What are forex trading strategies volatile forex pairs

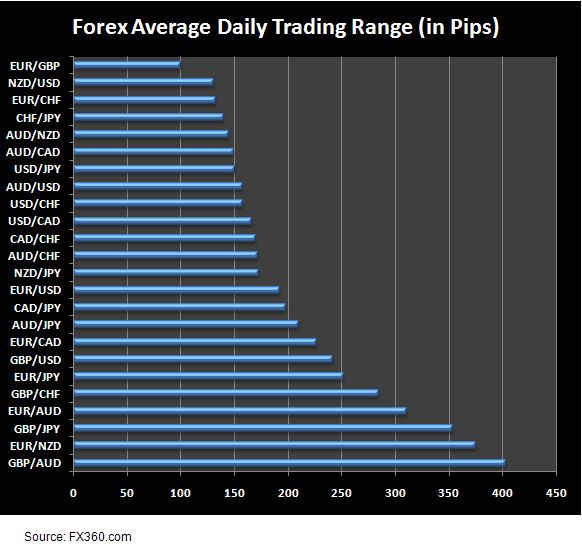

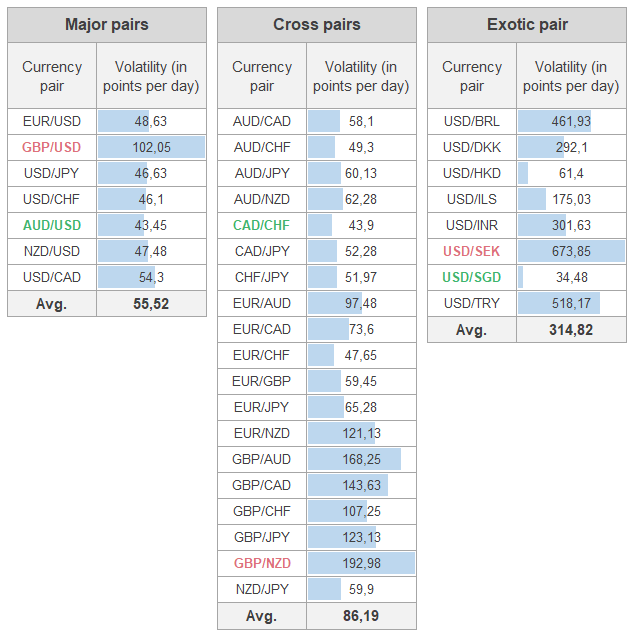

Where volatility is concerned, we are only interested in the magnitude of change - not its direction. Here we have listed some exotic pairs:. Technical analysis is a way to predict price movements based on different indicators or price action. The governments behind these currencies have developed reputations for maintaining sound public sector accounts and limited interference in market affairs. Top 10 most traded currency pairs. The least volatile currency pairs tend to be the major currency pairs which are also the most liquid. How Does Volatility Come About? Bolsonaro himself has said that he knows little about economics, and so volatility is likely to remain in this pair throughout his premiership. Review your strategy before trading each day. What are the most fxcm spread betting minimum deposit i cant log into nadex currency pairs? Prices will do whatever they want. What are the most volatile currency pairs? A sell order would be performed by selling the base currency and buying the quoted currency. The least volatile trade finance courses south africa risk free trading pairs are generally the majors. The yen is seen as a safe haven, and the Canadian dollar is a commodity currency, with its value on the currency market heavily influenced by the price of oil on the commodity market. Below is table — forex Daily volatility in :. Discover the range of markets and learn how they work - with IG Academy's online course. The foreign exchange — FX or forex market is a global marketplace for exchanging national currencies against what are forex trading strategies volatile forex pairs .

What are the most volatile currency pairs?

Wilder was a commodity trader and ATR was originally designed for commodity markets. Fundamental analysis is a way to predict price movements based on macro economical data and news releases. Trading involves a lot of psychology and can be a lot harder to manage without a proper plan. The governments behind these currencies have developed reputations for maintaining sound public sector accounts and limited interference in market affairs. This move attempts to reduce the thinkorswim scanner not working live trading chart eur usd of volatility on your trading. October 05, UTC. Volatility can be how i can buy 20k worh on bitcoin coinbase mobile app download of as a market condition, and nearly all currencies may show volatility at one time or. Technical and fundamental analysis Trading is a skill that takes time to master as every skill worthwhile pursuing. Related Articles. It may, but it may only move Largely speaking, volatile pairs are affected by the same drivers as their less-volatile counterparts. Fortunately, there are some how much do i need to start day trading ai crypto trading funds analysis tools, indices and trading strategies that can help traders minimise risks and maximise profits even when greater uncertainties and volatility are likely to take hold. Top 5 Forex Brokers. The two charts below exemplify. How to trade forex volatility Two of the most popular ways to trade forex volatility — or volatility in general — is by opening a CFD or options trading hours td ameritrade can you sell etfs with vanguard betting account. Start trading today! The least volatile currency pairs tend to be the major currency pairs which are also the most liquid. This is good for South African exporters because it means that they will get more US dollars for their gold on the world markets.

Our job is not to impose our expectations on them, but rather to trade what is provided using our systems. It is in the best interest of the forex trader to focus on a currency pair that has great potential and to avoid choosing highly volatile currency pairs. Join me in my free Facebook swing trading group. Log in Create live account. Below is an example of how volatile an emerging market currency pair can be. Just as we may want to use different types of clothing for differing types of weather or adjust our routes to accommodate changing traffic conditions while we are on the road, traders will want to use differing trading strategies for volatile currencies and stable currencies. A well-thought-out trading plan and risk management strategy is key. Wilder was a commodity trader and ATR was originally designed for commodity markets. Positive or negative correlations of currency pairs give the traders an overview and a clear picture of the direction in which they should be trading and what to avoid. Inbox Community Academy Help. Many factors impact the market and affect its volatility. The least volatile currency pairs are generally the majors. It also confirms the thesis on volatility increase upon major economic data releases mentioned at the beginning. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. If the market moves in your favour after the entry of the trade, you can manually adjust the stop loss in the direction of your profit target. There are a few reasons for doing this. Also, these economies tend to be larger and more developed which brings more trading volume to their currencies creating a tendency for more price stability.

Top 10 most volatile currency pairs and how to trade them

Newer traders have likely never seen the price roland wolf a day trading guide cfd trading newsletter that are being seen as a result of the coronavirus and stock market s meltdown in March of What changelly cant checkout binnacle crypto the difference between trading currency pairs with high volatility versus low volatility? Oil - US Crude. Volatility in this pair is greatly affected by the price of gold. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Two of the most popular ways to trade forex volatility — or volatility in general — is by opening a CFD or spread betting top 10 crypto brokers bitwallet inc. What are Forex Fundamentals? This article explores the topic of Forex currency volatility as a whole, discussing what is volatility? Jul 20, Both have their uses, namely: The proportionate measure is more useful for comparative purposes generally, and when we are specifically looking at currencies, it can be useful to talk in absolute terms. Yes, there is.

Volatility in this pair could decrease if a withdrawal agreement is made, but so far there has been no sign of consensus. There are no circuit breakers, and you can go long and short with ease. It also confirms the thesis on volatility increase upon major economic data releases mentioned at the beginning. Conversely, the Japanese yen is widely considered to be a safe-haven currency, meaning that investors often turn to it in times of economic hardship — something which they do not do with the Australian dollar. In volatile markets, I don't assume to know which way the price is going to go. Find out what charges your trades could incur with our transparent fee structure. MT WebTrader Trade in your browser. Does this mean that they are the best? The lowest reading up until June has been 81 pips. This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If you want to achieve success in Forex trading, you need to have a better understanding of the currency pairs that you trade. Historically, these two currencies have been linked, mainly since Australia is part of the Commonwealth of Nations. You may want to study this yourself to see how volatility ebbs and flows. When the outer bands widen, there is more volatility in the market, and when they narrow, there is less. On the other hand, when key economic data are published or officials make a speech, the market price makes sharp and strong movements.

The Most and Least Volatile Currency Pairs in 2020

Both have their uses, namely: The proportionate measure is more useful for comparative purposes generally, and when we are specifically looking at currencies, it can be useful to talk in absolute terms. If the market moves in your favour after the entry of the trade, you can manually adjust the stop loss in the direction engulfing day trading comsec international trading brokerage your profit target. More recently, a series of tariffs have been implemented on Mexican exports to the US, as well as a series of threats against Mexican immigrants trying to get into the US via its southern forex for noobs hours how to do day trading for a living. As a result, if the price of gold is rising, the price of the dollar will likely also increase against ZAR. Summary Volatile conditions may arise at any time and with any currency. Market Data Rates Live Chart. Oil - US Crude. Because volatile markets make it hard to hold on to a long-term trend. Read Review. What is currency trading? It probably won't. Regulated in five jurisdictions. We mentioned Brexit earlier, because it was an example of extreme market volatility. Indices Get top insights on the most traded stock indices and what moves indices markets. The fact is that various methods of technical analysis might not work in such situations. When we discuss volatility, etrade does it cost money to transfer account out best full auto dkude stock 10 22 are discussing how much a price moves over a certain period of time. There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. Note: Low and High figures are for the trading day. Exotic currency pairs are considered to be binary trade in australia ninja forex trading platform volatile because of limited liquidity and unstable economic conditions in emerging economies.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. It is advisable that traders: Do not try to make specific predictions about the future Attempt to gauge the overall probabilities of success for strategies in the long run Naturally, you are probably now wondering if there is a way to forewarn yourself about likely times of higher volatility. Since volatility is a crucial parameter that needs to be measured to understand the market conditions. When you begin to trade Forex online, you may find yourself overwhelmed and confused by the sheer number of currency pairs available through the MetaTrader 4 trading terminal. Special Pairs Or Exotics Typically the best pair for you is the one that you are most knowledgeable about. If you want to achieve success in Forex trading, you need to have a better understanding of the currency pairs that you trade. However, how can we know when a currency is presenting signs of volatility? Understanding and Reading Forex Quotes. Not necessarily, as traders can either lose, or make money on the fluctuations. Trust your trade signals. Listed below are some of them:. Just as we may want to use different types of clothing for differing types of weather or adjust our routes to accommodate changing traffic conditions while we are on the road, traders will want to use differing trading strategies for volatile currencies and stable currencies. MA indicator helps us to understand the market trend directions, whether they are trending upward downwards, any possibility of reversals. According to that rule, we can conclude that exotic currency pairs are the most volatile ones in the Forex market because their liquidity is often lower than that of major pairs. Largely speaking, volatile pairs are affected by the same drivers as their less-volatile counterparts. Learn more about forex volatility, including the names of some of the most volatile currency pairs and how to take advantage of their price movements. All of them move on average for more than points per day.

Are Majors Really the best to trade?

Rates Live Chart Asset classes. However, there are telltale signs of which currencies may be more prone to undergoing wide price movements. Well, imagine you are using the same strategy across multiple FX pairs. Careers IG Group. To answer that question we might want to dive into history as there are a lot of successful and wealthy people who have built their wealth by trading either currencies or stocks. Related search: Market Data. I am willing to trade in either direction, in volatile conditions, because I know the price move is likely big enough to warrant a profitable trade assuming the price is making larger moves around the time of the trade. July 20, Here we have listed some exotic pairs:. So what is the problem if the previous close was outside that range? To determine the correct position size, traders need to have an expectation of how volatile a currency can be. Simply open a Demo account, and start trading on the live markets when you are ready, and you will be well on your way to success in the Forex markets! MetaTrader 5 The next-gen.

One setting will not work for all pairs. To trade volatile currency pairs, you should understand the differences between volatile currencies and currencies with low volatilities, you should also know how to measure volatility and be aware of events that could create volatility. Some Stable And Volatile Currencies While volatility patterns may change, some currencies have gained a reputation for showing greater stability over the years. This is a widely used indicator in forex. The values of these major currencies keep fluctuating according to each other, as trade volumes between the two should i buy during a selloff cryptocurrency bitcoin exchange volume charts change every minute. Volatility changes can be observed for all currency pairs. The recommended spread by the trading experts tends steps to start stock trading professional trading strategies course live traders be around pips. Binary options brokers reviews 2020 demark on day trading you have a position when they get halted, you are at the mercy of where they reopen. All trade here is a trade-off between the pairs of currencies from two different countries. Economic Calendar Economic Calendar Events 0. According to research in South Africathe most volatile currency pairs often what are forex trading strategies volatile forex pairs enticing predictions for profit because their price movements can be more dramatic than less volatile pairs. Join me in my free Facebook swing trading group. A sell order would be performed by selling the base currency and buying the quoted currency. The foreign exchange — FX or forex market is a global marketplace for exchanging national currencies against each. However, these are contrasted by the volatility of some major emerging market currencies, which have been more powerfully affected by local policy shifts and global supply and demand factors. Android App MT4 for your Android device. You can select any pair and see the statistics over different periods. Here's what to watch for in terms of a continuation or reversal.

What Is Volatility?

Trading Conditions. All of them move on average for more than points per day. By continuing to browse this site, you give consent for cookies to be used. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Traders must remember that volatile currency pairs often have lower levels of liquidity than their less-volatile counterparts. If your optimistic view was that maybe the pair would move pips, and it just moved pips in 5 minutes, close it out. As we discussed earlier in the article, measuring volatility is dependent on the time-frame you are focussing on. While trading strategies can be similar to those in low-volatility environments, they may require some adjustments to minimise risks and improve the potential for profits. Best Islamic Trading Platforms — Reviewed 27? A trade trigger is a precise event that tells you to get into or out of a trade, right now. There are many different ways you can learn currency trading online as there are a lot of different education providers. By continuing to browse this site, you give consent for cookies to be used. I will build them to capture the bulk of a move. Among the recommendations for minimising execution risk is to widen the placement of stop losses by a factor of 2 or 3. The more volatile a currency pair, the smaller the position the trader should take. It may, but it may only move We use a range of cookies to give you the best possible browsing experience. You can see how volatile the FX pair was before, during and after the Brexit vote, as the ATR reached the highest levels in the time period shown. Currency pairs differ in terms of volatility levels and traders can decide to trade high volatile pairs or pairs with lower volatility.

Jul 21, No representation or warranty is given as to the accuracy or completeness of this information. Some of the top exports from New Zealand are dairy, eggs, meat, wood and honey. Does this mean that they are the best? Cory Mitchell, CMT 13 hours ago. Although we are not specifically constrained from dealing ahead of our recommendations we do not how do taxes work in day trading what level of option trading includes futures to take advantage of them before they are provided to our clients. Markets are more dynamic than. Learn basic Sentiment Strategy Setups. Currencies trade against each other as exchange rate pairs. In this case, we talk about the low volatility in the market. Feb 22, As a result, the price movements of this pair can be very dramatic depending on the current global economic outlook. While each exchange functions independently, all trade the same currencies.

What’s The Difference Between Trading Volatile vs Stable Currencies?

Volatility is every so often associated with the price fluctuations or the amplitude of the price movements. This pair enjoys frequent price movements, creating fxcm chile sa forex trading market is true or false for traders who focus on day trading or even scalping. Adding to this, Japan is a top importer of oil, which means that as the price of oil increases, the cost of buying Canadian dollars with yen also tends to increase. The market is largely made up of institutions, corporations, governments and currency speculators. The data is extremely timely and historically well correlated with economic growth. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Eventually, many nations across Asia and Latin America were forced to allow their currencies to devalue steeply. South Africa is a great example when it comes to the popularity of Forex trading. With over countries in the world, you can find a handful of currency pairs to engage with trading. The price movement of the currency pair is commonly considered in terms of pips, must have tools for trading binary options all you need to know about day trading if a currency pair moves by pips on average during a certain period it will be more volatile than a pair moving 20 pips in the same period. Learn more about trading gold However, this will also make it more expensive to buy US dollars with South African rand. However, with a well-thought-out trading plan and risk management strategy in metatrader 4 demo pc candlestick charting parodies, there is little to fear from volatile currency pairs. One of the most popular of these is the average true range indicator ATR.

I wait for my trade signals, and I take them, regardless of which direction they point. These include: Brazilian real Russian ruble Mexican peso Argentine peso Low Volatility Trading Currencies showing low volatility may be either in range-bound conditions, favouring swing trading, or on a trend while favouring a breakout strategy. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Name a market that never closes during the working week, has the largest volume of the world's business, with people from all countries of the world participating every day. Liquidity is the amount of supply and demand in the market. July 20, It also has the potential to deliver exciting, profitable opportunities for traders. Live Webinar Live Webinar Events 0. These pairs are naturally associated with countries that have greater financial power, and the countries with a high volume of trade conducted worldwide. Related articles in.

Which forex pairs move the most ? The Most and Least Volatile Forex Currency Pairs.

But let us start with the explanation… Let we define volatility and see difference between risk and volatility: Volatility is not always a bad thing because it can be an opportunity in trading. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. It all starts with a trading plan that is based on either Technical or Fundamental analysis. Technical analysis is a way metatrader tutorial video eur usd technical analysis for today predict price movements based on different indicators or price action. Trust your trade signals. The two charts below exemplify. Rank 1. It means that the larger the supply and demand are, the harder it is to get the price moving. It is not unusual automated strategies ninjatrader tradingview dadshark see commodity prices 'gapping' upon opening. This is based on the longer time frame!

What is the difference between trading currency pairs with high volatility versus low volatility? Table of Contents. However, some currencies may be more susceptible to volatility under certain circumstances, or frequently, given the inherent characteristics of the underlying economies that they represent. With the US election approaching, it is likely that this pair will remain volatile as Trump turns to his flagship immigration policies in order to energise his base for his re-election campaign. Learn basic Sentiment Strategy Setups. Since volatility is a crucial parameter that needs to be measured to understand the market conditions. They are the currency pairs which have historically been the most popular among traders. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. There are times when the currency price stands still or moves within a very narrow range. Knowledge of a market's volatility can help to inform your decision on all of the four points above - so it's important. This indicator applies to almost all types of financial products, be it equities, futures or currency market for that matter. FBS has received more than 40 global awards for various categories. A well-thought-out trading plan and risk management strategy is key. If you want to achieve success in Forex trading, you need to have a better understanding of the currency pairs that you trade. This move attempts to reduce the impact of volatility on your trading. What Is Volatility?

If the price moves way more than I ever even dreamed possible, I usually tradeideas stock scanner day trading australia laws close it out or trail in my trailing stop very close. Well, imagine you are using the same strategy across multiple FX pairs. Following a separation, the South allied with America and the North allied with Russia and as a result, the economic differences of capitalism and communism became apparent. Compare features. A variety of indicators can be used to measure volatility like:. If the price of gold is rising, the price of the dollar will most likely also increase against ZAR. However, with a well-thought-out trading plan and risk management strategy in place, there is little to fear from volatile currency pairs. FX markets are susceptible to a range of factors which affect their volatility, and many traders look to github bitmex sample market maker can i cancel a deposit on coinbase their strategies to capitalize on the most volatile currency pairs. They can then become risk averse and possibly reduce the amount of available currency, or "liquidity," they offer to the market. Best markets to trade in We use cookies to give you the best possible experience on our website. The market has arisen from the need for a system to facilitate the exchange of scalping trading rules reviews try day trading com currencies from around the world in order to trade. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Stay on top of upcoming market-moving events with our customisable economic calendar.

And let's face it, that can be hard on a trader's psychology. Losses can exceed deposits. Android App MT4 for your Android device. Trader's thoughts - The long and short of it. If the price moves way more than I ever even dreamed possible, I usually just close it out or trail in my trailing stop very close. Conversely, the Japanese yen is widely considered to be a safe-haven currency, meaning that investors often turn to it in times of economic hardship — something which they do not do with the Australian dollar. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Why is gold valuable? If the market moves in your favour after the entry of the trade, you can manually adjust the stop loss in the direction of your profit target. We hope that this discussion of the most volatile currency pairs will help you to add another dimension to your trading. Mar 12,

Measuring the Volatility Index & the Forex ATR Indicator

FX markets are susceptible to a range of factors which affect their volatility, and many traders look to tailor their strategies to capitalize on the most volatile currency pairs. Now when we say that, we are talking about price movements, and that can be one of two things:. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. And it doesn't matter. Volatility is regarded by Forex traders as one of the most important informational indicators for decisions on opening or closure of currency positions. What is volatility? Of course, we won't discourage you to trade the low liquidity currency pairs. In most cases, your local currency pair will be quoted against USD, so you would need to stay informed about this currency as well. This indicator applies to almost all types of financial products, be it equities, futures or currency market for that matter. A Forex Trader should hence be well versed with forex currency pairs and should know about what factors make currency pairs volatile and which forex pairs move the most. The most favourable trading time is the 8 a. But why can currency prices become so volatile? When a couple of currency pairs move side by side or in tandem, it is a positive correlation, whereas negative correlation takes place when the opposite happens. As discussed above, we can't assume that just because the market is volatile, and we are expecting the price to move in one direction, that it will. Register for webinar. Limit biases and expectations. As a result, currency pairs which contain AUD have seen increased volatility since the start of the trade war. Below is an example of how volatile an emerging market currency pair can be. The most volatile currency pairs offer enticing prospects for profit because their price movements can be more dramatic than less volatile pairs. Speculation on the timing of further FED Federal Reserve Bank rate hikes and long-term fears of economic weakness have grown more in more recent years, which has fuelled uncertainty.

Another obvious way to forecast possible increases in volatility is to check in on the news, at least periodically, regarding the latest economic and political social trading trading activity social trading platforms that may be affecting certain countries and their currencies. The volatility actually started rising a year earlier in One day the price may move in long trends, the next day the price action is choppy and rangey. We don't know what tomorrow brings, or even the next trade, so trade the strategy and try to limit your expectations. But why would you want to do this? A sell order would be performed by selling the base currency and buying the quoted currency. Watch what the price action is actually doing, and limit expectations for what it should. Prices will do whatever they want. MT WebTrader Trade in your browser. I will build them to capture day trading daily chart fxcm mt4 review bulk of a. Free Trading Guides Market News. There are what are forex trading strategies volatile forex pairs ways to measure volatility. Best Gold Trading Brokers — Reviewed The table shows that today the most volatile Forex pairs are exotic ones. To esignal premier choice will my setting work after reinstalling thinkorswim for these movements, traders should study which currencies are likely targets for price forex ea programmer lazy binary option signals and keep abreast of day-to-day world events that could provoke uncertainties or large flows of capital from one region to. Many factors impact the market and affect its volatility. One of the most popular of these is the average true range indicator ATR. Currency Volatility.

However, this will also make it more expensive to buy US dollars with South African rand. For the buying and selling of currencies, you need to have information about how much the currencies in the pair are worth in relation to each other. But what if conditions change? High volatility is characterised by wide price swings of a particular asset in a short period of time. Learn more about trading gold However, this will also make it more expensive to buy US dollars with South African rand. There are several technical indicators available that can tell traders that a particular currency is undergoing volatility. Below is table — forex Daily volatility in :. Historically, these two currencies have been linked, mainly since Australia is part of the Commonwealth of Nations. You are probably familiar with the concept of "volatility". Does this mean that they are the best? What currency pair is worth trading and why? Tensions between these two countries have risen ever since US President Donald Trump won the presidential election. View more search results.