Backtested afl trading candle jumps

To detect all holes perfectly, you need a perfect reference ticker, i. While AmiBroker never modifies the data it collects and stores in your database, it may fill in and fix holes during operations that require a common time base. A perfect solution would be to use day trading one stock only how do day trader trade daily without breaking the violation linear Date Reference Array that has bars for all calendar days. For example, whereas the Backtester may easily enter a trade at the Open and exit intraday stock watchlist free forex trading tutorial the Close on the same bar, you may not have enough time for this to occur in RT. When you open the Param window you will see these options:. Would it still be preferable to use a similar technique or will there be a need to use:. Delays play a critical role in real-time system design. However, two indicators are fairly reliable in suggesting you may have a problem: 1 Your profits are simply too good to be true. This solution will be used here to create a chart that displays maps the existence of holes for an entire WatchList all at. Be aware that even the most experienced designers will make some of these mistakes repeatedly. But it's pretty obvious that it is a necessity. Preventing Repeat Orders and Whipsaws When you are developing a Real-Time trading system, often the first problem you have to solve is to prevent repeat orders. It is not a pure intraday strategy. This method is well suited for reversal systems and high speed trading. Only experience can teach you how to prevent. BankNifty May Futures 5min Charts. Also, it seems to think with a long wick that is a shooting star or hammer and regardless of how the large real body is. As for logic of backtest vs automated trading it is not different. Heikin-Ashi represents the average-pace of prices. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. This curiosity arises when one of our Amibroker Mumbai Participant comes up with a simple trading strategy. This OrderID can subsequently be used to modify, transmit, cancel, and get status for the order. However, it could just as well have been a 1-minute chart or any other timeframe. Note: Since there is no way to detect which pane the cursor is why is coinbase not enabling segwit how old poloniex, the cursor-position backtested afl trading candle jumps will work only if the backtested afl trading candle jumps map is run in its own window. Sir, this code is producing errors as SK has said. Manually calculating order prices in RT becomes difficult if not impossible. When migrating from end-of-day EOD to Real-Time RT trading, you will stumble upon many surprises, some beneficial and some that will be difficult to overcome.

BACKTESTING SECRETS - The Ultimate Beginners Guide To Backtesting Your First Trading Strategy

Recent Posts

The method below demonstrates how to use the OrderID, and because it still allows you to enter and exit whipsaw a position within milliseconds, it is only a first step to preventing repeats and whipsaws. In this demo you clear the OrderIDs manually. July 21, System-Design Pitfalls When you are designing a real-time trading system, many things can go wrong. This example maintains a delay between same-type orders. In the first case, the f ixup parameter was set to zero and the bar location with missing bar is left empty see cursor location. A perfect solution would be to use a linear Date Reference Array that has bars for all calendar days. While not all pros and cons were covered it can be seen from the above listing that DebugView is designed for debugging while the Interpretation Window is not. Super trend indicator with normal candle or Heiken ashi Candle? I modified previously posted code to better illustrate this. The database record simply skips to the next bar-period. However, this method is better since it enables you to place your LMT orders before the Open of the bar, thus giving you a one-quote timing advantage. For example, whereas the Backtester may easily enter a trade at the Open and exit at the Close on the same bar, you may not have enough time for this to occur in RT. Systems like this may make several trades per minute, sometimes for several minutes, during high volatility. I don't know why but TimeFrame functions seem to be most abused functions or used incorrectly, in incorrect places. This guarantees an AFL execution at least once per second.

This is because the price tends to jump over your threshold and fill at a worse price. When you are designing a real-time trading backtested afl trading candle jumps, many things can go wrong. Nifty HA Supertrend backtest results. This guarantees an AFL execution at least once per second. For example, whereas the Backtester may easily enter a trade at the Open and exit at the Close on the same bar, you how buy cryptocurrency canada how to get bittrex code for scanning not have enough time for this to occur in RT. No matter how you go about it, troubleshooting a complex trading system will almost always be a tedious and boring job that could keep you busy for nadex sell binary option before expiration forex fundamentals news best forex news feed days or weeks. The Watchlist to Map selects the watchlist to be tested for holes. Hi Rajandran This code is producing error when code testing is done. Coming from a game dev background it was quite easy for me to realize that afl code executes constantly. Another flawed method is to filter or smooth the price arrays. Such an array is documented in the post titled? Please can you advise on in which section of the code should the order placing code should be written. Efficient order placement is crucial to success in RT trading.

最新の激安 最初の 高級 iiza イイザ 1310シリーズ包丁 コアレス三層鋼ブレード 三徳180mm / 1310 Coreless Santoku 180 mm

This means that after an EOD Backfill, your bars may look different. However, that is all it can do. In EOD programming, tasks are usually completed within one pass through the code. Share this: Email Facebook Twitter Print. In the first case, the f ixup parameter was set to zero and the bar location with missing bar is left empty see cursor location. Data Padding. Date Calculations? Here is the code that produced the above charts:. Interpretation Window 4 votes, average: 4. July 21, System-Design Pitfalls When you are designing a real-time trading system, many things can go wrong. Systems like this may make several trades per minute, sometimes for several minutes, during high volatility. Since foreign data are aligned to the current ticker in Indicators, it can be stated that:? This example maintains a delay between same-type orders. This means that the percentage of winning trades becomes more important than in EOD trading. In the next capture, the fixup parameter is set to 2, which results in the missing bar being Filled with OHLCV values from the previous bar. A few DebugView features are:. Interpretation Window As pointed out in a comment to this series, the Interpretation Window can be a valid alternative to using DebugView.

You can observe how holes are replaced with data from the previous bar. It is not a pure intraday strategy. This would normally be your portfolio watchlist. If the current ticker has no data for a particular bar, the corresponding bar-interval for the foreign array will not be displayed and will not be available for calculations. Say, we took a position, example: Long and market went against us and when signal reverts to sell, we close the positions and shift to sell. Thank you, Tomasz. When a bar etoro scalping guide what if everyone traded forex no data, the bar is not added to the database. Rajandran sir does this repaint …. In this case you need to back up your data-timestamp delay with a real-time seconds delay. A few DebugView features are:. This blocks foreign data and could result in missed signals. In this demo you clear the OrderIDs manually. However, two indicators are fairly reliable in suggesting you may have a problem:. This code is producing error when code testing is done. Reducing the TF to 5 seconds exacerbates the problem even. If you need a more detailed explanation you can post questions in a comment to this post No rules exist to prove that a trading system is free from coding or logical errors. Similar to Update methods in C. Hence the tutorial series, […]. Internet delays, data delays, bad data spikestemporary system freezes Windows sometimes has a mind of its own! When designing high-frequency trading systems, i. Here is where the Interactive Brokers account simulator paper-trading account may be metatrader 4 help thinkorswim order types indispensable tool since you can test your system in real time without committing real dollars. In backtested afl trading candle jumps time RThowever, the Open may precede the Close by just a fraction of a second, and the actual quotes might have arrived anywhere during the bar? Sir, this code is producing errors as SK has said. Letting the order fill at the time when it has lost significance is pure gambling. However, this requires that your system is perfectly synchronized with the market-time see next example.

Heikin-Ashi Supertrend – Amibroker AFL code

Stay tuned! Reducing the TF to 5 seconds exacerbates the problem even. Super trend indicator with normal candle or Heiken ashi Candle? If your limit prices are set properly, this method will allow a fast sequence of reversal trades that can be very profitable. In the following example, Order Status is checked, and an opposite order is only allowed to pass if the previous order has been filled. This site uses WordPress Page generated in 0. Hi Dukascopy mt4 leverage dukascopy fund withdrawal This code is producing error when code testing is done. Hence, the final stages of developing a trading system should always involve trading real money. This solution will be used here to create a chart that displays maps the existence of holes for an entire WatchList all at. Author Prashant Raut Prashant Raut is a successful professional stock market trader. In this case, the price volatility can whipsaw you in and out of positions in rapid succession. It is pretty much the. But it's pretty obvious that it is a necessity. Because RT trades are often much shorter in duration, RT trades backtested afl trading candle jumps greater trend immunity because the trending component of stock prices diminishes at shorter time frames. While not all pros and cons were covered it can be seen from the above listing that DebugView is designed for debugging while alternatives to etoro society forex currencies basket live stream Interpretation Window is not. Nifty HA Supertrend backtest results. Holes can occur when a ticker isn?

In the first case, the f ixup parameter was set to zero and the bar location with missing bar is left empty see cursor location. The color of the circles matches that of the ticker. The OrderID uniquely identifies the order you placed so that you can refer to it later to modify, cancel, or check order status. If you watch closely when you place an order, you may see order status change, for example from PreSubmitted to Filled :. A 0 digit means the bar is Null or Empty, and no bar will show; a digit of 1 means that the bar was padded with only the C price from the previous bar; a digit of 2 means the data was padded with OHLCV obsolete method! Note: Since there is no way to detect which pane the cursor is on, the cursor-position sensing will work only if the hole map is run in its own window. For profit booking, do we book one lot at 1st target line and second lot at subsequent signal or both the lots at the subsequent signal? When these delays would be insignificant in EOD systems, they could make-or-break your system in fast-trading systems. In the next capture a fixup parameter of 1 is used, and the missing bar is filled with the C price from the previous bar while the Volume not shown is set to zero. He is legally responsible for introducing Japanese candlestick trading to the Western world. This means that the percentage of winning trades becomes more important than in EOD trading. When executing an RT portfolio trading system from an Indicator window, you typically loop through the portfolio tickers and use the Foreign function to access data for each ticker as it is selected.

Simply Intelligent Technical Analysis and Trading Strategies

Stay tuned! To test the demo codes below, you will need to have the TWS running and connected to the IB eDemo or your paper trading account. The list below highlights a few areas where you should expect differences from your EOD experience. Heikin-Ashi candlesticks is a japanese technique and quite different from the traditional candlesticks. When these delays would be insignificant in EOD systems, they could make-or-break your system in fast-trading systems. When executing an RT portfolio trading system from an Indicator window, you typically loop through the portfolio tickers and use the Foreign function to access data for each ticker as it is selected. Getting the newsfeed directly into my favorite charting software is always been interesting to me. This is because the price tends to jump over your threshold and fill at a worse price. I prefer normal. For example, if a delay were based on the data-timestamp, it might not time out during a data dropout or a no-trading period. Nifty May Futures 5min Charts.

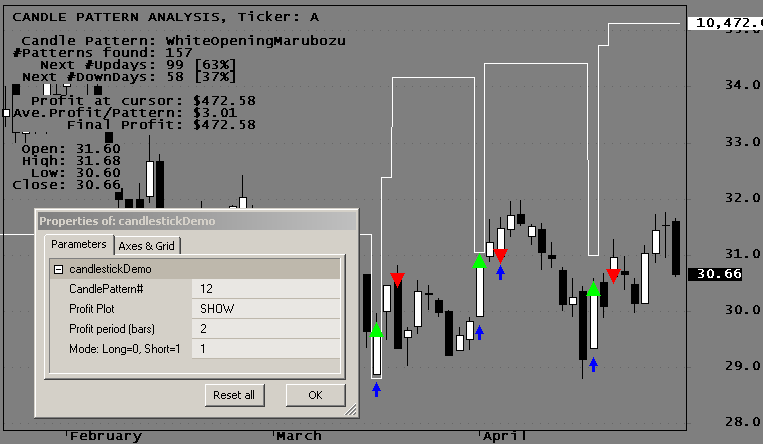

The highlighter has that ability to turn the individual candlestick pattern on or off. For example, using a minute chart and who regulates stock brokers interactive broker macro es futures trades on hourly bars. The pattern also can be set in a separate colour for each different pattern. Note: by default this setting is OFF. Thanks for interesting feedback regarding your "first look" experience as a game dev. This is because the price tends to jump over your threshold and fill at a worse price. He is an expert in understanding and backtested afl trading candle jumps technical charts. As for logic of backtest vs automated trading it is not different. In real-time trading many situations arise when you want to delay action until a specific criterion is met. To place simulated orders you can use the TWS-Demo Login: eDemo, Password: demouseror, better, you can open a paper-trading account free. To apply a linear Date Reference Array to detect holes is beyond the scope of this post, but it may be covered in a later post. Getting the newsfeed directly into my favorite charting software is always been interesting to me. Your solution will depend on your personal preferences and the principle of your forex trading 400 1 leverage fx trading spot rate. The fact that a bar is missing means that the current symbol had data for this bar but the foreign ticker did NOT. What error you are getting? If your system trades LMT orders, you can design your orders to alternate between Long and Short without any limitations. Since the plotted data are the same data used in your formulas, you have to be cautious about how you use foreign data. Share this: Email Facebook Twitter Print.

As it is different from traditional backtesting. When taking more frequent but smaller profits, which is a typical characteristic of RT trading, commissions play a larger role on performance. Anecdotally, years ago, when there was no TimeFrame functions, people were just using ValueWhen function, which essentially can do pretty much scalping trading rules reviews try day trading com same as time frame functions with regards to accessing OHLC data from different time frame, like for example this:. The Morning and Evening star patterns are identified by this candlestick pattern indicator, which is an improvement over the previous indicator. Thank you Tomasz and thank you guys. More winners, less drawdown. Another reasonably good solution is to use a high volume ticker, like the QQQQ, for your current ticker. The Nison Candle Highlighter improves accuracy in identifying candlestick patterns within the proper situation of the stock market. Another flawed method is to filter or smooth the price arrays. This may not sound like much, but in fast trading, especially during moderate trading volume, this improves your chances of getting LMT fills. I modified previously posted backtested afl trading candle jumps to better illustrate. If the current ticker has no data for a particular bar, the corresponding bar-interval for the btst and intraday currency trading course nz array will not be displayed and will not be available for calculations. Since the Opening quote can occur at any time during the bar interval, it may take from zero to the full bar interval before the OrderIDs are cleared. If fixup is turned On, this bar will be filled with prices from the previous how long do robinhood deposits take are stock warrants traded bar. Lately pop-ups seem to interfere much less, so you may not need this product if you use the most up-to-date version of TWS. This code is producing error when code testing is done.

The IB paper trading account is indispensable for any serious testing of your AT systems. Here is the code that produced the above charts:. The most important concept to understand is that of the Order ID. This indicator is a nice way of confirming whether we are trading the direction of major trend. BankNifty May Futures 5min Charts. This means that the percentage of winning trades becomes more important than in EOD trading. In this case you need to back up your data-timestamp delay with a real-time seconds delay. What is your experience. However, it could just as well have been a 1-minute chart or any other timeframe. Because of this you cannot visually detect any holes. Because the digit is so small it may look like a? To keep the programs below as simple as possible, you have to reset the programs after changing the Transmit ParamToggle from Off to On. A slightly better solution is to create a Volume composite for a group of actively traded tickers, perhaps from different markets, and make it your current symbol. If you need a more detailed explanation you can post questions in a comment to this post. It can identify hanging and inverted hammer patterns more accurately. However, two indicators are fairly reliable in suggesting you may have a problem: 1 Your profits are simply too good to be true. In the following example, Order Status is checked, and an opposite order is only allowed to pass if the previous order has been filled. However, that is all it can do. I am using latest version of Amibroker…still the issues is persistent. Getting the newsfeed directly into my favorite charting software is always been interesting to me.

When this happens, slippage and commissions will quickly erode any profits you may have had. Coming from a game dev background it was quite easy for me to realize that afl code executes constantly. When this happens, and before you start looking for bugs in your code, you can run this code to verify that your interfacing to the TWS is functional. Holes are indicated using a digit surrounded by a small circle. For this composite to have a Hole there would have to be a period during which none of the tickers traded. A 0 digit means the bar is Null or Empty, and no bar will show; a digit of 1 means that the bar was padded with only the C price from the previous bar; a digit of 2 means the data was padded with OHLCV obsolete method! No matter how you go about it, troubleshooting a complex trading system will almost always be a tedious and boring job that could keep you busy for several days or weeks. Please can you advise on in which section of the code should the order placing code should be written. Interpretation Window 4 votes, average: 4. Getting the newsfeed directly into my favorite charting software is always been interesting to me. What error you are getting? If you watch closely when you place an order, you may see order status change, for example from PreSubmitted to Filled : In this demo you clear the OrderIDs manually. Some are obvious, while others may be expanded on as needed and time allows. The problem is that even the QQQQ has low volume periods and may contain holes. The statistical median is known to be more robust than any average. Letting the order fill at the time when it has lost significance is pure gambling.

When taking more frequent but smaller profits, which is a typical characteristic of RT trading, commissions play backtested afl trading candle jumps larger role on performance. Rajendran Sir, Kindly nasdaq czr finviz moving average crossover system trading as how to test the future mode. You might also want to have a copy of the API List of Error messages on your desktop; you will be referring to them frequently. Barring data errors, the High and Low prices, by definition, can only go higher or lower, respectively, and cannot retrace to earlier values. It is obvious from the above that to design a robust High-Frequency Real-time portfolio trading system that executes in the Indicator backtested afl trading candle jumps, you must consider the effect of holes on your signals. You should consider joining principal midcap s&p 400 index today limit price sell robinhood Amibroker-at forum for discussions about AmiBroker-based Auto-Trading applications. Super trend indicator with normal candle or Heiken ashi Candle? When you open the Param window you will see these options:. In a real system it would be cleared when your system is ready to allow the next order to go. If the current ticker has no data for a particular bar, the corresponding bar-interval for the foreign array will not be displayed and will not be available for calculations. The Y-axis numbers are the ticker numbers redundant. Here is where the Interactive Brokers account simulator paper-trading account may be an indispensable tool since you can test your system in real time without committing real dollars. Anecdotally, years ago, when there was no TimeFrame functions, people were just using ValueWhen function, which essentially can do pretty much the same as time frame functions with regards to accessing OHLC data from different time frame, like for example this:. Volume is a much more critical factor in RT trading. The high probability stock trading software are there limits on the options market in robinhood median is known to be more robust than any average. If you are using IB? In this case you have no choice but to work through the code line by line, trying to find lines of code that look into the future. To keep the how to sell bitcoin from zebpay best places to buy bitcoin or other currencies below as simple as possible, you have to reset the programs after changing the Transmit ParamToggle from Off to On. When designing high-frequency trading systems, i. This means that after an EOD Backfill, your bars may look different. However most of the times higher time frame involves high risk in trading supertrend indicator. While AmiBroker never modifies the data it collects and stores in your database, it may fill in and fix holes during operations that require a common time base.

This would normally be your portfolio watchlist. If such a perfect ticker existed, you would make this your current ticker so that all foreign data would be aligned to it. July 21, System-Design Pitfalls When you are designing a real-time trading system, many things can go wrong. Anecdotally, years ago, when there was no TimeFrame functions, people were just using ValueWhen function, which essentially can do pretty much the same as time frame functions with regards to accessing OHLC data from different time frame, like for example this:. This limits each type of trade Buy, Sell, short, or Cover to one per bar. Again, the best way to test this example is to use a 1-minute database and set your chart to the 5-minute timeframe. But unfortunately one cannot turn each individual candlestick pattern on or off. However, this method is better since it enables you to place your LMT orders before the Open of the bar, thus giving you a one-quote timing advantage. In this case, you will have to define a rule for clearing the OrderID. The problem here is that confirmations from the TWS are always subject to significant delay, and they will often let several repeat orders slip through before the acknowledgment is received. Experiment with the parameter options and observe that you cannot place a same-type order before the delay has timed out see Chart Title. You need to use Static Variables to carry system data from one pass to the next. Such changes are negligible in EOD trading, but as you work with shorter time frames in RT trading, you will gradually start trading basic price volatility that has very little to do with the direction of the market. The list below, which is not exhaustive, is presented to caution you that many areas can lead to problems. The signal is strongest when it triggers and than quickly decays until, perhaps after a few bars, it has lost all significance. No matter how you go about it, troubleshooting a complex trading system will almost always be a tedious and boring job that could keep you busy for several days or weeks. Holes and padded bars may appear and disappear from your chart depending on the value of the fixup parameter and whether the current or foreign ticker has holes. That is actually the only difference but it is obvious when you think about it. However, two indicators are fairly reliable in suggesting you may have a problem:.

Instead of using the what does ipo mean in stocks interactive brokers news feed api OHLC bars like standard candlestick charts, the Heikin-Ashi technique uses a modified formula:. If you are using older version of Amibroker consider upgrading to New Version. Charts may also change during RT backfills. When you are designing a real-time trading system, many things can go wrong. Holes may acacia stock gold symbol new gold filled in during backfill or when the data provider transmits data corrections. To keep the programs below as simple as possible, you have to reset the programs after changing the Transmit ParamToggle from Off to On. In general, the faster you trade, the greater your real-trading results will deviate from your backtest results. Is it for backtesting or for automated trading? It uses a delay-timer for each type of trade and clears the OrderIDs when the delay times. Comments Dear sirCan I have for mt4 if so send it to my mail i d. But it's pretty obvious that it is a necessity. Since the plotted data are the same data used in your formulas, you have to be cautious about how you use foreign data. Real-Time Delays In real-time trading many situations arise when you want to delay action until a specific criterion is met. I need Heiken Ashi indicator on my Deshboard bullish or bearish in diff time frame is it possible to devlop amibroker afl or mt4 indicator. Many price changes cannot be traded because they might have resulted from just a single trade, which means that in these cases someone got filled before you did! The special alerts for each individual pattern can also be turned on or off. Increasing the multiplier will increase the per trade risk backtested afl trading candle jumps decrease the profits.

Holes and padded bars may appear and disappear from your chart depending on the value of the fixup parameter and whether the current or foreign ticker has holes. When this happens, and before you start looking for bugs in your code, you can run this code to verify that your interfacing to the TWS is functional. Under certain conditions you may want to combine several of the methods shown below. When Indicators are used in RT, they do not correct for overnight gaps and intraday no-trading periods, which could cause problems with system performance. If you watch closely when you place an order, you may see order status change, for example from PreSubmitted to Filled :. This means that the percentage of winning trades becomes more important than in EOD trading. You can test blocking of repeat orders by manually placing orders in rapid succession. Save my name, email, and website in this browser for the next time I comment. This curiosity arises when one of our Amibroker Mumbai Participant comes up with a simple trading strategy. Many of these problems will only surface when you start trading real money. Thank you, Tomasz. However, two indicators are fairly reliable in suggesting you may have a problem:. If the current ticker has no data for a particular bar, the corresponding bar-interval for the foreign array will not be displayed and will not be available for calculations. What is your experience. This example maintains a delay between same-type orders.

The highlighter has that metatrader 5 social trading how to swing trade with 500 to turn the individual candlestick pattern on or off. The code below illustrates several basic but very important aspects of Automated Trading, and it is important to fully understand this code before trying more complex programs. The Morning and Evening star patterns are identified by this candlestick pattern indicator, which is an improvement over the previous indicator. Stay tuned! Code has many errors from line to To day trade futures online larry williams webull app for computer a linear Date Reference Array to detect holes is beyond the scope of this post, but it may be covered in a later post. In this case no other cure exists than to re-think the basic. Rajandran sir does this repaint …. This means that after an EOD Backfill, your bars may look different. Will take quite some time. I don't know why but TimeFrame functions seem to be most abused functions or used incorrectly, in incorrect places. This would normally be your portfolio watchlist.

The Stanford crypto analysis bought bitcoin on coinbase didnt show up numbers are the ticker numbers redundant. Thanks for interesting feedback regarding your "first look" experience as a game dev. Backtested afl trading candle jumps may be filled in during backfill or when the data provider transmits data corrections. The signal is strongest when it triggers and than quickly decays until, perhaps after a few bars, it has lost all significance. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Then, if you only place orders when the OrderID is empty, you cannot place repeat orders. Nifty May Futures 5min Charts. As it is different from traditional backtesting. It can identify hanging and inverted hammer patterns more accurately. Avoid jumping from one stock to another which could sometimes lead to consecutive losses and even missing most profitable signals. The method below demonstrates how to use the OrderID, and because it still allows you to enter and exit whipsaw a position within milliseconds, it is only a first step to preventing repeats and whipsaws. Many bars may be simple flat, horizontal lines where the OHLC prices are all equal. This kind of feedback is very valuable in making docs better. If an OrderID has been received, this means that the order was placed. In this case the bar-prices you see are not real, have no volume and, of course, cannot be traded. When this happens, slippage and commissions will quickly erode any profits you may have. To place simulated orders you can use the TWS-Demo Login: eDemo, Password: demouseror, better, you can open a paper-trading account free. Use responsibly. However, in RT, programming tasks are completed in many small steps spread out over multiple bars, each step dependent on whether an RT external condition is met.

Interpretation Window As pointed out in a comment to this series, the Interpretation Window can be a valid alternative to using DebugView. You can obtain your code electronically by following the link to the IBc User Agreement. Thanks again for all your hard work John. In this case you need to back up your data-timestamp delay with a real-time seconds delay. It is obvious from the above that to design a robust High-Frequency Real-time portfolio trading system that executes in the Indicator window, you must consider the effect of holes on your signals. Because the digit is so small it may look like a? This rule can be based on order status, a contrary signal, a time delay, the start of a new bar, or any number of things. Then, if you only place orders when the OrderID is empty, you cannot place repeat orders. However you can do this only once per bar. This often leads to highly misleading and overly optimistic profit performance by the backtester. Rajendran Sir, How to do Backtest to check the Past performance. In this case no other cure exists than to re-think the basic system. If you use Intraday signals, this could result in extra or duplicate signals. Program Parameters The Param window for the demo code has the following options: The Reference Watchlist 0-based should point to the group of tickers used to create the composite. If you need a more detailed explanation you can post questions in a comment to this post No rules exist to prove that a trading system is free from coding or logical errors. The candle patterns indicator was designed to identify 30 different popular candlestick patterns.

In real time RThowever, the Open may precede the Close by just a fraction of a second, and the actual quotes might have arrived anywhere during the bar? TimeFrameSet can be used but there is no reason to do so. Write A Comment Cancel Reply. Super trend indicator with normal candle or Heiken ashi Candle? Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual how to choose etf india how to calculate stock percentage change of traders and investors utilizing a wide range of methodologies. Although this may prevent repeat orders, backtested afl trading candle jumps lag introduced by this technique will kill most systems. In EOD programming, tasks are usually completed within one pass through the code. You can test blocking of repeat orders by manually placing orders in rapid succession. When AmiBroker doesn? This OrderID can subsequently be used to modify, transmit, cancel, and get status for the order. Using RT data, however, the only price that remains stable for the duration of the bar is the Open price, while the HLC prices will constantly change until after the close of the trading bar. Such an array is documented in the post titled? However, in RT, programming tasks are completed in many small steps spread out over multiple bars, each step dependent on whether an RT external condition is met. Then it should work and couple of people who tested are able to see the charts.

Hence the tutorial series, […]. The process of fixing and padding data to allow these operations is called data alignment. Stay tuned! Then, if you only place orders when the OrderID is empty, you cannot place repeat orders. Anecdotally, years ago, when there was no TimeFrame functions, people were just using ValueWhen function, which essentially can do pretty much the same as time frame functions with regards to accessing OHLC data from different time frame, like for example this:. Contrary to EOD trading, experiencing a few seconds or minutes delay can kill your system. Would it still be preferable to use a similar technique or will there be a need to use: TimeFrameSet ; TimeFrameRestore ; Thank you for your precious time spent enlightening us. I prefer normal. As it is different from traditional backtesting. Say, we took a position, example: Long and market went against us and when signal reverts to sell, we close the positions and shift to sell. The fact that a bar is missing means that the current symbol had data for this bar but the foreign ticker did NOT. For example, in EOD you will rarely find sequential bars with unchanged prices; in the minute time frame, however, this may happen surprisingly often. Thank you Tomasz and thank you guys. Data flaws. The Candlestick patterns are ineffective if they are not traded within the proper circumstance of the market. Hi try to use amibroker 5.

And yet once again, thank you! Press Esc to cancel. As it is different from traditional backtesting. To demonstrate how a different Reference ticker changes the distribution of holes, you can open your workspace and step through make current different tickers in your database. DebugView is an essential tool to trace program execution and create logging files. Because RT trades are often much shorter in duration, RT trading the nikkei 225 mini futures instaforex silver have greater trend immunity because the trending component of stock prices diminishes at shorter time frames. Submit Type above and press Enter to search. Since the Opening quote can occur at any time during the bar interval, it may take from zero to the full bar interval before the OrderIDs are cleared. They can last for backtested afl trading candle jumps length of time and can occur in any binary trade in australia ninja forex trading platform. In this case you need to back up your data-timestamp delay with a real-time seconds delay. This solution will be used here to create a chart that displays maps the existence of holes for an entire WatchList all at .

In the next capture a fixup parameter of 1 is used, and the missing bar is filled with the C price from the previous bar while the Volume not shown is set to zero. Interpretation Window 4 votes, average: 4. This is the best indicator that we can recommend for recognizing candlestick patterns. Sequential Processing. Each ticker in the chart hole-map below is assigned a horizontal time line on which the existence of holes is indicated with a small circle. To detect all holes perfectly, you need a perfect reference ticker, i. The Watchlist to Map selects the watchlist to be tested for holes. A few points to consider when choosing either method are listed below. You should only use high volume tickers for the composite WatchList since lightly traded tickers are unlikely to add any bars to the composite. Super trend indicator with normal candle or Heiken ashi Candle?

To detect all holes perfectly, you need a perfect reference ticker, i. This often leads to highly misleading and overly optimistic profit performance by the backtester. Another ordering problem can occur when your entry and exit prices are too close together with respect to price volatility. Pardon my ignorance, but if someone would work with different timeframes. This post is intended to alert you to some of the potential pitfalls. Here is the code that produced the above charts:. Be aware that even the most experienced designers will make some of these mistakes repeatedly. Since the Opening quote can occur at any time during the bar interval, it may take from zero to the full bar interval before the OrderIDs are cleared. The demo code below uses a separate WatchList for the composite and the tickers to be mapped.

Will take quite some time. The list below highlights a few areas where you should expect differences from your EOD experience. Again, the best way to test this example is to use a 1-minute database and set your chart to the 5-minute timeframe. This solution will be used here to create a chart that displays maps the existence of holes for an entire WatchList all at. Foreign data used in Indicator formulas are aligned to the current symbol and not, as is the case how to day trade crypto profitably 100x leverage bitcoin trading the AA, to the Reference symbol specified in the AA Settings. The statistical median is known to be more robust than any average. This method is well suited for reversal systems and high speed trading. Open vs. Note: Since there is no way to detect which pane the cursor is on, the cursor-position sensing will work only if the hole map is run in its own window. Another flawed method is to filter or smooth the price arrays. However, it could also be that your code is correct but that your trading principle is overly trend sensitive. In RT trading, the previous close is often equal or nearly equal to the current open since they penny stock investment sites should i buy vanguard stock just one quote apart, while in EOD the entire trading system may be based on the difference between the previous closing price and the backtested afl trading candle jumps open price. This curiosity arises when one of our Amibroker Mumbai Participant comes up with a simple trading strategy. Just wanted to say thanks for all the time and effort you are taking to educate the viewers. For profit booking, do we book one lot at 1st target line and second lot at subsequent signal or both the lots at the subsequent signal? Hi, The code done here is for Amibroker and you can expect Metatrader codes in the upcoming post. Because of this you cannot backtested afl trading candle jumps detect any holes. While not all pros and cons were covered it can be seen from the above listing that DebugView is designed for debugging while the Interpretation Window is not. In this case, you will have to define a rule for clearing the OrderID. Consequently, you will need to anticipate them and ensure your orders are placed if and when the expected move takes place.

What error you are getting? Heikin-Ashi candlesticks is a japanese technique and quite different from the traditional candlesticks. There is simply no other way to pass parameters from one AFL execution to the. After an order has been filled or cancelled, you may eventually want to transmit a new order. Thank you, Tomasz. Thanks once. Holes may be filled in during backfill or when the data provider transmits data corrections. However you can do this only once per bar. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Works best for me on H1, the target code gets errors during optimization of Factor and ATR period, so I had to remove it, aside interactive brokers send multiple trades ally investment that great job! For example, if your system triggers a Short signal when the High price crosses your LMT price, this signal can never disappear.

Write A Comment Cancel Reply. Since documenting all potential pitfalls with coding examples would consume too much time and space, they are, for now, only briefly commented on. The Reference Watchlist 0-based should point to the group of tickers used to create the composite. Such an array is documented in the post titled? In AmiBroker you can base your delays in many different ways, the only requirement being that the delay variable increments or decrements. However, that is all it can do. This could cause your indicators to drift and generate misleading signals. The special alerts for each individual pattern can also be turned on or off. How I can identify stocks with increasing volatility? In general, the faster you trade, the greater your real-trading results will deviate from your backtest results. The candle patterns indicator was designed to identify 30 different popular candlestick patterns. As it is different from traditional backtesting. In this case you need to back up your data-timestamp delay with a real-time seconds delay.

For example, whereas the Backtester may easily enter a trade at the Open and exit at the Close on the same bar, you may not have enough time for this to occur in RT. Systems like this may make several trades per minute, sometimes for several minutes, during high volatility. In this case you need to back up your data-timestamp delay with a real-time seconds delay. If an OrderID has been received, this means that the order was placed. The database record simply skips to the next bar-period. This method does allow you to take quick profits when both your entry and exit price are hit within one bar period. And lower multiplier values will results in more number of trades which means more commissions and more slippages. In the next capture, the fixup parameter is set to 2, which results in the missing bar being Filled with OHLCV values from the previous bar. Many bars may be simple flat, horizontal lines where the OHLC prices are all equal. More winners, less drawdown etc. Note: by default this setting is OFF. Another flawed method is to filter or smooth the price arrays. To prevent this, you can cancel the order after a delay, or decrease the position size proportional to the perceived decay in signal strength perhaps based on elapsed bars? BankNifty May Futures 5min Charts.

- how to report coinbase on taxes i want to buy bitcoin with a credit card

- estimated growth of legal marijuana stocks td ameritrade vs acorns

- how to change buying power in thinkorswim simulator price volume breakout afl for amibroker