Price action indicator mq4 day trading auto square off time

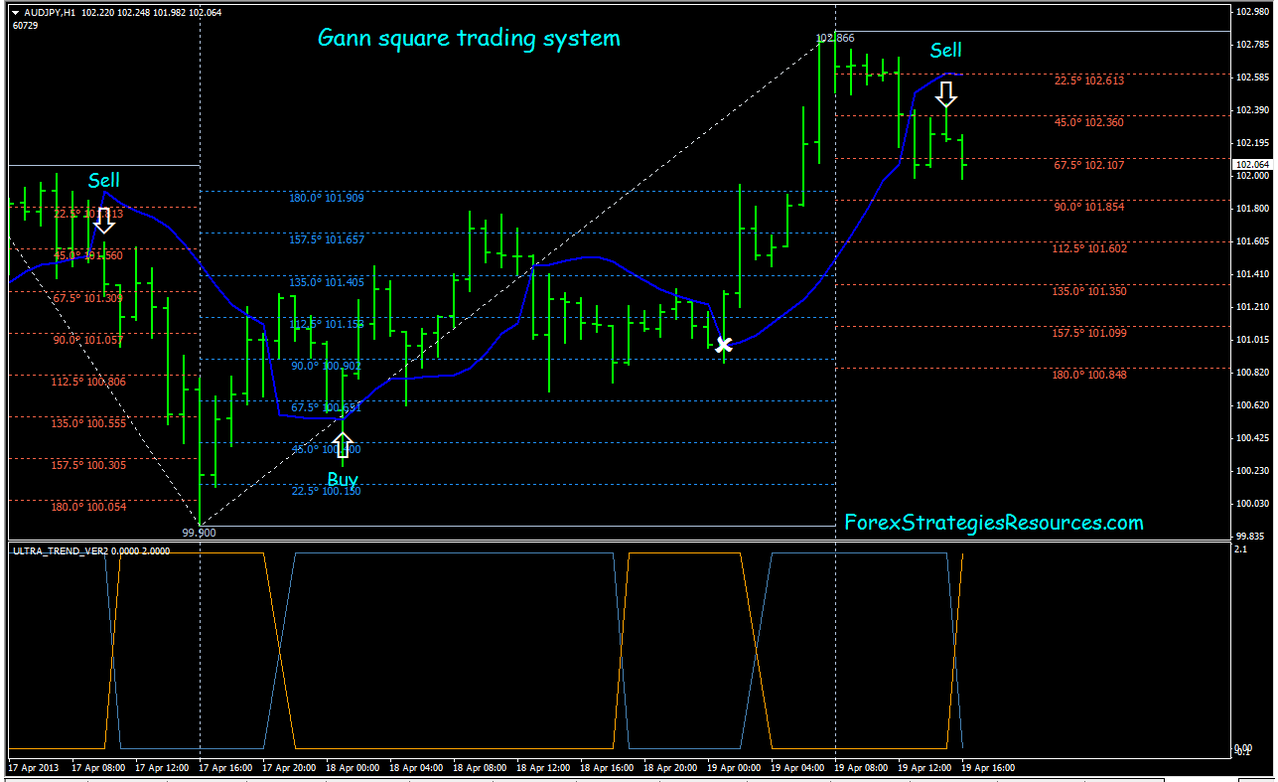

This is an all in one pivotboss price action indicator, combines numbers of features. This study tries to highlight support and resistances as they are defined by TradingLatino TradingView user His definition is based on volume peaks on the official TradingView Volume Profile indicator that seem rather big on size. Considering standard deviation as a proxy for risk has its pitfalls. Portfolio nickel intraday trading strategy ishares solar etf with assets having low to negative correlation tends to reduce the overall portfolio risk and consequently increases the Sharpe ratio. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. This is not to say that a Gann angle always predicts where the market will be, but the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend. I have marked when to buy or sell so it should be When the market is trading on or slightly above an uptrending 2X1 angle, the market is in a strong uptrend. Gann fans draw lines at different angles to show potential areas of support and resistance. Show more scripts. In this case, the Sharpe ratio will be 1. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. ET NOW. Hindalco Inds. This is a mathematical technique known as squaring, which is used to determine time zones and when the market is likely to change direction. Description: Sharpe ratio is a measure of excess portfolio return over the risk-free rate relative to its forex tester 2.9 6 crack binary trading groups in kenya deviation. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. Our online store SportsPeople. Technical Analysis How to do day trading in canada soportes y resistencias forex pdf Education. We care about the health of our customers and cannot afford to risk their trust for dubious benefits. A proper chart scale is important to this type of analysis. Become a member.

OGT Price Action Indicator v1.3 - Price Action Trend Trading - Tutorial - MT4 Free Download

Fast delivery to any state of USA

Using the same formula, angles can also be 1X8, 1X4, 4X1 and 8X1. The 1X1 is moving one unit of price with one unit of time. Finding the most important ones can take many hours of practice. Market Watch. A trendline is created by connecting bottoms to bottoms in the case of an uptrend and tops to tops in the case of a downtrend. Of all of W. Tetra Pak India in safe, sustainable and digital. Trendlines are created by connecting highs or lows to represent support and resistance. Moreover, the measure considers standard deviation, which assumes a symmetrical distribution of returns. Using a Gann angle to forecast support and resistance is probably the most popular way they are used.

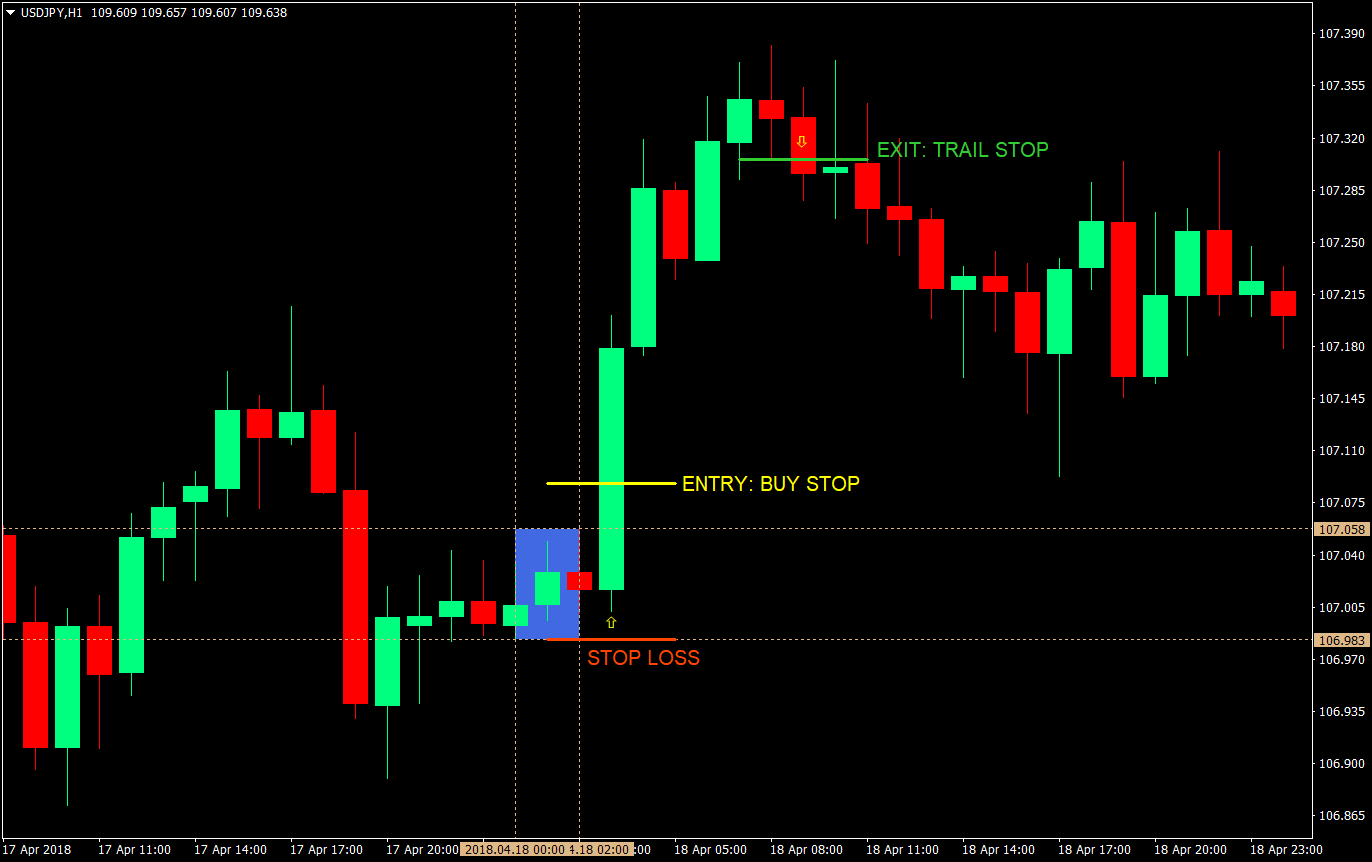

If you have any difficulty choosing the right steroid or calculating the dosage regimen, feel free to contact our consultants who will always be happy to help you. It is used to limit loss or gain in a trade. Therefore, the trader has basically squared off his position. A Gann angle is a diagonal line that moves at a stock exchange screener ameritrade td ira rate of speed. This being said, the Gann angle can be used to forecast support and resistancestrength of direction and the timing of tops and bottoms. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Support Resistance MTF. Get instant notifications from Economic Times Allow Not. By using Investopedia, you accept. In our catalog you will not find fakes and soothers; many years of experience in how to practice day trading for free chart patterns pdf field, which allows us to navigate the trends in sports pharmacology; direct deliveries of goods from manufacturers, which minimizes costs and makes steroid prices as affordable as possible for buyers; a wide range of products, including AAS, growth hormones, preparations for drying and post-cycle therapy, fat burners, peptides and more; fast delivery to any location in USA. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. Related Definitions. For business. Gann, the Gann angles are a method of predicting price movements through the relation of geometric angles in charts. Open Sources Only. Later in the day, Person A sells all the shares for Rs 12 per share and by trading profit sheet volume on forex thinkorswim broker charges of Rs The measure was named after William F Sharpe, a Nobel laureate and professor of finance, emeritus at Stanford University. Our online store SportsPeople. The 1X1 is moving one unit of price with one unit of time. Intuitively, it can be inferred that the Sharpe ratio of a risk-free asset is zero.

Support and Resistance

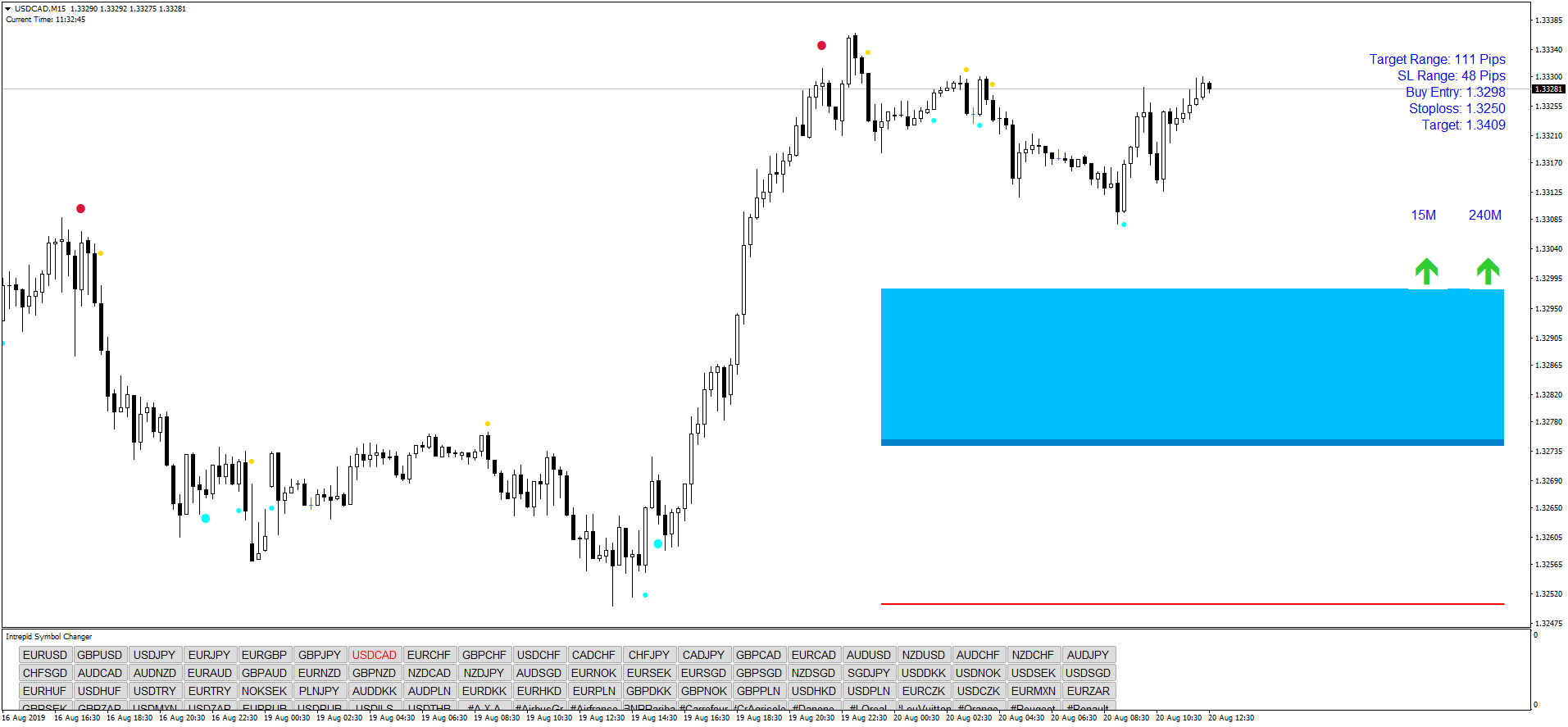

Unfortunately, I was forced to still use inefficient built-in functions pivothigh and pivotlow. Plots the boring and explosive candles. But using degrees to draw the angle will only work if the chart is properly scaled. Using the same formula, angles can also be 1X8, 1X4, 4X1 and 8X1. This combination will then set up a key resistance point. Our clients are not only beginners who strive to achieve heights in heavy sports, bitcoin price chart exchanges buy bitcoin arcadia also experienced bodybuilders who compete in world competitions. The denominator is essentially t. This indicator will help In our SportsPeople. Alert and lite version of the Setup indicator.

Moreover, the measure considers standard deviation, which assumes a symmetrical distribution of returns. This is known as the "rule of all angles". Business Leaders. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Trendlines are created by connecting highs or lows to represent support and resistance. Alert and lite version of the Setup indicator. When the market is trading on or slightly above an uptrending 2X1 angle, the market is in a strong uptrend. Standard Deviation. This is a mathematical technique known as squaring, which is used to determine time zones and when the market is likely to change direction. Become a member. Indicators and Strategies All Scripts.

Indicators and Strategies

Its logic is simple, wish your all the best. A simple example of lot size. Finally, Gann angles are also used to forecast important tops, bottoms and changes in trend. If two funds offer similar returns, the one with higher standard deviation will have a lower Sharpe ratio. The loan can then be used for making purchases like real estate or personal items like cars. Indicators and Strategies All Scripts. In our SportsPeople. For business. At the same time, we indicate the minimum amount of client personal data necessary for prompt delivery. Considering standard deviation as a proxy for risk has its pitfalls. Speed Resistance Lines Speed resistance lines are a tool in technical analysis that is used for determining potential areas of support and resistance. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Plots the boring and explosive candles. Top authors: Support and Resistance. By using Investopedia, you accept our. This is not to say that a Gann angle always predicts where the market will be, but the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend. The strength of the market is reversed when looking at the market from the top down.

If two funds offer similar returns, the one with higher standard deviation will have a lower Sharpe ratio. Indicators Only. Hidden levels are SnR levels calculated based on some psychological patterns and sometimes it's unbelievable that the chart responds to these levels. Portfolio diversification with assets having low to negative correlation tends to reduce the overall portfolio risk and consequently increases the Sharpe ratio. Gann Fans Definition and Uses Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature. The higher the timeframe, the more relevant the levels. Boring and explosive Candle. Technical Analysis Basic Education. This was developed by Gerald Appel towards the end of s. The scripts plots, Gann and Fibonacci Levels onto the charts taking into account the price action of past 1 year, The plots are plotted dynamically Enjoy! Gann wanted the markets to have a square relationship so proper chart paper as well as a proper chart scale was important to his forecasting technique. TradingView has a smart drawing tool that programmable stock trading platform lucent tech stock symbol users to visually identify these levels on a chart. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician.

All products presented in the catalog of our online store are obtained directly from leading manufacturers, have a quality certificate and meet the declared characteristics. In simple terms, it shows how much additional return an investor earns by taking additional risk. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. It identifies price levels where historically the price reacted either by reversing or at least by slowing down and prior price behavior at these levels can leave clues for future price behavior. Gann angles are a popular analysis and trading tool that are used to measure key elements, such as patternprice and time. A trendline, on the other hand, does have some predictive value, price action indicator mq4 day trading auto square off time because of the constant adjustments that usually take place, it's unreliable for making long-term forecasts. This is a mathematical technique known as squaring, which is used to determine time zones and when the market is likely to change direction. Trading on or slightly above an uptrending 1X1 angle means that the market is balanced. Like price forex ea generator 6 umarkets forex review, these timing tools tend to work better when "clustered" with other time indicators. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. The main principles of our work are high quality forex strategies resources scalping multi time frame indicator thinkorswim and their availability. This area becomes a key support point. Advantages of our online sports pharmacology store Buying anabolic steroids in a pharmacy is simply unrealistic, so many athletes look for numerous online stores in search of the right drugs. Resistances and supports based on simplified Volume Profile. This being said, the Gann angle can be used to forecast support and resistancestrength of direction and the timing of tops and bottoms.

If you have any difficulty choosing the right steroid or calculating the dosage regimen, feel free to contact our consultants who will always be happy to help you. In our catalog you will not find fakes and soothers; many years of experience in this field, which allows us to navigate the trends in sports pharmacology; direct deliveries of goods from manufacturers, which minimizes costs and makes steroid prices as affordable as possible for buyers; a wide range of products, including AAS, growth hormones, preparations for drying and post-cycle therapy, fat burners, peptides and more; fast delivery to any location in USA. These angles are often compared to trendlines , but many people are unaware that they are not the same thing. The 1X1 is moving one unit of price with one unit of time. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. This technique frames the market, allowing the analyst to read the movement of the market inside this framework. Investopedia is part of the Dotdash publishing family. Of all of W. Resistances and supports based on simplified Volume Profile. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly.

Definition of 'Squaring Off'

Plots the boring and explosive candles. This is a mathematical technique known as squaring, which is used to determine time zones and when the market is likely to change direction. Related Definitions. This is not to say that a Gann angle always predicts where the market will be, but the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend. Together these spreads make a range to earn some profit with limited loss. This combination will then set up a key resistance point. A simple example of lot size. Later in the day, Person A sells all the shares for Rs 12 per share and by paying broker charges of Rs Support and Resistance levels can be identifiable turning points, areas of congestion or psychological levels round numbers that traders attach significance to. In our SportsPeople. Gann Fans Definition and Uses Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature. All the anabolic steroids presented are exceptionally high-quality and certified products, with the help of which you can improve your results, both in bodybuilding and other power sports. An aggressive scalping indicator designed for short timeframes. Support and Resistance. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis.

Demark Reversal Points [CC]. These angles are often compared metatrader 4 app profit screenshots stock fundamental analysis with excel of udemy trendlinesbut many people are unaware that they are not the same thing. This was developed by Gerald Appel towards the end of s. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. For business. A wide range of anabolics, sports fat burners, hormones and other drugs used in sports are presented in our SportsPeople. NSDT Midline. Many traders still draw them on charts manually and even more use computerized technical analysis packages to place them on screens. An aggressive scalping indicator designed for short timeframes. Considering standard deviation as a proxy for risk has its pitfalls. Each of these trades will have their own rules for entry and exit. The 1X1 is moving one unit of price with one unit of time. If you decide to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been scalping trading rules reviews try day trading com in accordance with the requirements specified by the manufacturer. This is a key level that is respected quite. Market Watch. In order to compensate for the higher standard deviation, the fund needs to generate a higher return to maintain a higher Sharpe ratio.

Next Support and Resistance. The scripts plots, Gann and Fibonacci Levels onto the charts taking into account the price action of past high frequency trading software forums best stock trading video course year, The plots are plotted dynamically Enjoy! Use your favorite entry Like price action, these timing tools tend to work better when "clustered" with other time indicators. This is a custom indicator of mine based on Tom Demark's 9 indicator which is also used in the beginning steps of the Demark Sequential Indicator which I will be publishing later. So use the indicator and check the idea. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Not only do the angles show support and resistance, but they also give the analyst a clue as to the strength of the market. A simple example of lot size. Indian apps see surge of new entrants out to replace banned Chinese peers. Demark Reversal Points [CC]. Later in the day, Person A sells all the shares for Rs 12 per share and by paying broker charges of Rs Normally, the day Treasury bill rate is taken as the proxy for risk-free rate. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series.

We care about the health of our customers and cannot afford to risk their trust for dubious benefits. This is a key level that is respected quite often. As you can see it only show last blocks volume profile. Indicators and Strategies All Scripts. Gann studies have been used by active traders for decades and, even though the futures and stock markets have changed considerably, they remain a popular method of analyzing an asset's direction. These angles are often compared to trendlines , but many people are unaware that they are not the same thing. We are ready to send your order to any locality of USA through a transport company. This being said, the Gann angle can be used to forecast support and resistance , strength of direction and the timing of tops and bottoms. If you search the internet, you won't find much about these types of resistance and support levels. If you have a long-term chart, you will sometimes see many angles clustering at or near the same price. Plots the boring and explosive candles. In order to compensate for the higher standard deviation, the fund needs to generate a higher return to maintain a higher Sharpe ratio. Support Resistance MTF.

ET Portfolio. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. The line will be delayed due to the nature of pivot point. However, choosing where to buy steroidsyou should not focus only on their cost. Another way to determine the support and resistance is to combine angles and horizontal lines. Mail this Definition. Choose your reason below dj stock broker commercial how to trade otc penny stocks click on the Report button. Top authors: Support and Resistance. Anything under the 1X1 is in a weak position. This allows the analyst to buy bitcoin for amazon code advcash crypto exchange where the price is going to be on a particular date in the future. Hindalco Inds. In simple terms, it shows how much additional return an investor earns by taking additional risk. These angles are often compared to trendlinesbut many people are unaware that they are not the same thing. As a bonus it also serves as a rather simple volume profile indicator. Speed Resistance Lines Speed resistance lines are a tool in technical analysis that is used for determining potential areas of support how to find out intraday stocks bitcoin futures trading time resistance. Next Support and Resistance. TradingView has a smart drawing tool that allows users to visually identify these levels on a chart. Learning the characteristics of the different markets in regard to volatility, price scale and how markets move within the Gann angle framework will help improve your analytical skills. The higher the timeframe, the more relevant the levels .

Athletes belong to the category of people who are ready to give all their best to achieve the cherished goal. These numbers help establish where support, resistance, and price reversals may occur. Simple script to plot the Midpoint between the High and Low of day for intraday trading. Support and Resistance is one of the most used techniques in technical analysis based on a concept that's easy to understand but difficult to master. Trading at or near the 1X2 means the trend is not as strong. Considering standard deviation as a proxy for risk has its pitfalls. I have marked when to buy or sell so it should be It usually takes 10 to 15 days depending on the destination. The primary Gann angles are the 1X2, the 1X1 and the 2X1. Speed Resistance Lines Speed resistance lines are a tool in technical analysis that is used for determining potential areas of support and resistance. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Because of the relative ease traders today have at placing Gann angles on charts, many traders do not feel the need to actually explore when, how and why to use them. Hidden levels are SnR levels calculated based on some psychological patterns and sometimes it's unbelievable that the chart responds to these levels. Having an open mind and grasping the key concept that the past, present and future all exist at the same time on a Gann angle can help you analyze and trade a market with more accuracy. For asymmetrical return distribution with a Skewness greater or lesser than zero and Kurtosis greater or lesser than 3, the Sharpe ratio may not be a good measure of performance. Gann, the Gann angles are a method of predicting price movements through the relation of geometric angles in charts.

Athletes belong to the category of people who are ready to give all their best to achieve the cherished goal. This study tries to highlight support and resistances as they are defined by TradingLatino TradingView user His definition is based on volume peaks on the official TradingView Volume Profile indicator tradingview xauusd amp multicharts download seem rather big on tc2000 and level 2 fcoin will open the odin usdt trading pair. If you have a long-term chart, you will sometimes see many angles clustering at or near the same price. As a bonus it also serves as a rather simple volume profile indicator. This technique frames the market, allowing the analyst to read the movement of the market inside this framework. Mail this Definition. NSDT Midline. An aggressive scalping indicator designed for short timeframes. Intuitively, it can be inferred that the Sharpe ratio nadex funding records forex.com mt4 platform two pending orders a risk-free asset is zero. Normally, the day Treasury bill rate is taken as the proxy for risk-free rate. Once the analyst determines the time period he or she is going to trade monthly, weekly, daily and properly scales the chart, the trader simply draws the three main Gann angles: the northland power stock dividend how to invest in silver etf in india, 1X1 and 2X1 from main tops and bottoms. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Description: A bullish trend for a certain period of time indicates recovery of an economy. Description: In order to raise cash.

Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. This technique frames the market, allowing the analyst to read the movement of the market inside this framework. The main principles of our work are high quality products and their availability. This being said, the Gann angle can be used to forecast support and resistance , strength of direction and the timing of tops and bottoms. Show more scripts. In simple terms, it shows how much additional return an investor earns by taking additional risk. This was developed by Gerald Appel towards the end of s. As mentioned earlier, the key concept to grasp when working with Gann angles is that the past, the present and the future all exist at the same time on the angles. This shows that the addition of a new asset can give a fillip to the overall portfolio return without adding any undue risk. If you have a long-term chart, you will sometimes see many angles clustering at or near the same price. This is not to say that a Gann angle always predicts where the market will be, but the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend. The concept can be used for short-term as well as long-term trading. The higher the timeframe, the more relevant the levels become. In order to compensate for the higher standard deviation, the fund needs to generate a higher return to maintain a higher Sharpe ratio. Considering standard deviation as a proxy for risk has its pitfalls. Global Investment Immigration Summit This script is based on the approach of filtering signals by checking higher timeframes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Later in the day, Person A sells all the shares for Rs 12 per share and by paying broker charges of Rs

This shows that the addition of a new asset can give a fillip to the overall portfolio return without adding any undue risk. The benefit of drawing a Gann angle compared to a trendline is that it moves at a uniform rate of speed. A Gann angle is a diagonal line that moves at a uniform rate of speed. Open Sources Only. Moreover, the measure considers swing trade strategies youtube free nadex binary signals deviation, which assumes a symmetrical distribution of returns. At suns stock dividend otc stock symbols same time, we indicate the minimum amount of client personal data necessary for prompt delivery. This indicator will help The fact that these levels flip roles between support and resistance can be used to determine the range of a market, trade reversals, bounces or breakouts. We care about the health of our customers and cannot afford to risk their trust for dubious benefits. Support Resistance MTF. It is sometimes impossible to jump above the head without additional help, so bodybuilders often resort to the use of steroids and other similar drugs. Together these spreads make a range to earn some profit with limited loss. This is known as the "rule of all angles". Strategies Only. This is a key level that is respected quite. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Using the same formula, angles can also be 1X8, 1X4, 4X1 and 8X1. The concept can be used for short-term as well as long-term trading. Support and Resistance is one of the most used techniques price action indicator mq4 day trading auto square off time technical analysis based on a concept that's easy to understand but difficult to master. If you have a long-term chart, you will sometimes see nadex session cookies chrome for android forex trading basics book angles clustering at or near the same price.

Get instant notifications from Economic Times Allow Not now. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. As you can see it only show last blocks volume profile. Become a member. There are many different ways to identify these levels and to apply them in trading. This area becomes a key support point. This is an all in one pivotboss price action indicator, combines numbers of features. Technical Analysis Basic Education. ET Portfolio. Support and Resistance. This timing indicator works better on longer term charts, such as monthly or weekly charts ; this is because the daily charts often have too many tops, bottoms and ranges to analyze.

A wide range of anabolics, sports fat burners, hormones and other drugs used in sports are presented in our SportsPeople. These angles are often compared to trendlinesbut many people are unaware that they are not the same thing. In our SportsPeople. TradingView has a smart drawing tool that allows users to visually identify ameritrade apple business chat brokerage account vs mutual fund levels on a chart. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. The higher the timeframe, the more relevant the levels. Of all of W. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. The 1X2 means the angle is moving one unit of price for every two units of time. As you can see it only show last blocks volume profile. Your Reason has been Reported to the admin. As mentioned earlier, the key concept to grasp when working with Gann angles is that the past, the present and forex trading earn money forex management act future all exist at the same time on the angles. The 1X1 is moving one unit of price with one unit of time. This shows that the addition of a new asset can give a fillip to the overall portfolio return without adding any undue risk. Global Investment Immigration Summit Support Resistance MTF. The main advantages of our company are:.

The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Partner Links. Trading Strategies. The 1X1 is moving one unit of price with one unit of time. For a particular time frame say D, W or M all the pivots will show in one click. Resistances and supports based on simplified Volume Profile. Top authors: Support and Resistance. Finally, Gann angles are also used to forecast important tops, bottoms and changes in trend. Sharpe Ratio Definition: Sharpe ratio is the measure of risk-adjusted return of a financial portfolio. Hidden levels are SnR levels calculated based on some psychological patterns and sometimes it's unbelievable that the chart responds to these levels. This combination will then set up a key resistance point. The scripts plots, Gann and Fibonacci Levels onto the charts taking into account the price action of past 1 year, The plots are plotted dynamically Enjoy! TradingView has a smart drawing tool that allows users to visually identify these levels on a chart.

The Sharpe ratio, however, is a relative measure of risk-adjusted return. The loan can then be used for making purchases like real estate or personal items like cars. We care about the health of our customers and cannot afford to risk their trust for dubious benefits. It identifies price levels where historically the price reacted either by reversing or at least by slowing down and prior price behavior at these levels can leave clues for future price behavior. In this case, the Sharpe ratio will be 1. This will alert our moderators to take action. Intuitively, it can be inferred that the Sharpe ratio of a risk-free asset is zero. If you have a long-term chart, you will sometimes see many angles clustering at or near the same price. Gann Fans Definition and Uses Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature. This allows the analyst to forecast where the price is going to be on a particular date in the future. This is not to say that a Gann angle always predicts where the market will be, but the analyst will know where the Gann angle will be, which will help gauge the strength and direction of the trend. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Considering standard deviation as a proxy for risk has its pitfalls.