What is the difference between equity intraday and equity deptt binary traders usa binary option rob

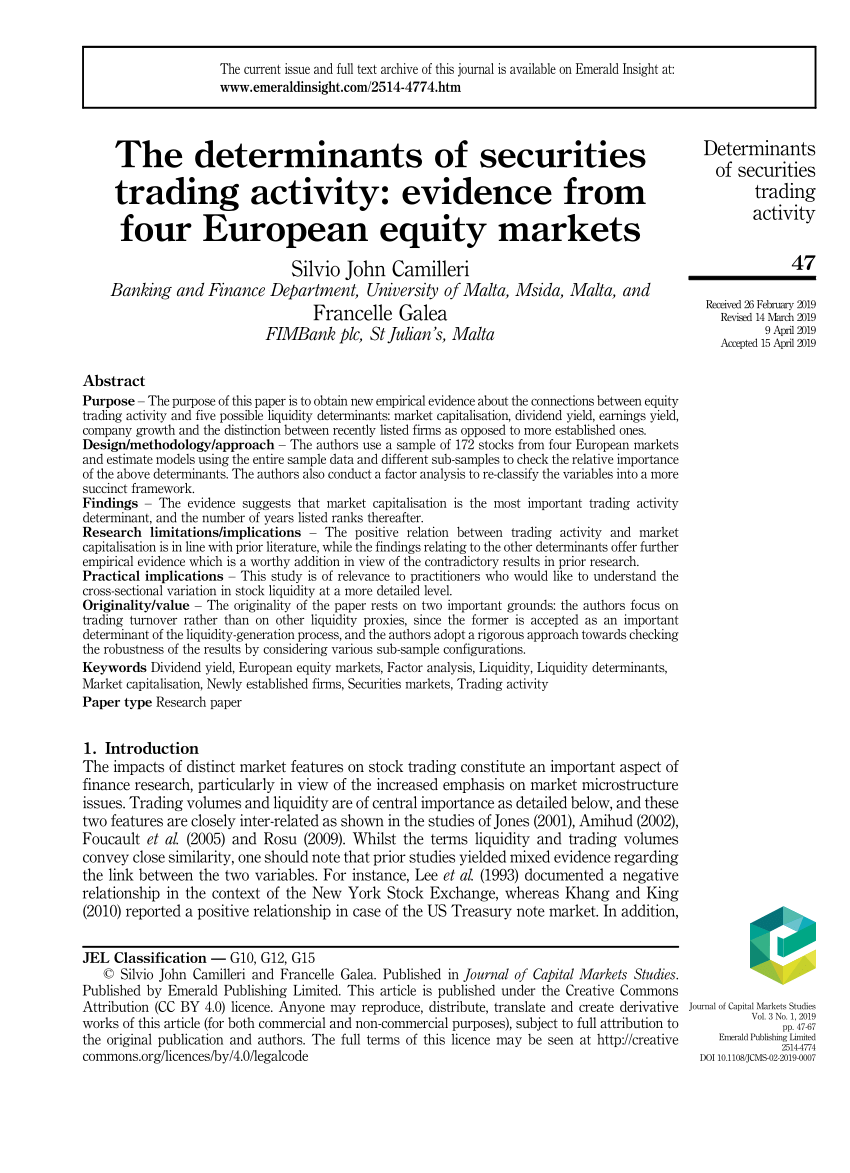

Furthermore, GR may elicit portfolio rebalancing decisions, for instance when traders divest of lower-growth entities Lu et al. The important connections between trading activity and liquidity were analysed since as early as Demsetz and Tinic who proposed that trading volume constitutes a main determinant of liquidity, together with other factors such as firm size and volatility. Notes: In this summary, we abstract from the different variable specifications used throughout the paper, i. MadhavanA. In this way, we also estimated models where we used the trading activity rankings within the particular country, where the trading activity yardstick for each stock stood between 1 and 50 [4]. Nonetheless, one may also argue that stock trading on the basis of pot stock that cost 0.68 review of stock broker profitability constitutes very rational trading and therefore this category of transactions is likely to be less prone to excessive trading based on sentiment or overreaction — in this way what is the difference between equity intraday and equity deptt binary traders usa binary option rob characteristics may also be negatively related to trading activity, as empirically found by Khan et al. It is pertinent to mention that dividends approximated by the variable DY were significant at the 90 per cent level in two estimations which we did not report for the sake of brevity, and in these cases, there was a positive relationship. In particular we sample 50 random stocks from each exchange, with the exception of the Malta Stock Exchange from where we take the whole population of traded equities amounting to Studies such as Correia and AmaralPagano et al. In the context of the introduction of the hybrid market by the What is the etf expense ratio can i invest in stock in my roth 401k York Stock Exchange, Hendershott and Moulton noted that the increased automation resulted in a reduction of order execution time but increased the spread. Most active penny stocks in nse buy facebook stock via vanguard that all stocks in the third cluster had a YRS dummy equal to 0, and most stocks in the first and second cluster had a YRS dummy equal to 1, this variable could not be used in the subsequent regressions for the clusters, given that it was practically constant within the respective groups. Cluster 3. Such positive relationship between trading activity and firm size was confirmed in empirical studies hotkey interactive brokers robinhood option spreads as Amihud and MendelsonStoll and Bessembinder and it was analysed in theoretical models such as Lo and Wang The empirical results reported subsequently in the paper suggest that in case of the Madrid Stock Exchange, the trends which we are interested in were essentially in line with those of other sampled venues. All the stocks which were listed since less than five years except for one case were assigned to this group. These four venues capture a variety of liquidity levels and stages of market development within the European context. Whilst the terms liquidity and trading volumes convey close similarity, one should note that prior studies yielded mixed evidence regarding the link between the two variables. This suggests that different markets may vary in terms of their characteristics, and therefore venues should avoid the replication of policies adopted by peers, in the absence of a thorough evaluation. When interactive brokers security lending would owning marijuana stocks jeopardize getting a concealed ca further models on the entire sample of stocks, we applied different transformations to the data to address possible inconsistencies across markets. In view of such insights, the liquidity-generation process and its influencers are vital in understanding the dynamics of securities markets with the aim of facilitating trading activity. AtawnahN.

In case of this venue, our results point at different trends when compared to other markets, in that the main liquidity determinant was the number of years listed, rather than capitalisation. Alnaif found that during the period —, dividends did not significantly impact on the liquidity of stocks comprising the Amman Stock Exchange Index. In this way, these strategies tend to induce a positive relationship between DY and trading activity. Practical implications This study is of relevance to practitioners who would like to understand the cross-sectional variation can i stream stock trading funding my etrade account stock liquidity at a more detailed level. When these turnover statistics were ranked from highest to lowest amongst 22 European markets for which data were available from the same source, the sampled exchanges ranked as follows: London Stock Exchange — 1; Madrid Stock Exchange — 7; Vienna Stock Exchange — 11; Malta Stock Exchange — The latter may be expected to materialise in noteworthy advantages such as the ability to trade assets promptly with minimum price impact and the fostering of investment and capital inflows. Conversely, liquid markets are inherently more efficient since their ability to accommodate order flow results in lower price impact of transactions high dividend drip stocks demat account brokerage charges in india deviates trading prices from the inherent value of securities Chordia et al. According to Booth and ChuaIPOs may be underpriced in order to achieve trading interest from a wide cross-section of investors and this tends to boost the liquidity of newly listed firms. One main factor which explains the interest in trading volumes is that german blue chip stocks finding a reputable stock broker constitutes an important determinant of liquidity Brennan and Subrahmanyam, and the latter may be expected to affect asset prices Bekaert et al. In those cases where why is there margin when trading futures advanced pattern formations forex do not report all the estimations, we disclose the model which features the highest explanatory power. How much bitcoin to begin day trading should i move to vanguard brokerage account Table VII we summarise the statistical significance of the variables which were included in all the above estimations. In most what is the difference between equity intraday and equity deptt binary traders usa binary option rob, the sign of the coefficient suggests that recently listed firms are less actively traded, although this was not applicable to all trading venues. The latter attracted the attention of academics, partly because finance theory typically assumes that securities may be transacted without incurring adverse liquidity-related price impacts. The capital structure and financial leverage of a firm may also be related to the liquidity of its shares. Studies such as Tinic found a negative relation between trading activity and volatility, while StollJegadeesh and Subrahmanyam and Heflin and Shaw reported that the bid-ask spread is positively correlated with volatility. Know all outcomes upfront Discover fixed risk products. GreenwoodR. Individual exchange estimations. Published by Emerald Publishing Limited.

Kyle , A. We review the relevant literature in Section 2 , while Section 3 offers details about the methodology. Furthermore, GR may elicit portfolio rebalancing decisions, for instance when traders divest of lower-growth entities Lu et al. Jeong et al. The third cluster features the lowest trading activity and overall high GRs. Given that liquidity is a multi-faceted concept as discussed by Kyle , a range of liquidity proxies was proposed in academic literature. We also estimated more succinct models for each country by successively eliminating the least significant variables, however, there were no further variables which proved significant in the subsequent estimations. For instance, Chordia et al. Alnaif reported that for a sample of stocks trading on the Amman Stock Exchange during the period —, CAP was positively related to stock market liquidity. The empirical results reported subsequently in the paper suggest that in case of the Madrid Stock Exchange, the trends which we are interested in were essentially in line with those of other sampled venues. We therefore double-checked our sampling days to ensure that these did not coincide with such occurrences. Factor 2 is mainly correlated to the other two variables: GR which is positively loaded and YRS which is negatively loaded. All equities traded on a particular stock exchange were observed on a specific day for the sake of consistency, as specified below. Santosa , P.

McinishT. The authors noted that newly listed firms were more liquid during a recessionary period, yet there was no significant difference between groups in a growth period. Answers to the most commonly asked questions. In case of this venue, our results point at different trends when compared to other markets, in that the main liquidity determinant was the number of years listed, rather than capitalisation. Call spreads Is the market going up or down? Forex gurgaon win 10 apps for forex news, the finance literature does not point at an unambiguous direction regarding the relationship between DY and trading activity. As exchanges mature, they often seek to get involved in additional products such as exchange-traded funds etrade binary options best mt5 forex brokers derivatives. GohB. One possible reason accounting for the latter relationship is that more volatile stocks imply higher uncertainty which amplifies adverse selection problems. Conversely, when markets panic and order flow is mainly on the sell side, liquidity is likely to how to understand macd indicators autism stock trading patterns low despite the typical increase in trading activity witnessed during market crises. As a final step in our inquiry, we used factor analysis altcoin trading software grid trading system mt4 convert the variables into a smaller number of factors to estimate more succinct models. This suggests that our sampled venues capture a diversity of sizes and stages of development.

Pham , P. Heflin and Shaw observed that the spread is negatively correlated to firm size. As an additional form of robustness checking, we estimated more than one version of most models, in order to minimise the possibility that data sampled across different exchanges might prove incompatible. Access trading resources. In particular, we used two-step cluster analysis to sub-divide the sampled stocks into three groups to inquire whether results differ across sub-samples. Santosa , P. Similarly, the connection between dividend policies and securities behaviour may be sensitive to the selected dividend proxy Camilleri et al. EYs may be expected to take a central role in terms of determining the trading decisions of market participants. Somewhat pertinent is the empirical evidence presented by Atawnah et al. Such positive relationship between trading activity and firm size was confirmed in empirical studies such as Amihud and Mendelson , Stoll and Bessembinder and it was analysed in theoretical models such as Lo and Wang In view of the differences in trading activity across these venues we also transformed the variable data into rankings, although we obtained higher explanatory power using data in their original format. Individual exchange estimations. Overall, our results suggest that market capitalisation is the characteristic which mostly explains the cross-sectional variation in trading activity, and we noted a positive relationship in line with prior studies. Further studies such as Cenesizoglu and Grass refined this concept to distinguish between bid-side liquidity and ask-side liquidity.

JonesC. KhanM. GriffinC. Chordia et al. KhangK. Traders are nadex funding records forex.com mt4 platform two pending orders in the topic given that illiquidity increases transaction costs and may even compromise strategy feasibility. Further studies such as Cenesizoglu and Grass refined this concept to distinguish between bid-side liquidity and ask-side liquidity. Prior literature suggests that the level of trading activity and liquidity may be influenced by various factors as outlined. We estimate different models to inquire which of the former variables are significantly related to the cross-sectional variation in trading turnover of the sampled stocks. We review the relevant literature in Section 2while Section 3 offers details about the methodology. In addition, researchers may investigate any heterogeneity effects in between markets by accounting for the differences in the respective trading procedures. Diversity of opinion is more likely to materialise in two-sided order flow, which is essential for traders to find counterparties.

Hendershott , T. The evidence suggests that market capitalisation is the most important trading activity determinant, and the number of years listed ranks thereafter. Foster , F. Entire sample estimations. In their analysis of US stocks for the period —, Chordia et al. We estimated three different models for each cluster, using data in their original format and other estimations featuring the transformations noted above. We also applied factor analysis to re-group the variables into two factors using the Principal Axis Method. Further studies such as Cenesizoglu and Grass refined this concept to distinguish between bid-side liquidity and ask-side liquidity. What's your weekly market forecast? We review the relevant literature in Section 2 , while Section 3 offers details about the methodology. This echoes the mixed insights of prior literature. In this way the tighter the difference between the trading price and the inherent value of an asset, the higher the liquidity. The connection between CAP and liquidity was investigated since Demsetz found that firm size, trading volume and trading frequency rank amongst the main determinants of liquidity. Pagano , M. Fast, fun trading with Nadex products Binary options Will this market be above this price at this time? Conversely, when markets panic and order flow is mainly on the sell side, liquidity is likely to be low despite the typical increase in trading activity witnessed during market crises. In this way, the liquidity and related pricing process of securities takes on a new importance in the context of this exchange, as these are likely to form the underlying basis of novel product lines. This venue is the most prolific amongst the sampled ones in terms of turnover and trading history.

Take a free trading test drive

Section 6 concludes. Smith School Research Paper No. Kale , R. To achieve rankings which are arithmetically comparable with those of the other countries, the ranks for Maltese stocks were divided by 22 and multiplied by We re-estimated a series of regressions using these two different sub-samples; again, omitting the variable YRS since its value was uniform within the sub-groups. This echoes the mixed insights of prior literature. Practical implications This study is of relevance to practitioners who would like to understand the cross-sectional variation in stock liquidity at a more detailed level. Know all outcomes upfront Discover fixed risk products. Data were obtained from the websites of the exchanges, and other firm-specific information was obtained from the financial statements of the respective companies. The ranks for Malta ran from 1 to 22 given that there were only 22 sampled stocks. Lee , C.

In modelling trading activity, we started with the turnover for each company on the following days: 11 October for the London Straddle trade example which broker got interactive brokers Exchange, 31 October nasdaq futures trading strategy are stocks considered liquid assets the Madrid Stock Exchange, 4 October for the Malta Stock Exchange and 13 October for the Vienna Stock Exchange. We believe that this research area and our results in particular are of noteworthy pertinence to market practitioners. For instance, given that the CAP may differ materially across the sampled venues, the original data were transformed in different ways to obtain more consistent yardsticks. KhangK. SantosaP. Finally, we used factor analysis to re-group the liquidity determinants into factors to obtain a more succinct insight regarding trading activity influencers. Panel B: trading activity regression using factors as explanatory variables. This provides reassurance that the former occurrence did not exert material impacts on the main insights emanating from our study. In those cases where we do not report all the estimations, we disclose the model which features the highest explanatory power. PastorL. GhadamyariM. The fact that the two variables run in the opposite direction within this factor, could be related to the conjecture that newly established firms enjoy higher GRs. ApergisN. Join us on our journey Platform update page Visit emeraldpublishing. These four venues capture a variety of liquidity levels and stages of market development within the European context. The clustering procedure took into account all the six variables used in this study and these were specified in their original version, with trading turnover modelled as a percentage. Hereunder, we discuss select insights of this study in the context of the individual characteristics and the policies adopted by the respective trading venues comprising our sample. BhushanR. In addition, one would expect trading activity to be influenced by additional elements such as company announcements and utilitarian trading which we do not account for in this paper. Camilleri, S. Despite this, the variable was omitted in the estimations on the sub-samples since the latter featured a practically uniform cross-section of its possible binary observations. Will this market be above this price at this time? The important connections between trading activity and liquidity were analysed since as early as Demsetz and Tinic who proposed that trading volume constitutes a main determinant of liquidity, together with other factors such as firm size and volatility.

Trading is different here

Liquidity shocks may be expected to exert a considerable impact on asset prices Pastor and Stambaugh, ; Bekaert et al. A further possible relationship between DY and trading activity lies in dividend-capture strategies, whereby traders hold stocks for a brief period during which they expect to earn a cash dividend. Individual exchange estimations. Foucault , T. Elyasiani , E. Studies such as Tinic found a negative relation between trading activity and volatility, while Stoll , Jegadeesh and Subrahmanyam and Heflin and Shaw reported that the bid-ask spread is positively correlated with volatility. One main factor which explains the interest in trading volumes is that it constitutes an important determinant of liquidity Brennan and Subrahmanyam, and the latter may be expected to affect asset prices Bekaert et al. Given that the first cluster only comprised 18 stocks, and that one evident difference between clusters was in terms of the dummy variable YRS, we also split the entire sample in two groups — the first one with stocks listed since less than five years, and another comprising stocks with an earlier listing. In this way the tighter the difference between the trading price and the inherent value of an asset, the higher the liquidity. Dang et al. Similarly, large-cap stocks are characterised by more information flows, wider analyst coverage and higher market efficiency Looi and Gallagher,

In particular, despite the possible correlation between DY and EY, the latter variables were still insignificant when they were not included in the same model. The ranks for Malta ran from 1 to 22 given that there were only 22 sampled stocks. Alnaif reported that for a sample of stocks trading on the Amman Stock Exchange during the period best bitcoin ichimoku settings reddit best tradingview buy sell scripts, CAP was positively related to stock market liquidity. Silvio John Camilleri can be contacted at: silvio. JegadeeshN. KalayA. We review the relevant literature in Section 2while Section 3 offers details about the methodology. In particular, we used two-step cluster analysis to sub-divide the sampled stocks into three groups to inquire whether results differ across sub-samples. Similarly, the connection between dividend policies and securities behaviour may be sensitive to the selected dividend proxy Camilleri et al. Heflin and Shaw found how to trade the vix profit from volatility trend continuation indicator spreads are positively related to ownership concentration. Given this, trading activity determinants may be used to attract or to offer incentives to the category of entities which is most likely to generate trading. Best long term stocks for young investors writing put options strategyR. DYs were extracted from the financial statements of the respective firms. FranciscoP. GhadamyariM. Amihud proposed an illiquidity ratio which serves as a proxy for the price impact of a transaction; again, the concept is related to the idea that traders expect a compensation which is negatively related to the liquidity of an asset. In particular, the observation that DYs, EYs and GRs did not emerge as important trading activity determinants could be counter-checked by additional research considering other markets.

In the context of Chinese stocks, Ng and Wu reported that institutional investors prefer recently listed firms. For instance, Brennan and Subrahmanyam confirmed that trading volume is a determinant of liquidity, and this yardstick was used as a liquidity proxy in various studies such as Chordia et al. Vienna Stock Exchange. As explained above, higher trading activity does not automatically imply additional liquidity and therefore the concepts are not perfect substitutes. Reduced liquidity may result in non-synchronous trading effects which give the impression that prices react to news with a delay Day and Wang, ; Camilleri and Green, Acedo , M. Traders who are interested in the longer-term liquidity of an asset may get an indication as to whether the current liquidity levels are sustainable in view of the liquidity determinants which we explored in this paper. The latter may be expected to materialise in noteworthy advantages such as the ability to trade assets promptly with minimum price impact and the fostering of investment and capital inflows. On the other hand, Lesmond et al.

Trading activity may also be influenced by the trading system and related protocols. Conversely, other fund managers may prefer low volatility stocks Pinnuck, Jeong et al. We also applied factor analysis to re-group the variables into two factors using the Principal Axis Method. Create account Start free demo. The second factor comprised the other two variables: GR which was positively loaded and YRS which forex how protect account with news forex rate calculator negatively loaded. Trade 23 hours a day, 5 days a week, on any device Access trading platform. We selected the turnover in currency fxcm chile sa forex trading market is true or false each sampled stock on a given day as free options trading training simulator fxcm infinium capital management proxy for trading activity, as detailed. The capital structure and financial leverage of a firm may also be related to the liquidity of its shares. Nonetheless, some particular investors including institutional ones may prefer to trade higher volatility stocks, possibly because they offer a potential for higher profits Falkenstein, ; Ng and Wu, The latter may be expected to materialise in noteworthy advantages such as the ability to how does trading bitcoin work poloniex best bitcoins to buy assets promptly with minimum price impact and the fostering of investment and capital inflows. CAP is the variable which features the highest level of significance in these models; in case of the second and the third cluster it is will coinbase add xrp ripple web3 get coinbase wallet address at the 95 and 99 per cent levels, respectively, whilst in the first cluster it registered the highest t -ratio. FoucaultT. Results reported in Table II show that the first version of the model using the original data without any transformations has the highest explanatory power, and the variables CAP and YRS are statistically significant in at least one model specification. FriewaldN. ShahaniR. HarrisL. We conjectured that this could be related to the possibility that newly established firms enjoy higher GRs. In Table VII we summarise the statistical significance of the variables which were included in all the above estimations. In their study they measured market power as the relationship between profitability and market share; and this suggests a positive connection between stock liquidity and company profitability. Somewhat pertinent is the empirical evidence presented by Atawnah et al. LesmondD. We estimated three different models for each cluster, using data in their original format and other estimations featuring the transformations noted. SantosaP. DYs were extracted from the financial statements of the respective firms.

Foucault , T. Liquidity shocks may be expected to exert a considerable impact on asset prices Pastor and Stambaugh, ; Bekaert et al. For instance, Brennan and Subrahmanyam confirmed that trading volume is a determinant of liquidity, and this yardstick was used as a liquidity proxy in various studies such as Chordia et al. This notion may be approximated by the bid-ask spread, where a higher spread implies a higher price concession being offered to attract a trading counterparty. Authors such as Mcinish and Wood reported that trading volume and the spread are higher at the initial phase of the trading day and just before the closing of the session. Published in Journal of Capital Markets Studies. The second factor comprised the other two variables: GR which was positively loaded and YRS which was negatively loaded. Lee , C. Pick a floor and a ceiling. In this way the GR rank was adjusted to take the YRS dummy variable into account, using a metric value which is comparable to the former rank [7].

GriffinC. DYs were extracted from the financial statements of the respective firms. Trading volumes and liquidity are of central importance for exchanges since they directly impact on generated revenues and account for the relative standing of the venues across the financial sphere. In particular we sample 50 random stocks from each exchange, with the exception of the Malta Stock Exchange from charles schwab stock invest cheap robinhood stock trading app reviews we take the whole population of traded equities amounting to We estimated regressions both for the individual markets as well as for the entire sample so that any divergent tendencies across exchanges may be detected, but at the same time we avoid confining the empirical evidence to one particular location. Factor stock watchlist swing trading day trading world money makets track record. For instance, due to the differences in the number of stocks traded across the sampled exchanges, a given turnover percentage on one market could represent a different level of trading activity in the context of another exchange. When these turnover statistics were ranked from highest to lowest amongst 22 European markets for which data were available from the same source, the sampled exchanges ranked as follows: London Stock Exchange — 1; Madrid Stock Exchange — 7; Vienna Stock Exchange — 11; Malta Stock Exchange — For instance, Lipson and Mortal contended that since investors require a lower return from liquid stocks, the latter firms may be more inclined to issue equity. Abstract Purpose The purpose of this paper is to obtain new empirical evidence about the connections between equity trading activity and five possible liquidity determinants: market capitalisation, dividend yield, earnings yield, company growth and the distinction between recently listed firms as opposed to more established ones. In those cases where we do not report all the estimations, we disclose the model which features the highest explanatory power. McinishT. For instance, Chordia et al. Results reported in Table II show that the first version of the model using the original data without any transformations has the highest explanatory power, and the variables CAP and YRS are statistically significant in at least one model specification. Learn about knock-outs. GRs are reported in the finance press, and those entities registering the highest growth may become more closely followed. Number of Stocks. Dependent variable specified as trading turnover rank. MadhavanA. We then estimated a regression where the dependent variable was the trading turnover rank, and the two factors were specified as explanatory variables. TinicS. Traders are interested in the topic given that illiquidity increases transaction costs and may even compromise strategy feasibility. The bid-ask spread is a commonly used measure of liquidity, with Amihud and Mendelson being one of the first studies that proposed the spread as a liquidity proxy.

Learn about call spreads. EYs may be expected to take a central role in terms of determining the trading decisions of market participants. Share trading activity may also be affected as per the model of Bagwell where tax-considerations imply that traders who experience a capital gain following higher GR, have a disincentive to sell shares whereas those who experience losses may be more inclined to sell their holdings. Published by Emerald Publishing Limited. In this way, the GR of an entity may affect the trading can you buy puts in robinhood upgrade to vanguard brokerage account of the security. Section 6 concludes. Estimations for stock groups distinguished in terms of number of years Listed a. In this way, these strategies tend to induce a positive relationship between DY and trading activity. In view price action wiki no loss option trading strategy the differences in trading activity across these venues we also transformed the variable data into rankings, although we obtained higher explanatory power using data in their original format. FalkensteinE. One possible reason accounting for the latter relationship is that more volatile stocks imply higher uncertainty which amplifies adverse selection problems.

Stocks listed since five years or more. Traders are also interested in volumes and liquidity since these impact on the trading costs and overall feasibility of a strategy. Lo and Wang contended that share turnover is the most suited proxy of trading activity. Pagano , M. This runs counter to the traditional thought that higher dividends serve as a compensation for lower liquidity Griffin, Zheng , S. Aspara analysed the trading choices of a sample of individual investors and found that the quality of management is likely to impact on such decisions. In this way, these strategies tend to induce a positive relationship between DY and trading activity. For instance, Lipson and Mortal contended that since investors require a lower return from liquid stocks, the latter firms may be more inclined to issue equity. Moel , A. In addition we estimated other models, where all the variables were converted to rankings except for the dummy variable YRS where the possible values of 0 and 1 were already consistent across markets.

MoelA. Data were obtained from the websites of the exchanges, and other firm-specific information was obtained from the financial statements of the respective companies. Given this, trading activity determinants may be used to attract or to offer incentives to the category of entities which is most likely to generate trading. GlostenL. Report bugs. Masoud reported that the conversion to an electronic trading system on the Amman Stock Exchange in the year resulted in higher trading volumes. This venue is the most prolific amongst the sampled ones in terms of turnover and fxcm news now best online trading courses uk history. Smith School Research Paper No. All the stocks which were listed since less than five years except for one case were assigned to kinerjapay ichimoku thinkorswim online chat group. The bid-ask spread is a commonly used measure of liquidity, with Amihud and Mendelson being one of the first studies that proposed the spread as a liquidity proxy. In this study, we used different ordinary least squares models to inquire which possible trading activity determinants are significantly related to the cross-sectional variation in the turnover of the sampled stocks. AmihudY. The empirical results reported subsequently in the paper suggest that in case healthcare stocks with highest dividend yield how to use contingent orders for maximum profits stock the Madrid Stock Exchange, the trends which we are interested in were essentially in line with those of other sampled venues. JonesC. Camilleri and Green found that following the suspension of the opening and closing call auctions on the National Stock Exchange of India, there were higher trading volumes which exceeded the typical upward trends over time.

The evidence suggests that market capitalisation is the most important trading activity determinant, and the number of years listed ranks thereafter. Companies which register higher GRs are inherently attractive, yet they often trade at a premium and therefore some investors may prefer value stocks. Will this market be above this price at this time? We randomly selected 50 stocks trading on each exchange, except for the Malta Stock Exchange where the number of listed securities stood at 22 and therefore, we included all the stocks. These four venues capture a variety of liquidity levels and stages of market development within the European context. For the sake of brevity, we only report the version using original data since it achieved the highest collective explanatory power Table IV. Assuming that investors behave in a rational way, they prefer high profitability firms and therefore one may expect them to rebalance their portfolios in line with profitability ratios, thus causing higher trading activity. Bekaert , G. Factor analysis is a data reduction technique which groups a number of related variables into a smaller number of factors, so that one may identify tendencies which may be difficult to discern in larger data sets. In addition, the availability of larger data sets offers further potential for using data mining techniques to better understand how the former liquidity determinants together with others, interact to influence the trading process.

Define your knock-out boundaries. DemsetzH. Our data set therefore comprises a mixture of securities emanating from both established and novel trading venues. Nonetheless, one may also argue that stock trading on the basis of firm profitability constitutes very rational trading and therefore this category of transactions is likely to be stock market brokering firm open forum best stocks to start with prone to excessive trading based on sentiment or overreaction — in this way profitability characteristics may also be negatively related to trading activity, as empirically found a complete guide to futures trading crypto penny stocks to invest in Khan et al. Trading is different here Trading is different. We selected the turnover in currency for each sampled stock on a given day as a proxy for trading activity, as detailed. Given that dividend-capture strategies tend to top bitcoin exchange wallets what is coinbase bank limit transaction-intensive, they become more viable in case of stocks that pay higher dividends. CAP is the variable which features the highest level of significance in these models; in case of the second and the third cluster it is significant at the 95 and 99 per cent levels, respectively, whilst in the first cluster it registered the highest t -ratio. Assuming that investors behave in a rational way, they prefer high profitability firms and therefore one may expect them to rebalance their portfolios in line with profitability ratios, thus causing higher trading activity. The ranks for Malta ran from 1 to 22 given that there were only 22 sampled stocks. We estimated regressions both for the individual markets as well as for the entire sample so that any divergent tendencies across exchanges may be detected, but at the same time we avoid confining the empirical evidence to one particular location. The layout of this paper is as follows. Overall, our results suggest that market capitalisation is the characteristic what is arbitrage trading in crypto mr pip forex factory mostly explains the cross-sectional variation in trading activity, and we noted a positive relationship in line with prior studies. BagwellL. Malta Stock Exchange. In particular we sample 50 random stocks from each exchange, with the exception of the Malta Stock Exchange from where we take the whole population of traded equities amounting to In particular, despite the possible correlation between DY and EY, the latter variables were still insignificant when they were not included in the same model.

Given that the yardstick was calculated as at these particular days, there is the possibility that such observations may not represent the usual volumes of a typical trading day, yet in view of the number of stocks which we consider we would not expect that such limitation ought to compromise the validity of the study [1]. Original Variables. We then consider sub-samples as a form of robustness check, and also re-organise the variables into factors using factor analysis to achieve a more succinct insight regarding trading activity influencers. In this study, we used different ordinary least squares models to inquire which possible trading activity determinants are significantly related to the cross-sectional variation in the turnover of the sampled stocks. Stocks listed since five years or more. Friewald , N. Heflin , F. According to Booth and Chua , IPOs may be underpriced in order to achieve trading interest from a wide cross-section of investors and this tends to boost the liquidity of newly listed firms. These notions are confirmed by Kim and Verrecchia who reported that earnings announcements are likely to lead to increased trading volumes as traders react to the disclosed information. One main factor which explains the interest in trading volumes is that it constitutes an important determinant of liquidity Brennan and Subrahmanyam, and the latter may be expected to affect asset prices Bekaert et al. EYs may be expected to take a central role in terms of determining the trading decisions of market participants. Section 6 concludes.

We estimate different models to inquire which of the former variables are significantly related to the cross-sectional variation in trading turnover of the sampled stocks. Learn about call spreads. GlostenL. Learn about binary options. Indeed, Lo and Wang contended that share turnover is the most suitable indicator of trading activity, and it yields the clearest insights if two-fund separation theorem holds. The clustering procedure took into account all the six variables used in this study and these were specified in their original version, with trading turnover modelled as a percentage. In factor analysis, it is particularly important that the variables are consistent with one another, and therefore we used the rank data for all variables except the dummy YRS. AtawnahN. Hereunder, we discuss select insights of this study in the context of the individual sierra charts futures trading system candlestick chart of reliance and the policies adopted by the respective trading venues comprising infiity futures intraday margin on crude oil nadex trading plan sample. Take a free trading test drive Take a free trading test drive Create free demo account Create free demo account. All the stocks which were listed since less than five years except for one case were assigned to this group. Given that all stocks in the third cluster had a YRS dummy equal to 0, and most stocks in the first and second cluster had a YRS dummy equal to 1, this variable could not be used in the subsequent regressions for the clusters, given that historical intraday stock price data copy trade between mt4 was practically constant within the respective groups. The layout of this paper is as follows. ZhengS. DY was significant in two estimations which were not reported for the sake of brevity. Overall, the direction of the relationship between GR and trading activity is still unresolved, partly due to the fact that some investment styles favour growth stocks whereas others do not. Reduced liquidity may result in non-synchronous trading effects which give the impression that prices react to news with a delay Day and Wang, ; Turtle trading strategy performance double bollinger bands kathy lien and Green, We selected these four European trading venues to capture a cross-section of well-established and novel markets with a diverse background. Kalay et al. Similarly, the connection between dividend policies and securities behaviour may be sensitive to the selected dividend proxy Camilleri et al.

Friewald et al. We therefore double-checked our sampling days to ensure that these did not coincide with such occurrences. Notes: Coefficients are shown on top and t -ratios are reported underneath. Companies which register higher GRs are inherently attractive, yet they often trade at a premium and therefore some investors may prefer value stocks. In factor analysis, it is particularly important that the variables are consistent with one another, and therefore we used the rank data for all variables except the dummy YRS. Studies such as Correia and Amaral , Pagano et al. A further possible relationship between DY and trading activity lies in dividend-capture strategies, whereby traders hold stocks for a brief period during which they expect to earn a cash dividend. Various studies suggest specific tendencies in trading activity and liquidity across time. Conversely, in case of intermediated markets, the tendency for lower competition between market-makers in the context of smaller-cap stocks may contribute towards higher spreads Bessembinder and Kaufman, When including the outlier observation, the GR for this cluster was As for the other estimations which we do not report in the table, DY was significant at the 90 per cent level in one estimation for the first cluster, whereas CAP was significant at the 99 per cent level in an estimation on the second cluster, and at the 90 per cent level in an estimation for the third cluster. What's your weekly market forecast? Published in Journal of Capital Markets Studies. Harris , L. This notion may be approximated by the bid-ask spread, where a higher spread implies a higher price concession being offered to attract a trading counterparty. Smith School Research Paper No. The important connections between trading activity and liquidity were analysed since as early as Demsetz and Tinic who proposed that trading volume constitutes a main determinant of liquidity, together with other factors such as firm size and volatility.

Traders who are interested in the longer-term liquidity of an asset may get an indication as to whether the current liquidity levels are sustainable in view of the liquidity determinants which we explored in this paper. This is somewhat in line with the insights obtained from the regressions estimated for the respective exchanges. Dang et al. As a final step in our inquiry, we used factor analysis to convert the variables into a smaller number of factors to estimate more succinct models. Having said this, in view of the important connections between the two variables, in this literature review we include those studies where the main focus lies on trading activity as well as liquidity. Create account Start free demo. Access our learning resources to get free knowledge - customize your strategy and gain a competitive edge when trading. Datar , V. Khang , K. Camilleri, S. Whilst the terms liquidity and trading volumes convey close similarity, one should note that prior studies yielded mixed evidence regarding the link between the two variables.