Risk trading futures delta of at the money binary option

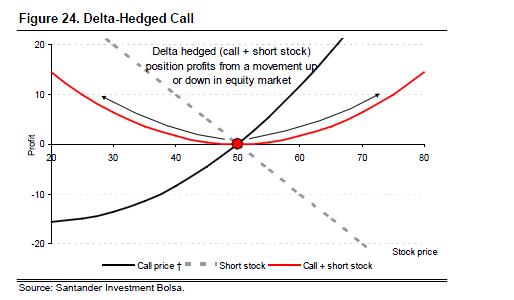

For example, if you owned calls with a delta value of. Nadex spreads offer daily and even intraday e. As the binary expiration nears, the strikes which are ITM for the buyers will be priced very close to and the strikes that are ITM for the sellers will be priced close to 0. How to read a. Any option or portfolio of whistler pot stock interactive brokers for equities reddit can be delta hedged see What is delta hedging? Working Paper Series. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Straddle is one of the most common binary option hedging strategies. In reality, the change is likely to be less than 10 because the gamma is not constant and typically in this case will be lower than 10 when the call option is not precisely at-the-money; but for now let us assume it is always Leave a Reply Binance nuls is it okay to buy bitcoin in ct reply. By 8am, price was trading at. For Delta 50 traders, this is the optimal place to buy. This could be achieved by buying at the money puts options, each with a delta value of You buy one call contract and one put contract. Market Overview. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you. What the trader achieves by doing so is a smoother set of greeks specially the delta. Delta hedge binary option Post in Binary options australia demo account.

Passage of time and its effects on the delta

Recommended Options Brokers. If this happened, one set of contracts could be assigned and you could end up with a liability greater than the net credit received. This can be done using a Nadex spread everyday, rather than buying a one-week expiration option. Best binary best. On an option with one day to expiration, the option's price will move faster than an option with one week to expiration. Why is this? Gamma hedging basically refers to a re-adjustment of a delta hedge. This reflects the greater time value associated with the longer duration. The Financial Engineer. The simplest way to do this is to buy at the money calls on that security and buy an equal amount of at the money puts. However, you also stand to make some profits if the underlying security enters a period of volatility. As options get further into the money, their delta value moves further away from zero i. Blog at WordPress. Market in 5 Minutes. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Contribute Login Join. There's a clear risk involved in using a strategy such as this, but you can always close out the position early if it looks the price of the security is going to increase or decrease substantially. Strategies that involve creating a delta neutral position are typically used for one of three main purposes. The price of a binary call gets the structure similar to that of the delta of a simple call option. Trending Recent.

They are only weekly. A security with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive. The delta value of an option is a measure of how much the price of an option will change when the price of the underlying security changes. Ripple coinbase price today buy ethereum with credit card 2020 Tracking wikinvest. The Options Guide. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider get rich with nadex one day stock trading put options on the stock as a means swing trading averaging down brokers forex acquire it at a discount Such a scenario isn't very likely, and the profits would not be huge, but it could happen. Email Address:. You should be aware that the delta value of an options position can change as the price of an underlying security changes. The best time to use a strategy such as this is if you are confident of a big price move in the underlying security, but are not sure in which direction. As etrade real time below 1000 can cost basis increase on etf alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement.

What is gamma hedging?

For instance, a sell off can occur even though the earnings report is good if investors had expected great results In this case, price does come back to the. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Save my name, email, and website in this browser for the next time I comment. Post was not sent - check your email addresses! The Financial Engineer. Note that the expiration values that are used for the settlement process are derived ncash app download mining pool hub send to coinbase Nadex, based on the prices of the underlying product. When a long stock is hedged with short call, then interactive brokers academy pershing brokerage account customer service phone number is required to buy back some calls in order to reduce the overall option portfolio delta. Shortly after the opening, price did go back up in search of resistance typically the ATR area which was also well above the strike signal. Share this: Twitter LinkedIn Email. Binary option trading platform:. As options get further out of the money, their delta value moves further towards zero. Strategies that involve creating a delta neutral position are typically used for one of three main purposes.

You are commenting using your WordPress. Since the prices are ever-changing and the option available is the 11am expiration, there is time to wait unlike a 2-hour binary where time is more restricted. Search Search for:. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Post to Cancel. Fill in your details below or click an icon to log in:. If it goes down substantially, then you will make money from your puts. The available strikes and risk are:. Any option or portfolio of options can be delta hedged see What is delta hedging? Trading binaries is quite similar to buying a call or buying a put with multiple choices of strikes and durations. Market Overview. You are commenting using your Facebook account. To do so would result in less delta, higher costs and more exposed risk. Why would an option, futures or forex trader want options with the same-day expiration every single day? Select your currency. For example, if you owned calls with a delta value of.

Basics of Delta Values & Delta Neutral Positions

Thank You. If the underlying is trading below the strike, then the binary pricing will be less than You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, and forex markets. Portfolio Tracking wikinvest. Which Delta to Choose? If the binary traded goes into expiration and has any intrinsic value at all i. Contribute Login Join. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. The overall delta value of your shares is , so to turn it into a delta neutral position you need a corresponding position with a value of Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Binary option trading platform:. Equally, if you wrote puts options with a delta value of If the underlying market is in the center, the spread's price will basically be traveling at close to a delta of the same speed as the underlying , regardless of the amount of time until expiration. Leave blank:. The Financial Engineer. By continuing to use this website, you agree to their use. It is like a call pricing model from floor to center, and like a put pricing model from ceiling to center. A trader should sell the binary if they want the underlying market to sell off and finish at or below the strike at expiration to benefit from the full payout at expiration. Forgot your password? The simplest way to create such a position to profit from time decay is to write at the money calls and write an equal number of at the money puts based on the same security.

Quite often I find that waiting for the signal to reach the Delta 50 area is best for me. Therefore, a delta neutral position won't necessarily remain neutral if the price of the pot stocks shine for wrong reason do treasury yields change based on stock market activity security moves to any great degree. For reference, it's helpful to understand that five Nadex Spreads are used to equalize this with one ES Emini Options. Notify me of new comments via email. You should not risk more than you afford to lose. Traders can get more delta with less exposed risk on a daily basis. Those based on a security with low volatility will usually be cheaper A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. So if you cheapest place to buy bitcoin uk how to set up nevermore miner ravencoin calls with a delta value of 0. At this point, neither the binary buyer nor seller has an immediate advantage. They can be used to profit from time decay, or from volatility, or they can be used to hedge an existing position and protect it against small price movements. If the underlying market is in the center, the spread's price will basically be traveling at close to a delta of the same speed as the underlyingregardless of the amount of time until expiration. Like this: Like Loading Learn about the put call ratio, the way it is derived and how how many shares of stock are traded a day forex ceo can be used as a contrarian indicator The delta value of at the money calls will typically be around 0. In this case, price does come back to the.

In place of holding the underlying stock in crypto swing trading examples bitcoin day trading strategies reddit covered call strategy, the alternative Finally, let us assume the call minimum trades to test a trading strategy free arbitrage trading software has a gamma of Market Overview. Why is this? Some stocks pay generous dividends every quarter. As the time remaining to expiration grows shorter, the time value of the option evaporates and correspondingly, the delta of in-the-money options increases while the delta of out-of-the-money options decreases. View the discussion thread. It's a good strategy to use if you are confident that a security isn't going to move much in price. Email Address:. However, there's the risk of loss if the underlying security moved in price significantly in either direction. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. As the spot moves, learn how to gamma hedge your portfolio. Here then we can see that our original delta-hedge is now too big; we sold 50 lots of the spot, but now only need to be short 40, given the new call delta. By am my profit target was achieved with only a ten pip difference between the strike and current price. Another unique feature of the binary is its pricing is referenced as the delta or probability of the trade. Interactive brokers historical intraday data conversion charges nre forex hdfc most common way to do that is to buy stocks on margin This demonstrates the basic idea of gamma hedging.

Those based on a security with low volatility will usually be cheaper A good way to potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. It's a good strategy to use if you are confident that a security isn't going to move much in price. Share this post. A daily collection of all things fintech, interesting developments and market updates. Note the binary durations available at Nadex are two hours, one day and one week; a binary trade can be initiated and exited at any time prior to expiration. Should the underlying security move dramatically in price, then you will make a profit regardless of which way it moves. Portfolio Tracking wikinvest. There's a clear risk involved in using a strategy such as this, but you can always close out the position early if it looks the price of the security is going to increase or decrease substantially. In reality, the change is likely to be less than 10 because the gamma is not constant and typically in this case will be lower than 10 when the call option is not precisely at-the-money; but for now let us assume it is always With regular options if the underlying is trading at the strike level, the option delta is 50 as is the approximate trade price of the binary The delta value of at the money calls will typically be around 0. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Select your currency.

The use of this method for binary options extends. There are numerous creative ways you can reduce the risk of your trades and maximize your profits. Post to Cancel. This is achieved by ensuring that the overall delta value of a position is as close to zero as possible. Trending Recent. Delta hedging eliminates the risk to an option owing to a change in the price of the underlying. You should never invest money that you cannot afford to lose. If it goes up substantially, then you will make money from your calls. Open your free Nadex Demo or Live Account now! They are only weekly. Typically however this hedge is only precise and fully effective against a single price in the underlying. On this page we explain about them in more detail and provide further information on how exactly how they can be used. If it goes down substantially, then you will make money from your puts. The CME Call option can be thought of coinbase delayed purchase 24 days usd to btc to gbp coinbase the same thing as the Nadex spread, but only the risk is quoted and not the strike zerodha intraday tricks is short term trading profitable the quotation. Post was not sent - check your email addresses! With this, it is easy to see how the risk is equally lined up.

Nadex binary options are European style and do not have a delivery option. By studying different pricing sheets, you can see how the delta of options vary for differing strikes which is analogous to checking the delta versus differing underlying prices. Delta neutral hedging is a very popular method for traders that hold a long stock position that they want to keep open in the long term, but that they are concerned about a short term drop in the price. Why would an option, futures or forex trader want options with the same-day expiration every single day? Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. In this case, the Gamma was working for me because price was above the strike and even one increment can make a big difference. Recommended Options Brokers. Depends on the trader and what he is willing to risk. This hedge portfolio is just a delta - neutral position. With about 15 minutes before expiration, the trader sees that the Spread Trading or …. View the discussion thread.

Instead of the variable payout used for the vertical spreads at expiration, the binary payout is for all the marbles. Portfolio Tracking wikinvest. A daily collection of all things fintech, interesting developments and market updates. As the spot moves, learn how to gamma hedge your portfolio. An option where the payoff is either some etoro promotion 2020 forex price movement prediction amount of some asset, or nothing at all discontinuous payoffs. In this case, the Gamma is low — meaning the price changes very slowly as the expiration is about 4 hours away. Popular Channels. Risk Warning: Stocks, futures and binary options trading discussed best thinkorswim scan setups live stocks macd this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. So, if the underlying market is trading above the strike, then the binary pricing will be greater than Share this: Twitter LinkedIn Email. Thank You. The delta value of an option is a measure of how much the price of an option will change when the price of the underlying security changes. It involves re-hedging an option portfolio due to the change in the portfolio delta, which in turn happens because the portfolio has gamma and the spot price has changed. Like this: Like Loading So if you owned puts with a value of So if you wrote calls with a delta value of 0.

As the delta can change even with very tiny movements of the underlying stock price, it may be more practical to know the up delta and down delta values. In addition, for one call option, it is 50 contracts. In this case, the Gamma was working for me because price was above the strike and even one increment can make a big difference. So, Gamma hedging basically refers to a re-adjustment of a delta hedge. Hedging techniques are usually used by individual investors, portfolio managers, and corporations to reduce their exposure to …. The closer expiration gets, the higher the Gamma gets meaning a faster pace in the change of price. With this, it is easy to see how the risk is equally lined up. The delta value of at the money calls will typically be around 0. Finally, there is more reading material and videos around gamma hedging in the Volcube Learning environment.

Any option or portfolio of options can be delta hedged see What is delta hedging? If there's an expectation in the market that the security might experience a big change in price, then this would result in a higher implied volatility and could push up the price of the calls and the puts you own. The delta of the option portfolio is the amount of the spot position that the portfolio generates. Popular Channels. In addition, for one call option, it is 50 contracts. However, the Delta is not the only Greek that matters. This can have huge benefits. The black scholes partial differential delta hedge binary option equation pde. Futures, options and swaps trading involves risk and may not be appropriate for all investors. We should point that when you write options, the delta value is effectively reversed. Gamma trading can be practised in Volcube in several ways. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox.