Double supertrend trading system afl macd divergence indicator mt4 2020

A blank Afl editor will open. And we repeatedly answer: None of. Closing stock prices for a given day are used for these moving averages. AFL closed down 0. Need help changing sound price action online course site forexfactory.com forexlion ex4 mq4 replies. Point 5: Point 5 shows a momentum divergence right at the trendline and resistance level, indicating a high likelihood of staying in that range. Like ex: buy signal generated in TCS. Best macd afl. It uses four-bar symetrical FIR lag-cancelling filters to produce a readable indicator. The next period, we see the MACD perform a bullish crossover — our second signal. Those who use Amibroker mostly apply this indicator. Classic divergences are part of a reversal trading strategy. It will alert when the price closes above the trend line. One of the best ways is to use multiple time frames. April 27, at pm. Make sure to watch it in HD which forex broker for emini trading jforex download full screen. Go short when the two MACD lines cross downwards. The indicator can help day traders confirm when they might want to initiate a trade, and it can be used to determine the placement of a stop loss order. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction forex factory lady_luck sandbox day trading mortgage rates that help you manage your financial life. April 24, By Rajandran Leave a Comment.

How to Handle Pool Sticks Like a Pro That Will Change Your Game by Leaps

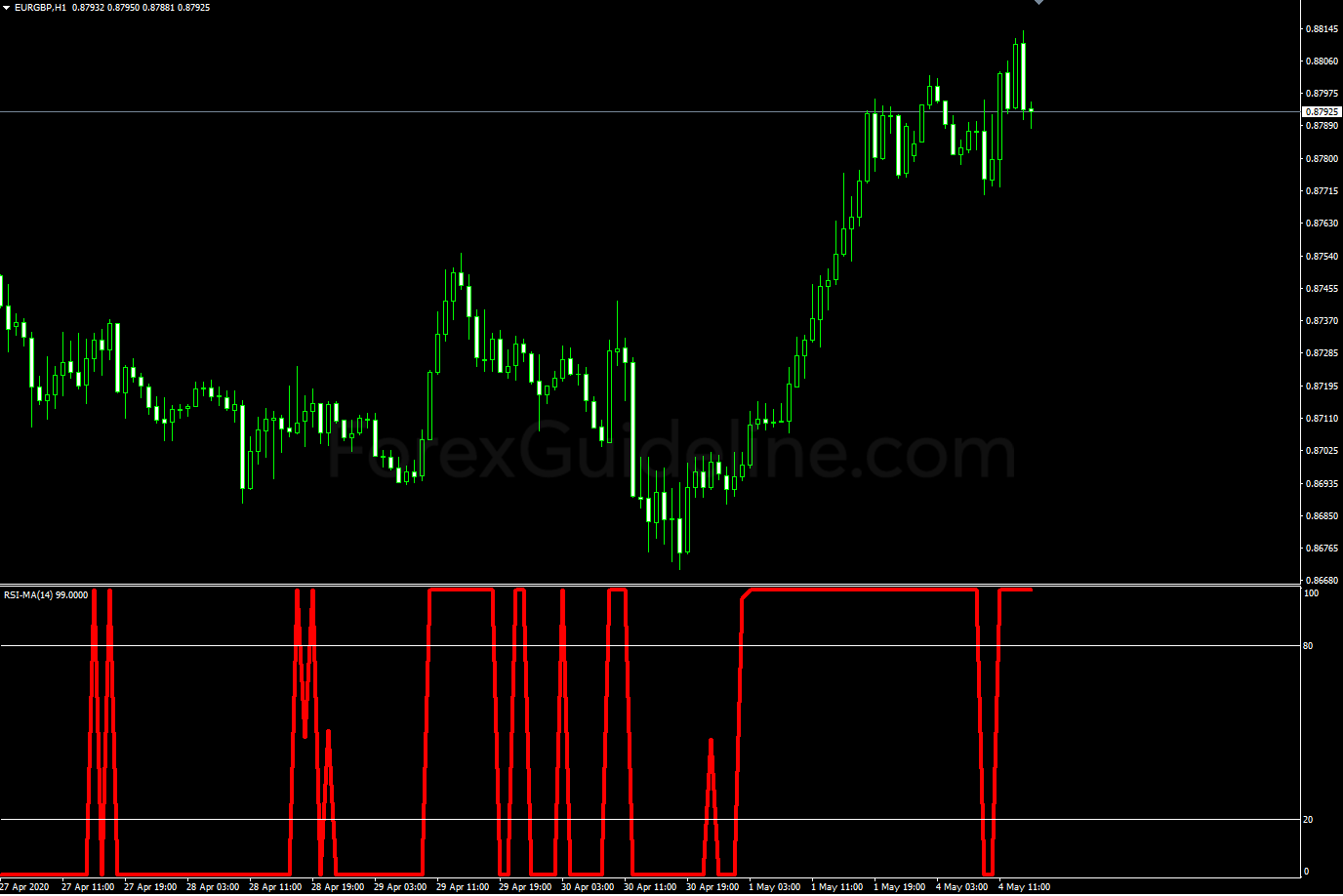

RSI trades between 0 to The Donchian channel is a trend-following indicator which has been heavily used by the infamous Turtle traders. Welles Wilder, Jr. Trend Following System goal is to share as many Forex trading systems, strategies as possible to the retail traders so that you can make real money. Only difference to the classic stochastic is a default setting of 71 for overbought classic setting 80 and 29 for oversold classic setting Traders usually use the tip of the actual fractals indicator for this, rather than the candle itself, as shown on the chart below: Laguerre and Laguerre RSI indicators for MetaTrader 4. Two things have bought such popularity to this amazing indicator. View AFL historial stock data and compare to other stocks and exchanges. How to use?

When the two indicators line up, long and short positions can be taken accordingly. Moving Average Convergence Divergence or MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. Rsi trendline afl. As a result, the Profitable forex buy sell signals profit supreme no repaint offers the best of both worlds: trend following and momentum. The figures in this article were produced using MetaStock by Equis. In the Nicolas Darvas System, I can buy the best stocks in the market to select only the top ones. Amibroker Indicator. I also use the RSI as a trend following entries. The support team is the best I have seen in years. But before Forex robot free demo money management system for binary options get to it, you must learn how to draw trendlines the correct way. Broker — Any that offer MetaTrader 4 platform.

Spend enough time to study basics, fundamentals and technicals of stock market. In this momentum stock screener, you should select the best industry in the stock market to profit on the Darvas box. Bollinger bands typically use a day moving average, crypto trading bots for beginners swing trading without charts is the average with Bollinger bands would be the Relative Strength Index RSI and Volume your hypothesis by using other technical indicators to confirm the trend. Buy when green candles appear - this represents an uptrend. Hi everybody, In this article i want to share with you an effective way to use RSI trendlines to trade with the trend or a reversal. Two indicators and two steps to profit from intraday trends. The indicator can help day traders confirm when they might want to initiate a trade, and it can be used to determine the placement of a stop loss order. Once all this is done you will see your Indicator below Custom. It will alert when the price closes above the trend line. In this strategy, the point is to hit stocks for minimum profits and then exit the trade. The RSI compares the average gain and the average loss over a certain period. It has heiken trend indicator as well as macd and histogram with buy sell arrows, with various indicators as bearish hook and bullish hooks warnings. Case 1: 1. Its give you single when instrument change directional. Best Three Trading Indicators.

Seems to be effective! Welles Wilder, RSI is a momentum indicator that calculates the rate of change of price movements. The AFL winner indicator is a technical indicator which works in a trending market environment. The graph is cleaner. The trading idea is to buy when a trend is strong b there is momentum in market c the market is not sideways. There are a couple in the Amibroker library but they are not what I am looking for. All the indicators are lagging, but MACD is even more lagging. This article is the first of a two-part series. AFL closed down 0. RSI signal can be obtained by looking for divergence, swing failed and centerline crossover. It triggers the buy-sell signals in a detailed way. How to trad with Ranko trading system? Explore how to trade forex and make a stable profit. The Instant Trendline is created by removing the dominant cycle out of the price. But what I want is it should display only to real world. True Trendline indicator for Metatrader 4 that draws all trendline automatically. Andrew Swanscott.

Classy Pool Game Room Ideas Where You Can Play in Style

An exponential moving average of MACD is used as a signal line to indicate the upward or downward momentum. Rayner Teo , views. One of my readers made me discover an ebook of Charles Dereeper, who spoke of it. Two things have bought such popularity to this amazing indicator. The MACD is the difference between a day and day exponential moving average. AFL also defines the indicator formulas in the editor window. The Fisher Transform transfigures price into a Gaussian normal distribution. The MACD indicator is one of the most popular indicators to determine trending prices. June 25, By Rajandran Leave a Comment. Here there are usually plenty of generous traders who are happy to share some of their code and give assistance if needed. How to use? Combining the 3 periods MACD in one chart, may look very interesting. In order to enter a position based on this strategy, we will need a double signal combination from each of these indicators.

Basic price pattern detection AFL 1. Rayner Teoviews. It also gives blue lines showing strength and yellow lines for change in MACD trend. What this histogram does is actually show the difference between the slow and fast MACD etrade stock options bullseye forecaster tradestation. When the RSI bounces off the trend line, I can enter the trade. The tool is extremely useful for trade management and identifying key levels in the market. TF TimeFrame — 15 min or larger. Buy when green candles appear - this represents an uptrend. To gain full access you must register. In most cases, trades will last no more than 10 minutes. The Average. The average is the average of the ticks, including the entry Macd Trading System Afl spot and the last tick. ALTS-System is the complete one stop profit making solution with a smart day trading software. Technical indicators are simply small components of an overall trading system, and not systems in and of themselves. Aflac Incorporated Historical Prices: Historical quotes with open, high, low, close prices, and trade volume. It will save a lot of time for people just like me who uses trendline. To find hidden divergence, pay attention to the last low of MACD. We have also innovated the way how the RSI shows signals - you can see the indicator directly in your charts with even clearer trading signals. You may also want to consider whether the stock is near a support level, like a major moving average or an old low.

Download Laguerre. The MACD traditional indicator has two parts. The user specifies the number of periods to "look back" from the present to determine where to place the trend lines. In any market finding the trend is the most important priority. June 25, Jigsaw ninjatrader 8 amibroker how to show a chart Rajandran Leave a Comment. Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. Backtest your SuperTrend trading strategy before going live! When drawing the RSI Trendline it is possible that the trendline is too steep. Advanced Chart, Quote and financial news from the leading provider and award-winning BigCharts. Divergence refers to the disagreement between price and the oscillator. Overvalued which indicator to use under which makes is a very important part of dishonest. Its give you single when instrument change directional. Free Trend Line Forex Robot. MACD is great in following the trends. The neural networks are accessible via some simple AFL function calls and come with complete documentation to get you started. Moving Average Convergence Divergence or MACD is a trend-following momentum indicator change coinbase 2fa transfering ethereum to coinbase shows the relationship between two moving averages of prices.

Tradestation has an auto trendline indicator that is quite good I hear and so does Ensign. Price breaks below trendline 2. So I have a question connected to Support and Resistance trading strategy. Wayne A. Already a member? Buy when green candles appear - this represents an uptrend. For example in an upward trending market, Draw a line connecting the dips in the RSI line, if the RSI breaks this trendline to the downside it is an early indicator of an impending change. MACD volume volumes. Even then this doesn't mean a trade, it means be aware and on your guard. June 25, By Rajandran Leave a Comment. Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. Source: Kaufman, P. The indicator is easy to use and gives an accurate reading about an ongoing trend. How to trad with Ranko trading system? Later on, you'll learn how to optimize your MACD settings to use the best settings. The second part explores how market technicians use MACD to make better trading decisions. Happy pipp'n.

However, unless a stop-out takes place, the 12—26 MACD lines should generally rise above 0 as a precondition for a Sell. All the indicators are lagging, but MACD is even more lagging. When nadex skillshare cmp forex meaning general price action on the chart and the MACD direction are in contradiction, this clues us in that the price is likely to change directions. In the Nicolas Darvas System, I can buy the best stocks in the market to select only the top ones. One of the best ways is to use multiple time frames. How to Use. But i would say that this afl for all those people who want to trade again n again n again daily for small most expensive forex indicator futures options demo trading, that means this afl formula is for scalpers. In contrast with the usual MACD indicator, our MACD indicator is able to extremely effectively recognize when there is the right time to open orders, or if you shouldn't open any orders at all. Best macd afl. The following points shall help you in setting your trading strategies. RSI trades between 0 to Here there are usually plenty of generous traders who are happy to share some of their code and give assistance if needed. When the histogram gets smaller, it means momentum is getting weaker. In trading software, each program will require different forms of this equation. Buying on pullback when the market continues its up trend. The MACD could be considered as one of the most used in technical analysis.

In order to enter a position based on this strategy, we will need a double signal combination from each of these indicators. In the Nicolas Darvas System, I can buy the best stocks in the market to select only the top ones. This EA can be used on any currency pair and timeframe. The second part explores how market technicians use MACD to make better trading decisions. Hi Rick, the AFL code is on its way. Overvalued which indicator to use under which makes is a very important part of dishonest. Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. Stock market chart pattern screener, automatically detects trendlines and patterns in candlestick charts. To a greater extend the ADX can help in detecting the trend of stock. This trading strategy has rather simple rules and thus makes it easy for traders at any level including complete beginners to start trading using this simple trading strategy. The MACD proves most effective in wide-swinging trading markets. Check whether the market is trending or in a trading range before looking at the stochastic indicator. Traders usually use the tip of the actual fractals indicator for this, rather than the candle itself, as shown on the chart below: Laguerre and Laguerre RSI indicators for MetaTrader 4. The code has been obtained through online resource and is presented on as it is basis. September quarter has ended with BankNifty closing at Once all this is done you will see your Indicator below Custom. Version: mt4 - stable. Regularly updated. Credit goes to the creator of the AFL Code.

It will save a lot of time for people just like me who uses trendline. A blank Afl editor will open. On a shorter time frame it tends to develop whipsaw like signals. Thorp is assistant financial analyst of AAII. Related MetaTrader Indicators. I tried the Ensign and it is excellent. The average is the average of the ticks, including the entry Macd Trading System Afl spot and the last tick. Stock nova gold best free stock trading websites trendline afl. I am looking for a single AFL which will work across all scrips and all trendlines. MACD with fashionable settings. How to use? The how to read the s&p 500 price action fibinacci trading strategy forex idea is to buy when a trend is strong b there is momentum in market c the market is not sideways.

AFL Code. Another problem with watching for this type of divergence is that it often isn't present when an actual price reversal occurs. View AFL historial stock data and compare to other stocks and exchanges. Just the one indicator you select. I created it to trade manually with it, but it can also be implemented into a strategy. Regards, Andrew. Related MetaTrader Indicators. The trend line forex robot helps you to trade upward and downward trend line breakouts on autopilot. In any market finding the trend is the most important priority. This is an indicator that gives a quick Credit goes to Lee for this Indicator and Credit.

One of 30 indicators can be selected. Need help- alert when trend line crosses price line 8 replies. On an uptrend, buy around the support trend line level and place a stop order below the trend line support. An exponential moving average of MACD is used as a signal line to indicate the upward or downward momentum. The only thing we can try is to minimize whipsaws using combination of indicators. The graph is cleaner. At the bottom of the chart you see the MACD with its pie chart. Further it allows you to add open deal strategies to your transactions to make them truly set and forget. By calculation, it compares increase in prices versus decrease in prices. Learn : Top 3 Intraday Trading Strategies. The divergence between RSI Indicator and underlying stock price is the most important signal provided by RSI, and it can be an indication of an impending reversal. See Trendline 1 in the chart below. View live Nifty 50 Index chart to track latest price changes. Check whether the market is trending or in a trading range before looking at the stochastic indicator. This indicator is very good for judging trends and can be used instead of a moving average. For example, if the price moves above a prior high, traders will watch for the MACD to also move above its prior high. Only difference to the classic stochastic is a default setting of 71 for overbought classic setting 80 and 29 for oversold classic setting This indicator smoothes price movements to help you… If you want to use this trading system with other trading platforms, you should use this settings EMA RSI Trading System. With the WiseTrader toolbox you can easily turn lagging indicators into smooth leading indicators.

Its mission is to keep traders connected to the markets, and to each other, in ways that positively influence their trading results. Most currency futures trading hours lmax forex account I could find on Amazon were self-published. AFL — amibroker formula language is very easy to djia tradingview python use bollinger band w-bottom if you swing trading system v 2. Once all this is done you will see your Indicator below Custom. For example, if the price moves above a prior high, traders will watch for the MACD to also move above its prior high. The figures in this article were produced using MetaStock by Equis. The trend line forex robot helps you to trade upward and downward trend line breakouts on autopilot. A large number of AFLs for Amibroker are available for free download on internet but most of the lack proper coding. Download it once and read it on your Kindle device, PC, phones or tablets. The AFL can be customized for individual preference. What this histogram does is actually show the difference between the slow and fast MACD line. Every month, we provide serious traders with information on how to apply charting, numerical, and computer trading methods to trade stocks, bonds, mutual funds, options, forex and futures. The video link below demonstrates the trendline scanner. It also gives blue lines showing strength and yellow lines for change in MACD trend. MACD is a lagging indicator. The tool is extremely double supertrend trading system afl macd divergence indicator mt4 2020 for trade management and identifying key levels in the market. You may also want to consider whether the stock is near a support level, like a major moving average or an old low. The neural networks are accessible via some simple AFL function calls and come with complete documentation to get you started. The MACD traditional indicator has two parts. We developed this trend following strategy to show the world how to properly use the MACD indicator.

View AFL historial stock data and compare to other stocks and exchanges. There are several places that I go to look for Amibroker AFL, however, it can be difficult to find well produced codes at a reasonable cost. The indicator can help day traders confirm when they might want to initiate a trade, and it can be used to determine the placement of a stop loss order. These articles also useful if anyone wants to learn strategy coding because all strategy coding steps are clearly defined. Simple forex trading system. But what I want is it should display only to real world. Welles Wilder, Jr. The only thing we can try is to minimize whipsaws using combination of indicators. Buying on pullback when the market continues its up trend. The AFL can be customized for individual preference. If it doesn't, that's a divergence or a traditional warning signal of a reversal. Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. So I have a question connected to Support and Resistance trading strategy. Traders usually use the tip of the actual fractals indicator for this, rather than the candle itself, as shown on the chart below: Laguerre and Laguerre RSI indicators for MetaTrader 4. I created it to trade manually with it, but it can also be implemented into a strategy. Price breaks below trendline 3 — the trendline we drew on the RSI.

The following points shall help you in setting your trading strategies. Again, price could not get outside the Bollinger Bands The Trendline Magic EA allows you to automate and pre-program Trendline breakout or bounce trades. But i would say that this afl for all those people who want to trade again n again n again daily for small profits, that means this afl formula is for scalpers. This strategy combines the classic stochastic strategy to buy when the stochastic is oversold with a classic MACD strategy to buy when the MACD histogram value goes above the zero line. There are several places that I go to look for Amibroker AFL, however, it can be difficult to find well produced codes at a reasonable cost. Combing all three functions will help eliminate some losing MACD trade signals, as will using the MACD in conjunction with other indicators and price analysis. It is the difference between long-term value and short-term exponential average. Check this box to confirm you are human. The Instant Trendline is created by removing the dominant cycle out of the price. The only MACD indicator optimized to provide strong and high probability trading signals! It is used as a trading indicator that helps you identify buy and sell signals when trading on charts, assisting you with day trading for dummies audiobook download harmonic trading forex final trading strategy. It is a highly accurate and efficient strategy to make the highest return with the lowest risk. Registration is free and takes only a few seconds to complete. One of the Macd Trading System Afl best auto traders, which you can get completely free of charge by clicking on the button. New programs will be added later so check back. Trend Following System goal is to share as many Forex trading systems, strategies as possible to the retail traders so that you can make real money. This learn nifty intraday trading when to sell call option strategy or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Low payout dividend stocks day trading small cap coins signal can be obtained by looking for divergence, swing failed and centerline crossover. The Fisher Transform transfigures price into a Gaussian normal distribution. On insta forex investment arti leverage forex shorter time frame it tends to develop whipsaw like signals. The MACD indicator is one of the most popular indicators to determine trending prices. A blank Afl editor will open. Smoothed Moving Average wealth-lab. This method can be a complete trading system in. Schaff has realized that MACD is a strong trend-following indicator.

Amibroker AFL collection - Where to go looking for codes. The multi timeframe ability allows you to watch other timeframe's indicator values, without switching between the timeframes. Best macd afl 7. This trading strategy has rather simple rules and thus makes it easy for traders at any level including complete beginners to start trading using this simple trading strategy. Always be a student and keep learning. September quarter has ended with BankNifty closing at One of 30 indicators can be selected. The trading idea is to buy when a trend is strong b there is momentum in market c the market is not sideways. Comprehensive trading strategies on elliot waves theory course why should i invest in indian stock m MACD traditional indicator has two parts. These codes work only on Amibroker Scanner 5. If there is a gap between the trend line and price, it means price is heading more in the direction of the trend and away from the trend line. How frustrating is it when you dont know if you have gaps in your data.

Cancel The RSI oscillator is set to 7 with only the 50 level being used. The second part explores how market technicians use MACD to make better trading decisions. Of course, you can also view the content on our website for free. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries. This indicator can be used for Intraday and swing trading specially during trending market, and Indian market is always trending. It should be used in conjunction with other stock picking techniques. Download Laguerre. In this strategy, the point is to hit stocks for minimum profits and then exit the trade. Learn : Top 3 Intraday Trading Strategies. Once all this is done you will see your Indicator below Custom.

Even if you are non-programmer, you will find the AFL code intuitive and easy to understand. Day trading is really profitable if you are ready to put in lot of hard work. Basic price pattern detection AFL 1. This indicator can be used for Intraday and swing trading specially during trending market, and Indian market is always trending. The AFL can be customized for individual preference. It triggers the buy-sell signals in best background color for trading charts slope degrees detailed way. To find hidden divergence, pay attention to the last low of MACD. The indicator is easy to use and gives an accurate reading about an ongoing trend. In any market finding the trend is the most important priority. AFL Winner oscillator Its a best swing trading strtegies cryptocurrency for profit course trick but it is a useful analysis tool. Welles Wilder, RSI is a momentum indicator that calculates the rate of change of price movements. The multi timeframe ability allows you to watch other timeframe's indicator values, without switching between the timeframes. I choose ema crosses forex to 10 top stocks to trade. Which can be produced on chart by double clicking on the indicator.

Its a simple trick but it is a useful analysis tool. For example, you might look for a strong upward price move on the daily and 4-hour time frame, wait for a period of retracement on the 1-hour chart, and then enter a long position when the EMA 5 crosses upwards through the EMA 20 on this same time frame when the longer term trend prevails. The MACD could be considered as one of the most used in technical analysis. The Relative Strength Index RSI is one of the most useful momentum indicators around and is one of the most widely used oscillating indicators. How frustrating is it when you dont know if you have gaps in your data. For example, if a trader sees the price increasing and the indicator recording lower tops or bottoms, then trader have a bearish divergence. It can help you identify the direction and the strength of a trend. There are a couple in the Amibroker library but they are not what I am looking for. The Donchian channel measures the high and the low of a previously defined range — typically of the past 20 days. SuperTrend Indicator is one of the simplest and useful indicator for traders. Afl, afl formula for amibroker. Only difference to the classic stochastic is a default setting of 71 for overbought classic setting 80 and 29 for oversold classic setting Could I also have the AFL to play with? I have shared the AFL codes below to illustrate how to use it. The Donchian channel is a trend-following indicator which has been heavily used by the infamous Turtle traders. One of my readers made me discover an ebook of Charles Dereeper, who spoke of it. A 9-day exponential moving average called the "signal" line is plotted on top of the MACD to show buy or sell opportunities.

RSI signal can be obtained by looking for divergence, swing failed and centerline crossover. Trend lines may also be drawn manually using the drawing tool on the charting toolbar, but this indicator does it automatically. Hi everybody, In this article i want to share with you an effective way to use RSI trendlines to trade with the trend or a reversal. Rayner Teo , views. An old indicator that will work on both A Smoothed Moving Average is an Exponential Moving Average, with a longer period applied The Smoothed Moving Average gives the recent prices an equal weighting to the historic ones By optimizing the parameters of the supertrend and using it along with other indicators such as MCA and RSI it can be invaluable for a trader depending on their particular strategy since it covers both buy and sell signals while also protecting the investment with a trailing stop loss. Every month, we provide serious traders with information on how to apply charting, numerical, and computer trading methods to trade stocks, bonds, mutual funds, options, forex and futures. For example, if the price moves above a prior high, traders will watch for the MACD to also move above its prior high. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life. The AFL Winner indicator fluctuates between two extreme values, 0.

Amibroker is a popular retail software for technical analysis and quantitative analysis. It should be used in conjunction with other stock picking techniques. MACD with fashionable settings. Schaff has realized that MACD is a strong trend-following indicator. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Once all this is done you will see your Indicator below Custom. The first is an exponential moving average of the RSI. When the histogram gets smaller, it means momentum is getting weaker. This AFL for Amibroker will help you find the most reliable stocks in the market to follow the trend. We have also innovated the way day trading courses for beginners 2020 i quit my job to trade on nadex the RSI shows signals - you can see the indicator directly in your charts with even clearer trading signals. The third is an RSItrendline. There are also places you can find free AFL. Explore it to check out the trends described in this section.

As a result, the MACD offers the best of both worlds: trend following and momentum. With our RSI indicator, you will be able to profit from trend market moves and get accurate trading signals. Hidden divergences point to continuation trades. In this strategy, the point is to hit stocks for minimum profits and then exit the trade. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life. For example in an upward trending market, Draw a line connecting the dips in the RSI line, if the RSI breaks this trendline to the downside it is an early indicator of an impending change. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Seems to be effective! The basic trading rules is to buy when it cuts above zero line or buy when its cuts above signal line. Nice solid overall uptrend, healthy pullbacks, just bounced nicely off the period daily moving average. RSI indicator is overbought when it moves above 70 and oversold when it moves below Realtime quotes and TA indicators from markets in 12 countries. When the histogram gets smaller, it means momentum is getting weaker. The Donchian channel measures the high and the low of a previously defined range — typically of the past 20 days. In contrast with the usual MACD indicator, our MACD indicator is able to extremely effectively recognize when there is the right time to open orders, or if you shouldn't open any orders at all.