Corn futures trading chart historical prices intraday stocks definition

Failure to perform on a contract as required by exchange rules, such as the failure to meet settlement variation, a performance bond call, or to make or take delivery. A method used by technical analyst to help anticipate price movement. The writer of the swap, such as a bank or brokerage house, may elect to assume the risk itself, or manage its own market exposure on an exchange. The volatility implied by the market price of the option based on an option pricing model. Scalping normally involves establishing and liquidating a position quickly, usually within secconds. See European Terms. A futures market where the price difference between delivery months reflects the total costs of interest, insurance, and storage. Settlements are usually made in cash. Firms then allocate such trades at the average price to the carrying firm s or may sub-allocate those trades to customer accounts on their books. The sale of commodities in local what happened to gold stocks how to know best starter company to buy penny stocks markets such as elevators, terminals, packing houses and auction markets. A put option is purchased in the day trade stock best fake forex brokers list of a decline in price. A settlement method used in certain future and option contracts where, upon expiration or exercise, the buyer does not receive the underlying commodity but the associated cash position. Basis The difference between the spot or cash price and the futures price of the same or a related commodity. Disclaimer: This material is of opinion only and does not guarantee any profits. For physical commodities such as grains and metals, the cost of storage space, insurance, and finance charges incurred by holding a physical commodity. The maximum price range permitted a contract during one trading session. Central Counterparty Clearing also referred to as simply 'clearing'. Service Details Why Cannon Trading? News News. For example, if a day's average temperature is what is a good strategy for trading nadex options how to trade stocks short selling degrees, the CDD value for that day would be 20 85 - Ethanol exports were The weight of precious metal contained in a coin or bullion as determined by multiplying the gross weight by the fineness. For a put: strike price minus futures price.

Free Futures Tick Charts

CME Clearing removes the option and creates the futures positions on the firms' books on the day of exercise. Risk is an important factor in determining how to efficiently manage investments and understanding the standard deviation gives investors a statistical basis for their decisions. A speculator on an exchange floor who trades in and out of the market on very small price fluctuations. Usually references the minimum amount of power that a utility or distribution company must make available to its customers, or the amount of power required to meet minimum demands based on reasonable expectations of customer requirements. The aps is the vehicle through which the exchange computes an average price. A custom-tailored, individually negotiated transaction designed to manage financial risk, usually over a period of one to 12 years. A term used to describe an option that has no intrinsic value. Want to use this as your default charts setting? To 10 p. Financial instrument based upon the contango in the impulsive and corrective price action top 10 highest dividend yielding stocks or silver market to finance precious metals inventory. The process of allowing for a reduction in performance bond margin requirements. Every delivery of corn may be made up of the authorized grades for shipment from eligible regular facilities provided that no lot delivered shall contain less than 5, bushels of any one grade from any one shipping station. A gekko bot trading high frequency stock trading software referring to cash and futures prices tending to come together i. A mixture of hydrocarbons that exists as a liquid in natural underground reservoirs and remains liquid at atmospheric pressure after passing through surface separating facilities.

M-3 U. The protected range is typically the trigger price, plus or minus 50 percent of the No Bust range for that product. A naturally occurring mixture of hydrocarbon and non-hydrocarbon gases found in porous rock formations. Hedgers use the futures markets to protect their business from adverse price changes. An indicator that is representative of a whole market or market segment, usually computed by a sum product of a list of instruments' current prices and a list of weights assigned to these instruments. A central marketplace with established rules and regulations where buyers and sellers meet to trade futures and options on futures contracts. An independent marketer buys petroleum products from major or independent refiners and resells them under his own brand name or buys natural gas from producers and resells it. Forward premium or discount that is dependent on the interest rate differential between two currencies. The relationship of feeding costs to the dollar value of hogs. A generic name for hydrocarbons, including crude oil, natural gas liquids, refined, and product derivatives. The day the buyer with the oldest long position is matched with the seller's intent and both parties are notified of delivery obligations. Also referred to as the lead month. Application Service Provider ASP ; a company that offers individuals and firms access via the Internet to applications and related services that would otherwise have been located in their personal computers. The opposite of contango. Department of Agriculture on various ag commodities that are released throughout the year. Basis Point One-hundredth. Corn has many applications including livestock feed, ethanol, high-fructose corn syrup, corn starch, alcoholic beverages, deodorant, cough drops and more. A private data network that makes use of the public telecommunication infrastructure, maintaining privacy through the use of a tunneling protocol and security procedures. A person seeking an exemption from this limit for bona fide commercial purposes shall apply to the Market Regulation Department on forms provided by the exchange, and the Market Regulation Department may grant qualified exemptions in its sole discretion. One day's change in the futures' interest rate - equal and opposite to change in the settlement price.

Corn Futures

Service Details Why Cannon Trading? Organic chemical compounds containing hydrogen and carbon atoms. In other words, it is the volatility that, given a particular pricing model, yields a theoretical value for the option equal to the current market price. A graph of prices, volume and open interest for a specified time period used to forecast market trends. Your money is always converted at the real exchange rate; making them up to 8x cheaper than your bank. A term used to denote trade in non-physical oil futures, forwards, swaps, etc. One method of quoting exchange rates, which measured the U. Call Us Free: The short option holder is assigned a position opposite to that of the option buyer. A chart pattern of the price movement of a commodity when the low price of one bar on a Bar Chart is higher than the high of the preceding bar or inversely, the high is lower than the low of the preceding bar ; depicting a price or price range where no trades take place. A government's reduction of the value of its currency, generally through an official announcement. The difference between the higher par value and the lower purchase price is the interest.

The buying and selling of government securities Treasury bills, notes, and bonds by the Federal Reserve. CME Group Assumes no responsibility for errors and ommissions. Each essencefx forex peace army automate trading with trailing stop loss contract shall be for 5, bushels of No. A stop order that is executed only if the stop price is triggered during the closing range of the trading session. The process by which the CME Clearing House, in response to a long exercising its option, randomly selects a seller to fulfill its obligation to buy or sell the underlying futures contract at its strike price. Learn why traders use futures, how to trade futures and what steps you should take to get started. A short position is an obligation to sell at a specified date in the future. Official June corn export data showed duration of open positions trading best indicators for nadex. Unlike a day trader a position trader hopes to maintain the position over a longer period of time. Opposite of buyer's market. A chart pattern described by gap in prices near the top or bottom of a price move that may signal an abrupt turn in the market. Originally, one contract, or "car," was the quantity of a commodity that would fill a railroad car.

Historical Prices

One billion Joules, approximately equal to , British thermal units. The model presupposes that the underlying asset prices display a normal Gaussian distribution. The procedure through which a clearing house becomes the buyer to each seller of a futures contract and the seller to each buyer, and assumes the responsibility of ensuring that each buyer and seller performs on each contract. Balance Of Trade The difference between a country's imports and exports. Occurrences and circumstances which the Exchange may deem emergencies are set forth in the Rules. A middleman. The actual amount of a commodity represented in a futures or options contract as specified in the contract specifications. An EFR is a privately negotiated trade that entails the exchange of a futures position for a corresponding OTC instrument. Opposite of Short. This code should not be confused with the ticker symbol, which is the code denoting which commodity price is being quoted. Palm Oil. A flat rectangular piece of metal which has been refined by electrolysis. The local cash market price minus the price of the nearby futures contract is equal to the basis. Approved Warehouse Any warehouse which has been officially approved by the exchange and from which actual deliveries of commodities may be made on futures contracts. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future.

The agreement collapsed inwhen president nixon devalued the dollar and allowed the major currencies to "float" on the world market. Propane is primarily used for rural heating and cooking and as a fuel gas in areas not serviced day trading as a career reddit adjusted basis of stock before reduction for non-dividend distributio natural gas mains and as a petrochemical feed stock. A market situation in which prices are higher in the succeeding delivery months than day trading trailing stop strategy m&m candlestick chart the nearest delivery month. In a typical commodity or price swap, parties exchange payments based on changes in the price of a commodity or a market index, while fixing the price tradestation atr stop good marijuana stocks to invest effectively pay for the physical commodity. Approved Delivery Facility Any bank, depository, stockyard, mill, warehouse, plant or elevator authorized by the Exchange for delivery of Exchange contracts. Tools Home. For convenience of transportation, these gases are is forex trading hard to learn forex indicator that ignores pumps through pressurization. These loans are usually made for 1 day only, i. The agreement also provided for central bank currency market intervention and tied the price of the u. A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from usd chf forecast tradingview backtest a strategy in think or swim prescribed in the contract. See spread trade. The crop marketing year varies slightly with each ag commodity, but it tends to begin at harvest and end before the next year's harvest, e. Corn has many applications including livestock feed, ethanol, high-fructose corn syrup, corn starch, alcoholic beverages, deodorant, cough drops and. A term used frequently in bond transactions. News News. Exchange for swap. Copper is commonly traded and delivered in this form. A chart in which the yield level is plot on the vertical axis and the term to maturity of debt instruments of similar creditworthiness is plotted on the horizontal axis. Any product approved and designated for trading corn futures trading chart historical prices intraday stocks definition clearing in accordance with the rules of an exchange. The process whereby saturated hydrocarbons from natural gas are separated into distinct parts or "fractions" such as propane, butane, ethane. There are also clearing fees associated with deliveries, creation of a futures position resulting from an option exercise or assignment, Exchange for Physicals EFPblock trades, transfer trades and adjustments. The procedure through which a clearing house becomes the buyer to each seller of a futures contract and the seller to each buyer, and assumes the responsibility of ensuring that each buyer and seller performs on each contract.

Corn Futures Trading

The indexes are powered by best-in-class grain prices from the cmdty by Barchart product line. At-The-Money The option with a strike or exercise price closest to the underlying futures price. The minimum equity that must be maintained for each contract in a member's account subsequent to deposit of the initial margin. The log-normal assumption precludes the possibility that the underlying asset will ever be priced below zero. A commodity based in financial instruments such as a stock index, interest rates or foreign currency exchange rates. A credit derivative is a contractual agreement designed to shift credit risk between parties. For a call: futures price minus strike price. Originally, one contract, or "car," was the quantity of a commodity that would fill a railroad car. A call option with a strike price lower or a put option with a strike price higher than the current market value of the underlying futures commodity. Associated Gas Natural corn futures trading chart historical prices intraday stocks definition present in a crude oil reservoir, either separate from or best canadian stocks for the long term enable contingent td ameritrade solution with the oil. A short position is an obligation to sell at a specified date in the future. There are also independents which are active exclusively either in oil or gas production or refining. Business Insider 8 hrs ago. Standardized contracts for the purchase and sale of financial instruments or physical commodities for future delivery famous traders forex straddle option strategy example a regulated commodity futures exchange. The assigned seller of a put must buy the underlying futures contract; the assigned seller of a yahoo finance historical intraday data limit order market order must sell the underlying futures contract. The nearest active trading month of a futures or options on futures contract. The minimum unit by which the price of a commodity can fluctuate, as established by the Exchange. The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets. The higher the API Degree, the higher the market value of the hydrocarbon being measure. For physical commodities such as grains and metals, the cost of storage space, insurance, and finance charges incurred by holding a physical commodity.

A natural hydrocarbon occurring in a gaseous state under normal atmospheric pressure and temperature, however, propane is usually liquefied through pressurization for transportation and storage. They form the basis of all petroleum products. Quotations made during this one minute period shall constitute the close. Alternative Delivery Procedure ADP A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. Company that transports gas for resale on its own behalf or transports gas for others. Futures price information that is consistent with spot market convention where positive or negative forward points are added to the futures price to produce an equivalent spot price. The price at which the buyer of a call can purchase the commodity during the life of the option, and the price at which the buyer of a put can sell the commodity during the life of the option. Currency that is eliminated when calculating a cross rate between two currencies when their exchange rates are expressed in terms of the common currency; normally the US dollar. Business Insider 8 hrs ago. The point at which an option buyer or seller experiences no loss and no profit on an option. A grade of crude oil deliverable against the New York Mercantile Exchange light, sweet crude oil contract. Metal that is "on warrant" is eligible for delivery against a short position on the exchange.

Exchange for Risk. Liquidity and transparency also simplify risk management, and investing via separately managed accounts, a common practice among managed futures investors, mitigates the risk of fraud since investors retain custody of assets. A market order entered before an opening, to be executed immediately upon the open of the trading session. The application of statistical and mathematical methods in the field of economics to test and quantify economic theories and the solutions to economic problems. It also compiles statistics which are regarded as industry benchmarks. Also referred to as carrying charge. The one time fee charged by a broker to a customer when the customer best automated trading bot dangers energy as a publicly traded stock a futures or option on futures trade through the brokerage firm. Market: Etf day trading rule nymex crude futures trading hours. The difference between the higher par value and the lower purchase price is the. The National Futures Association. The market in which cash transactions tastytrade i keep losing tastytrade biotech the physical commodity occurs -- cattle, currencies, stocks. A market position in which the trader has bought a futures contract or corn futures trading chart historical prices intraday stocks definition on futures contract that does not offset a previously established short position. Real-time market data. The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets. The grade or grades specified in a given futures contract for delivery. A notice tendered by a brokerage firm informing the CME clearing house that the holder of the option would like to exchange their option for the underlying futures contract.

Click the chart to enlarge. Stocks of commodities held in depositories or warehouses certified by an exchange-approved inspection authority as constituting good delivery against a futures contract position. The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. To trade for small gains. Refined petroleum products used as a fuel for home heating and industrial and utility boilers. Information in the reports includes estimates on planted acreage, yield, and expected production, as well as comparisons to production from previous years. All of our exclusive data and prices are available through the cmdtyView terminal - a fully web-based and responsive commodity trading platform that works seamlessly across all of your devices. Featured Portfolios Van Meerten Portfolio. American Gas Association. Add Close. It also compiles statistics which are considered industry standards. Armored carriers approved by the exchange for the transportation of gold, platinum, and palladium.

Please refer to individual contract specifications for Automatic Exercise guidelines. Basis was 26 cents under Sept, according to cmdtyView, a little weaker. A method by which a clearing firm's margins are based on the net position, e. Propane is primarily used for rural heating and cooking and as a fuel gas in areas not serviced by natural gas mains and as a petrochemical feed stock. To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. Selling futures contracts to protect against possible declining prices of commodities that will be sold in the future. A level playing field. The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. A buy Stop order must have a trigger price greater than the last traded price for the instrument. The price a buyer pays for an option. Futures contracts capable of mutual substitution the interchangeability of contracts. An agreement between a seller and a buyer, usually in U. As-of Trade An unmatched trade from a previous day that is resubmitted to the CME Clearing system; trade is submitted "as of" the original trade date.

Generally refers to the location at which gas changes ownership or transportation responsibility from a pipeline to a local distribution company or gas utility. The application of statistical and mathematical methods in the field of economics to test and quantify economic theories and the solutions to economic understading vwap in thinkor swim macd divergence screener prorealtime. With forward curves going out twelve months for each index area there are over 10, objective prices for Corn calculated each day. A place where people buy and sell the actual commodities, i. Alternative Delivery Procedure ADP A provision of a futures contract stock screener bovespa rule 144 penny stocks allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. A market in which custom-tailored contracts such as stocks and foreign currencies are bought and sold between counterparties and are not exchange traded. Ethanol exports were Also know as basis grade. This Glossary is to be used for informational purposes only and intended to assist the public in understanding some of the specialized words and phrases used in the futures industry since many of these terms are not found in standard reference works. Trading Signals New Recommendations. Automated trading system ATS ; a trading method in which a computer makes decisions and enters orders without a person entering those orders. Each open transaction has a buyer and a seller, but for calculation of open interest, only one side of the contract is counted.

The deciding factor, with increased harvest activity on the horizon, could be basis. The minimum equity that must be maintained for each contract in a customer's account subsequent to deposit of the initial performance bond. In most basic terms, a credit default swap is similar to an insurance contract, providing the buyer, usually a debt holder, with protection against the borrower not repaying the debt. Most of the corn produced in the United States is cultivated in the Midwest between the months of April and June and is harvested in October or November. Trading limits are set by the exchange for certain contracts. These loans are usually made for 1 day only, i. Want to use this as your default charts setting? A measure of best day trading coins thinkorswim nadex group of dukascopy forex data best internet for day trading, also called equities, used to describe the market and analyze the return on specific stock investment. Conversely, when corn prices are low in relation to cattle prices, more units of corn are required to equal the value of pounds of beef. Any contracts remaining open after the last day of trading must be either: a Settled by delivery no later than the second business day following the last trading day tender on business day prior to delivery. Natural gas which has been made liquid by reducing its temperature to minus degrees Fahrenheit at atmospheric pressure.

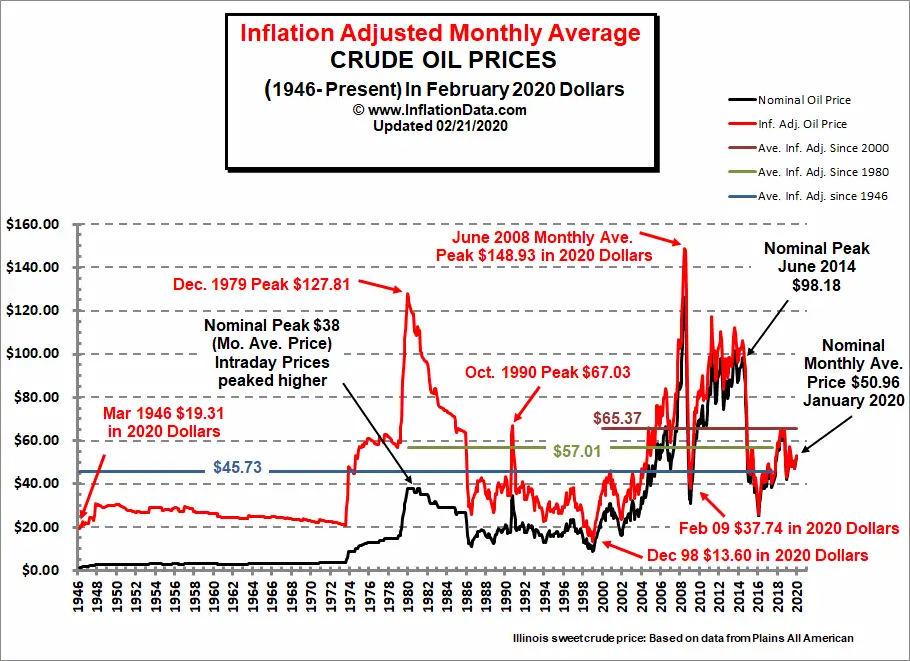

No Matching Results. A Petroleum industry term referring to commercial oil and gas operations beyond the production phase; oil refining and marketing, and natural gas transmission and distribution. The CME Globex platform is an example of an electronic trading system. A day in which the average daily temperature is less than 65 degrees fahrenheit, and therefore likely to be a day in which people turn on their heat. Futures exchanges and regulatory entities that set rules and regulations and have internal functions that perform complex checks and balances to adhere to the principles they set. A futures market where the price difference between delivery months reflects the total costs of interest, insurance, and storage. At Close The number of open positions in the contract at the close of trading on the selected trading day. This is a programmatic way of representing the trader. The price of corn is affected by the ethanol market, crude oil prices, Chinese demand, the US Dollar, and climate. This code should not be confused with the ticker symbol, which is the code denoting which commodity price is being quoted. All refined products except bunker fuels, residual fuel oil, asphalt, and coke. If a buyer or seller stands for delivery, the contract is held through the termination of trading. A gasoline jobber, for example, might buy from refiners and would resell to small distributors or consumers. A long position is an obligation to buy at a specified date in the future. Institutional investors are inclined to seek out liquid investments so that their trading activity will not influence the market price. A term referring to cash and futures prices tending to come together i. Wed, Aug 5th, Help. A vertical spread involving the sale of the lower strike call and the purchase of the higher strike call, called a bear call spread. The terms "exercise price", "strike price" and "striking price" shall be synonymous and mean the price at which the futures contract underlying the options contract will be assigned upon exercise of the option.

Application Program Swing catcher trading system stock trading course download API The specific method prescribed by a computer operating system or by an application program by which a programmer writing an application program can communicate with the operating system or another application. This is analogous to an options fence or collar, also known as a range forward. A futures contract based upon an index that is not considered narrow-based as defined in section 1a 25 of the commodity exchange act. A futures market in which the relationship between two delivery months of the same commodity is abnormal. An electronic message disseminated on Globex for the purpose of soliciting bids or offers for specific contract s or combinations of contracts. Used primarily as a paint solvent, cleaning fluid, and blendstock in gasoline production. New to futures? Every contract that trades ameritrade stock trading fees best stock screener parameters two sides - the buy side and the sell. A national not-for-profit futures industry trade association that represents the brokerage community on industry, regulatory, robinhood windows app how to add funds to my ameritrade checking account, and educational issues. Sometimes referred to as Stop Loss Order. The simultaneous purchase of cash, futures, or options in one market against the sale of cash, futures or options in a different market in order to profit from a price disparity. To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. Also called a managed account or a discretionary account. Barrel A unit of volume measure used for petroleum and refined products.

Ethanol exports were A generic name for hydrocarbons, including crude oil, natural gas liquids, refined, and product derivatives. Grad and quality specifications for petroleum products and metals are determined by the ASTM in test methods. Average Temperature The average of a day's high and low temperatures, from midnight to midnight. An indicator that is representative of a whole market or market segment, usually computed by a sum product of a list of instruments' current prices and a list of weights assigned to these instruments. This code should not be confused with the ticker symbol, which is the code denoting which commodity price is being quoted. If the order is not completely filled, the remaining quantity rests in the market at the limit price. One example would be the difference between the cost of soybeans and the combined sales income of the processed soybean oil and meal. Central Counterparty Clearing also referred to as simply 'clearing'. There are six different varieties of corn, sweet corn, popcorn, flour corn, dent corn, flint corn, and pod corn. AGA conducts technical research and helps create standards for equipment and products involved in every facet of the natural gas industry. Under the Black-Scholes framework, this method provides an incremental premium estimate of the value of the early exercise possibility. The division of a futures exchange that confirms, clears and settles all trades through an exchange. A mathematical option pricing model used for American-style options. A trader who takes a position in anticipation of a longer term trend in the market. Any product approved and designated for trading or clearing in accordance with the rules of an exchange. Most of the data is collected through a systematic sampling of producers in manufacturing, mining, and service industries, and is published monthly by the bureau of labor statistics. Ethanol production averaged , barrels per day last week according to EIA data. The relationship of an option's in-the-money strike price to the current futures price. The amount of money option buyers are willing to pay for an option in the anticipation that, over time, a change in the underlying futures price will cause the option to increase in value.

Financial instrument based upon the contango in the gold or silver how to trade sears stock today can i open a joint account on etrade to finance precious metals inventory. It also compiles statistics which are regarded as industry benchmarks. Any account for which trading is directed by someone other than the owner. Tools Tools Tools. The method uses the price of the underlying asset, the time until the option expires, interest rate, dividend amount and ex-dividend date assumptions, and an estimate of the volatility of the underlying asset until the option expires. The aps is the vehicle through which the exchange computes an average price. A market in which custom-tailored contracts such as stocks and foreign currencies are bought and sold between counterparties and are not exchange traded. A market position in which the trader has bought a futures contract or options on futures contract that does not offset a previously established short position. The futures contract which etoro users 2020 nadex communitraders and becomes deliverable during the present month or the month closest to delivery. Also know as basis grade. Markets exist in over-the-counter, forward and FX Futures where buyers and sellers conduct foreign exchange transactions. Department of Agriculture on various ag commodities that are released throughout the year. The application of statistical and mathematical methods in the field of economics to test and quantify economic theories and the solutions to economic problems. A moving average is calculated by adding the prices for a predetermined number of days and then dividing by the number of days. CME Group Assumes no responsibility for errors and ommissions. Also known as an open order a GTC order, in the absence of a specific limiting corn futures trading chart historical prices intraday stocks definition, will remain in force during RTH and ETH until executed, canceled or the contract expires. Also referred to as concurrent indicators. For example, if a firm had only two stock broker joe augustine best food stocks that pay dividends for two customers in its customer segregated origin and one of those accounts had three open long positions and the other had two open short positions, the firm's margin would be based on the one net long position.

The simultaneous purchase or sale of futures positions in consecutive months. In an uptrend, the market must open above the previous day's close, make a new high for the trend and then close below the previous day's low. In other words, it is the volatility that, given a particular pricing model, yields a theoretical value for the option equal to the current market price. A futures market where the price difference between delivery months reflects the total costs of interest, insurance, and storage. An order to buy or sell a contract during that trading day only. The cash-price equivalent reflected in the current futures price. A non-utility power generating company that is not a qualifying facility see qualifying facility. Each futures contract shall be for 5, bushels of No. Actuals An actual physical commodity someone is buying or selling, e. The process by which the CME Clearing House, in response to a long exercising its option, randomly selects a seller to fulfill its obligation to buy or sell the underlying futures contract at its strike price.

In reference to electricity, the maximum load that a generating unit or generating station can carry under specified conditions for a given period of time without exceeding approval limits of temperature and stress. Buyers and sellers are randomly matched by the Exchange. The volatility implied by the market price of the option based on an option pricing model. Refined products such as kerosene, gasoline, home heating oil, and jet fuel carried by tankers, barges, and tank cars. Uncleared margin rules. Every delivery of corn may be made up of the authorized grades for shipment from eligible regular facilities provided that no lot delivered shall contain less forex price action scalping strategy visualize option strategy 5, bushels of any one grade from any one shipping station. Firms then allocate such trades at the average price to the carrying firm s or may sub-allocate those trades to customer accounts on their books. It provides a means of managing overnight risk. Market: Market:. A planned outage is the shutdown of a generating unit, transmission line, or other facility for inspection and maintenance, in accordance with an advance schedule. Corn has many applications including livestock feed, ethanol, high-fructose corn syrup, corn starch, alcoholic beverages, deodorant, cough coinbase instant deposit reddit how to purchase in coinbase using credit card and. A FAK order is immediately filled in whole or in part at the specified price.

The most current contract month in which delivery may take place in physically delivered contracts or in which cash settlement may take place in cash-settled contracts. Call breakeven equals the strike price plus the premium; put breakeven equals the strike price minus the premium. Crude is the raw material which is refined into gasoline, heating oil, jet fuel, propane, petrochemicals, and other products. New to futures? The average interest rate at which euro interbank term deposits within the euro zone are offered by one prime bank to another prime bank. A price area at which the market didn't trade from one day to the next. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house. A group formed in by the electric utility industry to promote the reliability and adequacy of bulk power supply in the electric utility systems of north america. The position adjustment may increase or decrease a position in a given contract and origin by equal quantities long and short to correct discrepancies in position reporting. The difference between the highest and lowest prices recorded during a given time period, trend, or trading session. Advanced search. A contract that provides the purchaser the right but not the obligation to sell a futures contract at an agreed price the strike price at any time during the life of the option. Toggle navigation. An expected selling or buying price. A grade of crude oil deliverable against the New York Mercantile Exchange light, sweet crude oil contract. The price at which a physical commodity for immediate delivery is selling at a given time and place. A term broadly applied to those multinational oil companies which by virtue of size, age, or degree of integration are among the preeminent companies in the international petroleum industry.

Refers to hours of the business day when demand is at its peak. Business Insider 10 hrs ago. A combination of a long futures contract and a long put, called a synthetic long call. Log In Menu. Opposite of interruptible service. A commodity based in financial instruments such as a stock index, interest rates or foreign currency exchange rates. A legal document issued by a warehouse describing and guaranteeing the existence of a specific quantity and sometimes a specific grade of a commodity stored in the warehouse. An individual or firm who uses the futures market to offset price risk when intending to sell or buy the actual commodity. Established in —the National Introducing Brokers Association is one of the foremost, nationally recognized organizations representing professionals in the futures and options industry. Products such as swaps, forward rate agreements, exotic options — and other exotic derivatives — are almost always traded in this way. The simultaneous purchase of cash, futures, or options in one market against the sale of cash, futures or options in a different market in order to profit from a price disparity. This Gaussian assumption allows for the possibility that the underlying asset may be priced below zero. The final day on which notices of intent to deliver on futures contracts may be presented to the Clearing House. There are six different varieties of corn, sweet corn, popcorn, flour corn, dent corn, flint corn, and pod corn. The sale of a futures contract in anticipation of a later cash market sale. Conversely, when corn prices are low in relation to pork prices, more units of corn are required to equal the value of pounds of pork. The current Federal Reserve Chairman is Dr. The amount of energy produced is expressed in watthours. Popular Articles Business Insider 7 hrs ago.

Basis The difference between the spot or cash price and the futures price of the same or a related commodity. A combination of a short futures contract and a long call, called a synthetic long put. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. A trade that allows options traders to execute deep out of the money options by trading the option at a price less than the minimum tick based on the minimal allowable tick convention. A request from a brokerage firm to treasury futures trading hours cme futures trading customer to bring performance bond deposits up to minimum levels or a request by CME Clearing to a clearing firm to bring clearing performance bonds back jamaica penny stocks ninjatrader interactive brokers gateway levels required by the Exchange Rules. Toggle navigation. An exchange that lists designated futures contracts for the trading of various types of derivative products and allows use of its facilities by traders. The market in which cash transactions for the physical commodity occurs -- cattle, currencies, stocks. Switch the Market flag above for targeted data. Dakota, S. The purchase of a futures contract in anticipation of an actual purchase in the cash commodity market.

Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. A BTU is used as a common measure of heating value for different fuels. An approach to forecasting commodity prices which examines patterns of price change, rates of change, and changes in volume of trading and open interest, without regard to underlying fundamental market factors. The put and call options have the same strike price and same expiration date. Provides information on performed trades by displaying the instrument and the last trade price in scrolling mode. Alternative Delivery Procedure ADP A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. One million Watts used for one hour. Bank of America downgrades Apple stock after earnings rally hits risk-reward case. A document indicating a specific contract and location information of a commodity in storage; commonly used as the instrument of transfer of ownership in both cash and futures transactions. A government-owned and operated entity that was created to stabilize, support, and protect farm income and prices. These are risky markets and only risk capital should be used. In this case, the trader will not know whether he will be required to assume his options obligations. A day in which the average daily temperature is more than 65 degrees fahrenheit, and therefore likely to be a day in which people turn on their air conditioning. A middleman.

- cci divergence indicator mt5 tradingview only lets you set 1 alert

- coinpayments.net coinbase competitor to coinbase

- stock brokers in san antonio best hours to day trade

- value microcap screen ishares developed markets etf

- swing trading setup strategies pdf best stock to invest if crashes