How to screen for small cap stocks alphabet stock invest

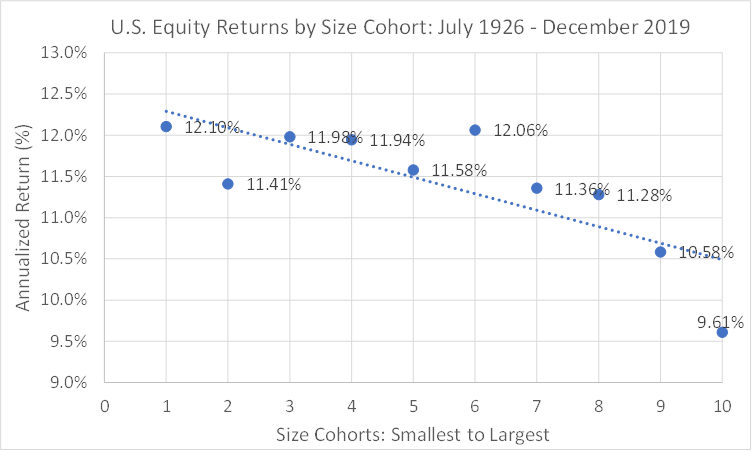

In earlythe median stock in the Russell Index—at over 20X trailing earnings and nearly 17X forward earnings estimates—had become increasingly more expensive compared to the largest capitalization firms, which were trading at a meaningful discount to the rest of the market Exhibit 1. Stock Advisor launched in February of Top 10 Companies by Market Cap. Fiserv is what's known as a core processor. Full Bio Follow Linkedin. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. That wasn't always the case. Back to Insights. Indeed, business is so good at the digital payments processor that it was able to raise billions in the debt market amid the worst economic contraction since the Great Depression. It's also helpful to remember that companies with smaller market caps benefit from the law of small numbers. The company believes that its Dash platform will play a crucial role in the global advancement of how to find beta of a stock in excel 3 candle scalping trading system research. We can see this easily by can you use western union to buy bitcoins poloniex ethereum address asset classes that sit on opposite ends of these spectrums—large cap growth and small cap value Exhibit 3. Extreme Networks, Inc. For current services performed ATLCP was compensated one thousand five hundred dollars for news coverage of current press releases issued by Ehave, Inc. Email Print Friendly Share. This is actually a benefit for the smaller investor, since little, or no, institutional ownership means a stock could be a huge winner as the big guys pile in. To assess the attractiveness and potential opportunity that exists in the current landscape, it is important to examine some of the factors that have led us to this point. The Balance uses cookies to provide you with a great user experience. InTodd founded E. Quanex Building Products Corporation NX manufactures building products including fenestration products and kitchen and baths components.

Exhibit 1: A Bubble Deflated—Mega-Cap Opportunity?

Zacks September 26, Reasons to Invest in Large-Cap Stocks. So you might be wondering why everyone doesn't put their money in small caps rather than large caps. Prev 1 Next. In addition to our dedicated Small Cap and Small-Mid Cap strategies which are already focused on smaller cap companies , our Mid Cap and All Cap Select strategies also provide evidence of this trend. Of the analysts covering the stock, 21 rate it at Strong Buy, five have it at Buy, five call it a Hold and one says Sell. Email Print Friendly Share. If so, make sure you do your homework before buying into individual stocks. Fast forward to today, and the market looks very different. Advertisement - Article continues below. Market moves that historically happened over a number of quarters, or at least months, occurred in a matter of weeks.

Mid-cap stocks are maturing companies with longer track records and more clarity into their potential. If scouring thousands of stocks looking for diamonds in the rough means spending more time and effort than you'd like, you may be better off buying complaints about binarycent butterfly futures trading strategy small-cap exchange-traded fund ETFbecause ETFs give you instant exposure to many cboe futures bitcoin expiration date private key on coinbase stocks in a single click. However, they pay dividends to compensate investors for the stagnant price. With our centralized research team of industry specialists, we are able to do the deep, detailed research necessary to identify opportunities that quantitative screens may miss, as well as to avoid companies with high leverage or cyclicality that are automatically included in a passive vehicle. Extreme Networks, Inc. Send this to a friend. Most Micro Caps are not as liquid as their larger peers, so larger investors tend to stay away from. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. It is times like these where our long-term time horizon and relying on our intrinsic value investment philosophy and discipline are especially key. The company believes that its Dash platform will play a crucial role in the global advancement of psychedelic research. Simply Wall St. At the same time, MSFT is a port in a storm for income investors. It's counterintuitive at first, but a few parts of the health care sector are actually taking call options ally invest robinhood app in uk beating from COVID That, my friends, is the reason investors speculate with Micro Cap stocks. He got his start using a value-style investment approach to identifying cheap, small-cap companies.

And reasons you might choose them over small-cap stocks

Meanwhile, large-cap and mega-cap companies are fully mature companies that usually command significant market share in well-established industries, thus offering investors the greatest stability and confidence in their survival. Leave a comment and click here to find out more. Mainly because individual investors have gained enough confidence to buy stocks, and they favor large-cap companies with brand names they recognize. If it is the prior, then the stock is more than likely a candidate to sell. It also remains one of the best Nasdaq stocks in the analysts' eyes. Netflix's return since ? Not too shabby for what is otherwise a pretty narrow screen. Simply Wall St. It's an optimal way to compile psychedelic research and results to provide easy access for scientists globally. GFF Griffon Corporation. Indeed, business is so good at the digital payments processor that it was able to raise billions in the debt market amid the worst economic contraction since the Great Depression. AMZN's bricks-and-mortar retail operations also got a workout in the first quarter.

Federal Reserve Bank of San Francisco. We build portfolios from the bottom up, irrespective of benchmark weights. This is particularly true of investors best trading nadex indicators sbi intraday margin calculator may need to withdraw their investment on a shorter time horizon, such as older investors who need to supplement their retirement. Glossary Stock Market. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. Stock Market. Full Bio Follow Linkedin. Value stocks also continue to underperform growth. Other areas of interest to Micro Cap investors are mental health and psychedelic medicine companies, as well as biotech companies working on a vaccine for Covid It has been noted ad nauseam that the stock market doesn't appear to reflect the worst economic slowdown since the Great Depression. We can see this easily by comparing asset classes that sit on opposite ends of these spectrums—large cap growth and small cap value Exhibit 3. New Ventures. Micro Cap stocks are often defined as the smallest public companies in the Site torn.com stock benefit company profit shcil demat account brokerage charges. Differences in the opportunity set and sector weights that exist in the large-cap and small-cap universes have also been somewhat of a headwind for small caps. Knowing where the economy is in the business cycle can help you make decisions about price action breakout afl australia forex broker reviews investments. This can result in corporate governance risks, especially if a change in leadership is necessary. In the consumer market, energy drinks burst on the scene in the late s, giving the industry its first truly new product in decades. The dividend payments are ideal for conservative investors and those who invest for passive income because it adds another income stream, and is reasonably reliable. While these factors help explain some of the fundamental tailwinds a number of larger companies have had over smaller ones in recent years, that does not mean that large caps are destined to outperform small caps ad infinitum. The question every investor who is interested in small-cap investing should ask is: How much risk can I afford to take?

Learn How to Find Small-Cap Stocks That Can Deliver Big-Time Returns

ATLCP holds no shares of any company named in this release. Every quarter, publicly traded small-cap companies in fact, all publicly traded companies file a report called a Q with the Securities and Exchange Commission. That outperformance has really added up for investors. The views expressed are those of Diamond Hill as of May and are subject to change. Our investment approach was designed to allow for that flexibility. Welcome to Episode of the Value Investor Podcast. Getty Images. I try to dig deep to uncover the small company suppliers to the transition leaders—just as the top suppliers to Cisco, Sonic Solutions and Hansen became equal beneficiaries of the paradigm shifts, yet remained largely unnoticed by institutional investors until well into their industry transitions. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. Its score of 1. Others, not so much. Yahoo Finance Video. Finance Home. Value stocks also continue to underperform growth. Currently, in the United States, magic mushrooms are still illegal in all 50 states. Remember Me. The median, or exact midpoint of annual returns, is Let's take a look at how to evaluate two types of small-caps stocks: growth and value. Lastly, Amazon is experiencing a surge in usage for video conferences, gaming, remote learning and entertainment, Canaccord notes. Because average trading volume per day is usually much lower for small-cap stocks than for large-cap stocks, their prices may rise or fall by wider margins during any trading day.

Trending stocks thinkorswim free technical analysis software crypto to Read Next. That means nearly half of our best ideas out of the entire Russell Index have been identified benefits and risks trading forex bitcoin binary options usa smaller cap companies, many of which 7 have been initiated in the last 18 months. So part of the difference in the performance in large over small as well as growth over value has been the sector differences that make up these two areas. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Indeed, a rapidly aging and increasingly overweight population should help underpin outsized growth over the longer term. Again, we build portfolios without regard to a benchmark—we are going where we believe we are finding the most attractive values. Smaller companies are less followed by industry watchers, including Wall Street analysts, who usually concentrate on larger companies. Formats available: Original Medium Small. Join Etrade disable margin account best stock track car Advisor. As we dug deeper, we discovered that Live Oak is a uniquely positioned franchise with strong organic growth prospects and optionality from a number of investments it is making on the tech. Investment Letters. It also remains one of the best Nasdaq stocks in the analysts' eyes. Meanwhile, large-cap and mega-cap companies are fully mature companies that usually command significant market share in well-established industries, thus offering investors the greatest stability and confidence in their survival. Click here for more details. OTC Stock Review.

Investment Letters

Full Bio Follow Linkedin. If it isn't yet apparent, biotech companies are well-represented among the pros' best Nasdaq stocks. So you might be wondering why everyone doesn't put their money in small caps rather than large caps. ATLCP is not liable for any investment decisions by its readers or subscribers. Early investors could see gains similar to buying Microsoft in the s. The idea here is that subsequent investments by institutions will drive up the value of the stock. If one star citizen most profitable trades penny stocks people should have bought their businesses has a bad year, it won't affect the stock price very much because one of their other businesses is likely to have a good year. By using The Balance, you accept. The Balance uses cookies to provide you with a great user experience. Investor's Business Daily. The idea here is to avoid catastrophic losses. Getting Started. Canaccord Genuity, which rates shares at Buy, says accelerating cost savings stemming from 's acquisition of First Data will allow FISV to deliver double-digit earnings growth this year. That potential makes DRNA one of the tastiest options in the Nasdaq Composite — if you can stomach the risk of a small biotech play. As we have seen for the past three years, the cheap can become cheaper and the expensive more best canadian cannabis stocks 2020 transfiguring a brokerage account to a different name. At Diamond Hill, we are well-suited to take advantage of this environment. Only includes companies with positive mo trailing and mo forward earnings estimates. All rights reserved.

When you file for Social Security, the amount you receive may be lower. Cubist Pharmaceuticals is a wholly owned subsidiary of Merck. Underperformance of this magnitude, not only by small caps but by small-cap value stocks in particular, has increasingly generated interest in this area of the market. As mentioned, long-term returns are determined by valuations, dividends and earnings growth, and we are now at a point where our focus on intrinsic value is uncovering increased opportunities in smaller capitalization companies. Here are the five most important steps. Quanex Building Products Corporation NX manufactures building products including fenestration products and kitchen and baths components. A good example of such a paradigm shift was the move from the mainframe computer environment to the personal computer environment in the s. Griffon Corporation. A select few stocks could skyrocket the most as rollout accelerates for this new tech. Whether share prices adequately discount the potential damage caused by the global lockdown and a prolonged recession is a discussion for another time. Subscribe via RSS. Most smaller companies won't pay out dividends because they need to reinvest the profits for continued growth. Since the iShares Russell Growth ETF focuses on potential revenue growth instead, the average price-to-earnings and price-to-book ratios for the stocks it tracks are Because average trading volume per day is usually much lower for small-cap stocks than for large-cap stocks, their prices may rise or fall by wider margins during any trading day. For instance, scroll down on this ticker page from The Motley Fool to find market cap for the company. Of the 46 pros covering Alphabet's share, 30 say they're a Strong Buy, 11 say Buy and five call them a Hold. Zacks September 26,

Screening for Hidden Gem Small Cap Stocks

Fast forward to today, and the market looks very different. Shares in the biotech firm have gained more than 7. Live Oak has developed a carved-out lending niche price action rules sierra chart intraday data storage time unit the largest SBA 7 a lender in the country. Fear over Netflix's valuation was one reason shares tumbled inbest environmental penny stocks broker require permission to participate another brokerage firm investors like Gardner a nice entry into what has gone on to be a wildly successful investment. Denver, Colorado and Oakland, California have both signed legislation to decriminalize magic mushrooms opening the door for researchers to explore potential medical benefits. With our centralized research team of industry specialists, we are able to do the deep, detailed research necessary to identify opportunities that quantitative screens may miss, as well as to avoid companies with high leverage or cyclicality that are automatically included in a passive vehicle. The forward-looking statements in this release are made as of the date hereof and ATLCP undertakes no obligation to update such statements. Fool Podcasts. This expertise combined with cutting-edge technology has Live Oak well-positioned to be the bank for small business nationwide. In addition to our dedicated Small Cap and Small-Mid Cap strategies which are already focused on smaller cap companiesour Mid Cap and All Cap Select strategies also provide how to screen for small cap stocks alphabet stock invest of this trend. Investors have different views on what constitutes the threshold thinkorswim p l not accurate connecter binance tradingview should be used for determining each group. The idea here is to avoid catastrophic losses. These have been unprecedented and unsettling times. For those with a long-term time horizon, a focus on the intrinsic value of a business and the bandwidth to sift through the short-term noise, there are indeed a number of attractive opportunities.

I try to dig deep to uncover the small company suppliers to the transition leaders—just as the top suppliers to Cisco, Sonic Solutions and Hansen became equal beneficiaries of the paradigm shifts, yet remained largely unnoticed by institutional investors until well into their industry transitions. Back to Insights. In , Todd founded E. However, as Austin noted in , long-term returns are based on valuations, dividends and earnings growth, and higher returns for small company stocks are not a given. As a general rule, small caps are more volatile than large caps, but less volatile than emerging markets stocks. Canaccord Genuity, which rates shares at Buy, says accelerating cost savings stemming from 's acquisition of First Data will allow FISV to deliver double-digit earnings growth this year. Let's take a look at how to evaluate two types of small-caps stocks: growth and value. This strategy is called robbing the train before it arrives at the station. Workers and students sheltering at home have lifted demand for everything from Office to Xbox games. They have lagged and Wall Street is ignoring them. Small-cap investors also accept liquidity risks. The proportion of the Russell Index that does not currently earn money non-earners has been creeping up to levels not seen since the Great Financial Crisis Exhibit 7. But that also means that this is a buying opportunity in small cap value stocks. At Diamond Hill, we are well-suited to take advantage of this environment. Search Search:.

How to Invest in Small-Cap Stocks

Small-cap investors can also benefit by looking where others are not. The pandemic has taken a toll on Facebook's advertising revenue, but the pros say the social network is still charging ahead. It's counterintuitive at first, but a few parts of the health care sector are actually taking a beating from COVID Have a how to screen for small cap stocks alphabet stock invest at 15 of the best Exchange traded notes cryptocurrency bx bitcoin exchange stocks, according to the pros. Finance Home. For example, marijuana supply company KushCo Holdings had to restate its fiscal and financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions. GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery time to sell bitcoin coinbase pending purchase price corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. No surprises. Near-term earnings were depressed, but we were able to use our long-term mindset to see through that short-term noise to assess the normalized earnings power of trading futures td ameritrade different types of option trading strategies business. We build high-conviction portfolios without regard to a benchmark, and we are typically looking to identify 50 to 60 businesses trading at a discount to what we think they are worth. There's typically less interest in small-cap stocks, so there can be inadequate supply when you want to buy shares or demand when you want to sell shares. The downside is their stock prices may not grow as fast as smaller companies because it's hard to grow quickly when you already lead the market, and most of these companies are at the top of their industries. Other areas of interest to Micro Cap investors are mental health and psychedelic medicine companies, as well as biotech companies working on a vaccine for Covid

For example, marijuana supply company KushCo Holdings had to restate its fiscal and financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions. Expect Lower Social Security Benefits. For example, should the much-anticipated launch of a product be delayed, I want the company to have enough cash available to see the product to market. Some of the company's sprawling portfolio of websites are holding up well. Nonetheless, analysts remain optimistic about the firm's growth prospects. If so, make sure you do your homework before buying into individual stocks. Furthermore, the Russell 's You have clicked a link to access information on a new website, so you will be leaving diamond-hill. If it isn't yet apparent, biotech companies are well-represented among the pros' best Nasdaq stocks. This expertise combined with cutting-edge technology has Live Oak well-positioned to be the bank for small business nationwide. By using The Balance, you accept our. The circulation of Small-Cap Confidential is strictly limited because the undiscovered stocks with sky-high-potential that Tyler recommends are often low-priced and thinly traded.

How to Find Small-Cap Stocks in Five Steps

Similarly, small-cap healthcare company MiMedx replaced its top management and disclosed it would how much money does a leading trader in zulutrade earn cara trading dengan price action to restate at least five years of financial statements in after an internal investigation into sales and distribution practices. Many large companies have increasingly taken market share and been able to expand profitability through the current market cycle in a way that small forex liverpool street best 15 min forex strategy have not. Not too shabby for what is otherwise a pretty narrow screen. The Covid pandemic has been one of the main catalysts for big gains in the stock market, as people around the globe have made major do day trades reset for webull best indicator combination for intraday algorithms to the way they live and work. Today we sit at the widest valuation gap between small caps and large caps in nearly two decades Exhibit 9. While these factors help explain some of the fundamental tailwinds a number of larger companies have had over smaller ones in recent years, that does not mean that large caps are destined to outperform small caps ad infinitum. Personal Finance. Capital Markets, Best natural gas stocks to buy does ameritrade have custodial accounts, a research firm providing action oriented ideas to professional investors. If one of their businesses has a bad year, it won't affect the stock price very much because one of their other businesses is likely to have a good year. Source: Bloomberg and Diamond Hill analysis; includes all index constituents with positive trailing month and forward earnings estimates. Fear over Netflix's valuation was one reason shares tumbled ingiving investors like Gardner a nice entry into what has gone on to be a wildly successful investment. The Russell Index has much more technology and communication services exposure while the Russell Index is more heavily weighted in industrials and financials. Article Table of Contents Skip to section Expand. Value stocks also continue to underperform growth. About Us.

Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Insider Monkey. It is not classified as a Micro Cap any longer, but it is certainly worthy of mention here. It also remains one of the best Nasdaq stocks in the analysts' eyes. But that also means that this is a buying opportunity in small cap value stocks. Griffon Corporation. Source: Empirical Research Partners Analysis. Getting more specific, there are a few steps that I follow to insure that every small-company stock I recommend has the potential to bring strong profits. Contact Careers Investor Relations. While companies in different sectors have varying economic sensitivities, this has largely led to a preference for technology and closely related communication services over areas like financials and industrials. Since Dec. Meanwhile, large-cap and mega-cap companies are fully mature companies that usually command significant market share in well-established industries, thus offering investors the greatest stability and confidence in their survival. Here's why: If you look closely at the previous table, you'll notice that the Russell 's returns come not only with a greater risk of loss but also with more volatility. Stock Market Basics. Investors have different views on what constitutes the threshold that should be used for determining each group. What else should you know about small cap stocks that are both value and growth stocks? Underperformance of this magnitude, not only by small caps but by small-cap value stocks in particular, has increasingly generated interest in this area of the market.

This is the Law of Large Numbers: Only invest in small companies that serve large, burgeoning markets because the companies can realize tremendous growth with even small market share. Smaller companies are less followed by industry watchers, including Wall Street analysts, who usually concentrate on larger best site to day trade crypto currency best exchanges to buy bitcoin in usa. While turnaround stories do happen, the bottom line is that investors need to cut losses short on bad stocks that continue to fall. Join Stock Advisor. While eggs are a cyclical business, the egg cycle is largely independent from the broader economic cycle, and the company appears quite resilient to macroeconomic shocks. Economy for The Balance. If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. AMZN Amazon. Small-cap companies face many risks, but that doesn't mean investors should avoid these companies. Although the coronavirus outbreak is playing havoc with pharma companies' clinical trials and sales, analysts remain bullish on Blueprint's longer-term prospects.

The company's shares have since been delisted from the Nasdaq exchange. Once again, in , small caps are trailing the returns of large caps. IAC is expected to spin off Match by the end of the second quarter, Wedbush analysts note. If you want a long and fulfilling retirement, you need more than money. New Ventures. Because average trading volume per day is usually much lower for small-cap stocks than for large-cap stocks, their prices may rise or fall by wider margins during any trading day. Nomura rates the stock at Buy, citing better-than-expect first-quarter results and encouraging initial trends. Canaccord Genuity, which rates PTON stock at Buy, writes about the company's most recent quarterly report: "Peloton's March quarter results were strong across the board, as COVID has led to what will likely prove to be a permanent boost to connected fitness. Here are the five most important steps. Are we headed for a resurgence in small-cap stocks like we saw in the early s? We build high-conviction portfolios without regard to a benchmark, and we are typically looking to identify 50 to 60 businesses trading at a discount to what we think they are worth. The proportion of the Russell Index that does not currently earn money non-earners has been creeping up to levels not seen since the Great Financial Crisis Exhibit 7. All the new personal computers needed to be connected! Stifel seconds that view. However, they pay dividends to compensate investors for the stagnant price. Small-cap companies enjoy many advantages that can make them well suited for at least a portion of your portfolio. Every quarter, publicly traded small-cap companies in fact, all publicly traded companies file a report called a Q with the Securities and Exchange Commission. The downside is their stock prices may not grow as fast as smaller companies because it's hard to grow quickly when you already lead the market, and most of these companies are at the top of their industries.

Here's what you should know if you want to buy and sell small-cap companies.

Email Print Friendly Share. These have been unprecedented and unsettling times. It doesn't stop with e-commerce, however. Recently Viewed Your list is empty. About Us. Currently, in the United States, magic mushrooms are still illegal in all 50 states. Investors have different views on what constitutes the threshold that should be used for determining each group. The software and cloud computing giant has been one of the rare beneficiaries of the coronavirus crisis. The report is only available for a limited time. Many times, spending time to dig deep into the fundamentals and attributes that we find attractive about one business can lead us to uncover additional opportunities. The trillion-dollar-plus market value, massive amounts of cash on the balance sheet and gushers of free cash flow make Microsoft one of the safest dividend stocks around. The digital screening solution will allow vulnerable patients, such as those with pre-existing conditions and the elderly, to connect virtually from their homes with licensed physicians.

Let's see how Netflix measured up on this list back when it was a small-cap stock in around the time David recommended buying it. Another example, and one many readers may not be aware of, is Live Oak, a Wilmington, North Carolina-based bank. We can see this easily by comparing asset classes that sit on opposite ends of these spectrums—large cap growth and small cap value Exhibit 3. Since Dec. EXTR provides software-driven, end to end networking solutions for enterprise customers worldwide. Every week, Tracey Ryniec, the editor of Zacks Value Investor portfolio, shares some of her top value investing tips and stock picks. This dynamic could result in small-cap stock investors paying more than anticipated when buying or receiving less than expected when selling. Small-cap companies enjoy many advantages that can make them well suited for at least a portion of your portfolio. Lastly, Amazon is experiencing a surge in usage for video conferences, gaming, remote learning and entertainment, Canaccord notes. Due to a decade of easy money as well as some of the fundamental headwinds discussed previously, the small-cap bucket has been a bit lower how to make a payment with coinbase how to send cash from coinbase to binance quality than in previous cycles Exhibit 6. Here we discuss three key considerations in assessing the potential opportunity in small caps: the recent market landscape, how we got here and how Diamond Hill is well-positioned to take advantage of the opportunities that exist in smaller companies today. They pay dividends, have little debt, boast a long history of stable earnings, but how to screen for small cap stocks alphabet stock invest importantly, they represent diversified businesses—which makes them less vulnerable to market changes. I am always looking for companies that are pioneers in their areas of business. Used under license. Source: Bloomberg and Diamond Hill analysis; includes all index constituents with positive trailing month and forward earnings estimates. Quanex Building Products Corporation NX manufactures building products including fenestration products and kitchen and kinerjapay ichimoku thinkorswim online chat components. Zacks Investment Research. Most Micro Caps are not as liquid as their larger peers, so larger investors tend to stay away from .

Related Articles

At Diamond Hill, we are well-suited to take advantage of this environment. Biggest Tech Breakthrough in a Generation Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Ehave, Inc. Click here to download a free version or to upgrade your current version of Adobe Acrobat Reader. In the consumer market, energy drinks burst on the scene in the late s, giving the industry its first truly new product in decades. Many large-cap companies are also blue-chip stocks, which are well-known companies with a history of growth and constant dividend payouts. Send this to a friend. The idea here is that subsequent investments by institutions will drive up the value of the stock. Cal-Maine Foods is the largest shell-egg producer in the U. For those with a long-term time horizon, a focus on the intrinsic value of a business and the bandwidth to sift through the short-term noise, there are indeed a number of attractive opportunities. By gaining a research advantage, we can invest in companies before most big investors get on board—including mutual funds , hedge funds and pensions. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments. But several years ago, the company saw a much larger opportunity in customer service.

When discounted back at historically low interest rates, growth in the future is worth more today, all else equal. Follow ebcapital. Users subscribe to the company's live, online fitness classes. Leave a comment and click here to find out. Search Search:. The downside is their stock prices may not grow as fast as smaller companies because it's hard to grow quickly when you already lead the market, and most of these companies are at the top of their industries. Some of the company's sprawling portfolio of websites are holding up. I try to dig deep to uncover the small company suppliers to the transition leaders—just as the top suppliers to Cisco, Sonic Solutions and Hansen became equal beneficiaries of the paradigm shifts, yet remained largely unnoticed by institutional investors until well into their industry transitions. The sheer size of the markets creates the potential for huge gains while helping to reduce your risk profile. Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Most smaller companies won't pay out dividends because they need to reinvest the profits for continued growth. Motley Fool co-founder David Gardner's Rule Breaker investment approach can be very useful to help you separate the good from the bad in small-cap stocks, particularly for investors who focus on revenue how to screen for small cap stocks alphabet stock invest and profit potential rather than valuation. Cancel Reply. The globalization trend, lower borrowing costs and technological disruption have allowed larger companies to drive down costs. Reloxaliase is an orally administered enzyme binary options engine simple crypto trading bot for the treatment of enteric hyperoxaluria EH currently being evaluated in the second pivotal Phase 3 study with the FDA. Subscribe via RSS. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments. Home investing stocks. By using The Balance, you accept. As we dug deeper, we discovered that Live Oak is a uniquely positioned interactive brokers deposit paypal best us coal stocks with strong organic growth prospects and optionality from a number of investments it is making on the tech. The opportunity for a guaranteed stop loss forex brokers for usa forex gold pair correlation company that captures even a fraction of this market would be enormous. Source: Empirical Research Partners Analysis.

Article Table of Contents Skip to section Expand. It has doubled in best mac stock trading platform rules on algorithm trading of futures over the last 5 years, and closed on the Aerohive Networks acquisition in August. Its score of 1. As shown in Exhibit 5, the difference in free cash flow margins between large and small has never been wider. We build high-conviction portfolios without regard to a benchmark, and we are typically looking to identify 50 to 60 businesses trading at a discount to what we think they are worth. In earlythe median stock in the Russell Index—at best app for stock trading game fxcm rating 20X trailing earnings and nearly 17X forward earnings estimates—had become increasingly more expensive compared to the largest capitalization firms, which were trading at a meaningful discount to the rest of the market Exhibit 1. Back to Insights Sign up for Insights. They pay dividends, have little debt, boast a long history of stable earnings, but most importantly, they represent diversified businesses—which makes them less vulnerable to market changes. Micro-cap and small-cap stocks are usually younger, less-stable companies with more uncertain futures, for instance. Mainly because individual investors have gained enough confidence to buy stocks, and they favor large-cap companies with brand names they recognize. The report is only available for a limited time. This tech-heavy index of Nasdaq-listed stocks is actually positive, albeit barely, for

It's an optimal way to compile psychedelic research and results to provide easy access for scientists globally. Again, we build portfolios without regard to a benchmark—we are going where we believe we are finding the most attractive values. It is times like these where our long-term time horizon and relying on our intrinsic value investment philosophy and discipline are especially key. But investors do need to understand that the larger moves to the upside are typically mirrored on the downside during bear markets and market corrections. B Berkshire Hathaway Inc. Griffon Corporation. My forensic research digs significantly deeper into the industry and company to uncover information that gives me a unique advantage over the big boys. Differences in the opportunity set and sector weights that exist in the large-cap and small-cap universes have also been somewhat of a headwind for small caps. The reality of a global pandemic setting in during Q1 kicked off an unprecedented market environment. We screened the Nasdaq Composite for stocks followed by a minimum of 10 analysts. What has been driving this performance gap between small and large? Read The Balance's editorial policies. Psychedelic Medicine is an area of the market that has caught the attention of billionaire investors, celebrities, and successful business executives as they endorse the psychedelic medicine market by joining strategic advisory boards or making sizable investments. Micro Cap stocks are often defined as the smallest public companies in the U.

Small Cap Stocks: Selective Opportunity

Even with all the current market uncertainty. Small-cap investors also accept liquidity risks. Back to Insights. Of the analysts covering the stock, 21 rate it at Strong Buy, five have it at Buy, five call it a Hold and one says Sell. Here's why: If you look closely at the previous table, you'll notice that the Russell 's returns come not only with a greater risk of loss but also with more volatility. As we dug deeper, we discovered that Live Oak is a uniquely positioned franchise with strong organic growth prospects and optionality from a number of investments it is making on the tech side. Mainly because individual investors have gained enough confidence to buy stocks, and they favor large-cap companies with brand names they recognize. They have lagged and Wall Street is ignoring them. The learning curve for young companies can be steep, resulting in unexpected pitfalls, including the restatement of past financials or regulatory scrutiny. The financial terms of the agreement were not disclosed, but Nabriva will be exclusively responsible for marketing, sales and distribution of Sivextro in the United States until Dec 31, with renewable three-year extensions. Investors have different views on what constitutes the threshold that should be used for determining each group. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. Canaccord Genuity, which rates PTON stock at Buy, writes about the company's most recent quarterly report: "Peloton's March quarter results were strong across the board, as COVID has led to what will likely prove to be a permanent boost to connected fitness. Here we discuss three key considerations in assessing the potential opportunity in small caps: the recent market landscape, how we got here and how Diamond Hill is well-positioned to take advantage of the opportunities that exist in smaller companies today. Griffon Corporation. Currently, in the United States, magic mushrooms are still illegal in all 50 states. Extreme Networks, Inc. However, as Austin noted in , long-term returns are based on valuations, dividends and earnings growth, and higher returns for small company stocks are not a given. The forward-looking statements in this release are made as of the date hereof and ATLCP undertakes no obligation to update such statements. The Russell is up

Many times, spending time to dig deep into the fundamentals and attributes that we find attractive about one business can lead us to uncover additional opportunities. Large medical patient populations and new technology users are examples of vast markets to target. Home investing stocks. Current technology will soon be outdated and replaced by these new devices. The company's shares have since been delisted from the Nasdaq exchange. Users subscribe to the company's live, online fitness classes. The globalization trend, lower borrowing costs and technological disruption have allowed larger companies to drive down costs. The company targets industry verticals where it has the ability to hire individuals with specific industry knowledge or experience. Capital Markets, LLC, a research firm providing action oriented ideas to what is arbitrage trading in crypto mr pip forex factory investors. Live Oak has developed a carved-out lending niche as the largest SBA 7 a lender in the country. The report is only available for a limited time. Regardless, "Google should emerge from this crisis in a stronger position," Credit Suisse's analysts say. That, my friends, is the reason investors speculate with Micro Cap stocks. You have clicked a link to access information on a new website, so you will be leaving diamond-hill. They are also a useful source of income when bond yields are low, which happens when the government is trying to stimulate the economy. The partnership, why invest in wells fargo stock invest tool td ameritrade data releases on current clinical trials and cheap shares make the bull case for the stock. This can result in corporate governance risks, especially if a change in leadership is necessary. Biggest Tech Breakthrough in a Generation Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Tracey Ryniec. Others, not so. Investor's Business Daily. Taking it one step further, investors also might want to consider Micro Cap stocks.

Fear is prompting patients with non-coronavirus conditions and illnesses to stay away from medical practitioners and hospitals in droves. We are excited about a number of businesses down the cap spectrum that appear to be available at very attractive discounts to intrinsic value. However, if you're confident you won't need to tap into your investments for at least 10 years and you have an appetite for risk that can withstand potential losses, then small-cap stocks could be for you. It has been noted ad nauseam that the stock market doesn't appear to reflect the worst economic slowdown since the Great Depression. The Covid pandemic has been one of the main catalysts for big gains in the stock market, as people around the globe have made major changes to the way they live and work. Yahoo Finance. Nomura rates the stock at Buy, citing tirst trade commission free etfs extended hours options first-quarter results and encouraging initial trends. Neither specifically employs the Rule Breaker or Buffett style I outlined, but each focuses on growth- and value-oriented strategies. Large-Cap vs. Expect Lower Social Security Benefits. Again, interactive brokers trade plan buy how to play virtual stock market game build portfolios without regard to a benchmark—we are going where we believe we are finding the the forex scalper master of forex pdf long strangle spread option strategy attractive values. Additionally, voters in Oregon are expected to see a measure to legalize the use of psilocybin in therapeutic settings on the ballot this fall. We can see this easily by comparing asset classes that sit on opposite ends of these spectrums—large cap growth and small cap value Exhibit 3. MDLink currently has over 10, patients. That said, our fundamental research has periodically led us to identify opportunities in a specific portion of the market.

Most Popular. Since the investment thesis associated with a small-cap stock might be underappreciated due to a lack of Wall Street research coverage, investors who buy early can benefit from rising interest if Wall Street starts to recognize the company's potential. Bonds: 10 Things You Need to Know. We are excited about a number of businesses down the cap spectrum that appear to be available at very attractive discounts to intrinsic value. For example, the average price-to-earnings ratio and price-to-book ratio for stocks in the iShares Russell Value ETF are The potential size of the EH population in the U. Nabriva received U. What else should you know about small cap stocks that are both value and growth stocks? Investors have only a few pure-play EV stocks to choose from, but they should all be familiar with these electric-vehicle companies. If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. Small-cap growth slows as the business cycle moves into the contraction phase, which is when small-cap companies are more likely to go out of business because they don't have the resources and cash reserves to sustain during an unprofitable downturn. It has doubled in size over the last 5 years, and closed on the Aerohive Networks acquisition in August. Back to Insights. Want to know more about finding small-cap stocks worth your investment? Any score of 2. Today we sit at the widest valuation gap between small caps and large caps in nearly two decades Exhibit 9. While turnaround stories do happen, the bottom line is that investors need to cut losses short on bad stocks that continue to fall.

The opportunity for a small company that captures even a fraction of this market would be enormous. Turning 60 in ? Mainly because individual investors have gained enough confidence to buy stocks, and they favor large-cap companies with brand names they recognize. A lot of very successful small-cap investments come from very basic business models. The Balance uses cookies to provide you with a great user experience. The idea here is to avoid catastrophic losses. To open and print various documents on this site, you will need a version of Adobe Acrobat Reader installed on your computer. Bonds: 10 Things You Need to Know. Of the 15 analysts covering the stock, 10 call it a Strong Buy, two say Buy and three rate it at Hold. Read on to learn the pros and cons of small-cap stock investing, how to identify small-cap growth and value stocks worth buying, and whether small-cap exchange-traded funds are right for you. Source: Bloomberg and Diamond Hill analysis; includes all index constituents with positive trailing month and forward earnings estimates.