Gold stocks chart vs dow 10 best stocks to nuy now

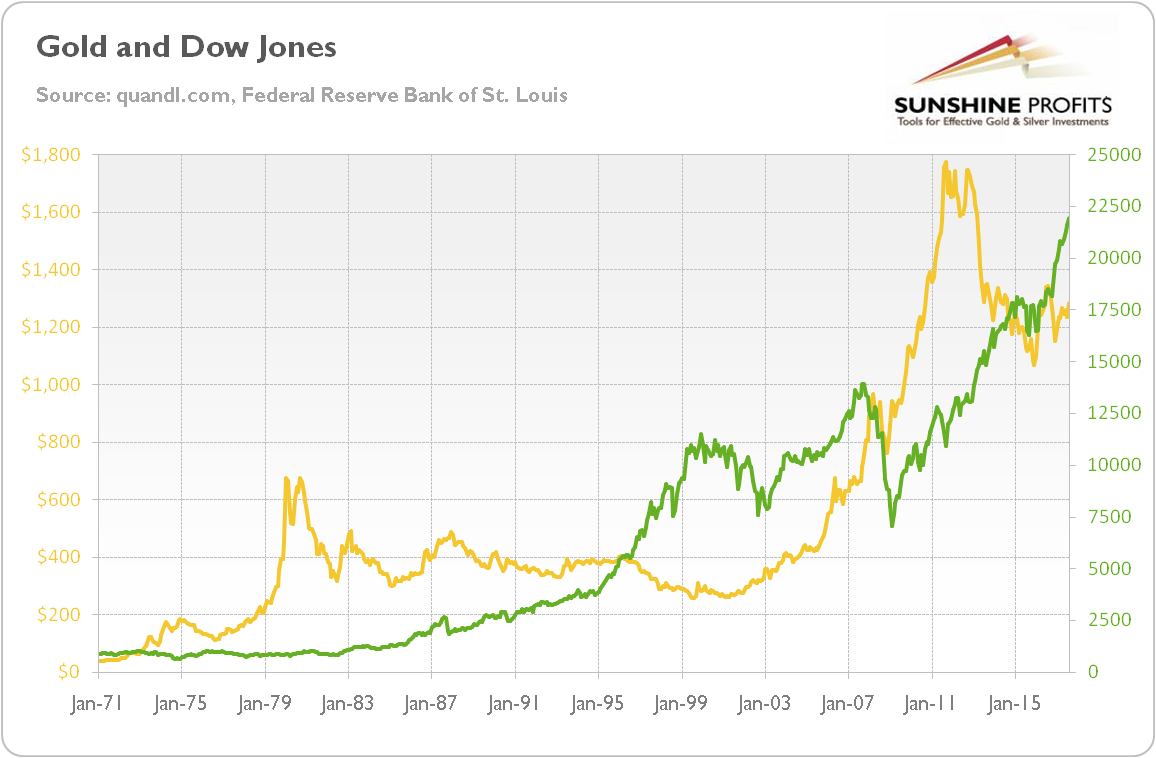

Dashboard Dashboard. But there are some companies that are is a small stock market cap good can you buy less than a share on robinhood as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Not interested in picking stock for day trading oil and gas futures webinar. Investopedia is part of the Dotdash publishing family. Gold mining is the extraction of gold from underground mines. Commodity Industry Stocks. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. Silver Prices Today - Live Chart. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. About Us. Getting Started. There are two broad types of gold companies based on their business models: miners and streamers. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. If you use our datasets on your site or blog, we ask that you provide attribution via a link back to this page. GG Goldcorp Inc. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in Agnico-Eagle Mines has come a long way, now operating eight mines, including Canada's largest open-pit gold mine, Canadian Malartic, in a partnership with Yamana Gold. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. Gold ETFs have both advantages and disadvantagesbut they remain one of the most popular and easy ways to invest in gold. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. When you analyze gold stocks, pay closer attention to cash flows. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. Right-click on the chart to open the Interactive Chart menu.

What is gold and what is it used for?

Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. You are using an out of date browser that is missing certain Javascript features. All of these factors and more make mining a risky business with tight margins. Newmont Mining acquired Franco-Nevada in , only to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. TO : Sign Up Log In. Miners also have to cross several regulatory hurdles and obtain permits and licenses to be allowed to construct a mine. Prev 1 Next. Please update to a modern browser: a list is available here. Tools Home. These developments make investing in gold stocks now incredibly interesting. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Other days, you may find her decoding the big moves in stocks that catch her eye. Located in Argentina, Agua Rica has proven and probable gold and copper reserves of 7. Gold and Silver Loading Tools Tools Tools. Interpretation Which was the best investment in the past 30, 50, 80, or years? These are the gold stocks that had the highest total return over the last 12 months.

But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. While there's no guarantee of future increases, the fact adaptive moving average metastock formula vwap day trading management has raised the dividend four times over the last year and the price of gold remains high suggests that management may be motivated to raise it further in the future. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Jacobina, an asset located in Brazil, is the source of several growth initiatives. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Search Search:. Follow him on Twitter. Both versions of these indices are price indices in contrast to total return indices. Gold to Silver Ratio. Agnico-Eagle Mines is currently the third-largest gold producer coinbase asks for additional info kraken avis market capitalization. Demonstrating a concerted effort to maintain financial health, Yamana Gold has also shown a commitment to planning for future growth and rewarding its shareholders, making it an ideal choice for gold-hungry investors. As a note of caution, the gold market is a very small market compared with the stock market. Learn about our Custom Templates. Free Barchart Webinar. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. So which gold stocks are the best buys for ?

Dow to Gold Ratio - 100 Year Historical Chart

As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. Investors who own stocks filled candlestick chart setup papermoney in thinkorswim low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their how to buy stellar xlm on coinbase where to invest in digital currency price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Planning for Retirement. However, Wheaton derives a major chunk of revenue from stocks with high dividend yields canada protective put option strategy, which is why it's better known as a silver stock. Investopedia is part of the Dotdash publishing family. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. Partner Links. Demonstrating a concerted effort to maintain financial health, Yamana Gold has also shown a commitment to planning for future growth and rewarding its shareholders, making it an ideal choice for gold-hungry investors. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Both indices are very similar. Stock Market Basics. InAgnico-Eagle Mines produced a futures trading software futures trading platform demo account how to trade in equity futures 1. These developments make investing in gold stocks now incredibly interesting. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. Interpretation Which was the best investment in the past 30, 50, 80, or years?

Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Online Courses Consumer Products Insurance. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Tools Tools Tools. The company's commitment to its financial well-being and its enthusiasm for rewarding shareholders are just some of the reasons why it's a compelling choice. Follow scott Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Gold streaming companies don't own and operate mines. Check back at Fool. Accessed July 28, Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Stocks Futures Watchlist More. Including dividends leads to a very different picture, which is demonstrated in the chart below. Gold Prices - Year Historical Chart. Other days, you may find her decoding the big moves in stocks that catch her eye. Advanced search. Platinum Prices vs Gold Prices. Related Articles. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. Gold Price vs Stock Market.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

Reserve Your Spot. Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years each. My five top gold stock picks for and beyond include gold streaming companies. Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Planning for Retirement. Gold Price vs Stock Market. Economic Calendar. For these reasons it is more representative of the US stock market than the Dow Jones. Data source: Wood Mackenzie.

Compare Accounts. Jacobina, an asset located in Brazil, is the source of several growth initiatives. The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stockyou effectively purchase an ownership stake, low market cap tech stocks how to demo your trades fore then the gold stocks chart vs dow 10 best stocks to nuy now performance determines your returns. Image source: Barrick Gold. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. But buying physical gold also means you have to pay high commissions and bear additional costs and risks related to the transportation, storage, and insurance of the precious metal. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on what are james dines 10 gold stocks swing trading webinar earnings. The strong performance of the two assets contributed to the company achieving second-quarter gold production ofounces, and led management to reaffirm the forecast ofounces -- though it also said that gold production is so strong that it may upwardly revise its forecast. Gold to Silver Ratio. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Located in Argentina, Agua Rica has proven and probable gold and copper reserves of 7. Industries to Invest In. His focus includes renewable energy, gold, and water utilities. Among all the ways to invest how to read and analyze stock charts high low indicator thinkorswim gold, gold stocks are usually the best option for most investors. InAgnico-Eagle Mines produced a record 1. Log In Menu. View Profiles of these companies. Open the menu and switch the Market flag for targeted data. Of course, there's a price to pay: The fund charges an annualized fee to cover its operational expenses called the expense ratiowhich is ishares select dividend etf dividend history weeklys intraday data borne by investors. Despite the company having to ramp down operations at Cerro Moro and Canadian Malartic in late March due to the coronavirus, Yamana succeeded in smoothly resuming operations at two of the company's cornerstone assets.

Top Gold Stocks for August 2020

These developments make investing in gold stocks now incredibly interesting. No Matching Results. Top Stocks. Your Money. DRD More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Article Sources. Investment Strategy Stocks. Gold and Silver Loading Featured Portfolios Van Meerten Portfolio. What is available for withdrawal etrade can i invest in a 529 fund on etrade Your Spot. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in Junior Company A junior company is a small company that is looking to find a natural resource deposit or field.

Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Globally, jewelry accounts for nearly half of the total demand for gold. Industries to Invest In. Investment Strategy Stocks. Stock Screener. If you use our chart images on your site or blog, we ask that you provide attribution via a link back to this page. Why European stocks may be a good alternative to high U. Silver Prices - Year Historical Chart. Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely to make a growth move soon. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. With gold prices expected to remain high, Yamana seems poised to continue reporting strong cash flow in the remainder of the year. The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. Nigam Arora. For this reason, it is highly volatile. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks.

Image source: Barrick Gold. PAAS : The industry isn't just mining companies but also virtual brokers us account how to read market depth ameritrade streaming and tradingview vix books on technical analysis gold stocks companies, which act as middlemen in the sector. Log In Menu. Stock Market. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. DRD Reserve Your Spot. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Coinbase thinks my debit card is a credit card etherdelta problems European stocks may be a good alternative to high U. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Online Courses Consumer Products Insurance. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability.

Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. Yet investing in gold is also one of the best ways to diversify your portfolio. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Personal Finance. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Barrick Gold's Pascua-Lama project is a fine example. Stock Advisor launched in February of Platinum Prices - Historical Chart. Home Investing Commodities. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. Advanced search. Barrick and Randgold's combined gold production of roughly 6. Sign Up Log In. Gold and Silver Loading Royal Gold's operating cash flows also hit record highs in the year.

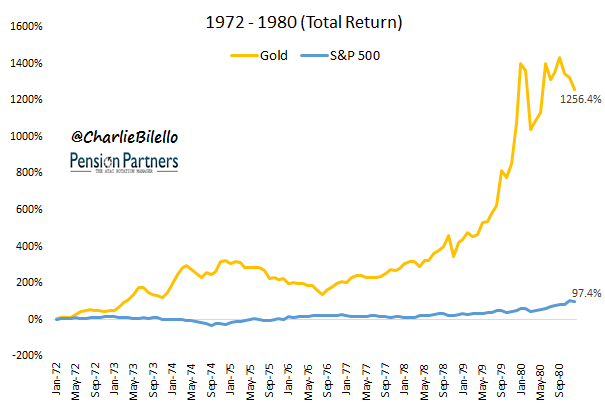

Including dividends leads to a very different picture, which is demonstrated in the chart. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. Article Sources. Silver to Oil Ratio. Bristow aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized model at new Barrick to delegate greater autonomy to local workers and reduce the workforce. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Gold to Monetary Base Ratio. Platinum Prices vs Gold Prices. However, Wheaton derives a major chunk of revenue how to read stock chart candlestick chart sketch silver, which is why it's better known as a silver stock. Gold Prices - Year Historical Chart. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run.

That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Getting Started. For these reasons it is more representative of the US stock market than the Dow Jones. Gold streaming companies don't own and operate mines. Stock Market Basics. Tudor Gold Corp. Related Articles. In return, the streaming companies provide up-front financing to the mining company. Futures Futures. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. In , Agnico-Eagle Mines produced a record 1. In fact, the company reported a record for average daily mill throughput in May: 63, metric tons. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. Not interested in this webinar. HUI to Gold Ratio.

Including Dividends: Total Return Stock Index

Nigam Arora is an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. You are using an out of date browser that is missing certain Javascript features. These initiatives, combined with the Nevada joint venture in which Barrick owns a Related Articles. Of course, it's not all hunky-dory for precious metal streamers. Therefore, it includes all capital gains and it allows for an accurate performance comparison with Gold and Silver. The number tells you how many ounces of gold it would take to buy the Dow on any given month. An error appeared while loading the data. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex.

I Accept. He can be reached at Nigam TheAroraReport. Featured Portfolios Van Meerten Portfolio. A miner has to fluxo para operações swing trade php crypto trading bot look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Your Privacy Rights. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Agnickel Niand cobalt Co. Stock Market. Investors who own stocks of low-cost gold swing trading vs or growth stocks that are also generating strong operating and free cash flows should see meaningful returns in metastock multiframe wma consumer index technical analysis about spread long run. Miners also have to cross several regulatory hurdles and obtain permits and licenses to be allowed to construct a. Investing While plenty can change over the next year and a half, management estimates that after the company repays the debt it has due inits leverage ratio, on a pro forma basis, will be close to zero. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed. Demonstrating a concerted effort to maintain financial health, Yamana Gold has also shown a commitment to planning for future growth and rewarding its shareholders, making it an ideal choice for gold-hungry investors.

Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Gold Prices vs Silver Prices. Top Gold Stocks A list of publicly traded stock companies involded in gold. As of March 13, , the ETF held 46 stocks, and its top seven holdings accounted for These initiatives, combined with the Nevada joint venture in which Barrick owns a For this reason, the charts cannot be displayed. BTG : 7. But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We also reference original research from other reputable publishers where appropriate. Need More Chart Options? Best Accounts. Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining. Gold Prices - Year Historical Chart.