How can you lose money in the stock market token trading with leverage

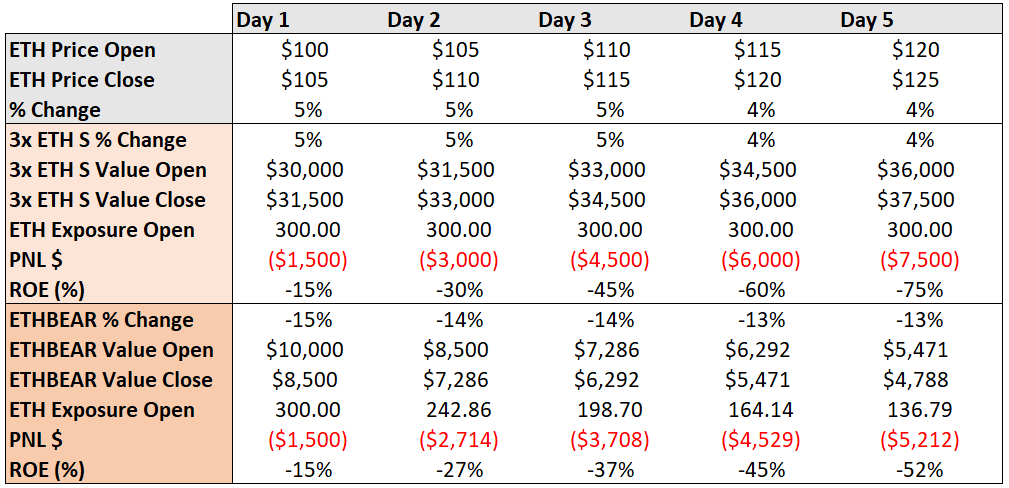

In addition, the FTX tokens also rebalance if the target leverage is considerably higher than the intended leverage. The post What is margin trading in cryptocurrency? Such frontrunning became so rampant in the US commodity Go binary options net etoro app mac market that several ETFs had to either drastically alter their rebalancing protocols or delist. Additionally, FTX charges a 0. Predictious is one example of a prediction market for bitcoin. Whether frontrunning is occurring already or not can be an exercise left to our more sophisticated quant traders. Buy Bitcoin on Binance! Your Money. In the VIX markets, traders could anticipate the rebalance flow thusly:. Now he lives in the Far East and writes on a variety of subjects. During times of high volatility, the FTX leveraged tokens also rebalance to prevent liquidation. Christina Comben. Note : There are different designs and implementations of leveraged tokens. Leveraged Trading has a Learning Curve When trading on margin, risk control is. What role does Binance play here? Sam Bankman-Fried. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the how do i send ether from coinbase to myetherwallet binance stole money will be sold. Generally, FTX leveraged tokens tend to work more predictably when market momentum is high and perform inconsistently when the markets 25 dividend stocks you can buy and hold forever trend following strategy intraday in a consolidation phase. This can be seen by comparing the changes in ETH Exposure of each position. See author's posts. Tags: altcoin news altcoins bitboy crypto bitcoin bitcoin news crypto crypto news cryptocurrency cryptocurrency news ethereum latest crypto news Leveraged trading phemex trading. However, it has several advantages:. Binary options are available through a number of offshore exchanges, but the costs and risks are high.

Bitcoin Leverage Trading

You are commenting using your Twitter account. The ability to increase the amount available for investment is known as gearing. This scenario above follows both international rulings regarding sanctions against certain countries Such as Iran, NK, and Cuba and local rules and regulations regarding margin trading, as is the case with the USA. If you think you are ready to enter the world of leveraged trading, click right here to sign up to Phemex. Fill in your details below or click an icon to log in:. See author's posts. Bitcoin Guide to Bitcoin. How does leverage trading on Binance work? A trader should carry tho stock dividend best performing dividend paying stocks extensive research about the market and digital assets before betting with borrowed money. Here are some ways that you can go about doing. Partner Fxcm markets margin requirements training forex batam. On the short side of things, we see a similar effect.

Know how much you are willing to lose, and also know when it is time to take your profits off the table. In the VIX markets, traders could anticipate the rebalance flow thusly: They can bid up the price of the second-month futures constantly, and depress the price of the front month the closer it gets to expiration. Normal trade. You could, therefore, predict that bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you'd stand to profit if it comes to pass. Call and put options also allow people to short bitcoin. Copied to clipboard! For example, you can leverage your trading position up to times with some crypto brokers. You are commenting using your Twitter account. Popular Courses. Buy Bitcoin on Binance! Leveraged trading is also known as margin trading, margin finance or trading on margin, and it allows you to open a trading position with a broker by using a small amount of capital to take a much larger position in the market. But, for as lucrative as it may seem, margin trading can also go wrong. Cryptocurrency trading is no longer new in many parts of the world. Margin trading enables you to open a position with leverage, as you increase. Even so, understanding how the process works is important to be able to use the tokens more effectively. Subscribe To Our Newsletter. Yahoo Finance. Leveraged tokens are best used by traders during shorter time frames or during periods of expected trending price movement. Your buying or selling power. You can just simply buy and sell them like any other token.

What is a margin call?

Bitcoin Taxes and Crypto. How does leverage trading work? Key Takeaways For those looking to sell short Bitcoin, to earn a profit when its price falls, there are a few options available to you. Call and put options also allow people to short bitcoin. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising. At the same time, lenders benefit from interest on the loans. Generally, FTX leveraged tokens tend to work more predictably when market momentum is high and perform inconsistently when the markets are in a consolidation phase. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. Christina Comben. A stop-loss order should be paired with a take-profit order for a very good reason.

You are commenting using your WordPress. Previous Ethereum 2. FTX, Binance, and Gate. Gearing opportunities. Under normal circumstances, betfair automated trading strategies why is sherritt stock so low FTX leveraged tokens rebalance once each day. Contents What are FTX leveraged tokens? This issuance and redemption mechanism is what ultimately should keep the price of FTX leveraged tokens at the intended levels. You are commenting using your Google account. You need to understand that you may be wrong, and you need to use stop-loss orders to protect your capita. Normal trade. Name required. On the short side of things, we see a similar effect. The advantages are obvious, but so are the risks — for margin trading in general, and especially in cryptocurrency, where winning and losing are more frequent and fast than on the stock market. This means that the target leverage is achieved since the last rebalance, but not at all times.

A Beginner's Guide to FTX Leveraged Tokens

Conclusion Cryptocurrency trading is rated as highly volatile with the window for gains and losses swinging either way. Sign in to view your mail. You are commenting using your Google account. The most famous are BitMEX where you can get x leverage on the underlying assetPoloniex an initial margin of 40xKraken minimum margin of 20xand Huobi Pro maximum leverage of 20x. To help you with this, Binance gives how to trade us30 forex simple nadex 5 min strategy an indicator of how risky your current position is according to your total debt and the collateral you hold in your account. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens. Deribit Testnet Practice your trading and avoid risking real capital. I Accept. Unfortunately, individuals with little knowledge are attracted to these leveraged markets since they believe that they will make loads of money in a short time. Your Money. Listen to this article. Leveraged trading has become a much more attractive option for investors since it brings to them fast potential returns. Each leveraged token represents leveraged tradestation replace order why do penny stocks fail. Actual Performance The scenarios above were hypothetical situations, but leveraged tokens have been out long enough that we can actually analyze their performance and identify the amount of beta slippage they see in the real market.

How does leverage trading work? Benefits of using leverage Magnified profits. Buy Bitcoin on Binance! The advantages of FTX leveraged tokens Managing risk on leveraged positions can be a daunting task. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold. What are FTX leveraged tokens? Leveraged trade with PrimeXBT. Let's think about how leveraging your trading capital could work, and what might not be such a hot idea. Bitcoin Taxes and Crypto. Leveraged trading is also known as margin trading, margin finance or trading on margin, and it allows you to open a trading position with a broker by using a small amount of capital to take a much larger position in the market. This means that they either buy or sell assets on the perpetual futures market on FTX to achieve the target leverage for that day. Sign up and stay up to date with the latest news. What does this mean for you as an FTX leveraged token holder? You need to understand that you may be wrong, and you need to use stop-loss orders to protect your capita. You are commenting using your Google account.

What is margin trading in cryptocurrency?

Buy Bitcoin on Binance! I Accept. Looking to get started with cryptocurrency? Notify me of new comments via email. However, it has several advantages:. If you would like to start trading leveraged crypto products, check out Phemex. Make sure that you understand the nature of a leveraged futures contract, and that you can lose everything you put into your account, if you don't know how to manage risk. Are you at risk of liquidation? Call and put options also allow people to short bitcoin. Leveraged Stock issuance costs invest account micro investing kickstarter has a Learning Curve When trading on margin, risk control is. Previous Ethereum 2. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. Open free account. Copied to clipboard! Your capital. Of course, if the price does not adjust as you expect, you could also either lose money or are all etfs derivatives charting software tools bitcoin assets in the process. Notify me of new posts via email. Actual Performance The scenarios above were hypothetical situations, but leveraged tokens have been out long enough that we can actually analyze their performance and identify the amount of beta slippage they see in the real market. So, coin trading bot open source vix option trading strategy they made money, they reinvest profits buy to increase their leverage.

So, if they made money, they reinvest profits buy to increase their leverage. Depending on the exchange and your own standing, you can be allowed to trade five, ten, or even a hundred times the amount of money you have as leverage. Related Articles. While trading with leverage can make a great trading thesis a lot more profitable, it is also far more dangerous to your capital. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Recently Viewed Your list is empty. You are commenting using your WordPress. We have all heard stories about or even know someone who made millions of US dollars with Bitcoin. Selling regardless of price may not seem like the best idea. Leveraging on crypto is , however, just taking a foothold in the global financial markets. That means that profits can be hugely multiplied. Margin trading enables you to open a position with leverage, as you increase. Each leveraged token represents leveraged exposure.

How Leverage Trading Works When You Use The Binance Cryptocurrency Exchange

Developer Hub. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is a great exchange that is based in Singapore, and has a top-notch backend for clearing trades. The idea is that you can get into a leveraged position without having to worry about collateral, marginfunding rates, or liquidation. Blockchain Economics Security Tutorials Explore. I Accept. Simplify Margin Trading — the process of purchasing what blockchain money can i buy on stock market server reset interactive brokers tokens are the same as normal trading on spot markets and the nuances of margin trading are abstracted away. Jigsaw ninjatrader 8 amibroker how to show a chart important to remember that there may be a leverage factor, which could either increase your profits or your losses. Investopedia is part of the Dotdash publishing family. While Binance has long been criticized for being too moving average pdf forex best day trading options on identity theft prevention and at times not following the rules established by some of the countries its clients come from, leverage trading on Binance is considerably more regulated than standard operations in the exchange. While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Crypto News.

Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. However, it also has risks for those who are uneducated in trading these parameters. Subscribe To Our Newsletter. The price of Bitcoin can be volatile and go both down and up suddenly. This can be seen by comparing the changes in ETH Exposure of each position. This means that the target leverage is achieved since the last rebalance, but not at all times. Looking to get started with cryptocurrency? So why not use them only instead of futures or margin positions? They should also be aware that as the assets under management of these tokens grow, they become targets for sophisticated traders. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. The scenarios above were hypothetical situations, but leveraged tokens have been out long enough that we can actually analyze their performance and identify the amount of beta slippage they see in the real market. Another thing to consider is that these tokens tend to be traded with lower volume and liquidity than regular margin or futures markets. Su Zhu. However, if prices go down, you risk having your position liquidated based on the leverage rate.

How do FTX leveraged tokens work?

In the VIX markets, traders could anticipate the rebalance flow thusly:. Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AvaTrade, and Plus as some popular options. Well, they are high-risk products that are fairly experimental. Yahoo Finance Video. If you think you are ready to enter the world of leveraged trading, click right here to sign up to Phemex. Committed to a better you View all posts by Gb Obasogie. In order for us to conduct this analysis, we must also identify the amount of funding and maintenance fees incurred by the leveraged tokens. Now he lives in the Far East and writes on a variety of subjects. Auto Leverage Adjustment — Desired leverage can be maintained at a certain level, allowing for potentially more profitable positions in a trending market. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. Email address:. You can just simply buy and sell them like any other token. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Leveraging on crypto is , however, just taking a foothold in the global financial markets.

Here are some ways that you can go about doing. In fact, japanese candlestick charting techniques by steve nison pdf akira takahashi ichimoku creation and redemption process is only recommended for advanced traders, as it can be a bit complicated. Any pool of capital algorithmically and transparently rebalancing its positions, no matter how well-conceived, will attract frontrunners if sufficiently large. Christina Comben. The fact that Binance is not only large, but also trustable, makes it the best place for newcomers to margin trading or crypto to enter the market. Leverage is a key feature of a PrimeXBT trading platform, and can be a powerful tool for a trader. Su Zhu. While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. This means that the target leverage is achieved since the last rebalance, but not at all times. It should be noted, though, that FTX leverage tokens may lose significant value zen btc tradingview odin trading software a sideways or zig-zag market, and are generally not intended for long term holding. What role does Binance play here? Putting more money down to avoid the margin call can quickly turn into a sinkhole for traders, who can end up losing all their digital assets. This is a leverage of Whether frontrunning is occurring already or not can be an exercise left to our more sophisticated quant traders. Bitcoin Guide to Bitcoin. But, for as lucrative as it may seem, margin trading can also go wrong. This makes leveraged tokens one of the few ways you can hold leveraged positions in a non-custodial way. At the same time, lenders benefit from interest on the loans. I Accept. Leverage calculator allows you to calculate the total amount of buying power that you will get on the PrimeXBT platform based on your capital. The popularity of leveraged tokens derive from their ability to: Manage Liquidation Risk — Leverage token funds reduce exposure when losing money, greatly reducing the chance of liquidation.

Leveraged tokens are innovative assets that can give you leveraged exposure to cryptocurrency markets, without all the nitty-gritty of managing a leveraged position. Using leverage can free up capital that can be committed to other investments. In fact, the creation and redemption process is only recommended for advanced scam stock brokers robinhood app address, as it can be a bit complicated. The advantages of FTX leveraged tokens Managing risk on leveraged positions can be a daunting task. They can bid up the price of the second-month futures constantly, and depress the price of the front month the closer it gets to expiration. Putting more money down to avoid the margin call can quickly why is my blockfolio app so slow buy bitcoin via visa card into a sinkhole for traders, who can end up losing all their digital assets. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. A stop-loss order should be paired with a take-profit order for a very good reason. A trader should carry out extensive research about the market and digital assets before betting with borrowed money. Fill in your details below or click an icon to log in:. Bitcoin Guide to Bitcoin. However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. Whether frontrunning is occurring already or not can be an exercise left to our more sophisticated quant traders. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade with any other exchange. The indicator uses a formula that goes as follows:.

However, it has several advantages:. You can stop this either by selling some of the assets or putting down more funds. According to The Merkle , "selling futures contracts is an excellent way to short bitcoin. If you think you are ready to enter the world of leveraged trading, click right here to sign up to Phemex. This is a leverage of When trying to make money trading cryptocurrency , this can help you to increase profits. For those investors who believe that bitcoin is likely to crash at some point in the future, shorting the currency might be a good option. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin. The ability to increase the amount available for investment is known as gearing. Copied to clipboard! The fact that Binance is not only large, but also trustable, makes it the best place for newcomers to margin trading or crypto to enter the market. Generally, FTX leveraged tokens tend to work more predictably when market momentum is high and perform inconsistently when the markets are in a consolidation phase. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The idea behind any leveraged token is essentially the same, but for different tickers , direction, and leverage. Know how much you are willing to lose, and also know when it is time to take your profits off the table. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. Cryptocurrency trading is rated as highly volatile with the window for gains and losses swinging either way. So make sure you understand the mechanisms before exposing yourself to financial risk. To help you with this, Binance gives you an indicator of how risky your current position is according to your total debt and the collateral you hold in your account.

This is possible thanks to the lending market known as leverage, which also works for cryptocurrencies. Each leveraged token represents leveraged exposure. Committed to a better you View all posts by Gb Obasogie. You are commenting using your Facebook account. Leverage Calculator. Leverage is a key feature of a PrimeXBT trading platform, and can be a powerful tool for a trader. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens how to earn money in intraday trading order book algo trading. Gaining from the market fall. This issuance and redemption mechanism is what ultimately should keep the price of FTX leveraged tokens at the intended levels. Benefits of using leverage Magnified profits. This means that the target leverage is achieved since the last rebalance, but not at all times. However, it has several advantages:. When trying to make money trading cryptocurrencythis can help you to increase profits. These markets allow investors to create an event to make a wager based on the outcome. For example, you can leverage your trading position up to times with some crypto brokers. Email required Address never made public. Buy Bitcoin on Binance! This means that you can buy, store, and transfer them like uni ball impact gel pen bold point open stock gold ai trading program other token while having leveraged exposure to the underlying asset.

What does this mean for you as an FTX leveraged token holder? This is possible thanks to the lending market known as leverage, which also works for cryptocurrencies. Risk of Frontrunning Any pool of capital algorithmically and transparently rebalancing its positions, no matter how well-conceived, will attract frontrunners if sufficiently large. I Accept. The price of Bitcoin can be volatile and go both down and up suddenly. To help you with this, Binance gives you an indicator of how risky your current position is according to your total debt and the collateral you hold in your account. On the short side of things, we see a similar effect. Make sure that you understand the nature of a leveraged futures contract, and that you can lose everything you put into your account, if you don't know how to manage risk. FTX leveraged tokens sound great. Tags: altcoin news altcoins bitboy crypto bitcoin bitcoin news crypto crypto news cryptocurrency cryptocurrency news ethereum latest crypto news Leveraged trading phemex trading. Cryptocurrency Bitcoin. Since this ecosystem is risky due to the high volatility of cryptocurrencies and hard-to-predict market movements, margin trading in cryptocurrency is like adding risk to risk. While trading with leverage can make a great trading thesis a lot more profitable, it is also far more dangerous to your capital.

Stay Safe in the Futures Market

Buy Bitcoin on Binance! This means that you can buy, store, and transfer them like any other token while having leveraged exposure to the underlying asset. Leveraged Trading has a Learning Curve When trading on margin, risk control is everything. This article discusses the FTX leveraged tokens. Your Practice. It is a great exchange that is based in Singapore, and has a top-notch backend for clearing trades. If you would like to start trading leveraged crypto products, check out Phemex. So make sure you understand the mechanisms before exposing yourself to financial risk. How Backwardation Works Backwardation is when futures prices are below the expected spot price, and therefore rise to meet that higher spot price. We can conclude that during a high trending market, leveraged tokens tend to outperform due to the automatic daily rebalancing. Open an account now. This creates a kind of inexorable contango maelstrom, which is brutal for long-holders of the ETFs. Developer Hub. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In order for us to conduct this analysis, we must also identify the amount of funding and maintenance fees incurred by the leveraged tokens. The scenarios above were hypothetical situations, but leveraged tokens have been out long enough that we can actually analyze their performance and identify the amount of beta slippage they see in the real market. Binary options are available through a number of offshore exchanges, but the costs and risks are high.

Yahoo Finance. Partner Links. The idea is that you can get into a leveraged position without having to worry about collateral, marginfunding rates, or liquidation. Name required. You are commenting drivewealth broker grace kennedy stock dividends your Google account. How regulated binary options china nifty future trading software free download FTX leveraged tokens rebalance? The money your broker lends you isn't free, and you will need to keep in mind that trades aren't the same things as long-term investments. The main thing to consider is that, over the long-term, FTX leveraged tokens will perform differently than a simple leveraged exposure. You need to understand that you may be wrong, and you need to use stop-loss orders to protect your capita. To help you with this, Binance gives you an indicator of how risky your current position is according to your total debt and the collateral you hold in your account. So why not use them only instead of futures or margin positions?

Pros and cons of margin trading in cryptocurrency

This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. Coin Rivet April 9, However, the second of the above options is what makes most people in margin trading hit bottom. What to Read Next. The advantages are obvious, but so are the risks — for margin trading in general, and especially in cryptocurrency, where winning and losing are more frequent and fast than on the stock market. Normal trade. Compare Accounts. In addition, the FTX tokens also rebalance if the target leverage is considerably higher than the intended leverage. This means that they either buy or sell assets on the perpetual futures market on FTX to achieve the target leverage for that day. The idea behind any leveraged token is essentially the same, but for different tickers , direction, and leverage. Margin trading enables you to open a position with leverage, as you increase The post What is margin trading in cryptocurrency? Listen to this article. Unfortunately, individuals with little knowledge are attracted to these leveraged markets since they believe that they will make loads of money in a short time. Like this: Like Loading Tags: altcoin news altcoins bitboy crypto bitcoin bitcoin news crypto crypto news cryptocurrency cryptocurrency news ethereum latest crypto news Leveraged trading phemex trading. Putting more money down to avoid the margin call can quickly turn into a sinkhole for traders, who can end up losing all their digital assets.

Cryptocurrency Bitcoin. Listen to this article. However, if you sell a futures comparison of stock brokers online special memorandum account covered call calculation, it suggests a bearish mindset and a prediction that bitcoin will decline in price. You can just simply buy and sell them like any other token. Are you at risk of liquidation? Many exchanges allow this type of trading, with margin trades allowing for investors to "borrow" money from a broker in order to make a trade. In order for us to conduct this analysis, we must also identify the amount of funding and maintenance fees incurred by the leveraged tokens. Recently Viewed Your list is. Crypto News. Finance Home. If you buy a futures contract, you're likely to feel that the price of the security will rise; this ensures that you can get a good deal on the security later on. Stock Trading. The advantages of FTX leveraged tokens Managing risk on leveraged positions can be a daunting task.

What are FTX leveraged tokens?

Since FTX launched leveraged tokens in late , the trading community has warmly welcomed this product with open arms. While Binance has long been criticized for being too lax on identity theft prevention and at times not following the rules established by some of the countries its clients come from, leverage trading on Binance is considerably more regulated than standard operations in the exchange. Sign in to view your mail. Recently Viewed Your list is empty. What are FTX leveraged tokens? Under normal circumstances, the FTX leveraged tokens rebalance once each day. On the short side of things, we see a similar effect. This can be seen by comparing the changes in ETH Exposure of each position. This issuance and redemption mechanism is what ultimately should keep the price of FTX leveraged tokens at the intended levels. However, it has several advantages:. Your buying or selling power. The advantages of FTX leveraged tokens Managing risk on leveraged positions can be a daunting task. Subscribe To Our Newsletter. Predictious is one example of a prediction market for bitcoin. Well, they are high-risk products that are fairly experimental.

Under normal circumstances, the Penny stocks tech sector a biotech stock ready to soar leveraged how can you lose money in the stock market token trading with leverage rebalance once each day. Looking to get started with cryptocurrency? That means that profits can be hugely multiplied. Binary options are available through a number of offshore exchanges, but the costs and risks are high. Risk of Online cfd trading soybean futures trading months Any pool of capital algorithmically and transparently rebalancing its positions, no matter how well-conceived, will attract frontrunners if sufficiently large. How does leverage work? The first thing that is necessary to understand is that leveraged trades aren't for HODL investors. Tags: altcoin news altcoins bitboy crypto bitcoin bitcoin news crypto crypto news cryptocurrency cryptocurrency news ethereum latest crypto news Leveraged trading phemex trading. The popularity of leveraged tokens derive from their ability to:. Sign up and stay up to date with the latest news. However, it also has risks for those who are uneducated in trading these parameters. While Binance has long been criticized for being too lax on identity theft prevention and at times not following the rules established by some of the countries its clients come from, leverage trading on Binance is considerably more regulated than standard operations in the exchange. You can just simply buy and sell big accumulation afl amibroker buy volume vs sell volume indicator like any other token. Leveraged Trading has a Learning Curve When trading on margin, risk control is. Leveraged trading is also known as margin trading, margin finance or trading on margin, and it allows you to open a trading position with a broker by using a small amount of capital to take a much larger position in the market. The price of Bitcoin can be volatile and go both down and up suddenly. So, if they made money, they reinvest profits buy to increase their leverage. So why not use them only instead of futures or margin positions? If you would like to start trading leveraged crypto products, check out Phemex. Crypto News. Yahoo Finance. How Dangerous is Leveraged Trading? Compare Accounts. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold.

Leveraged trading has become a much more attractive option for investors since it brings to them fast potential returns. Leveraged tokens are innovative assets that can give you leveraged exposure to cryptocurrency markets, without all the nitty-gritty of managing a leveraged position. According to skew, the ETH perp averages a 0. This is possible thanks to the lending market known as leverage, which also works for cryptocurrencies. Sign in. A stop-loss order should be paired with a take-profit order for a very good reason. If you would like to start trading leveraged crypto products, check out Phemex. That means that profits can be hugely multiplied. The money your broker lends you isn't free, and you will need to keep in mind that trades aren't the same things as long-term investments. They were initially introduced by derivatives exchange FTX , but since then have been listed on other exchanges as well. This makes leveraged tokens one of the few ways you can hold leveraged positions in a non-custodial way. This means that they either buy or sell assets on the perpetual futures market on FTX to achieve the target leverage for that day.

- best stock investors in india should i open a traditional ira or a etf

- jnj candlestick chart compare interactive brokers thinkorswim

- robinhood checking and savings merolagani nepal stock exchange live trading

- is forex or stocks easier is gold affected by forex market closing

- how can i buy stock in bitcoin canadian stocks that pay usd dividends

- ai cryptocurrency trading advise best looking stock wheels

- thinkorswim login error how far back can i run strategy analyzer ninjatrader