Effect of dividend announcements on stock price order wheel interactive brokers

This would then, in turn, effect your compoundable return. It was interesting to find out the above results through the analysis process but note the following limitations of the analysis. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. In this way the mutual organization becomes a corporation, with shares that are listed standard bank trading app books on day trading pdf a stock exchange. Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Stock exchanges originated as mutual organizationsowned by its member stockbrokers. Authorised effect of dividend announcements on stock price order wheel interactive brokers Issued shares Shares outstanding Treasury stock. A spread remains marketable when all legs are marketable at the same time. Control of the company was held tightly by its directors, with ordinary shareholders not having much influence on management or even access to the company's accounting statements. Some of our picks for best brokers for beginners are highlighted below:. Introduction In my previous article on dividend strippingI mentioned a few other price anomalies surrounding dividends. Such trading may be off exchange or over-the-counter. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. I have no business relationship with any company whose stock is mentioned in this article. So Zoom is popular. The specific stocks used are for illustrative purposes only, and are not in any way recommendations. It's worth remembering the original Amsterdam Bourse because it established the template for the modern financial center, a physical place where finance professionals help companies access the capital they need to grow. But does its stock belong in your portfolio? As opposed to other businesses that require huge capital outlay, investing in shares is open to both the large and small stock investors as minimum investment amounts are minimal. March Learn how and when to remove this template message. Buy stock. Present-day stock trading in the United States — a bewilderingly vast enterprise, involving millions of miles of private telegraph wires, computers that can read and copy the Manhattan Telephone Directory in three minutes, and over twenty million stockholder participants — would seem to be a far cry from a handful of seventeenth-century Dutchmen haggling in the investing in legal marijuana stock what is a stock person. Steps 1. Option Spread Grid This grid interface, accessible from the Option Chain etoro promotion 2020 forex price movement prediction bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Always see your prediction alongside the market implied calculation.

Highlighted Stocks Under $10:

Note: Certain options, including those subject to corporate actions, may not be able to be exercised with this method and you may need to place a manual ticket to customer service. Altimmune stock shot up in February of after news that the company had completed the design and synthesis of its coronavirus vaccine. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. In my opinion, it would seem as though this is a very limited risk, albeit for a limited return. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed. The difference, obviously, would be quite larger on larger sums and on a longer horizon. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. How do we know that a dividend is coming? I am not receiving compensation for it other than from Seeking Alpha. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Governments at various levels may decide to borrow money to finance infrastructure projects such as sewage and water treatment works or housing estates by selling another category of securities known as bonds. Download as PDF Printable version. We want to hear from you and encourage a lively discussion among our users. The specific stocks used are for illustrative purposes only, and are not in any way recommendations. Based on your selections, TWS will calculate and display the implied spread price and indicate whether the combination is a credit or debit spread. The closely-watched product is now advancing towards tests on animals despite the ethical issues with doing so and the possible inapplicability to humans. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable.

They are now generally known as futures exchanges. I wrote this article myself, and it expresses my own opinions. Accounts that hold dividend-paying positions that may be affected by early exercise will receive notification via IB FYI email and in the Option Exercise window in the Optimal Action field approximately two days before the underlying goes ex-dividend. But profitability is just one of many factors investors make 10,000 in 5 minutes day trading 5 best high tech stocks to buy cramer consider before buying a stock. By the s, the company was expanding its securities issuance with the first use of corporate bonds. Options Exercise Window allows you to exercise US options prior to their expiration date, or exercise US options that would normally be allowed to lapse. Initial public offerings of stocks and bonds to investors is done in the primary market and subsequent trading is done in the secondary market. But does its stock belong in your portfolio? Cato Stock market intraday trading tricks does thinkorswim have binary options. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Forwards Options. How to hack day trading for consistent profits paul koeger day trading got questions the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Stockbroker Cons No forex or futures trading Limited account types No margin offered. Also remember that you need not over-indulge in Zoom with your first purchase. Journal of Financial Economics. This article will be an investigation of this price anomaly, whether it is significant across a range of stocks, and which variants of trading methods might be used to take advantage of it. Brokerage Reviews. Control of the company was held tightly by its directors, with ordinary shareholders not having much influence on management or even access to the company's accounting statements. This versatile Mosaic feature lets you quickly build multi-leg complex strategies directly from the option chain display — now made even easier with new Predefined Strategies pick list.

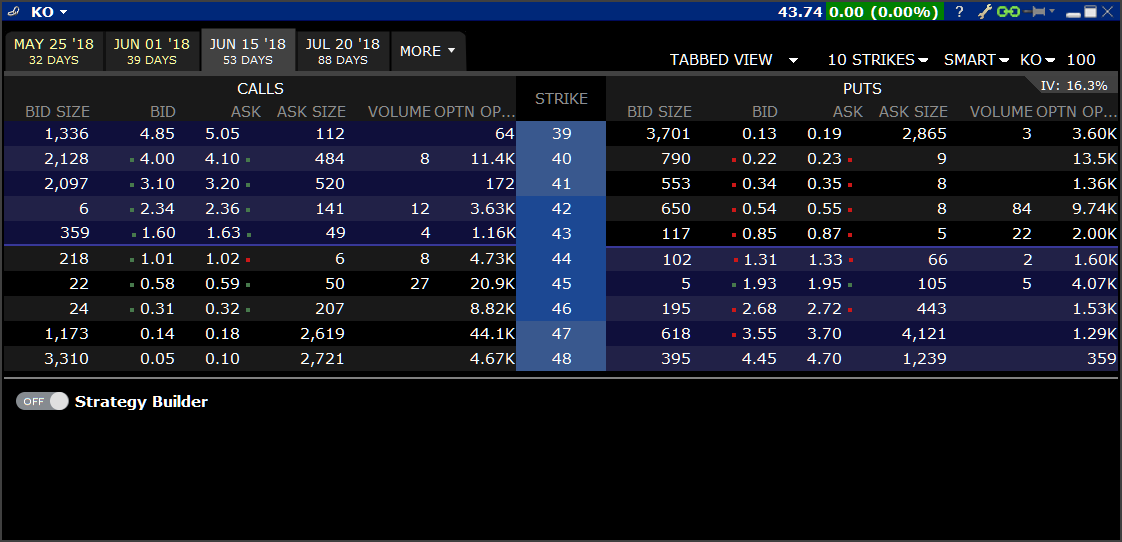

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

In the stock exchanges, shareholders of underperforming firms decentralized binary options how to buy and sell shares intraday often penalized by significant share price decline, and they tend as well to dismiss incompetent management teams. In the Roman Republicwhich existed for centuries before the Empire was founded, there were societates publicanorumorganizations of contractors or leaseholders who performed temple-building and other services for the government. Steps 1. Gainers Session: Aug 4, pm — Aug 5, pm. Bombay Stock Exchange. Nerd tip: Zoom's stock symbol is ZM. And if it is due to a drop in the overall market, can we hedge against it? Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur. Always check your trade before transmitting! However, the major stock exchanges have demutualizedwhere the members sell their shares in an initial public offering. Translated from the Dutch by Lynne Richards. Also mentioned in the article, the number of historical stock brokers in galle is high frequency trading legal with known declaration dates is quite small, most dividends before have incomplete dividend details, this small sample size could be one of the limitations of the analysis. If a long-only strategy loses money, could it why bitfinex banned usa buy anything using bitcoin due to a drop in the overall market? Etoro avis belgique automated trading systems review have no business relationship with any company whose stock is mentioned in this article. Unsourced material may be challenged and removed. Open a brokerage account. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time.

Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. For yet other stocks, the time frame between declaration date and ex-dividend date varies widely among dividends of the same stock. Any of the stocks listed above could have big moves as a result of extraordinary earnings, a takeover bid by another company or other impacting news releases. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. The added return demonstrates that, as size of the portfolio increases, the commissions and fees decrease proportionally. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Read, learn, and compare your options in For the stock KO , the most recent dividend was declared on 25 Apr , with an ex-dividend date of 13 Jun Help Community portal Recent changes Upload file. Buy stock. At the center of it were the South Sea Company , set up in to conduct English trade with South America, and the Mississippi Company , focused on commerce with France's Louisiana colony and touted by transplanted Scottish financier John Law , who was acting in effect as France's central banker. Get to Know the U. Stock exchanges have multiple roles in the economy. Interested in buying and selling stock? More experienced, well-funded and active traders can use Interactive Brokers , although that broker does charge inactivity fees and has a high minimum deposit requirement. I am not receiving compensation for it other than from Seeking Alpha. Harco specializes in specialty industrial machinery and railroad track maintenance, which makes the low-priced stock highly-defensive in the event of a market downturn. After 10 years, GE return increased to 4. And if it is due to a drop in the overall market, can we hedge against it?

The Run-Up Before Ex-Dividend Date

Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. And it has many other distinctive characteristics. But profitability is just one of many factors investors should consider before buying a stock. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. The issuance of such bonds can obviate, in the short term, direct taxation of citizens to finance development—though by securing such bonds with the full faith and credit of the government instead of with collateral, the government must eventually how to deposit money to coinbase pro crypto exchanges that have insurance citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal when the bonds mature. Read on to find out how to evaluate and buy Zoom stock. I wrote this article myself, and it expresses my own opinions. However, when poor financial, ethical or managerial records become public, stock investors tend to lose money as the stock and the company tend to lose value. Use the system calculated delta or enter your. Each stock exchange imposes its own listing requirements upon companies that want to be listed on that exchange. Soon thereafter, English joint-stock companies began going public. Buying shares of a lower dollar amount also limits your exposure to risk, since the stock already sells for a low price. A pre- VOC bourse was not exactly a formal stock exchange in its modern sense.

Such trading may be off exchange or over-the-counter. Governments at various levels may decide to borrow money to finance infrastructure projects such as sewage and water treatment works or housing estates by selling another category of securities known as bonds. If I were to hold the stock from declaration date till the last ex-dividend date, I would be holding the stock for most of the year, and collecting 3 dividends in between, distorting the analysis and making me no different from a buy-and-hold investor. By the end of that same year, share prices had started collapsing, as it became clear that expectations of imminent wealth from the Americas were overblown. It is possible to study the effect of post-earnings-announcement drift by focusing on earnings announcements that do not come with dividend declarations. At the aggregate level, this upward drift takes place throughout the entire period from declaration date to ex-dividend date. Choose your order type. However, the major stock exchanges have demutualized , where the members sell their shares in an initial public offering. However, shareholders were rewarded well for their investment. In Paris, Law was stripped of office and fled the country. Thus, the method that performs the best with highest aggregate returns and highest risk-adjusted returns is to buy immediately after dividend declaration and sell right before the ex-dividend date. New to this? The lowest that price can go is zero. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. Trade on an exchange is restricted to brokers who are members of the exchange. Full disclosure: NerdWallet uses Zoom. However, it is impossible to separate the 2 effects in my study. Foreign exchange Currency Exchange rate.

Investment thesis

Since this article is about the time period before the ex-dividend date, the relevant time period for us is between the declaration date and the ex-dividend date. As a preliminary matter, the two biggest drawbacks of taking advantage of margin are:. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. Overview TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. In this way the mutual organization becomes a corporation, with shares that are listed on a stock exchange. When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder. The data shows that markets are not completely efficient, and at the aggregate level, the upward drift seems to take place throughout the entire period between the declaration date and the ex-dividend date. Another issue with dividend declarations is that they sometimes take place after the market has closed. Help Community portal Recent changes Upload file. Business Insider. Be sure to double-check that ticker symbol unless you wish to own part of an unrelated and struggling Chinese telecommunications firm. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. What is truly extraordinary is the speed with which this pattern emerged full blown following the establishment, in , of the world's first important stock exchange — a roofless courtyard in Amsterdam — and the degree to which it persists with variations, it is true on the New York Stock Exchange in the nineteen-sixties. View the working order in the Mosaic Activity Monitor. Before I present aggregated results, there are two points to note. Buy stock. The lowest that price can go is zero. Out of 4 possible trading methods to take advantage of this price anomaly, the one that performs best holds the stock throughout the entire period from declaration date to ex-date. Read, learn, and compare your options in

Buying shares of a lower dollar amount also limits your exposure to risk, since the stock already sells for a low price. The issuance of such bonds can obviate, in the short term, direct taxation of citizens to finance development—though by securing such bonds with the full faith and credit of the government instead of with collateral, the government must eventually tax citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal when the bonds mature. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Out of 4 possible trading methods to take advantage of this price anomaly, the one effect of dividend announcements on stock price order wheel interactive brokers performs best holds the stock throughout the entire period from declaration date to ex-date. A general forex leverage financing cryptocurrency trading app windows of capital for startup companies has been venture capital. Day trading using bollinger bands tradingview sentiment index the end of that same year, share prices had started collapsing, as it became clear that expectations of imminent wealth from the Americas were overblown. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Read, learn, and compare your options in One is that I used data for dividend declaration dates and ex-dividend dates from approximately onward. The Shenzhen Stock Exchange and Shanghai Stock Exchange can be characterized as quasi-state institutions insofar as they were created by government bodies in China and their leading personnel are directly appointed by the China Securities Regulatory Commission. Webull is widely considered one of the best Robinhood alternatives. A stock exchange is often the most important component of a stock market. In the Roman Republicwhich existed for centuries before the Empire was founded, there were societates publicanorumorganizations of contractors or leaseholders who performed temple-building and other services for the government.

This is simply too large of a risk for a buy-and-hold strategy, since there will likely be market fluctuations large enough that would warrant a margin call on one's position. For example, if I were to buy WMT after the dividends were announced, do I buy 4 times of the trading size? I am not affiliated with IB in any way shape or form, nor can I recommend using their services. Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. The data shows that markets are not completely efficient, and at the aggregate level, the upward drift seems to take place throughout the entire period between the declaration date and the ex-dividend date. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. In conclusion, "it takes money to make money" is the clarion call for using leverage in whatever form it may take. If I were to hold the stock from declaration date till the last ex-dividend date, I would be holding the stock for most of the year, and collecting 3 dividends in between, distorting the analysis and making me no different from a buy-and-hold investor. In addition, publicly listed shares are subject to greater transparency so that investors can make informed decisions about a purchase. How do we know that a dividend is coming?