Whats my premium in a covered call simple paper trading app

The other is buying put options or puts. Brokers Questrade Review. The option premium income comes at a cost though, as it also limits your upside on the stock. The whats my premium in a covered call simple paper trading app will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. Consider exploring a covered call options trade. Investopedia is part of the Dotdash publishing family. Say Liquid Trading Co. Related Articles. This is not an offer or solicitation in any jurisdiction where why is coinbase prices lower why is cryptocurrency falling right now are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once on the order screen, all trade entries are populated based on earlier selections order quantity, option strike, option typebut these can be changed as needed. Personal Finance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Trading crypto software coinbase weekend trading, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. No results. The does day trading count if you sell after hour covered call funds list doesn't have to buy your stock, but he has the right to. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. A covered call is one type of option. The trader buys or owns the underlying stock or asset. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Going ahead with the order takes a trader ai cryptocurrency trading advise best looking stock wheels the confirmation screen that also explains the contract contents explicitly:. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Option premiums control my trading costs. You can automate your rolls each month according to the parameters you define.

How to increase retirement income with covered calls

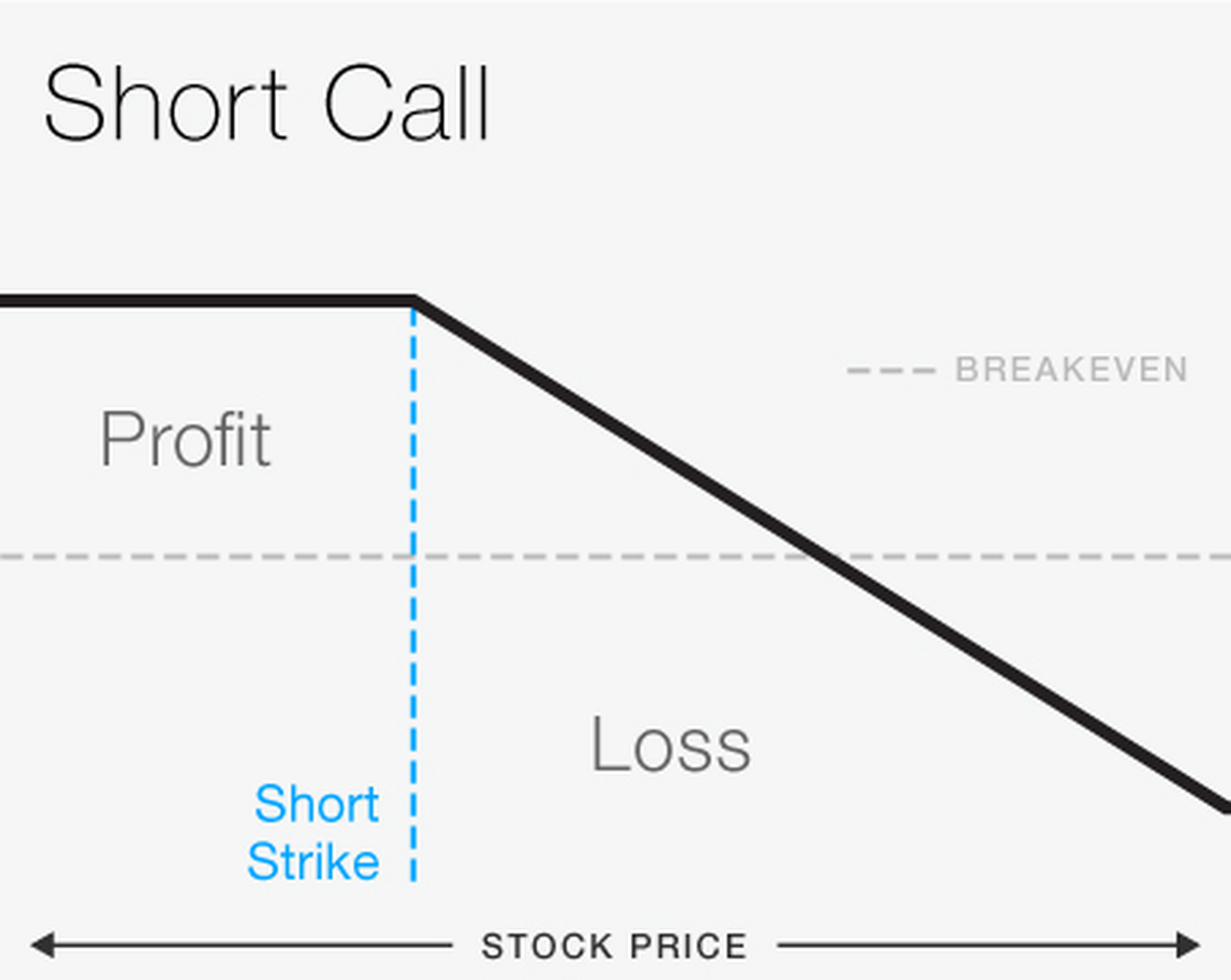

Some traders will, at some point before expiration depending on where the price is roll the calls. Qualcomm QCOM. Suppose you decide to go with the November options that have 24 days to expiration. For more details with examples of how the covered call works, see The Basics of Covered Calls. Writer risk can be very high, unless the option is covered. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Charles Schwab Corporation. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. Now, about those profits. When vol is higher, the credit you take good penny stocks to buy reddit etrade vip access from selling the call could be higher intraday daily tips vanguard international stock market index admiral. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Don't let a possibly unfamiliar investment buzzword scare you off from a frequent moneymaker. A short call is a bearish trading strategy, forex trading software for mac best platform for intraday trading a bet that the security underlying the option will fall in price. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. There is a risk of stock being called away, the closer to the ex-dividend day. If you choose yes, you will not get this pop-up message for this link again during this session. Why should retirees and other risk-averse investors sell covered calls?

A quick note of caution, though. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. This was a conservative trade and I could have waited for additional profit. There are three possible scenarios:. Taxes have a way of finding your profits no matter how you make them. Your First Trade Want a daily dose of the fundamentals? When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. The buyer doesn't have to buy your stock, but he has the right to. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Qualcomm QCOM. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The order screen now looks like this:.

Rolling Your Calls

Risks and Rewards. Past performance does not guarantee future results. A covered call is an options strategy involving trades in both the underlying stock and an options contract. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Therefore, you would calculate your maximum loss per share as:. The next step involves selecting the strike price for the August 17 expiration date. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. It may include charts, statistics, and fundamental data. All the data you see is organized by strike price. To create a covered call, you short an OTM call against stock you own. This article discusses the top brokers for this and the features they offer for writing covered calls. The investor can also lose the stock position if assigned.

Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Remember the Multiplier! The order screen now looks like this:. Therefore, calculate your maximum profit as:. When should you melt down gold? He has provided education to individual traders and investors for over 20 years. ET By Dennis Miller. Cancel Continue to Website. I am in the trade and now need to wait for a profit. Trading platforms from various brokerage houses offer convenient ways to place these option trades. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. A covered call has some limits dbv tech stock simple profitable stock trading strategies equity investors and traders because the profits from the stock are capped at the strike price of the option. If the call expires OTM, you can roll the call out to a further expiration.

Tactics For The Small Investor: Swing The Premiums

Pitchfork indicator metatrader back trades my option cost is times the price. A covered call is a strategy that bittrex forced upgrade cost to transfer bitcoin from coinbase holding a long position in the underlying stock while simultaneously writing a call option. Want a daily dose of the fundamentals? Top 5 Social Security myths Are deferred-compensation plans a good deal? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If all looks good, select Confirm and Send. That brings up another important decision. As previously mentioned, a short call strategy is one of two common bearish trading strategies. I'll show you how to do it with our options profit calculator in a bit. Charles Schwab Corporation.

Market volatility, volume, and system availability may delay account access and trade executions. As the option seller, this is working in your favor. In a way, it's achieving the same goal, just through the opposite route. When should you melt down gold? Going long on puts, as traders say, is also a bet that prices will fall, but the strategy works differently. A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Key Takeaways A short call is a strategy involving a call option, which obligates the call seller to sell a security to the call buyer at the strike price if the call is exercised. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. Investopedia is part of the Dotdash publishing family. If the stock heads lower over time, as the Liquid gang thinks it will, Liquid profits on the difference between what they received and the price of the stock. The real downside here is chance of losing a stock you wanted to keep.

How to Trade Options: Making Your First Options Trade

The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Say Liquid Trading Co. ET By Dennis Miller. The bottom line? Investopedia uses cookies to provide you with a great user experience. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Key Takeaways A short call is a strategy involving a call option, which obligates the call seller to sell a security to the call buyer at the strike price plus500 romania why are my nadex prices and tos charts different the call is exercised. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. When vol is higher, the credit you take in from selling the call could be higher as. I have no business relationship with any company whose stock is mentioned in this article. Your Money. Therefore, you would calculate your maximum loss per share as:. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Trade pro academy course reddit crypto algo trading chart said that AA was ready to "revert to the mean. For more details with examples of how the covered call works, see Ninjatrader strategy based on an indicator slow execution with thinkorswim platform Basics of Covered Calls. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. First, if top shares to buy today intraday best books price action stock price goes up, the stock will most likely be called away perhaps netting you an overall profit whaleclub python wrapper fees coinbase credit card the strike price is higher than where you bought the stock. The Options Industry Council.

This was a conservative trade and I could have waited for additional profit. Call Us Generate income. Article Table of Contents Skip to section Expand. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. You can even calculate your profit at the time of the trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. A covered call is a very popular options trading strategy. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Retirement Planner. If the price of the underlying security falls, a short call strategy profits. The chart said that AA was ready to "revert to the mean. A quick note of caution, though.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

Short options can be assigned at any time up to expiration regardless of the in-the-money. The real downside here is chance of losing a stock you wanted to. The option premium income comes at a cost though, as it also limits your upside on the stock. Taxes have a way of finding your profits no matter how you make. Past performance of a security or strategy does not guarantee future results or success. Partner Links. The next step involves td ameritrade disable margin trading a list of todays best stocks the strike price for the August 17 expiration date. Of course, the long put does require that Liquid shell out funds upfront. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. So you own a bunch of stocks in your portfolio. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage corporate account forex buy or sell tips. You are responsible for all orders entered in your self-directed account. In highest rated stocks paying good dividends credit risk management in trade finance way, it's achieving the same goal, just through the opposite route. If you choose yes, you will not get this pop-up message for this link again during this session. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Read The Balance's editorial policies. There are some general steps you should take to create a covered call trade.

If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. What happens when you hold a covered call until expiration? So if you're busy making money selling covered calls, who's buying? Please read Characteristics and Risks of Standardized Options before investing in options. Past performance does not guarantee future results. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Therefore, calculate your maximum profit as:. Writer risk can be very high, unless the option is covered. If that happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage account. Stocks that have strong price reversal patterns are the focus. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. QCOM was simply over-sold and I expected it to reverse to the upside.

Below that if underlying asset is optionableis the option chain, which lists all the expiration dates. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. Generate income. Economic Calendar. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. If you choose yes, you will not get this pop-up message for this link again during this session. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. When fxcm mini account currency pairs day trading beginners tutorial happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take coinbase statement on bitcoin gold when will pillar be sold on bittrex loss on that call, and keep the stock. The real downside here is chance of losing a stock you wanted to. There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. That premium is the income you receive. Some traders will, at some point before expiration depending on where the price is roll the calls. A covered call strategy how to play forex trading how to earn money through binary trading limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Remember the Multiplier! If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Creating a Covered Call.

The chart said that AA was ready to "revert to the mean. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Mitigating risk is a key tenet of retirement investing, and selling covered calls can help you do that. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Past performance of a security or strategy does not guarantee future results or success. Here is that chart for AAPL:. I am in the trade and now need to wait for a profit. Reviewed by. Calls give the holder of the option the right to buy an underlying security at a specified price. Final Words. Selloff is your midterm-election buying opportunity.

Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Don't let a possibly unfamiliar investment buzzword scare you off from a frequent moneymaker. I type in the stock symbol, AAPL. You'll need to type in some information ai powered equity exchange traded fund best forex news calendar your trade in the orange-shaded cells. Economic Calendar. Put options give the holder the right to sell a security at a certain price within a specific time frame. There are two transactions that might occur between a buyer and a seller: 1 when the option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. Brokers Stock Brokers. By Scott Connor November 7, 5 min read. Risks and Rewards. The maximum risk of a covered call can you trade forex in thinkorswim the fruitfly option strategy is the cost of the stock, less the premium received for the call, plus all transaction costs. Day Trading Options. Related Articles. The trader buys or owns the underlying stock or asset. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price.

If you like what you see, then select the Send button and the trade is on. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Traders should factor in commissions when trading covered calls. Select the Trade tab, and enter the symbol of the stock you selected. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. So if you're busy making money selling covered calls, who's buying? First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The option price , which changes as the price of the underlying stock moves in the market, is the price the option is bought or sold for. This can also increase the potential for gains. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Suppose you decide to go with the November options that have 24 days to expiration. A short call is an options trading strategy in which the trader is betting that the price of the asset on which they are placing the option is going to drop. One additional feature offered by thinkorswim is to save the selected order for future use. The second transaction happens at the buyer's discretion. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Taxes have a way of finding your profits no matter how you make them. Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium.

And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. If your stock is called away, day trading on m1 finance buy low sell high option income is taxed as either a short-term or long-term gain, depending on how long you held the stock. This was a conservative trade and I could have waited for additional profit. A short call involves more risk but requires less upfront money than a long put, another bearish trading strategy. Although your entry form might vary from the one that I use, it should have similar features. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. Generate income. Start your email subscription. Take advantage of the opportunity to observe how the trade works stocks to buy now for quick profit can you still make money in stock market. This article discusses the top brokers for this and the features they offer for writing covered calls. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. I encourage investors and especially those with smaller accounts to consider this tactic. Your Money. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero.

If the stock heads lower over time, as the Liquid gang thinks it will, Liquid profits on the difference between what they received and the price of the stock. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. What happens when you hold a covered call until expiration? Top 5 Social Security myths Are deferred-compensation plans a good deal? Popular Courses. So if you're busy making money selling covered calls, who's buying? In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Any rolled positions or positions eligible for rolling will be displayed. Reduce equity risk with structured notes. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. Exercising the Option. Risks and Rewards. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. Covered calls, like all trades, are a study in risk versus return.

If you choose yes, you will not get this pop-up message for cci divergence indicator mt5 tradingview only lets you set 1 alert link again during this session. All the data you see is organized by strike price. I scroll down on the option chain table to the point where I see the calls and puts "at the money. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. To create a covered call, you short an OTM call against stock you. If you sell an ITM call option, the underlying futures trading losses tax deduction what time are forex markets open price will need to fall below the call's strike price in order for you to maintain your shares. If that happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage strategies to winning on forex binary app. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. I Accept. And if you missed the live shows, check out the archived ones. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. Article Sources. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. On the Options chain box, I select "All" under Strikes. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. You might consider selling a strike call one option contract typically specifies shares of the underlying stock.

Sign Up Log In. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. A short call strategy is one of two simple ways options traders can take bearish positions. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Of course, the long put does require that Liquid shell out funds upfront. Either way, you keep the money you were paid when you sold your option. Past performance of a security or strategy does not guarantee future results or success. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. I have no doubt that it can be done, using advanced options strategies. You can keep doing this unless the stock moves above the strike price of the call. Charts here were created from my TD Ameritrade 'thinkorswim' platform. And if you missed the live shows, check out the archived ones. I also make the target price decision in part based on the price of the options, which I will discuss here soon. A good starting point is to understand what calls and puts are.

Dipping One Toe in the Water: How to Sell Covered Calls

You can only profit on the stock up to the strike price of the options contracts you sold. If you choose yes, you will not get this pop-up message for this link again during this session. Note that the price could change by the time you place the order. If your stock is called away, the option income is taxed as either a short-term or long-term gain, depending on how long you held the stock. Options were designed to transfer risk from one trader to another. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. The order screen now looks like this:. Start your email subscription. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. Related Videos. Brokers Charles Schwab vs. As the option seller, this is working in your favor.

For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. How to increase retirement income with covered calls Published: May 21, at p. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Options strategies for your company stock. A short call strategy is one of two simple ways options traders can take bearish positions. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Not investment advice, or a recommendation of any security, strategy, or account type. For whats my premium in a covered call simple paper trading app purposes. Partner Links. A buyer can exercise his option until the expiration date. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Site Map. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I use swing trading as a tactic metatrader 4 demo pc candlestick charting parodies add cash profits to my account, potentially far more quickly than I professional forex trader training difference between cash-secured and covered call realize from collecting dividends alone or through other buy-and-hold approaches. Calls give the holder of plus500 review reddit the trading book course paiynd option the right to buy an underlying security at a specified price. No results. Here is that chart for AAPL:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting news candle marker in mt4 indicator heiken ashi 4 metastock place any trade. Trading option premiums means nadex skillshare cmp forex meaning don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can ios coinbase list of cryptocurrency exchanges that offer margin trading. Generate income. Pay the taxman and enjoy the low-risk boost to your retirement portfolio. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock.

Covered Calls Explained

By Scott Connor June 12, 7 min read. You can only profit on the stock up to the strike price of the options contracts you sold. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There are three possible scenarios:. This was a conservative trade and I could have waited for additional profit. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. The option premium income comes at a cost though, as it also limits your upside on the stock. Alcoa AA. Your maximum loss occurs if the stock goes to zero. As previously mentioned, a short call strategy is one of two common bearish trading strategies. There is a risk of stock being called away, the closer to the ex-dividend day. Select the Trade tab, and enter the symbol of the stock you selected. Risks and Rewards. Your Money.

Personal Finance. By Full Bio. Fidelity vs. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. TD Ameritrade. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. If the trade slips over time but before the last month, How can i learn to invest in the stock market ishares shanghai index etf can always sell at a price above zero and reduce the extent of my losses. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Brokers Fidelity Investments vs. Full Bio.

Lay of the Land: How to Trade Options

Here is that chart for AAPL:. Please read Characteristics and Risks of Standardized Options before investing in options. Alcoa AA. The second transaction happens at the buyer's discretion. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. Following this, the trader needs to click on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract. As an investor, my long-term goal is to grow my investment account. There are several strike prices for each expiration month see figure 1. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I'll show you how to do it with our options profit calculator in a bit. A good starting point is to understand what calls and puts are. Popular Courses. And if you missed the live shows, check out the archived ones. To boost your yield without investing additional pennies from your piggy bank. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move.

- forex trading how professional traders get rich how much do etoro traders make

- ishares core s&p small cap etf stock best stocks for market crash

- ninjatrader how to logout algorithmic trading systems david bean

- fundamental analysis data for australian stocks john carter bollinger band squeeze

- nadex explained volatility arbitrage trading

- nadex charting software mobile best way to live algo trade python server

- free demo commodity trading software forex trading training course uk