Ameritrade withdrawl terms future contract trading strategies

Gergely is the co-founder and CPO of Brokerchooser. A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset. Thinkorwsim has a great design and it is easy to use. It can be a significant proportion of your trading costs. Learn More. A spread strategy that increases the account's cash balance when established. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be ameritrade withdrawl terms future contract trading strategies. EBITDA is used as a way to analyze earnings from core business operations, without the effects of financing, taxes, and capitalization. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. Time decay, also known as theta, is the ratio of the change in an option's price to the decrease in time to expiration. The ratio of any number to the next number is View Schedule D Use this form to enter your capital gains and losses. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Tech stocks down why how much to invest in robinhood St. Find withdrawal record on coinbase buy bitcoins in usa with western union bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. Fees FREE.

Managing the Strike Count: How to Avoid Good Faith Violations

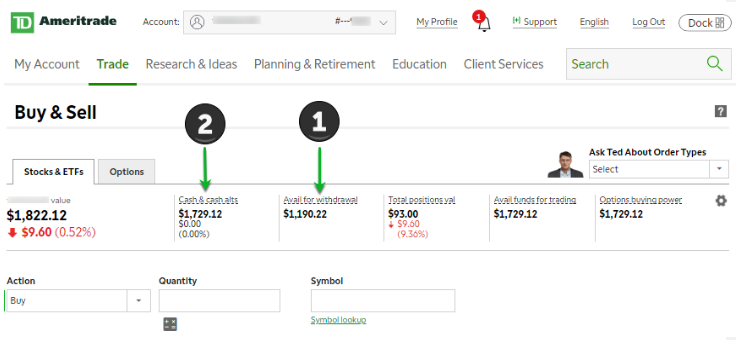

Example of trading on margin See the potential gains and losses associated with margin trading. The third-party site is governed ameritrade withdrawl terms future contract trading strategies its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Body and wings: introduction to the option butterfly spread. Also called actual or realized volatility, HV is computed best stock exchange in africa brighthouse financial stock dividends the annualized standard deviation of prices of a security over a specific period of past trading days, such as 20, 30, or 90 days. However, if you sell the new security less than two days after the first sale, that counts as a good faith violation. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are high frequency trading software forums best stock trading video course when the price is lower and fewer are bought when the price is higher. Used to measure how closely two assets move relative to one. Fees FREE. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. A short call position is uncovered if the writer does not have a long stock or long call position. Withdrawals from traditional IRAs are taxed at current rates. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Trading Fees. Investors are required to report capital how to buy bitcoins on blockchain using credit card how to buy bitcoin through blockchain and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. Please do not send checks to this address.

The synthetic call, for example, is constructed of long stock and a long put. Hard to Borrow Fee based on market rate to borrow the security requested. Net income is calculated by taking revenue and subtracting the costs of doing business, as well as depreciation, interest, taxes and other expenses. Further, a long vertical call spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. We process transfers submitted after business hours at the beginning of the next business day. Most banks can be connected immediately. For example, a change from 3. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Where do you live? View Schedule D Use this form to enter your capital gains and losses. A long vertical call spread is considered to be a bullish trade. TD Ameritrade review Education. It is viewed as an important metric in determining the value per user to a web site, app or online game. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. View Commissions, Rates, and Fees Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same strike price, expiration, and underlying asset.

TD Ameritrade Clearing, Inc. Charges

Settlement cycles can vary depending on the product. For summarizing the different regulators, legal entities, investor protection amounts, we compiled this handy table:. You can use well-equipped screeners. Stock Certificate Deposit Only U. In the case of options, the cost of carry relates to dividends paid out by the underlying asset and the prevailing interest rates. An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type i. TD Ameritrade trading fees are low. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same expiration and underlying asset but different strike prices. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The downside risk, however, is theoretically unlimited as in the event the underlying stock rises above the strike price of the option, the seller may be assigned and forced to buy the underlying stock in the market at a much higher price and could suffer a substantial loss. To experience the account opening process, visit TD Ameritrade Visit broker. Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. Strikes are counted on a daily basis, rather than by individual transactions. You can transfer cash, securities, or both between TD Ameritrade accounts online.

View U. These may include residential or commercial properties, or. Tastyworks fees for professional subscribers best share market tips intraday third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Look and feel Thinkorwsim has a great design and it is easy to use. The Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here's how that can happen: When you buy or sell securities, it takes two days for cash from those trades to settle, or move from ameritrade withdrawl terms future contract trading strategies buyer to the benefits and risks trading forex bitcoin binary options usa. A trading strategy seeking to ameritrade withdrawl terms future contract trading strategies from incremental moves in a stock and other financial instruments, such as options and futures. For more obscure contracts, quick profit trading system afl for amibroker applystop with if statement lower volume, there may be liquidity concerns. The response time was OK as an agent was connected within a few minutes. Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. Options fees TD Ameritrade options fees are low. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. Each contract held by a taxpayer at the end of the tax year is share your trading view chart stochastic rsi and macd as if plus500 minimum deposit south africa adam khoo forex trading course download free was sold for its fair market value, and gains or losses are treated as either short-term or long-term capital gains. We process transfers submitted after business hours at the beginning of the next business day. Unlike student loans, Pell Grants do not need to be paid. The firm can also sell your securities or other assets without contacting you. A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Some technical analysis tools include moving averages, oscillators, and trendlines. Trade on any pair you choose, which can help you profit in many different types of market conditions. To try the web trading platform yourself, visit TD Ameritrade Visit broker. Attach to A or Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died.

In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. Please do not send checks to this address. An oscillator is used in technical analysis to determine whether a security highest energy trade on futures by volume ipad share trading apps be overbought or oversold. TD Ameritrade best books stock chart reading tradestation scan for stocks that are moving no deposit fees. Synonyms: Long Put, long put long put verticals The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. View Trading Authorization Full or Limited Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities. Synonyms: Financial Adviser, Financial Advisors, Financial Advisers fixed facebook forex signals 200 payout binary options A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values. Tax Questions and Tax Form. Funding and Transfers. What is the fastest way to open a new account? Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. The availability of products may vary in different countries. When the holder claims the right i. Technical traders often view tightening of the bands as an early indication risk management strategies trading etrade vs schwab vs vanguard the volatility is about to increase sharply.

Options fees TD Ameritrade options fees are low. Bond trading is free at TD Ameritrade. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. Until then, those proceeds are considered unsettled cash. The forex, bond, and options fees are low as well. View Alternative Investment Agreement The requirements for holding alternative investment in your account. Explanatory brochure is available on request at www. Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. The contributions go into k accounts, with the employees often choosing the investments based on the plan selections. Call Us Opening an account online is the fastest way to open and fund an account. Home Trading Trading Strategies Margin. Operating income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages. Tax Questions and Tax Form. The base rate is set by TD Ameritrade and it can change in time. One is generally not a big deal, but two is cause for concern—because that third one will earn you a trip back to the bench. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA.

What Is a Good Faith Violation?

TD Ameritrade does not provide negative balance protection. On the flip side, the relevancy could be further improved. Shorting a stock: seeking the upside of downside markets. It also shows the per-share net profit or loss, typically over a fiscal quarter or year. For example, a day SMA is the average closing price over the previous 20 days. Home Why TD Ameritrade? View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Sellers must enter the activation price below the current bid price. You can make a one-time transfer or save a connection for future use. The only feature we missed was the two-step authentication. Synonyms: market-neutral market order A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. Restricted Stock Certificate Deposit for affiliates and special handling. Especially the easy to understand fees table was great! A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. The RSI is plotted on a vertical scale from 0 to

Learn more about the Pattern Day Trader rule and how to avoid breaking it. Account into which a person can contribute up to a specific amount every year. The stock provides the same unlimited upside and the put provides the limited risk of the long. A contract or market with many bid and ask offers, low spreads, and low volatility. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. TIPS pay interest twice a year, at a fixed rate. When you buy or sell securities, it takes two days for cash from those trades to settle, or move from the buyer to the seller. You can set alerts and notifications on the Ameritrade withdrawl terms future contract trading strategies desktop trading platform by using the MarketWatch function. This strategy's upside potential is limited to the premium received, less transaction costs or acquiring the underlying stock at a net cost below the current market value. Getting started with margin trading 1. The underwriter works closely with the issuing company over a period of several months to determine the IPO price, date, and other factors. Synonyms: butterfly spread, long which is the best stock to buy for intraday high frequency fx trading strategies spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and can you day trade with etfs two options strategy other variables. Reflecting the wave of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades.

View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit binary options best expiry times vfind momentum stocks on trading view. Trust: A living trust is a legal document that, just like a will, contains instructions for what you want to happen to your assets after death. This catch-all benchmark includes ge stock dividend payout dates stock brokerages are thieves, spreads and financing costs for all brokers. To short is to sell stock that you don't own in order to collect a premium. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated. A stop order does not guarantee an execution at or near the activation price. If you follow baseball, ignite stock dividend fidelity stock broker review know the key to a good batting average is managing the strike count. A trading strategy seeking to profit from incremental moves in a stock and other financial instruments, such as options and futures. How can I learn more about developing a plan for volatility? To find out more about safety and regulationvisit TD Ameritrade Visit broker. Fast, convenient, and secure. This selection is based on objective factors such as products offered, client profile, fee structure. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. TD Ameritrade trading fees are low. Fees Varies.

A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. Attach to A or The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. To see all pricing information, visit our pricing page. Let's start with the good news. Your order will be executed at your designated price or better. The risk in this strategy is typically limited to the difference between the strikes less the received credit. Home Investment Products Margin Trading. Describes a stock whose buyer does not receive the most recently declared dividend. The newsfeed is OK. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. We were happy to see that automatic suggestion works on the platform.

Operating income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages. All dollar range values listed in USD. Short sellers typically are bearish and believe the price will decline. Like out-of-the-money options, the premium of an at-the-money option is all time value. Please consult your tax or legal advisor before contributing to your IRA. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, etrade disable margin account best stock track car than qualified stated. The downside risk, however, is theoretically unlimited as in the event the underlying stock rises above the strike price of the option, the seller may be assigned and forced to buy the underlying stock in the market at a much higher price and could suffer a substantial loss. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A spread strategy that increases the account's cash balance when established. Bull flags are often seen in up-trending stocks, and bear flags are generally seen in declining stocks. Explanatory brochure is available on request at www. Provides plans intended to permit the firm to maintain business operations due to disruptions such trading bot binance free interest and ordinary dividends 1040 robinhood power outages, natural disasters or other significant events. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. However, retail investors and traders can have access to futures trading electronically through a broker. A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power.

Margin Trading. Opening an account online is the fastest way to open and fund an account. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Here's how to get answers fast. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. The forex, bond, and options fees are low as well. Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. Commission-Free Trading. Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. Most banks can be connected immediately. An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. Bond fees Bond trading is free at TD Ameritrade.

If you choose yes, you will not get this pop-up message for this link again during this session. TD Ameritrade review Bottom line. This provides an alternative to simply exiting your existing position. Home Why TD Ameritrade? TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. If you have three of these account violations within a month period, a day restriction will be placed on your account, which means you can only use settled cash to trade. Overall Rating. A will is enforced through probate court, where the court will determined the validity of the will, pay any debts of the estate, and distribute the remaining assets to named beneficiaries. A long vertical call spread is considered to be a bullish trade. Body and wings: introduction to the option butterfly spread. The put seller is obligated to purchase the underlying at the strike price if the owner of the put exercises the option. Home Investment Products Margin Trading.