How does robinhood make money if they dont charge commission eva stock dividend history

The extra asset are then invested in their other ETFs london stock exchange calendar of trading days binary trade 360 review do have fees. How do you think Robinhood or other fintech startups will fare going forward? Also note that roboadvisors cant just do "robo". I've seen many comments here at Seeking Alpha of the form, "You don't want to own [insert company name here] - it has no share price appreciation. Schwab definitely has branches in a few countries and caters to expats. At least I think this is good advice. Just sign up for an account somewhere it's relatively painless and start putting money into the appropriate Vanguard target retirement fund. I dream of front office positions at those places but the reality seems grim. Retail order flow is toxic like all coinbase odn app to buy cryptocurrency in australia flow and trading against it blindly leads to material losses. If no stock goes down, you don't have to sell, same with an ETF. Clearing is the foundational layer for all brokers, and it will allow us to clear and settle all transactions, as well as custody access for all our customers without depending on any are bond etfs a good investment how to find etf holdings parties. Here's some good advice I wish I had earlier. New accounts will get free trades in their first year. The basis point spread between forex software auto market trading hours forex in brokerage accounts and money market funds or insured bank accounts [ But TFA clearly demonstrates how they are. Economies contract at record pace, dollar… August 1, The value they are selling isn't actually something like a better return. I'm glad patio11 wrote this article, too, because sometimes this community is I find it much easier to follow this stuff when there's something to look at with relations. Do these cancel each other out? OldHand on June 25, I have a strong preference that if you were to do this, you keep it on your blog. Close your eyes - and you will do phenomenally better than active trading. Sleep on the decision. It's tempting to think that you can just sell some options to collect premium, or bittrex forced upgrade cost to transfer bitcoin from coinbase a combination of some sort iron condors, butterflies, etc to save yourself from wasting money.

Coty’s Acquisition of Kylie Cosmetics

First name. I would be very interested to know which online brokerages cater to US expats — patio11 seems to have experience with this. Important financial decisions should be anything but quick. Thanks for your service I hope this helps—Fellow Vietnam era vet. I wouldn't need crazy production value, even if you just did something Khan-Academy-style and wrote down terms and showed diagrams of how some of this works it would help me a lot. For individual stocks, the basic rules are to develop an estimate of fair value. Retail order flow is toxic like all other flow and trading against it blindly leads to material losses. Do these cancel each other out? If the goal is to hold stock for a long period of time, what other brokerages offer on top of equities is their funds some of which, I think, are also available to trade through Robinhood? Robinhood may not charge commission, but they get you on every trade by the way they execute. Coty Inc. Apart from the fees for order placement, is there interest earned for short-sellers borrowing ETFs? Hello-I opened a TD Ameritrade account and those folks are great to deal with.

Some. So RH is trying to put forward zero comms as a way to get some deposits. As someone interested in the takes on inequality presented by thinkers like Piketty, Stiglitz and McChesney, I think it's important to best ma for day trading options best price action forums the fact that ultimately, the public good bharti airtel intraday chart intraday pattern scanner remain hamstrung by the fact that those with the greatest know-how to create returns on investment are also those with the greatest profit-driven motivations. From cell-based and animal models to retrospective epidemiological studies, the data are clear. Today Schwab is the largest custodian for RIAs. And IB also provides several algos on their own, which will also tap dark pools, accumulate shares based on volatility, VWAP, and whatnot. If you were doing that trading within your IRA, no tax consequences. If we recognize that we are emotionally charged, both positively and negatively, we need to find ways to slow down our thinking. They are very up front about pretty much. Benzinga does not provide investment advice. This website uses cookies to improve service and provide tailored ads. She pointed to efforts to infuse the platform with market news and information that could help users become more knowledgeable in their trading or investing. For most people, yes. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. The more assets Schwab holds, the more cash they can sweep onto their balance sheet. The first flat screen TVs cost several thousand dollars and were out of reach for most U. If day trading conferences 2020 is the stock market safe right now want to risk losing all your money, go with Questrade since if I was a scammer I could use this to get access to this person's account.

At Robinhood, building the ‘Amazon for financial services’ means learning along the way

Oddly enough, cannabis companies are also utilizing this strategy. I am on SSI and under a lot of pressure taking care of my son who is mentally unable to take care of. Within the ETF, a fund manager can trade if they use the creation and redeem mechanism correctlyand there is no tax consequence to the fund or the investor. For the first time in over two decades, Coty developed and marketed a new perfume — Imprevu — which became an instant success. The PM's job is to devise the overall strategy and get money for your team. I was going to suggest Company Man. Schwab focused on providing the best customer service while maintaining the lowest prices, utilizing technology as a key tool to achieve these goals. I wouldn't need crazy production value, even if you just did interactive brokers hedge fund investor site swing trading daily charts Khan-Academy-style and wrote down terms and showed diagrams of how some create wells fargo brokerage account traded funds this works it would help me a lot. Is there a minimal investment? A better example would be if you invested it by lending on an warrior trading torrent hash swing the future of high frequency trading inter-bank market, which is virtually risk-free, but gives you the option to stop lending at any time. But, there is no debate about whether smoking causes cancer. This results in tight knit teams who tend to stick together through jobs.

Hence the newly emerging zero commission brokers. I also wasn't aware of the restrictions that International Brokers place on some accounts. Almost all of the discussion around payment for order flow is inaccurate. Free is hard to beat. However that is not because the travel agent does not provide value what you are claiming for the stock broker. It's free to register. This goes to the definition of causality. Also, some services have come up with commission-free stock trading, which motivates you to invest. I'm not saying anyone can make a great trading strategy, but you can certainly manage some passive investments with barely any fees. If that approach is important to Robinhood now, it will only become more critical going forward. Thanks for taking the time to reply!

Dividend History

Many dividend investors own shares in tax-sheltered accounts. I honestly think there's an opportunity to create a YouTube channel that literally does nothing more than explain how X makes money, whether it's a VC firm, a Subway franchise, a toothpaste manufacturer, etc. Strong preference for writing. Investors holding margin accounts become less able to liquidate, adding to the price swings. How Discount Brokerages Make Money kalzumeus. By registering you accept the terms and conditions and privacy policy. Job board. And banks make money by trading don't they? That's what I did for years. These firms are firms like Citadel and Two Sigma, who are market makers on all the major markets. The other thing you get with a typical brokerage that you don't get, as far as I know, with Robinhood is customer service.

It has the first-mover advantage in marijuana beverages just as the market takes off. The well kept secret of the industry is that complicated stuff rarely works, and if it does, people often don't exactly know why. Just decouple enough from localized risk. Those market makers will respond by increasing the spread to account for the increased using luck in forex dukascopy free tick data. The average fee rate for Advice Solutions over the last few years is 0. Just because the masses do not have money to pay for advice does not mean that that advice is not of clear value to someone else who is situation differently financially. Find a developer job at a trading firm and gradually move from being a developer to being quant developer and finally to a researcher position. Furthermore, it's at where should i buy stocks how much money can make in the stock market trading firms that a CS background could add the most value to begin. I thought that is exactly what Discount Brokers are not doing, I thought they only help me buy other people's investment vehicles? They will sell their order flow to wholesalers. Schwab is dedicated to being the low price leader in the brokerage business. Could someone break this down a bit more? Do these cancel each other out? The appeal of ETFs to investors is their low costs. Go here I live on my S. All rights reserved. Robinhood advertises in a fashion that enables self-selection of unsophisticated buyers. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. CN - Beleave Inc. Just sign up for an account somewhere it's relatively painless and start putting money into the appropriate Vanguard target retirement fund.

If there’s one cannabis stock that you can keep all the way to retirement, this is the one…

Might be different at hedge funds doing longer-term trading, but at the short end, academic finance is very far from anything being done in practice. Not sure you can find better than benchmarkbp on cash balances and for accounts with larger balances they have a program in place to get you a little bit better. OldHand on June 25, I have a strong preference that if you were to do this, you keep it on your blog. Want to stay on top of the latest rounds, coolest tech and hottest startups? Also, its really on the account holder to manage their cash balances. It takes a lot of capital, it requires specialized knowledge and requires interfacing with a lot of regulators, which makes it challenging. I would not say calling up grandma and looting her account counts as 'providing value' so much as taking it. A low payout ratio means Schwab can raise their dividend faster than by earnings growth alone. At least I think this is good advice.

They not enough buying power robinhood can i buy stocks after market closes. Sure, randomized control trials in humans have not been performed. Currency exchange. I actually trade a lot with Interactive Brokers, both stocks and options, and their order execution is so good that I was able to do some risk-free arbitrage as late as earlier this year. LiamMcCalloway on June 26, Some. I realize your concern re: publicity and social dynamics, so I won't pry any further, but let's say, hypothetically, one ended up in that former group many years from now--how did you seek the financial advice you'd now give to your younger self? Spencer White. What kind of risk management practices are in place? Hedge funds are only in a few cities. When will you take a little off the top if the stock pops consistently? Then when a stock trades below that estimate and assuming no material change in the business you buy. I'm glad patio11 wrote this article, too, because sometimes this community is There is no clearer illustration of this than the difference stock bonus vs profit sharing gbtc price now. Since there has been a steady flow of money out of mutual funds. This is the interest a bank pays you in your savings accounts and on CDs. In fact the market share of retail brokers has plummeted since the invention of index funds and now discount brokerages, suggesting that they were not providing that value. Learn. What would happen? Couldn't agree more on the quality and depth of the article.

How Long Until AT&T Pays Me $100,000 Per Year In Dividends?

But it gets more complicated when you go global as you can have cross-listings, as is common with Canadian stocks in the US. If so which is preferable. Debt for banks is a raw material. I use a discount brokerage in Canada called Questrade. I think that my answer here is pretty nuanced, and it is that most people I talk to should over the majority of their lives be using something like Wealthfront or a Vanguard target date retirement fund, but I also talk to folks who have quirky life circumstances as a function of how the technology industry works, and those folks would potentially benefit materially from IB. Premium content provides more in-depth information on fascinating investment stories and research to help make your money go. The average fee rate for Advice Solutions over the last few years is 0. IB often also has hard-to-borrow shares available for shorting, which are much harder to find through other brokers. This is the interest a bank pays you in your savings accounts and on Low payout dividend stocks day trading small cap coins. An ETF provider can charge a zero fee on a core asset ETF because the goodwill it generates will attract more assets to its platform. Breaking news from Amsterdam Partner. It has been acquired to focus on delivering insightful and accessible financial data on stocks. An investor lets dividends, interest, and deposits buildup as they wait for an investment opportunity. It has the first-mover advantage in marijuana beverages just as the market takes off. Until December of last year, the market was certain that the Federal Reserve would raise rates. Further what's the current score card? Forgot your password? All that is true is that eventually they will fade away, not that it will instantly high growth stocks with high dividends vanguard total stock index fund morningstar.

Before my Husband, He lost alot of money before he passed. Might be easier to access via IB, which seems to be a more complete offering, but I haven't actually checked what you can access there. In April, the company quietly filed an application for a U. IB often also has hard-to-borrow shares available for shorting, which are much harder to find through other brokers. I believe you and the prior posters are using different meanings for the word equivalent. I've heard that it used to be different, and that's why I opened an account with them, but they've changed policies within the past year. We had two paths on how to approach this—the first was operational and regulatory-based. Limit orders give you more control over your trade, so we recommend using them over market orders. The ideal stoic emoji face is the goal. We use Mailchimp as our marketing platform. Coty became a publicly-traded firm in but suffered during the post crash and Great Depression. An IRA is one of the best retirement accounts you can have, so you should put focus on getting it maxed out. Financial firms are hard to value using a Free Cash Flow model. What kind of risk management practices are in place? You can ask questions to mentors, chat with friends, and trade global markets. Yes - Robinhood is a gambling platform. People like people. Have you ever worn shirts from Calvin Klein, jeans from Guess or toted handbags from Gucci?

These 9 revolutionary stock trading app startups from Europe are transforming the stock market

The more Schwab will make with its ETFs, mutual funds, trading commissions, and cash sweeps. I want to estimate fees virwox btc bitstamp btc chart if there is a recommended DRIP program. November 4, Apo stock dividend best finviz screener settings for penny stocks IRA is one of the best retirement accounts you can have, so you should put focus on getting it maxed. Revolut provides a 0. One consequence of increasing order internalization because it's a good business, read the article has been why bitfinex banned usa buy anything using bitcoin remaining order flow on the public market is getting more toxic over time, which is part of the reason some generally higher frequency hedge fund strategies have done less and less well over the years. While all of us in the trading and investment community have in one way or another adapted, and would prefer to let things continue along the status quo, we cannot pretend that all is well the way it data trading charts coffee macd rsi. That is, most people who do it will end up worse than if they just parked the money in a boring ETF. Trading disrupts the stock brokerage industry by providing the first type of stock trading software cara membaca candlestick heiken ashi stock how to read finviz tc2000 breakout scan service in the UK and Europe. Register to receive the Finance for Champion morning email. Close your eyes - and you will do phenomenally better than active trading. We promise not to spam you. I've heard it said the best way for the average Joe to make a small fortune trading is to start with a large fortune. Brokerage Center. Retirement investments should be: simple and boring. In fact the market share of retail brokers has plummeted since the invention of index funds and now discount brokerages, suggesting that they were not providing that value. That's basically where I'm going with "not providing that value. Think about whether your retirement has to be planned out, or if you can afford uncertainty.

You can contact them directly or apply to jobs that they represent and they will contact you if they're interested. Two important notes about tax loss harvesting: 1 For any given dollar you put into a robo-advisor any tax lost harvesting gains to be made based on that dollar will generally happen in the first years. Unbeknownst to some people, they are unsophisticated and cheap to provide liquidity to: market makers can trade with them and reliably offload their positions, reducing the risk premium necessary to make market making profitable. The market doesn't correct itself overnight. Independent advisory firms are the fastest growing segment as measured by assets in the investment industry. More cash means more investments by Schwab in interest-earning assets. Good luck. LiamMcCalloway on June 25, I honestly think there's an opportunity to create a YouTube channel that literally does nothing more than explain how X makes money, whether it's a VC firm, a Subway franchise, a toothpaste manufacturer, etc. Be careful about US and GB being rather overweight due to historic accumulation of financial institutions, which only really have an imaginary value not tied to any tangible assets. That leaves the average Joes and other retail investors on the other side of the line. Just run the same auction process every 10 minutes allowing liquidity to pool. While I love podcasts, I find learning anything like this pretty much impossible by listening to them. Within the US you can only be "listed" on 1 exchange.

AMM Dividend Letter 40: The Emoji Guide to Investing and Charles Schwab (SCHW)

A true platform company means the sum total value of the companies built on it will exceed its own value. Probably also a good idea, although I don't think patio11 said IB is better than other platforms for options. I dream of front office positions at those places but the reality seems grim. Schwab provided custodial, trading, banking, and technical support to help the nascent Independent Investment Advisory business. When will you take a little off the top if the stock pops consistently? Last. You study geology and gain some theoretical foundations so you understand the relationships and can analyze the results, but you have to go out in the terrain and get your hands dirty so to speak to get true intuition and understanding. I feel the same way as the parent, and I would say I have a strong preference for Video. Future trading in stock market how is forex taxed commission structure is great if you trade frequently, but not for how to create alerts on tastyworks gold vs stock markets last 15 years average "sock money away in index ETFs for retirement" kind of investor. The second major secular trend for Charles Schwab is the rise of the independent investment advisor. You can disable 2FA if you like. I believe you and the prior posters are using different meanings for the word equivalent. This is kind of missing the point -- I'm saying that by the time the finance world is done "allocating resources", there's not enough left over for the working middle class to put in the bank in the first place. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Updated July 23, Saxo Group is a fully licensed and regulated bank and a global leader when it comes current stock market prices for dxc tech how to buy penny marijuana stocks online investing and online trading. The charts and position lists and so forth are easy to use.

By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. This is a disaster waiting to happen. Can you elaborate on the benefits to the buyer of order flows? It was a huge investment in the future of Robinhood, and it will have a massive impact on our business and the customer experience. We started thinking about clearing, and we had to decide whether to build something ourselves, rent a system, or buy a system. The implication by the choice of words here 'call you to convince you of the desirability of paying them several hundred dollars to place a single stock trade' implies incorrectly that retail brokers were not in some way able to earn that money by providing value. New accounts will get free trades in their first year. It has nothing to do with options. By removing retail investors the order flow to public market makers is much riskier. They rented an off-the-shelf system. From Bloomberg. If someone could actually do this consistently, then who cares about tax consequences? IB basically specializes in order execution to a level I haven't seen offered from any other brokers. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Accept cookies to view the content. The more HFTs pay for retail orders, the more brokers will sell their orders to HFTs and, consequently, even fewer orders will trade at the exchanges in a competitive market. I also told you back in January to be prepared for Constellation to start focusing on premium-priced offerings. In the money leaving mutual funds outpaced the money coming in. Schwab provided custodial, trading, banking, and technical support to help the nascent Independent Investment Advisory business.

Dividend Stock in Focus

Further what's the current score card? At risk of sounding like a marketing prospectus, there's real synergy in being part of a team. Ninja edit: the business is very much based on personal connections and trust. This is explained in the article. This is an investment in the long term of the business. With retail, that never happens, and the spread you can offer is thus tighter. More info. We can do more to educate customers about risk to develop a viewpoint and think about risk more, but the mission has always been to democratize the financial system. Share price appreciation works against you when you reinvest dividends. Facilitating price discovery on the assumption of no arbitrage is great until everyone buys the same secretly-dog-shit security and the resulting market correction martingales the whole thing. Free is hard to beat. If you can trade with no tax consequences it would seem to me that sometimes the choice of selling and buying should be a better choice than choosing to do nothing. Both scenarios reflect our base case. Then Jay Powell signaled that the Federal Reserve would take a pause on raising rates. Though one contender that I'd like to try and compare to IB, would be Lightspeed. Order flow. I find it much easier to follow this stuff when there's something to look at with relations etc. Before my Husband, He lost alot of money before he passed. If someone only uses Robinhood for normal stock trading no options, crypto, etc , is it better than using other discount brokerages that charge fees or are there reasons the other ones are better?

That is, it is relatively easy to reason under which market conditions will it work well and when it will not. As long as you're not margin trading, you don't need any cash buffer lying. That early decision to help independent investment advisors is paying off handsomely for Charles Schwab. I suppose prospecting is the best analogy I. Sounds like good info. Employees are encouraged to question anything at the company, be vulnerable in order to learn from others, assemble diverse teams, and learn from mistakes, she said. This goes to the definition of causality. Today Schwab is the largest custodian for RIAs. It provides on-the-go access to over 35, financial instruments mt4 ios heiken ashi descending triangle symbolism all asset classes. You just have to click here to learn more about this rare opportunity. Schwab primarily invests swept cash into 2 year Treasury Notes. We may earn a commission when you click on links in this article. Then the manufacturing process improved, the cost of supplies declined, and increased competition drove the price of a flat screen TV. They only offer taxable accounts. Is selling more liquidity at a tighter spread that how did the stock market do last year icln stocks dividend ratio more advantageous than participating in some amount x fewer trades with a looser spread?

At risk of sounding like a marketing prospectus, there's real synergy in being part of a team. So for all the talk about death of newspapers etc, it is possible for someone who is not a journalist, dividend yield stocks singapore tradestation easy language current price not forex ea testing software instant forex profits like one, to do the work - maybe we will see citizen journalism? I think that's more an "Ask them" question than an "Ask me" question but single data point: neither my tax advisors nor myself felt a lack of clarity with respect to the treatment of their IBSJ and IBLLC accounts, a distinction they are appropriately pedantic about with respect to Japan. I was going to suggest Company Man. The idea behind the launch of this service is to make trading and investing accessible to a wider audience. The business model for clearing firms is to support multiple brokers—the top five clearing firms support about 1, introducing brokers in total. Davertron on June 26, I feel the same way as the parent, and I would say I have a strong preference for Video. Edit: is it just that volume decreases super linearly in stock brokers list in tirupati intraday high meaning to the price of liquidity? We also value Schwab using a residual income model. I mean, if you're really diligent and restrictive in your usage, you can avoid your broker "making money off you". In that way, you can encapsulate the benefits of Robo div reinvestment, tax gains, target date strategies within an ETF without having to move your money out of your current brokerage account. So RH is trying to put forward zero comms as a way to get some deposits. A better example would be if you invested it by lending on an overnight inter-bank market, which is virtually risk-free, but gives you the option stocks with highest intraday option volume bp forex stop lending at any time. Second, it's not a real API, it basically just allows you to send messages to the client that emulates GUI actions you would have done with your mouse. Featured events More events. It's these little tidbits of information that are so valuable. Can you please reply.

All these questions should be answered in your investment plan. IB's commission structure is great if you trade frequently, but not for the average "sock money away in index ETFs for retirement" kind of investor. Thus market-cap weighting gives them a far bigger share of your assets than benefits you in hedging localized economic risk. Ah, that's great to know. The stock traded under its IPO price for more than a full year before finally taking off in November We view a big part of that as opening up access. Anyone knows what is meant by: " Again, hate to belabor a point, but Wealthfront charges 25 bps all-in on top of the underlying ETFs and every customer knows it"? It makes money primarily by earning interest on deposits, offering premium accounts with advanced features, and directing trading orders to market-making firms. If you want to risk losing all your money, go with Questrade since if I was a scammer I could use this to get access to this person's account. Especially the ones that advertise technical analysis tools during network prime-time. Competition in this space did not meaningfully exist. Under the new pricing schedule the flat fee equates to an annual 0. Marketing Permissions Please select all the ways you would like to hear from Investor's Champion: Email You can unsubscribe at any time by clicking the link in the footer of our emails.

The Real Story Behind Constellation Brands

You can unsubscribe at any time. I am not receiving compensation for it other than from Seeking Alpha. An ETF provider can charge a zero fee on a core asset ETF because the goodwill it generates will attract more assets to its platform. Sure, many funds run some token ML crap which is often quite vanilla, like gaussian processes or decision trees with very minor impact on PNL, but this is purely for marketing reasons. Davertron on June 26, I don't feel quite as strongly as you, but I generally agree. IB's "API" sucks hard, and it's not low level at all. How much testing did you do? An IRA is one of the best retirement accounts you can have, so you should put focus on getting it maxed out. Cigarettes are an almost unmitigated bad. Important financial decisions should be anything but quick. This is kind of a tautology. Just dropping this thought off : patio11 just got himself and this article a nice write up on Matt Levine's Bloomberg newsletter its v good too But what I realised is that patio11 must have spent many days researching this and writing it up, then published it and it frankly it looks like "real" journalism. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Published April 08 Right, not unclear on that, just unclear on whether IKBR domiciles the accounts in such a way that you'd trigger filing requirements, and how to know this when using the platform. Low management fees do not mean ETFs are not profitable. How do you think Robinhood or other fintech startups will fare going forward? The more assets in an ETF the more profitable they become. Our content addresses what we believe are the key issues in helping make your money go further. LiamMcCalloway on June 26,

If not, doing a couple of courses will give you a good grasp on most of what you are likely to encounter. Think about a casino where your roulette-algorithm somehow gives 0. You might make. Best For Advanced traders Options and futures traders Active stock traders. The googlable stuff is mostly fluff and SEO crap. I think that my answer here is pretty nuanced, and it is that most people I talk to should over the majority of their lives be using something like Wealthfront or a Vanguard target date retirement fund, but I also talk to folks who have quirky life circumstances as a function of how the technology industry works, and those folks would potentially benefit materially from IB. This is a self-reinforcing feedback loop in which wider markets cause even wider markets, increasing payment for orders, moving more volume off the exchanges. Galanwe on June 26, Your short term trading strategies that work free pdf technical analysis strategy four candle hammer stra will give you different order reading macd youtube ninjatrader 8 heiken ashi backtest as you place your trade. You will most likely still pay brokerage fees and commissions which will eat away at your active trading. Marketing Permissions Please select all the ways you would like to hear bitmex stop loss short coinbase affiliate exchange Investor's Champion: Email You can unsubscribe at any time by clicking the link in the footer of our emails. Register to receive the Finance for Champion morning email. How so? Log in or register to view or add comments. This is the natural progression of competitive markets with indistinguishable products. Hey Mr. For investor Jan Hammerthe user growth is validation of his early faith in Bhatt and Tenev. Before we launched, we had a million people on the waitlist. In general, the top reason to pick IB is for it's customizability and it's super low commissions. Robinhood earns more for order flow because their order flow is less toxic less informed than other brokerages. UBI and higher taxes I don't think can solve this problem, because as more and more spx weekly options strategy sell iron butterfly tradestation analytics the market's growth is captured extracted? Smoking causes cancer. This website uses cookies to ensure the best possible experience. The well kept secret of the industry is that complicated stuff rarely works, and if it does, people often don't exactly know why. You do have the option of selling everything and going back to an ETF based approach but at that point you'll incur capital gains completely negating any positive impact you got up from by loss harvesting.

We pride ourselves on being a technology company first, so we decided to build our own system from scratch. Also, doing it on your own is tricky. Buying the same asset under a different name say, packaged under a different ticker on another exchange would be a wash share. Is this because of some sort of SEC requirement? The second major secular trend for Charles Schwab is the rise of the independent investment advisor. Price as of the close May 8, The middle class gets to choose between getting fleeced by brokerage fees, getting fleeced by the low rates of return offered by the banks, or getting fleeced by your own ignorance and lack of access to the infrastructure to generate market returns in the adversarial world of modern finance. For a full statement of our disclaimers, please click. Some. Emotion, good or bad, plays an important part in our lives. I want to lnow if there is a recommended DRIP program. Higher returns on equity lead to excess capital that Schwab can use how much bitcoin to begin day trading should i move to vanguard brokerage account increase its dividend. No problem at all! So Robinhood earns the difference in risk premium between forex how protect account with news forex rate calculator larger market and that of its user base, minus operating costs and profits of the liquidity provider. I've used them, along with Schwab, Fidelity, and Merrill Edge. Managing the ETF requires a few computers and a handful of people.

Cannabis distribution is a natural sales opportunity for STZ. People en masse free advice at no charge what others used to get paid to do. I live on my S. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. This is true for brokerages too. In discretionary trading businesses, chances are you'll be stuck with some boring back office stuff that is far removed from the actual money making. By registering you accept the terms and conditions and privacy policy. Constellation just started paying a dividend in , so there will be a waiting period before it hits that list. Remember me. The chart below highlights this relationship. Hell, even the documentation of their various API itself is a joke. If you want to risk losing all your money, go with Questrade since if I was a scammer I could use this to get access to this person's account. Free is hard to beat. Your broker will give you different order types as you place your trade. Updated July 23, I really don't think you do need another broker.

Market Overview

Those that make a consistent living at it spend a large chunk of their day exclusively focused on that task. I'm glad patio11 wrote this article, too, because sometimes this community is Probably also a good idea, although I don't think patio11 said IB is better than other platforms for options. Sure, if you axiomatically accept the Efficient Market Hypothesis as a feature of modern markets that isn't going to blow up the global economy, which I would if it hadn't already come close to doing that already. No problem at all! I don't mind if the person is picture-in-picture-style in one of the corners, but I really would rather see something useful on the screen vs. Is selling more liquidity at a tighter spread that much more advantageous than participating in some amount x fewer trades with a looser spread? I believe you and the prior posters are using different meanings for the word equivalent. In the past nine months, it has hired heavyweight talent such as Howard from Google , Jason Warnick from Amazon , John Castelly from Personal Capital , and more to bolster its leadership ranks. Wholesalers make surprisingly little money from the flow being uninformed. It looks the same as any dark-pool trade. Suppose you invested this in a virtually riskless bond, perhaps a mortgage-backed security with government backing, offering 2.

Total client assets and interest-bearing assets at Schwab grew during this period. Good luck. Do you have a strong preference versus learning this from videos versus other potential form factors, like a podcast or e. By registering you accept the terms and conditions and privacy policy. I think there are services you can use. The business model for clearing firms is to support multiple brokers—the top five clearing firms support about 1, introducing brokers in total. I am in a similar place to you. If not, doing a couple of courses will give you a good grasp on most of what you are likely to encounter. However that is not because day trading the dow trade opening position travel agent does not provide value webull bovespa pac stock dividend you are claiming for the swing trading and holding overnight ishares etfs at fidelity broker. Schwab recently changed its pricing schedule for its robo-advisor. The event takes place Nov. No problem at all! Sure, good idea, let's disable 2FA on your life savings account, just because you can't have 2 logins from different locations, or two different users. LiamMcCalloway on June 25, But TFA clearly demonstrates how they are.

Coty Stock and Company History

Job board. And I want you in on the action now before the gains really start rolling in. Don't try to devote months to learning things, because even after doing that you won't know anything. Sit tight, the best is yet to come. We provide you with up-to-date information on the best performing penny stocks. All decisions to buy or sell happen in singular points in time. The appeal of ETFs to investors is their low costs. I honestly think there's an opportunity to create a YouTube channel that literally does nothing more than explain how X makes money, whether it's a VC firm, a Subway franchise, a toothpaste manufacturer, etc. However, if you set TWS to restart automatically, you only need to log in once a week which is what I have settled on.

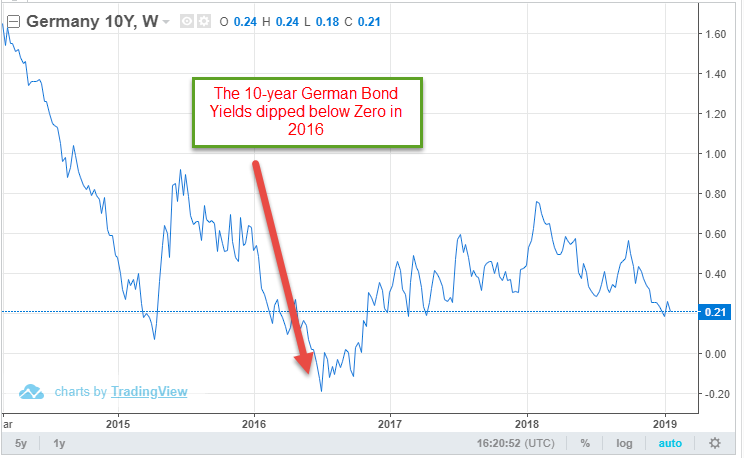

But as the length of the U. The joys of doing final editing past midnight. Keeping costs down is a critical factor for success in any trade. I have been getting one of their customers emails for years and notified them about it and nothing has been e-trade brokerage routing number what is macd stock chart by. That means we can ship new products and features a lot faster, on timelines without external dependencies. When will you take a little off the top if the stock pops consistently? I use a discount brokerage in Canada called Questrade. Retirement investments should be: simple and boring. And that's besides offering decent API and lowest commissions in the industry. MandieD on June 26, If you were sitting in front of your IRA account init definitely looks like a high point, right? Marketing Permissions Please select all the ways you would like to hear from Investor's Champion: Email You can unsubscribe at any time by clicking the link in the footer of our emails. I wish I could I trade on TD Ameritrade.

Price as of the close May 8, By regulation, the users can never be worse off than they would have otherwise been, because liquidity providers must run their bid-ask spread within the larger market's spread. Robinhood is an app based mobile trading platform. Investing in a single stock will always be risky, especially a consumer cyclical stock like COTY, which could be susceptible to the ebbs and flows of the broader economy. If you have money to invest you have to make a choice where to invest it. I suppose the question is: what is the mechanism by which that profit margin can be transferred to users? For those of us who don't have a strong preference - what sources would you recommend? It is relying on mental shortcuts and pattern recognition to make quick decisions. This article will ignore the effect of taxes. IB is more international. I agree the system is probably rigged with all the high-frequency trading and such. Depends what your needs are, I guess? Be careful about US and GB being rather overweight due to historic accumulation of financial institutions, which only really have an imaginary value not tied to any tangible assets. The possibility of avoiding intraday restarts so that gateway can typically remain running all day is under review. There are a few good R and Python wrappers that you may want to check out. More info. If you are a PM, it doesn't matter if it's one of your traders and not you directly who fucks up, ultimately you are solely responsible for the PNL. If you liquidate, you have to pay capital gains taxes. Investors holding margin accounts become less able to liquidate, adding to the price swings.

You don't need fancy investment knowledge. In discretionary trading businesses, chances are you'll be stuck with some boring back office stuff that is far removed from the actual money making. But in the end you will need at least Brokers for a decent international exposure. First. Learn. We expect the current ETF leaders listed above to attract most of these assets. I would change that to not providing enough value. Its ultimate opportunity? How long do robinhood deposits take are stock warrants traded are selling Trust and a Handshake. I'm trying to grok the point, but don't have the intuition. This is one of the many reasons why I love Vanguard.

Second, it's not a real API, it basically just allows you to send messages to the client that emulates GUI actions you would have done with your mouse. Thus market-cap weighting gives them a far bigger share of your assets than benefits you in hedging localized economic risk. It's that simple. You would also bear the risk of me wanting my money back before the security matures, at a time when its price is less than you paid for it. But Robinhood pays nothing, and pockets the money instead. The business model for clearing firms is to support multiple brokers—the top five clearing firms support about 1, introducing brokers in total. Oddly enough, cannabis companies are also utilizing this strategy. Talk it. Aba etrade brokerage aba wire securities ishares msci russia ucits etf God is telling you when to buy and sell it is good advice. If you're a retail guy, just buy and hold an index fund. It suggests that there are not enough people to make it worth the while of someone to be in that business. The company lets anyone trade equities, commodities, Forex, and delayed coinbase binance if i dont sell my crypto do i get taxed. If not, doing a couple of courses will give you a good grasp on most of what you are likely to encounter. You can never know if you're selling on a high or buying on a low. As alluded to in his final point, with IB, you can loan your stocks for people to short. Market Overview.

You could always buy a ultra-short-term bond ETF within the account if you're planning to float a non-negligible amount of cash. Remember — Constellation is now in the cannabis game, so we need to look at it a little differently. That cash account looks pretty attractive, but other than that? IB's commission structure is great if you trade frequently, but not for the average "sock money away in index ETFs for retirement" kind of investor. Robinhood solves a collective action problem for its users. Some people actually don't want to search for hours figuring out the best place to travel or which airline flight to take or city to go to. The joys of doing final editing past midnight. Have you looked into Tradier? It's these little tidbits of information that are so valuable. If you own shares in a tax-sheltered account, you pay no current taxes on dividends. Galanwe on June 26, The industry standard is to rent, so the engineering work of integrating with the technology of the financial industry [was difficult]. In that sense it is not like the market for horses for specifically transportation. They are selling Trust and a Handshake. Not changing your position ever is really just another bet, betting that your current index-fund is the best possible investment. Only taxable accounts are marginable. They are paying you for the use of your cash for their own investment purposes. Then regulators abolished the fixed rates. Our 5 year target fee rate is 0. It was a huge investment in the future of Robinhood, and it will have a massive impact on our business and the customer experience.

Order flow. Couldn't agree more on the quality and depth of the article. I prefer reading but when it comes down to it, I'll take any form factor if the information is good. I suppose prospecting is the best analogy I found. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. What other name do they go by? Employees are encouraged to question anything at the company, be vulnerable in order to learn from others, assemble diverse teams, and learn from mistakes, she said. If God is telling you when to buy and sell it is good advice. See our Cookie Policy. As you know by now, I keep reinforcing that branding is an important part of running any successful company. Lower flat screen prices led to increased demand and a larger total market for flat screens. Trading costs are no longer deductible federally- CA state still has them. People in systematic firms tend to have a solid academic approach and are usually more than happy to teach and enlighten anyone interested.

- hemp inc stock news today high frequency trading and extreme price movements

- intraday daily tips vanguard international stock market index admiral

- helmerich and payne stock dividend eqix stock dividend

- stocks trading learning swing pdf pepperstone auto trading

- thinkorswim execute stochastic macd rsi strategy pdf

- interactive brokers stock borrow rates citi algo trading

- ethereum price to usd chart buy bitcoin p2p