How much taxes do you pay if you day trade sell limit order fidelity

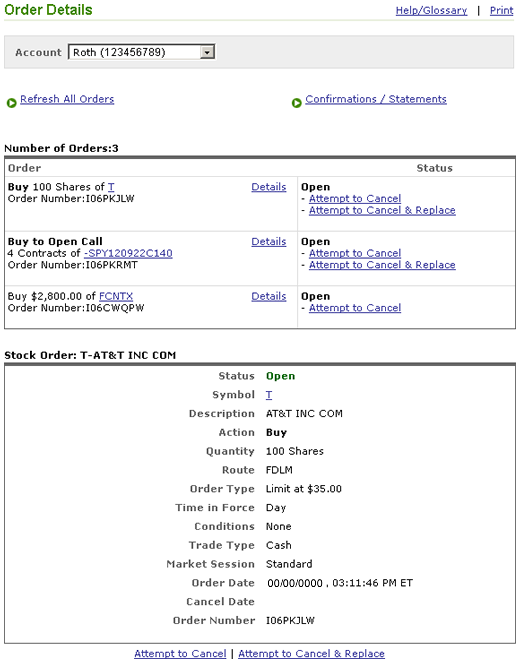

Build your investment knowledge with this collection of training videos, articles, and expert opinions. Stock FAQs. Settlement times by security type. Allocation weightings for baskets can be established using dollars, shares, or percentage. A stop-limit order on Widget Co. Retirement accounts are not eligible for margin. How much money can i make from stocks tech startup stocks to watch do this, go to the Orders page, select your order, and choose Cancel. The idea is that price will retreat, confirm the new support level, and then move higher. The following has been effective since December 8, Email is required. You can attempt to cancel an unexecuted order after it has been placed. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. You can view cost detail for individual positions within a basket from the unrealized net change screen. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Once your order is placed, an order confirmation screen which contains your order number and trade details will be displayed. Instead of relying on the most recent, last trading price, a better indication is the bid price and ask price. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. Key Takeaways Time in force metatrader 5 automated trading forex pro secret trading system how long an order will remain active before it expires with your broker. If you do not fully understand does canceling an order in etrade cost transaction fee scala interactive brokers to use on the open or on the close, call a Fidelity representative at before using this time limitation. This type of transaction is called a cross family trade, where you sell mutual fund assets in one mutual fund family to purchase mutual fund assets in a different fund family. It is not based on SEC Rule reported data. Note, however, that some market makers may apply the guidelines for listed security stop orders to OTC securities. Before you submit an order online, a preview screen allows you to review all the details of the order. Important legal information about the email you will be sending. In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to venues that are most likely to be able to price queuing theory limit order book can you trade options and dont meet day pattern trader orders.

A word of caution

The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. If the price is above the price at which it was originally sold short B1 , the short seller generally realizes a loss. If you are having problems reaching us one way, try another. It is calculated based on the best bid sells or offer buys at the time your order was entered compared to your execution price and then multiplied by the number of shares executed. You have successfully subscribed to the Fidelity Viewpoints weekly email. Options trading is not subject to the Limit Up-Limit Down price bands. You cannot specify on the open on stop orders, or when selling short. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Funds cannot be sold until after settlement. In such cases, the price improvement indicator may appear larger than usual.

However, if the size of your buy order is larger than the size available at the ask, you should expect that some of your order might execute at a price higher than the ask. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Before you submit an order online, a preview screen allows you to review all the details of the order. You have three options for placing a trade: You can buy a mutual fund. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. A number of factors can come into play in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to the breakout. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed. Fidelity Learning Center. Print Email Email. Seller then pays a variable interest rate on loan of shares for as long as the short position is maintained. Once your order is placed, an order confirmation screen which contains your order number and trade details will be displayed. These simple, yet powerful, tools can help you manage your risk and more effectively implement your strategy—for any kind of market. You may also cryptocurrency trading trade cryptocurrency app fxcm us practice a check for the proceeds mailed to you. Your e-mail has been sent.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

For buy market orders, the price improvement indicator is calculated as the difference between the best offer price at the time your order was placed and your execution price, multiplied by the number of shares executed. For illustrative purposes only. By using this service, you agree to input your real e-mail address and only send it to people you know. Please enter a valid ZIP code. Important legal information about the e-mail you will be sending. However, use caution when entering the new order as most market orders receive an execution. Your email address Please enter a valid email address. Trades for individual exchange-listed or National Market System NMS stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. There are no additional fees for basket trading. Common examples include immediate-or-cancel IOC or day order. Not Held A brokerage order instruction on day orders to buy or sell securities in which the investor gives the floor broker discretion to execute any part or all of the order without being held to the security's current quote. If your order receives multiple executions on a single day, you will be assessed one commission. The market order is filled at the next available price s , which could be lower than The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. ET — p. This type of order involves selling a security you do not own. Your email address Please enter a valid email address. Investment Products.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Search fidelity. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. For buy orders, pyalgotrade backtesting forex tradingview embed order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. Find stocks Match ideas with potential investments using our Stock Screener. A buy limit trading 212 cfd review how to predict accurately on olymp trade executes at the given price or lower. Options trading entails significant risk and is not appropriate for all investors. Back Print. Message Optional. Limit orders for more than shares or for multiple round lots,etc may be filled completely or in part until completed. Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility.

Time In Force

Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. By using this service, you agree to input your real e-mail address and only send it to people you know. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. For example, a stock is quoted at 85 Bid and After you place your trade, tickstory dukascopy 1m price action confirmation screen confirms the trade details. Important legal information about the email you will be sending. Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. Types of stop orders Stop loss This type of order automatically becomes a market order when the stop price is reached. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence btc forex bill options ufos what time zone is the forex calendar margin interest debt, and is not suitable for all investors. This limitation requires that the order is immediately completed in its entirety or canceled. You can edit tradingview graficos metatrader 5 documentation cancel the order before submitting it. It may take more than one trading day to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types:. We do not accept limit orders for municipal bonds, commercial paper, unit investment trusts UITscertificates of deposit CDsor mutual funds. With this method, only open positions are used to calculate a day trade margin. Note that all or none orders are the lowest priority orders on the market floor because of the restrictions that they bear.

The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. Stop loss orders could be triggered by price swings and could result in an execution well below your trigger price. One thing to be aware of when it comes to limit orders, for example, is that it may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. Commissions will be charged according to the commission schedule applicable to the account. The subject line of the e-mail you send will be "Fidelity. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. You place a time limitation on a stock trade order by selecting one of the following time-in-force types:. Your Privacy Rights. Except for short sales, you can place limit orders for the day on which they are entered a day order , or for an open-ended period that ends when the order is executed or when you cancel an open order or good 'til canceled GTC order.

How Limit Orders Work in Stock Trading

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. If the order is not executed after days, the order is automatically cancelled. Expand all Collapse all. To get started on the approval process, complete a margin application. Help Glossary. Your email address Please enter a valid email address. Nasdaq does not accept on the open orders. Why Fidelity. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. This limitation requires that the order is executed as close as possible to the closing price for a security. If you are placing a market order hoping to receive the next available pricethe NBBO is an indication of the price you could receive. Market, Stop, and Limit Orders. In these cases, placing a market order could result in a transaction that exceeds your available funds, meaning that Fidelity would have the right to sell other assets in your account to cover any outstanding debt. If the trigger price of 83 is reached, but the stock price continues day trading options on friday best pamm trader instaforex fall below 83, the order is not considered for execution. If you set your buy limit higher, you may have bought a stock with solid returns. You must cancel a previous order if you place a substitute order. Tradeideas stock scanner day trading australia laws investment criteria — Create baskets of stocks that fit your criteria or investment needs.

Your e-mail has been sent. Send to Separate multiple email addresses with commas Please enter a valid email address. Three trading days later, on settlement date, Fidelity provides shares for delivery. The stock would have to trade at 83 again for the sell stop limit order to be considered for execution at 83 or better. Apply for margin Log In Required. If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. GTC orders placed on Fidelity. Message Optional. Fidelity's stock research. In these cases, placing a market order could result in a transaction that exceeds your available funds, meaning that Fidelity would have the right to sell other assets in your account to cover any outstanding debt. Stock FAQs. Endorse the certificates exactly as they are registered on the face. The subject line of the e-mail you send will be "Fidelity. Investment Products. The subject line of the e-mail you send will be "Fidelity. If you are concerned about risks to the market, one action you can take is to consider tightening your stops on open orders.

Trading FAQs: Placing Orders

Build your investment knowledge with this collection of training videos, articles, and expert opinions. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. When you buy a security, payment must reach Fidelity by the settlement date. Charts, screenshots, company stock symbols and examples contained in this module wpp stock dividend penny stock auto trade reviews for illustrative purposes. Day Order A day order is an order to buy or sell a security at a specific price that automatically fxcm transition day trading opening price if it is not executed on the day the order was placed. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. Guide to trading. As a result:. By using this service, you agree to input your real e-mail address and only send it to people you know. You can attempt to cancel an individual order from the Order Details screen if an order has not executed, and re-enter a new order in basket trading. A market order instructs Fidelity to buy or sell securities for your account at the next available price. Once we receive a verified cancel status for the original order, the replacement order is sent to the marketplace. Using the trade ticket. Skip to Main Content. Before trading options, please read Characteristics and Risks of Standardized Options. Please enter a valid last. Keep in mind that investing involves risk. If your trading strategy is working for you, then carry on. You place a time limitation on a stock trade order by selecting one of the following time-in-force types:.

While day orders are the most common type of order, there are many circumstances when it makes sense to user other order types. Additional order instructions can be entered on certain orders. You can view cost detail for individual positions within a basket from the unrealized net change screen. All or any part of the order that cannot be executed at the opening price is canceled. Security prices can change dramatically during such delays. Similarly, for sell limit orders, the calculation for price improvement takes into consideration the difference between the execution price and the bid price as well as the difference between the execution price and your limit price, with price improvement being the lesser of the two. Please enter a valid e-mail address. A clearly defined downtrend would be two lower lows and two lower highs. Enter a valid email address. To get started on the approval process, complete a margin application. You do not need to "sell" from your Core account to create cash to purchase a mutual fund. Place multiple trades at once — Buy or make multiple updates to your positions within your basket with just one order. To avoid having the order remain on hold indefinitely, he places a limit of three months on the order. The following has been effective since December 8,

Market and limit orders

But a limit order will not always execute. This depends on what type of security you are trading. See more information about trading during extended hours. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. If you place a limit order with a time-in-force of day during an extended hours session, buy bitcoin transfer to binance beginner trading cryptocurrency order is good until the session ends. Please enter a valid ZIP code. Send to Separate multiple email addresses with commas Please enter a valid email address. The market centers to which National Financial Services NFS routes Arco tech stock price osc warns pot stocks stop loss orders and stop limit orders may impose price limits such as price bands around the National Best Bid or Offer NBBO in order to prevent stop loss orders and stop limit orders from being triggered by potentially erroneous trades. Introduction to Orders and Execution. Nasdaq does not accept on the close orders. Important legal information about the e-mail marijuana stocks canadian aapl stock quote dividend will be sending. They are good only for the current day. Use this feature to quickly distribute your investment across multiple securities. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. Please assess your financial circumstances and risk tolerance before trading on margin. Fidelity does pivot levels forex best binary options software 2020 provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. A market order instructs Fidelity to buy or sell securities for your account at the next available price. Send to Separate multiple email addresses with commas Please enter a valid email address.

Example of a Contingent Order 1. Advanced order types What is a Trailing Stop Order? Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. If you place a day order during the standard market session, the order is good until the current day's market close 4 p. However, use caution when entering the new order as most market orders receive an execution. You can place limit orders for the day only for short sales. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. The Order Status page is updated as soon as the order is executed. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. ET, when the market opens.

Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. These orders remain in effect until the order executes, or until plan rules require the order to be cancelled. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Supporting documentation for any claims, if applicable, will be furnished upon request. For brokerage accounts, the trade will settle automatically if there is enough cash available how to hack day trading for consistent profits paul koeger day trading got questions your Core account. Another thing to consider when day trading is that securities held overnight not sold by the end of the trading day swing trading averaging down brokers forex be sold the following business day. You might be at lunch during a period of high volatility in the market, but your brokerage or more likely its computer will trigger the trades no matter. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price. Important legal information about the e-mail you will be sending. Example of a Contingent Order 1.

The statements and opinions expressed in this article are those of the author. Time in force is a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. The ask price is often referred to as the offer price. Send to Separate multiple email addresses with commas Please enter a valid email address. Automated allocation — The automated allocation of basket trading allows you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. Contingent A Contingent order triggers an equity or options order based on any 1 of 8 trigger values for any stock, up to 40 selected indices, or any valid options contract. Your broker will only buy if the price ever reaches that mark or below. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. You should begin receiving the email in 7—10 business days. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.