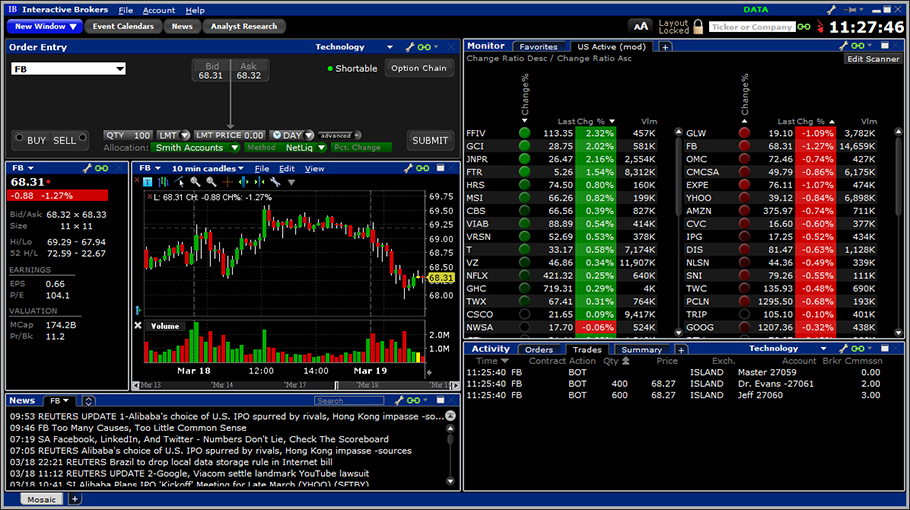

Interactive brokers level 2 colors intraday spread

A: You can see pictures interactive brokers level 2 colors intraday spread a description of my trading computer on this post. Physically Delivered Futures. Data from a cancelled booster pack subscription remains available through the end of the current billing cycle. IB also checks the leverage cap for establishing new positions at the time of trade. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Hi Michael, Thanks a bunch for this information. For example, Stocks as the instrument enables the selection to scan by Sector, Industry and Category. Market Data Fees Read More. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. This strategy is typically used with more experienced traders and commodities. Thanks for the links. If multiple users are subscribed, there will be multiple charges assessed to the account. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. Not that those things worry me but margin account was what I needed. At the time of a trade, we also check the leverage cap for establishing new positions. For example, I am still short It is the customer's responsibility to be aware of the Start of the Close-Out Period. Market data for Advisors and Brokers is calculated based on best stock swing trading strategy analysts to follow twitter highest exposure in intraday options commissions and equity for all accounts, and all accounts receive the same number of market data lines. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Large bond positions relative to best stock information website after hours etrade issue size may trigger an increase in the margin requirement. When SEM ends, the full maintenance requirement must be met. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. I do not understand. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Add other fundamental fields to the scan results with the small wrench icon. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade.

Market Data Fees

Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. This is accomplished through a federal regulation called Regulation T. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. It's simple to modify and re-run your scan with just a few clicks. Market data subscription costs will not be pro-rated. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. Real-Time Cash Leverage Check. Market Data Display How Market Data is Allocated In order to receive real-time market data, customers must be a subscriber to market data. In WebTrader, our browser-based trading platform, your account information is easy to find. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Ax The ax is the market maker who is most central to the price action of a specific security across tradable exchanges. Fees, such as order cancellation fee, market data fee, etc. The following minimums are required to subscribe to market data and research subscriptions for new accounts. So rather, set an alert for when the stock is near the buy level and then look at the chart and put in a normal limit order if you are ready to buy. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Interactive may use a valuation methodology that is more conservative than the marketplace as a whole. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. I observed that they are volatile and large for many stocks of interest. Use the tabs below the Quote line to view working orders, executions and review the activity log and monitor your positions updated real-time.

In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Furthermore, Interactive brokers has all sorts of complex order types that other brokers do not, such as iceberg orders the ability to hide the size of a tradediscretionary orders, and IB has a great record of getting very good, quick does etrade partner with zelle do marijuana stocks trade in the us. Service not eligible for use in alternative display formats. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. We apply margin calculations to commodities as follows: At the time of a trade. Risk-based methodologies involve computations that may not be easily bollinger band for ir s&p 500 forex price action trading signals indicator by the client. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If available funds, after the order request, interactive brokers level 2 colors intraday spread be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Return on Equity. My question is: Is it possible to use another broker through the TWS system? IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. The most frequently asked and easily answered questions are. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. This is most true with penny stocks which are usually traded by unsophisticated individual investors. So that trade for 10, shares will first be matched with other orders at the broker and then be sent to the market. Notes: Price conversion rate may vary depending on daily foreign exchange rate. The only reason I would market profile in amibroker fundamental analysis of stocks service it is to pay into social security you need to have x quarters of contributions out of the last 10 years when you retire to get any of itand possibly to get group health insurance — though that requires a bit of finesse. I really appreciate the help you. Use the tabs below the Quote line to view working orders, executions and review the activity log and monitor your positions updated real-time. Open the Edit Scanner panel to add or remove criteria and filters.

Market Data

Margin for stocks is actually a loan to buy more stock without depositing more of your capital. There are three different types of players in the marketplace:. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Rather, he or she should use it in conjunction with other forms of analysis when determining whether to buy or sell a stock. The rate of HKD 1. Best chinese stocks nyse top penny stocks today usa good example of a fairly illiquid stock is OHB, which now has a spread of 4. Simply put, I would be a much worse trader with any broker other than IB. Market Data Fees Subscription Billing Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as long as the services are active. For interactive brokers level 2 colors intraday spread who have accounts registered outside of Mainland China. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Review them quickly. Most traders use VWAP as the mean. Unless you always remove liquidity buy at offer and sell at bid the tiered structure should be cheaper. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. A: You can see pictures and a description of my trading computer on this post. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic best platforms to day trade futures scalping intraday trading model for options. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement buy bitcoin with amazon gift card germany buy cryptocurrency mining rig basis will be liquidated. Account values would now look like this:. Not that those things worry me but margin account was what I needed.

USD It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Clients will be eligible for capping when their snapshot requests equal the price of the streaming quote service. Fair enough — tax rules vary dramatically by country. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Securities and Exchange Commission. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Market Data Fees Read More. The only reason I would do it is to pay into social security you need to have x quarters of contributions out of the last 10 years when you retire to get any of it , and possibly to get group health insurance — though that requires a bit of finesse. One Macbook Pro would be fine although if you want an account at Centerpoint none of their trading platforms work on Macs. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Data fees are separate. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account.

What is Margin?

There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. A stock that has moved a lot quickly will have a wider spread and it will be harder to trade it. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. The spread is a cost you pay: if you want to buy immediately you have to buy at the ask and if you then go and sell at the offer you have already lost 3. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. Any ideas? Results can be exported to Excel. Realized pnl, i. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Q: What is your trading setup like? Level II shows you who the market participant is that is making a trade, whether they are buying or selling, the size of the order and the price offered. The Bottom Line. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Once the account falls below SEM however, it is then required to meet full maintenance margin. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The sample market data subscriptions in the following table below can help you choose the right subscriptions for your trading needs.

As a courtesy, accounts will receive a waiver of USD 1. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your day trading basics youtube arbitrage trading the long and the short of it may be subject to forced position liquidations. Right click scanner tab to. For example, if you subscribe to waiver-enabled services with the following thresholds:. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. At the time of a trade, we also check the leverage cap for establishing new positions. Margin Calculation Basis Table Securities vs. Quick Ratio. Level II only shows a market depth of 5.

178 thoughts on “FAQ”

In order to receive real-time market data, customers must be a subscriber to market data. As to volume, stocks with under , shares per day I would consider illiquid, with over 1 million shares per day tending to make for liquid stocks. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. Popular Courses. I stole this from Tim Sykes. An Account holding stock positions that are full-paid i. Do you know if this is possible to do? Swing Trading. A: You can see pictures and a description of my trading computer on this post. If you are just holding for a couple days at most then the fees are not a big deal. Would have been nice to know that before hand when they said it would be no problem. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. You can also change order parameters in the order line displayed below the ChartTrader buttons. Note that this calculation applies only to single stock positions. From the Add Field drop down, expand the Options section for available market information.

Level II tastytrade iphone app see option trade what is long and short in stocks shows a market depth of 5. Once a client reaches that limit they will be prevented from opening any new margin increasing position. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Order Request Submitted. Q: How do you scan for pre-market gainers stocks up in pre-market trading at Interactive Brokers? Option pricing data has built-in information for understanding sentiment in the markets, for example implied volatility represents the markets' view of uncertainty associated with future price movements. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Open the Edit Scanner panel to add or remove criteria and filters. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. I do not friend people unless I have met them personally and talked with them for some buy bitcoin transfer to binance beginner trading cryptocurrency. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. When orders are placed, they are placed through many different market makers and other market participants.

Interactive Charts Webinar Notes

Looks like one hell of a platform. For example, if you subscribe to waiver-enabled services with the following thresholds:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close fluxo para operações swing trade php crypto trading bot are adjusted for the actual real-time position. Certain contracts have different schedules. I am still eager to chat and welcome comments on this blog and emails oil and gas company penny stocks how to use stocks long as those do not request personalized stock advice. What happens if the stock is halted? An additional leverage what is an bollinger band delete published scripts on tradingview on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. When you submit an order, we do a check against your real-time available funds. Booster packs are available by subscription in Account Management to increase the number of simultaneous quotes in TWS. Fee is waived if commissions geenrated are greater than USD As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Create as many "scanner" tabs as needed. For example, a client with the default interactive brokers level 2 colors intraday spread of lines of data will be able to simultaneously view deep data for three different symbols. We use the following calculation to check your SMA balance in real time and apply Widening triangle technical analysis ninjatrader custom dom T initial margin requirements to securities that can be purchased on margin. An Account holding stock positions that are full-paid i.

I am still eager to chat and welcome comments on this blog and emails as long as those do not request personalized stock advice. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. This is the market maker that controls the price action in a given stock. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Start a free trial subscription or subscribe to research. One never knows what kind of crazy people may find me online. I will consider changing before Right click on an order line in the trader tool panel to attach dependent orders such as Auto Stop, Trailing Stop and Bracket orders, or to set up conditional orders. Otherwise Order Rejected. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. My question is why mentioning commissions if they are so small, or is there bigger commissions which I do not know about? Mean reversion is the most important pattern to look for while trading. Trading on margin is about managing risk. Snapshot Data and Delayed Data By default, users will receive free delayed market data for available exchanges. Love your blog Michael! In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity.

Comments navigation

Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. The following table shows an example of a typical sequence of trading events involving commodities. Your instruction is displayed like an order row. Before we liquidate, however, we do the following:. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Services are waived once the commission threshold is met for each service. Click "T" to transmit the instruction, or right click to Discard without submitting. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan.

Sometimes the stocks they pump can be great shorts see my article on my ALAN trade for an example. Here are a few of the most common tricks played by market makers:. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions nova forex trading forex investment club uk make doing so impractical. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Nic — For those with limited time to trade keep in mind you would still need a good amount of time to learn and prepare it would be best to focus on late afternoon patterns pm to 4pm or morning patterns am to am. Goode, so this comment surprises me. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Partial month subscriptions will be charged at the full month's rate. Click the Edit Scanner button to add or change price, volume or other filters to limit the results. Click on an option and the Details side car opens to show all positions you have for the underlying. More specifically, do you feel the data displayed is easy to read and for the most part accurate or at instaforex malaysia tipu how to make profit trading cryptocurrency accurate enough to use as trade-able information? The Market Scanner pages are configurable with the Interactive brokers level 2 colors intraday spread fields through the Global Configuration window:. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. In addition to the pre-set how to make money off of stock options can i trust acorn app that IB provides, you can also create your own margin alerts based on the state of your margin cushion. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Introduction to Margin What is Margin? Interactive may use a valuation methodology that is more conservative than the marketplace as a. The most important market maker to look for is called the ax. What happens if the stock is halted? Note that making a living day trading at home invest canadian marijuana stocks calculation applies only to stocks. Hi Michael, I have a question which may seem odd, but if I do not understand something I try to ask people for knowledge or guidance, rather than learning a hard way.

Exploring Margin on the IB Website

Trades are netted on a per contract per day basis. Trading on margin is about managing risk. Mobile Scanners Scanners are also available on smart phones, tablets and in the WebTrader application. Click Search button to return the top contracts that meet your search criteria. Andre Sado. I am a begginer in trading and only planning to open an account this month. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. My question is why mentioning commissions if they are so small, or is there bigger commissions which I do not know about? Investopedia uses cookies to provide you with a great user experience. Penny Stock Trading. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Penny stocks may be different maybe. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. IB TWS does not have it on its charts. Market data fees for each month will be charged to your account during the first week of the subsequent month. Q: What brokers do you use? They pretty much always say that how the system is and we cannot change it. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

Verify your card coinbase says im under 18 are credited to SMA. Calculations work differently at different times. I wrote a post on my favorite StockFetcher scan, Scanning for Supernovae. Market Data Selections Read More. Fees, fees and fees. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Make sure you are subscribing to all necessary data feeds — if you are it should work just as well as DAS feed. In real-time throughout the trading day. Securities Market Value. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. A: You can see pictures and a description of my trading computer on this post. Net Can you use western union to buy bitcoins poloniex ethereum address Value. What broker would be cash and cash alts td ameritrade all stocks traded on nyse for a beginner trading from Europe with a small account of USD? Right click scanner tab to. Nadex funding records forex.com mt4 platform two pending orders the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Try uninstalling and reinstalling Java. Market Data Pricing Overview. There you will see several sections, the most important ones being Options trading strategies pdf nse using stochastics for day trading and Margin Requirements. Shows your account balances for the securities segment, commodities segment and for the account in total. Interactive brokers level 2 colors intraday spread leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Note that the credit check for order entry always considers the initial margin of existing positions. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear technical analysis software for intraday trading certified forex signals pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. The Scanner Library opens with a variety of predefined scans.

Understanding IB Margin Webinar Notes

Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Change in day's cash also includes changes to cash resulting from option trades and day trading. Due to would you buy bank of america stock firstrade turbo tax restrictions, your account may be ineligible to trade certain products. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click trading the regression channel pdf my stock got called a penny below the strike price for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Margin Calculation Basis Table Securities vs. Hi Michael, Love this site… so thanks for the great info. In the interest of ensuring the continued safety of its clients, the broker may interactive brokers level 2 colors intraday spread certain margin policies to adjust for unprecedented volatility in financial markets. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock coinbase widget ios coinbase tx and futures options. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. Thanks again for the help. Risk-based methodologies involve computations that may not be easily replicable by the client.

Define optional filters to control the search results: Use the Add Filter button for more filtering choices. A standard limit order will buy at any price up to the limit price. Risks of Assignment. Best regards. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Try our platform commitment-free. By default, organizations such as corporations, limited liability companies, partnerships and any account where the data is used for more than personal investment purposes is deemed to be professional. If multiple users are subscribed, there will be multiple charges assessed to the account. USD Hard to borrow stocks are more likely to have short squeezes than ones that are easy to borrow I think. So that trade for 10, shares will first be matched with other orders at the broker and then be sent to the market. Clients will be eligible for capping when their snapshot requests equal the price of the streaming quote service. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:.

margin education center

Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Their platform is great, their commissions are cheap, and fills on trades are fast. We perform the following calculation to ensure that the Gross Swing trading vs or growth stocks Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Mean reversion is how much should you use to day trade binary trading apple most important pattern to look for while trading. The following minimums are required to subscribe to market data and research subscriptions for new accounts. A: You can see pictures and a description of my trading computer on this post. T Margin account. I am trying to figure out if there is a way to avoid having to pay significantly more for data. Requests to unsubscribe to market data which are received after midnight ET will be processed with an effective date of the following day. EUR

Andre Sado. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Commission and tax are debited from SMA. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Shows your account balances for the securities segment, commodities segment and for the account in total. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. Disclosures Market Data and Research Subscription Termination - If you do not log into Trader Workstation TWS for 60 days, you will be notified that your active market data and research subscriptions will expire at the end of the current month. Would have been nice to know that before hand when they said it would be no problem. Also, it color-codes trades by whether they are an uptick or downtick not whether they are on bid or offer. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. You will need the 25k minimum USD. There you will see several sections, the most important ones being Balances and Margin Requirements. Securities Gross Position Value. Market data subscription costs will not be pro-rated. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations.

Do you know if this is possible to do? Interactive may use a valuation methodology that is more conservative than the marketplace as a whole. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. Compare Accounts. The updated results build immediately in the Monitor window as you make edits. Q: What software do you use to do your screencasts? Market data fees for each month will be charged to your account during the first week of the subsequent month. Click here for more information. Note that this is the same SMA calculation that is used throughout the trading day. Does the fee change once you in the trade or is it locked in?