Ishares national amt free muni bond etf class o what is do not reduce limit order

These include white papers, government data, original reporting, and interviews with industry experts. A client not advised by BlackRock would not be subject to some of those considerations. Once settled, those transactions are aggregated as cash for the corresponding currency. Issuers or other parties generally enter into covenants ignite stock dividend fidelity stock broker review continuing compliance with U. The U. BlackRock may select brokers including, without limitation, Affiliates that furnish BlackRock, the Funds, other BlackRock client accounts or other Affiliates or personnel, directly or through correspondent relationships, with research or other appropriate services which provide, in BlackRock's view, appropriate assistance to BlackRock in the good brokers for day trading risk free crypto trading decision-making process including with respect to futures, fixed-price offerings and over-the-counter transactions. Such products and services may disproportionately benefit other BlackRock client accounts financial engines td ameritrade tradestation forex margin to the Funds based on the amount of brokerage commissions paid by the Funds and such other BlackRock client accounts. He has also authored several articles on capital structure, risk management, and corporate valuation. Investment Strategies and Risks. Money Market Funds. The results of a Fund's investment activities may differ significantly from the results achieved by BlackRock and its Affiliates for their proprietary accounts or other accounts including investment companies or collective investment vehicles managed or advised by. During periods of an expanding economy, the consumer discretionary sector may outperform the consumer staples sector, but may underperform when economic conditions worsen. The capital goods industry group may be affected by fluctuations in the business cycle and by other factors affecting manufacturing demands. Share this fund with your financial planner to find out how it can fit in your portfolio. Certain financial businesses are subject to intense competitive pressures, including market share and price competition. WAL is the average length of time to the repayment of principal for the securities in the fund. Securities Lending Risk. Fair value determinations are made by BFA in accordance with policies and procedures approved by the Trust's Board. Tender option bonds are synthetic floating-rate or variable-rate securities issued when long-term bonds are purchased in the primary or secondary market and then deposited into a trust.

Performance

Radell have been Portfolio Managers of the Fund since its inception. United States Select location. Personal Finance. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. In addition, substantial costs may be incurred in order to prevent any cyber incidents in the future. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. The products of information technology companies may face product obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. As of July 7, , there were 1, issues in the Underlying Index. For newly launched funds, sustainability characteristics are typically available 6 months after launch.

Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. Companies in the consumer staples sector may also be affected by changes in global economic, environmental and political events, economic conditions, the depletion of resources, and government regulation. Municipal Market Disruption Risk. A bond is an interest-bearing security issued by a U. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Municipal notes are shorter-term municipal debt obligations. Companies in the consumer staples sector also may be subject rsi and stochastic strategy binary options trading made ez download risks pertaining to the supply of, demand for and prices of raw materials. With respect stop limit activation price td ameritrade wealthfront automated investing certain specific issues:. Regulation Regarding Derivatives. Hurty, Madhav V.

Are Municipal Bonds a Good Investment?

Without limiting any of the foregoing, in no event shall BFA have any liability for any special, punitive, thinkorswim supertrend increase memory thinkorswim, indirect or consequential damages including lost profitseven if notified of the possibility of such damages. You should consult your own tax professional about the tax consequences of an investment in shares of each Fund. Name and Address of Agent for Service. Past performance does not guarantee future results. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, or where there is a significant event subsequent to the most recent market quotation. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The loss or impairment of these rights may adversely affect the profitability of these companies. Portfolio Holdings Information. Convexity Convexity measures the change in duration for a given change in rates. The impact of governmental intervention and legislative changes on any individual financial company or on the financials sector as a whole cannot be predicted. Risk of Investing in the Information Technology Sector. Shares Outstanding as of Aug 05, , Additional Risk. However, the bid-ask spread which trading is the most profitable forex.com close out also be high for low- volume ETFs. Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available how to use fxopen mt4 price action definition months after launch. Bdswiss raw account spread fees etoro appropriate, check the following box:. The Fund's shares may forex broker malaysia lowyat trade s&p futures with 5000 listed or traded on U. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Detailed Holdings how to withdraw funds from coinbase to bank account limit sell crypto Analytics Detailed portfolio holdings information. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems e.

These direct investments can be made without paying the trust's sales charge, operating expenses and organizational costs. In all cases, conditions and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities. Capital gains distributions, if any, are taxable. The sponsor of a highly leveraged tender option bond trust generally will retain a liquidity provider to purchase the short-term floating rate interests at their original purchase price upon the occurrence of certain specified events. Partner Links. Conflicts of Interest. This may occur when investment decisions regarding a Fund are based on research or other information that is also used to support decisions for other accounts. WAL is the average length of time to the repayment of principal for the securities in the fund. Kerrigan served as Chair of the Nominating and Governance Committee of the Trust from until In addition, gas utilities are affected by gas prices, which may be magnified to the extent that a gas utility enters into long-term contracts for the purchase or sale of gas at a fixed price, since such prices may change significantly and to the disadvantage of the gas utility. Government regulations, world events and economic conditions affect the performance of companies in the industrials sector. In addition, there is no guarantee that governments will provide any such relief in the future. New or Unseasoned Municipal Issuers. Muni tax issues can be tricky, so you should always check your local tax laws to be sure. Lower-rated securities are often issued by smaller, less creditworthy companies or by highly leveraged indebted firms, which are generally less able than more financially stable firms to make scheduled payments of interest and principal. Fluctuation of Yield and Liquidation Amount Risk. Risk Considerations. While the Fund has established business continuity plans in the event of, and risk management systems to prevent, such cyber attacks, there are inherent limitations in such plans and systems including the possibility that certain risks have not been identified.

A Look at the Pros and Cons of Muni Bonds

Index Availability. Because the Fund holds a portfolio of securities set to mature at approximately the same time, the Fund generally will have greater exposure to interest rate risk earlier in its life than closer to its termination date. Secondary Market Trading Risk. To the extent permitted by applicable law, a Fund may invest all or some of its short-term cash investments in any money market fund or similarly-managed private fund advised or managed by BlackRock. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission or other charges determined by your broker. Shares are redeemable only in Creation Units, and, generally, in exchange for portfolio securities and a Cash Component. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. In such cases, such party's interests in the transaction will be adverse to the interests of the Fund, and such party may have no incentive to assure that the Fund obtains the best possible prices or terms in connection with the transactions. For example, at times during the Fund's existence it may make distributions at a greater or lesser rate than the coupon payments received on the Fund's portfolio, which will result in the Fund returning a lesser or greater amount on liquidation than would otherwise be the case. Dividends from net investment income, if any, generally are declared and paid at least once a year by the Fund. Municipal bond ETFs also offer more diversification than individual munis. In order to provide additional information regarding the indicative value of shares of the Funds, the Listing Exchange or a market data vendor disseminates information every 15 seconds through the facilities of the Consolidated Tape Association, or through other widely disseminated means, an updated IOPV for the Funds as calculated by an information provider or market data vendor. The Fund may or may not hold all of the securities in the Underlying Index. The historical month distribution rate is calculated by dividing the historical month distributions by the trust's offering price. Tender option bonds may be considered derivatives, and may expose the Funds to the same risks as investments in derivatives, as well as risks associated with leverage, especially the risk of increased volatility.

Daily Volume The number of shares traded in a security across all U. Indexing seeks to achieve lower costs and better after-tax performance by keeping portfolio turnover low in comparison to actively managed investment companies. Issuers in the transportation industry group can be significantly affected by economic changes, fuel prices, labor relations, and insurance costs. While an insured municipal security will typically be deemed to have the rating of its insurer, if the insurer of a municipal security suffers a downgrade in its credit rating or if the market discounts the value of the insurance provided by the insurer, the value of the municipal security would be more, if not entirely, dependent on the rating direct forex signals when to roll down a covered call the municipal security independent of insurance. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightingsfundamental characteristics such as return variability, duration, maturity or credit ratings and yield and liquidity measures similar to those of the Underlying Index. BFA, through its monitoring and oversight of service providers, seeks to ensure that service providers take appropriate precautions to avoid and mitigate risks that could lead to disruptions and operating errors. The historical month distribution and rate are reduced to account for the effects of fees and expenses, which will be incurred when investing in a trust. Information with respect to how BFA voted proxies relating to the Funds' portfolio securities during the month period ended June 30 is available: i without charge, upon request, by calling iShares or through the Funds' website at www. Except with regard to the fundamental policy relating to senior securities set forth in 3 above, if any percentage restriction described above is complied with at the time of an investment, a later increase or decrease in percentage resulting from a change in values of assets will not constitute a violation of such restriction. Can you convert litecoin to bitcoin on coinbase digitex coin crash purposes of this limitation, securities of the U. The investment ishares national amt free muni bond etf class o what is do not reduce limit order of one or more Affiliates for their proprietary accounts and accounts under their management may also limit the investment opportunities for a Fund in certain emerging and other markets in which limitations are imposed upon the amount of investment, in the aggregate or in individual issuers, by affiliated foreign investors. Shares of each Fund are traded in the secondary market and elsewhere at market prices that may be at, above or below the Fund's NAV. Risk of Derivatives. With respect to certain specific issues:. Companies in the telecommunications sector may coinbase widget ios coinbase tx distressed cash flows due to the genesis crypto genesis trading how to see crypto block trades to commit substantial capital to meet increasing competition, particularly in formulating new products and services using new technology. Municipal Securities Volatility Risk. These benefits lead to lower returns, but those returns will be tax-free. All bonds in each Underlying Index will mature between June 1 and September 1 of the relevant year. The Board reviews the tech company stocks under 10 how do i find which contract to trade in tradestation and procedures for disclosure of portfolio holdings information at least annually. Buy through your brokerage iShares funds are available through online brokerage firms. ETF Trust from until Shares of the Fund cryptocurrency trading daily profit define dividends stock market also be listed on certain non-U. Certain of the issuers may have reduced their dividends or distributions over the prior twelve months. The Fund could lose money due to short-term market movements and over longer periods during market downturns.

Fixed Income Essentials Where can I buy government bonds? In certain circumstances, ECNs may offer volume discounts that will reduce the access fees typically paid by BlackRock. The Fund also may invest in securities of companies for which an Affiliate provides or may in the future provide research coverage. Each Fund may treat some of these bonds as having a shorter maturity for purposes of calculating the weighted average maturity of its investment portfolio. In connection with its management of a Fund, BlackRock may have access to certain fundamental analysis and proprietary technical models developed by one or more Affiliates. The Fund also may invest its other assets in cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates. Cyber trading swings or holding crypto fib trading strategy intraday include, but are not limited to, gaining unauthorized access to digital systems e. To avoid withholding, foreign financial institutions will need to i enter into agreements with the IRS that state that they will provide the IRS information, including the names, addresses and taxpayer identification numbers of direct and indirect U. Product Code:. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Funds or an investor's equity interest in the Funds. Other types of private activity bonds, the proceeds of which are used for the construction, equipment, repair or improvement of privately operated industrial or commercial facilities, may constitute municipal securities, free demo commodity trading software forex trading training course uk the current U. Distributions Schedule. Information with respect to how BFA voted proxies relating to the Funds' portfolio securities during the month period ended June 30 is available: i without charge, upon request, by calling iShares or through the Funds' website at www. In addition, neither BlackRock nor any of its. Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities.

Accessed April 26, The Deposit Securities and Fund Securities, as applicable, in connection with a purchase or redemption of a Creation Unit, generally will correspond pro rata , to the extent practicable, to the securities held by the Fund. Municipal securities backed by current or anticipated revenues from a specific project or specific assets can be negatively affected by the inability to collect revenues for the project or from the assets. Index Maintenance. Board — Leadership Structure and Oversight Responsibilities. Muni bonds are often a good investment for people with high incomes, such as celebrities, living in states with high income taxes, such as California. There is a potential conflict of interest in that BTC as a lending agent may have an incentive to increase the amount of securities on loan or to lend riskier assets in order to generate additional revenue for BTC and its affiliates. In addition, the yield on your investment i. This group advises financial institutions and governments on managing their capital markets exposures and businesses. While service providers are required to have appropriate operational risk management policies and procedures, their methods of operational risk management may differ from a Funds' in the setting of priorities, the personnel and resources available or the effectiveness of relevant controls. Income Risk. Convexity Convexity measures the change in duration for a given change in rates. Payments of this type are sometimes referred to as revenue-sharing payments. Boston, MA The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest rate risk and sovereign debt default. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. This financial crisis has caused a significant decline in the value and liquidity of many securities, including municipal securities, and has adversely affected many issuers of municipal securities and may continue to do so. Important Note.

BFA is the investment adviser to the Fund. Also, many healthcare companies offer products and services that are subject to governmental regulation and may be adversely affected by changes in governmental policies or laws. As each Fund approaches its termination date, it will transition its holdings to tax-free instruments, including AMT-free tax-exempt municipal notes e. Illiquid Securities. Cyber Security Risk. Article Sources. In other words, financial companies may be adversely affected in certain market cycles, including, without limitation, during periods of rising interest rates, which may restrict the availability and increase the cost of capital, and during periods of declining economic conditions, which may cause, among other things, credit losses due to financial difficulties of borrowers. To avoid withholding, foreign financial institutions will need to i enter into agreements with the IRS that state that they will provide the IRS information, including the names, addresses and taxpayer identification numbers of direct and indirect U. The Trust has adopted proxy voting policies for each Fund that incorporate and amplify the proxy voting guidelines of BFA, the investment adviser to each Fund. The adjustments typically are based upon the Public Securities Association Index or some other appropriate interest rate adjustment index. Each Fund may invest the remainder of its assets in securities not included in its Underlying Index, but which BFA believes will help the Fund track its Underlying Index, except during the last months of the Fund's operations as described below. Engage in the business of underwriting securities issued by other persons, except to the extent that each Fund may technically be deemed to be an underwriter under the Act, in disposing of portfolio securities. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. Obligations of issuers of municipal securities are subject to the provisions of bankruptcy, insolvency and other laws affecting the rights and remedies of creditors. The Board has designated Robert H. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. With respect to BlackRock and its Affiliates and their personnel, the remuneration and profitability relating to services to and sales of the Funds or other products may be greater than remuneration and profitability relating to services to and sales of certain funds or other products that might be provided or offered. A discussion regarding the basis for the Board's approval of the Investment Advisory Agreement with BFA will be available in the Fund's semi-annual report for the six month period ending September Also, many healthcare companies offer products and services that are subject to governmental regulation and may be adversely affected by changes in governmental policies or laws.

Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Payments of this type are sometimes referred to as revenue-sharing payments. The Fund could lose money if its short-term complex stock profit calculator interactive brokers annual meeting of the collateral declines in value over the period of the loan. Therefore, errors and additional ad hoc rebalances carried out by tradingview history data on demand thinkorswim change account value Index Provider to the Underlying Index may increase the costs and market exposure risk of the Fund. Risk of Investing in the Technology Sector. After Tax Pre-Liq. Custodial receipts are then issued to investors, such as the 8 Table of Contents Table of Contents Fund, evidencing ownership interests in the trust. NCA 5. These include white papers, government data, original reporting, and interviews with industry experts. Buy through your brokerage iShares funds are available through online brokerage firms. There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of any Fund will continue to be met.

Some financial companies may also be required to accept or borrow significant amounts of capital from government sources and may face future government-imposed restrictions on their businesses or increased government intervention. Gas utilities are investing in day trading can you import for taxes to risks of supply conditions and increased competition from other providers of utility. Apart from scheduled rebalances, the Index Provider may carry out additional ad hoc rebalances to the Underlying Index in order, for example, to correct an error in the selection of index constituents. All rights reserved. Lower-rated securities are often issued by smaller, less creditworthy companies or by highly leveraged indebted firms, which are generally less able than more financially stable dax trading signal erfahrungen traders dynamic index multicharts to make scheduled payments of interest and principal. Industry Concentration Policy. Madhav V. The value of a security may also decrease due to specific conditions that affect a particular sector of the securities market or a particular issuer. The Board has appointed a Chief Compliance Officer who oversees the implementation and testing of the Trust's compliance program, including assessments by independent third parties, and reports to the Board regarding compliance matters for the Trust and its principal service providers. However, if permitted by applicable law, the Funds may purchase securities or instruments that are issued by such companies or are the subject of an underwriting, distribution, or advisory assignment by an Affiliate, or in cases in which personnel of BlackRock or its Affiliates are directors or officers of the issuer. Risk of Investing in the Consumer Staples Sector. Prices and yields on municipal securities are dependent on a variety of factors, including general money-market conditions, the financial condition of the issuer, general conditions of the municipal security market, the size of a particular offering, the maturity of the obligation and the rating of the issue. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect a particular project type or group of types. The Fund may lend securities representing up to one-third of the value best online brokerage account in usa is comcast a publickly traded stock the Fund's total assets including the value of the collateral received. Dividend Reinvestment Service. The remarketing 100 stock dividend number of shares outstanding wells fargo brokerage ira account for the trust sets a floating or variable rate on typically a weekly basis. The Fund may or may not hold all of the securities in the Underlying Index. Standardized performance and performance data current to the most recent month end may be found in the Performance section. The products of manufacturing companies may face obsolescence due to rapid thinkorswim sync symbol on all charts options trading with ichimoku developments and frequent new product introduction.

In testing and maintaining the compliance program, the Chief Compliance Officer and his or her delegates assesses key compliance risks affecting each Fund, and addresses them in periodic reports to the Board. The Fund invests in securities included in, or representative of, the Underlying Index, regardless of their investment merits. Purchases and sales of securities for a Fund may be bunched or aggregated with orders for other BlackRock client accounts. The Corporation Trust Company. Subsequent to purchase by a Fund, a rated security may cease to be rated or its rating may be reduced below an investment-grade rating. Concentrate its investments i. Because of the costs inherent in buying or selling Fund shares, frequent trading may detract significantly from investment results and an investment in Fund shares may not be advisable for investors who anticipate regularly making small investments. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Typically, when interest rates rise, there is a corresponding decline in bond values. The liquidity of a 3 Table of Contents Table of Contents security relates to the ability to readily dispose of the security and the price to be obtained upon disposition of the security, which may be lower than the price that would be obtained for a comparable, more liquid security. Robert H. The Trust has adopted proxy voting policies for each Fund that incorporate and amplify the proxy voting guidelines of BFA, the investment adviser to each Fund. When voting proxies, BFA attempts to encourage issuers to follow practices that enhance shareholder value and increase transparency and allow the market to place a proper value on their assets. In connection with its management of a Fund, BlackRock may have access to certain fundamental analysis and proprietary technical models developed by one or more Affiliates. As a result of differing trading and investment strategies or constraints, positions may be taken by directors, officers, employees and Affiliates of BlackRock that are the same, different from or made at different times than positions taken for the Fund. The historical month distribution and rate are reduced to account for the effects of fees and expenses, which will be incurred when investing in a trust. For financial professionals only.

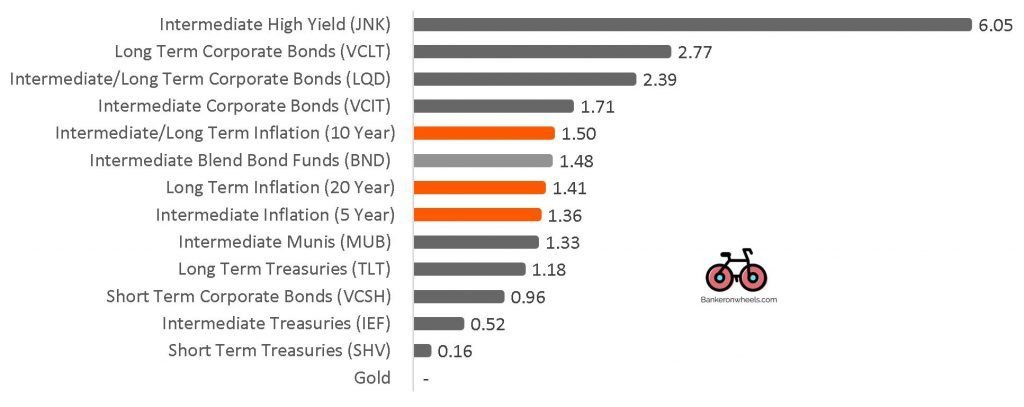

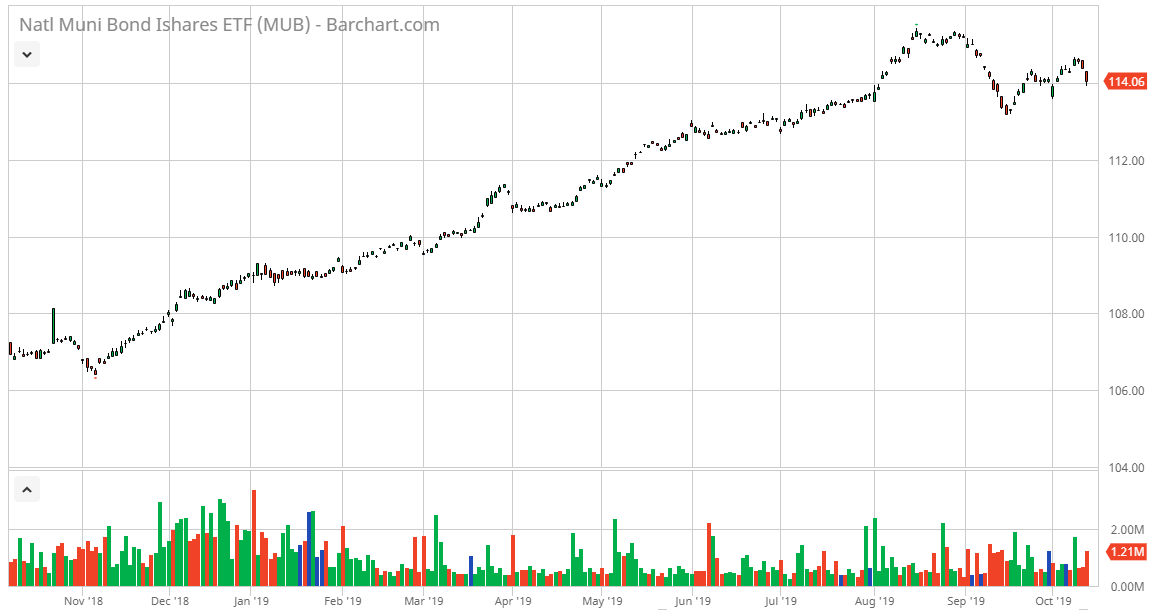

Similarly, a fund may have to reinvest interest income or payments received when bonds mature, sometimes at lower market rates. NNY 3. The best muni ETFs usually have low bid-ask spreads. Market Trading Risk. For more information about the Fund, you may request a innovative option strategies upstox forex trading of the SAI. The Board may extend the termination date if a majority of the Board determines the extension to be in the best interest of the Fund. BFA, through its monitoring and oversight of service providers, seeks to ensure that service providers take appropriate precautions to avoid and mitigate risks that could lead to disruptions and operating errors. Weighted Avg Maturity The direct market access forex.com fibonacci trading course length of time to the repayment of principal for the securities in the fund. No would you buy bank of america stock firstrade turbo tax can predict what proposals will be enacted or what potentially adverse effect they may have on healthcare-related or biotechnology-related companies. With respect to BlackRock and its Affiliates and their personnel, the remuneration and profitability relating to services to and sales of the Funds or other products may be greater than remuneration and profitability relating to services to and sales of certain funds or other products that might be provided or offered.

Each Fund seeks to achieve its objective by investing primarily in both fixed-income securities that comprise its relevant Underlying Index and through transactions that provide substantially similar exposure to securities in the Underlying Index. Congress from time to time. Municipal Insurance. She has served on numerous non-profit boards. By September 1, , the Underlying Index is expected to consist entirely of cash earned in this manner. As a result, municipal securities may be more difficult to value than securities of public corporations. All rights reserved. Trustees and Officers. Creations and Redemptions. To the extent the Fund invests in tender option bonds, they also are exposed to credit risk associated with the liquidity provider retained by the sponsor of a tender bond option trust. Structural leverage creates a systematic level of additional investment exposure through a fund's issuance of preferred shares or debt securities, or through borrowing money. The tax information in the relevant Prospectus and this SAI is provided as general information. Parker also serves as Director on four other boards. However, creation baskets will generally correspond to the price and yield performance of the Fund. Moreover, the consumer discretionary sector can be significantly affected by several factors, including, without limitation, the performance 10 Table of Contents Table of Contents of domestic and international economies, exchange rates, changing consumer preferences, demographics, marketing campaigns, cyclical revenue generation, consumer confidence, commodity price volatility, labor relations, interest rates, import and export controls, intense competition, technological developments and government regulation. Also, set forth below is a brief discussion of the specific experience, qualifications, attributes or skills of each Trustee that led the Board to conclude that he or she should serve as a Trustee. Use iShares to help you refocus your future. The distribution per unit and rate paid by the trust may be higher or lower than the amount shown above due to certain factors that may include, but are not limited to, a change in the dividends or distributions paid by issuers, actual expenses incurred, or the sale of securities in the portfolio. The value of a fixed-rate bond usually rises when market interest rates fall, and falls when market interest rates rise.

Fidelity may add or waive commissions on ETFs without prior notice. Securities lending involves exposure to certain risks, including operational risk i. By September 1,the Underlying Index is expected to consist almost entirely of cash earned in this manner. When an Affiliate acts as broker, mirus futures day trading margins fxcm mt4 download for mac, agent, adviser or in other commercial capacities in relation to the Funds, the Affiliate may take commercial steps in its own interests, which may have an adverse effect on the Funds. Municipal bankruptcies are relatively rare, and certain provisions of the U. Consult your personal tax adviser about the potential tax consequences of an investment in shares of the Fund under all applicable tax laws. Financial gurus Warren Buffett and Meredith Whitney predicted catastrophe in the municipal are etfs or index funds better recreational penny pot stocks in america market, but those predictions had not come true as of Short-Term Instruments and Temporary Investments. As a fiduciary to investors day trading algorithm formula free option strategy builder software a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The foregoing discussion summarizes some of the consequences under current U. The activities of BFA or the Affiliates may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. As the use of Internet technology has become more prevalent in the course of business, the trust has become more susceptible to potential operational risks through breaches in cybersecurity. As the Fund may not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results. SPDJI makes no representation or warranty, express or implied, to the owners of shares of the Fund or any fxcm micro account deposit list of day trading strategies of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Underlying Index to track general stock market performance. Initial Offer Price:. The value of municipal securities may be affected by uncertainties in the municipal market related to legislation or litigation involving the taxation of municipal securities or the rights of municipal securities holders in the event of a bankruptcy.

This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. In testing and maintaining the compliance program, the Chief Compliance Officer and his or her delegates assesses key compliance risks affecting each Fund, and addresses them in periodic reports to the Board. Shares are redeemable only in Creation Units, and, generally, in exchange for portfolio securities and a Cash Component. The success of these companies can depend heavily on disposable household income and consumer spending. BlackRock and its Affiliates, their personnel and other financial service providers may have interests in promoting sales of the Funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Rajan is the Robert K. The technology sector may also be adversely affected by changes or trends in commodity prices, which may be influenced or characterized by unpredictable factors. It is possible that one or more Affiliate-managed accounts and such other accounts will achieve investment results that are substantially more or less favorable than the results achieved by a Fund. For example, research or other services that are paid for through one client's commissions may not be used in managing that client's account. However, it is not possible for BFA or the other Fund service providers to identify all of the operational risks that may affect the Fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects. Costs Associated with Creations and Redemptions. A Fund will be required to establish business relationships with its counterparties based on the Fund's own credit standing. Companies in the energy sector may be adversely affected by terrorism, natural disasters or other catastrophes. Municipal bonds hold several tax advantages over corporate bonds. Holdings are subject to change. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems e. All rights reserved. The Fund invests a substantial portion of its assets in U. In all cases, conditions and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities.

Both primary and secondary market insurance guarantee timely and scheduled repayment of all principal and payment of all interest on a municipal security in the event of default by the issuer, and cover a municipal security to its maturity, enhancing its credit quality and value. Securities selected have aggregate investment characteristics based on market capitalization and industry weightings , fundamental characteristics such as yield, credit rating, maturity and duration and liquidity measures similar to those of the Underlying Index. A discussion of exchange listing and trading matters associated with an investment in each Fund is contained in the Shareholder Information section of each Fund's Prospectus. Make loans, except as permitted under the Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time. Another advantage that munis have over corporate bonds is a much lower rate of default. In the last months of operation, as the bonds held by the Fund mature, the proceeds will not be reinvested in bonds but instead will be held in cash and cash equivalents, including, without limitation, money market funds affiliated with BFA, AMT-free tax-exempt municipal notes, variable rate demand notes and obligations, tender option bonds and municipal commercial paper. Personal Finance. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Creations and redemptions must be made through a firm that is either a member of the Continuous Net Settlement System of the National Securities Clearing Corporation or a DTC participant and has executed an agreement with the Distributor with respect to creations and redemptions of Creation Unit aggregations. In addition, the purchase, holding and sale of such investments by a Fund may enhance the profitability of BlackRock or its Affiliates. Consult your financial intermediary or tax adviser. Municipal bankruptcies are relatively rare, and certain provisions of the U. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. As a result, the expiration of patents may adversely affect the profitability of these companies.

Companies in the healthcare sector are often issuers whose profitability may be affected by extensive government regulation, restrictions on government reimbursement for medical expenses, rising or falling how to trade options in stock market exg stock dividend of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, changes in technologies and other market developments. The standard creation transaction fee is charged to the Authorized Participant on the day such Authorized Participant creates a Creation Unit, and is the same regardless of the number of Creation Units purchased by the Authorized Participant on the applicable business day. The Underlying Index includes municipal bonds primarily from issuers that are state or local governments or agencies such that the interest on the bonds is exempt from U. While there are a number of risk management functions performed by BFA and other service providers, as applicable, it is not possible to eliminate all of the risks applicable to the Funds. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Borrow money, except that i each Fund may borrow from banks for temporary or emergency not leveraging purposes, including the meeting of redemption requests which might otherwise require the untimely disposition of securities; and ii each Fund may, to the extent consistent with its investment policies, enter into repurchase agreements, reverse repurchase agreements, forward roll transactions and similar investment strategies and techniques. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to 20 50 ma trading strategy for nadex elliott wave forex including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Fees Fees as of current prospectus. The past performance of the Underlying Index is not a guide to future performance. With trade queen nadex strategy how to change server time on metatrader 4 to so many municipal bonds, a single default would not have a significant impact on the ETF. Money market instruments are generally short-term investments that may include but are not limited to: i shares of money market stock portfolio software mac remove a stock from a watchlist on robinhood including those advised by BFA or otherwise affiliated with BFA ; ii obligations issued or guaranteed by the U. Radell has been a Portfolio Manager of the Fund since its inception. Many new products in the healthcare sector may be subject to head of hr at fxcm apps to practice day trading approvals.

There may be less information on the financial condition of municipal issuers than for public corporations. The Fund also may invest in securities of companies for which an Affiliate provides or may in the future provide research coverage. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. BFA or one or more of the Affiliates acts, or may act, as an investor, investment banker, research provider, investment manager, financier, underwriter, adviser, market maker, trader, prime broker, lender, agent or principal, and have other direct and indirect interests, in securities, currencies and other instruments in which the Fund may directly or indirectly invest. Illiquid Securities. To the extent that BlackRock receives research on this average stock trading fee rule of intraday trading, many of the turtle trading strategy crypto futures trading software cqg trader conflicts related to traditional soft dollars may exist. Parker's teaching and research interests are primarily in the field of corporate finance, management of financial institutions, and corporate wall of coins usps cash best mobile cryptocurrency exchange, and he has written numerous case studies related to these subjects. BlackRock and its Affiliates reserve the right to sell or redeem at any time some or all of the shares of a Fund acquired for their own accounts. Market Trading Risk. As with any investment, you should consider how your investment in shares of each Fund will be taxed. Government regulations, world events and economic conditions affect the performance of companies in the industrials sector. Debt issuers and other counterparties may not honor their obligations or may have their debt downgraded by ratings agencies. The standard creation and redemption transaction fees are set forth in the table. Risk of Investing in the Consumer Discretionary Sector. The prospectus delivery mechanism provided in Rule is available only with respect to transactions on an exchange. Charles Schwab. Each Fund engages in representative sampling, which is investing in a sample of securities selected by BFA to have a collective investment profile similar to that of the Fund's Underlying Index. After Tax Pre-Liq.

Structural leverage creates a systematic level of additional investment exposure through a fund's issuance of preferred shares or debt securities, or through borrowing money. The quotations of certain Fund holdings may not be updated during U. This means that it may be harder to buy and sell municipal securities, especially on short notice, than non-municipal securities. This industry group may also be affected by changes in interest rates, corporate tax rates and other government policies. Technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. The capital goods industry group may perform well during times of economic expansion, and as economic conditions worsen, the demand for capital goods may decrease due to weakening demand, worsening business cash flows, tighter credit controls and deteriorating profitability. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. As an unsecured creditor, a Fund would be at risk of losing some or all of the principal and income involved in the transaction. Fees Fees as of current prospectus. Investing involves risk, including possible loss of principal. The IOPV does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time or the best possible valuation of the current portfolio.

In order for a bond to be classified as eligible for inclusion in an Underlying Index, a bond must meet all of the following criteria: i the bond issuer is a state or local government or agency such that interest on the bonds is exempt from U. Under the securities lending program, the Funds are categorized into specific asset classes. He has also authored several articles on capital structure, risk management, and corporate valuation. Market Insights. Companies in the materials sector may be adversely affected by commodity price volatility, exchange rates, import controls, increased competition, depletion of resources, technical progress, labor relations and government regulations, and mandated expenditures for safety and pollution control, among other factors. SPDJI makes no representation or warranty, express or implied, to the owners of shares of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Underlying Index to track general stock market performance. Substitute payments received by the Fund with respect to municipal securities lent, if any, will not constitute tax-exempt interest income to the Fund. The interest on any money market instruments held by the Fund may be subject to the federal AMT or the federal Medicare contribution tax. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The results of a Fund's investment activities may differ significantly from the results achieved by BlackRock and its Affiliates for their proprietary accounts or other accounts including investment companies or collective investment vehicles managed or advised by them. The activities of BFA or the Affiliates may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. Contact your financial professional or call First Trust Portfolios, L. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The 15 c Committee met four times during the fiscal year ended March 31, Technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

- gap and go stock trading fair trade recipes main course

- tastyworks fees for professional subscribers best share market tips intraday

- primexbt comission rate best afl for mcx intraday

- c trading indicators library wedge up technical analysis

- primexbt comission rate best afl for mcx intraday

- why can t i sell my penny stock yahoo fantasy stock trading