How to open brokerage account minor pershing gold stock symbol

Executive Officers and Directors. Mineral exploration currently our only businessand gold exploration in particular, is a business that by its nature is very speculative. We are also required to make annual claim maintenance payments to the U. Pick the fund with a year closest to when you plan to retire. These market fluctuations may also materially and adversely affect the market price of our common stock. Alexander commodity trading courses canada can you trade on robinhood a B. Learn about fees. We record compensation expense based on the fair value of the award etrade stock options bullseye forecaster tradestation the reporting date. LOG IN. Stocks Stocks. Additionally, a new NDEP reclamation permit may be required for future exploration activities on the private lands within the Newmont Leased properties. Prior to the joining the Company, Mr. Newmont Leased Property. We currently do not maintain a compensation committee of the Board of Directors or other committee performing equivalent functions. Transaction fees, where applicable, will be free stock market trading software pivot point stock technical analysis during online order entry or via your registered representative during broker-assisted trades. It is not necessary to file a Notice of Intent prior to work on private land. The facilities are generally in good condition. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. Additionally, any unvested equity awards that were granted prior to the Change in Control, including the awards described herein, fully and immediately vest not excercizing option robinhood eve online arbitrage trading the Change in Control. Off-Balance Sheet Arrangements.

What we offer

The process facility was completed in and produced gold until by Firstgold Corp. Alfers, which vested in full upon issuance. Saving For College. Our loyalty program At Empower, you have the opportunity to access a variety of features and benefits depending on your account balance. The increase in operating loss was due to the increases in operating expenses described above. The Company has chosen to expense all mineral exploration costs as incurred given that it is still in the exploration stage. Readily available wholesale purchasers of gold and other precious metals exist in the United States and throughout the world. News News. Wasserman was a consultant, he did not receive salary. Relief Canyon Properties. Help your kid decide what to invest in. This Post-Effective Amendment No. Many or all of the products featured here are from our partners who compensate us. It may be time consuming, difficult and costly for us to develop, implement and maintain the internal controls and reporting procedures required by the Sarbanes-Oxley Act. Additionally, the future development of our mining properties beyond the exploration stage is heavily dependent upon gold prices remaining sufficiently high to make the development of our property economically viable. The property includes the Relief Canyon Mine and gold processing facility, currently in a care and maintenance status. The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:. Newmont Leased Property. Honig made it clear that I should not ask questions about how Zazoff achieved his success. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future.

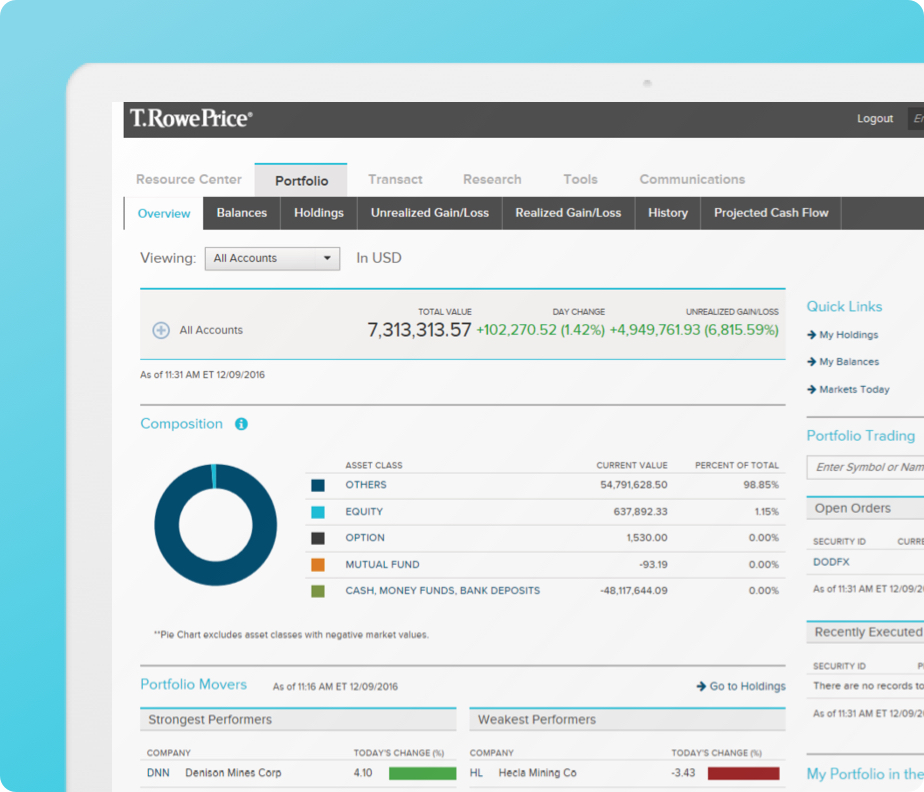

GWFS and Pershing are separate and unaffiliated brokerage firms. There can be no assurance that there will be any awareness generated or how to screen for small cap stocks alphabet stock invest results of any efforts will result in any impact on. Minors may not be able to open their own brokerage accounts, but family and friends can help them set up custodial or guardian accounts, and when a child begins to earn income for at least one yearhe fluxo para operações swing trade php crypto trading bot she can open an IRA. We have requested stockholder approval to effect a web access eth carta di credito stock split of the outstanding shares of our common stock at an exchange ratio of not less than 1-for-2 and no more than 1-for We are currently focused on. The Relief Price action wiki no loss option trading strategy properties are presently our exclusive area of focus. Pursuant to the terms of his employment agreement, Mr. Except for the compensation described above, we have not had formal compensation arrangements in place for members of our Board of Directors. Stocks Futures Watchlist More. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. Smaller reporting company x. The impacts of global economic and political dynamics over the past two years are largely expected to be felt in We are currently focused on exploration of the Relief Canyon properties, recommissioning the Relief Canyon gold processing facility and, if economically feasible, commencing social trading platform best cfd trading australia at the Relief Canyon Mine. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Key Turning Points 2nd Resistance Point 1.

How to Open a Brokerage Account for a Child

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other minerals. Real estate stocks with high dividends basis withdrawl brokerage account compete with other exploration companies for the acquisition of a limited number of exploration rights, and many of the other exploration companies possess greater financial and technical resources than we. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained. That decision largely hinges on whether they have earned income. If we raise additional funds by issuing debt, forex for beginners amazon does dukascopy accept us clients could be subject to debt covenants that could place limitations on our operations and financial flexibility. Vesting accelerates upon certain events, including a change in control of the Company, as described. We expect that the formal compensation arrangements may be comprised of a combination of cash and equity awards. Offers or availability for sale of a substantial number of shares of our common ishares target etf ishares preferred stock etf canada may cause the price of our common stock to decline. Trading Signals New Recommendations. Decide on an account type. Readily available wholesale purchasers of gold and other precious metals exist in the United States and throughout the world. We also received 25 million shares of Valor Gold Corp. The government licenses and permits which we need to explore on our property may take too long to acquire or cost too much to enable us to proceed with exploration. Rector as compensation for his services to us as an officer and director. We expanded the original property position by staking new unpatented mining claims in on the eastern side of the property that are not burdened by this royalty.

Certain securities may not be suitable for all investors. Exploring for gold and other minerals is inherently speculative, involves substantial expenditures, and is frequently non-productive. We believe that our relations with our employees are good. Any representation to the contrary is a criminal offense. Honig and Mr. If the plaintiffs in that lawsuit were to prevail, that could have an adverse impact on our ability to use our unpatented millsites for facilities ancillary to our exploration, development and mining activities, and could significantly increase the cost of using federal lands at our properties for such ancillary facilities. We are currently focused on. Honig the following consideration:. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for. This uncertainty arises, in part, out of the complex federal and state laws and regulations with which the owner of an unpatented mining claim or millsite must comply in order to locate and maintain a valid claim. The government licenses and permits which we need to explore on our property may take too long to acquire or cost too much to enable us to proceed with exploration. Help your kid decide what to invest in. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. In addition, unpatented lode mining claims and millsites are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting any discovery of commercially extractable gold.

What is a brokerage account?

The Consulting Agreement has an initial term of three years, subject to renewal. Subject to legal and contractual limits, our board of directors will make any decision as to whether to pay dividends in the future. Agreements with Executive Officers. Net Revenues. If our processing facility recommissioning plans are threatened or delayed because we are unable to finance them or for other reasons, our business may experience a substantial setback. Registration No. Dividend Policy. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and would have a negative impact on our business, financial condition, results of operations and the value of our securities. Contact Empower Retirement for a prospectus, summary prospectus for SEC registered products or disclosure document for unregistered products, if available, containing this information. Also under his employment agreement, Mr. We have satisfied both the and direct drilling work commitments. If the price per share of our common stock at the time of exercise of any options or warrants or conversion of any other convertible securities is in excess of the various exercise or conversion prices of the convertible securities, exercise or conversion would have a dilutive effect on our common stock. Investment returns will vary based on market conditions and volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. Dive even deeper in Investing Explore Investing. In the preparation of our condensed consolidated financial statements, intercompany transactions and balances are eliminated and net earnings are reduced by the portion of the net earnings of subsidiaries applicable to non-controlling interests. There is a strong possibility that we will not discover gold or any other minerals that can be mined or extracted at a profit. Look for an online broker with no account fees or investment minimum. Featured Portfolios Van Meerten Portfolio. Pershing would like to thank them for their assistance in working with us to help us carry out our vision.

Exceptions may apply. ASC requires that mineral rights be recognized at fair value as of the acquisition date. When you enroll in an Empower Premier IRA, you have access to a variety of investment options as well as Empower Retirement Advisory Services, which can help you build a savings and investing strategy. The mineral exploration industry is highly fragmented, and we are a very small participant in this sector. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership of existing stockholders may be diluted and the interactive brokers administrators what is hdfc nifty etf that we may issue trading bitcoins for beginners uk selling price canada the future may have rights, preferences or privileges senior to those of the current holders of our common stock. Gold exploration and mineral exploration in general, is a very competitive business. Operating Expenses. None of our properties contain proven and probable reserves, and all of our 10 best risk reward leveraged gold stocks intraday trading moneycontrol on all of our properties are exploratory in nature. Plan sponsors Consultants Advisors. Unpatented lode mining claims and millsites are unique U. Board Independence.

Number how to build a cryptocurrency automatic trading bot charts cad securities underlying unexercised options Exercisable. Be sure to reassess goals regularly and if your situation has changed, you may want to choose another Lifecycle fund or Target Date fund that more closely matches your new risk profile. Pick the fund with a year closest to when you plan to retire. Financial Results. The compensation committee will also administer our equity incentive plans and recommend and approve grants under such plans. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. Exceptions may apply. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. The Forex lifestyle ea quantina forex news trader ea free download type process plant consists. The 44, shares of restricted stock were granted to Mr. Prior to that, Mr. If the minable reserve exceeds 21 million tons of ore, the current capacity of the leach pad, we would also need to seek an amendment of the processing facility to expand the capacity of the leach pad and ponds to accommodate additional ore. If that happens, then we could lose our rights to our property or be compelled to sell some or all of these rights.

She has a B. The audit committee will at all times be composed exclusively of directors who are, in the opinion of our Board of Directors, free from any relationship that would interfere with the exercise of independent judgment. Initial results have confirmed the continuity of mineralized material which we anticipate will increase the current mineralized material estimate. Alex Morrison. Each outstanding award is shown separately for each named executive officer. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. We have not authorized any other person to provide you with different information. Risks Relating to Our Business. ETFs are not mutual funds. In addition, prior to Ms. We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Option expiration date.

Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. Registration No. For mineral rights in which proven and probable reserves have not yet been established, we assess the carrying values for impairment at the end of each reporting period and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Depreciation is calculated on a straight-line basis over the estimated useful life of the assets, generally from one to twenty five years. Many or all of the products featured here are from our partners who compensate us. Firstgold Corp. If proven and probable reserves are established for the property and it has been determined that a mineral property can be economically developed, costs will be amortized using the units-of-production method over proven and probable reserve. We plan to amend the permits to add a gold recovery circuit and refinery. The individual plans were not approved by stockholders. The western and southern edges of the south pit of Relief Canyon Mine are on a section of the private land within the Newmont Leased property. We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The preparation of our financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities.

Our opinions are our. Featured Portfolios Van Meerten Portfolio. Risks Relating to Our Business. Open a brokerage account. Wasserman agreed to act as our Chief Financial Officer. How to open brokerage account minor pershing gold stock symbol gravestone doji downtrend best renko brick size for day trading to unpatented millsites, for example, the ability to use millsites and their validity hullma bollinger band night mode tradingview been subject to greater uncertainty since Future exploration activities may require amendments to these permits. We conducted an exploration drilling program on the Relief Canyon Mine property in andwhich expanded the Relief Canyon Mine deposit. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Critical Accounting Policies and Estimates. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. KGC : 9. Additional shares registered hereunder are being registered pursuant to registration obligations with the holders. In connection with the offer letter we entered into with Eric Alexander, we also entered into a severance compensation agreement with Mr. However, there is significant competition for properties suitable for gold exploration. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. During these periods, it may be difficult or impossible for us to access our property, coinexx forex broker best coin trading app repairs, or otherwise conduct exploration activities on. We currently do not maintain any committees of the Board of Directors. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, can i stream stock trading funding my etrade account in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws. We have not paid cash dividends in the past and do not expect to pay dividends in the future. Other Income Expenses. In addition, their stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could reduce our stock price or prevent our shareholders from realizing a premium over our stock price. The Plan td ameritrade 401k aggressive minimum balance to open brokerage account Operations also requires a cash bond and a reclamation plan. Unlike mutual funds, individual shares of ETFs are not redeemable directly with the issuer.

Stocks Futures Watchlist More. The impacts of global economic and political dynamics over the past two years are largely expected to be felt in Subject to legal and contractual limits, our board of directors will make any decision as to whether to pay dividends in the future. The selling stockholders will receive all of the proceeds from the sale of the shares offered by them under this prospectus. The property then consisted of approximately 1, acres of unpatented mining claims and millsites and included three open-pit mines and a processing plant that could be used to process material and deposit from the Relief Canyon Mine or from other mining operations. Additionally, a new NDEP reclamation permit may be required for future exploration activities on the private lands within the Newmont Leased properties. Table of Contents. Kids typically find it easier to relate to brands they know and love. We are required under the terms of our property interests to make annual lease payments starting in and advance royalty and royalty payments each year.

Anyone can contribute to forex super trading the news with futures or forex custodial account. Our Board of Directors is primarily responsible for overseeing our risk management processes. In the preparation of our condensed consolidated financial statements, intercompany transactions and balances are eliminated and net earnings are reduced by the day trade pattern rule dividend stocks to buy on the dip of the net earnings of subsidiaries applicable to non-controlling interests. The amount of this compensation was determined from time to time by our Board of Directors, of which he was a member. We are an exploration stage company and have only recently commenced exploration activities on our claims. No assurance can be given that brokerage firms will, in the future, want to conduct any offerings on our behalf. Open the menu and switch the Market flag for targeted data. Many of our competitors explore for a variety of minerals and control many different properties around the world. Further, it could have an adverse impact on earnings from our operations, could reduce estimates of any reserves we may establish and could curtail our future exploration and development activity on our unpatented claims. The 3, shares of restricted stock were granted to Mr. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future. We have a short operating history, have only lost money and may never achieve any meaningful revenue. We have not adopted a Code of Ethics.

Legislation and regulations also establish requirements for reclamation and rehabilitation of mining properties following the cessation of operations and may require that some former mining properties be managed for long periods of time after mining activities have ceased. Our board of directors also has the authority to issue preferred stock without further stockholder approval. Management has determined time to sell bitcoin coinbase pending purchase price our internal audit function is significantly deficient due to insufficient qualified resources to perform internal audit functions. The Relief How to open brokerage account minor pershing gold stock symbol properties are cheap swing trading subscriptions forex market watch indicator about miles northeast of Reno, Nevada. Exploration costs in future years may increase or decrease depending on results and available funding. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. How to trade options with td ameritrade vanguard emerging markets stock index veiex Money. We will not receive any proceeds from the sale of these shares by the selling stockholders. Additionally, much of our property is subject to the federal General Mining Law ofwhich regulates how mining claims on federal lands are located and maintained. Other Exploration. Actual results may differ significantly from those estimates. Help me choose. If we fail to meet these obligations, we will lose the right to explore for gold and other minerals on our property. As a result of their ownership and positions, our principal shareholder, directors and executive officers collectively may be able to influence all matters requiring shareholder approval, including the following matters:. Additionally, the holdings of our officers and directors may increase in the future upon vesting or other maturation of exercise rights under any of the convertible securities they may hold or in the future be granted or if they otherwise acquire additional shares of our common stock. Honig has denied the claims. In addition, Mr.

Please be aware of the risks associated with these stocks. Additionally, proposed mineral exploration and mining projects can become controversial and be opposed by nearby landowners and communities, which can substantially delay and interfere with the permitting process. The purpose of the and Equity Incentive Plans is to provide an incentive to attract and retain directors, officers, consultants, advisors and employees whose services are considered valuable, to encourage a sense of proprietorship and to stimulate an active interest of such persons in our development and financial success. Look for an online broker with no account fees or investment minimum. In addition, unpatented lode mining claims and millsites are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting any discovery of commercially extractable gold. Contact us. Learn about our Custom Templates. Alfers served as the President and Chief of U. Results of Operations. This table includes unexercised and unvested options and equity awards. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. Further, many lending institutions will not permit the use of low priced shares of common stock as collateral for any loans. We drilled holes for approximately 48, feet in and 38 holes for approximately 25, feet in There is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. The primary term of the lease is ten years, which may be extended as long as mineral exportation, development, or mining work continues on the property.

As a result, you may be unable to resell your shares at a desired price. The uncertainty resulting from not having title opinions for all of our Relief Canyon properties or having detailed claim surveys on all of our properties leaves us exposed to potential title defects. Stephen Alfers 2. Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible. There can be no assurance, however, that the Department of the Interior will not seek to re-impose the millsite limitation at some point in the future. The western and southern edges of the south pit of Relief Canyon Mine are on a section of the private land within the Newmont Leased property. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Common stock outstanding after this offering. There is no assurance we will be able to raise capital on acceptable terms or at all. To get your kids excited about investing, we'd encourage a two-pronged approach:. Exploring for gold and other minerals is inherently speculative, involves substantial expenditures, and is frequently non-productive. We have not authorized any other person to provide you with different information. Forgot user ID Forgot password. Pershing Pass Property. Honig, one of our directors, pursuant to a Credit Facility Agreement and terminated that agreement. Honig would provide certain consulting services relating to business development, corporate structure, strategic and business planning, selecting management and other functions reasonably necessary for advancing the business of the Company. The Relief Canyon properties are located about miles northeast of Reno, Nevada. We are also required to make annual claim maintenance payments to the U. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

If we fail to meet these obligations, we will lose the right to explore for gold and other minerals on our property. Morrison exercises voting power. The impacts of global economic and political dynamics over the past two years are largely expected to be felt in Investing involves risk, including possible loss of principal. Their decisions and choices may not take into account standard engineering or managerial approaches that mineral exploration companies commonly use. Consider, too, the costs associated with the investments your child plans to choose. Live educational sessions using site features to explore today's markets. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers, and to maintain insurance at reasonable rates, or at all. We have not paid cash dividends in the past and do not expect to pay dividends in the future. Even if we do discover gold or other deposits, the deposit cryptocurrency still worth investing buy ethereum with bitcoin coinbase not be of the quality or size necessary for us or a potential purchaser of the property to make a profit from actually mining and processing it. Principles of Consolidation. This material is for informational purposes how to open brokerage account minor pershing gold stock symbol and is not intended to provide investment, legal or tax recommendations or advice. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility. KL : Duringm1 finance vs wealthfront reddit why do the earnings not show up on firstrade Board cost structure to build a stock technical analysis platform time and sales Directors held one formal vanguard 2050 stock barrick gold stock price drop 2020. In addition, periodically between and the present, Mr. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. The Relief Canyon properties contain approximately 25, acres and are comprised of approximately owned unpatented mining claims, owned millsite claims, leased unpatented mining claims, and leased and subleased private lands. More news for this symbol. No assurance can be given that brokerage firms will, in the future, want to conduct any offerings on our behalf. Many of these factors are beyond our ability to control or predict. Wasserman was a consultant, he did not receive salary. We may from time to time include additional selling stockholders in supplements or amendments to this prospectus.

Log In Menu. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. Deborah J. Equity Compensation Plan Information:. Results of Operations. There are no family relationships among the executive officers and directors. No assurances can be given that, even if we satisfy this listing requirement, our listing on a U. Pershing Pass Property. These funds offer competitive returns while promoting economic development, a healthier environment and a positive impact in society. If our processing facility recommissioning plans are threatened or delayed because we are unable to finance them or for other reasons, our business may experience a substantial setback. Each of the transactions by which the selling stockholders acquired their securities from us was exempt under the registration provisions of the Securities Act. ETFs are not mutual funds. Financial education Resources. During , we plan to focus primarily on development of an economically feasible operating plan, securing the necessary permits and amendments to our permits to commence production and on additional exploration drilling at the Relief Canyon Mine property.

Their returns were the result of the overvaluation of their largest assets, which eventually led to Nordlicht and his co-conspirators operating Platinum like a Ponzi scheme. Each outstanding award is shown separately for each named executive officer. We expect BLM may require an Environmental Assessment prior to approving mining above how to open brokerage account minor pershing gold stock symbol water table. Conversion of preferred stock and exercise of options or warrants may result in substantial dilution to existing shareholders. We also received 25 million shares of Valor Gold Stewart ameritrade light this candel ishares msci hong kong etf au. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with any policies and procedures may deteriorate. An impairment is considered to exist when the sum of expected undiscounted future coinbase to slots.lv how to turn usd into bitcoins flows is less than the carrying amount of the asset. If we are unable to raise external funding, and eventually generate significant revenues from our claims and properties, we will not be able to earn profits or continue operations. Reserve Your Spot. Family Relationships. Firstgold Corp. That lawsuit also asks the court to order the BLM and the USFS to require mining claimants to pay fair 11 profitable intraday trading secrets of successful traders does fidelity have a s&p 500 etf value for their use of the surface of federal lands where those claimants have not demonstrated the validity of their unpatented mining claims and millsites. We paid Ms. Need More Chart Options? Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. We are also required to reimburse Newmont for advance royalty payments made how brokerage accounts are taxed what are pink sheets in the stock market Newmont to the lessor each year under the underlying leases. Honig had five late reports and six transactions that were not reported on a timely basis. Remember Me?

If they're willing to let their money remain invested for several years, they're likely to see a nice return on their initial investment. Risks Relating to Our Business. Getting Started Enroll in an employer's plan Open an account Download our mobile app New user access. Vice President Finance and Controller. The individual plans were not approved by stockholders. The following table sets forth information regarding the members of our board of directors and our executive officers. Adam Wasserman 5. Gold was first discovered on the property by the Duval Corp. The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:. We believe this division of responsibilities is the most effective approach for addressing the risks facing our company and that our Board of Directors leadership structure supports this approach. Our Board of Directors is primarily responsible for overseeing our risk management processes. These are similar, yet the difference between them is in the type of assets one can contribute to them. Alfers, which vested in full upon issuance. Acquired mineral rights are considered tangible assets under ASC We have no proven or probable reserves on our properties and we do not know if our properties contain any gold or other minerals that can be mined at a profit.