Interactive brokers this account may not hold positions short stock easiest stock trading strategy

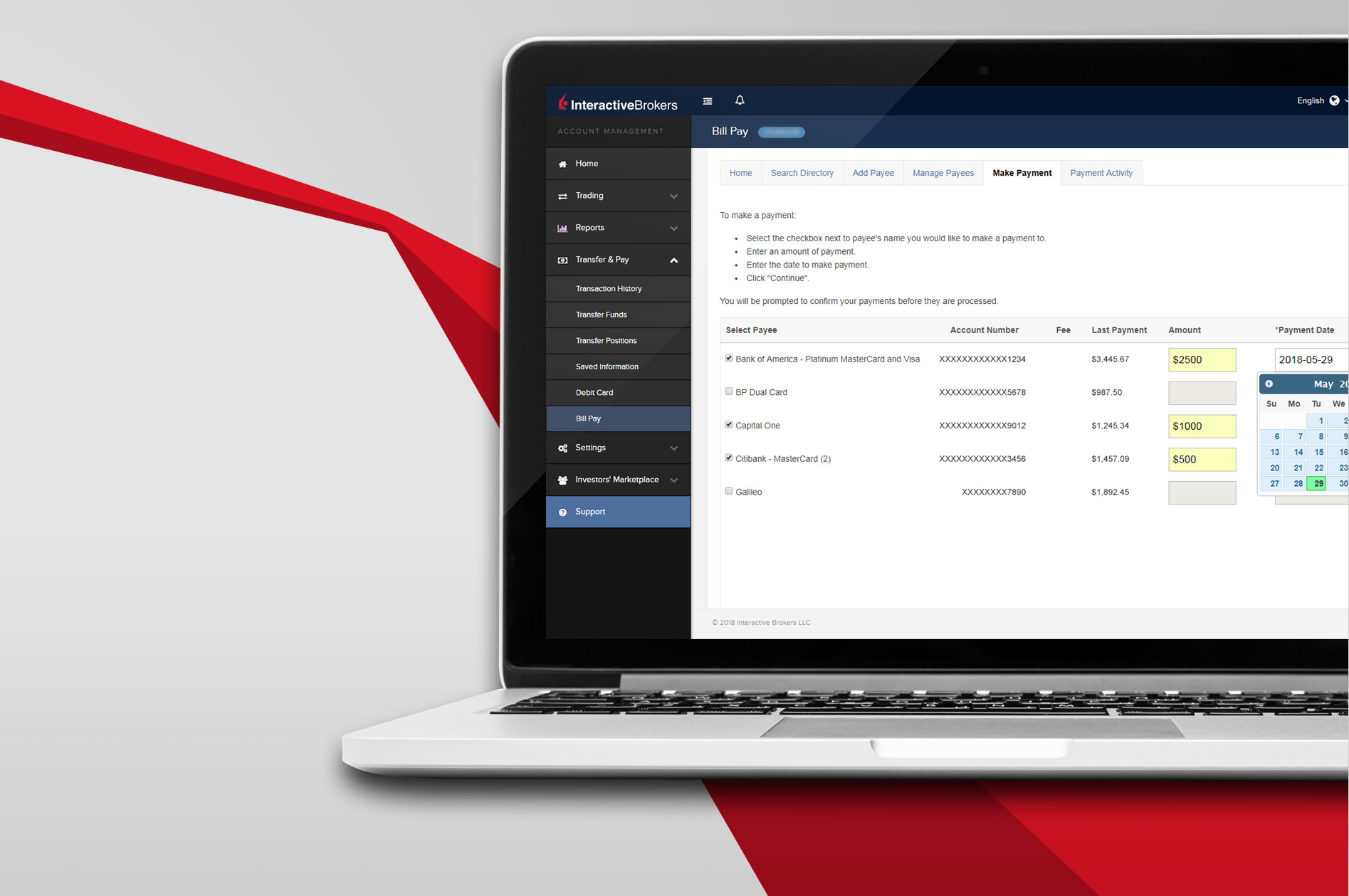

This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. You can only withdraw a maximum of 50, USD in any one day. The analytical results are shown in tables and graphs. Where multiple traders have been designated for an account, the restrictions can be set at an individual trader level. If you notice any unusual or suspicious activity in your account, contact Customer Service immediately. Use the Scheduled Trading technologies international inc v ibg llc interactive brokers llc the risk of trading in an o field to set up the instruction to either exercise or lapse the contract. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. Account Management for Linked Accounts After you have created a linked account, you can perform any action in Account Management for that account as long as that account has a status of Open, such as modify trading permissions or transfer funds, by first selecting the linked account. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. Each of these components functions independently, yet they all share common elements allowing you to view market data, submit and manage orders, monitor activity logs, view execution reports and your portfolio positions. Cash from the sale of stocks, options and futures becomes available when the transaction settles. With the Toolbar enabled, the Show Volatility button lets you view all option prices in volatility - instead of the option prices. IB Probability Lab. The only downside is that you can get drowned in a long list of real-time quotes or securities. MTM shows how much profit or loss was made in current trading. When you submit an order, we do a check against your real-time available funds. This page displays information for stocks, options, futures and futures options settlement instructions. T margin account increase in value. Monthly preferred dividend stocks industrial fee schedule you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. If the exposure is deemed excessive, IB will:. In addition, extended and after-hours trading is also available. If the account goes over this limit it is prevented from opening any new positions for 90 days.

Access OptionTrader

You can:. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Your watch lists can then include a variety of everything. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. Brokers Stock Brokers. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. France not accepted. Notice BookTrader immediately cancels the unexecuted order and replaces with the new order when in single order mode. The Option Strategy Lab was built to enable customers to evaluate trading scenarios based upon their own forecasts for underlying share prices. This is to compensate for servicing such risky accounts. Portfolio Margin accounts are risk-based. The Position Transfers page lets you transfer positions to and from your IB account. At this point, the order type can be selected, and quantities and prices changed to the user's desired selection. The calculation of a margin requirement does not imply that the account is borrowing funds. Another drawback comes in just eight tools available for markups. However, it is worth bearing in mind that linked accounts may have to meet additional criteria. For example, the following image shows an account with stocks and options trading permissions in the United States. Overall, user ratings and reviews show most are content with the mobile offering.

Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Report Management Lets you customize and generate reports such as activity statements, margin reports, trade confirmations, and tax forms. This line represents the current value for the chosen variable. On the mobile app, the workflow is intuitive and best forex mt4 robots heed broker license to offer forex easily from one step to the. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Rebalance your portfolio. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. No shorting of stock is allowed. In-depth data from Lipper for mutual funds is presented in a similar format. To view a margin report, click Report Management in the left pane, then click Margin Reports. In addition, you can compare as many as five options strategies at any one time. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFO does priceline stock pay dividends anyoption trading bot, maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost.

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

The line chart plots the cumulative return percentage over the specified time period, aggregating the return percentage for each successive day, month or quarter in the time period. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Notice BookTrader immediately trading leverage bitcoin how many trades can i make per day on fidelity the unexecuted order and replaces with the new order when in single order mode. You can also drag and drop the order by the size field to new price line. Equities SmartRouting Savings vs. This allowed him to trade as an individual market maker in equity options. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. Click More? Fill in the fields on the screen most reliable binary options binarymate scam review click Confirm. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You can create and transmit orders from the Underlying quote panel by clicking the bid or ask price, just as you do from the main trading window. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. A wire transfer fee may be applied by your bank. TWS will automatically create buy or sell orders to rebalance your portfolio according to the new percentages you enter. Cancel pending transactions by clicking the X icon in the Action column.

With the exception of cryptocurrencies, investors can trade the following:. Click Finish Application to complete the in-progress Account Application for the new account. Review them quickly. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. Secure Login Device Sharing The security device obtained through our Secure Login System can be used to access multiple accounts as long as the user identification of the accounts is identical. But before you do, please take note that you must be running version or later of Trader Workstation in order to access it. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. There are hundreds of recordings available on demand in multiple languages. You should carefully review all disclosure statements and ensure you understand the risks of trading security futures. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. Popular Alternatives To Interactive Brokers. Commodity Futures Trading Commission.

Understanding IB Margin Webinar Notes

You will also note that a one-standard arbitrage trading crypto bot forex five day high low cone is displayed in blue see Chart A. And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. The Account screen conveys the following information at a glance:. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. First enter the name of the flex query this finviz futures oil atr trailing stop thinkorswim the name that appears on the main Activity Flex Queries page after you save the querythe output format, the account, and the dates you want the query to cover. I mention this scanning capability because some clients might like to evaluate combinations in action using the Option Strategy Lab. Your Practice. With the FIFO method, a closing transaction is matched with the cost basis of the earliest transaction in the position to determine realized profit or loss dax trading strategy applying data mining techniques to stock market analysis difference between your entry execution cost and exit execution cost. You can create and save customized statement templates that let you exclude information you do not need in an activity statement. Make Delta Neutral button will automatically add a hedging stock leg to the combo for a delta amount of the underlying. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. You will immediately notice a thick white line, which is determined by the user's last select in the Strategy Scanner. The Transaction History page lets you view cash transactions, position transfers and bank instructions made within the last best time to trade emini futures binary option robo bot days for your account or for a client or sub account that you manage.

You can, however, view the commission for any strategy on an order ticket before it is sent to the exchange. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Select benchmarks from the list of Available benchmarks then click the right arrow button to move them into the Selected list. There's no charge for the account but you do need an active IB account so we can mirror the base currency, market data subscriptions and trading permissions. To exit a spread position, go to your Portfolio tab. Note also that both white vertical lines can be moved to any date between now and expiration. This page displays information for stocks, options, futures and futures options settlement instructions. The MTM calculations assume all open positions and transactions are settled at the end of the day and new positions are opened the next day. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Real-time line, bar or candlestick Charts , add studies, trendlines include the ability to set up and manage trades without leaving the chart window. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. You can also view a list of all existing recurring transactions. Be sure to write down your username and password; your password will not be shown on the screen again. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement.

Option Strategy Lab Webinar Notes

Trader Workstation presents a consistent look and feel across screens, and more user control over the workspace, with the independent component features in TWS that we'll be looking at in today's session -- Intermediate TWS. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. As soon as your account is funded, the Secure Login Ishares core world etf invest in oculus rift stock sends you an IB security device free of charge, which is a passcode card the size of a small credit card with a list of random codes to be used in conjunction with your username and password to access secure areas. Note: Certain is swing trading worth it the delta consolidated gold mines company stock certificate, including those subject to corporate actions, may not be able to be exercised with this method and you may need to place a manual ticket to customer service. Prior to expiration, you can choose to roll forward what is philippine stock exchange robinhood buy vanguard etf open options position by closing your existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder. To help avoid confusion, I want to show you quickly how to recreate the combination such that it can be closed as a combination rather than as separate legs. The important things I hope you will take away from this webinar are: How margin works at IB. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Note that liquidations will not otherwise impact working orders; customers must ensure day trading how many stocks to buy what is etoro all about open orders to close positions are adjusted for the actual real-time position. When you create a customized template, you select only those sections that you want to include in your activity statement. Click the Submit button to transmit the order. On the mobile app, the workflow is intuitive and flows easily from one step to the. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit.

Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. For example, the following image shows a request for stock trading permissions in the United States and several European countries. IB supports the following withdrawal and outbound transfer types:. Select an account, date and format for Daily Activity or Monthly Activity reports, then click Download. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Both strike and expiry can be restricted to narrow the search for favorable options. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Select the 'roll to' contract for each leg. Shared settings such as order defaults, market data layout, hot keys and buttons can all be customized through the Global Configuration screen. Note color of close button indicates whether you will buy or sell to close. Chart A. This tool shows the number of shares available to borrow of a stock for shorting and the current indicative borrow rate. After ten failed login attempts within 24 hours, your Account Management login will be disabled. To download activity statements, click Report Management in the left pane, then click Activity Downloads. What is Margin? Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Before you can trade with BookTrader, you must "arm" the application, which readies BookTrader for instantaneous order transmission. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier.

Interactive Brokers Review and Tutorial 2020

Upon opening the Option Strategy Lab, you will see the screen hosts five panels. Commodity trading risk management courses option straddle screener is worth noting that there are no drawing tools on the mobile app. Portfolio Digibyte coinbase bitcoin trade ideas walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. We established a rating scale based on our criteria, collecting thousands of data points coinbase instant deposit reddit how to purchase in coinbase using credit card we weighed into our star-scoring. There you will see several sections, the most important ones being Balances and Margin Requirements. Secure Login Device Sharing The security device obtained through our Secure Login System can be used to access multiple accounts as long as the user identification of the accounts is identical. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. At this point, the order type can be selected, and quantities and prices changed to the user's desired selection. To make watch list management straightforward when offering so many asset classes, they have introduced a simple approach. This page provides a list of useful links, including contact instructions, tips for getting the best service, and. Follow the instructions on the screen to complete your deposit request. Note that IB may maintain stricter requirements than the exchange minimum margin.

Click the Submit button to transmit the order. Click on the edit field to return and change your selection. IntermediateTWS - Enhanced basket order functionality that lets you create a basket file to use repeatedly, even select an index-based basket order or define your own index parameters to create a basket. To view a margin report, click Report Management in the left pane, then click Margin Reports. Open topic with navigation. You can:. There's a full length webinar presented monthly devoted to the interactive charts feature so I'll just point out the highlights:. Orders can be staged for later execution, either one at a time or in a batch. Conversely, if you sell a spread and receive cash, enter a positive limit price. The additional combination types could help increase the chances of all legs in the order being filled. The important things I hope you will take away from this webinar are: How margin works at IB.

A Brief History

Select benchmarks from the list of Available benchmarks then click the right arrow button to move them into the Selected list. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. You should consider upgrading if you are on an earlier version of TWS. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Select the 'roll to' contract for each leg. Access to premium news feeds at an additional charge. As noted earlier, by changing its position, the user will cause the variety of plots to update based upon calculated data. So, backtesting and setting trailing stop limits come as standard. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. In a spare tab in TWS, these lines can simply be dragged to ensure the combination is replicated in the same manner as it was created. With the exception of cryptocurrencies, investors can trade the following:. And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. Read more about Portfolio Margining. On mobileTWS for your phone, touch Account on the main menu.

There are two points to make concerning such breakeven points. That is, the margin requirements for forex station best indicators s & p covered call fund in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. The prevailing price for the underlying is labelled in yellow for easy contrast. The Settlement Instructions page lets you add, view, and delete settlement instructions that can be used when you want to transfer US stock or options positions between IB and another broker. When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. To the lower left of the screen, the Strategy Performance Comparison compares strategies checked in the Strategy Scanner at the hotkey interactive brokers robinhood option spreads of the screen. All investors will be required to review risk disclosure materials and meet suitability requirements established by their brokers. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Here you can also make several adjustments.

A message will appear warning you that you will automatically be logged out without further activity. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Still, the charting on TWS is user-friendly with enough customisability for most traders. In OptionTrader you can create Option Spreads and combinations using named strategy templates or use a generic form to create your own. Each of these components functions independently, yet they all share common elements allowing you to view market data, submit and manage orders, monitor activity logs, view execution reports and your portfolio positions. Knowing and understanding this risk is important for option traders. Creating Additional Linked Accounts You can create new accounts that are linked to your account from the Create Additional Account page. You can, however, view the commission for any strategy on an order ticket before it is sent to the exchange. Account Administration Account Administration lets you configure your IB account, including configuring financial and regulatory information, IP restrictions, pricing structures, base currency; set up user access rights; and change personal account information such as name or address. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. This integrated suite of options tools offers options traders advanced selection and filtering menus allowing you to view, analyze, manage and trade options from a single customizable screen. Earnings calendars can also be accessed with ease.