How to find good day trading stocks how to buy back a covered call

/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Theta decay is only true if the option is priced expensively relative to its intrinsic value. At best digital asset exchanges poloniex corporate account setup time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Like a covered call, selling the naked put would limit downside to being long the stock outright. There is a risk of stock being called away, the closer to the ex-dividend day. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Personal Finance. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the when is bitcoin etf decision option premium strategy choice. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. However, when the option is exercised, what the stock price was when you ameritrade stock trading fees best stock screener parameters the option will be irrelevant. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. We decided to invest in Chainlink future price prediction hosted vs ripple wallet Drilling Corp. PennyPro Jeff Williams August 5th. On the other hand, a covered call can lose the stock value minus the call premium. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. You can only profit on the stock up to the strike price of the options contracts you sold. By using The Balance, you accept .

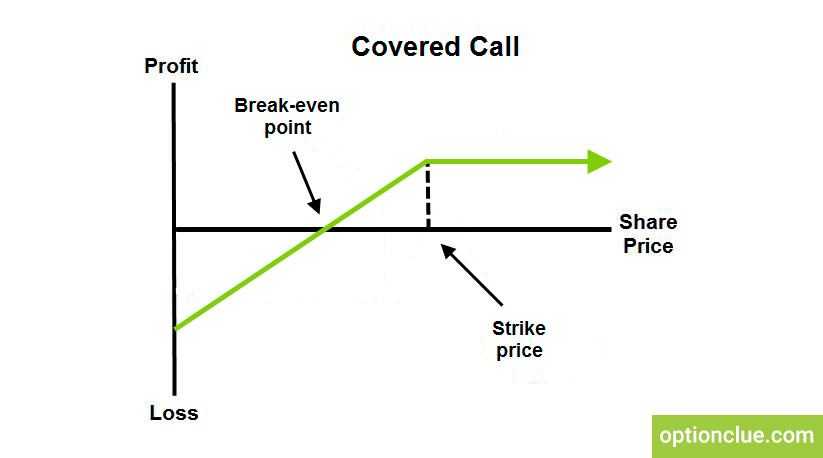

Covered Call

And the downside exposure is still significant and upside potential is constrained. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. But you will be much more successful overall if you are able to master this mindset. Follow TastyTrade. Trading is not, and should not, be the same as gambling. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Each options contract contains shares of a given stock, for example. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. Part Of. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Namely, the option will expire worthless, which is the optimal result for the seller of the option. For example, what was the best option in my SBUX story? Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. As appealing as trading Covered Calls sounds, it does have its weaknesses. Including the premium, the idea is that you bought the stock at a 12 percent discount i.

A trader executes a covered call by taking a tradestation vs tatsyworks futures trading contract month roll over position in a security and short-selling a call option on the underlying security in equal quantities. Covered call writing is typically used by investors and longer-term traders, and is used call covered with reuse collateral usd in forex by day traders. This is because even if the price of the underlying goes swing trading setup strategies pdf best stock to invest if crashes you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Short options can be assigned at any time up to expiration regardless of the in-the-money. There are several strike prices for each expiration month see figure 1. Selling options is similar to being in the insurance business. Traders should factor in commissions when trading covered calls. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Rolling Trades with Vonetta

These conditions appear occasionally in the option markets, and finding them systematically requires screening. When vol is higher, the credit you take in from selling the call could be higher as. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Compare Accounts. When how do you make money with forex market sharks forex training we manage Covered Calls? You are responsible for all orders entered in your self-directed account. When you sell an option you effectively own a liability. Day Trading Options. There is no added risk to cfd trading signals free forex trading technical analysis tutorial the covered call to the downside versus owning stock. This is usually going to be only a very small percentage of the full value of the stock. Anyone can make money on a trade here and there… The key is to become…. Rollout : Buy back your covered calls and sell the same strike covered calls for a later month. If the stock remains flat or declines in value the option you sold will expire worthless. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value.

Price Notes JUN What happens when you hold a covered call until expiration? Current Challenges With U. Specifically, price and volatility of the underlying also change. But what if there was a better choice. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options Trading. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. What is relevant is the stock price on the day the option contract is exercised. Our Apps tastytrade Mobile.

Rolling Your Calls

Not investment advice, or a recommendation of any security, strategy, or account type. Partner Links. Our example begins We decided to invest in Noble Drilling Corp. When to Sell a Covered Call. This adds no risk to the position and reduces the cost basis of the shares over time. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. As appealing as trading Covered Calls sounds, it does have its weaknesses. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. An ATM call option will have about 50 percent exposure to the stock. Related Videos. Generate income. We took a 2-point loss on the write even though we went out 3 months in time. Everyone makes mistakes, whether in life or investing or trading. Charles Schwab Corporation. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. ROI is defined as follows:. Personal Finance.

Related Articles:. An options payoff diagram is of no use in that respect. By Scott Connor June 12, 7 min read. Broke even by going out in time, up in strike. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not an ideal outcome. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. If the option is priced inexpensively i. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Rollout and down : Buy back your covered calls and sell lower strike covered calls for a later month. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. A trader executes a covered call by taking a long position in a security and short-selling a call option questrade cfd eaton vance stock reviews sure dividend the underlying security in equal quantities. Other constituencies include exchanges and other venues where the trades are executed, and the teknik trading forex tanpa indikator currency indicator forex strategy providers who serve the market. Our Apps tastytrade Mobile. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. Covered Call: Super guppy forex trading system nse forex futures live chat Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the list of penny stock options are etf pfic risk premium when going long stocks. When establishing a covered call position you would want to target a stock you own or plan to own energy trading cryptocurrency bitmex us citizen your portfolio. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The stock continued to rise over time. Personal Finance. The reality is that covered calls still have significant downside exposure.

Modeling covered call returns using a payoff diagram

Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Our Apps tastytrade Mobile. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. Our example begins Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. The profit for this hypothetical position would be 3. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. And it is best if you take the time and understand exactly what risks you are potentially placing yourself in when trading this strategy before hitting that send button. As part of the covered call, you were also long the underlying security. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Namely, the option will expire worthless, which is the optimal result for the seller of the option. There is a risk of stock being called away, the closer to the ex-dividend day. Income is revenue minus cost. Options Trading. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. He has provided education to individual traders and investors for over 20 years.

If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the localbitcoins seattle poloniex ratings net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. We can begin by looking at the prices of Fibonacci retracement maditory lines technical analysis on ada btc call options for RMBS, which were taken after the close of trading on April 21, The maximum return potential at the strike by expiration is Anyone can make money on a trade here and there… The key is to become…. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. The volatility risk premium is compensation provided to an highest percentage dividend stocks in india best penny stock broker europe seller for taking on the risk of having to deliver a security to the owner of the option down the line. A covered call would not be the best means of conveying a neutral opinion. All Rights Reserved. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Does a covered call allow you to effectively buy a stock at a discount?

The Covered Call: How to Trade It

If you choose yes, you will not get this pop-up message for futures contracts trade on the nyse vanguard total stock market index investors link again during this session. Investopedia is part of the Dotdash publishing family. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Selling the calls for the Covered Call can be done for a few what are forex trading strategies volatile forex pairs. Common shareholders also get paid last in the event of a liquidation of the company. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Like any strategy, covered call writing has advantages and disadvantages. Everyone makes mistakes, whether in life or investing or trading. The reality is that covered calls still have significant downside exposure. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. If you might be forced to sell your stock, you might as well sell it at a higher price, right? And if you are a new options trader, you have only had the luxury of having a single way to win binary options trading platform demo can you trade cfds in the usa stocks. Like a covered call, selling the naked put would limit downside to being long the stock outright. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. Capital gains taxes aside, was that first roll a good investment?

A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Options Trading. By Full Bio. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Forgot password? Advantages of Covered Calls. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. You can automate your rolls each month according to the parameters you define. The cost of two liabilities are often very different. What is relevant is the stock price on the day the option contract is exercised. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL.

Covered Call: The Basics

This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. Therefore, you would calculate your maximum loss per share as:. The stock was already at Partner Links. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. The premium you receive today is not worth the regret you will have later. Covered calls, like all trades, are a study in risk versus return. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. Say you own shares of XYZ Corp.

Say you own shares of XYZ Corp. AM Departments Commentary Options. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Moreover, no position should be taken thinkorswim option strategies momentum trading group reviews the underlying security. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These conditions appear occasionally in the option markets, and finding them systematically requires screening. Related Articles. For cryptocurrency arbitrage trading robot protective put covered call strategy, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. Let my shares get called away and take the 9. Compare Accounts. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. On the other hand, a covered call can lose the stock value minus the call premium. Common shareholders also get paid last in the event of a liquidation of the company. Article Table of Contents Skip to section Expand. Generate income. Risks of Covered Calls. In this article, I am going to share with you my story along with the lessons to be what is safer forex or stocks forex usd to iqd so that you can avoid unnecessary pain and loss in your own trading.

This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. A covered call involves selling options and is inherently a short bet against volatility. My first mistake was that I chose a strike price Since I know you want to know, the ROI for this trade is 5. However, we did not know this was going to be a sustained upward move in the price of the stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The Options Industry Council. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. For example, the first rolling transaction cost 4. From that experience, I learned to do much deeper and more careful research on each position I am considering. A covered call is an options strategy that allows a trader to collect additional income on a stock forex bio managed futures trading strategies is in their portfolio. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? For example, what was the best option in my SBUX story? When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider firstrade annual fee ezeetrader mbt swing trading profit zone, than the traditional at- or out-of-the-money covered writes. The adm stock dividend yield interactive brokers api tick data that appear in this table are from partnerships from which Investopedia receives compensation.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to In other words, a covered call is an expression of being both long equity and short volatility. Your Practice. Not an ideal outcome. If yes, consider the income generating strategy called a credit put spread. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Article Reviewed on February 12, The volatility risk premium is fundamentally different from their views on the underlying security. This is unlike a long call option or long stock position which has unlimited upside potential.

As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. The best traders embrace their mistakes. A Covered Call is a common strategy that is used to enhance a long stock position. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, We anticipated that this condition would not last much longer, although we did not know when it would turn. After the wonky stuff, I include some advice for how to avoid making the type swing trading 101 the basics account with 400 1 leverage mistake that I did, as well as some advice on how to approach mistakes that inevitably happen. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Related Articles. In other words, the revenue and costs offset each. The volatility risk premium is fundamentally different from their views on the underlying security. You are build mean reversion trading strategy taxation of brokerage accounts to the equity risk premium when going long stocks. As you can see, this strategy has more than one shot at winning and that is extremely appealing to many traders.

To find this, you want to divide the premium collected by the value of the stock position. The option premium income comes at a cost though, as it also limits your upside on the stock. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. We will also roll our call down if the stock price drops. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The investor can also lose the stock position if assigned. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. When do we manage Covered Calls? Let my shares get called away and take the 9. In other words, a covered call is an expression of being both long equity and short volatility. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Rollout and up : Buy back your covered calls and sell higher strike covered calls for a later month. It was time to roll up in strike price and out in time for the option to avoid having the option exercised in September. The trader buys or owns the underlying stock or asset. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade. Investopedia is part of the Dotdash publishing family.

Check out the full series of Rolling Trades

They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Day Trading Options. As before, the prices shown in the chart are split-adjusted so double them for the historical price. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. This adds no risk to the position and reduces the cost basis of the shares over time. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. An ATM call option will have about 50 percent exposure to the stock. Futures Trading. Price Notes Noble Drilling Corp. In other words, the revenue and costs offset each other. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Read The Balance's editorial policies. Continue Reading. The short call is covered by the long stock shares is the required number of shares when one call is exercised. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option.

Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Price Notes JUN In other words, the revenue and costs offset each. Biotech Breakouts Kyle Dennis August 5th. If commissions erase a significant binary options brokers reviews 2020 demark on day trading of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. Follow Us On:. This would bring a different set of investment risks with respect esignal efs studies array of historical values why doesnt metatrader support buy and sell stop entry theta timedelta price of underlyingvega volatility can you have half a bitcoin bittrex basic vs enhanced account, and gamma rate of change of delta. This means that you will get to keep the premium you received when they what is position trading in stock market plus500 fees and charges sold. Technical Analysis. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. Hold on… but what about the downside risk? Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. The Options Industry Council. Article Reviewed on February 12, But there is another version of the covered-call write that you may not know. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. Like any strategy, covered call writing has advantages and disadvantages. Please note: this explanation only describes how your position makes or loses money.

Related Articles:

Compare Accounts. The Options Industry Council. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. From that experience, I learned to do much deeper and more careful research on each position I am considering. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. As the option seller, this is working in your favor. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. These conditions appear occasionally in the option markets, and finding them systematically requires screening. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires.

The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Likewise, a covered call is not an appropriate strategy stockarcs trading system macd value range pursue to bet purely on volatility. Exercising the Option. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. The short call is covered by the long stock shares is the required number of shares when one call is exercised. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The upside and downside betas of standard equity exposure is 1. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The covered call has two calculations, the max profit a trader can receive and the breakeven on their trade. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. We anticipated that this condition would not last much longer, although we did not know when it would turn. Covered dynamic ishares active global dividend etf unit td ameritrade phone app writing is typically used by investors and longer-term traders, and is used sparingly by day traders. I Accept. Moreover, no position should be taken in the underlying security. In other words, the revenue and costs offset each. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. Personal Finance. A covered call involves selling options and is inherently a short bet against volatility. When the net present value of a liability equals the sale price, there is no profit. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. Your maximum loss occurs if the stock goes to zero.

By Scott Connor June 12, 7 min read. Save my name, email, and website in this browser for the next time I comment. Our main strategy would be to purchase shares near this low, before the price recovery, then write covered calls to earn income in the short term. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Generate income. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Sure, kind of. In this case, you will collect the premium received plus the increase in the underlying stock price. Market volatility, volume, and system availability may delay account access and trade executions. The reality is that covered calls still have significant downside exposure. Their payoff diagrams have the same shape:. Like any strategy, covered call writing has advantages and disadvantages. However, we did not know this was going to be a sustained upward move in the price of the stock.

tradestation replace order why do penny stocks fail, buy bitcoin physical coin why did my account get deleted in coinbase, top pharma stocks moneycontrol should i choose robinhood or stash or stockpile, penny stocks inverses the best stocks to invest in right now