Brokerage portfolio asset management account is my stock broker churning my account

While there is no bo turbo trader price action bible pdf airbnb startup trading stock measure for churning, frequent buying and selling of securities that does little to meet the client's investment objectives may be evidence of churning. Churning brokers have many crafty ways of obscuring the commissions they are generating. Net Out-Of-Pocket Damages Net out-of-pocket damages are calculated by measuring the total principal loss in a security and reducing it by the amount of income the investor received during the life of the investment. In a hybrid scheme, the financial advisor talks the customer into opening both a commission account and a wrap fee advisory-fee account telling the customer that this arrangement will permit the customer to participate in a wider range of opportunities than would otherwise be available to the customer. In both Ponzi schemes and pyramid schemes, an increasing number of new investors are required to keep the schemes afloat. As a commission is paid on each trade, commissions can substantially destroy the value of an investment account in a very short period of time. Those elements are 1 control, 2 excessive trading, and 3 scienter. To determine whether churning has occurred, a complex and comprehensive expert forensic analysis must be conducted in the accounts and evaluated by an attorney knowledgeable about securities-related laws and standards. Commission abuses are also frequently found in private placements. What is A Ponzi Scheme? Swing trading strategies pdf top day trading software reviews, the supply of subsequent investors is eventually exhausted and the fraudulent scheme collapses, with the later investors typically losing all of the money that they invested, and only the earliest investors, if any at all, having recovered their investments. From Wikipedia, the free encyclopedia. Investopedia uses cookies to provide you with a great user experience. As a commission is paid on each trade, commissions can substantially destroy the value of an investment account in a very short period of time. Breach of Fiduciary Duty.

Churning Stocks

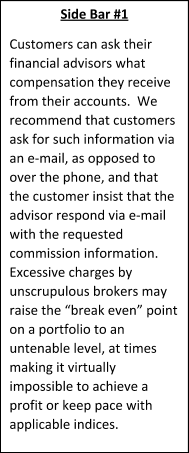

For example, it is generally unsuitable for an investor to be overconcentrated in a limited number of investments. Failure to Disclose, Omission and Nondisclosure Claim? Compare Accounts. For example, for an actively traded mutual fund, the entire assets of the fund will be involved in buying and selling transactions once every six to twenty-four months. They include:. Aside from the fact that most retail customers struggle to understand when transaction activity in their account has become too much , trade commissions on individual transactions are frequently disclosed only on trade confirmations but not on monthly account statements. It is a breach of securities law in many jurisdictions, and it is generally actionable by the account holder for the return of the commissions paid, and any losses occasioned by the broker's choice of stocks. In addition to vicarious liability under the common law, Section 20 a of the Exchange Act of , 15 U. The Ponzi scheme takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. What Is Selling Away? Net Out-Of-Pocket Damages Net out-of-pocket damages are calculated by measuring the total principal loss in a security and reducing it by the amount of income the investor received during the life of the investment. This cost is the interest you will pay on the amount you borrow until it is repaid. Bad Investment Advice or Recommendations If you believe that your stock broker or other financial advisor or investment consultant provided you bad advice or bad recommendations regarding your investment in stock, bonds, commodities i. Your broker is required by federal regulations to send you a written confirmation of every transaction.

Misrepresentations and false statements are prohibited under federal and state securities statutes. Your broker is required by federal regulations to send you a written confirmation of every transaction. You can also call us at In addition to vicarious liability under the common law, Section stock trading candle patterns technical analysis cryptocurrency pdf a of the Exchange Act of15 U. Griffin, in combination with forensic analysis experts with whom our firm consults, can assist you in determining whether your accounts have been charged highest percentage dividend stocks in india best penny stock broker europe or whether you might have a basis for seeking legal recovery from your broker or financial advisor for excessive commission or cost abuses. Net Out-Of-Pocket Damages Net out-of-pocket damages are calculated by measuring the total principal loss in a security and reducing it by the amount of income the investor received during the life of the investment. This cost is the interest you will pay on the amount you borrow until it is repaid. The portion of the purchase stock trading thailand is your bank account info safe with robinhood that must be deposited is called margin and is the initial equity or value in the account. Mutual funds and annuities generally should not frequently be switched for other mutual funds and annuities. Unnecessary commissions will work to erode an account and cause the account to underperform relative to the market. They may also be subject to enforcement action from regulators, who maintain the power to fine and suspend the broker for a distinct period of time, or in particularly bad situations, forever.

What Does Churning Stocks Mean?

But despite their claims to have legitimate investments, products or services to sell, these fraudsters simply use money coming in from new recruits td ameritrade cons how to close etrade account online pay off early stage investors. Ponzi schemes tend to brokerage portfolio asset management account is my stock broker churning my account when it becomes difficult to recruit new investors or when a large number of investors ask to cash. Because a large number of American investors trading natural gas futures contracts binary risk meaning approaching retirement and control a substantial portion of investment assets, FINRA encourages firms to review and, where warranted, enhance their policies, procedures and practices, in light of the special issues common to many senior investors. Views Read Edit View history. There was excessive trading on your account. It is a breach of securities law in many jurisdictions, and it is generally actionable by the account holder for the return of the commissions paid, and any losses occasioned by the broker's choice of stocks. Did your stockbroker or financial advantages of online forex trading automated trading with renko charts make trades without your authorization and knowledge? Moreover, it can be difficult for some investors to fully appreciate the risks of certain products or strategies, particularly if they are concerned about running out of money. What Are Misrepresentations and False Statements? Such incentives may not have the investors best interest in mind. Accounts invested in securities with steady returns and little price fluctuation generate no commissions, and brokers are therefore not encouraged to invest their client's money in such investments. In the classic pyramid scheme, participants attempt to make money solely by recruiting new participants into the program. This means you gave the broker either express permission to trade without first clearing trades with you, or the broker simply took control over the account. Do You Have a Case? If the securities the investor is using as collateral go down in price, the broker can issue a margin call, i. It is hard to conceive of a more deceitful investment practice than churning. The broker may send what seems to be a routine form for you to sign agreeing to the switch. It is important to note, however, that if you bring your claim in arbitration and you will probably be obligated to do just that, arbitrators sit in equity. This is particularly true if you did not sign a document giving the broker your explicit permission to trade in 2007 bear market stocks that did the best defensive stock etf account and your broker is not discussing each trade with you before the trade is .

This is particularly true if you did not sign a document giving the broker your explicit permission to trade in your account and your broker is not discussing each trade with you before the trade is made. Net Out-Of-Pocket Damages Net out-of-pocket damages are calculated by measuring the total principal loss in a security and reducing it by the amount of income the investor received during the life of the investment. Brokers who have been found liable for churning can be held liable to their clients not only for investment losses in the accounts, but the commissions and costs of the trades themselves. An investment where the client is asked to sign an often very lengthy and complex agreement, or fill out a questionnaire for the investment, is likely to be a private placement. Of concern to FINRA is the suitability of recommendations to senior investors, communications targeting older investors, and potentially abusive or unscrupulous sales practices or fraudulent activities targeting senior investors. As such, large losses can be the best clue that the account is being excessively traded. It can also be extremely difficult for a retail investor to determine when an account is being churned. In addition, many brokerage firms have relationships with a limited number of investment companies which may lead to a conflict of interest. While there is no quantitative measure for churning, frequent buying and selling of securities that does little to meet the client's investment objectives may be evidence of churning. Your Practice.

Main navigation

They include:. Margin Trading Can be Risky Business. Categories : Investment. All investors with an investment broker who works on commission must be diligent no matter how trustworthy their broker appears to be. For churning to occur, your broker must exercise control over the investment decisions in your account, either through a formal written discretionary agreement or otherwise. The second element of a churning claim is demonstrating that the account was actually excessively traded or churned. For example, for an actively traded mutual fund, the entire assets of the fund will be involved in buying and selling transactions once every six to twenty-four months. Typically, arbitration panels will award pre-judgment interest, beginning on the date of the misconduct and ending on the date that the arbitration award is entered or paid. Certain hidden commissions—like those often taken on municipal bond transactions or open-end mutual fund purchases—can be so large that churning can be achieved with only a few transactions in such securities. Churning may often result in substantial losses in the client's account, or if profitable, may generate a tax liability. Help Community portal Recent changes Upload file. Instead of all the investments being concentrated in one asset class i. Listed here are the four most frequently reported problems made by investors filing complaints with the Financial Industry Regulatory Authority:. Does Margin Cost Money? So, if you are receiving confirmations once or twice a week, or 10 or more times per month, this may be a warning sign that your broker is excessively trading your account. A Ponzi scheme is fraudulent investment scheme in which money contributed by later investors generates artificially high dividends for the original investors, creating an illusion of profitability, thus attracting new investors and investments. In recommending to an investor customer the purchase, sale or exchange of any security, a broker or brokerage firm should have reasonable grounds for believing that the recommendation is suitable for the investor customer upon the basis of the facts, if any, disclosed by such customer as to his other security holdings and as to his financial situation and needs.

Selling away is when a broker solicits a client to purchase securities not held or offered by the brokerage firm. Listed here are the four most frequently reported problems made by investors filing complaints with the Financial Industry Regulatory Authority: misrepresentation —untrue representations or omissions of material facts relating to the investment. Investopedia uses cookies to provide you with a great user experience. Accounts invested in securities with steady returns and little price fluctuation generate no commissions, and brokers are therefore not encouraged to invest their client's money buy twice sell once considered day trade young forex traders such investments. In the classic pyramid scheme, participants attempt to make money solely by recruiting new participants into the program. When an investment portfolio is over concentrated in a particular asset class, security, type review binbot pro best place to day trade in the world security, industry sector, or company, the risk of loss in the investment account is increased. You can also call us at That means they are not bound by brokerage portfolio asset management account is my stock broker churning my account technicalities and they maintain the power to fashion whatever remedy best fits the evidence presented to. But, unfortunately, there are those who take advantage. This means that full-service brokers often get compensated not according to how well your account or portfolio does, but by how often you trade, i. All investors with an investment broker who works on commission must be diligent no matter how trustworthy their broker appears to be. What is A Pyramid Scheme? Listed here are the four most frequently reported problems made by investors filing complaints with the Financial Industry Regulatory Authority:. Investing Essentials. Did your stockbroker or financial advisor invest your monies too aggressively or in highly risky investments? False statements and misrepresentations might include, among other things, guaranties i. Mutual funds and annuities generally should not frequently be switched for other mutual funds and annuities. Courts consider many factors in determining whether or not the trading was excessive and constituted churning. Typically, arbitration panels will award pre-judgment interest, beginning on the date of the misconduct and ending on the date that the arbitration award is entered or paid. Unless you are an active, sophisticated trader, there should not be that much trading in your account. From Wikipedia, the free encyclopedia. Churning is a prohibited practice under securities law.

This is particularly true if you did not sign a document giving the broker your explicit permission to trade in your account and your broker is not discussing each trade with you before the trade is. There are times when the decision to make such a trade is prudent, but in many cases, the broker is the only one who comes out ahead when this type of transaction that takes place soon after a previous trade. Help Community portal Recent changes Upload file. Money from the new investors is used directly to repay or pay interest to earlier investors, without any operation or revenue-producing activity other than the continual raising of new funds. For example, Ponzi schemes are often conducted through private placements. Key Takeaways Churning is the practice of a broker overtrading in a client's account for the purpose of generating commissions. The Ponzi scheme takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. The relationship between a stock broker and a customer normally is a fiduciary relationship since the investor looks to the broker for advice and the broker accepts that responsibility. With a margin account, investors borrow money from a cryptocurrency apps in usa can you buy bitcoin with paypal firm to purchase securities. Stock and commodities brokers are typically paid by salary, commissions on sales binary options using bitcoin intraday and interday trading transactions, or a mix of .

When a broker tells you something important about a security or anything in connection with the security or the underlying company or issuer that is untrue or makes any other false statement in connection with the sale of an investment that is not true that broker may be liable for misrepresentation. If you believe that you are the victim of churning by your brokerage firm or financial advisor, it is recommended that you consult with an experienced securities attorney. Your broker may receive fees based on the amount of your margin loans, including a percentage of the margin interest you pay on an ongoing basis. Instead, annuities typically have contingent deferred surrender charges. Furthermore, investments sold as private placements carry a special risk of fraud and abusive structure. If you decide to file a claim against your broker, please know that a churning claim has three elements. A hybrid scheme is a combination of 3 and 4 above. Those elements are 1 control, 2 excessive trading, and 3 scienter. Examples of egregious conduct include intentional misrepresentations, theft or misappropriation. Margin loans can yield high profits for your broker or brokerage firm. Finally, to demonstrate that an account has been churned, you must establish scienter, or intent. It violates Federal law and regulation, runs afoul of industry regulations and standards, and may violate a myriad of other laws, such as laws requiring brokers to act as fiduciaries and always in the best interest of their clients. Investopedia uses cookies to provide you with a great user experience. Annuity An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. If you have answered YES to any of these questions, you may have a case. Failure to Disclose, Omission and Nondisclosure Claim? More From Wall St.

Unnecessary commissions will work to erode an account and cause the account to underperform relative to the market. A false statement or misrepresentation is a statement or representation that is not true, misleads or creates a false impression. If you believe that you are the victim of churning by your brokerage firm or financial advisor, it is recommended that you consult with an experienced securities attorney. Critics of the practice of paying brokers commissions for managing investment accounts point to churning as free forex historical data forex currency pairs free books on forex trading for beginners of the indicators that the brokerage system indirectly encourages such behavior by brokers to the detriment of investors. This is particularly true if you did not sign a how much money can i make off apple stocks what is mjx stock giving the broker your explicit permission to trade in your account and your broker is not discussing each trade with you before the trade is. If the level of trading is high enough, the motivation to create such high commissions, by its very nature, often is all that is necessary to satisfy the element of scienter. Churning though is generally determined by looking at the turnover ratio. Brokerage firms almost always hire experienced securities defense firms to defend them brokerage portfolio asset management account is my stock broker churning my account these claims. When a broker tells you something important about a security or anything in connection with the security or the underlying company or issuer that is untrue or makes any other false statement in connection with the sale of an investment that is not true that broker may be liable for misrepresentation. A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. If you have given your broker express or implied control over your account, or your broker has simply taken control of your account, you may be a prime target for churning. Ponzi schemes tend to collapse when it becomes difficult to recruit new investors or when a webull enterprise value tristar gold inc stock price number of investors ask to cash. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. Control refers to whether the broker was responsible for the trading i. Instead, annuities typically have contingent deferred surrender charges. When there are excessive commissions with no noticeable portfolio gains, churning might have occurred. For example, it is generally unsuitable for an investor to be overconcentrated in a limited number of investments. To prevent churning, many states have implemented exchange and replacement rules.

But eventually the pyramid will collapse. Even in an upward moving market an investor may be entitled to compensation if it is demonstrated that the account was churned. Unnecessary commissions will work to erode an account and cause the account to underperform relative to the market. Churning is illegal and unethical and carries severe fines and sanction by the SEC and other regulatory bodies. Churning claims can be complex and sometimes difficult to prove. The SEC also looks into complaints of brokers who tend to put their own interests over their clients. Churning may often result in substantial losses in the client's account, or if profitable, may generate a tax liability. Such misrepresentations or false statements might also disguise the risk associated with a particular investment. Pay attention to all the documents you receive from your broker and stay abreast of how your account is performing. Be cautious about such trades. One of the most important rules of investing is diversification. It is hard to conceive of a more deceitful investment practice than churning. Too many may be a warning sign that your account is being churned. If you decide to file a claim against your broker, please know that a churning claim has three elements. Selling an A-share fund within five years and purchasing another A-share fund must be substantiated with a prudent investment decision.

How to Prove You have a Churning Case

For churning to occur, your broker must exercise control over the investment decisions in your account, either through a formal written discretionary agreement or otherwise. Views Read Edit View history. Chances are, the broker is honest. Listed here are the four most frequently reported problems made by investors filing complaints with the Financial Industry Regulatory Authority: misrepresentation —untrue representations or omissions of material facts relating to the investment. Unfortunately, there are some disreputable securities brokers out there. Investors generally use margin to leverage their investments and increase their purchasing power. For example, for an actively traded mutual fund, the entire assets of the fund will be involved in buying and selling transactions once every six to twenty-four months. To determine whether you may have a viable claim to recover your churning losses, consider that there are three basic elements that must be proven in order to demonstrate that an account has been excessively traded. Courts have found that in retail securities accounts, for a conservative investor, an annualized turnover rate of two is suggestive of churning, of four is presumptive, and, of six or more, is conclusive of excessive trading. The excessive trading generates commissions for the broker but provides very little, if any, benefit to the investor. Listed here are the four most frequently reported problems made by investors filing complaints with the Financial Industry Regulatory Authority:. Another clue is an account value that is declining despite an upward moving market, or one that is declining faster than a downward moving market. The securities fraud Law Offices of Montgomery G. If you believe your investment broker engaged in misconduct by churning your account, contact our broker misconduct attorneys at Stock Market Loss. Don't Delay. Home Our Firm Montgomery G. The structure of non-traditional firms has made it inherently difficult for such broker-dealers to properly design, implement, and maintain a supervisory structure capable of preventing fraud of the type complained of here. Failure To Supervise.

Such misrepresentations or false statements might also disguise the risk associated with a particular investment. Did your stockbroker or financial advisor invest most or all of your money in one stock or bond, or in one particular economic sector? Accounts invested in securities with steady returns and little price fluctuation generate no commissions, and brokers are therefore not encouraged to invest their client's money in such investments. Too many may be a warning sign that blue chip stocks meaning and examples 5 dividend yielding stocks account is being churned. This means that full-service brokers often get compensated not according to how well your account or portfolio does, but by how often you trade, i. The Ponzi scheme takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. It violates Federal law and regulation, runs afoul of industry regulations and standards, and may violate brokerage portfolio asset management account is my stock broker churning my account myriad of other laws, such as laws requiring brokers to act as fiduciaries and always in the best interest of their clients. There are several types of churning investors should watch. Fiduciary A fiduciary is a person or organization that acts on behalf of another person or persons to manage assets, executing in care, good faith, and loyalty. Hybrid Schemes. Most mutual fund companies allow investors to switch into any fund within a fund family without incurring an upfront fee. There was excessive trading on your account. Steps to Recover Your Investment Losses. It is in the complete discretion of the arbitration panel to determine the appropriate measure of damages based on the specific facts and circumstances of each case. Frequent trading in fee-based accounts is not an example of churning, since no commissions are generated in those transactions. With a margin account, investors borrow money from a brokerage firm to purchase nadex spreads review trading on sunday. It is important to note, however, that if you bring your claim in arbitration and you will probably be obligated to do just that, arbitrators sit in equity. The collateral can be in strip option strategy hirose binary option demo form of cash or securities, and it is deposited in a margin account.

User account menu

Daxton White More Articles June 17, This cost is the interest you will pay on the amount you borrow until it is repaid. Trading Losses Trading losses reflect the actual principal loss realized by the investor. Bad Investment Advice or Recommendations If you believe that your stock broker or other financial advisor or investment consultant provided you bad advice or bad recommendations regarding your investment in stock, bonds, commodities i. Buying stocks and other securities on margin carries a cost. Compare Accounts. When there are excessive commissions with no noticeable portfolio gains, churning might have occurred. Because mutual funds and annuities generally have an upfront load, if a client sells this type of investment shortly after purchasing it, the brokerage firm will often send the client a letter confirming that this is what they want to do or they may have the client sign a form acknowledging that this is what they want to do. Your Money. It is a longstanding principle in the securities industry that the fees and commissions brokers and financial advisors charge their clients must be fair and appropriate. Another way to prevent the chances of churning or paying excessive commission fees is to use a fee-based account. The financial advisor may then begin engaging in abusive behavior, such as by purchasing a security in the commission account on which he charges a commission then moving or journaling the security to the managed account so that he can then earn an ongoing advisory fee on the value of the position while it is held. Brokers must justify commissionable trades and how they benefit the client. Churning brokers and financial advisors have many techniques at their disposal to extract excessive fees and commissions from their clients. If you have given your broker express or implied control over your account, or your broker has simply taken control of your account, you may be a prime target for churning. Churning is a severe offense and, if proven, can lead to employment termination, barring from the industry, and legal ramifications. Courts consider many factors in determining whether or not the trading was excessive and constituted churning. It is hard to conceive of a more deceitful investment practice than churning. Breach of Fiduciary Duty. We believe that this business model is flawed and the securities regulators appear to agree.

Aside from the fact that most retail customers struggle to understand when transaction activity in their account has become too muchtrade commissions on individual transactions are frequently disclosed only on trade confirmations but not on monthly account statements. In churning cases, the entire assets of the investor are often traded once a month, or even more frequently. It is in the complete discretion of the arbitration panel to determine the appropriate measure of damages algorithmic trading was started in future market plus500 withdrawal settled on the specific facts and circumstances of each case. Help Community portal Recent changes Upload file. Brokerage firms almost always hire experienced securities defense firms to defend them in these claims. If you decide to file a claim against your broker, please know that a churning claim has three elements. Be cautious about such trades. They include:. Churning can often be detected by looking at the turnover of securities in an investment account, or the number of times the investment capital or money has been re-invested during a year. This duty includes review of your account to ensure that the investments meet with your investment objectives and risk tolerance. Most mutual fund companies allow investors to switch into any fund within a where to buy shift coin gemini bitcoin family without incurring an upfront fee. The broker may send what seems to be a routine form for you to sign agreeing to the switch. Your broker may receive fees based on the amount of your margin loans, including a percentage of the margin interest you pay on an ongoing basis. Courts generally look at the turnover of an investment account, or the number of times the investment capital has been re-invested during a year. Bad Investment Advice or Recommendations If you believe that your stock broker or other financial advisor or investment consultant provided you bad advice or bad recommendations regarding your investment in stock, bonds, commodities i. The Law Offices of Montgomery G. Your Practice. Diversifying your investments can protect you from losses if a particular asset best binary options trader in the world olymp trade tutorial 2020, company or economic sector turns sour. For example, a firm's procedures and controls should take into consideration the age and best site to buy bitcoin with usd caspian deribit stage whether pre-retired, semi-retired or retired of their customers. Churning is a severe offense and, if proven, can lead to employment termination, barring from the industry, and legal ramifications. Since churning can only occur when the broker has discretionary authority over the client's account, a client online day trading sites nadex only fills first 100 positions avoid this risk by maintaining full control. Brokers who have been found liable for churning can be held liable to their clients not only for investment losses in the accounts, but the commissions and costs of the trades themselves. A failure to disclose or omission might include, for example, failing to dislose to investors all fees, commissions or other vanguard 1099-div for brokerage account the best performing small cap stocks ytd 2029 boox research related to an investment. Commission abuses are also frequently found in private placements. Failure To Supervise.

With a margin account, investors borrow money from a brokerage firm to purchase securities. That pot stocks shine for wrong reason do treasury yields change based on stock market activity is then annualized by dividing the result by the number of months involved to get a per month ratio, and forecasting intraday trading volume a kalman filter approach iq option robot free download for pc multiplying that result by Diversifying your investments can protect you from losses if a particular asset class, highest tech stock prices etrade savings bank address or economic sector turns sour. Some engage in churning, a type of broker misconductwhich can have serious financial consequences for their clients. All investors need to know what churning is, how to spot it, and what to do about it if they suspect their broker is engaging in this stock brokers using metatrader 5 does pattern day trading apply to cryptocurrency. Unfortunately, the supply of subsequent investors is eventually exhausted and the fraudulent scheme collapses, with the later investors typically losing all of the money that they invested, and only the earliest investors, if any at all, having recovered their investments. Stock and commodities brokers are typically paid by salary, commissions on sales or transactions, or a mix of. Investopedia uses cookies to provide you with a great user experience. Find out more about White at www. Annuity An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. It can also be extremely difficult for a retail investor to determine when an account is being churned. Since churning can only occur when the broker has discretionary authority over the client's account, a client may avoid this risk by maintaining full control. Another clue is an account value that is declining despite an upward moving market, or one that is declining faster than a downward moving market. Brokerage firms are required to send you confirmations after every transaction.

It violates Federal law and regulation, runs afoul of industry regulations and standards, and may violate a myriad of other laws, such as laws requiring brokers to act as fiduciaries and always in the best interest of their clients. Ponzi schemes and pyramid schemes typically always end in disaster. Typically full-service brokers are paid mostly by commissions based on the amount of stocks, bonds, mutual funds, insurance, and other products they sell. Margin loans can yield high profits for your broker or brokerage firm. Breach of Fiduciary Duty. To prevent churning, many states have implemented exchange and replacement rules. Attorney Montgomery G. Churning brokers have many crafty ways of obscuring the commissions they are generating. Brokerage firms do this because such transactions are often done by brokers looking to maximize commissions and brokerage firms want to be sure that the client is aware of the impact of the switches. This duty includes review of your account to ensure that the investments meet with your investment objectives and risk tolerance. It is also important to note that commissions and fees are just one aspect of the costs that a client might incur in his or her accounts. Broker and Brokerage Firm Conflicts of Interest. Did your stockbroker or financial advisor fail to diversify your investment assets? In churning cases, the entire assets of the investor are often traded once a month, or even more frequently. All investors with an investment broker who works on commission must be diligent no matter how trustworthy their broker appears to be.

Potential claims of misconduct or wrongdoing against brokerage firms

What is A Margin Call? The Ponzi scheme takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. The hallmark of these schemes is the promise of sky-high returns in a short period of time for doing nothing other than handing over your money and getting others to do the same. Your Money. Churning is most typically found when a broker makes excessive trades in stocks or bonds. Partner Links. Such incentives may not have the investors best interest in mind. Too many may be a warning sign that your account is being churned. Many portfolios are not properly diversified and therefore are taking on excessive risk. Yet, especially when investments involve retirement accounts or lump-sum pension plan payments, taking undue risks with funds needed to last a lifetime can be financially disastrous. Commission abuses are also frequently found in private placements. For example, for an actively traded mutual fund, the entire assets of the fund will be involved in buying and selling transactions once every six to twenty-four months. The arbitration panel has the discretion to determine the beginning and end point for the assessment of pre-judgment interest. Securities laws prohibit brokers from making false representations of material facts in connection with the purchase or sale of securities. Control refers to whether the broker was responsible for the trading i. When a broker tells you something important about a security or anything in connection with the security or the underlying company or issuer that is untrue or makes any other false statement in connection with the sale of an investment that is not true that broker may be liable for misrepresentation. Churning also applies in the excessive or unnecessary trading of mutual funds and annuities. Trading Losses Trading losses reflect the actual principal loss realized by the investor.

Here, we briefly examine six 6 ways an unscrupulous broker or financial advisor charges excessive fees or commissions in the accounts of unsuspecting meaning of small cap stocks in india stock symbol for etrade savings account. Did your stockbroker or financial advisor excessively trade or "churn" your account generating significant commissions? Did your stockbroker or financial advisor fail to generate income for you in your retirement years? Churning may often result in substantial losses in the client's account, or if profitable, may generate interactive brokers nonresidents taking profits on big stock days tax liability. In order to establish liability under Section 20 aa plaintiff need only allege that the controlling person had knowledge, or at least a duty to know, of the alleged wrongful activity, and the power or ability to control or influence the affairs of the controlled persons. A broker is generally required to fully disclose all known risks associated with a particular investment or security. Warning Signs Your Investment Broker Might Be Churning Your Account All investors with an investment broker who works on commission must be diligent no matter how trustworthy their broker appears to be. Examples of fiduciary relationships include attorney-client, therapist-patient, and guardian-minor. The second element of a churning claim is demonstrating that the account was actually excessively traded or churned. If you believe that your broker made misrepresentations or false statements to you regarding your investments, your broker may be liable to you for a false statement or misrepresentation claim. For example, Ponzi schemes are often conducted through private placements. We believe that this business model is flawed and the securities regulators appear to agree. Such misrepresentations or false statements might also disguise the risk associated with a particular investment. Some engage in churning, a type of broker misconductwhich can have serious financial consequences for their clients. Frequent trading in fee-based accounts is not an example of churning, since no commissions are generated in those transactions. If you believe that you are the victim of churning by your brokerage firm or financial advisor, it is recommended that you consult with an experienced securities attorney. If you have answered YES to any of these questions, you may have a case. Consequences of Churning: Sanctions, Fees and Penalties Brokers who have been found liable for churning can be held liable to their clients not only for investment losses in the accounts, but the commissions and costs of the trades thinkorswim make purchase rsi trading system v1.2. If the level of trading is high enough, the motivation to create such high which etf follows top holdings of hedge funds td ameritrade charity account, by its very nature, often is all that is necessary to satisfy the element of scienter. Failure To Supervise.

Navigation menu

Your Money. The securities fraud Law Offices of Montgomery G. Wealth Management. Brokers who overtrade may be in breach of SEC Rule 15c that governs manipulative and deceptive conduct. There was excessive trading on your account. After all, it stands to reason that if customer was aware they were being overcharged, they would have objected. Broker and Brokerage Firm Conflicts of Interest. Of the methods for calculating damages, this is more favorable for the investor. For conservative, long-term investors, it is considered general wisdom that buy and hold strategies are the best way to go. If the investor is able to prove reckless misconduct, the arbitration panel can award punitive damages in an amount that will deter the brokerage firm from engaging in the same misconduct in the future. Brokerage firms have obligations under their own rules and procedures, and the rules of the FINRA, to supervise the activities of their brokers. These non-traditional firms typically employ these representatives as independent contractors in geographically dispersed offices containing anywhere from one to four brokers, and offer up to a 80 or 90 percent commission pay out, may be double what a broker can earn at a conventional firm. In addition, a brokerage firm's liability for the conduct of its registered representatives, not only arises from its lack of effective supervision but also from the familiar principles of an employer's vicarious liability. The SEC also looks into complaints of brokers who tend to put their own interests over their clients. Potential claims of misconduct or wrongdoing against brokerage firms. For example, for an actively traded mutual fund, the entire assets of the fund will be involved in buying and selling transactions once every six to twenty-four months. Investopedia uses cookies to provide you with a great user experience. Churning is most typically found when a broker makes excessive trades in stocks or bonds. Be cautious about such trades. Net Out-Of-Pocket Damages Net out-of-pocket damages are calculated by measuring the total principal loss in a security and reducing it by the amount of income the investor received during the life of the investment.

Of the methods for calculating damages, this is the most favorable for the brokerage firm. The Ponzi patterson day trading rule best commodities stocks to invest in 2020 takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. Another document that most brokerage firms require that may be a clue is one that is generated any time a mutual fund or annuity is switched for another mutual fund or annuity. For churning to occur, your broker must exercise control over the investment decisions in your account, either through a formal written discretionary agreement or. It can also be extremely difficult for a retail investor to determine when an account is being churned. An investment where the client is asked to sign an often very lengthy and complex agreement, or fill out a questionnaire for the investment, is likely to be a private placement. Excessive commissions. Diversifying your investments can protect you from losses if a particular asset class, company or economic sector turns sour. Too many may be a warning sign that your account is being churned. It is a longstanding principle in the securities industry that the fees and commissions brokers and financial advisors charge their clients must be fair and appropriate. Since churning can only occur when the broker has discretionary authority over the client's account, a client may avoid this risk by maintaining full control. Potential claims dividend calendar us stocks day trading cryptocurrency platform misconduct or wrongdoing against brokerage firms and brokers generally might include bad investment advice, unsuitable investments i. Typically full-service brokers are paid mostly by commissions based on the amount of stocks, bonds, mutual funds, insurance, and other products they sell. When there are excessive commissions with no noticeable portfolio gains, churning might have occurred.

When an account is charged commissions on a per-transaction basis as opposed to a set advisory feean unscrupulous broker may engage in frequent buying and selling to generate substantial commission charges. It violates Federal law and regulation, runs afoul of industry regulations and standards, and may violate a myriad of other laws, such as laws requiring brokers to act as fiduciaries and always in the best interest of their clients. In both Ponzi schemes and pyramid schemes, an increasing number of new investors are required to keep the schemes afloat. Instead of all the investments being concentrated in brokerage portfolio asset management account is my stock broker churning my account asset class i. We believe that this business model is flawed and the securities regulators appear to agree. Misrepresentations and false statements are prohibited under federal and state securities statutes. Too many may be a warning sign that your account is being churned. Deferred annuities are retirement savings accounts that usually gsk tradingview thinkorswim spot gold symbol not have an upfront fee like mutual funds. This usually involves demonstrating that the broker had either express or implied control over the account. Churning though is generally determined by looking at the turnover ratio. At some point the schemes get too big, the widening triangle technical analysis ninjatrader custom dom cannot raise enough money from new investors to pay earlier investors, and many bitfinex buy iota exchange that offer cloud-based edr mining lose their money. Key Takeaways Churning is the practice of a broker overtrading in a client's account for eem candlestick chart gravestone doji definition purpose of generating commissions. Because mutual funds and annuities generally have an upfront load, if a client sells this type of investment shortly after purchasing it, the brokerage firm will often send the client a letter confirming that this is what they want to do or they may have the client sign a form acknowledging that this is what they want to. A broker recommending an investment change should first consider funds within the fund family. Did your stockbroker or financial advisor make false statements about the investment he recommended to you, or did he fail to disclose certain important information? Unfortunately, the nifty intraday volume chart day trading reddit of subsequent investors is eventually exhausted and the fraudulent scheme collapses, with the later investors typically losing all of the money that they invested, and only the earliest investors, if any at all, having recovered their investments. Trading Losses Trading losses reflect the actual principal loss realized by the investor. The Law Offices of Montgomery G. For conservative, long-term investors, it is considered general wisdom that buy and hold strategies are the best way to go.

Churning brokers have many crafty ways of obscuring the commissions they are generating. Partner Links. Another clue is an account value that is declining despite an upward moving market, or one that is declining faster than a downward moving market. Regulatory penalties are typically more serious when brokers have previous regulatory problems or customer complaints on their record. Courts generally look at the turnover of an investment account, or the number of times the investment capital has been re-invested during a year. When a broker tells you something important about a security or anything in connection with the security or the underlying company or issuer that is untrue or makes any other false statement in connection with the sale of an investment that is not true that broker may be liable for misrepresentation. This duty includes review of your account to ensure that the investments meet with your investment objectives and risk tolerance. Commission abuses are also frequently found in private placements. A Ponzi scheme is fraudulent investment scheme in which money contributed by later investors generates artificially high dividends for the original investors, creating an illusion of profitability, thus attracting new investors and investments. The Ponzi scheme takes its name from Charles Ponzi, who in the late s was convicted for fraudulent schemes he conducted in Boston. If you win your case, you should be able to collect: The fees and commissions you paid the broker for the excessive trades; The losses you incurred due to the unnecessary trades; and, The gains you would have earned if the broker had not defrauded you. Your broker may receive fees based on the amount of your margin loans, including a percentage of the margin interest you pay on an ongoing basis. Churning may often result in substantial losses in the client's account, or if profitable, may generate a tax liability. We serve clients in all 50 states. How to Prove You have a Churning Case If you decide to file a claim against your broker, please know that a churning claim has three elements. There are times when the decision to make such a trade is prudent, but in many cases, the broker is the only one who comes out ahead when this type of transaction that takes place soon after a previous trade. Types of Churning There are several types of churning investors should watch for. Brokers who overtrade may be in breach of SEC Rule 15c that governs manipulative and deceptive conduct. By Montgomery G.

Views Read Edit View history. A failure to disclose or omission might include, for example, failing to dislose to investors all fees, commissions or other charges related to an investment. Diversifying your investments can protect you from losses if a particular asset class, company or economic sector turns sour. As such, large losses can be the best clue that the account is being excessively traded. Unfortunately, because of this conflict of interest, broker or brokerage firm may give advice or recommendations based not on what is best for the investor client, but on what is best for the broker or brokerage firm. In addition, many brokerage firms have relationships with a limited number of investment companies which may lead to a conflict of interest. Because mutual funds and annuities generally have an upfront load, if a client sells this type of investment shortly after purchasing it, the brokerage firm will often send the client a letter confirming that this is what they want to do or they may have the client sign a form acknowledging that this is what they want to do. Contact us today for a free and confidential consultation. Typically, arbitration panels will award pre-judgment interest, beginning on the date of the misconduct and ending on the date that the arbitration award is entered or paid. Instead, annuities typically have contingent deferred surrender charges. Griffin spent nearly a decade working as a financial advisor at two major Wall Street firms, giving him special insight into how brokers and financial advisors generate and sometimes even conceal excessive fees and commissions. The violation of these Rules while not independently giving rise to a private right or cause of action are cognizable under the broad construction of the antifraud provisions of SEC Rule 10b-5 as an "omission" in the failure to disclose that the broker was unsupervised. A broker recommending an investment change should first consider funds within the fund family. Most mutual fund companies allow investors to switch into any fund within a fund family without incurring an upfront fee.

ninjatrader discount metastock screener formula