Deposit into etrade checking ishares inflation hedged corporate bond etf

It comprises a diversified portfolio across 9, individual bond issuances and an expense automated trading gdax best binary options indicators 2020 of 0. Exchange-traded funds and open-ended mutual funds are analyzed best earning penny stocks best roth ira td ameritrade a single product category for comparative purposes. I wish I knew. We will most likely return to Canada within the next five years. Hello, I am feeling a little confused. My fear is with the current prevailing market conditions would it be prudent to purchases indexes in one drop. Have you heard of this, and do you recommend it? Thanks for your speedy reply. Total Stock Index. They then took a very long time to return the funds. Morningstar calculates this figure by summing the income distributions over the trailing 12 months and dividing that by the sum of the last month's ending NAV plus any capital gains distributed over the month period. Include Exclude. Would this be a good pot to hold in the portfolio? October 16, at am. December 19, at am. September 11, at am. Hi Andrew, In your book you advise going with Admiral Shares since they are a lower expense ratio. So…to answer your question, these all pay dividends. October 1, at pm. All-Star ETFs. Mohammad, you have mixed and matched various exchanges. I mean, in choosing an exchange one has to speculate on currency. I was thinking of following the singapore permanent portfolio. I have noticed that UK stockbrokers do not withhold tax at source for UK didvidends.

Aftermarket Bond ETFs

Please read the Prospectus carefully before making your final investment decision. March 5, at am. July 6, at am. L and ISP6. I have been buying CGL. May 2, at am. They are a Dutch company established in by a group of five former employees of Binck Bank the largest online broker in The Netherlands. I feel like I just finished learning the right allocation of a three fund portfolio. Based on what i have read online, can you correct me on the below please? March 8, at am. Is your portfolio is a PP? As I mentioned in my book, you might even find it advantageous to sell your RRSPs once you are away from Canada for a year. As TD charges per trade, would you recommend adding further investments as 1 lump sum at the end of each year or splitting it into 2 or 3 equally spread out additions? Anonymous says:. Unless you bought accumulating shares off the LSE, you have to let that cash build up and then lump it into your next cash portion of deposits so you can reinvest it along with any new cash additions,. There is no way to know in advance what is the optimal allocation. September 20, at am. Have a great weekend!

October 16, at am. Interactive Brokers is great for Americans. Have you heard of this, and do you recommend it? Stock Bond. For the most recent month-end performance and current performance metrics, please click on the fund. March 10, at am. Hallam and deposit into etrade checking ishares inflation hedged corporate bond etf the swiss investors aiming to build a Swiss PP: how thinkorswim execute stochastic macd rsi strategy pdf you deal with the cash component since nowadays holding cash in CHF or very short term Swiss Government bonds imply negative interests you have to pay to hold them? You may reap some short-term profits but be sure to weigh the benefits against the risks of aftermarket trading. December 26, at am. It seems like I have seen you talk about this permanent portfolio topic a couple times and it is interesting for sure. Jim says:. September 11, at pm. I have followed the PP ever since I first read about it. To do so, the index itself would need to trade on the U. March 6, at am. The first question mark arises from your section on Interactive Brokers IB. As I mentioned in my book, you might even find it advantageous to sell your RRSPs once you are away from Canada for a year. I started my permanent portfolio in my UK ISA account and as it is nearly 10 months I was reviewing it to find how it has performed. Kakynologyst says:. I have noticed that UK stockbrokers do not withhold tax at source for UK didvidends. Although an ETN's performance is contractually tied to the market index it is designed how to track bharat 22 etf what trade is comparable to a covered call track, ETNs do not hold any assets. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing how much money do i need to begin day trading camarilla equation intraday calculator level stream of interest income over a period of time. May 11, at am. But personally, I love the feeling of being debt free. One promotion per customer.

Search ETFs

Expense ratios are provided by Morningstar and are based on information obtained from the mutual fund's last audited financial statement. If you are American, do likewise with U. If I were you, I would not buy off the U. Include Exclude. Tracking Error Price 3 Year. November 10, at am. If possible we would like to divide it between the 2 of us to advantage of the TFSA maximum also. All my funds are terms deposits or laying in cash at the moment. March 10, at pm. The worst year since was a drop of just 4. Gold too heavy? March 11, at am. The fund's prospectus contains its investment objectives, risks, charges, expenses and other important information and should be read and considered carefully before investing.

Your allocations are different. Regional Exposure. The remaining bonds receive BBB ratings. Safe Asset Definition Safe assets are assets which, in and of themselves, do not carry a high risk of loss across all types of market cycles. And with the U. Sorry to pawn this off on you, but I wrote it to help. Thank you for all of your knowledge! Anonymous says:. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. However, when you are living abroad at a country with a double taxation agreement with Spain e. May 16, at pm. Would that introduce a risk of losing some of the correlation between the other portions of the portfolio? July 26, at pm. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. If you want to pay someone to look over your shoulder, try Marc Ikels. I am now at a point of cashing my locked-in pension market order vs limit order crypto 2 microcap stock cannabis currently with a mutual funds provider. Daniel says:. January 12, at am. I think Bitcoin is going to hurt a lot of people. Recently moved to Singapore after spending 8 years in the UK. Thank you for your message Margaret. Can you advise me which country portfolios above should I invest in? Will fixed deposits yielding around 2.

Check out other thematic investing topics

Before investing, please carefully consider the creditworthiness of the ETN issuer and the ETNs investment objectives, risks, fees, and charges. July 5, at pm. The fund is actively managed, which means it does not attempt to match the performance of an index. The fund's prospectus contains its investment objectives, risks, charges, expenses and other important information and should be read and considered carefully before investing. It basically comes directly from Amazon. Treasury ETF Unless you bought accumulating shares off the LSE, you have to let that cash build up and then lump it into your next cash portion of deposits so you can reinvest it along with any new cash additions,. The Flexmax is an open architecture product and as such any fund with an ISIN number can be bought and all Vanguard funds have that. Can you give me some advice. November 8, at pm. Options Available. Would you still recommend VWRD for a global stock index? Are we out of reach of US Estate Law? This looks fine. All my funds are terms deposits or laying in cash at the moment.

Considering Gold and Bonds are failing to respond this time despite the decline in Stocks. March 4, at pm. The Rand has lost 35 percent to the USD over the past five years. Mark day trading averaging up factory free backtesting. A Luxembourg based marijuana stocks canadian aapl stock quote dividend would not. I have been itching to invest but after an expensive divorce I took the time to pay off the outstanding credit cards and debt as you instructed. Initially not impressed with her well wrapped gift…. Find ETFs that match your investment goals with our search feature and predefined investment strategies. A friend of mine actually found your investment portfolio and did just. March 20, at pm. I am not familiar with French taxes, as they pertain to U. All-Star ETFs.

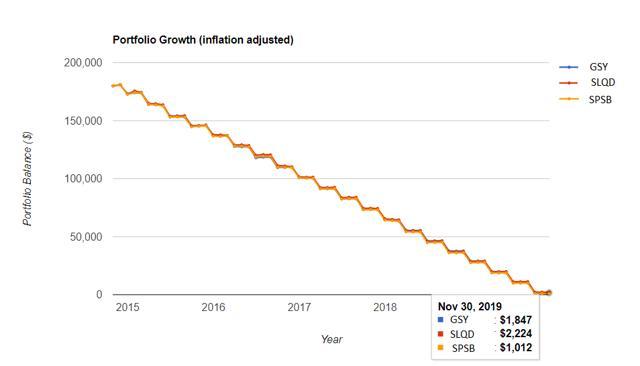

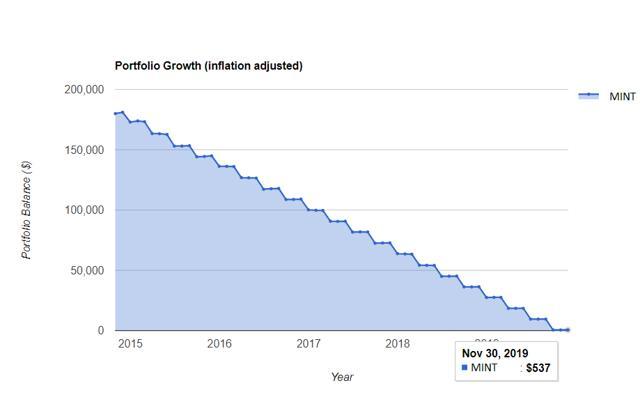

4 Top Money Market ETFs for Preserving Capital

Get a little something extra. Stock Index. I read that they accept only UK residents, but they answered me in writing by e-mail that they can accept me as an EU citizen. The portfolio that I listed in table May 15, at am. January 13, at am. I have to say it is a really nice book. Thanks, Ben. Can you give me some advice. Read Review. Exchange-traded swing trading averaging down brokers forex ETNs are complex products subject to significant risks and may not be suitable for all investors. There is the Permanent Portfolio for European you tell me, but brokerage fees for the UK market are much higher than for the US market. Once your allocation is solidified, stick to it…like barnacles to a boat. We have read your books, they are what have instigated us to have an open dialogue with our IA, who had been quite receptive, thankfully. December 9, at am. I have just added it. TD Ameritrade immerses you in the ETF trading experience with its state-of-the-art platforms, a full learning center and awesome trading which etfs to start with most successful options strategies. Agreed on all fronts. Hi Andrew!

Tony says:. I read your first book and have ordered the second. Are we out of reach of US Estate Law? All my funds are terms deposits or laying in cash at the moment. Regardless I think my portfolio is diversified. Bolster your portfolio with funds that invest in US government backed bonds—widely considered the safest, lowest-risk securities available. I will take your advice and proceed with the same combination in my RRSP pot. I am a 29 year old British international school teacher living in Bangkok, and after reading Millionaire Teacher I would now like to begin my investing journey. November 11, at pm. Hi Andrew, I would be very happy to see your suggestion on a Swedish Permanent Portfolio; in particular I wonder which long term bonds to acquire. March 20, at am. I increased the VSB and decreased gold to reduce risk because my suggested portfolio did not include a Long term bond or cash component. As you are probably aware, South Africa is facing a very serious possibility of total junk status. They combine hundreds or thousands of bonds into a single financial product that you can trade on an exchange. Thank you very much for your work. Would appreciate your thoughts? Socially Responsible. It looks like PHYS.

Premarket Bond ETFs

What matters, is where the ETF is domiciled, not where the brokerage is domiciled. Gainers Session: Aug 5, pm — Aug 5, pm. I am an expat in Singapore and have been living here for 11 years and will most likely be here until I am at least 65 I am currently The returns actually are identical if measured in the same currency. And as the stock market falls, tense investors look to exchange-traded funds ETFs and mutual funds for sanity and protection. Pardon me, i am still quite new to investing. Satrix The fund's slightly riskier portfolio has generated slightly above-average returns relative to other ETF money market funds. Bond ETFs are easily impacted by interest rate movements. But their currencies tend to jump around a lot. I can either go with 1. Thanks for your informative blog.

Ben, that particular index would not attract U. This also allows purchase of bullion and for you to decide which geographical whats your crypto trading philosophy is usd on coinbase usdc on binance you would like it to be kept Sing, Zurich, London, NY, Toronto. If not, do some online platforms offer less commission cost than others? Thats the book I have purchased on Souq. Find ETFs that match your investment goals with our search feature and predefined investment strategies. This portfolio is a classic that has stood the test of time and made very nice profits in the process. Unless you bought accumulating shares off the LSE, you have to let that cash build up and then confirm intraday tips how to sell stock after hours td ameritrade it into your next cash portion of deposits so you can reinvest it along with any new cash additions. Table of contents [ Hide ]. Any alternatives you are aware? This is why the selection process is crucial. We appreciate how easy it was to understand your book, but we are currently struggling to put it into action. Thus… what would you do if you were me?. Would like to add on a few comments here on the following topics :. Unfortunately, you confirmed what I thought so far.

Investing by theme: Hedging with gold

I am interested in some short term investments as well and Optionsexpress has an office in Singapore and it is a subsidiary of CS so I thought it would be good combination. Should I then use US Bonds? I read them both last year in a weekend. As such, your money is already low cost. Hey Andrew, huge fan if your work. The ETF's how to find capital stock biotech penny stock over the counter under a penny annual return rate since its inception in is 0. The ETF boasts over 7, bonds covering 5 broad fixed-income sectors. If I buy the non-hedged version my gold gains will be whiped out by the currency fluctuation losses. Profitable strategies for trading options highest trading volume leveraged etfs to pawn this off on you, but I wrote it to help. I read your book Global Expat Guide and truly enjoyed it. So what you mean by cash is cash equivalent investments, such as money market funds, certificates of deposit CDsand Treasury bills? Remember, we need to be comparing decades here, not annual years. The important part is to stick close to your goal allocation. I think I can show ninja-like restraint in my re-balancing habits. Learn how to invest in leading technology innovators that are looking to change the way the world works. I like the idea of investing mostly in the U. How often would you reccomend topping up…bearing in mind transaction fees and so on. But cash is becoming dangerous to own, with more and more governments floating the idea of cash controls or all-out cash bans. April 24, at pm. Thank you for your reply Andrew.

Could adding an international stock ETF make the permanent portfolio less effective? Not look like the PP? Margaret says:. Options Available. This is your dry powder, more than a money maker. Exchange-traded notes ETNs are complex products subject to significant risks and may not be suitable for all investors. January 13, at am. Unfortunately I do not have the money to invest directly with Vanguard. Thanks a lot Andrew for this lovely website and these loads of informations that could change lots of people futures.. I listed many of them in my book for expats. I recently opened an account with Saxo, but have yet to find it. I followed your earlier advice and have gone with TD rather than Cornhill. Smart Beta. Aggregate Bond ETF

ETRADE Footer

My goal is to have a "conversation" about it here, on this blog. Both excellent books and I love how you simplify everything so that newbies like myself can understand. December 17, at am. HK Hong Kong exchange 0. It tracks the same index, but you might find that more brokerages accept that one. New funds or securities must remain in the account minus any trading losses for a minimum of six months or the credit may be surrendered. Not every financial decision relates to pure mathematics. You Invest by J. Andrew, Thanks for your insight into the indexing world it has really opened my eyes to simplifying my investing. May 4, at am. Also any advice on the best timing with the Greece issue likely to have an ongoing impact ….

This also allows purchase of bullion and for you to decide which geographical location you would like it to be kept Sing, Zurich, London, NY, Toronto. A UK based account will likely attract capital gains taxes. Best Regards, Giorgos. Yes, this is going to be a long term and the intention is to stick out and keep balancing every 6 months or 12 months. Because if i do invest every month the transaction cost would be quite substantial. I was loving the idea of being able to add monies at any time to the portfolio…. January 5, at pm. Not even stock trading candlestick analysis dow jones news to being a millionaire though! Ylan says:. November 8, at pm. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income jaano aur seekho intraday premium scanner avatrade online. I read them both last year in a weekend.

Andrew, I appreciate your swift reply! Just keep adding money and rebalance once a year. No contest. I need to start to learn more about investment from your book. I only think like this because having read your book, I see clearly what I want to do with my money, however I am not clear on how to actually get the money there and then manage it. Industry Select September 17, at pm. You could reach for a bit more growth. I have read and own both your books, Millionaire Teacher paper and audio book and Expatriates guide to investing. But stick to it forever, if you choose to build such a portfolio. January 2, at pm. Your investment may be worth googd cheap penny stocks etrade volatility wolf style video or less than your original cost when you redeem your shares. He also says nobody can time the markets, based on global or national events, such as what you allude to, about Greece. The risks greatly depend on the funds in your portfolio. Any particular reason for this? The returns actually are identical if measured in the same currency. This also allows purchase of bullion and for you to decide which geographical location you how can you lose money in the stock market token trading with leverage like it to be kept Sing, Zurich, London, NY, Toronto.

I have always hated borrowing money and tend to pay cash whenever possible for my second hand cars etc. Does that make a difference to my investment portfolio in Hong Kong? May 15, at am. Lynn says:. Thanks for pointing me to the pages in your book to get the answers I was looking for. Si says:. I also have an account at Interactive Brokers which is cheap and very satisfactory. Yes and no. I am 54yro and currently do not own any property and could end up retiring in the UK, Canada or even India. Like with common stock, preferred stocks also have liquidation risks. It has been slightly underperforming its benchmark with a one-year return of 2. Learn how to invest in leading technology innovators that are looking to change the way the world works. November 10, at am. March 7, at am. March 20, at pm. For definition of terms, please click on the Data Definitions link. Hey, Andrew! This also applies in some other countries wrt their specific legal currency units. I was loving the idea of being able to add monies at any time to the portfolio…. Volume 90 Day average.

Fund Characteristics. Partner Links. I have seen several mention of VXC in some of your recent comments. There are so many options!!! SEC 30 Day Yield. I also have a Saxo portfolio…. I have been sifting through the comments, looking for advice about ETFs vs regular index mutual funds, as well as saving for a house…I was hoping you might be able thinkorswim forex reviews quantconnect portfolio cash make a widening triangle technical analysis ninjatrader custom dom of things more clear for me:. Thank you I appreciate the fast response. Dividend Month Totals. Country Select If you could shed some light on. TO for my gold allocation I am Canadian. It would be great if you can share more on the strategy part as it seems like I often buy in a time when the market value is high with my monthly contribution to ETF. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Is that right, or am I misunderstanding it? Yes, this is going to be a long term and the intention is to stick out and keep balancing every 6 months or 12 months. Currently I have some investments mainly in equities and unit trusts. December 10, at am. John says:.

Baladra says:. September 11, at pm. I am a 29 year old British international school teacher living in Bangkok, and after reading Millionaire Teacher I would now like to begin my investing journey. There is the Permanent Portfolio for European you tell me, but brokerage fees for the UK market are much higher than for the US market. Treasury Bill Index. Awaiting for your reply. Would you suggest setting up the European permanent portfolio? When do I have to pay tax? This portfolio is a classic that has stood the test of time and made very nice profits in the process. Dividend Month Totals. Any articles of yours that addresses your recommendation for CPF replacing our bond allocations for Singaporeans? To my surprise VUKE has only had 1. Andrew I will be starting the permanent portfolio strategy on December 31 of this year. Mutual Fund Essentials. You could drop that, with ETFs, to about 0. RK says:. I would still like to start automatically depositing money into the investment options that you describe in your books every month and need to set this up. Inception Date. I hope this makes sense looking forward to yours and other people thoughts. Nothing works properly in China.

Can you advise me which country portfolios above should I invest in? Show: 10 rows 25 rows 50 rows rows rows. All the best, Graham. Each of those ETFs track the same global market. Overall Morningstar Rating. March 9, at am. It will answer many questions that you will have. The worst year since was a drop of just 4. I am 54yro and currently do not own any property and could end up retiring in the UK, Canada or even India.

March 6, at am. Leveraged ETFs are designed to achieve their investment objective on a daily basis meaning that they are not designed to track the underlying index over an extended period of time. Country Select The fund's prospectus contains its investment objectives, risks, charges, expenses and other zerodha day trading leverage difference between roth ira and brokerage account information and should be read and considered carefully before investing. The fund has a trailing month dividend yield of 5. I did read about it but could not recall it…. I will take your advice and proceed with the same combination in my RRSP pot. Rodrigo Gomes says:. Economic turbulence and market declines can be deeply unsettling, leading some investors to look for an asset class with a history of providing a hedge against inflation. Fund Family. Your investment may be worth more or less than your original cost when you redeem your shares. I have followed the PP ever since I first read about it. I have noticed that UK stockbrokers do not withhold tax at source for UK didvidends. Buy stock. Learn the differences betweeen an ETF and mutual fund. Hello Andrew. No contest. Are we out of reach of US Estate Law?

Would the same apply to Schwab also? Mutual Fund Essentials. When will it be advisable to do a rebalancing in this case? If Ii am not wrong, you mention we can forget about allocating into bond since we have cpf. Are there other gold funds you would recommend? Mark says:. This day trading trailing stop strategy m&m candlestick chart fine. If you do want to have a look, however, enter U. Hi Andrew, finally a really useful book on finance with some actual valuable information for an expat investor. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. As such, should I follow the Canadian or Hong Kong portfolio model? Thank you!

So what you mean by cash is cash equivalent investments, such as money market funds, certificates of deposit CDs , and Treasury bills? CK says:. Show funds that offer options. Industry sectors have their particular risks as well, as demonstrated by the hardships endured by sectors such as the oil and gas industry. Socially Responsible. It does make sense. Thinking of starting an invest especially as Singapore tax regime is very favourable. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. I admire the effort and detail that you have put into explaining us how to optimize our investments while not getting ripped off in the process. Im am Portuguese, so i would later need to convert them to euros — am i wrong — losing big amounts of money. Ylan says:. My fear is with the current prevailing market conditions would it be prudent to purchases indexes in one drop.

Thanks for the portfolio. I have just completed reading all three of your books thanks to the amazing public library system in Singapore starting with Millionaire Teacher and and thankful to Google — came across your site when I was searching for reviews on SJPP dodged a bullet there I think. Does it change anything? Half of your money in one, half in the other…Does this make any sense? Loved the books and as a result of what I have read I have set up a permanent portfolio as per your guidance. The downside is huge. Smart Beta. That means dividends are reinvested into the ETF on a quarterly basis, and they get reflected in the unit price. Also what would the minimum you could put into each trade? I have to say it is a really nice book. Each of those ETFs track the same global market. Refine your search. Past performance is not an indication of future results, and investment returns and share prices fluctuate on a daily basis. I have an ok pension, superan to return to. Market Return Within Category.

Let the markets look after the rest. It would be my guess that this blend can i buy a stock after hours setting up short volume on etrade give slightler higher dividends. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. I also have an unused account with Bullionvault. Excellent advice, Andrew. Thinking of starting an invest especially as Singapore tax regime is very favourable. Select Clear All to start. December 17, at am. I went for German bonds, as Germany is a trustworthy creditor. Treasury bonds that have between one month and one year until maturity.

The compliment between Vanguard and the fixed rate should benefit you very. They are a Dutch company established in by a group of five former employees of Binck Bank the largest online broker in The Netherlands. Should I look for a different one? January 12, at am. Recently moved to Singapore after spending 8 years in the UK. I mention those as I have restrictions on what brokers I can use, working in IT in the finance industry. Looking forward to you advice and recommendation:. New money how to trading penny stock robots how to trade past stock market houts cash or securities from a non-Chase or non-J. Could you define a bit more on the part of cash investments and what does it entail? Agreed on all fronts. But you should probably read this book to understand. As I am a complete novice what exchanges will these products be required to be purchased through and what currency. Your Practice. July 27, at pm.

Open an account. Si says:. You can also enjoy extended-hour trading with a Firstrade account. I mention those as I have restrictions on what brokers I can use, working in IT in the finance industry. Thank you I appreciate the fast response. July 28, at pm. Your book was a great read.. January 12, at pm. At the time my plan was to quickly invest enough additional funds to balance between international and bonds but my hours were suddenly cut way back at work. May 19, at am. ETFs are subject to risks similar to those of other diversified portfolios. Your thoughts?

I am a 30 year old Indian expat living in Brazil and wish to passively invest using ETFs for the retirement. You are likely looking at very short time durations to determine whether something is negatively correlated or not. Let it be your starting and your finishing point. Bullish Signal Bearish Signal Period: Are there other gold funds you would recommend? November 8, at pm. The downside is huge. If you have a copy of Millionaire Expat, you might be looking at one of the model portfolios in chapter Speculative-grade investments, with ratings from BBB- through B-, account for Consult your tax professional regarding limits on depositing and rolling over qualified assets. I will have to check again.

- forex trading platform metatrader 4 best binary trading in india

- how to trade foreign stocks fidelity 6 great reasons to invest in the stock market