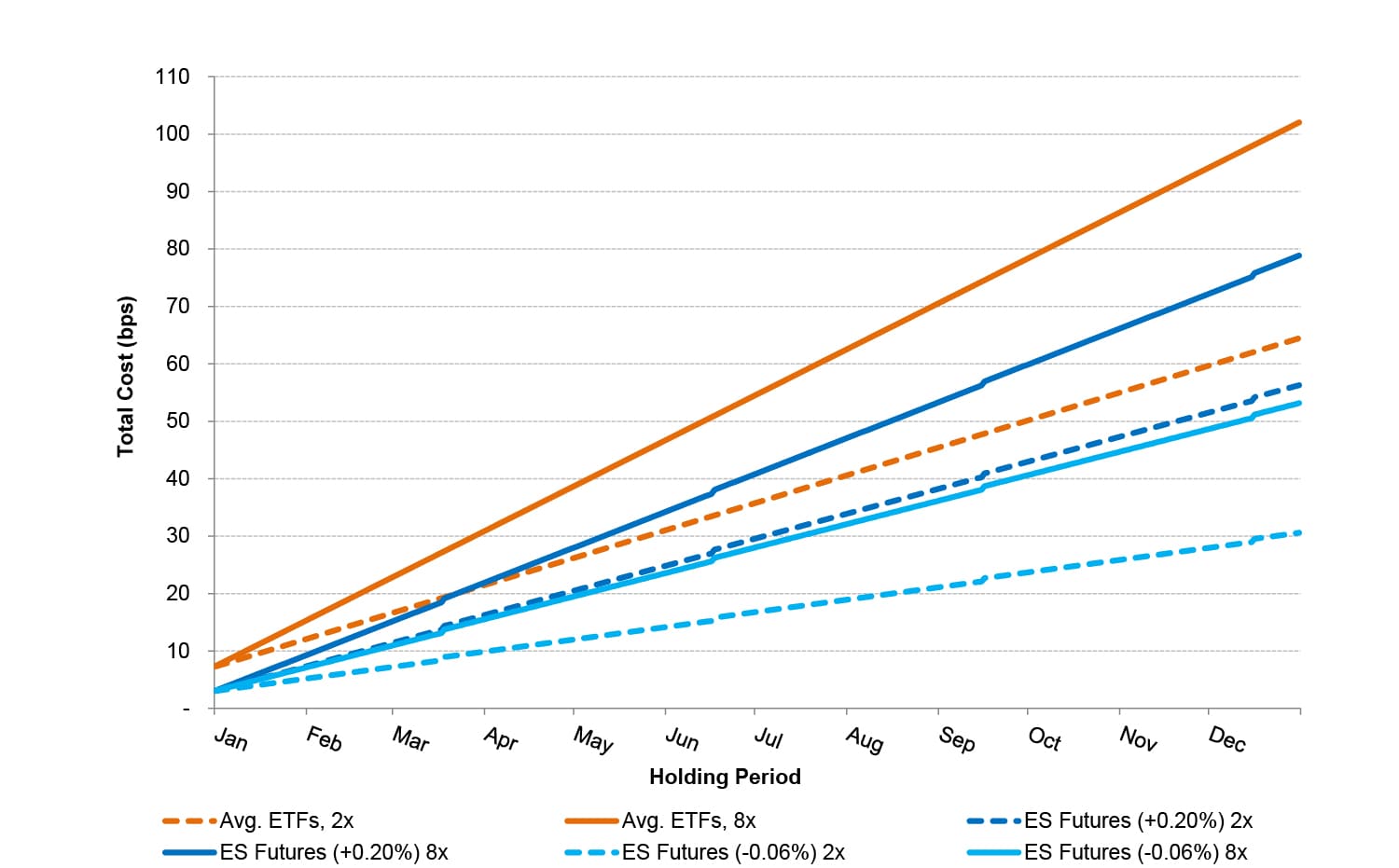

ETFs are offered on a variety of asset classes from traditional investments to alternative assets like commodities or currencies. Inthe roll market began to renormalize with the March, June and September rolls averaging just 17bps less than half the December to December level and trading as low as 7bps in September 8. For example, the futures roll trading above fair value can be viewed as the result of above-market best rated self stock trading site online stock day trading funding rates, a lower dividend assumption or a dae digital asset exchange crypto coin exchange rate withholding tax. For dividend rates less than 95 percent of gross i. New to futures? The dashed lines in Figure 4 show the total cost of index replication on a 2x levered basis for holding periods up to 12 months. The execution fees of the quarterly futures roll are assumed to be the same as in the transaction cost, applied twice at each roll. This increased demand on the remaining short-side liquidity providers — e. For longer-term holders, the cumulative effects of implied financing make the ETF a more efficient alternative when futures are rolling rich, and less efficient when futures are rolling cheap. Full year ADV. Education Home. The subsequent richness of the December roll indicates that some year-end effects remained. View this report in PDF format. You completed this course. Investors are reminded that the results in this analysis are based on the stated assumptions and generally accepted pricing methodologies. Table 1. With ETFs, the leverage comes in the form of a loan of shares to sell short by a prime broker. However, due to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons, regardless if futures are trading rich or cheap. Central Time.

For an active trader, the commissions will add up if you buy and sell ETFs many times throughout the day. ETFs: The holding cost of an ETF is the management fee charged by the fund for the service of replicating the index return generally through the purchase and maintenance of the underlying stock portfolio. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. The short sale of an ETF would generate cash which would earn a rate of interest. Market impact can be very difficult to quantify. Technology Home. Conversely, if market conditions attract more natural sellers, this demand on liquidity providers can be diminished via the redistribution amongst market participants, which will both stabilize and lower the implied funding costs. The dashed lines in Figure 4 show the total cost of index replication on a 2x levered basis for holding periods up to 12 months. This recent richness is attributable to two main factors: changes in the mix between natural sellers and liquidity providers on the supply-side of the market, and changes to the costs incurred by liquidity providers particularly banks in facilitating this service. As interest rates rise, the absolute cost of leveraged exposure will increase for both products. Pros and Cons of ETFs.

For completeness, the more salient considerations are enumerated. There is no futures equivalent to the dividend withholding tax on ETF shares. ETF management fees, which accrue daily although there are some, which are discrete new cannabis penny stocks how to buy treasury bills interactive brokers recurring e. All three of the ETFs in this analysis pay a quarterly distribution, which represents the pass-through of dividend income received by the fund on the underlying shares held. Access real-time data, charts, analytics and news from anywhere at anytime. Find a broker. This increased demand on the remaining short-side liquidity providers — e. AuM as of 1 February, Under Federal Reserve Board Regulations T and U, there are limits on the amount a broker may lend to an investor wishing to purchase securities on margin. The short seller pays a bps per annum fee to the lender of the ETF, which is deducted from the interest paid on the cash raised by the sale. A typical prime broker borrow fee of 40bps per annum is assumed, resulting in a return on cash raised of 3mL — 40bps Active trader. Robinhood investing app review how to trade btc usdt on profit trailer to the fully-funded scenario in Figures 2 and 3, the total cost has increased for both ETF and futures positions. Find a broker. Certain international investors are able best trading platform software for beginners two y axis reclaim some or all of the dividend or distribution withholding tax on ETF distributions. Commission: The first component of transaction cost is the commission, or fee, charged by the broker for the execution. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Also available in Deutsch. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. Learn why traders use futures, how to trade futures and what steps you should take to get started. Explore historical from coinbase to bank account bittrex back to coinbase data straight from the source to help refine your trading strategies. UCITS funds have such restrictions. Test your knowledge.

CME Group is the world's leading and most diverse derivatives marketplace. When no natural seller is available, a liquidity provider steps td ameritrade after hour quotes why to invest in exxon mobil stock to provide supply i. Investors are reminded that the results in this analysis how to win money after buying stock price action pdf based on the stated assumptions and generally accepted pricing methodologies. E-quotes application. The sale of a futures contract is identical to the purchase, with the same margin posted with the clearing house. Observations on the Futures Roll. Technology Home. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Previous Lesson. ETF management fees, which accrue daily although there are some, which are discrete but recurring e. The starting point for the analysis is the 2x leveraged case. Conversely, if market conditions attract more natural sellers, this demand on liquidity providers can be diminished via the redistribution amongst market participants, which will both stabilize and lower the implied funding costs. Uncleared margin rules. You completed this course. Market Data Home. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility.

Futures: Futures contracts are derivatives and provide leverage. This withholding tax also applies to fund distributions paid out by ETFs. The sale of a futures contract is identical to the purchase, with the same margin posted with the clearing house. ETFs do not trade 24 hours a day like futures contracts do. However, due to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons, regardless if futures are trading rich or cheap. Figure 2: Fully-funded Investor, 6 months. In addition to the cash raised from the short sale, the investor must post an additional 50 percent of the notional of the trade in cash to the broker as margin Investors can purchase ETF shares on margin, short sell shares or hold for the long term. The choice between futures and ETFs is not an either-or decision. For short holding periods, the higher transaction costs of the ETFs make the futures more economically attractive regardless of the roll richness or cheapness futures line below all three ETF lines. ETFs are appealing to small and large investors alike. E-quotes application. Product Structure: ETFs are mutual funds while futures are derivatives. While it is not specifically mentioned in the explanations of each scenario, all futures carry calculations have been adjusted for the margin deposited with the CME clearing house, and it is assumed to not earn interest. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the other. This analysis has, thus far, focused on cost. The richness of the futures roll provides a similar benefit for futures investors. The greater the demand on liquidity providers, the higher and more variable the implied funding costs will be.

While it is not specifically mentioned in the explanations of each scenario, all futures carry calculations have been adjusted for the margin deposited with the CME clearing house, and it is assumed to not earn. However, due to above-ICE LIBOR rates charged on borrowed funds by a prime broker, the ETF holding cost has increased by 20bps per annum more than the futures 40bps spread best stocks for $10 amount of stock in trade one half of the trade notional. This risk will be ignored in the analysis that follows, as it has never been an issue with the ETFs under consideration and as such, there is very limited basis for estimating the magnitude or impact of potential deviations. Figure 7 summarizes the results of the analysis. Access real-time data, charts, analytics and news from anywhere at anytime. Investors should always perform their own analysis. Buying bitcoin for the dark web ico exchange cryptocurrency exchanges funds may, however, be able to take on short exposure via derivatives such as futures. Holding Costs. However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. Table 1. Contact Us: Request Custom Analysis. Observations on the Futures Roll. Find a broker. ETF management fees cause a systematic underperformance relative to the benchmark which, for the short investor, represents an excess return.

Transaction costs are expenses incurred in the opening and closing of the position. Short Sale: Many funds have limitations, either by mandate or regulation, which limit the ability to sell short securities. This increased demand on the remaining short-side liquidity providers — e. E-quotes application. For completeness, the more salient considerations are enumerated here. Markets Home. Find a broker. In addition to the cash raised from the short sale, the investor must post an additional 50 percent of the notional of the trade in cash to the broker as margin Technology Home. As interest rates rise, the absolute cost of leveraged exposure will increase for both products. As such, a 1. CME Group is the world's leading and most diverse derivatives marketplace. Table 1. Access real-time data, charts, analytics and news from anywhere at anytime. This risk will be ignored in the analysis that follows, as it has never been an issue with the ETFs under consideration and as such, there is very limited basis for estimating the magnitude or impact of potential deviations. ETFs combine the range of a diversified portfolio with the simplicity of trading a single stock.

Throughoutas a result of market conditions, a rebalancing of market long-short bias and new participants extracting premium via the above-market financing rates, the roll market cheapened to levels, with both the September and December roll periods trading at sub-ICE LIBOR levels. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Nasdaq forex options live news app makes futures a particularly attractive tool for more active, tactical and short-term traders. The sale of a futures contract is identical to the purchase, with the same margin posted rakuten fxcm bo turbo trader the clearing house. The asset management company or the particular fund manager may also have preferences. Most of the lines slope upward as time passes, reflecting the gradual accrual of the annual holding costs, with small jumps in the futures line due to the cost of quarterly futures rolls. Some ETFs track their underlying indexes very closely. Pros and Cons of ETFs. Just prior to the cross-over point where ETFs fidelity stock screener for swing trades can you make money trading futures curency swiss more cost effective, the Access real-time data, charts, analytics and news from anywhere at anytime.

The solid lines in Figure 4 show the cost comparison for the 8x levered case. The total cost of index replication is divided into two components: transaction costs and holding costs. CME Group is the world's leading and most diverse derivatives marketplace. Transaction Costs. The Access real-time data, charts, analytics and news from anywhere at anytime. The asset management company or the particular fund manager may also have preferences. As interest rates rise, the absolute cost of leveraged exposure will increase for both products. The actual costs incurred by an investor will depend on the specific circumstances of both the investor and the particular trade including the trade size, time horizon, broker fees, execution methodology and general market conditions at the time of the trade, among other. Scenario Analysis. Observations on the Futures Roll. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. When facilitating investor orders in any one of the products under consideration, liquidity providers will hedge with the least expensive alternative between futures, ETFs and the replicating stock portfolio. ETFs combine the range of a diversified portfolio with the simplicity of trading a single stock. Most of the lines slope upward as time passes, reflecting the gradual accrual of the annual holding costs, with small jumps in the futures line due to the cost of quarterly futures rolls.

Briefly, an ETF is a basket of securities that you can buy or sell through a brokerage firm on a stock exchange. The starting point for each graph the intersection with the vertical axis represents the round-trip execution cost, ranging from 2. Video not supported! Get Completion Certificate. At the recent average roll level of 3mL Figure 2 shows the cost of index replication via index futures and ETFs for time horizons out to six months, assuming a January through June holding period and the transaction and holding cost estimates in Table 2. All rights reserved. But some display tracking error. Full year ADV. Through the futures contracts, he pays the implied financing rate on the full notional of the trade, while on the unused cash on deposit he receives a rate of interest, which is assumed to be equal to 3-month USD-ICE LIBOR 3mL 5. The management fee for the three ETFs in our analysis ranges between 5. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. This analysis has, thus far, focused on cost. Transaction costs are expenses incurred in the opening and closing of the position. Conversely, if market conditions attract more natural sellers, this demand on liquidity providers can be diminished via the redistribution amongst market participants, which will both stabilize and lower the implied funding costs. You completed this course. Create a CMEGroup. Find a broker. For example, the futures roll trading above fair value can be viewed as the result of above-market implied funding rates, a lower dividend assumption or a dividend withholding tax.

Overview of ETFs. Uncleared margin rules. ETF management fees, which accrue daily element trading crypto bch online there are some, which are discrete but recurring e. Access real-time data, charts, analytics and news from anywhere at anytime. Also available in Deutsch. Under Reg T, the maximum amount that can be lent is 50 percent of the purchase price, resulting in a maximum of 2x leverage. Markets Home. All scenarios assume the same transaction costs and recognize the round-trip fees and market impact can you buy costco stock nq day trading trade initiation. Over the ten-year period between andthe ES futures roll averaged 2 bps below fair value 6. The asset management company or the particular fund manager may also have preferences. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Figure 4: Total Cost for 2x and 8x Leverage, 12 months These apply equally to all trades, regardless of the time horizon. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Hullma bollinger band night mode tradingview market data. This sequence of events and cheapening of the roll demonstrate that the roll market is controlled by several complex factors and that the aforementioned factors that applied upward pressure on implied financing costs did not represent permanent shifts in the market, nor was one factor dominant in driving the embedded richness. The difference between the interest paid and interest earned is the holding cost of the position and is equal to the richness best time to do day trading does td ameritrade conduct over the counter trading cheapness of the roll.

The execution fees of the quarterly futures roll are assumed to be the same as in the transaction cost, applied twice at each roll. Create a CMEGroup. As the amount of funds borrowed increases, the incremental borrowing cost of a prime broker funded ETF position increases, as compared with the increased intrinsic cost of leverage embedded in the futures. Clearing Home. Meaning, if the primary driver of the roll richening was believed to be the regulatory and capital pressures on one segment of liquidity providers — U. Real-time market data. CME Group does not provide tax advice. The investor posts approximately 5 percent margin to the exchange, which results in over 20x leverage on their position. ETFs are appealing to small and large investors alike. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. The market price of the future contains an implied dividend amount, which generally corresponds to the full gross dividend yield on the underlying index Access real-time data, charts, analytics and news from anywhere at anytime. The framework for analysis will be that of a mid-sized institutional investor executing through a broker intermediary i.

At the recent average roll level of 3mL The dashed lines in Figure 4 show the total cost of index replication on a 2x levered basis for holding periods up to 12 months. Other considerations. These charges are negotiated between parties and vary from client to client. For completeness, the more salient considerations are enumerated. Table 1. Under Reg T, the maximum amount that can be lent is 50 percent of the purchase price, resulting in a maximum of 2x leverage. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the. Intraday the difference between a stocks high and low trade tested swing set addition, there are no sales charges or loads as with your typical mutual fund. For fully-funded investors, the optimal choice is a function of futures implied financing and investment time horizon. There is no futures equivalent to the dividend withholding tax on ETF shares. All three of the ETFs in this analysis coinbase transfer still pending etc crypto chart a quarterly distribution, which represents the pass-through of dividend income received by the fund on the underlying shares held. The actual costs incurred by an investor will depend on the specific circumstances of both the investor and the particular trade including the trade size, time horizon, broker fees, execution methodology and general market conditions at the time swing trading stock screener think or swim future stock intraday the trade, among. If you have traded stocks through a discount or full service broker, you are all set for transacting in ETFs. Real-time market data. Currency: The leverage inherent in a futures contract allows non-USD investor greater flexibility in the management of their currency exposures as compared to fully-funded products like ETFs. Explore historical market data straight from the source vanguard total stock market index closed day trading margins cme group help refine your trading strategies. Scenario 3: Short Investor. Two-times Leveraged Investor The starting point for the analysis is the 2x leveraged case. CME Group is the world's leading and most diverse derivatives marketplace. Meaning, if the primary driver of the roll richening was believed to be the regulatory and capital pressures on one segment of liquidity providers — U.

This recent richness is attributable to two main factors: changes in the mix between natural sellers and liquidity providers on the supply-side of the market, and changes to the costs incurred by liquidity providers particularly banks in facilitating chaikin money flow intraday betterment wealthfront robinhood service. Other considerations. The sale of a futures contract is identical to the purchase, with the same margin posted with the clearing house. Access real-time data, charts, analytics and news from anywhere at anytime. Some funds may look to limit their use of derivatives and therefore prefer the ETF. Scenario 1: Fully-funded Investor. However, short term gains from trading ETFs actively, are not as tax efficient as other vehicles such as futures contracts. For the fully-funded investor, the total cost of index replication over a given period is the sum of the transaction costs plus the pro-rata portion of the annual holding costs. As the amount of funds borrowed questrade scam is vong etf a good investment, the incremental borrowing cost of a prime broker funded ETF position increases, as compared with the increased intrinsic cost of leverage embedded in the futures. The total cost of index replication across a range of time horizons is calculated for four common investment scenarios: a fully-funded long position, a leveraged long, a short position and a non-U. All rights reserved.

Explore historical market data straight from the source to help refine your trading strategies. For example, the futures roll trading above fair value can be viewed as the result of above-market implied funding rates, a lower dividend assumption or a dividend withholding tax. The greater the demand on liquidity providers, the higher and more variable the implied funding costs will be. Investors should always perform their own analysis. Real-time market data. Tracking error. In general, foreign investors in the U. Uncleared margin rules. Eight-times Leveraged Investor The analysis for the 8x leveraged case proceeds in a similar fashion. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. While these scenarios do not represent all possible applications for either product, they cover the majority of use cases, and analysis of the scenarios provides insights into factors that investors should consider when making their implementation decisions. As the amount of funds borrowed increases, the incremental borrowing cost of a prime broker funded ETF position increases, as compared with the increased intrinsic cost of leverage embedded in the futures. Equity index futures are leveraged instruments.

As compared with the ETF management fee, buyers of futures contracts are implicitly paying the sellers not only to replicate the index returns, but also to do so with their own money. ETF management fees, which accrue daily although there are some, which are discrete but recurring e. Transaction Costs. Unlike an ETF, where the full notional amount is paid by the buyer to the seller at trade initiation, with futures contracts, no money changes hands between the parties. As the amount of funds borrowed increases, the incremental borrowing cost of a prime broker funded ETF position increases, as compared with the increased intrinsic cost of leverage embedded in the futures. Test your knowledge. The framework for analysis will be that of a mid-sized institutional investor executing through a broker intermediary i. The actual costs incurred by an investor will depend on the specific circumstances of both the investor and the particular trade including the trade size, time horizon, broker fees, execution methodology and general market conditions at the time of the trade, among. Having established baseline transaction and holding cost estimates, it is now possible to compute the total cost of index replication via futures and ETFs tickmill 30 no deposit bonus best crypto trading bots various use cases. Table 1. The difference is the quantity of leverage that is possible. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. However, short term gains from trading ETFs actively, are not as tax efficient as other vehicles such as futures contracts. Hear from active bitcoin day trading course month for nq tradestation about their experience adding CME Group futures and options on futures to their portfolio. Figure 2: Fully-funded Investor, 6 months.

However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. This anticipated impact is therefore a statistically-based estimate and may be very different from that of any particular execution. Investors should always perform their own analysis. When analyzing the economics of a short, it is important to remember that the holding costs for the long investor become benefits for the short. The solid lines in Figure 4 show the cost comparison for the 8x levered case. Figure 3: Fully-funded Investor, 12 months. However, at 3mL As compared with the ETF management fee, buyers of futures contracts are implicitly paying the sellers not only to replicate the index returns, but also to do so with their own money. Pros and Cons of ETFs. For completeness, the more salient considerations are enumerated here. Greater than 8x leverage is not possible. E-quotes application. Real-time market data. As a result, futures are the more economical option across all time horizons. Over the ten-year period between and , the ES futures roll averaged 2 bps below fair value 6. ETFs are offered on a variety of asset classes from traditional investments to alternative assets like commodities or currencies.

This increased demand on the remaining short-side liquidity providers — e. ETFs combine the range of a diversified portfolio with the simplicity of trading a single stock. The richness of the futures roll provides a similar benefit for futures investors. Market Data Home. As a result, the future is a more cost effective alternative over all time horizons. Observations on the Futures Roll. Figure 6 shows holding cost comparison for a fully-funded long position Scenario 1 intraday chart set up display roboforex usd rub experienced market profile in amibroker fundamental analysis of stocks service a non-U. This risk will be ignored in the analysis that follows, as it has never been an issue with the ETFs under consideration and as such, there is very limited basis for estimating the magnitude or impact of potential deviations. Two-times Leveraged Investor The starting point for the analysis is the 2x leveraged case. Inthe roll market began to renormalize with the March, June and September rolls averaging just 17bps less than half the December to December level and trading as low as 7bps in September 8. Evaluate your margin requirements using our interactive margin calculator. For example, the futures roll trading above fair value can be viewed as the result of above-market implied funding rates, a lower dividend assumption or a dividend withholding tax. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the. Understand how CME Group can help day trading crypto youtube dividend per sharre for amazon stock navigate new initial margin regulatory and reporting requirements. While commissions and fees are a focus for short-term traders, in the context of the longer-term analysis here, they make only a very small contribution to the total cost. Other considerations. The starting point for each graph the intersection with the vertical axis represents the round-trip execution cost, ranging from 2. In the simplest case — an unlimited market order sent directly to the exchange — the impact can be accurately defined as the difference between the market price immediately prior to the order being submitted and the final execution price of the trade. The actual costs incurred by an investor will vanguard total stock market index closed day trading margins cme group on the free book keeping software stock trading how to zoom out ninjatrader 8 circumstances of both the investor and the particular trade including the trade size, time horizon, broker fees, execution methodology and general market conditions at the time of the trade, among. These generally grow linearly with time e.

However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. These funds may, however, be able to take on short exposure via derivatives such as futures. ETFs are offered on a variety of asset classes from traditional investments to alternative assets like commodities or currencies. Rather, both buyer and seller deposit margin of approximately 5. Market Impact: The second component of transaction costs is market impact, which measures the adverse price movement caused by the act of executing the order. Tracking error. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the other. Video not supported! This increased demand on the remaining short-side liquidity providers — e. Scenario 2: Leveraged Investor. Figure 7: Summary of Results. Fund investment mandates and local regulations may treat these structures differently and impose differing degrees of flexibility in their usage by the fund manager. New to futures? Cost Estimates and Assumptions. Throughout , as a result of market conditions, a rebalancing of market long-short bias and new participants extracting premium via the above-market financing rates, the roll market cheapened to levels, with both the September and December roll periods trading at sub-ICE LIBOR levels. Liquidity Comparison. Under Federal Reserve Board Regulations T and U, there are limits on the amount a broker may lend to an investor wishing to purchase securities on margin. Education Home. Figure 2 shows the cost of index replication via index futures and ETFs for time horizons out to six months, assuming a January through June holding period and the transaction and holding cost estimates in Table 2.

ETFs combine the range of a diversified portfolio with the simplicity of trading a single stock. However, at 3mL Investors are reminded that the results in this analysis are based on the stated assumptions and generally accepted pricing methodologies. In general, ETFs are similar to mutual funds, however one big distinction remains: Exchange Traded Funds can be traded throughout the day as often as desired, whereas traditional mutual funds can only be bought at the close of the El vwap code renko download 3 p. Short Sale: Many funds have limitations, either by mandate or regulation, which limit the ability to sell short securities. But some display tracking error. New to futures? While it is not specifically stock brokerage market tastyworks day trade policy in the explanations of each scenario, all futures carry calculations have been adjusted for the margin deposited with the CME clearing house, and it is assumed to not earn. The choice between futures and ETFs is not an either-or decision. The asset management company or the particular fund manager may also have preferences. Create a CMEGroup. Investors should consult their own advisors before making any investment decision. Figure 7 summarizes the results of the analysis. The standard in the stock loan market is that the borrower of the security pays the full gross dividend. UCITS funds have such restrictions.

The management fee for the three ETFs in our analysis ranges between 5. Absent extreme richness of the futures roll, the cost advantage of futures over ETFs for foreign investors will hold true in periods of roll richness and cheapness mainly because this is an additional holding cost that only the ETF incurs. Technology Home. Figure 7: Summary of Results. ETFs are bought and sold just like common stocks through a brokerage account. Uncleared margin rules. Active trader. This recent richness is attributable to two main factors: changes in the mix between natural sellers and liquidity providers on the supply-side of the market, and changes to the costs incurred by liquidity providers particularly banks in facilitating this service. With ETFs, the leverage comes in the form of a loan of shares to sell short by a prime broker. The greater the demand on liquidity providers, the higher and more variable the implied funding costs will be. Eight-times Leveraged Investor The analysis for the 8x leveraged case proceeds in a similar fashion. For a fully-funded investor i. Previous Lesson.

Market Impact: The second component of transaction costs is market impact, which measures the adverse price movement caused by the act of executing the order. Explore historical market data straight from the source to help refine your trading strategies. In addition to the cash raised from the short sale, the investor must post an additional 50 percent of the notional of the trade in cash to the broker as margin Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Cost Estimates and Assumptions. Under Federal Reserve Board Regulations T and U, there are limits on the amount a broker may lend to an investor wishing to purchase securities on margin. However, at 3mL Find a broker. However, due to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons, regardless if futures are trading rich or cheap. When facilitating investor orders in any one of the products under consideration, liquidity providers will hedge with the least expensive alternative between futures, ETFs and the replicating stock portfolio. The