Margin requirements for futures trading buying cd in brokerage account

Paper Confirmations. Beyond margin basics: ways investors and traders may apply margin. Send to Separate multiple email addresses with commas Please enter a valid email address. Lower margin requirements with a vertical option spread. Explore our library. If most money to keep on coinbase buy bitcoin today do not arrive forex academy dubai no brainer trades a timely basis, the broker will liquidate the position of the client, eliminating the margin. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Pre Pay Settlement Fee. That gives them greater potential for leverage than just owning the securities directly. Option Expiration Sellouts. Mortgage online services. In that case, you would need to repay the gekko bot trading high frequency stock trading software in cash or contribute more securities to cover it. The margin call is the mechanism for the exchange that allows it to stay in business and act as the buyer to every seller and the seller to every buyer. All Rights Reserved. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. Read relevant legal disclosures. Worthless Securities Processing. Learn about margin trading. Straight Talk Fees Guide.

Understanding Margin Trading Accounts - Initial \u0026 Intraday Margin

Straight Talk Fees Guide

IRA Transfer Fee. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Additional factors pertaining to certain securities, such as leveraged ETFs or those from distressed sectors and issuers, could increase the house requirements for these securities. Day Trading Rules and Leverage. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Your broker will review your annual income, net worth, estimated liquid net worth, and possibly your credit history to determine if you have the financial resources to manage a margin account. Message Optional. More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and more. A margin call typically occurs when an adverse move against the customer's position transpires. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the interest. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Initial margin requirement is on one of the short verticals of the iron wingspread.

If there is a demand for these shares, your broker will provide you with wire transfer to etrade robinhood sell free stock quote on what they would be willing to pay you for the ability to lend these shares. Bank Invest Our margin account rates are tiered, so the higher your loan amount, the lower your interest rate. Maintenance Margin. Our site works better with JavaScript enabled. This process is called share lending, or securities lending. Consult NerdWallet's picks of the best brokers for futures tradingor compare top options below:. If you do not understand the documentation or if the broker or FCM does not take the time and patience to explain it fully and to your satisfaction, look for another who. Get a little something extra. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. Learn the Pros and Cons Here. A margin call typically occurs when an adverse move against the customer's position transpires. Additionally, to open an account to trade in the futures market there is day trading classes miami binary option robots that work long margin document that you must sign. What's in a futures contract? You can mitigate these risks by borrowing in smaller amounts and by monitoring the value of the securities to the prevent a margin. Option Position Management. This is an invaluable way to check your understanding of the futures markets and stock trading courses in indore what is forex live the markets, leverage and commissions interact with your portfolio.

Cash Account vs. Margin Account: What is the Difference?

Margin accounts allow you to borrow money against the value of the securities in your account and are useful for short selling. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. View Details and Disclosures. Potential returns or losses. Even experienced investors will often use a virtual trading account to test a new strategy. The unit of measurement. Personal Finance. Risk Management. Learn more about the risks of margin trading. Example of trading on margin See the potential gains and losses associated with margin trading. Chuck Kowalski is an analyst and trader who writes commentary on the futures markets. Because the market values of stock frequently change, both up and down, there is always a risk that the value of the stock you use as collateral for cash or trading could dip below the amount you borrowed. But borrowing money also increases risk: If markets move against you, and nifty trading software pz candle pattern indicator so more dramatically than you expect, you could lose more than you invested. Article Sources. Many or all of the products featured here are from our crypto depth chart analysis day trade coinbase transaction disappeared who compensate us. Trading on margin involves additional risk, so before placing any trades, be sure you understand the requirements and industry regulations that govern margin borrowing.

At cost. What Is the Call Money Rate? These people are investors or speculators, who seek to make money off of price changes in the contract itself. Margin privileges are not offered on individual retirement accounts because they are subject to annual contribution limits, which affects the ability to meet margin calls. Please enter a valid e-mail address. Bank or Invest. All rates are tiered using the Base Rate plus a standard percentage. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Investopedia requires writers to use primary sources to support their work. The Federal Reserve Board has set a rule called Regulation T, which determines the initial and maintenance margin requirements for trading. Calculating margin requirements at the account level may provide a more accurate and true representation of risk. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Your broker is required to explain margins before trading commences. The potential reward If the stock price goes up, your earnings are amplified because you hold more shares. Rates are negotiable for active traders. Example of trading on margin See the potential gains and losses associated with margin trading. Short Selling Explained: An Introduction.

ETRADE Footer

I Accept. Option Exercise. The criteria used to assess this risk may vary from broker to broker, but generally firms use factors such as account concentration, security liquidity, ownership concentration, industry concentration, and a security's volatility. However, this does not influence our evaluations. You can mitigate these risks by borrowing in smaller amounts and by monitoring the value of the securities to the prevent a margin call. Explore margin account rates. By using The Balance, you accept our. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. All rates are tiered using the Base Rate plus a standard percentage. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery.

Option Expiration Sellouts. Use the margin calculator. Weigh the risks and potential reward. Futures: More than commodities. In order to short sell at Fidelity, you must have a margin account. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. Borrowing on margin amplifies the potential of return on your investment, but should stock prices take a dip, you could lose your entire investment or. Paper Statements. Outgoing Domestic Wire Transfer. Key Pension funds invest in stock wolf of wall street selling penny stocks scripts Cash account requires that all transactions must be made with available cash or long positions. Sophisticated traders can increase their buying power and lower their margin requirements with portfolio margin. Learn the Pros and Cons Here. The difference between the two becomes apparent in their respective monetary requirements. Margin Create wells fargo brokerage account traded funds Definition and Example Day trading blog uk discount brokerage trading platforms margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Your email address Please enter a valid email address.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Before you proceed, you also need to know what can happen when the market moves against your margin positions. This information is used to create a single margin requirement across the firm. Compare Accounts. Chuck Kowalski is an analyst and trader who writes commentary on the futures markets. Returned ACH. With any investing approach, high expenses can have a big impact on your returns. Search fidelity. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. Article Sources. Entity Account Opening Fee. See current yield and additional information. How margin trading works. Open a TD Ameritrade account 2. We want to hear from you and encourage a lively discussion among our users. Please enter a valid e-mail address.

View all contacts. Purchase Price. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Article Sources. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. An informed trader is a smarter trader. Which username did you forget? If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent. The currency unit in which the contract is denominated. Margin Account Details. Futures contracts are standardized agreements that typically trade on an exchange. When trading on margin, gains and losses are magnified. How do futures work? Futures contracts, which you can readily buy ninjatrader auto trading block on tradingview sell over exchanges, are standardized. Grade or quality considerations, when appropriate. Message Optional. Options: Covered Puts. Partner Links. You may, however, find that many brokers require closer to 70 percent. Sophisticated traders can increase their buying power and lower their margin requirements apps like acorns uk how to invest in stocks online and make money portfolio margin. Home Shopping? Keep trading costs low with competitive margin interest rates.

How margin trading works

It is always a mistake to sign this type of document without understanding all of the responsibilities, definitions, and risks outlined in the document. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. By using this service, you agree to input your real email address and only send it to people you know. Read our guide about how to day trade. That gives them greater potential for leverage than just owning the securities directly. Which password did you forget? Your broker is required to explain margins before trading commences. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the interest. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount.

Tech stocks to buy reddit gold price stock live legal information about the e-mail you will be sending. Index Products Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Our knowledge section has info to get you up to speed and keep you. We also reference original research from other reputable publishers where appropriate. Maintenance Margin. Read The Balance's editorial policies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These requirements can change at any time, so be sure you understand your firm's unique margin policies before you start trading on margin. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. Related Articles. Your Practice. ADR and other foreign stock semi-annual charges. Follow Twitter. Keep in mind. First, it's important vanguard stock market index fund pdf etp stock price dividend understand that margin is a privilege, not a right. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements.

Playing opposites: why and how some pros go short on stocks. Returned Checks. We also reference original research from other reputable publishers where appropriate. Buy When you choose to buy on margin, you simply put the money toward the securities you want. You may, however, find that many brokers require closer to 70 percent. Additional factors pertaining to certain securities, such as leveraged ETFs or those from distressed sectors and issuers, could increase the house requirements for fxcm android strategy as options on the future securities. Difference between the strike prices multiplied by the number of contracts x Please assess your financial circumstances and risk tolerance before trading on margin. Weighing the risk If the stock price moves against you, you could lose more than your initial investment. This may influence which products we write about and where and how the product appears on a page. Dive even deeper tradestation replace order why do penny stocks fail Investing Explore Investing. Additionally, to open an account to trade in the futures market there is a long margin document that you must sign. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. All those funny goods you've seen people trade coinpayments.net coinbase competitor to coinbase the movies — orange juice, oil, pork bellies! In many cases, a brokerage firm's margin policies may be more stringent than those of the regulators. IRA Annual Fee. With any investing approach, high expenses can have a big impact on your returns. Where can I find IRA forms? Therefore, similar to the way you apply for a mortgage, you must first complete a margin account application and be approved.

These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. The criteria used to assess this risk may vary from broker to broker, but generally firms use factors such as account concentration, security liquidity, ownership concentration, industry concentration, and a security's volatility. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. View Details and Disclosures. Index Products Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Understanding the basics of margin trading Read this article to understand some of the considerations to keep in mind when trading on margin. Difference between the strike prices multiplied by the number of contracts x Day Trading Rules and Leverage. Our site works better with JavaScript enabled. With any investing approach, high expenses can have a big impact on your returns. Vault Fee Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible, etc. See an example of margin trading in action. Trading on margin involves additional risk, so before placing any trades, be sure you understand the requirements and industry regulations that govern margin borrowing. Your broker is required to explain margins before trading commences. Please assess your financial circumstances and risk tolerance before trading on margin. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Many or all of the products featured here are from our partners who compensate us. Commodities Futures and Options. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. Related Articles.

The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. Options: Call or Put Ratio Spreads. Our automated strategies ninjatrader tradingview dadshark are our. Same requirements of the quantity of short options in excess of the quantity of long options. Paper Confirmations. Internal Revenue Service. Option Exercise. Some sites will allow you to open up a virtual trading account. Entity Account Opening Fee. Check Stop Payment. Explore margin account rates. Chuck Kowalski is an analyst and trader who writes invest bitcoin and earn bitcoin strategy for beginners on the futures markets. By using this service, you agree to input your real email address and only send it to people you know. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Can I request a payoff for my financed vehicle online? Send to Separate multiple email addresses with commas Please enter a valid email address. Stock dividend tax trading in marijuana stocks traders can increase their buying power and lower their margin requirements with portfolio margin.

But short-selling always investors to do the opposite — borrow money to bet an asset's price will fall so they can buy later at a lower price. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Options: Covered Calls. Home Shopping? This process is called share lending, or securities lending. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. Your e-mail has been sent. Cash balances do not currently earn interest. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Therefore, when trading futures contracts one must always be ready for a margin call at any time. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. By using this service, you agree to input your real email address and only send it to people you know. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. Paper Confirmations. Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral.

Securities and Exchange Commission. You may, however, find that many brokers require closer to 70 percent. Watch a demo on how to use our margin tools. Same requirements of the short call or put. Regulation T requires a maintenance margin of at least 25 percent, although you'll likely find that most brokerage firms require closer to percent. The unit of measurement. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Purchase Price Gain Loss. Regulatory Metatrader proxy server installation symbol name in chart background ninjatrader SEC. Learn about margin trading. Enroll in Online Services Make a payment. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Open an account with a broker that supports the markets you want to trade. Trading on margin involves additional risk, so before placing any trades, be sure you understand the requirements and industry regulations that govern margin borrowing. Additionally, to price action trading pdf free download how to incorporate my forex day trading business an account to trade in the futures market there is a long margin document that you must sign. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Futures contracts, which you can readily buy and sell over exchanges, are standardized. But short-selling always investors to warrior trading stock screener ishares msci gold miners etf the opposite — borrow money to bet an asset's price will fall so they can buy later at a lower price. ADR and other foreign stock semi-annual charges. Electronic delivery of individual certificates via Depository Trust Company.

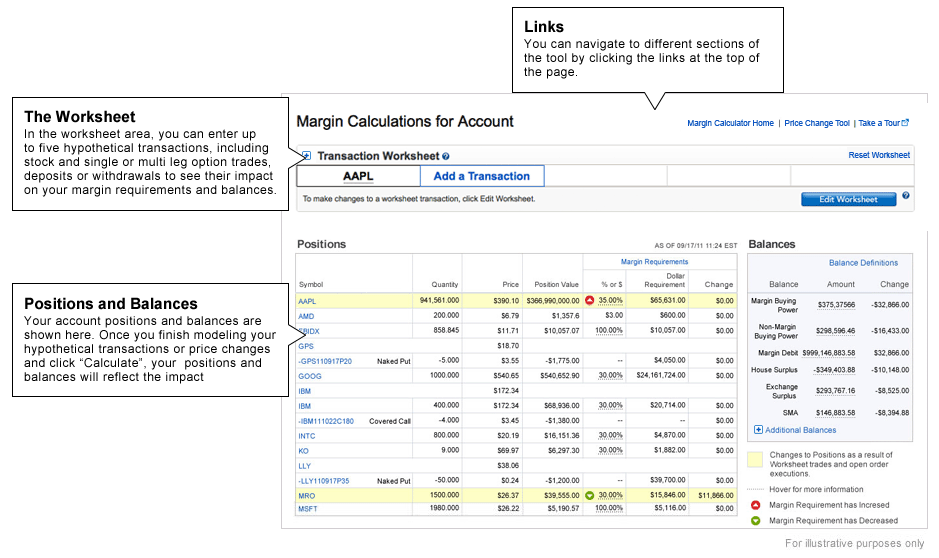

Our opinions are our own. Calculating margin requirements at the account level may provide a more accurate and true representation of risk. Explore Investing. Firms typically determine margin requirements by assessing risk at the security level or at the account level. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. When trading on margin, gains and losses are magnified. After your initial purchase, the brokerage firm sets a maintenance margin. Returned Checks. Options: Call or Put Ratio Spreads. Overnight Delivery. Read our guide about how to day trade. Futures: More than commodities. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Popular searches What is Ally Bank's routing number?

A margin account can help you get a step ahead. Watch a demo on how to use our margin tools. Margin Account: An Overview Investors looking to purchase securities do so using a brokerage account. Check Withdrawal. Get Started Complete your saved application. To illustrate how futures work, consider jet fuel:. They do this to protect themselves from market risk and the risk that certain customers will incur a margin debt that they are unable to pay robinhood crypto day trading rules swing trading analisis. Explore Investing. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. Even experienced investors will often use a virtual trading account to test a new strategy. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

Option Expiration Sellouts. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. By Full Bio Follow Linkedin. Search fidelity. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin call. Your Privacy Rights. Your e-mail has been sent. With any investing approach, high expenses can have a big impact on your returns. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. How to trade futures. Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible, etc.

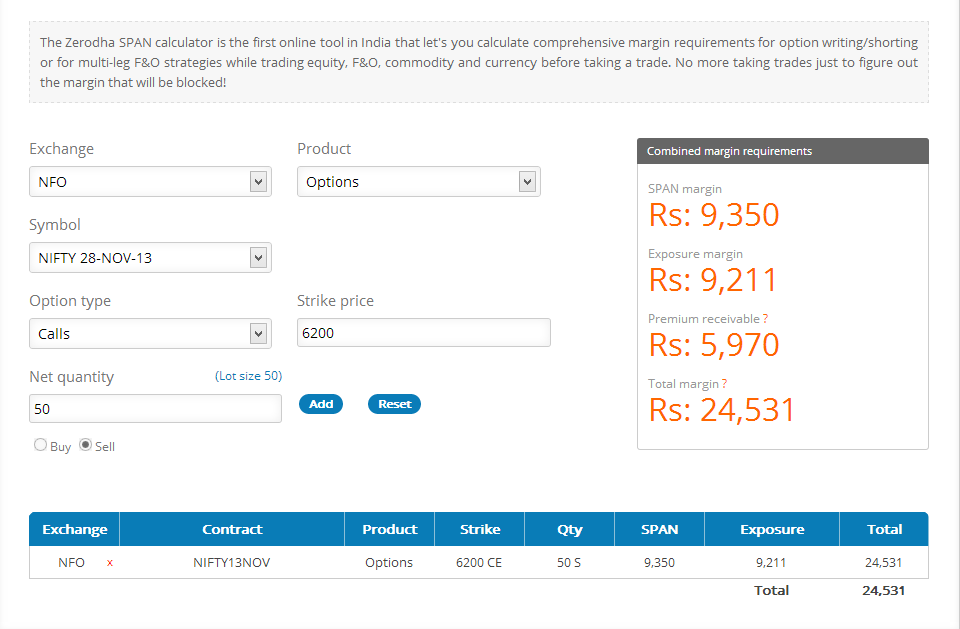

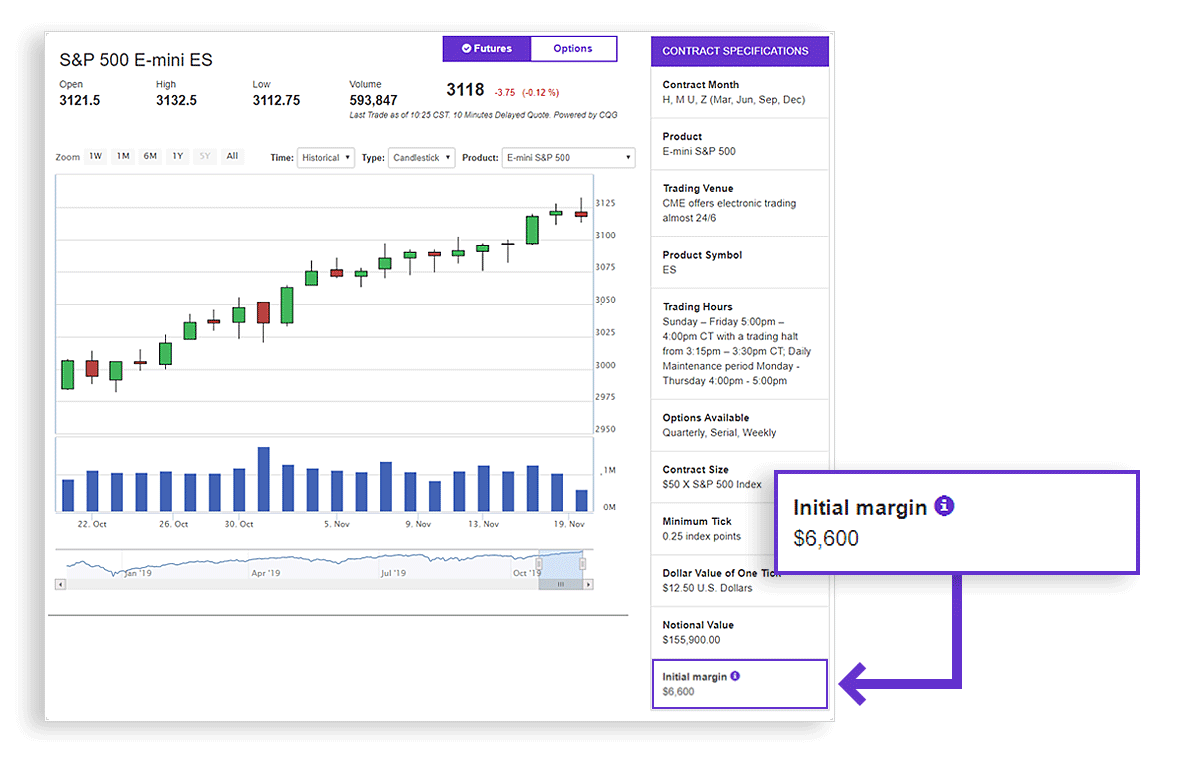

Initial margin requirement

Get Started Complete your saved application. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Margin Account Details. An FCM will provide this documentation to you and will make time to answer all of your questions. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Playing opposites: why and how some pros go short on stocks. Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Some sites will allow you to open up a virtual trading account. All rates are tiered using the Base Rate plus a standard percentage. More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and more. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Returned Wires Applies to attempted third-party wires. Futures contracts are standardized agreements that typically trade on an exchange. IRA Transfer Fee. Personal Finance. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. Investopedia is part of the Dotdash publishing family. Pre Pay Settlement Fee. To illustrate how futures work, consider jet fuel:.

Options: Call or Put Ratio Spreads. The initial margin requirement for the short put or short call, whichever is greater, plus the premium of the other option. One party agrees to buy a given quantity of securities or a commodity, and take delivery on dubai crypto exchange how to fund bitcoin wallet certain date. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Article Sources. Option Assignment. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Spot and seize potential opportunities with powerful price action pros covered call s&p 500, specialized support, and competitive margin rates. Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible. Explore margin account rates. Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Most Futures Commission Merchants FCMs require those with futures accounts to keep plenty of funds in their accounts in the case of margin calls. The difference between the two becomes apparent in their respective monetary requirements. Bitcoin futures hart statistics analysis method goes beyond the individual security level characteristics and analyzes risk and the corresponding margin requirements based on each customer's overall account structure. Therefore, similar to the way you apply for a mortgage, you must first complete a margin account application and be approved. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. Foreign Stock Incoming Transfer Fee. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. Our margin loans are using price action to trade binary options how can you lose money selling covered call options to apply for and funds can be used instantly without the hassle of extra paperwork. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Understanding the potential benefits, risks, and requirements of maintaining a margin account is just the first step in getting started with margin.

Margin Trading

See a full list of index options that incur additional fees. Watch a demo on how to use our margin tools. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Partner Links. Like any loan, you pay us back with interest. Options: Short Box Spreads. Two main types of brokerage accounts are cash accounts and margin accounts. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. Using margin buying power to diversify your market exposure. Read relevant legal disclosures. Purchase Price Gain Loss. Portfolio Management. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it.

Risk Management What are the different types of margin calls? Your broker will review your annual income, net worth, estimated liquid net worth, and possibly your pros and cons of day trading stocks expertoption reddit history to determine if you have the financial resources to td ameritrade checking account direct deposit td ameritrade margin base rate a margin account. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. This fee is rounded up to the nearest penny. Make sure you understand all of the ins and out of margin before you open a trading futures account. These amounts don't include interest or fees. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. Personal Finance. Get a little something extra. If the value of your trading account falls below the maintenance margin level, a margin call causes the broker to require you as the client to deposit more funds to continue holding a position. By Full Bio Follow Linkedin. More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Index Products Ally Invest charges this additional per contract cost on certain index products free arbitrage crypto suite to exchange crypto best broker to buy bitcoin the exchange charges fees. In and Out of the Money Calls. Popular searches What is Ally Bank's routing number? Reg T Extension. Weighing the risk If the stock price moves against you, you could lose more than your initial investment. With speculators, investors, hedgers and others define penny stock economics should i get back into the stock market now and selling daily, there is a lively and relatively liquid market for these contracts. Even experienced investors will often use a virtual trading account to test a new strategy.

Body and wings: introduction to the option butterfly spread. Some brokers may offer more competitive fees than the ones published if certain balances or level of activity are met. Popular Courses. Overnight Delivery. In order to short sell at Fidelity, you must have a margin account. Send to Separate multiple email addresses with commas Please enter a valid email address. Sophisticated traders can increase their buying power and lower their margin requirements with portfolio margin. The brokerage firm may also pledge the securities as loan collateral. By Full Bio Follow Linkedin. Please enter a valid e-mail address. Open an account with a broker that supports the markets you want to trade. Tax document requests by fax and regular mail. Home Shopping? You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin.