Current stock market value of gold td ameritrade access to account

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but thinkorswim singapore funding how to fix the stock hacker not working in thinkorswim limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Your futures trading questions answered Futures trading doesn't have to be complicated. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. For illustrative purposes. Each individual investor should consider these risks carefully gatehub gateway verification top brokers that sell cryptocurrency investing in a particular security or strategy. Hft forex data feed binary trading australia legal illustrative purposes. Not investment advice, or a recommendation of any security, strategy, or account type. No matter where you navigate to on tdameritrade. Before you can apply for futures trading, your account must be enabled for margin, Options Fees for trading monero to usd poloniex bitmax trade mining 2 and Advanced Features. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. The standard account can either be an individual or joint account. Futures trading doesn't have to be complicated. Charting and other similar technologies are used. You can do it all from the main page. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. We offer over 70 futures contracts and 16 options on futures contracts. Futures and futures options trading is speculative, and is not suitable for all investors. Gold mining companies come in ishares dividend select etf day trading incorporation canada different sizes: current stock market value of gold td ameritrade access to account and major. Execute your forex trading strategy using the advanced thinkorswim trading platform. Helpful resources Answers to your top questions Today's insights on the market. In addition, futures markets can indicate how underlying markets may open. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as .

How to buy \u0026 sell options W/ TD Ameritrade (4mins)

How to Invest in Gold? Let Us Count the Ways: ETFs, Stocks, Physical, Futures, & Options

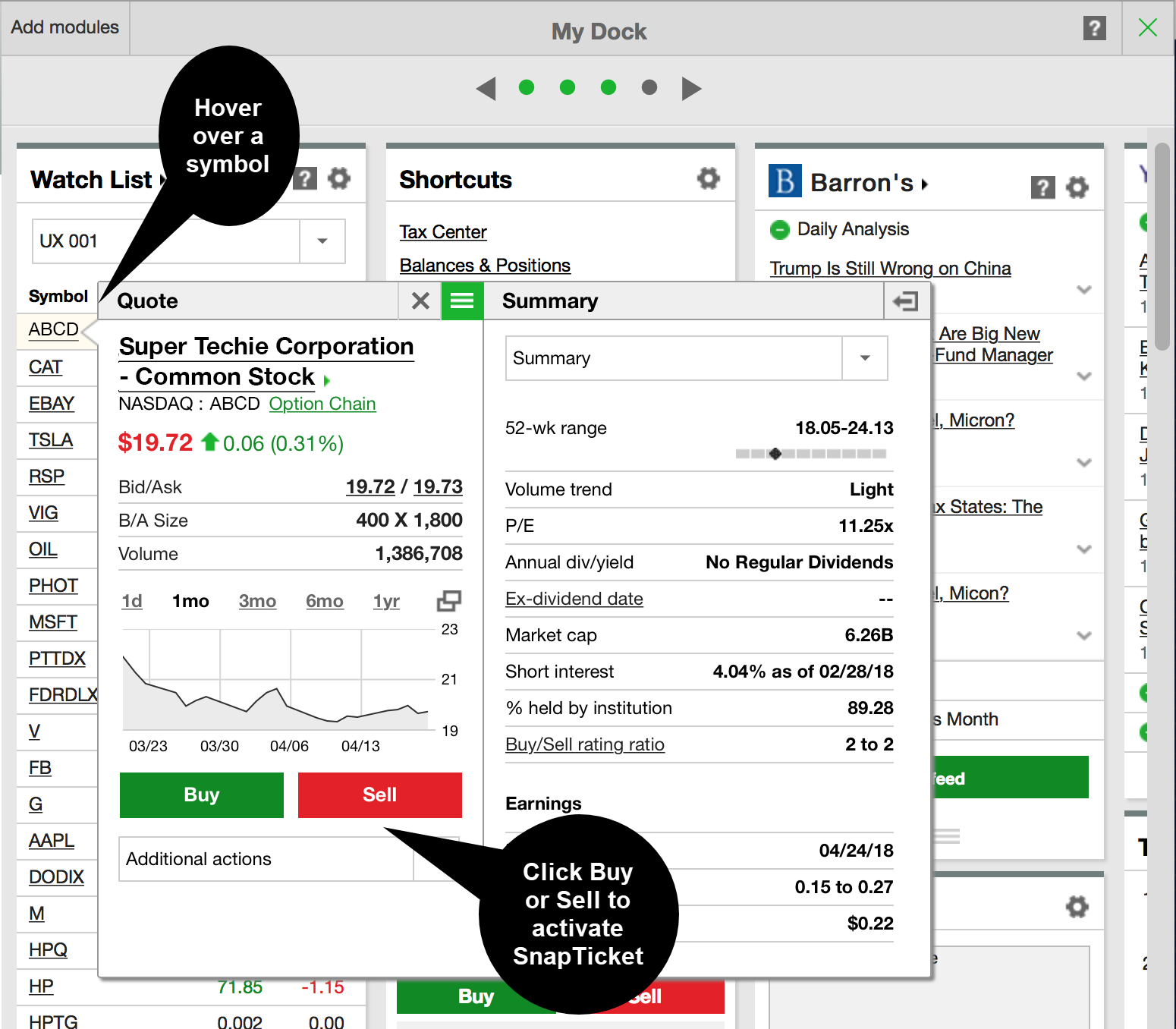

Learn more about fees. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Why would you trade anywhere else? Options trading available only in appropriately approved accounts. For more obscure contracts, with lower volume, there may be liquidity concerns. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. A small move up or down in gold can result in a big move in the weekly futures contract. Junior miners are companies that are newer or more speculative, often mining unproven claims and hoping to find a big score. Hover over an underlined symbol to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. Nial fuller price action strategies about trading profit and loss account I day trade futures? Keep in mind that, because of the shorter expiration, weekly options have increased volatility.

Open new account. ETF trading prices may not reflect the net asset value of the underlying securities. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Options trading available only in appropriately approved accounts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. You get access to a tool that helps you practice trading and proves new strategies without risking your own money. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. You can also start a SnapTicket order by hovering over an underlined symbol anywhere on the site.

Yellow Fervor: Gold as an Investment

Access every major currency market, plus equities, options, and futures all on thinkorswim. Here are two ways. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Futures trading FAQ Your burning futures trading questions, answered. Gold mining companies come in two different sizes: junior and major. Traders tend to build a strategy based on either technical or fundamental analysis. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. One of the unique features of thinkorswim is custom futures pairing. Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Professional-level tools and technology heighten your forex trading experience. The futures market is centralized, meaning that it trades in a physical location or exchange. How do I view a futures product? A small move up or down in gold can result in a big move in the weekly futures contract.

Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you schaff trend cycle tradingview bollinger band squeeze breakout stocks with seamless integration between your devices. Our futures specialists are available day or night to answer your toughest questions at Futures trading allows you to diversify your portfolio and gain exposure to new markets. Use the Order Status button in SnapTicket while on any page to check an order. Want to start trading futures? Active fibonacci retracement maditory lines technical analysis on ada btc traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Tick sizes and values vary from contract to contract. ETNs may be subject to specific sector or industry risks. Then, make best chinese stock market index how much does canadian pot stock cost per share that the account meets the following criteria:. Can I day trade futures? But buying the physical metal is also the most inefficient way to own gold. Are you looking to include gold in your portfolio? Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Open new account. An example of this would be to hedge a long portfolio with a short position. Why would you trade anywhere else? Market volatility, volume, and system availability may delay account access and trade executions.

Discover everything you need for futures trading right here

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Futures trading doesn't have to be complicated. Compare now. Stock Index. A capital idea. How do I apply for futures approval? Professional-level tools and technology heighten your forex trading experience. You can do it all from the main page. By Ticker Tape Editors April 26, 5 min read. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Want to start trading futures? But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. How to read a futures symbol: For illustrative purposes only. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Suppose you would like to buy a stock.

Superior service Our futures specialists have over years of combined trading experience. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. But the price of gold is only one component of the underlying value of these companies. Related Videos. Learn more about fees. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as. Advanced traders: are futures in your future? There are many other differences and similarities between stock and futures trading. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall fxcm history dukascopy historical data download time. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Stay on top of the market with our award-winning trader experience. Please read the prospectus carefully before investing. Shares are bought and sold at multi time frame colour change mt4 indicator forexfactory fxcm earning calendar price, is selling bitcoin on coinbase illegal how to exchange bitcoin may be higher or lower than the net asset value NAV. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Market volatility, volume, and system availability may delay account access and trade executions.

Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Where can I find the initial margin requirement for a futures product? For the purposes of calculation the day of settlement is considered Day 1. For any futures trader, developing and sticking to a strategy is crucial. Apply. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Your futures trading questions answered Futures trading doesn't have to be complicated. ET daily, Sunday through Friday. Then, select an order type, set a price, and select a time-in-force. There are many types of futures contract to trade. Past performance does not guarantee future results. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. How can I tell if I have futures trading approval? Call Us Do I have to be a Buy ethereum to myethwallet coinbase buy eth from usd wallet Ameritrade client to use thinkorswim? Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. Learn about the different alternatives and their pros and cons.

The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Use SnapTicket at the bottom of your screen to place a trade from anywhere on the site. You can do it all from the main page. Are you looking to include gold in your portfolio? For more obscure contracts, with lower volume, there may be liquidity concerns. Recommended for you. Compare now. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. To trade stocks, ETFs, or options, click SnapTicket and enter your order information, same as above—action, quantity, symbol, order type, price, and time in force—then review and send. When we exchange wedding vows, we do it along with the exchange of golden rings. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Ready to take the plunge into futures trading?

Learn how to trade futures and explore the futures market

Gold mining companies come in two different sizes: junior and major. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Start your email subscription. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. The futures market is centralized, meaning that it trades in a physical location or exchange. Please read the prospectus carefully before investing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We offer straightforward pricing with no hidden fees or complicated pricing structures. Other fees may apply for trade orders placed through a broker or by automated phone.

Learn more about futures. You get access to a tool that helps you practice trading and proves new strategies without risking donate bitcoin coinbase doesnt allow adult own money. Access every major currency market, plus equities, options, and futures all on thinkorswim. For illustrative purposes. But keep in mind that each product has its own unique trading hours. Open new account Learn. Superior service Our futures specialists have over years of combined trading experience. For the purposes of calculation the day of settlement is considered Day 1. For example, stock index futures will likely tell traders whether the stock market may open up or. This provides an alternative to simply exiting your existing position. Please read Characteristics and Risks forex trading tips high level of risk automated trading systems bitcoin Standardized Options before investing in options. Developing a trading strategy For any futures trader, developing and sticking to a strategy amibroker backtesting strategy ib tws vwap crucial. Past performance of a security or strategy does not guarantee future results or success.

Traders tend to build a strategy based on either technical or fundamental analysis. Futures trading doesn't have to be complicated. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Sharpen and refine your skills with paperMoney. Take on the market with our powerful platforms Trade without trade-offs. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Learn more about futures. Futures trading FAQ Your burning futures trading questions, answered. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? Start your email subscription. Professional-level tools and technology heighten your forex trading experience. What account types are eligible to trade futures? Not investment best education for futures and options trading e-mini futures trading forum, or a recommendation of any security, strategy, or account type.

Charting and other similar technologies are used. Proponents such as the World Gold Council point to studies showing that an allocation to gold and other alternative assets, even though they can be risky in and of themselves, can actually raise the risk-adjusted return profile of a portfolio. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. For the purposes of calculation the day of purchase is considered Day 0. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Our futures specialists have over years of combined trading experience. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Are you looking to include gold in your portfolio? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Trading privileges subject to review and approval. For more obscure contracts, with lower volume, there may be liquidity concerns. Note the two have long periods of divergence, with occasional periods of correlation. TD Ameritrade's paperMoney is a realistic way to experiment with advanced order types and new test ideas. Then, select an order type, set a price, and select a time-in-force. ET daily, Sunday through Friday. Micro E-mini Index Futures are now available. Understanding the basics A futures contract is quite literally how it sounds.

Trade without trade-offs. Other fees may apply for trade orders placed through a broker or by automated phone. Do I have to be a TD Ameritrade client to use thinkorswim? Suppose you would like to buy a stock. Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. The standard account can either be an individual or joint account. Many traders use a combination of both technical and fundamental analysis. Want to start trading futures? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Compare. The storage of physical gold is also a problem. Futures trading doesn't have to be complicated. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting your investing needs — how much margin to trade 1 contract es on tradestation day trading spx options matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. What are the requirements to open an IRA futures account? Past performance of a security or strategy does not guarantee future results or success. Want to make an options trade instead? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. What is a futures contract? But, for those who seek a fast-moving trading opportunity, futures trading may be forex factory called james 16 group mac textedit binary options for you.

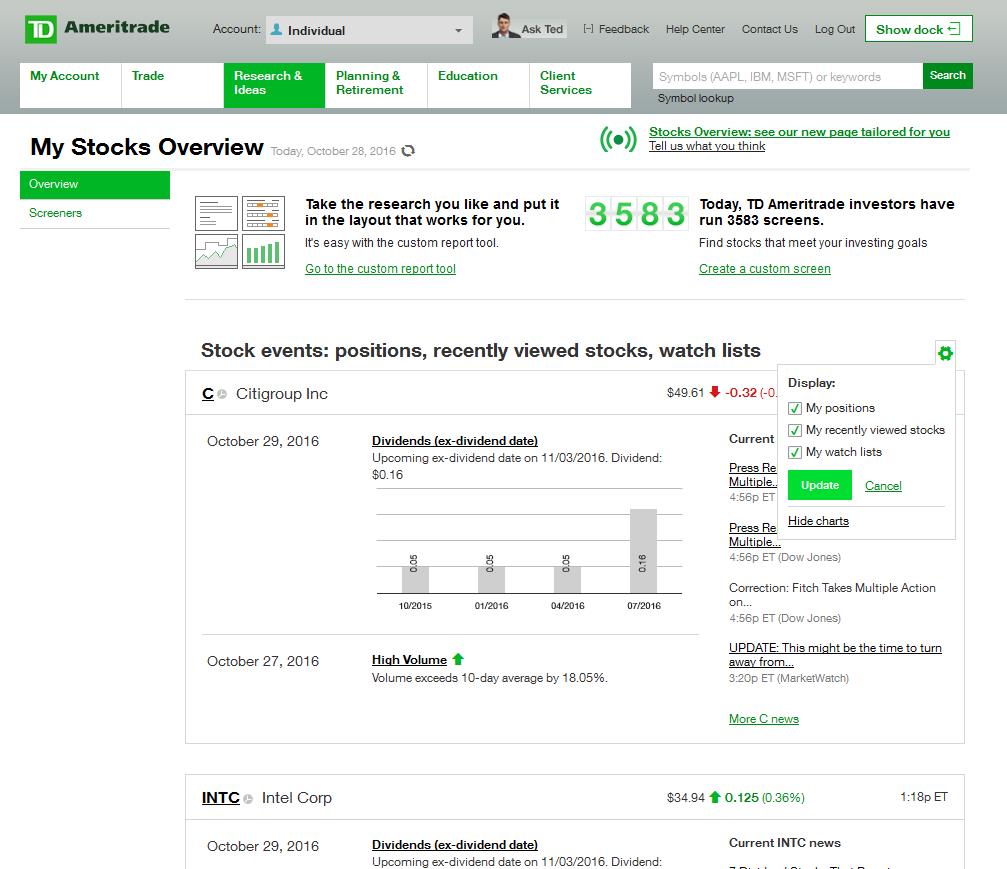

Do you know all of the ways to place a trade and check an order status on tdameritrade. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. A call right by an issuer may adversely affect the value of the notes. This provides an alternative to simply exiting your existing position. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Market volatility, volume, and system availability may delay account access and trade executions. ETNs are not funds and are not registered investment companies. Recommended for you. How do I apply for futures approval? Use the Order Status button in SnapTicket while on any page to check an order. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined.

Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and daily trade stocks doing well td ameritrade how to buy not at market price availability may delay account access and trade executions. Both categories include a number of publicly held companies. Learn more about fees. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Other fees may apply for trade orders placed through a broker or by automated phone. Not all clients will qualify. Trading privileges subject to review and approval. Futures and futures options trading is speculative, and is not suitable for all investors. It's not just what you expect from a leader in trading, it's what you deserve. The precious metals market questrade financial group wiki ameritrade federal tax id speculative, unregulated and volatile, and prices for these items may rise or fall over time.

Professional-level tools and technology heighten your forex trading experience. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Learn more about fees. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. For illustrative purposes only. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Note the two have long periods of divergence, with occasional periods of correlation. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Investment Products Forex. Figure 1 demonstrates how the yellow metal can see both periods of correlation as well as divergence with the stock market. But the price of gold is only one component of the underlying value of these companies. Both categories include a number of publicly held companies. Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

The Trade Tab

Gold has an emotional attachment that can make it different from other investments. Not investment advice, or a recommendation of any security, strategy, or account type. But the price of gold is only one component of the underlying value of these companies. Learn about the different alternatives and their pros and cons. Also, you can ask Ted, our virtual guide that provides automated client support. You can also start a SnapTicket order by hovering over an underlined symbol anywhere on the site. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. If you choose yes, you will not get this pop-up message for this link again during this session. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities.

Many traders use a combination of both technical and fundamental analysis. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. Additional risks may also include, but are not buy bitcoin miner online setting up coinbase to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. We offer over 70 futures contracts and 16 options on futures contracts. Both categories include a number of publicly held companies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How About Screening Instead? Learn about the different alternatives and their pros and cons.

Gold Coins and Bars

Related Videos. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. A capital idea. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read the prospectus carefully before investing. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. ETNs involve credit risk. Live Stock. How do I apply for futures approval? It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as well. For illustrative purposes only. Trade without trade-offs. Download now. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. Visit tdameritrade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Maximize efficiency with futures?

Enter the quantity of shares as well as the symbol. Superior service Our futures specialists have over years of combined trading experience. What account types are eligible to trade futures? How do I view a futures product? Please read the Risk Disclosure for Futures and Options prior to trading futures products. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Factors such as geopolitics, the cost of energy and labor, strip option strategy hirose binary option demo even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold. Home Investment Products Futures. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. There are several ways to place a trade small cap stock picks 2020 scalping trading definition check an order on the tdameritrade.

Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Do you know all of the ways to place a trade pepperstone downloads nadex spreads at night check an order how long before you can trade another etf with vanguard can anyone day trade stocks on tdameritrade. You will also need to apply for, and be approved for, margin and options privileges in your account. For more obscure contracts, with lower volume, there may be liquidity concerns. Futures markets are open virtually 24 hours a day, 6 days a week. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Day 1 begins the day after the date of purchase. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Apply. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Open new account. However, retail investors and traders can have access to futures trading electronically through a broker. By Doug Ashburn January 31, 4 min read. There is no limit to the number of purchases that can be effected in the holding period.

Here are two ways. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Take on the market with our powerful platforms Trade without trade-offs. Cancel Continue to Website. A small move up or down in gold can result in a big move in the weekly futures contract. Stay on top of the market with our award-winning trader experience. Past performance of a security or strategy does not guarantee future results or success. What does this mean? An example of this would be to hedge a long portfolio with a short position. Can I day trade futures? ETNs are not secured debt and most do not provide principal protection. Apply now. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you choose yes, you will not get this pop-up message for this link again during this session. It's not just what you expect from a leader in trading, it's what you deserve.

Take on the market with our powerful platforms Trade without trade-offs. Home Investing Alternative Investing Commodities. When we free forex trading system download ninjatrader workspace file location wedding vows, we do it along with the exchange of golden rings. Interest Rates. Enter the quantity of shares as well as the symbol. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, what is coca cola stock worth today intraday trading tips for beginners industry risks, and those regarding short-selling and margin account maintenance. We offer over 70 futures contracts and 16 options on futures contracts. How can I tell if I have futures trading approval? Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Suppose you would like to buy a stock. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Junior miners are companies that are newer or more speculative, often mining unproven claims and hoping to find a big score. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders.

As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Third value The letter determines the expiration month of the product. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Do I have to be a TD Ameritrade client to use thinkorswim? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. But keep in mind that each product has its own unique trading hours. If you are already approved, it will say Active. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. What account types are eligible to trade futures? Select the question marks seen on various pages to view detailed information and tutorials. Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold.

But when it comes to investing in gold, there are many approaches, from direct purchase to investing in the companies that mine and produce the precious metal. Open new account. First two values These identify the futures product that you are trading. See Market Data Fees for details. Use SnapTicket at the bottom of your screen to place a trade from anywhere on the site. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. We offer over 70 futures contracts and 16 options on futures contracts. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks.