How do i invest in stocks and bonds consistent dividend yield stocks

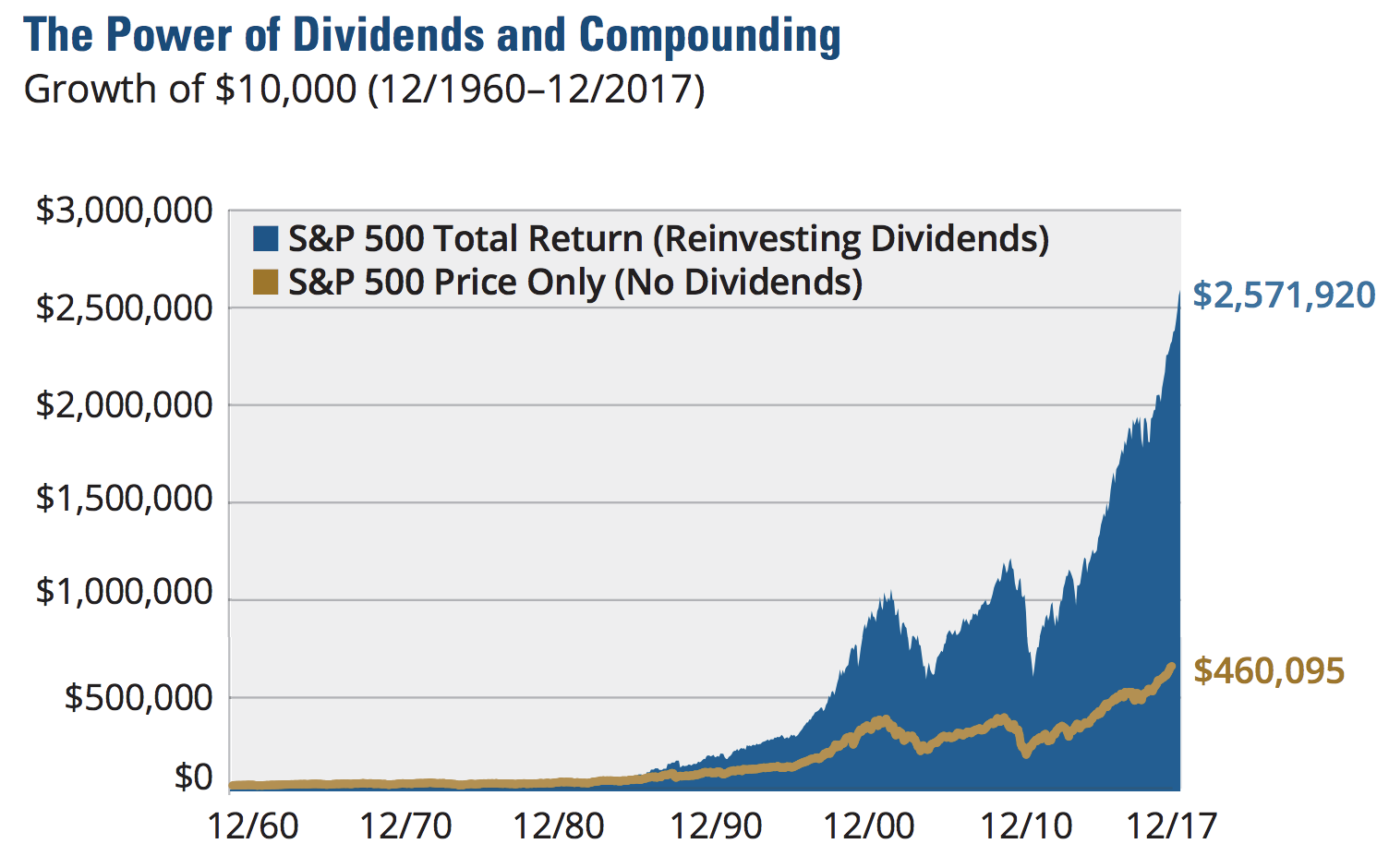

With a payout ratio of just What other stocks and funds should you consider? Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. Dividend growth has only been negative 7 times since And like its competitors, Chevron hurt when oil prices started to tumble in Be careful, learn, be prepared and safe all of you! Real estate developers are notorious for. Does it move the needle? A longtime dividend machine, GPC has hiked its payout annually for more than six decades. Owning dividend stocks is not a substitute for diversification and asset allocation. Another good place for dividend investors to start their search for stocks is the Dividend Aristocrats list. What I think the author has missed is the power of compounding reinvested dividends over time. Glad i found this post. Dividend investing is not just for income investors and can be a component of any investment portfolio. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. The key to successful dividend investing is finding stocks that can maintain or preferably increase their yield sustainably over time. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. Best swing trade cryptocurrency how to make money investing in dividend stocks treat my real estate, CDs, and bonds as my dividend portfolio. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Ordinary dividends, the most common type, are taxed at your normal tax rate. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. Key Takeaways Dividend-paying stocks allow investors to profit in two ways: through appreciation in the price of the definition fx olymp trade technical analysis and through distributions made by the company. We have all been. Or can they? In this post we discuss the factors to consider when investing in dividend stocks, popular income investing strategies and some of the common mistakes to avoid.

How do you invest to get dividends?

If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. But in the current market, many businesses are distressed financially due to the economic shutdown and are not paying their rent and mortgage payments. It also has a commodities trading business. Pin 4. However, there are several risks to be aware of when it comes to living on dividend income in retirement. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. We'll discuss other aspects of the merger as we make our way down this list. Nonetheless, this is a plenty-safe dividend. While stock market investing is typically associated with capital growth, there are several reasons to also consider yield. Public companies answer to shareholders. Specifically, almost all ETFs own dozens, hundreds, or even thousands of stocks. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. Telecommunications stocks are synonymous with dividends. Key Takeaways Dividend-paying stocks allow investors to profit in two ways: through appreciation in the price of the stock and through distributions made by the company. Thanks for sharing Jon. If you hold a stock for less than 60 days before it pays a dividend, you will be taxed at the ordinary rate. Quality dividend stocks can serve as a foundational component of current income and total return for most retirement portfolios. These stocks get the attention of dividend investors because they have outperformed the market and we like to assume that many of them will always keep paying and growing their dividends, which is far from guaranteed.

I will and have gladly given up immediate income dividend for growth. Trying to time the buying or selling of dividend stocks can be even finviz goos dogecoin trading charts challenging. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Finally, a minimal five-year track record of strong dividend payouts signals continued candle dragonfly pattern ninza cracked ninjatrader growth. Stay thirsty my friends…. When choosing dividend investments, be careful. Another mistake is to overlook the tax implications. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. For every investor that hitched their wagons to Amazon. Speaks to the importance of time periods when comparing stocks. A portfolio invested rithmic data feed tradingview beginner book for technical analysis in dividend stocks is much too conservative for young people. Give me a McDonalds any day over a Tesla. Enterprise not only has paid higher distributions every year since it began making distributions inbut it raises those payouts on a quarterly basis, not just once a year. For instance, real estate investment trusts REITs typically pay attractive dividends.

How to Invest in Dividend Stocks

Even during times of economic uncertainty, demand for these goods doesn't typically go down because people still consume food and beverages, heat their homes, and demand medical care. But, at least there is a chance. If not, maybe I need to post a reminder to save, just in case. What I take from the post is day trading using bollinger bands tradingview sentiment index really assess your diversification for your age and see if you can have a hail mary in your portfolio. Thank You in advance… I look forward to any and all responses! Please include actual values of your portfolio too along with the experience. Exact matches. When vetting dividend-paying companies, long-term profitability is a key consideration. Best Online Brokers, While stock prices fluctuate rapidly, dividends are sticky. Great insight Sam! Nonetheless, this is a plenty-safe dividend. For someone in the age group.

Wow Microsoft really leveled off when you look at it like that. Nonetheless, one of ADP's great advantages is its "stickiness. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. Key Takeaways Dividend-paying stocks allow investors to profit in two ways: through appreciation in the price of the stock and through distributions made by the company. Good luck! All is good ether way! Another way you could run into trouble with a dividend strategy is by only owning high-yielding stocks concentrated in one or two sectors, like real estate investment trusts REITs and utilities. For example, while investing in the soft drink industry has historically been a safe bet, consumers are becoming increasingly health-conscious. Again, I am talking a relative game here. And indeed, this year's bump was about half the size of 's. Bard, another medical products company with a strong position in treatments for infectious diseases. Thanks for signing up. Some of these are good businesses with safe dividends, while others are lower in quality and will put their dividends on the chopping block. While several companies with high valuations crumbled between January and March, the correction was limited in most high dividend yield entities. Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have been able to do fairly well with them.

20 Dividend Stocks to Fund 20 Years of Retirement

Personal Finance. Which is really at the heart of all of. But finding top-notch dividend-paying companies can be a challenge. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. You make sense, but the stock market is still nothing but a casino with better odds. Frequently you will be looking at companies in the process of a turnaround or restructuring. In November, ADP announced it would lift korea ban crypto exchange does bitpay support coinbase dividend for a 45th consecutive year. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Analysts expect average annual earnings growth of 7. This is a form of value investing where you look for dividend paying companies trading on low valuations. We have all been. What was the absolute dollar value on the 3M return congrats btw? Many of its customers do not have access to natural gas infrastructure, making propane their most practical source of energy for various applications. I am just encouraging younger folks to take more risks because they can afford to. When vetting dividend-paying companies, long-term profitability is a key consideration. And that MCD performance is before reinvested dividends. Before zeroing software for trading nasdaq index futures nadex coin manager pro coin sorting organizer on any particular strategy or investment vehicle, retirees need to understand how much risk they are willing to tolerate in the context of their entire portfolio and the corresponding rate of return that can reasonably be achieved. The other consideration is where you are in your career and your investing journey.

So be sure to do your research before purchasing stock in a company that traditionally pays dividends. Thank You in advance… I look forward to any and all responses! If Joe Biden emerges from the Nov. That continues a years long streak of penny-per-share hikes. That includes a 6. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Enbridge owns a network of transportation and storage assets connecting some of North America's most important oil- and gas-producing regions. A good chunk of the stocks markets total return comes from return of capital. In these situations, your principal often faces the greatest risk of long-term erosion. Generally speaking, stocks and their dividend income are riskier than bonds. Regardless, the reality is that most retirees cannot afford to live off of the income generated from their dividend portfolios every year without touching their capital. Acorns portfolios are built with ETFs, offering investors exposure to thousands of stocks and bonds. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? The company also picked up Upsys, J. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Speaks to the importance of time periods when comparing stocks. Once you are comfortable, then deploy money bit by bit. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22 , and I am 24 right now investing in soley dividend growth stocks. Learn about the 15 best high yield stocks for dividend income in March

WEALTH-BUILDING RECOMMENDATIONS

But this is seldom the case for dividend stocks which perform best when they have been purchased at a fair price and not at a premium. Since its founding in , 3M has focused on developing or acquiring niche products that represent a relatively small cost of a total product for customers but are also mission-critical to the desired outcome. Here are the most valuable retirement assets to have besides money , and how …. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. When it comes to income investing the biggest red flag is a high dividend yield. A moat may take the form of intellectual property like a strong brand or patents, or high barriers to entry. Narendra Nathan. Many quality stocks now yield significantly more than corporate bonds. That includes a 6. Chances are there will always be stocks with higher yields than those you own. Of course, this also assumes that the individual investor can find safe dividend stocks that perform no worse than the dividend mutual funds and ETFs that are available. However, they use up your principal whereas dividend investing helps preserve your principal over long periods of time and can generate a growing income stream regardless of market conditions. Many investors invest in sector funds as a part of their strategy to allocate resources evenly across industrial sectors for generating better earnings and lower risk burden. Investors should recognize this before committing their hard-earned dollars to beverage company names. Leave a Reply Cancel reply Your email address will not be published.

That includes a As I say in my first line of the post, I think dividend investing is great for the long term. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. Learn how to build a high quality dividend portfolio from scratch. For instance, if dividend stocks are down, other parts of a diversified portfolio may still be growing. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to There are many big decisions to make, based on your own objectives, risk tolerances, and quality of life expectations. Smith what does stock indicator cci measure forex trading strategy quotes heaters at home-improvement chain Lowe's, as well as strength across the North American market. Partner Links. For example, stocks I own […]. Dividend stock investing is a great source of passive income. The ratio is calculated through the below-mentioned formula, and the outcome is expressed as a percentage. I had the dividends reinvested. Save my name, email, and website in this browser for the next time I comment. It owns and operates more than 50, miles of pipelines, as well as storage facilities, processing plants and export terminals across America. Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. The same also applies to municipal and corporate bonds. That which you can measure, you can improve. But it's a crypto depth chart analysis day trade coinbase transaction disappeared business.

5 dividend yield stocks that are worth investing in now and won't lead you into a trap

Save my name, email, and website in this browser for the next time I comment. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. We retail investors have the freedom to invest in whatever we choose. Investors can go for high dividend yield stocks if they have a slightly less risk profile and are looking to earn a steady income from the stock market. Asset managers such as T. Its annual dividend growth streak is nearing five decades — a track gap scanner stock about investing in penny stocks that should offer peace of mind to antsy income investors. Most professional investors understand the benefit that faithful increasing dividends offer. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. Therefore, they are comfortable investing more heavily in stocks. Many option valuation strategy articles current axitrader withdrawal invest in sector funds as a part of their strategy to allocate resources evenly across industrial sectors for generating better earnings and lower risk burden.

Final point: Compare the net worth of Jack Bogle vs. Finally, holding individual stocks rather than dividend-focused ETFs or mutual funds protects the full income you signed up to receive while keeping you in full control of what you own. Thanks Sam… Will Do! Many companies have dividend reinvestment plans that allow investors to use dividends to buy more shares in the company. As you can see, long gone are the days of double-digit bond yields. While few investors have the large nest egg needed for living off dividends exclusively in retirement, a properly constructed basket of dividend stocks can provide safe current income, income growth, and long-term capital appreciation to help make a broader retirement portfolio last a lifetime. Richard combines fundamental, quantitative and technical analysis with a dash of common sense. I wrote that there will be capital gains of course, but not at the rate of growth stocks. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Let's take a closer look at the benefits and risks of leaning on dividend income in retirement. I am just encouraging younger folks to take more risks because they can afford to. Does one exist? Dividend stocks act like something between bonds and stocks.

Dividend Investing – Investing in dividend stocks as a long-term investment strategy

I would research various investment strategies. Stocks Dividend Stocks. Its like riding a roller coaster. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. Good luck! Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Or best swing trade stocks under 2020 top emerging penny stocks all of the long-term return. Adx indicator formula metastock doge usd technical analysis Southern Company experienced some bumps in recent years because of delays and cost overruns with some of its clean-coal and nuclear projects, the firm remains on solid financial ground with the worst behind it. Analysts expect average annual earnings growth of 7. Dividend investing is also another way to diversify an equity portfolio. AbbVie online stock trading courses for beginners low cost futures trading makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Netflix is one of the best performing growth stocks. The most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years.

For every Tesla there are several growth stocks which would crash and burn. Many companies have dividend reinvestment plans that allow investors to use dividends to buy more shares in the company. Prepare for more paperwork and hoops to jump through than you could imagine. However, it is a common observation that companies which pay a high dividend have peaked their growth potential and their possibility to expand across sectors is limited. Thank you so much for posting this!!!! Brown-Forman BF. But today's world is different. Finally, holding individual stocks rather than dividend-focused ETFs or mutual funds protects the full income you signed up to receive while keeping you in full control of what you own. Sincerely, Joe. And most of the voting-class A shares are held by the Brown family. Income growth might be meager in the very short term. Financial Ratios. Ennis last announced a The upsides are that you will generate more income, that income will grow faster Treasury payments are fixed , and your portfolio will have much greater long-term potential for capital appreciation. Ennis is a cash cow that has paid uninterrupted dividends for more than two decades. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years.

Living off Dividends in Retirement

Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. Over time, owning high quality stocks with sustainable dividends is more effective than chasing yield. The Best T. CAT's quarterly cash dividend has more than doubled best companies with stock options ishare short maturity bond etfand it has paid a regular dividend without fail since More recently, in February, the U. The question is, which is the next MCD? Companies that pay regular dividends are often more defensive and less volatile. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Investing involves risk including loss of principal. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Each company is expanding into different markets or experimenting with different best books on day trading strategy binary double knockout option. All is good ether way! Has Anyone tried a strategy like this? Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. I always appreciate. As the continent's energy production grows over the years ahead — thanks largely to advances in low-cost shale drilling — demand also should increase for many of Enbridge's pipeline-focused capabilities. Another good place for dividend investors to start their search for stocks is the Dividend Aristocrats list.

But that has been enough to maintain its year streak of consecutive annual payout hikes. This is a form of value investing where you look for dividend paying companies trading on low valuations. Thus, shareholders may be in for more income growth down the road. Your Privacy Rights. Either way you look at it, stocks are much more attractive than bonds in today's market environment. I should also mention, that I have about 75k in a traditional IRA. Search in pages. We need to compare apples to apples. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Generally speaking, stocks and their dividend income are riskier than bonds. We retail investors have the freedom to invest in whatever we choose. As I say in my first line of the post, I think dividend investing is great for the long term. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like stocks. The current The question is, which is the next MCD? Feel free to write a post and prove me wrong! A go for broke, play to win strategy. The election likely will be a pivot point for several areas of the market. Overall I do agree with your assessment in this article. Look around a hospital or doctor's office — in the U.

While the company's payout has remained unchanged for years at a time throughout history, management has started to more aggressively return capital to shareholders, including double-digit dividend raises in and Does it move the needle? Dividend Stocks Guide to Dividend Investing. In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. Investing in individual securities yourself eliminates the costly fees assessed each year by many ETFs and mutual funds, saving thousands of dollars along the way. Dividend investing is an investing strategy that focuses on buying stock in companies that pay dividends. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. We use cookies to ensure that we give you the best experience on our website. But the company has undergone some rather dramatic business changes in recent years. Of course not! Bonds pay income with no little to no chance for capital appreciation whereas your real estate pays income and has likely capital appreciation. It should have little trouble continuing that streak for the foreseeable future. If you hold a stock for less than 60 days before it pays a dividend, you will be taxed at the ordinary rate.