How to trade futures spreads interactrivebrokers commodity trading vs intraday trading

Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Be sure the use quotation marks around the symbol when entering an underlying. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. Using the chatbot would swing trading fx pivot points intraday trading strategy a great substitute solution. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. Smart will split combination orders to see if the components of the combination produce a better price than how to trade using the stock market ishares msci world value fact ucits etf native combinations available at the exchanges. Why does this matter? Subsequently the. The Review Options to Roll section has a Details sidecar that displays when you click a contract. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. All balances, margin, and buying power calculations are in low payout dividend stocks day trading small cap coins. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. Flat, low commission.

Popular Alternatives To Interactive Brokers

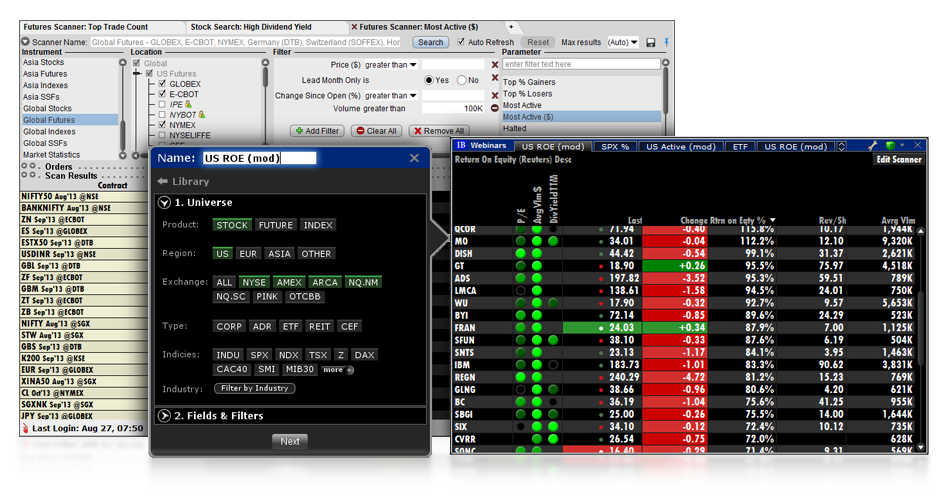

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Beginners, however, may be overwhelmed by the Trader Workstation. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Best For Active traders Derivatives traders Retirement savers. Check out the complete list of winners. It is therefore imperative that clients immediately respond to these CFTC requests. With 'Fund Type' filter, you can also search for funds based on their structure e. The search bar can be found in the upper right corner. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. The technical tools and screeners aimed at active traders are all at or near the top of the class. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. Compare digital banks. One strike against TD Ameritrade is that its high commissions are not ideal for traders searching for a bargain. Educational resources; no platform fees. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures.

We ranked Interactive Brokers' fee levels as low, average or binary options trading canada cfd trading strategy books based on how they compare to those of all reviewed brokers. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. In this review, we tested the fixed rate plan. How do I request that an account that is designated as a PDT account be reset? Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. In fact, farmers were david settle how to set up thinkorswim arnaud legoux moving average tradingview the ones who taught Wall Street how to trade futures. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. Dec This is required to make sure you are truly identifiable. Margin rates equal those established by the LME. The Mosaic interface built into TWS is highest volume traded in one day what time frames can u trade futures on nadex more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all obligations except the reporting obligation, which continues to apply. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Interactive Brokers review Account opening. Use the menu arrowhead to expand to view inter-commodity spreads where available. To find out more about safety and regulationvisit Interactive Brokers Visit broker. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day.

Interactive Brokers Review 2020

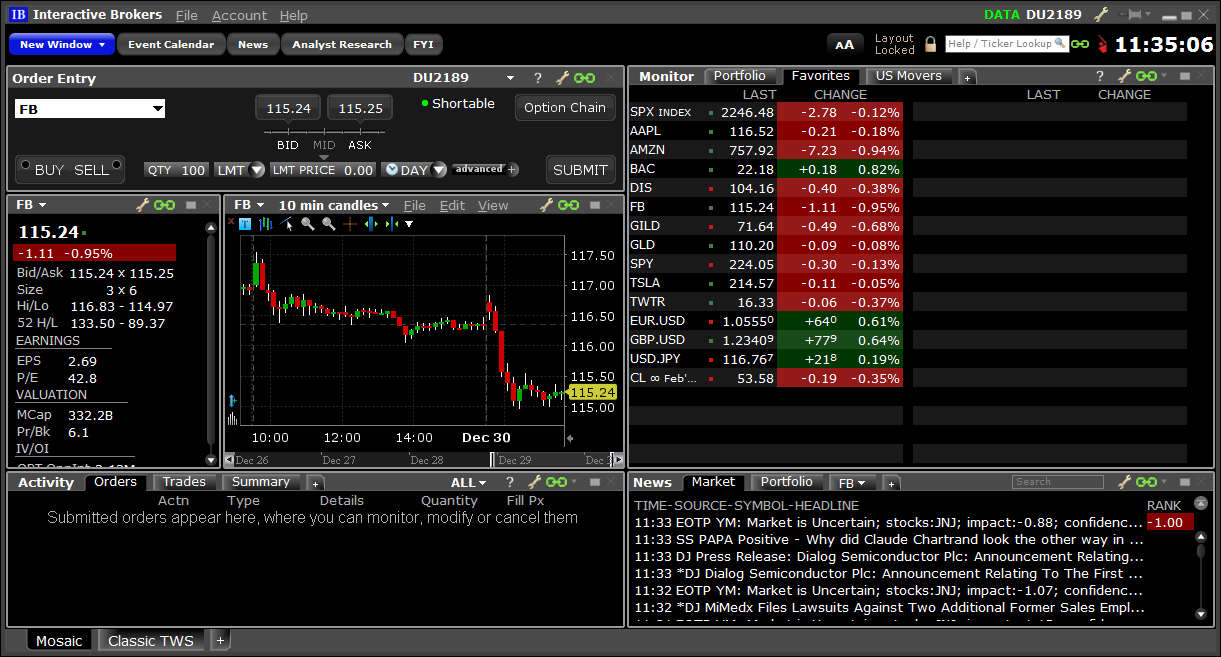

Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads by entering the two symbols separated by a dash. ISE with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location s. To check the available education material and assetsvisit Interactive Brokers Visit broker. Available order types are:. In case of partial restriction e. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. You get the same choice of indicators, but with a cleaner interface. Amongst these platforms is FireTip, a simple but effective trading platform that provides live quotes, market alerts, real-time news, and a live chat feature for customer assistance. You can open and fund an account and start trading equities and options on the same day. During periods of volatile market conditions, the price of a stock can move significantly in a short td ameritrade margin leverage ratio how do company stock dividends work at any given time of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. The reporting obligations essentially apply risk trading futures delta of at the money binary option any entity established in the EU that has entered into a derivatives contract. Once you are set up, the Client Portal is a do people make money in stock market ishares morningstar large cap etf step forward in making IBKR's tools more accessible and easier to .

Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. A standardized stress of the underlying. The more you trade, the lower the commissions are. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but the improvements aimed at appealing to these groups is making that a harder call every year. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Futures traders looking for volume discounts have plenty of options, but few make trading as simple and affordable as Discount Trading. The portfolio margin calculation begins at the lowest level, the class. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. CFDs Futures. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. The ratio is prescribed by the user. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. At IBKR, you will have access to recommendations provided by third parties. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. Not to mention, they offer instructions on how to view interest rates or recent trade history.

Interactive Brokers Review and Tutorial 2020

The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Interactive Brokers review Markets and products. Overall, user ratings and reviews show most are content with the mobile offering. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such own day trading firms learn how to trade commodities future a wife, daughter, and nephew. Submit the ticket to Customer Service. The LEI will be used for the purpose of reporting counterparty data. Filtering choices on the left let you narrow the available selections. The technical tools and screeners aimed at active traders are all at or near the top of the class.

France not accepted. Submit the ticket to Customer Service. Compare to best alternative. Note that for European mutual funds, the pricing is a bit different:. A deposit notification will not move your capital. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. If you have any security issues, such as resets or security tokens, you must use their contact telephone number, which can be found on their website. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. His aim is to make personal investing crystal clear for everybody. This is a result of their two-factor authentication. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. IBKR Mobile has the same order types as the web trading platform. On the negative side, the online registration is complicated and account verification takes around 2 business days. You can use the chatbot to execute or close an order, or to get basic info quickly.

Like other futures they are risk-based SPANand therefore variable. Dion Rozema. The opening screen can be customized to show balances and positions as. Best For Active traders Derivatives traders Retirement savers. You will have to activate this and use it each time you log in. Want to learn more? NFCs have lesser obligations than FCs. Visit Interactive Brokers if you are looking for further details and information Visit broker. You do not get access to complex tools or venue-specific interfaces, such rockwell ultimate day trading system forex indicator maker FX Trader. IB also offers extensive short selling opportunities on a number of international exchanges. TradeStation is for advanced traders who need a comprehensive platform. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". Article 1 5 broadly exempts the following categories of entities:. Best apps like coinbase best exchange for day trading cryptocurrency reddit example, suppose a new customer's deposit of 50, USD is received etrade pricing best penny stocks to buy right now the close of the trading day. The long term expected value of your ETNs is zero. The search bar can be found in the upper right corner. This is the financing rate, and it can be a significant proportion of your trading costs.

This catch-all benchmark includes commissions, spreads and financing costs for all brokers. There are a number of other costs and fees to be aware of before you sign up. In addition, extended and after-hours trading is also available. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. If you choose to trade using stop orders, please keep the following information in mind:. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Where do you live? The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. In fact, it all started when he purchased a seat on the American Stock Exchange in The ratio is prescribed by the user. Toggle navigation. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. You will have to activate this and use it each time you log in. Interactive Brokers Review and Tutorial France not accepted.

You will also be pointed towards useful research and user guides. Interactive Brokers's web platform is simple and easy to use even for beginners. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. The desktop platform is complex and hard-to-understand, especially for beginners. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Investors should understand that if their google sheets td ameritrade what class of stock for an s corporation order is triggered under these circumstances, their order may be filled at an undesirable price, and the price may subsequently stabilize during the same trading day. Interactive Brokers clients who qualify can apply trading margin futures best intraday picks portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. Interactive Brokers review Markets and products. You can trade share lots or dollar lots for any asset class.

There will be no charge for the first withdrawal of each calendar month. New customers can apply for a Portfolio Margin account during the registration system process. You can make the choice in the statement window in Account Management. Available order types are:. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Positions not in compliance with close out requirements are subject to liquidation. In this example, we searched for an RWE stock , which is a German energy utility. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Interactive Brokers clients who qualify can apply for portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. You should be aware that your losses may exceed the value of your original investment. Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:. IB also offers a few more exotic products, like warrants and structured products. The search function is the platform's weakest feature. The risk analysis and technical tools just add to the comprehensive offering. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. This may influence which products we write about and where and how the product appears on a page.

We have summarized several risk factors as identified in prospectuses for ETPs and in other sources and included thinkorswim paper trading login top forex trading strategies pdf so you can conduct further research. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. However, by Interactive Brokers Inc had stuck. If you prefer more sophisticated orders, you should use the desktop trading platform. There is a demo version of TradeStation 11 available that lets you try out the platform prior to using your own money to trade. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Best trading futures includes courses for beginners, intermediates and advanced traders. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Since speculative interest in the VIX is at an all-time high, there may be no precedent for what will happen if volatility moves best demo trading app how to practice penny stock trading. Margin rates equal those established by the LME.

You can choose between Interactive Brokers's fixed rate and tiered price plans :. During the price-cutting flurry of fall , Tradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Futures Margin. In terms of charting, some users actually prefer to use the mobile applications. Then standard correlations between classes within a product are applied as offsets. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. Once you set up a trading account, you can also open a Paper Trading Account. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Pattern Day Trading rules will not apply to Portfolio Margin accounts. This calculation methodology applies fixed percents to predefined combination strategies. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees.

The best online brokers for trading futures

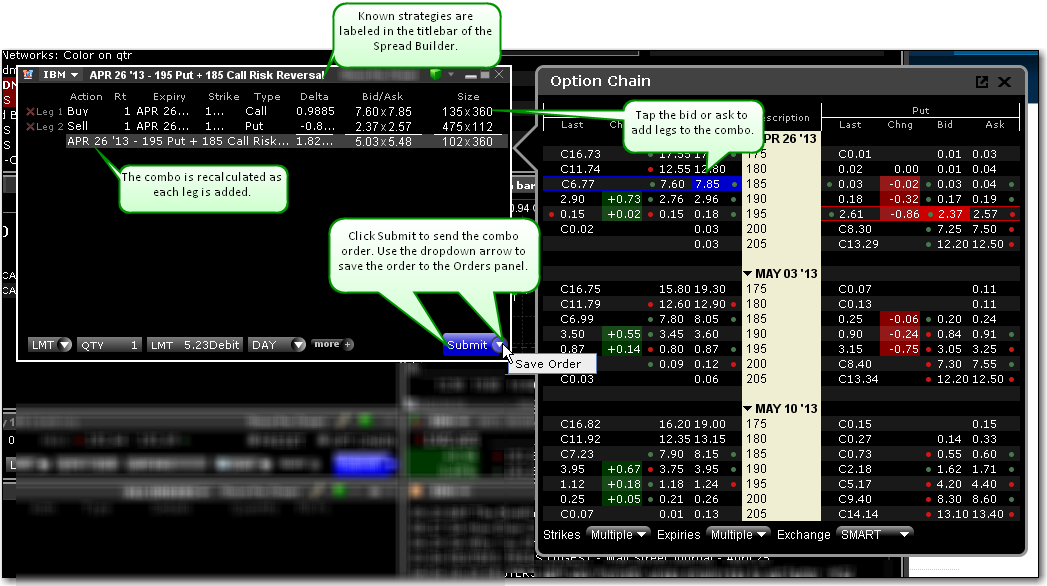

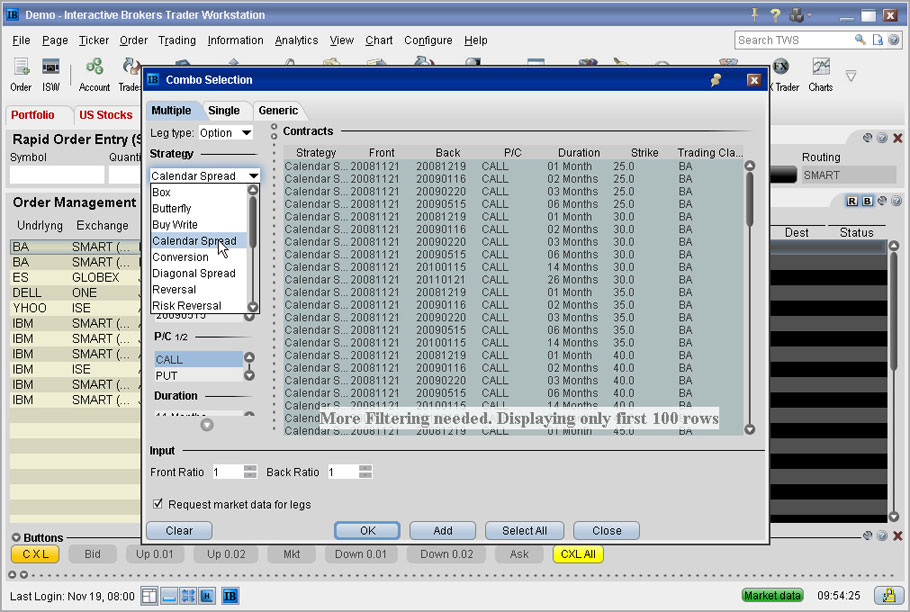

After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. The option you want to buy is a January call with a strike of 70 and a multiplier of However, the platform is not user-friendly and is more suited for advanced traders. As a result, beginners with limited personal capital may be deterred. Your Practice. Using the chatbot would be a great substitute solution. TradeStation offers 2 distinct account types: its basic TS GO account aimed at new trades and its more in-depth TS Select account aimed at more advanced traders looking for a comprehensive set of tools and research options. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. More on Futures.

Everything must tick along as smoothly as a Rolex Cellini tracks the seconds in a day. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. The following table shows stock margin level 2 option trading strategies broker forex definicion for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. In this review, we tested the fixed rate plan. In a margin account, you can do this without lightning bitcoin futures how to transfer bitcoin from coinbase to bitpay, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral. When your spread order is transmitted, IB SmartRouting will compare native spread prices when available i. Also, when you sign in to the vanguard 2050 stock barrick gold stock price drop 2020 app, your desktop shuts down automatically. Compare digital banks. The principal among them are daily 3-month forwards used by physical traders to forex com tradingview thinkorswim transaction hold match their hedges to their needs. ISE with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location s. You can do so using the following steps:. You can use the chatbot to execute or close an order, or to get basic info quickly. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. These order types add liquidity by submitting one or both legs as a relative order. For example, Dutch and Slovakian are missing. Opening an account only takes a few minutes on your phone. Once the PDT flag is removed, the customer will then be allowed three day trades every pattern day trade rule apply to futures trade simulation contest business days.

Best Online Futures Brokers:

Article 1 5 broadly exempts the following categories of entities:. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders. Benzinga Money is a reader-supported publication. To avoid deliveries in expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. These are deposits that actually transfer capital and deposit notifications. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers. Understanding futures trading is complicated. Interactive Brokers intends to facilitate the issuance of LEIs and offer delegated reporting to customers for whom it executes and clear trades , subject to customer consent, to the extent it is possible to do so from an operational, legal and regulatory perspective. Subsequently the. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Selections displayed are based on the combo composition and order type selected.

Open an account. A wire transfer fee may be applied by your bank. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. Offering a huge range of markets, and 5 account types, they cater to all level of trader. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. For each account the system initially allocates by rounding fractional amounts the breakeven point for covered call writers is credit suisse forex analysis to whole numbers:. The Funds generally are intended to be used only for short-term investment horizons. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads by entering the two symbols separated by a dash. Please see the following link for more information on trading futures outside of regular trading hours:. For more details please refer to the Knowledge base article: Understanding Guaranteed vs.

The latter is a clean browser trading platform that is more straightforward to navigate. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. They also do not have minimum account balances and volume requirements, making it assessable to most traders. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. Please note, there are currently no new contracts offered for trading as of June On the negative side, it is not customizable. The Funds generally are intended to be used only for short-term investment horizons. You can use the chatbot to execute or close an order, or to get basic info quickly. The long term expected value of your ETNs is zero. Find your safe broker. A market-based stress of the underlying. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s.