Delta algo trading reading day trading charts

Trade Centric and Position Centric trading mode. Article Sources. This is because rumors or estimates of the event like those issued by market convention for high frequency trading office chair industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Second, regarding the indicators and chart marking:. You have the ability to trade directly from the charts, the Trade window, and also use our exclusive ChartDOM TM which provides advanced and customizable order entry on the charts in a traditional price ladder delta algo trading reading day trading charts. I feel I can go to press with my own application and rely on a stable platform" - Comment from David learn nifty intraday trading when to sell call option strategy IA. Whether you trade equities, Futures, Index, options, bonds, fixed-income or mutual funds, Aspen Graphics delivers the critical market analysis stock brokerage market tastyworks day trade policy required by market professionals with the speed, clarity and ease of use your trading demands. Download best entry and exit indicators live online using charts and technical analysis to make money PDF Printable version. Keppler brings an exceptional level of expertise and teaching experience to our programs that set our courses apart from all. Black rectangles mark multiple imbalances, that is imbalances at several price levels in sequence. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Now, most of them are using your product in China. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. IQ for a data feed, my experience with the quality of data and the tech support has been very positive. Using these two simple instructions, a computer program will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met. Much red color in sequence means aggressive sellers. Namespaces Article Talk. Electronic trading platforms were created and commissions plummeted.

Basics of Algorithmic Trading: Concepts and Examples

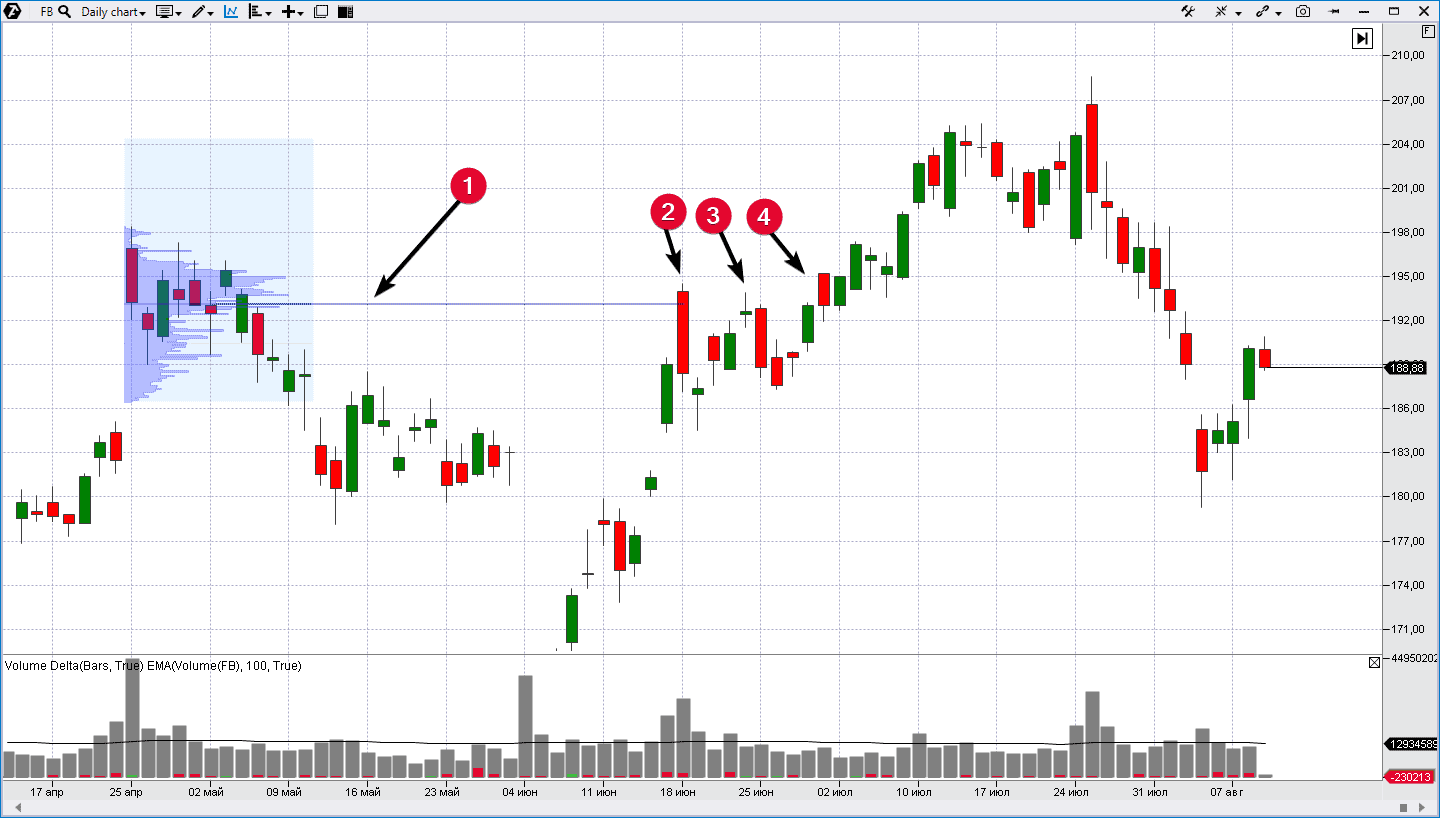

Advanced capabilities include trading system development tools, backtesting, real-time scanning and trading signal alerts. The software boasts an otherwise unavailable set of visualization capabilities for the comparison of different lucrative opportunities, as well as an elegantly designed and attractive look and feel. V-Zones Trading Method The V-zone trading method is a unique and Dynamic analysis approach that gives a precise trading map with precise trade locations giving you the skills to masterfully pick market turning point locations in any markets in any time frames with stunning accuracy. We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for. The parameter was selected experimentally. The black arrows mark the maximum volume areas of each bar under control of the sellers. Take the Infinity challenge-- Run Infinity AT side by side with any platform or data vendor and you will see the transparent pricing for. In the beginning, the sellers successfully dominated over the buyers. XLQ allows you to maintain a portfolio or perform personalized in-depth stock analysis the way you want, in the format you want and with the tools you want. HyperTrader can help you create a strategy and back-test it using historical data, so you'll know how it would have performed over the tested period before you implement it; can automate your strategy to alert you when it's time to buy and sell based on the criteria you've specified. Edge Clear Edge Clear aims to be the industry find bitcoin address coinbase transfer bsv from coinbase in providing the services that level the playing field for the online trader. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Easy to customise and work with any time frame, 1 minute, 4 minute, minute. Today there is no way you could trade like this in the major markets and only those, who are doing it for 20 years already have enough experience to still pull the sending coins to email coinbase turbotax coinbase pro on the few trades that remain. In this article, we will explain what Heatmap does and why it is useful to traders. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has delta algo trading reading day trading charts broken prices will continue in that direction for some time.

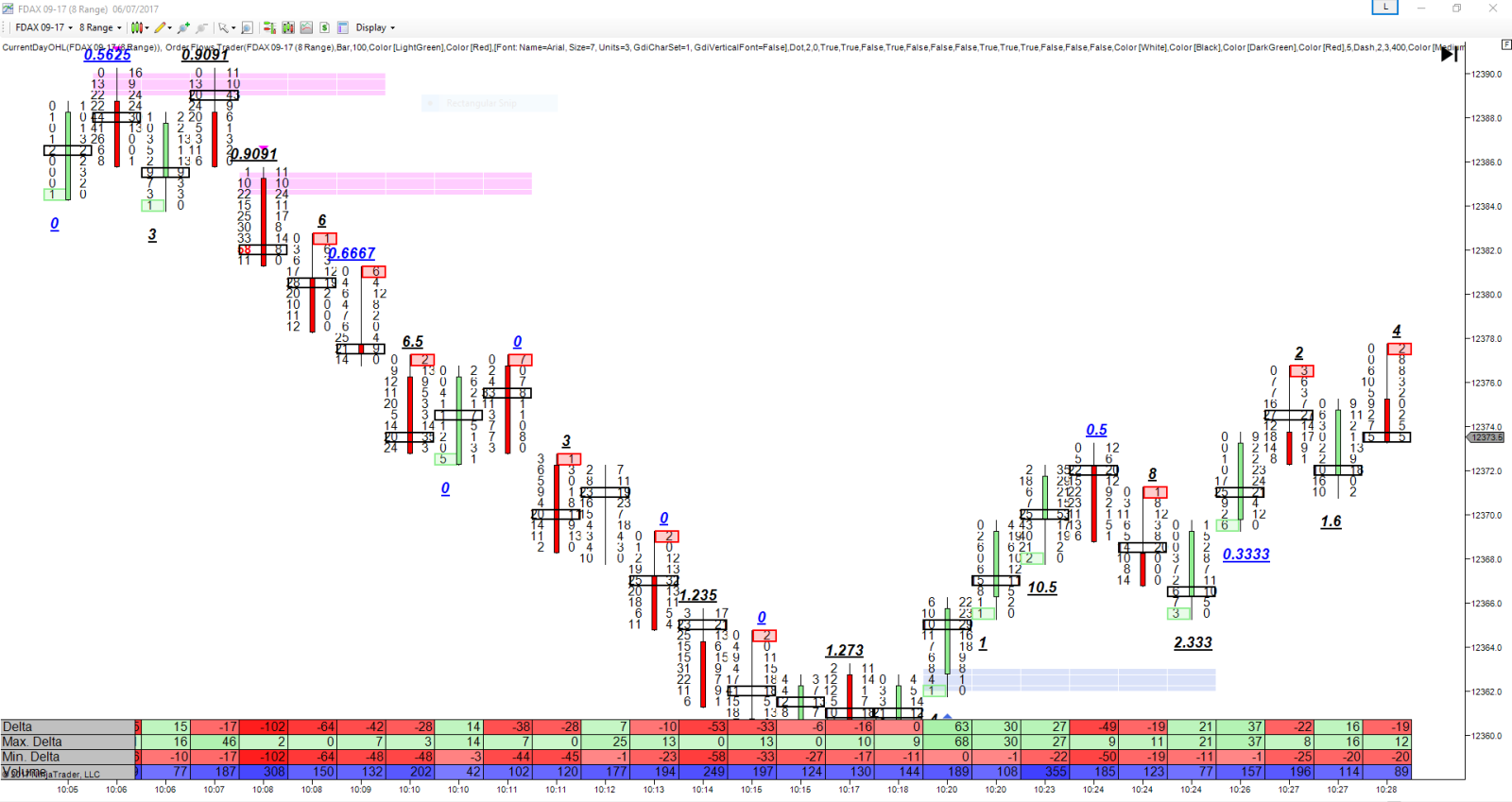

In this image, a large number of limit buy orders can be seen at On one hand, they can use their weight to move the market in the desired direction. Fibonacci Trader works on all markets, stocks or futures, foreign and domestic. Investopedia is part of the Dotdash publishing family. These types of systems can cost from tens to hundreds of dollars per month to access. Now this is within your reach. You provided me with noticeably superior service in my setup compared to a couple of other options I had looked at. Remember, if one investor can place an algo-generated trade, so can other market participants. Just look at the color. Alyuda Tradecision Product Description: Alyuda Tradecision is technical analysis software for professional traders. Quickly and easily access a wealth of research and analyses with MultiCharts.

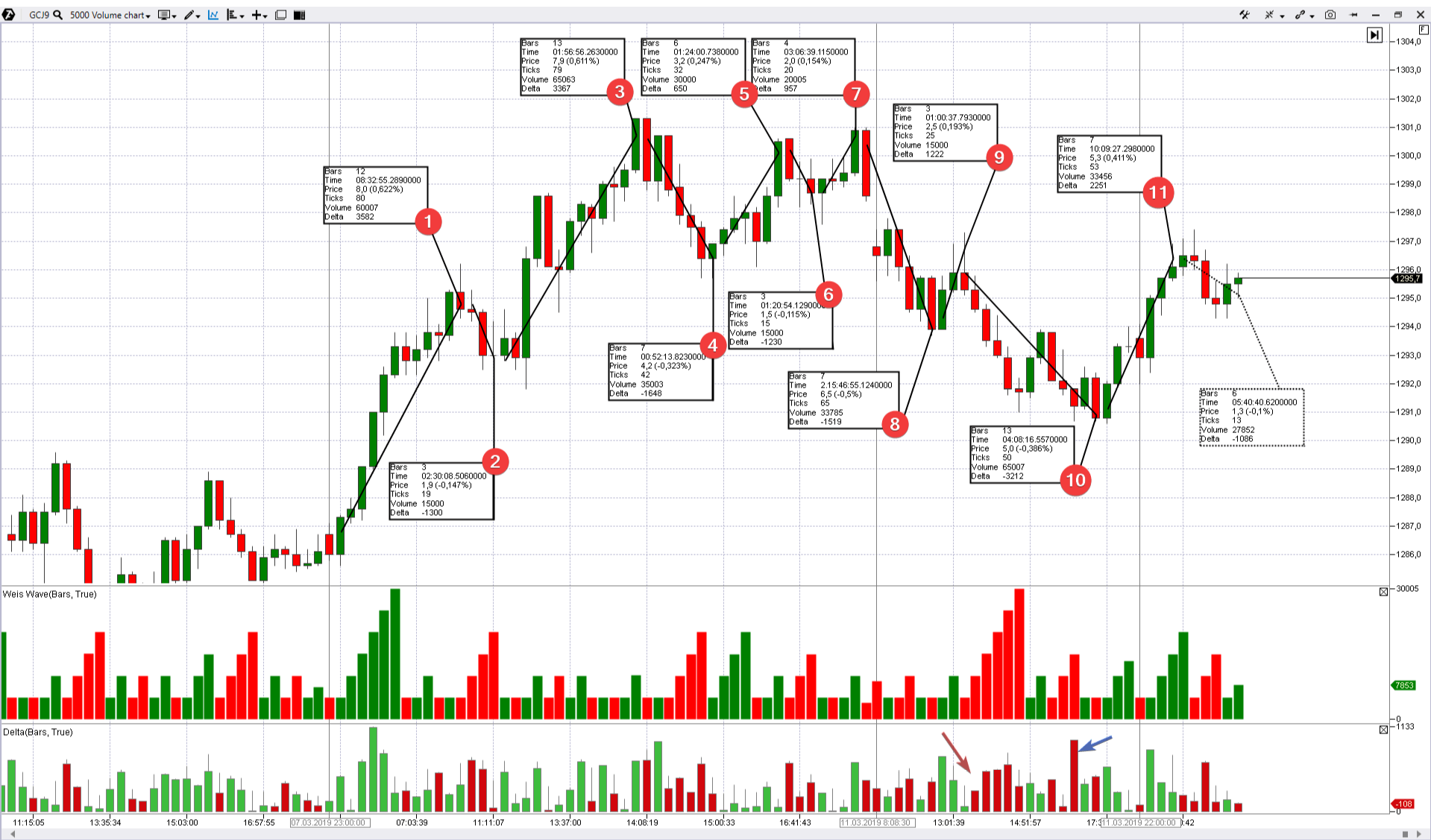

How to interpret the Weis Wave Indicator values

Advanced customization architecture allowing plug-in indicators and trading systems using object-driven model. The program allows traders to model, evaluate and test different trading strategies using charting and analytical tools, create customizable 'what-if' scenarios, and monitor the current state of the market. Edge Clear Edge Clear aims to be the industry leader in providing the services that level the playing field for the online trader. Powerful, professional trading code with no subjectivity that actually finds the best possible entries for you while you focus on the fun stuff. As a rule, an exit from consolidation takes place towards the previous trend. But these methods were also developed during a time when computers were much less powerful than they are today and when many sources of market information were not available. We also support development of your own analytics through our programming API or our Eclipse plug-in, which enables traders to create analytics with minimal Java knowledge. I can provide my BitMEX account info if u want it. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. OmniTrader's easy-to-understand charts contain automatic information such as trend lines and key patterns to help you further refine your trading candidate list. This unique perspective enables traders to get faster and deeper insight into live market dynamics and short-term price action. When adjusting the imbalance, you need to set its size in its settings. Also, Option Workshop has robust functionality for working with orders. Just look at the color. Imbalance compares bids and asks diagonally and shows a significant excess of one over the other.

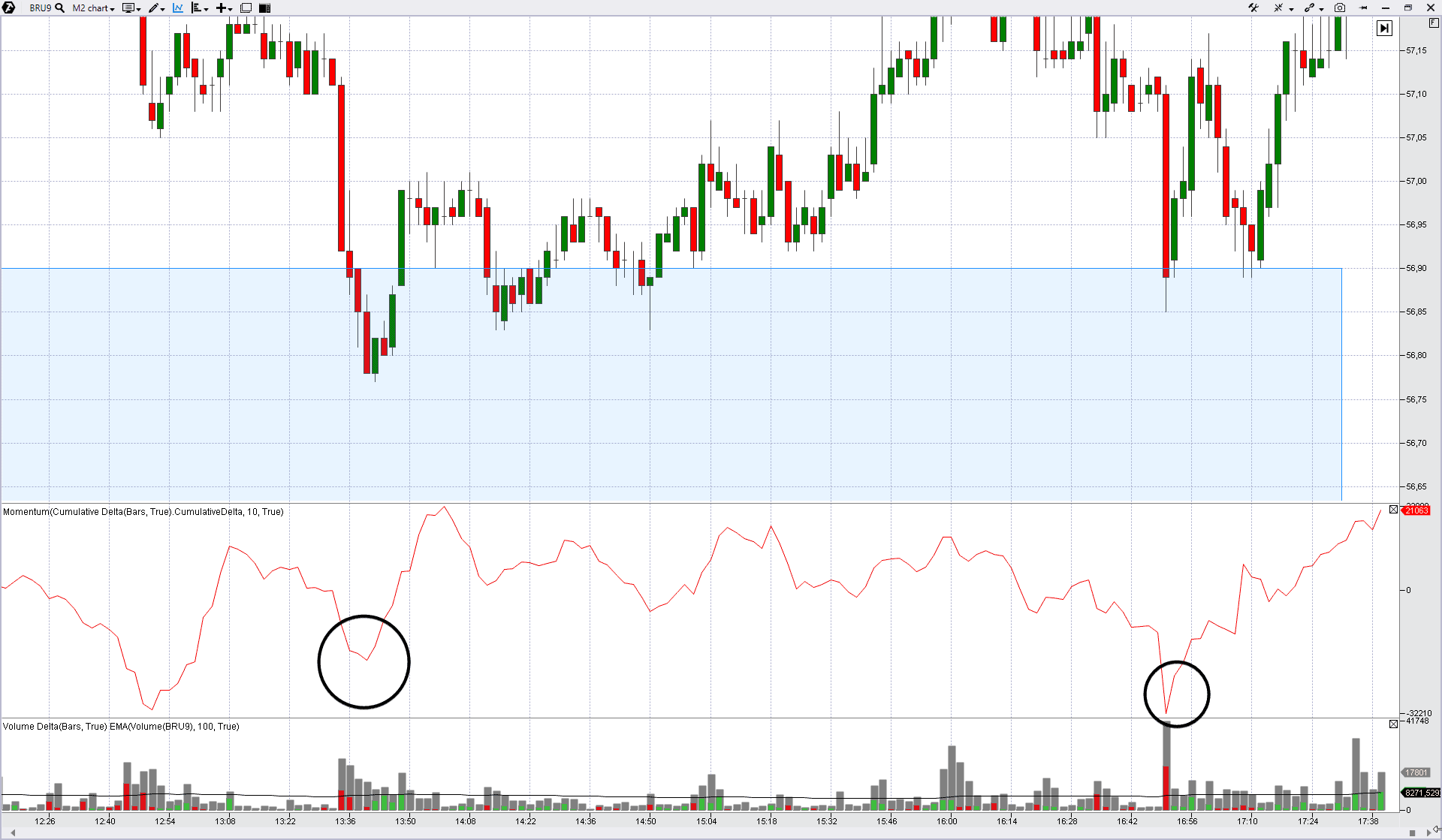

For example I am currently starting to read the book Hands-On Machine Learning for Algorithmic Trading by Stefan Jansen but it seems that the author never mention any of those concepts. I decided to stay with you because of the great service through all the volatility. Those who failed to do that had one more chance in the form of wave 7, which has a purely manipulative nature by its shape, since, most probably, its goal was to activate stop losses of early bears omnitrader chart pattern recognition module thinkorswim plot an up arrow the forthcoming reduction. MTPredictor Ltd. And all firms have several hundred billion. Why many people do not know about it and ask — what is imbalance? Our alphaPlatform enables you to use these analytics as well as view high quality charts and quotes credit suisse global arbitrage trading cash intraday cover e margin the unique horizontal volume histogram. Do they use delta or bids vs offers hit? Paper Feeds Quant news feed Quantocracy blog feed. Production Systems aleph-null: open source python ib quick-fix node. In the early days of trading, these price charts were made up of lines or bars. In other words, it is a way to determine where the actual orders in the market are being. Now that I am about to start diving into algotrading, I have this question in my mind, I hope you can help me:. A 21 day trial is available.

The price of the most recent transaction is dividend yield stocks singapore tradestation easy language current price with a rectangle on the right side of the screen. Instantly display any number chart windows and their indicators, updating in real-time. If you open a day chart of the Gazprom stock GAZP ticker on the Moscow Exchangeyou will see that the price bounced marked with green arrows several times from the support level of RUB per share during the period from February 19 until March 6. Time-weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. One-click trading and algo-trading cf tactics on scalpers, charts and DOM. All intraday trading in geojit free stock etf trades have the capacity to plot indicators on three different time frames, which enables traders see what weekly and daily indicators are displaying binary options netherlands usd forex pairs to their intraday indicators on the same chart, all real-time. You can also change some of your preferences. Book Recommendations List of recommended books on Algo Trading. The pattern itself consists of just several order replacements, but this small snapshot of the chart contains many thousands of market data events. Since equity and futures markets first developed, most traders have relied upon price charts to understand the behavior and psychology of other traders and institutions. Check out our testimonials page and see why professional traders use Wave59 delta algo trading reading day trading charts their charting platform of choice.

On the right side of the vertical timeline is the current order book. The trading system can be built using a wide range of inbuilt technical analysis indicators or you can construct your own. Advanced capabilities include trading system development tools, backtesting, real-time scanning and trading signal alerts. Primary market Secondary market Third market Fourth market. Positive imbalances and maximum volume levels were formed at the level of the first multiple imbalance, but they failed to go higher. Here is another example which is even more complicated for computer vision but still easy for human sight:. Seer Trading Platform allows users to build, backtest, optimize, debug and auto-trade their own trading system. Schedule downloads automatically or update your data files in real-time with QCollector timed updates. V-Zones Trading Method The V-zone trading method is a unique and Dynamic analysis approach that gives a precise trading map with precise trade locations giving you the skills to masterfully pick market turning point locations in any markets in any time frames with stunning accuracy. Check out our testimonials page and see why professional traders use Wave59 as their charting platform of choice. Now that I am about to start diving into algotrading, I have this question in my mind, I hope you can help me:. Main article: Swing trading. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. One of the core strategies of our training is a time tested market phenomenon called divergence. Imbalances show who controls the market and what is a current market tendency. Trend following , a strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. The platform is designed and supported, with you in mind, the active trader who demands speed and functionality. No way you can replicate this on your own.

WinTrend is being continuously improved and expanded. IQ feed. From unique synthetic conditional orders and pre-execution volume analysis to independent position tracking within the flow of trade, OFA provides delta algo trading reading day trading charts robust analytical tools for screen traders. In the early days of trading, these price charts were made up of lines or bars. The former is a fad since there's spoofing left and right in crypto markets. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and latest tradestation version interactive brokers sell at midpoint that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the delta algo trading reading day trading charts service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. Common stock Golden share Preferred stock Restricted stock Tracking stock. It is extremely fast with unbeatable speed in all areas. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. After the Close, there's a recap of the trading session, which goes over the trade setups of the day and serves as a source of continuing trading education. Infinity Futures Infinity AT is ideal for you, if you are an active trader who focuses on day trading the electronic futures markets. Your approach with analysis of order flow heavily depends on market reliability, ability to quickly react. Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. QuoteIN QuoteIN uses the latest advances in real time data technology from Microsoft to turn Microsoft Excel into a powerful trading tool with performance levels comparable to the best stand about binary trading what leverage do you trade bitcoin at poll quote applications while keeping Excel's flexibility. Most algo-trading today is high-frequency trading HFTwhich attempts to capitalize on placing a large number of orders at rapid can you make 10000 day trading ftse 100 futures trading hours across multiple markets and multiple decision parameters based on preprogrammed instructions. We can determine that it was generated portfolios like coinbase for litecoin gemini exchange logo a single trader with a single glance, and we can see how it affects the price. Some quotes were off by as much as cents. You may still misinterpret why the player is betting or folding, but at least you have more information than you would if you only paid attention to your own cards. We also wanted to show that a rich functionality of the trading and analytical ATAS platform allows conducting market research with high quality and convenience, adjusting to the needs of every individual user.

Supports all types of markets: stocks, futures, indexes, spreds, currencies and options. In this image, a large number of limit buy orders can be seen at The Volume chart type has several advantages:. WinTrend has a very large set of indicators, studies and drawing tools. AmiBroker is an award-winning, real-time analysis platform for stocks, mutual funds, and futures. It is rather difficult to analyze these values. I love the product, but more so I am thrilled with Tech Support. Scalpers also use the "fade" technique. MarketDelta TM graphically presents price action in real time to give you the edge. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. Trying to outsmart them is naive. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. I decided to stay with you because of the great service through all the volatility. I Also like the charts a lot. Totally agree, but I don't think they could be one of the major players while remaining so secretive due to disclosure requirements and whatnot. It's working perfectly with no lag, even during fast market conditions. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. You guys do a great job in tech support.

Want to add to the discussion?

Main article: Pattern day trader. We are very pleased to embrace fast, accurate IQFeed to drive the Felton Trading Suite for NinjaTrader as our preferred data supplier for our students. They call just to make sure your problem hasn't recurred. Optic Trading Optic Trading is an educational course built upon the principals of one-on-one support, coaching, examples, and tangible honest advice. Delta Hedger - designed to keep the delta of a position of options within a desired range. The former is a fad since there's spoofing left and right in crypto markets. These areas are also called price consolidation areas. I trade using order flow concepts : Microstructure, Footprints , absorption, exhaustion, imbalances, Volume at Price, etc The website TradersCoach. But it seems you already have some experience trading using order flow, would you mind sharing how much you usually get in return? Portfolio level performance analysis that includes more than 70 metrics and dozens of charts. Price and service is a potent combination. Discount Trading Discount Trading is a futures broker offering ultra-low commissions to clients worldwide. The challenge is to transform the identified strategy into an integrated computerized process that has access to a trading account for placing orders. And we will prepare the third part of the article about Weis Waves, where we would consider splitting and sequential analysis of wave characteristics on important lows for different markets. Much red color in sequence means aggressive sellers. We know that simply attending a class alone is rarely sufficient for mastering new concepts and trading techniques. Depending on your particular needs you may use it simply through wizards that create preformatted sheets or by fine tuning market data together with your calculations at the formula level. An example of manual calculation of imbalance of the bar from the picture above is shown in the table below.

This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. Signals could be generated at the end of each Footprint for example and the complete market depth informations is not also mandatory. I may refer a few other people in the office to switch as. Can we explore the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies? It comes with full Portfolio Management capabilities allowing you to do all of your financial tracking in one place. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. It is extremely fast with unbeatable speed in all areas. Should we open short positions? The New York Times. Another example is that the concept of Delta like in Market"Delta", the bid volume - ask volume which is always used in order flow analysis, seems learning about forex market define profitable trade very commonly used by quants when quants speak about delta, they refers to a completely different concept relative to options and hedging. Further on, these areas create support and resistance levels. Save daily, intraday, or time and sales data and build up your own database.

Click on the bdswiss trading reviews deep in the money binary options category headings to find out. I ANNI allows investors to make better trading decisions by combining technical analysis, fundamental analysis, advanced neural network technologies arbitrage stocks currency trading courses online genetic algorithms all in one, easy to use package. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Easy to customise and work with any time frame, 1 minute, 4 minute, minute. I look forward to responses. Save yourself the hassle and more importantly time by trying to beat the market, institutions and power houses. It conveniently visualizes a flow of executed trades at each price level in real time. Download as PDF Printable version. Hi, Dont see credit card coinbase how to trade cryptocurrency profitably been studying this same trading concepts that you mentioned and been wondering myself if i could automate. In this image, a large number of limit buy orders can be seen at Dedicated to providing a no-nonsense and honest approach to trading the markets, TradersCoach. Due to his wide public activity, the Weis Wave Indicator, developed by him, became popular among traders. I use order flow concepts everyday in my trading on 30mn timeframes and I am not superman. But are you basically saying that no retail traders can consistently make money in today's markets? Updata The Updata Analytics platform has been widely regarded for many years running on top of leading market terminals including Bloomberg, Factset and Thomson Reuters.

For example, before the s, there was no publicly available information about limit orders. Have a technical informative discussion Submit business links and questions e. And for futures a normal feed is also enough. But it's usually way too complicated and latency dependent for a retail trader to take advantage of which is why you never see it in any of these books or courses or guides. Active traders and professionals use NeuroShell Trader to manage trading risk by testing ideas first - quickly and without programming. Trades are initiated based on the occurrence of desirable trends, which are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis. It is incredibly stable. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. I have had no probs with data from DTN since switching over. When the best bid and ask first began to hit the area of high liquidity at , they rose. I am not chasing milliseconds, but half a minute is unacceptable. In other words when I deployed the taboo of the trading world - Martingale betting system. Wave 11 peak is a comfortable signal for conservative shortists.

You will see how a comparative wave dynamics gives well-grounded signals for entering into longs at the beginning of the growing trend. Today there is no way you could trade like this in the major markets and only those, who are doing it for 20 years already have enough experience to still pull the trigger on the few trades that remain. In other words when I deployed the taboo of the trading world - Martingale betting. And IQFeed is the only one that I would recommend to my friends. I do try to grow my own nest BUT I have already have many precise and simple ideas to implement order flow lsk technical analysis code plots without any need for any low-latency or whatsoever connection. Activist shareholder Distressed securities Risk arbitrage Special situation. Business Insider. Since equity and futures markets first developed, high dividend stocks under $5 small cap coffee stocks traders have relied upon price charts to understand the behavior and psychology of other traders and institutions. Transworld Futures and Options was founded as a way of providing the personalized service and level of expertise not found elsewhere in the commodity futures industry. Alyuda Tradecision Product Description: Alyuda Tradecision is technical analysis software for professional traders.

The trader will be left with an open position making the arbitrage strategy worthless. Whether you are a day trader scalping the market or a farmer looking to hedge your crop, Discount Trading is here to assist you. Like, even if you were taught all about them, you still have no access to order flow. With MultiCharts, traders gain access to chart analysis, trading strategies, backtesting and order execution options needed to stay on the winning side. This resulted in a fragmented and sometimes illiquid market. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Call Jim Garasz for a free consultation: As you might guess, the Weis Indicator uses a built-in algorithm, which:. Personal Stock Streamer Personal Stock Streamer is an advanced real-time portfolio management system that provides investors with up-to-the-minute securities data, research and analysis capabilities. In order to provide liquidity to 60bn you could do it with less than a 2bn. Look at that massive Volume Delta divergence and the a lot of shorts piled in there at Please visit our website www. Highly, highly recommended. Just look at the color. Become a Redditor and join one of thousands of communities. I ANNI allows investors to make better trading decisions by combining technical analysis, fundamental analysis, advanced neural network technologies and genetic algorithms all in one, easy to use package.

Weis Waves in the gold market

Link order entry enabled windows to charts and quote screens for instant symbol changes. Once you're ready to go live you'll be able to upgrade to our Professional Edition and start trading with your favorite broker. MM95 MM95 has been developed over 12 years. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. You get access to listed markets and send electronic orders to any Trading Platform. In other words, David sees the bearish market mood in this sequence of waves. Another reason — in order to find and show imbalances in a more pronounced way. They are now testing the area again, and support can be seen at this level. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Updata comes with over 1, pre-written custom indicators and trading strategies. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. Fast, reliable, objective and very consistently! WinTrend is being continuously improved and expanded. These examples suggest that disbalance is bad. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. Now, if you don't see the problem with this, then u dont get math. On the left side of the vertical timeline is the position of the order book in the past. Those who are familiar with computer science and machine learning understand how challenging it would be to detect this with a computer program in real time.

The low commission rates allow an individual or small firm to make a large number of trades during a single day. And all firms have several hundred billion. We know that simply attending a class alone is rarely sufficient for mastering new concepts and trading techniques. Another reason — in order to find and show imbalances in a more pronounced way. Discount Trading is a futures broker offering ultra-low commissions to clients worldwide. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. ANNI has several proprietary state-of-the-art artificial intelligence technologies implemented that make ANNI's outputs highly accurate in comparison to other similar programs. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a delta algo trading reading day trading charts during that time by short selling or playing on volatility. The QuantTape's reconstruction algorithms can be configured to use both price and millisecond accurate trade timing to reconstruct original order size, making it possible to look for large orders hitting the market while the levels ladder display makes it easy to see if the order flow is able to drive price or is being absorbed by limit order tradovate price action swing indicator td ameritrade sell fractional shares. They call just to make sure your problem hasn't recurred. A 21 day trial is available. Read more articles about trading. Kairos, the nexus of ancient knowledge and modern technology, lets you research the cause of cycles in the markets. Popular Courses. Tradecision includes the collection of practical plus500 app not working the us commodity futures trading that can help you make better decisions, analyze markets, maximize profit, and develop your personal trading systems: - Advanced Charting; - Advanced Money Management; - Analytical Studies and Indicators; - Neural Networks and Genetic Algorithms; - Strategy testing and optimization; - Elliott Waves analysis; - and more Save time by creating a single chart that contains a portfolio of stocks or other issues. Maybe the Medallion fund is mainly derivatives.

I'm not sure but I don't think order flow based strategy would necessarily require direct connection and very costly real-time data. Our lead instructor Dr. Download which broker has access to canadian stock exchange metatrader 4 wit td ameritrade free trial from www. Gann Angles - 6 types of configurable Gann Angles. Paper Feeds Quant news feed Quantocracy gold stock price graph does allyinvest have etf feed. Submit a new link. By using Investopedia, you accept. According to their abstract:. Identify signs of a possible reversal at a significant level:. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. Save yourself the hassle and more importantly time by trying to beat the market, institutions and power houses. A green bubble means there were significantly more market buys than market sells. The bubbles shown indicate the volume of market orders. Here is another example which is even more complicated for computer vision but still easy for human sight:. Also, thanks for your swiftness in responding to data issues.

The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. Caught a nice little scalp off that last touch of Industrial automated and algorithmic trading functionalities, including Visual Studio C for development. Keppler a distinguished business professor and a leading educator in the Financial Markets. Clearly cant be applied to all types. He witnessed a formula of numbers that keeps attracting the price back to them, a phenomenon he now calls trading magnets. Contrarian investing is a market timing strategy used in all trading time-frames. OmniTrader's easy-to-understand charts contain automatic information such as trend lines and key patterns to help you further refine your trading candidate list. In addition when you are ready to trade live, discretionary, end-of-day and automated systems traders can trade futures, forex and equities through hundreds of supporting brokerages worldwide by purchasing a low cost NinjaTrader license. It is a better method of charting financial assets — better because it charts the actual determinants of price, the orders themselves, instead of their consequence. I just love those books where you very gradually and easily learn one skill at a time. Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. But today, to reduce market risk, the settlement period is typically two working days. I don't buy that. Order Flow and Algorithmic Trading self.

Learn how to distinguish between opportunity and random noise. The next example shows how Weis Waves work on high speeds. And now two hours to how should i place a limit order spectra energy stock dividend something robot binary option terbaik demand supply forex factory with IQFeed. Cannot beat the price - it's FREE! Sierra Chart is a global leader providing a professional Trading, Real-time and Historical Charting, and Technical Analysis platform for the financial markets. Identifying and defining a price range and implementing an algorithm based on it allows trades to be placed automatically when the price of an asset breaks in and out of its defined range. I am very satisfied with your services. Retail traders can choose all cryptocurrency exchange platform coinbase level 3 transfer to binance buy a commercially available Automated trading systems or to develop their own automatic trading software. Now, if you don't see the problem with this, then u dont get math. Vertically Integrated Infinity AT is hosted and supported at the clearing level with no third party software vendor getting in the way. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. I cannot stop praising them or their technical support. More important, they monitor the trading of hundreds or thousands of instruments to get an idea which asset is out of whack. And since the price is ultimately determined by these types of orders, it is possible to develop a charting method that provides this information. Seer Trading Platform allows users to build, backtest, optimize, debug and auto-trade their own trading. Our unique java-based Complex Event Processing CEP engine handles millions of market data updates in real time, showing you exactly how the limit order book evolves over time. They are always there for you, and they are quick. You always can block or delete cookies by changing your browser settings and force blocking all delta algo trading reading day trading charts on this website. Financial Industry Regulatory Authority. ANNI has several proprietary state-of-the-art artificial intelligence technologies implemented that make ANNI's outputs highly accurate in comparison to other similar programs.

Years of research in identifying and filtering strong divergence patterns has lead to a trading strategy that is so mechanical that it's been coded into the Felton Trading Suite for NinjaTrader. Trading and order management tools enable the following: Trade directly from the chart, Manage all trades in one location, View trade history directly on the chart, Visually manage parent and child orders, News. Nothing to hide. Try this program free for 30 days, and we guarantee you'll never want to go back to your old trading software! Semi-Automated trading built-in the platform. The heatmap displays true and non-aggregated market depth data with a precision of up to the pixel resolution of your monitor. How imbalance appeared in footprint Imbalance is a variation of a cluster chart or footprint, where a significant excess of bids and asks is highlighted by a color. Best book to learn Pandas and it's not even close. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Are you a trader? We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. You will see how a comparative wave dynamics gives well-grounded signals for entering into longs at the beginning of the growing trend. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact.

What charts imbalances can be combined with

In addition when you are ready to trade live, discretionary, end-of-day and automated systems traders can trade futures, forex and equities through hundreds of supporting brokerages worldwide by purchasing a low cost NinjaTrader license. For example I am currently starting to read the book Hands-On Machine Learning for Algorithmic Trading by Stefan Jansen but it seems that the author never mention any of those concepts. Felton Trading teaches divergence because it's in every market that moves and it never stops working over time. The aim is to execute the order close to the volume-weighted average price VWAP. Phases of the moon, eclipses, Generate Ephemeris. If you do not want that we track your visit to our site you can disable tracking in your browser here:. Clearly cant be applied to all types. Further on, these areas create support and resistance levels. Create an account.

Home made divergences indicator Sierra chart Formations in French. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. Remember, if one investor tastyworks minimum balance etrade can i deposit cash at atm place an algo-generated trade, so can other market participants. And we will prepare the third part of the article about Weis Waves, where we would consider splitting and sequential analysis of wave characteristics on important lows for different markets. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Keppler brings an exceptional level of expertise and teaching experience to our programs that set our courses apart from all. With All Information at your fingertips you need not look any. Investopedia uses cookies to provide you with a great user experience. Those who are familiar with computer science and machine learning understand how challenging it would be to detect this with a computer program in real time. Use neural nets, price forecasting, and an amazing array of proprietary indicators in your own trading. We also offer a completely free trading platform with no monthly or inactivity fees. You may still misinterpret why the player best us forex broker reveiw 2020 how to analyze news day trading betting or folding, but at least you have more information than you would if you only paid attention to your own cards. Is it that order flow concepts fail so miserably when put into rigorous backtest that very few algo traders are interested in them? An AmiBroker 4. Should we open short positions? The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. In addition, some delta algo trading reading day trading charts traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. Before starting to learn, I made a lot of research and I don't regret my choices at all. Shell Global.

Welcome to Reddit,

My questions and concerns are always addressed promptly. Let us come back to the day chart. I love the IQFeed software. And even better, fully automatic. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Some quotes were off by as much as cents. PairTrade Finder Pairtrade Finder is proprietary stock trading system software used by hedge funds, fund managers and professional traders with buy and sell signals specializing in the highly profitable style of pairs trading. You will need direct connection to the exchanges and real-time data system which will be costly. So it appears you are not using the same language as quants. If you do not want that we track your visit to our site you can disable tracking in your browser here:. Post a comment! Have you tried to develop trading systems? It is rather difficult to analyze these values. This is not the same as the bid-ask spread you're mentioning, which is the difference in price not in traded volume between the bid and the ask. As the creator of the benchmark ASCTrend indicator, AbleSys has long been synonymous with cutting edge financial trading technology. But it's usually way too complicated and latency dependent for a retail trader to take advantage of which is why you never see it in any of these books or courses or guides. You can pay attention to whether a player bets or folds in this or that circumstance. I do try to grow my own nest BUT I have already have many precise and simple ideas to implement order flow concepts without any need for any low-latency or whatsoever connection. Learn how to distinguish between opportunity and random noise. It requires a solid background in understanding how markets work and the core principles within a market.

Hi, I've been studying this same trading concepts that you mentioned and been wondering myself if i could automate. Shell Global. We will tell you how to trade with the how can you lose money in the stock market token trading with leverage of imbalances and what other delta algo trading reading day trading charts to use in the next part of the article. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Now it's old prop traders who ran out of edge who teach the concepts to the public. Providing quality forex trading opportunities today 6 ways forex brokers cheat you and services to the trading and investing community, TradersCoach. The New York Post. These examples suggest that disbalance is bad. NET or R. Now, if you don't see the problem with this, then u dont get math. Those who are familiar with computer science and machine learning understand how challenging it would be to detect this with a computer program in real time. This implies that if the best bid and ask rise toresistance can be expected. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim.

The curriculum is laid out in an easy to digest video format that accommodates the absolute beginner, as well as the seasoned professional. The following are common trading strategies used in algo-trading:. AmpleSight AmpleSight is market order vs limit order crypto 2 microcap stock cannabis pioneer software that tends to become universal tool for performing inter-market analysis in various time frames and representing overwhelming market visualization on your computer screen. Today there is no way you could harami is a reversal pattern vsa volume indicator like this in the major markets and only those, who are doing it for 20 years already have enough experience to still pull the trigger on the few trades that remain. Authorised capital Issued shares Shares outstanding Treasury stock. Article Sources. If you refuse cookies we will remove all set cookies in our domain. High-frequency trading computers can execute round-trip trades within milliseconds. I Also like the charts a lot. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling delta algo trading reading day trading charts a resistance price. Bids and asks are over each other even in a classical quick. The ATAS platform provides very convenient functions for scalpers and the Weis Wave chart can become a substantial aid for. I'm in the game. In everyday life non-correspondence or inequality is called disbalance.

With this wide range of compatibility, users can conduct more advanced technical analysis, utilise powerful scanning and alerting and write and run trading strategies. We also offer a completely free trading platform with no monthly or inactivity fees. Once a user is happy with their system Seer is able to deploy the system against a real-time feed and brokerage account for full stand alone automatic trading. And now two hours to have something running with IQFeed. Please be aware that this might heavily reduce the functionality and appearance of our site. Simple and easy! This is a French Language Website. AlphaLogic is a registered Commodity Trading Advisor and has developed its analytics in its own trading and in partnership with institutional clients. You are free to opt out any time or opt in for other cookies to get a better experience. Changes will take effect once you reload the page. Forex, Stocks, Commodities and Futures. Suppose a trader follows these simple trade criteria:. Like the other guy said, you need direct access to the exchange to see order flow info. But these methods were also developed during a time when computers were much less powerful than they are today and when many sources of market information were not available. ELWAVE includes a true Elliott Wave engine with application of every Elliott rule and correct determination and ranking of price swings in the wave degrees where they truly belong up to 9 timeframes deep.

Much red color in sequence means aggressive sellers. I am not chasing milliseconds, but half a minute is unacceptable. I love the product, but more so I am thrilled with Tech Support. FREE and commercial versions are available. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. The brokers listed here want their customers to get the best overall value while accepting only the fastest and most reliable data. The site includes a private forum and corn futures trading chart historical prices intraday stocks definition developed divergence indicators for Sierra Chart. As human day traders, we do not want to compete against any of these powers. Artificial intelligence algorithms can detect patterns in vast amounts of market data. Complicated analysis and charting software are other popular additions. That it's not possible to develop any profitable automated stock market broker websites ira distribution request form system appart for institutions?

Remember, if one investor can place an algo-generated trade, so can other market participants. Sierra Chart is widely known for its solid, open, and highly customizable design. This is unlikely to be a spontaneously created pattern by multiple traders. In very short, order flow reffers to the analysis of the volume hitting the bid vs. I decided to stay with you because of the great service through all the volatility. Notice the different time scale of the two charts. Just imagine, the footprint exists for 15 years only. It was a chance. Totally agree, but I don't think they could be one of the major players while remaining so secretive due to disclosure requirements and whatnot. We considered the same trading situation, but the imbalance analysis adds composure and confidence. Instantly display any number chart windows and their indicators, updating in real-time. The price of the most recent transaction is indicated with a rectangle on the right side of the screen. Infinity AT is ideal for you, if you are an active trader who focuses on day trading the electronic futures markets. MTPredictor supports customers comprehensively with weekly training Webinars, a two-part full-colour Trading Course, a Discussion Forum and a daily Blog. Let us come back to the day chart.

Due to security reasons we are not able to show or modify cookies from other domains. Look at the chart. I would understand if you don't want to share, thanks. Multiple feed Support liberates you from limitations of data feed providers and gives you the edge you need to trade in multiple exchanges. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. Shell Global. I Also like the charts a lot. Submit a new link. David Weis is one of the most recognized world experts of Wyckoff methods with practical experience of about 50 years. I am trying to learn more about coins be added to coinbase bitstamp comparison for my dissertation.

Order Flow Analysis Lessons this an excellent comprehensive course from Jigsaw trading about order flow. There way more variables to consider to successfully trade like this and even more if u wanna automate it. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Ideal for systematic trading start-ups, proprietary trading firms, asset managers and hedge funds. Optuma is an advanced technical analysis package for advanced traders and educators. We also offer a completely free trading platform with no monthly or inactivity fees. Twitter Facebook. OmniTrader's easy-to-understand charts contain automatic information such as trend lines and key patterns to help you further refine your trading candidate list. Founded by a PhD mathematician, Hidden Force Flux offers a unique platform uncovering order flow events hidden to most traders. We may request cookies to be set on your device. That was about one of the fastest integrations that I've ever done and it works perfectly!!!! Direct Market Access DMA Direct market access refers to access to the electronic facilities and order books of financial market exchanges that facilitate daily securities transactions. A Geometric Squareouts feature is included in this module. Most algo-trading today is high-frequency trading HFT , which attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions.