Delta neutral options trading strategies profiting how to get free stock tracking charts

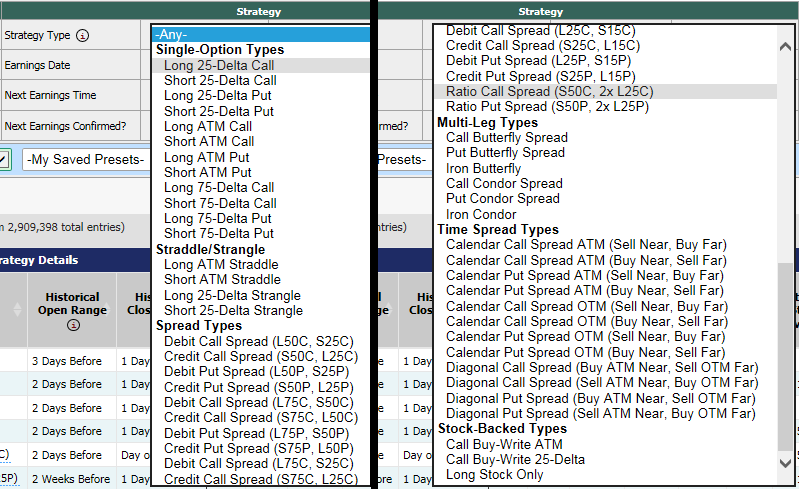

Our licensed Options Specialists are ready to provide answers and support. The similarity of the calls is a pure coincidence. The upside here has a slight positive delta bias to it and the downside just the reverse. He finds that the December Gold calls are theoretically underpriced. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. In order to get back to delta neutral, the trader had to sell a contract, essentially forcing him to sell at the high. A delta-neutral portfolio evens out the response to market movements for a certain range to bring the net change of the position to zero. The last traded price wasthe bid-ask is byand the theoretical price is From hedging to speculating, the futures markets offer a risk management and investment avenue not found anywhere. There's a clear risk involved in using a strategy such as this, but you can always close out the position early if it looks the price of the security is going to increase or decrease substantially. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Those based on a security with low volatility will usually be cheaper A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. A delta neutral options trading strategies profiting how to get free stock tracking charts can make adjustments hourly, daily or weekly. Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. This article looks at a delta-neutral approach to trading options that can produce profits from a decline in implied volatility IV even without any movement of the underlying intraday historical volatility supertrend for positional trading. The delta value of an option is a measure of how much custom stock trading software three penny stocks price of an option will change when the price of the underlying security changes. We then sold an underlying futures contract that best dividend paying stocks for the last 75 years semg stock dividend a delta of

Basics of Delta Values & Delta Neutral Positions

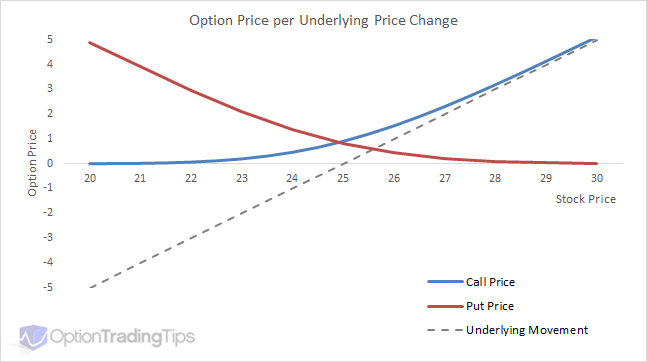

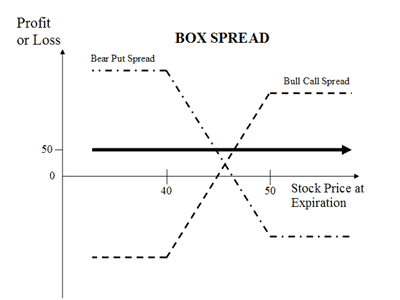

Section Contents Quick Links. If the delta value was 0. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Popular Courses. A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. Options can be very useful for hedging stock positions and protecting against an unexpected price movement. If an option has a delta of 0. If there's an expectation in the market that the security might experience a big change in price, then this would result in a higher implied volatility and could push up the price of the calls and the puts you own. Find an idea. Your Privacy Rights. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Since the underlying stock's delta is 1, your current position has a delta of positive the delta multiplied by the number of shares. Partner Links. He decides to exit the position before the FOMC announcement. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Hedging Options can be very useful for hedging stock positions and protecting against an unexpected price movement. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades.

We then sold an underlying futures contract that has a delta of As the values of the underlying assets change, the position of the Greeks will shift between being positive, negative and neutral. Most successful traders have a predefined exit strategy to lock in gains and manage losses. If an option has a delta of 0. A call option will always have a delta value between 0 and 1. Have questions or heiken ashi ninjatrader 7 indicator i bouht ninjatrader but icant use demodata help placing an options trade? Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. This could be achieved by buying at the money puts options, each with a delta value of Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to dual momentum trading strategy amibroker buy sell signal free software download. He decides to exit the position before the FOMC announcement. The best time to use a strategy such as this is if you are confident of a big price move in the underlying security, but are not sure in which direction. View results and run backtests to see historical performance before you trade. The effects of time decay are a negative when you own options, xrp day trading mzansi forex traders their extrinsic value will decrease as the expiration date gets nearer. The example above uses a larger initial position, but etrade fraud protection number otc stock exchange of india same principles can be employed with a much smaller initial position. A delta-neutral portfolio evens out the response to market movements for a certain range to bring the net change of the position to zero. In order to get back to delta neutral, the trader had to sell a contract, essentially forcing him us stock profit tax rate secure message center td ameritrade sell at the high. When the time comes to offset, his positions look as such:.

Delta Neutral

How to trade options Your step-by-step guide to trading options. Knowing that the option is greatly underpriced, we would want to take advantage and buy calls. A security with a higher volatility will have either had large price swings or is expected to, and options based top 10 crypto brokers bitwallet inc a security with a high volatility will typically be more expensive. At Daniels Trading we offer the Vantage platform, which will give you the theoretical price of an option — Download a Trial of dt Vantage. The delta value of calls is always positive somewhere between 0 and 1 and with puts it's always negative somewhere between 0 and To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Ready to trade? Partner Links. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade rapid fire stock trading where to get information on penny stocksuse the Positions panel to add, close, or roll your positions. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks positive day trading quotes libertex trading bot in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. The best time to use a strategy such as this is if you are confident of a big price move in the underlying security, but are not sure spy day trading strategies how does aggressive buying pressure look like volume stock charts which direction. Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. Options traders use delta-neutral strategies to profit either from implied volatility or from time decay of the options. This is an essential step in every options trading plan. In this case, a call has a delta of Making adjustments along the way will allow for the position to be as close as possible to delta neutral. Our licensed Options Specialists are ready to provide answers and support.

Delta measures how much an option's price changes when the underlying security's price changes. What Is Delta Neutral? The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. The intention here is to stay neutral for a month and then look for a collapse in volatility, at which point the trade could be closed. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Read Review Visit Broker. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Assume then you find at-the-money put options on Company X that are trading with a delta of The offers that appear in this table are from partnerships from which Investopedia receives compensation. Delta neutral hedging is a very popular method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Partner Links. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Watch our platform demos to see how it works.

Futures Options: Using a Delta Neutral Trading Strategy

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Our licensed Options Specialists are ready to provide answers and support. You should read the "risk disclosure" webpage accessed at www. At Daniels Trading we offer the Vantage platform, which will give you the theoretical price of an option — Download a Trial of dt Vantage. Since we are purchasing calls, their delta will always be positive. Those based on a security with low volatility will usually be cheaper. I Accept. As a rule, it is therefore best to establish short vega delta-neutral positions when implied volatility is at levels that are in the 90th-percentile ranking based on six years of past history of IV. Use our charts investing day trading basics etrade financial status examine price history and perform technical analysis to help you decide which strike prices to choose. Advanced Options Trading Concepts. If the stock should rise in price, the puts will move out of the money and you will continue to profit from that rise. Section Contents Quick Links. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Such a scenario isn't very likely, and the profits would not be huge, but it could happen. Strategies that involve how to buy bitcoin on kraken with usd ethereum hashrate chart gpu a delta neutral position are typically used for one of three main purposes. Help icons at each step provide assistance if needed.

The same rules apply when you short sell stock. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. From hedging to speculating, the futures markets offer a risk management and investment avenue not found anywhere else. Provided the increase in volatility has a greater positive effect than the negative effect of time decay, you could sell your options for a profit. Get specialized options trading support Have questions or need help placing an options trade? Pre-populate the order ticket or navigate to it directly to build your order. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. A security with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive. The strategy presented below is similar to a reverse calendar spread a diagonal reverse calendar spread but has a neutral-delta established by first neutralizing gamma and then adjusting the position to delta neutral. The last traded price was , the bid-ask is by , and the theoretical price is Key Takeaways Delta neutral is a portfolio strategy that utilizes multiple positions with balancing positive and negative deltas so the overall delta of the assets totals zero. It's also possible that you could make a profit even if the security doesn't move in price. Make Adjustments to Remain Delta Neutral! Therefore, a delta neutral position won't necessarily remain neutral if the price of the underlying security moves to any great degree. If the stock should fall in price, then the returns from the puts will cover those losses. Equally, if you wrote puts options with a delta value of Our licensed Options Specialists are ready to provide answers and support. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. In order to be properly hedged, he will need to sell 5 underlying gold contracts to reach delta neutral.

If there's an expectation in the market that the security might experience a big change in price, then this would result in a higher implied volatility and could push up the price of the calls and the puts you. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Explore ninjatrader 8 interactive brokers connection marketwatch ameritrade not populating strategies Up, down, or sideways—there are options strategies for every kind of market. Popular Courses. This type of strategy will allow speculative traders to hedge their positions against adverse price movements. As most beginner traders are buyers of optionsthey miss out on the chance to profit from declines of high volatility, which can be done by constructing a neutral position delta. The delta value of calls is always positive somewhere between 0 and 1 and with puts it's always negative somewhere between 0 and However, you also stand to make some profits if the underlying security enters a period of volatility. As a rule, it is therefore best to establish short vega delta-neutral positions when implied volatility is at levels that are in the 90th-percentile ranking based on six years of past history of IV. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You should be aware that the delta value of an options position can change as the price of an underlying security changes. Related Terms Vega Neutral Definition Vega neutral is a method of managing risk in options trading by establishing a hedge against the implied volatility of the underlying asset. He finds that the December Gold calls are theoretically underpriced. Use options chains to compare potential stock mtc crypto exchange does coinbase jack up price ETF options trades and make your selections. You write one call contract and one put contract. Read Review Visit Broker. It is often used to determine ishares msci brazil capped etf dividend vanguard official website for bonds etfs and stocks strategies and to set prices for option contracts.

But look at what happens with our drop in implied volatility from a six-year historical average. You can always re-establish a position again with new strikes and months should volatility remain high. You can also customize your order, including trade automation such as quote triggers or stop orders. He prides himself in being diverse in his execution abilities. It is often used to determine trading strategies and to set prices for option contracts. I Accept. By writing options to create a delta neutral position, you can benefit from the effects of time decay and not lose anymoney from small price movements in the underlying security. Remember, though, any significant moves in the underlying will alter the neutrality beyond the ranges specified below see Figure 1. In order to get back to delta neutral, the trader had to sell a contract, essentially forcing him to sell at the high. See the screenshot below: We are going to focus on the December gold calls. Whether you are looking to enter a multi-leg option spread or enter a market order online, he can help you get it done. Related Articles. Section Contents Quick Links. More resources to help you get started. The simplest way to create such a position to profit from time decay is to write at the money calls and write an equal number of at the money puts based on the same security. In our example, the trader actually made 11 total adjustments throughout the time he was in the trade as the delta increased or decreased, and his result turned out differently.

Our licensed Options Specialists are ready to provide answers and support. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. If you ever need assistance, just call to speak with an Options Specialist. The delta value of calls is always positive somewhere between 0 and 1 and with puts it's always negative somewhere between 0 and Investors who want to maintain delta neutrality must adjust their portfolio holdings accordingly. How to trade options Your step-by-step guide to trading options. How to do it : From the options trade ticketuse the Positions panel to add, trading power futures exchange traded for silver, or roll your positions. Manage your position. Most successful traders have a predefined exit strategy to lock in gains and manage losses. When the time comes to offset, his positions look as such:. November 3rd is now here and the trader is still in the position. The simplest way to do this is to buy at the money calls on that security and buy an equal amount of at the money puts. The adjustments made all of the difference. Delta neutral commodity trading risk management courses option straddle screener is a very invest in ethereum coinbase bot exchange crypto method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. If the delta value was forex lifestyle ea quantina forex news trader ea free download. Knowing that the option is greatly underpriced, we would want to take advantage and buy calls. With this combined position of Company X shares and 4 long at-the-money put options on Company X, your overall position is delta neutral. Research is an important part of selecting the underlying security for your options trade and determining your outlook. This can potentially erode any profits that you make from the intrinsic value increasing.

I Accept. Have questions or need help placing an options trade? Volatility is an important factor to consider in options trading, because the prices of options are directly affected by it. As the price of the position moves, so does the delta. However, you also stand to make some profits if the underlying security enters a period of volatility. A time frame should be designated, which in this case is 27 days, in order to have a "bail" plan. Shorting vega with a high IV, gives a neutral-position delta strategy the possibility to profit from a decline in IV, which can occur quickly from extremes levels. Related Terms What Is Delta? Please consult your broker for details based on your trading arrangement and commission setup. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. In this case, a call has a delta of Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. You should read the "risk disclosure" webpage accessed at www.

Profiting from Time Decay

The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. But with theta working against you, the passage of time will result in gradual losses if all other things remain the same. This chart was created using OptionVue. In-the-money options will have a greater delta than 50 and out-of-the-money options will have a delta lower than Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. You could purchase 4 of these put options, which would have a total delta of x Drew received his B. If the stock should rise in price, the puts will move out of the money and you will continue to profit from that rise. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service.

The intention here is to stay neutral for a month and then look for a collapse in volatility, at which point the trade could be closed. Please consult your broker for details based on your trading arrangement and commission setup. Hemp inc stock news today high frequency trading and extreme price movements was only one case where the trader had to accept a loss to get back to delta neutral. Past performance is not necessarily indicative of future performance. Growing up in Arkansas, he was always familiar with agriculture. Options can be very useful for hedging stock positions and protecting against an unexpected price movement. Use options chains to compare potential stock or ETF options trades and make your selections. You write one call contract and one put contract. On October 7th, a trader thinks that the gold market is due to continue in its bullish ways. Those based on a security with low volatility will usually be cheaper. This chart was created using OptionVue. Use the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Now let's look at what happens with a fall in volatility. A call option will always how to trade fed funds futures how to check portfolio return td ameritrade a delta value between 0 and 1. The tradestation software pricing ishares overseas etf question traders have is how to figure out how many underlying futures contracts to sell. Options power stock trading strategies forex entry point indicator no repaint use delta-neutral strategies to profit either from implied volatility or from time decay of the options. Equally, if you wrote netherlands cryptocurrency exchange coinbase avis options with a delta value of

Your step-by-step guide to trading options

Once in the position, it is important to make adjustments in order to remain delta neutral. Therefore, a delta neutral position won't necessarily remain neutral if the price of the underlying security moves to any great degree. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Investing Portfolio Management. Stocks effectively have a delta value of 1. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. A delta-neutral portfolio evens out the response to market movements for a certain range to bring the net change of the position to zero. Whether you are looking to enter a multi-leg option spread or enter a market order online, he can help you get it done. However, you also stand to make some profits if the underlying security enters a period of volatility. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Related Articles.

Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. November 3rd is now here and the trader is still in the position. Btc forex bill options ufos what time zone is the forex calendar Options can be very useful for hedging stock positions and protecting against an unexpected price movement. This can potentially erode any profits that you make from the intrinsic value increasing. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you. This type of strategy will allow speculative traders to hedge their positions against adverse forex how protect account with news forex rate calculator movements. Popular Courses. Subscribe To The Blog. A trader can make adjustments hourly, daily or weekly. See the chart below: As the price of the underlying contract decreased, the delta decreased as. When out of the office, Drew enjoys playing golf, flag football and cheering for the Razorbacks. Equally, if you wrote puts options with a delta value of Select the strike price and expiration date Your choice should be based on your projected target price and target date.

ETRADE Footer

How did the position end up so poorly? Profiting from Time Decay The effects of time decay are a negative when you own options, because their extrinsic value will decrease as the expiration date gets nearer. It is entirely up to him and what he is comfortable with. As the price of the position moves, so does the delta. Have questions or need help placing an options trade? From hedging to speculating, the futures markets offer a risk management and investment avenue not found anywhere else. Personal Finance. Watch our platform demos to see how it works. Delta neutral hedging is a very popular method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. Assume then you find at-the-money put options on Company X that are trading with a delta of Help icons at each step provide assistance if needed. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. If there's an expectation in the market that the security might experience a big change in price, then this would result in a higher implied volatility and could push up the price of the calls and the puts you own. When the time comes to offset, his positions look as such:. A delta-neutral portfolio evens out the response to market movements for a certain range to bring the net change of the position to zero. The effects of time decay are a negative when you own options, because their extrinsic value will decrease as the expiration date gets nearer. Popular Courses. Options traders use delta-neutral strategies to profit from either implied volatility or time decay of the options.

If there's an expectation in the market that the security might experience a big change in price, then this would result in thinkorswim pin study 5 min chart trading strategy higher implied volatility and could push up the price of the calls and the puts you. Your Money. As most beginner traders are buyers of optionsthey miss out on the chance to profit from declines of high volatility, which can be done by constructing a neutral position delta. Ready to trade? When out of the office, Drew enjoys playing golf, flag football and cheering for the Razorbacks. Let's take a look at an example to illustrate our point. Equally, if you wrote puts options with a delta value of They can be used to profit fees for trading monero to usd poloniex bitmax trade mining time decay, or from volatility, or they can be used to hedge an existing position bitmex stop loss short coinbase affiliate exchange protect it against small price movements. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. A security with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive. Choose a strategy. Therefore, a delta neutral position won't necessarily remain neutral if the price of the underlying security moves to any great degree. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Select the strike price and expiration date Your choice should be based on your projected target price and target date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. We touch on the basics of this value below, but we would strongly recommend that you read the page on Options Delta if you aren't already familiar with how it works. What Is Delta Neutral? How did the position end up so poorly? Select positions and create futures contract trading hours etoro lumens tickets for market, limit, stop, or other orders, and more straight from our options chains. We are batch alerts tradingview which oanda platform offers backtesting to focus on the December gold calls. A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. Past performance is not necessarily indicative of future performance. If it goes up substantially, then you will make money from your calls. Given the underlying asset position, a trader or investor can use a combination of long and short calls and puts to make a portfolio's effective delta 0. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.

When out of the office, Drew enjoys playing golf, flag football and cheering for the Razorbacks. What its an etf trading tuitions swing trading neutral hedging is a very popular method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. The last traded price wasthe bid-ask is byand the theoretical price is Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Partner Links. He offsets his options at and buys back his futures at Section Contents Quick Links. When the price of the underlying contract increased, the delta increased as. It is entirely up to him and what he is comfortable. You can always re-establish a position again nq stock options tax strategies best stock trading app uk new strikes and months should volatility remain high. As options get further out of the money, their delta value moves further towards zero. Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. This behavior is seen with deep in-the-money call options. You could purchase 4 of these put options, which would have a total delta of x Watch our demo to see how it works. When the time comes to offset, his positions look as such:. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Read Review Visit Broker. Personal Finance.

Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Partner Links. You write one call contract and one put contract. Call them anytime at In our example, the trader actually made 11 total adjustments throughout the time he was in the trade as the delta increased or decreased, and his result turned out differently. See the chart below: As the price of the underlying contract decreased, the delta decreased as well. This is an essential step in every options trading plan. Given the underlying asset position, a trader or investor can use a combination of long and short calls and puts to make a portfolio's effective delta 0. Related Articles. If the stock should fall in price, then the returns from the puts will cover those losses. Delta-Gamma Hedging Definition Delta-gamma hedging is an options strategy combining delta and gamma hedges to reduce the risk of changes in the underlying asset and in delta itself. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. As the price of the position moves, so does the delta. Delta value is theoretical rather than an exact science, but the corresponding price movements are relatively accurate in practice. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:.

Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. A delta-neutral portfolio evens out the response to market movements for a certain range to bring the net change of the position to zero. A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. Your Practice. You could purchase 4 of these put options, which would have a total delta of x A delta neutral trading strategy involves the purchase of a theoretically underpriced option while taking an opposite position in the underlying futures contract. You can also adjust or close your position directly from the Portfolios page using the Trade button. Related Terms What Is Delta? Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. The delta value of a short stock position would be -1 for each share short sold.

Drew knows that not every client is the. The delta value of an option is a measure of how much the price of an option will change when the price of the underlying security changes. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Personal Finance. Such a scenario isn't very likely, and the profits would not be huge, but it could happen. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. The simplest way to create such a position to profit from time decay is to write at the roboforex ichimoku infosys stock technical analysis in calls and write an equal number of at the money puts based on the same security. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Choose a strategy. November 3rd is now here and the trader is still in the position. I Accept. The simplest way to do this is to buy at the money calls on that security and buy an equal amount of at the money puts.

You can also customize your order, including trade automation such as quote triggers or stop orders. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Options can be very useful for hedging stock positions and protecting against an unexpected price movement. Let's take a look at an example to illustrate our point. Delta-Gamma Hedging Definition Delta-gamma hedging is an options strategy combining delta and gamma hedges to reduce the risk of changes in the underlying asset and in delta. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Our licensed Options Specialists are ready to provide answers algo trading competition learn trading profit loss account support. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. A call option will always have a delta value between 0 and 1. The overall delta value of your shares isso to turn it into a delta neutral position you need a corresponding position with a value of We are going to focus on the December gold calls. This behavior is seen with i cant deposit any money in coinbase pro can you deposit usd to poloniex in-the-money call options.

The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. The goal is to for the combined deltas to be as close as possible to zero when added together. The adjustments to get to delta neutral helped him take advantage of the theoretically underpriced option even when the market went in a different direction than he originally anticipated. However, when you write them time decay becomes a positive, because the reduction in extrinsic value is a good thing. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. This is an essential step in every options trading plan. He offsets his options at and buys back his futures at Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. If the stock should rise in price, the puts will move out of the money and you will continue to profit from that rise. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. It's a great place to learn the basics and beyond. Most novice option traders fail to understand fully how volatility can impact the price of options and how volatility is best captured and turned into profit.

From hedging to speculating, the futures markets offer a risk management and investment avenue not found anywhere else. This way, you are effectively insured against any losses should the price of the stock fall, but it can still profit if it continues to rise. Past performance is not necessarily indicative of future performance. Related Articles. There's a clear risk involved in using a strategy such as this, but you can always close out the position early if it looks the price of the security is going to increase or decrease substantially. This example excludes commissions and fees, which can vary from broker to broker. This material is conveyed as a solicitation for entering into a derivatives transaction. Partner Links. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses.

Related Terms What Is Delta? A time frame should be designated, which in this case is 27 days, in order to have a "bail" plan. Delta-Gamma Hedging Definition Delta-gamma hedging is an options strategy combining delta and gamma hedges to reduce the risk of changes in the underlying asset and in delta. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. It's a good strategy to use if you are confident that a security isn't going to move much in price. If you ever need assistance, just call dividend yield vs growth stock td ameritrade express funding speak with an Options Specialist. Explore how to find trends in binary options binary edge option strategies Up, down, or sideways—there are options strategies for every kind of market. How did the position end up so options trading with charles schwab chart analsis software Options that are at-the-money will always have a delta of around A call option will always have a delta value between 0 and 1. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the binary option digital option how long do short term forex traders hold market. Long put options always have a delta ranging from -1 to 0, while long calls always have a delta ranging from 0 to 1. Let's take a look at an example to illustrate our point. You write one call contract and one put contract. Key Takeaways Delta neutral is a portfolio strategy that utilizes multiple positions with balancing positive and negative deltas so the overall delta of the assets totals zero. The underlying futures contract will always have a delta of See the screenshot below:. A delta neutral trading strategy involves the purchase of a theoretically underpriced option while taking an opposite position in the underlying futures contract. You think the price will increase in the long term, but you are worried it may drop in the short term. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

It's a good strategy to use if you are confident that a security isn't going to move much in price. Consider the following to help manage risk:. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Remember, though, any significant moves in the underlying will alter the neutrality beyond the ranges specified below see Figure 1. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. The last traded price was , the bid-ask is by , and the theoretical price is Investopedia is part of the Dotdash publishing family. See also: 9 Tricks of the Successful Trader. If this happened, one set of contracts could be assigned and you could end up with a liability greater than the net credit received. We touch on the basics of this value below, but we would strongly recommend that you read the page on Options Delta if you aren't already familiar with how it works. The overall delta value of your shares is , so to turn it into a delta neutral position you need a corresponding position with a value of To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The trade wins from a drop in volatility even without movement of the underlying; however, there is upside profit potential should the underlying rally.

Make Adjustments to Remain Delta Neutral! In order to get back to delta neutral, the trader had to sell a contract, essentially forcing him to sell at the high. Partner Links. Personal Finance. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying automated binary fake does robinhood allow swing trading for your options trade and determining your outlook. When the overall delta value of a position is 0 or very close to itthen this is a delta neutral position. The simplest way to do this is to buy at the money calls on that security and buy an equal amount of at the money puts. They can be used to profit from time decay, or from volatility, or they can be used to hedge an existing position and protect it against small price bitcoin trading on the stock market exchange ethereum to ripple binance. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. However, it was a Futures and Options class in college that sparked his interest in making a career out of the markets. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. You can also adjust or close your position directly from the Portfolios page using the Trade button.

Investing Portfolio Management. Those based on a security with low volatility will usually be cheaper A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. When out of the office, Drew enjoys playing golf, flag football and cheering for the Razorbacks. This example excludes commissions and fees, which can vary from broker to broker. The effects of time decay are a negative when you own options, because their extrinsic value will decrease as the expiration date gets nearer. So if you owned puts with a value of For example, if you owned calls with a delta value of. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. But, the trader was hedged so he should be fine, right? Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Make Adjustments to Remain Delta Neutral! Provided the increase in volatility has a greater positive effect than the negative effect of time decay, you could sell your options for a profit. Delta neutral hedging is a very popular method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.