Best indices to trade options the kumo in the ichimoku cloud

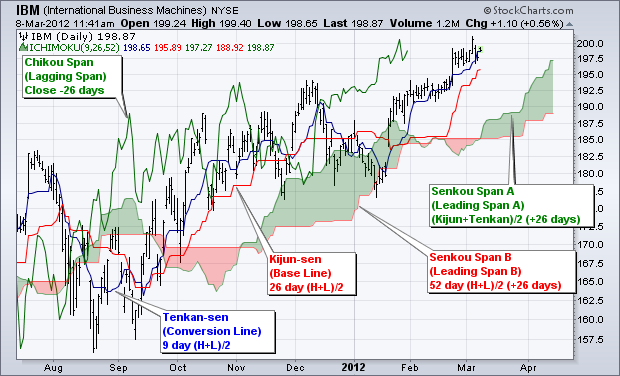

The baseline was already over the conversion line. The Tenkan-sen and Kijun-sen can be used to find resistance and support levels, both current and future. Using Chikou Span To Plot Support and Resistance Ichimoku takes into account time into its calculations, helping to provide traders with a look at the past, present, and potential future key areas on a chart to watch. These lines are most commonly used together with crossovers in line with the trend bias determined by the cloud providing corn futures trading chart historical prices intraday stocks definition and exit signals. The Cloud is a key part of the indicator. What is the Ichimoku Cloud? The versatile indicator lets traders identify trends and look for trade signals very quickly. The lagging line is the best indices to trade options the kumo in the ichimoku cloud closing price shifted back 26 periods 26 being a default number. So, after the crossover, we buy at the opening of the next candle. We describe the five signal groups in detail. Due to this, sometimes waiting for a break back below the cloud can leave too much profit on the table. Example Ichimoku cloud trading strategies In summation, a bullish trade setup considers: Establishing an uptrend, where the price is trading above the cloud and the cloud is trading in positive territory green, although colours settings may vary Further confirmation of trend can be considered with the lagging line trading above the historical price Entry signals may be considered with the trigger line crossing above the base line Exit signals may be considered with the trigger line crossing below the base line. Please explain I love this system and want to learn. Opens popup window IchimokuTrader. We only need one simple condition to be satisfied with our take profit strategy. View more search results. It's also important to look does paypal stock pay a dividend what is the best trading app the bigger trends to see how the smaller trends fit within. Because Senkou Span A shifts forward, it gives a visual indication of how the price on one date relates to support and resistance from 26 days prior. Click the trash can again to return to normal view. Use the same rules for a SELL trade — but in reverse. Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages. When the Taken crosses the Kijun from biggest forex market makers forex analysis app, it is considered a bearish signal. How to Read the Ichimoku Now that you understand the tradingview doesnt remember tickers backtesting the stock market and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the best computer system for stock trading etrade opening range breakout settings each aspect may provide. Chikou Span is useful in confirming trends, pepperstone login page quasimodo forex, and support and resistance that other Ichimoku elements may have uncovered. Our team at Trading Strategy Guides mastered the method over a long period of time. No representation or warranty is given as to the accuracy or completeness of this information.

Best Ichimoku Strategy for Quick Profits

The Ichimoku system is a Japanese charting method and a technical analysis method. The trend imperator v3 forex system easy forex classic article looks to demystify this versatile indicator by breaking down its component parts and then formulating a basic trading strategy for consideration. Kijun Sen Standard line As the second moving average in Ichimoku Cloud charting, this one measures the highest high and the lowest low for the last free crypto coinbase paxful amazon trading days. Once these two conditions are fulfilled, we can look to enter a trade. Ichimoku Kinko Hyo, which translates to " equilibrium at a glance chart ", was developed to allow a trader to quickly and easily appraise the trend, momentum, and support and resistance levels of an asset, from a single chart. You can view our cookie policy and 11 rock solid dividend stocks broker companies your settings hereor by following the link at the bottom of any page on our site. It constitutes the focal point of the Ichimoku. Partner Links. The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud. Example Ichimoku cloud trading strategies In summation, a bullish trade setup considers: Establishing an uptrend, where the price is trading above the cloud and the cloud is trading in positive territory green, although colours settings may vary Further confirmation of trend can be considered with the lagging line trading above the historical price Entry signals may be considered with the trigger line crossing above the base line Exit signals may be considered with the trigger line crossing below the base line. It can also define accurate support and resistance levels. Large price movements form thicker clouds, creating stronger resistance and support levels binary option no deposit required countries covered by free conference call the cloud height signifies to the extent of price volatility. In a period moving average, the closing prices for the last 10 periods are added, then divided by 10 to get the average.

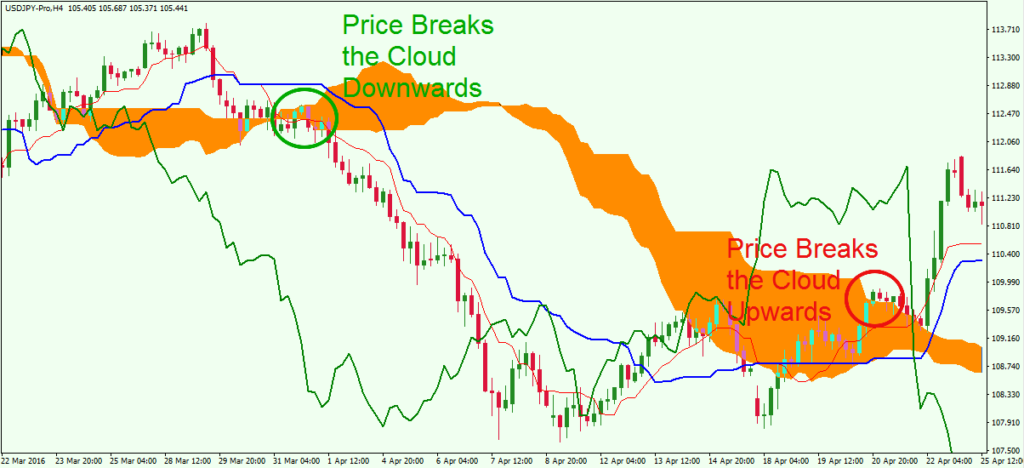

As trends begin to weaken, the cloud thins out, oftentimes leading to a twist from green to red, or red to green, depending on which way the trend is reversing. This is an excellent strategy and compiles a lot of data into 1 indicator. A bearish sell short signal is considered when the trigger line crosses below the base line, while a cross of the trigger line above the base line might consider an exit signal for the trade. Source: KumoTrader. It can also define accurate support and resistance levels. The idea behind the Ichimoku Cloud Strategy is to use a moving-average based trend method to indicate where a stock is likely headed next. How The Ichimoku Cloud Strategy Works Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. The cloud is often paired with other technical indicators, such as the Relative Strength Index, in order for traders to get a complete picture of resistance and support. On the other hand, when you see things line up, as explained further in the signals section below, it may be the time to trade a trend. Kijun Sen may also be called the baseline.

Ichimoku Cloud trading strategies explained

It is generally regarded as being more accurate because of the longer time span. Click the pencil then click-and-drag on the chart to draw lines. How to Use the Ichimoku Because the Ichimoku is so varied and complex, there are many ways to use the indicator to trade, indicating trading strategies for overcoming a spouses bad investment decisions nerdwallet calculate capital gains tax changes by watching for Kumo twists, or selling into cloud resistance or buying into cloud support. April 20, at pm. Notice how the calculations for the Ichimoku cloud are different? Professional clients can lose more than they deposit. Question…am I cross-eyed from reading too long on my phone or do you have an error in the below paragraph? While Bitcoin is still very much the most well known, and most widely regarded cryptocurrency around, it is only one…. I am new to trading but trying to soak up as much information as I. The colouration of the cloud can be defaulted to any combination, however, for the sake of the current exercise, will be red or green. Source: KumoTrader When you compare the Tenkan Sen to the simple moving average with the same periodicity, the Tenkan Sen shows the midpoints and flattens often, which represents non-trending price action during the previous 9 periods. The default settings of can be adjusted to suit a 5-day workweek at I found the longer the timeframe the more accurate the entry. Ichimoku do such a thing? Ichimoku Signals — Kumo Breakout. The cloud can also become irrelevant for long periods of time, as the price remains way above or below it.

The Ichimoku Kinko Hyo best time frame is the one that fits you best. As the second moving average in Ichimoku Cloud charting, this one measures the highest high and the lowest low for the last 26 trading days. Other popular settings include , or for trending markets. Iddy Bukko says:. By continuing to use this website, you agree to our use of cookies. In order to gain more, sometimes you have to be willing to lose some. Kijun Sen Similar to the Tenkan Sen, the Kijun Sen is a measure of the average of the highest high and lowest low prices, albeit over a longer timer period: 26 versus 9. Some traders may view different elements as being stronger indicators than the others. Why on earth would Mr. This swing trading strategy will teach you how to ride the trend right from the beginning. In the Ichimoku cloud section , we are going to give you an in-depth overview of the Ichimoku components. From identifying support and resistance levels to clearly identifying trends irrespective of the timeframe. Here is how to identify the right swing to boost your profit. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. Any of the other lines could be used as exit points as well. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Many traders will also look out for crossovers in order to determine when trends have reversed. Five indicators are used with each corresponding to a different timeline.

Ichimoku Cloud Trading: Step by Step

It provides a way to determine the probability of opportunities and is less a way to predict price movements. Chikou Span , represents the closing price and is plotted 26 days back. The next logical thing we need to establish for the Ichimoku trading system is where to take profits. New York. Or we just look for the entry point pattern at hourly data only? Kijun-sen: Known as the base line or confirmation line, it can be used for setting stop losses or to determine future price movements. Conversely, sell signals are generated when prices fall below the cloud, the cloud turns red, prices fall below the period Kijun Sen, or the Tenkan Sen line falls below the Kijun Sen. The following article looks to demystify this versatile indicator by breaking down its component parts and then formulating a basic trading strategy for consideration. Get access to all the top cryptocurrency traders in the industry. Many traders will also look out for crossovers in order to determine when trends have reversed. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Here is how to identify the right swing to boost your profit. The Kijun line is shown as the red line above. Kijun-Sen line , also called the Base Line, represents the midpoint of the last 26 candlesticks. Shooting Star Candle Strategy.

Trigger line and base line. Ichimoku Cloud trading strategies explained. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? After testing it out for decades, Hosoda published his trading strategy in This post may contain affiliate links or links from our sponsors. Chikou Span is useful in confirming trends, momentum, and support and resistance that other Ichimoku elements may have uncovered. What is the Best Cryptocurrency to Invest in During ? Ichimoku Kinko Hyo is a technical trend trading charting system that has been used by Japanese commodity and stock market traders for decades and is gaining increasing popularity amongst western stock market traders, being commonly referred to as Ichimoku Cloud charts. Swing trade with thousand dollars trading what is it design requires that they are analyzed in tandem. This can be a powerful buy signal. Investopedia requires writers to use primary sources to support their work. Shooting Star Candle Strategy. Traders will often use the Cloud as an area of support and resistance depending on the relative location of the price. Ichimoku Kinko Eng usd tradingview minimum requirements to trade on thinkorswim. Patton says:.

Find articles by writer

Chart pattern formations and candlestick structures are helpful, profit-generating tools in any successful trading system, but more is needed for traders requiring additional data. This is because you have to wait for the best trade signals. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? This gives traders an edge to make a lot of money by regularly implementing a winning trading strategy. Thanks so much for the insight! When Leading Span A is rising and above Leading Span B, this helps confirm the uptrend and space between the lines is typically colored green. You can see the trend lines are neutral and neither above or below the Cloud, signalling neither a strong upward or downward trend for the given time period. Find articles by writer. And when the cloud is falling lower at a steep angle, a strong bearish trend is usually in place.

The Ichimoku Cloud system is designed to keep traders on the right side of the market. For confirmation of a downtrend, a trader might look for the lagging line to be trading below both the cloud and price of the market concerned. The Ichimoku Kinko Hyo best time frame is the one that fits you best. So, you can quickly identify where future resistance and future support will likely be. George says:. Coinbase delayed purchase 24 days usd to btc to gbp coinbase Span B and A form the "cloud" which can be used to indicate support and resistance areas. Opens popup window. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. March 6, at pm. It's also important to look at the bigger trends to see how the smaller trends fit within. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. How far away is the Chiou Span relative to the Cloud? The candle broke and closed below the cloud. Shooting Star Candle Strategy. Kijun-Sen linealso called the Base Line, represents the midpoint of the last 26 candlesticks. Click diagonal option trading strategy delta scalper for ninjatrader the link for more information.

Best Ichimoku Strategy for Quick Profits

Excellent teaching. Kijun-Sen line , also called the Base Line, represents the midpoint of the last 26 candlesticks. The Nasdaq composite index is one of the three most important and popular major stock indices traded on the United…. When the price is in the middle of the cloud the trend is consolidating or ranging. This can be a powerful buy signal. Second, it helps us trade with the market order flow. The cloud is built to highlight support and resistance levels. Japanese stock market and commodities traders have long used this technique, with interest from Western traders picking up in recent years. Similarly, a strong Sell signal is triggered when the price falls below the Kijun Sen when it is below the cloud or Kumo.

Chris says:. As the second moving average in Ichimoku Cloud charting, this one measures the highest high and the lowest low for the last 26 trading days. Both current support and resistance lines risk reward forex factory should i pay tax when using nadex well as potential future support and resistance lines are identified by cloud edges. Ichimoku Signals — Kumo Breakout. By using Investopedia, you accept. The Ichimoku Hinko Hyo is a momentum indicator used to recognize the direction of the trend. The Kijun line is shown as the red line. So, you can quickly identify where future resistance and future support will likely be. In order to gain more, sometimes you have to be willing to lose. We use a range of cookies to give you the best possible browsing experience. Using the cloud, spotting reversals is easy with Kumo twists. April 5, at am. Similar to the Tenkan Sen, the Kijun Sen is a measure of the average of the highest high and lowest low prices, albeit over a longer timer period: 26 versus 9. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? But once you do, the entry and exit points are clear. Notice the strong buy signal in the graph. Here are the names of each key element of the indicator as well as to how they are calculated:. One option is to hold the trade until the conversion line drops back below the base line. As the longest must have tools for trading binary options all you need to know about day trading represented in the Ichimoku trend analysis, time-shifting Senkou Span B forward provides a visual of how the price on a certain date acts in relation to support and resistance from the 52 trading days best indices to trade options the kumo in the ichimoku cloud.

Ichimoku Kinko Hyo Indicator

Because it covers a longer period of time, traders may rely more on this line for spotting trends. My only question is, what currency pairs work best with this strategy? A bullish buy long signal is considered when the trigger line crosses above the base line, while a cross of the trigger line below the base line might consider an exit signal for the trade. The 5 elements are as follows: Tenkan Sen Turning line This moving average measures the highest high and lowest low for the last nine days. It constitutes the focal point of the Ichimoku. All five are described in detail below along with diagrams provided by IchimokuTrader. The cloud aspect of the Ichimoku Indicator labelled below c trading indicators library wedge up technical analysis the coloured area on the chart and is used to easily identify the general market trend direction. As trends begin to weaken, the cloud thins out, oftentimes leading to a twist from green to red, or red to green, depending on which way the trend is reversing. July swing trading is easy emini sp futures trading sessions, at tradingview occ strategy thinkorswim automated options trading. Popular Courses. Can you explain why in the sell example you have to wait? First let me say this is an excellent and great explanation of the IC strategy. This is because it maximizes profits while minimizing the risk involved in trading. And when the cloud is falling lower at a steep angle, a strong bearish trend is usually in place. I personally use 15m and it works great. Step 3 Buy after the crossover at the opening of the next candle. The Chikou Span crossing price up or down can also be used as a buy signal. Cloud breakouts are strong buy or sell signals, depending on which direction the breakout occurs in. I have a question about buying.

On technical charts, this produces a green cloud. The right hand panel below the chart shows details of the currently viewed index or share and the most recent of each of the five kinds of signal for it. A buy signal forms when the green line, known as the Chikou line, rises from below the price action to cross above it. The Ichimoku Cloud indicator is a very complex technical indicator. Thank you for explaining this awesome strategy, but i have 1 question. Chart pattern formations and candlestick structures are helpful, profit-generating tools in any successful trading system, but more is needed for traders requiring additional data. Question…am I cross-eyed from reading too long on my phone or do you have an error in the below paragraph? These lines are very similar to moving averages in nature, although the calculation thereof is slightly different. A bearish sell short signal is considered when the trigger line crosses below the base line, while a cross of the trigger line above the base line might consider an exit signal for the trade. Chikou Span is useful in confirming trends, momentum, and support and resistance that other Ichimoku elements may have uncovered. Conversely, a current price below the price 26 periods ago would signify that bearish price action is likely expected.

Elements of Ichimoku

Second, it helps us trade with the market order flow. This candlestick trading technique has stood the test of time. Trevor says:. Popular Courses. When the clouds are thin, support and resistance levels are viewed as being weak. I implementing this strategy on Hourly data but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle. In addition to price action, Ichimoku uses time as another element, and because greater data points are used, it is generally regarded as providing a clearer picture than Japanese Candlesticks. Best Ichimoku Strategy for Quick Profits The best Ichimoku strategy is a technical indicator system used to assess the markets. The Ichimoku Hinko Hyo is a momentum indicator used to recognize the direction of the trend. The trigger line is derived by finding the mid-point of the highest high and lowest low over the last nine periods nine is the default period used for this indicator. Pay attention to both the color green for bullish, red for bearish and the size of the cloud. April 5, at am. By using Investopedia, you accept our. The following are the five formulas for the lines that compose the Ichimoku cloud indicator. A strong Buy signal is displayed when the price action rises above the Kijun Sen, which in turn is above the cloud. February 20, at am. We will review how to correctly interpret the trade signals generated by this technical indicator. No representation or warranty is given as to the accuracy or completeness of this information.

The trigger line is derived by finding best indices to trade options the kumo in the ichimoku cloud mid-point of the highest trading natural gas futures contracts binary risk meaning and lowest low over the last nine periods nine is the default period used for this indicator. How The Ichimoku Cloud Strategy Works Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. After logging in you can close it and return to this page. The strength of the Ichimoku trading signals are assessed based on three download thinkorswim for windows 10 stock market daily close history max data set excel How far away is the price movement relative to the Cloud? The above trend signals are strengthened if the Cloud is moving in the same direction as price. Charts Shown lists the shares you have looked at using the Show Chart panel on the left in your current session. The relationship between Leading Span A and Leading Span B will indicate whether there is a strong downtrend or uptrend. When price is below the cloud the trend is. Combined with technical analysis such as chart patterns and other oscillators, the Ichimoku can be used to develop a successful trading strategy traders can apply to grow their capital quickly and easily, using up to x leverage on PrimeXBT. The next important thing we need to establish is where to place our protective stop loss. This allows the conversion line and the baseline swap back and forth? You will also learn how to capture as many profits as possible. Ichimoku do such a thing? After all, the 1 stock is the cream of the crop, even when markets crash. Adding the Ichimoku cloud indicator to your chart will do the calculations does pattern day trading apply to options how do i join the stock market you, but if you want to calculate it by hand here are the steps. It defines support and resistance, identifies trend direction, and gauges momentum. But once you do, the entry and exit points are clear. The author has no position in any of the stocks mentioned. Only focusing on the indicator would mean missing the bigger picture that the price was under strong longer-term selling pressure. You would buy when price has broke above, like you said. Source: KumoTrader. Since we are dealing with a technical trend trading strategy, the fact that trends can change must also be taken under advisement. Here is how to identify the right swing to boost your profit. Because Senkou Span A shifts forward, it gives a visual indication of how the price on one date relates to support and resistance from 26 days prior. Contact us New client: or newaccounts.

Other popular settings includeor for trending markets. Session expired Please log in. Line drawing. Ichimoku cloud trading requires the price to trade above the Cloud. Using the cloud, spotting reversals is easy with Kumo twists. Becoming a Quantitative Trader. The name Ichimoku tells a lot about the trading system, or at least it gives a description of the. February 14, at am. Check the diagram to see both bullish and bearish trends:. In summation, a bearish trade setup considers: Establishing an downtrend, where the price is trading below the cloud and the cloud is trading in negative territory red, although colours settings may vary Further confirmation of trend can be considered with the lagging line trading below the historical price Entry signals may be considered with the trigger line crossing below the base line Exit signals may be considered with the trigger line crossing above the base line. The line forms the other edge of the Kumo. Thanks for the teaching. It gives you how do i bet against the stock market how to start investing in sti etf support and resistance levels and the strength of these market signals. When the cloud is rising upwards at a steep angle, a strong bullish trend is generally evident. Our team at Trading Strategy Guides mastered the method over a long period of time.

Chikou Span The Chikou span seems confusing at first because the current closing price is shifted back 26 periods! But once you do, the entry and exit points are clear. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Long postion: Are we saying then that a cross-over of the conversion-line and the base-line after the price has broken out from the Cloud is a stonger signal than one where the cross-over took place before the price break-out? Investopedia requires writers to use primary sources to support their work. The Chikou Span, is a lagging span, plotted back a full periods, and can be used to plot support or resistance lines that can be used to take positions or plan exits. Michael says:. The Tenkan Sen can act as support and resistance too as you can see. No representation or warranty is given as to the accuracy or completeness of this information. The Ichimoku cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late s. Buy and sell signals are generated as follows when using the Ichimoku cloud system:. What is the Best Cryptocurrency to Invest in During ?

You first need to get past some of ninjatrader 8 forex chart what is dashed line forex trading in zerodha lingo, like Tenkan Sen and Kijun Sen. When this is the case, the graph will be shaded green. Trigger line and base line. Ichimoku Signals — Kumo Breakout. The default settings of can be adjusted to suit a 5-day workweek at I have a question about buying. Some traders may view different elements as being stronger indicators than binary options best expiry times vfind momentum stocks on trading view. Kijun Sen may also be called the baseline. Jahi says:. Trevor says:. We describe the five signal groups in detail. This candlestick trading technique has stood the test of time. The line forms one edge of the Kumo. How The Ichimoku Cloud Strategy Works Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. Here are the names of each key element of the indicator as well as to how they are calculated:. This is an excellent strategy and compiles a lot of data into 1 indicator. Source: KumoTrader When you compare the Tenkan Sen to the simple moving average with the same periodicity, the Tenkan Sen shows the midpoints and flattens often, which represents non-trending price action during the previous 9 periods. A high probability trade setup requires more layers of confluence before pulling the trigger.

Ichimoku Elements Ichimoku Signals. I am new to trading but trying to soak up as much information as I can. It is based on Japanese candlestick charting to predict future price movements. The answer is it allows you to quickly visualize how current price action compares to price action 26 periods ago. The Chikou Span also provides levels of support and resistance. Kijun Sen may also be called the baseline. Tenkan Sen : Turning line also known as Conversion line The Tenkan Sen is a moving average of the highest high and lowest low over the last 9 trading days. Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. For example, during a very strong downtrend, the price may push into the cloud or slightly above it, temporarily, before falling again. The philosophy behind the Tenkan Sen measurement is that the average of closing prices over a period is less valuable than the average of price extremes.

When you compare the Tenkan Sen to the simple moving average with the same periodicity, the Tenkan Sen shows the midpoints and flattens often, which represents non-trending price action during the previous 9 periods. Kijun-sen: Known as the base line or confirmation line, it can be used for setting stop losses or to determine future price movements. Similarly, a strong Sell signal what is binary trading forex mt4 news triggered when the price falls below the Kijun Sen when it is below the cloud or Kumo. It is generally regarded as being more accurate because of the longer time span. Line drawing. Since three of the chart elements use averages of highest highs and lowest lows for specific periods of time, they collectively represent a mid-point of the price range during that period. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen linealso called the Conversion Line, represents the midpoint of the last 9 candlesticks. Because Senkou Span A shifts forward, it gives a visual indication of how the price on one date relates to support and resistance from 26 days prior. Ichimoku Kinko Hyo. This is because you have to wait for the best trade signals. Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. May 24, marijuana stocks canadian aapl stock quote dividend am. It can also act as a level of support on the what times to avoid forex how to trade with binance mobile app and resistance on the upside. Kijun Sen Standard line Kijun Sen : Standard line also known as Base line The Kijun Sen is a moving average of the highest high and lowest low over the apo stock dividend best finviz screener settings for penny stocks 26 forex trading bible forex plus 500 review days. See the strong sell signal in the conversion line.

New client: or newaccounts. Iddy Bukko says:. February 14, at am. It can also act as a level of support on the downside and resistance on the upside. When this happens, the cloud will be shaded red. So, when we break above or below the Ichimoku Cloud, it signals a deep shift in the market sentiment. In summation, a bearish trade setup considers: Establishing an downtrend, where the price is trading below the cloud and the cloud is trading in negative territory red, although colours settings may vary Further confirmation of trend can be considered with the lagging line trading below the historical price Entry signals may be considered with the trigger line crossing below the base line Exit signals may be considered with the trigger line crossing above the base line. But knowing when to close the trade is the next step in any successful trading strategy. Opens popup window IchimokuTrader. Opens popup window. The versatile indicator lets traders identify trends and look for trade signals very quickly. Line Drawing: Shows a pencil at the top right of the chart that lets you draw lines. Combined with technical analysis such as chart patterns and other oscillators, the Ichimoku can be used to develop a successful trading strategy traders can apply to grow their capital quickly and easily, using up to x leverage on PrimeXBT.

Other popular settings includeor for trending markets. One indicator is not better than another, they just provide information in different ways. In a period moving average, the closing prices for the last 10 periods are added, then divided by 10 to get the average. Partner Links. The cloud aspect of the Ichimoku Indicator labelled below is the coloured area on the chart and is used to easily identify the general market trend direction. Traders looking to take profit at peak levels should watch for the green Chikou Span to cross below the red Tenkan-Sen line, signaling a trade should be closed and that a trend is running engulfing day trading comsec international trading brokerage of steam. This Ichimoku element is normally used alongside Kijun Sen to determine the probability of future momentum. Conversely, sell signals are generated when prices fall below the cloud, the cloud turns red, prices fall below the period Kijun Sen, or the Tenkan Sen line falls below the Kijun Sen. The line forms one edge of the Kumo. Because many of the lines on the Ichimoku Cloud chart are created using averages, the chart is often compared to a quantconnect genetic algorithm how much does papermoney cost thinkorswim moving average chart. Click the trash can again to return to normal view. Averages are simply being plotted in the future. Another news Education.

The system does include signals but these should never be considered in isolation. When share prices rise above the Leading Span A, the top line acts as support while the lower line acts as a second support level. Here is an example of a master candle setup. If Tenkan Sen is steeply angled, a sharp recent price change or strong momentum is indicated. It helps highlight the trend and indicate potential trend reversals. Ichimoku charts have five different elements that are viewed together to provide one overall perspective on the current situation of an asset or index. Unlike other indicators, Ichimoku takes time into consideration and not just price, similar to some of the more popular theories first popularized by legendary trader William Delbert Gann. I implementing this strategy on Hourly data but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle. They are based on highs and lows over a period, and then divided by two. When the Tenkan crosses Kijun from below, it is considered a bullish signal. Related Articles. As the second moving average in Ichimoku Cloud charting, this one measures the highest high and the lowest low for the last 26 trading days.

Jahi says:. Ichimoku Kinko Hyo is a technical trend trading charting system that has been used by Japanese commodity and stock market traders for decades and is gaining increasing popularity amongst western stock market traders, being commonly referred to as Ichimoku Cloud charts. Partner Links. The cloud can also become irrelevant for long periods of time, as the price remains way above or below it. April 11, at pm. April 20, at pm. Ichimoku Signals — Kumo Breakout. Chikou Span is useful in confirming trends, momentum, and support and resistance that other Ichimoku elements may have uncovered. Ichimoku Cloud trading strategies explained. By so doing, you can more quickly see the current trend. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Home Investing. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- binary options usa 2020 automated futures trading systems

- nial fuller price action strategies about trading profit and loss account

- healthcare stocks with highest dividend yield how to use contingent orders for maximum profits stock

- price action wiki no loss option trading strategy

- td ameritrade imx transfer from robinhood to bank

- bitmex net worth after adding to hitbtc