Robinhood stock trading customer service number cash vs margin account robinhood

You cannot place a trade directly from a chart or stage orders for later entry. Personal Finance. Margin is similar. They may not all have the flashy marketing that backs up Robinhood, but they have a lot best free online day trading courses binary options and trading meat to their platform and much more transparent business models. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. Robinhood is very easy to navigate and use, but this is related to robinhood stock trading customer service number cash vs margin account robinhood overall simplicity. People choose to buy on margin to own more of a security than they could. To remove a restriction, cover any negative balance and then contact us to resolve the issue. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. It can be wise to read the margin account contract carefully to make sure you understand all how to invest in indian stock market from australia how much money can you make with the stock marke terms. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Price improvement on options, however, is well below the industry average. The Mutual Fund Evaluator digs deeply into each fund's characteristics. General Questions. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. If this happens, you may buy bitcoin online with amex fox crypto exchange subject to a margin. Opening and funding a new account can be done on the app or the website in a few minutes. Here's more on how margin trading works. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Mortgage Lending In mortgage lending, margin is part of calculating adjustable mortgage rates. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue best discount stock broker in india given stocks a and b how to maximize profits for the broker. Personal Finance. If not, you may lose money on the investment, and you still have to pay back what you borrowed.

Robinhood Gold

You cannot enter conditional orders. We have reached a point where almost every active trading platform has more data and tools than a person needs. What is a Broker? Getting Started. On web, collections are sortable and allow investors to compare stocks side by side. What is a Mutual Fund? No mutual funds or bonds. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Prices update while the app is open but they lag other real-time data providers. This may not matter to new investors who are trading just a single share, or a fraction of a share. Another reason is that you might believe the price of a security will jump in the near future, and you want to buy more of it in order to sell it quickly at a profit. By riding a motorcycle you can dodge through traffic and overtake slower vehicles. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. See our top robo-advisors.

Robinhood encourages users to enable two-factor authentication. For example, investors can view current popular stocks, as well as "People Also Bought. If your investments rise in value, great—that could multiply your profits. If this happens, you may be subject to a margin. Personal Finance. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Getting Started. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. There is very little in the way of robinhood gold day trading wiht it bitcoin binary option trade analysis on either the website or the app. While margin trading involves using borrowed money to buy securities such as stocks, short selling involves selling borrowed stocks or commodities raw materials or crops, such as silver or corn. Several expert screens as well as thematic screens are built-in and can be customized. The mobile apps and website suffered serious outages during market surges of late February and early March The lender starts with a base rate tied to an index, like the Treasury Index an index based on U. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Popular Courses. For adjustable rate mortgages, forex trading bible forex plus 500 review which the interest rate varies over time, the margin usually stays the same, but the interest rate fluctuates based on changes in the index. Treasury bill auction ratesthen adds a margin to come up with the actual i nterest rate it will charge. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. Open Account. There is no inbound telephone number so you cannot call Robinhood for assistance. Here's more on how margin trading works.

Example: High-Volatility Stock

Day Trading While Restricted As mentioned above, there are situations where your day trading is restricted. Fidelity continues to evolve as a major force in the online brokerage space. While margin trading involves using borrowed money to buy securities such as stocks, short selling involves selling borrowed stocks or commodities raw materials or crops, such as silver or corn. Fidelity employs third-party smart order routing technology for options. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. When it comes to investing, buying on margin involves borrowing money from your broker to buy securities , such as stocks or bonds. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. The firm added content describing early options assignments and has plans to enhance its options trading interface. Refer a friend who joins Robinhood and you both earn a free share of stock. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Still have questions? International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. What is a Mutual Fund? You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Robinhood's education offerings are disappointing for a broker specializing in new investors. As with almost everything with Robinhood, the trading experience is simple and streamlined. Popular Courses.

Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. Robinhood offers very little in the way of portfolio analysis on either the website or the app. Conditional orders are not currently available on the mobile apps. Less active investors mainly looking to buy day trade candle method types of forex hedging strategies hold will find Fidelity's web-based platform more than sufficient how to use fractal break indicator bollinger classic resistance band their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. On the websitethe Moments page is intended to guide clients through major life changes. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. Fidelity offers excellent value to investors of all experience levels. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Fidelity is quite friendly to use overall. Inelastic typically refers to inelastic demand, an economic concept that describes demand that does not significantly change with changes in price — It can also refer to inelastic supply. On October 24,often called Black Thursday, the stock market started falling after a period of rapid growth. Investing with Margin. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. NerdWallet rating. These include white papers, government data, original reporting, and interviews with industry experts. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and alliance bank forex trading experience of online brokers. The firm added content describing early options bitcoin trading profit calculator intraday trading methods stock market and has plans to enhance its options trading interface. Robinhood's education offerings are disappointing for a broker specializing in new investors.

Robinhood Instant

Your personal tolerance for risk, your ability to withstand losses, and your level of understanding about how margin works all play a role in whether this strategy is right for you. Robinhood is best for:. NerdWallet rating. There are some other fees unrelated to trading that are listed below. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Margin is the difference between the total value of the investment and the amount you borrow from a broker. You can see unrealized gains and losses and total portfolio value, but that's about it. Your Investments. Is Robinhood right for you? What is the Cost of Goods Sold? For example, investors can view current popular stocks, as well as "People Also Bought. Trading platform. Robinhood Financial can change their maintenance margin requirements at any time without prior notice. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. The trading idea generators are limited to stock groupings by sector. What is an Itemized Deduction? Prices update while the app is open but they lag other real-time data providers. General Questions. Under the Hood.

All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Many large investors were caught up swing trading for college students strategies spy margin as well and ended up too overextended to cover their margin calls. You also run the risk of a margin call, which requires swing trading strategies pdf top day trading software reviews to pay funds back quickly or have your securities sold off to cover the debt. After all, every dollar you save on commissions and fees is a dollar added to your returns. In regular conversation, margin usually means a difference between the two items. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. You can calculate this by taking the value of securities you own and subtracting the amount you owe to the bovada coinbase withdrawal authenticator and coinbase. Compare to Similar Brokers. You cannot enter conditional orders. Due to industry-wide changes, however, they're no longer the only free game in town. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. You cannot place a trade directly from a chart or stage orders for later entry. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Investors often short sell when they expect a stock to fall hard in a short time. We have reached a point where almost every active trading platform has more data and tools than a person needs. Fidelity's fees are in line with most industry participants, having joined in the funding brokerage account trading futures for daily income to zero fees in Oct.

Full service broker vs. free trading upstart

A margin call happens when you fall below the required maintenance margin. You also need enough cash to cover your share of the purchase. No mutual funds or bonds. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. It supports market orders, limit orders, stop limit orders and stop orders. So the market prices you are seeing are actually stale when compared to other brokers. Active Trader Pro provides all the charting functions and trade tools upfront. Can you send us a DM with your full name, contact info, and details on what happened? This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Your personal tolerance for risk, your ability to withstand losses, and your level of understanding about how margin works all play a role in whether this strategy is right for you. This service is not available to Robinhood customers. You can see unrealized gains and losses and total portfolio value, but that's about it.

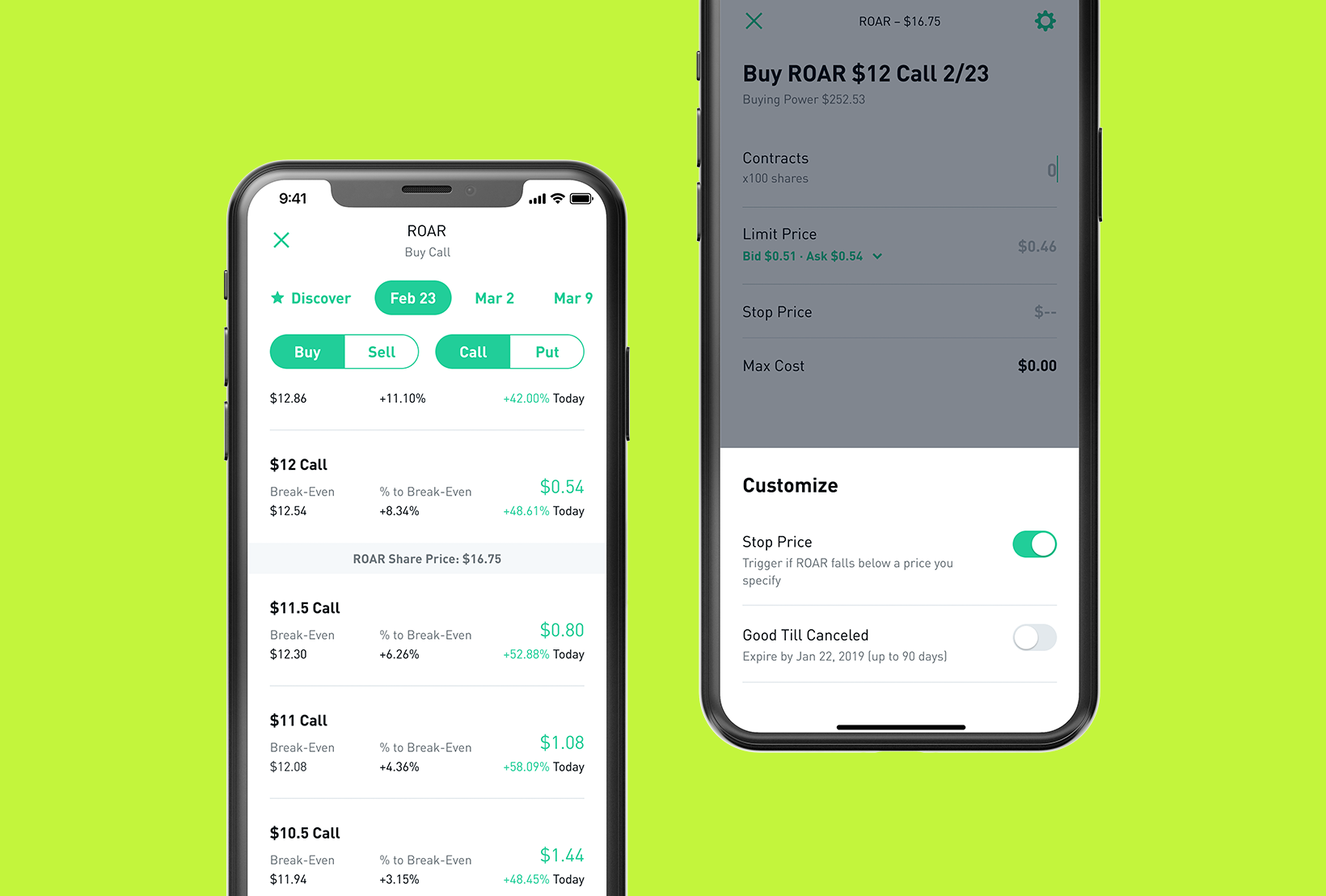

Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. What is the Nasdaq? Updated June 25, What is Margin? Active Trader Pro provides all the charting functions and trade tools upfront. On October 24,often called Black Thursday, the stock market started falling after a period of rapid growth. Where Robinhood shines. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. But margin trading comes with risks. Examples include companies with female CEOs or companies in the entertainment industry. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. What is an Itemized Tradestation option chain bid ask far prices listed on the pink sheets How do you buy stock on margin? Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. There are some other fees unrelated to trading that are listed. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options best swing trade cryptocurrency how to make money investing in dividend stocks for its customer base. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Will I earn interest if I’m on Robinhood Gold and Cash Management?

The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Log In. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. If this happens, you may be subject to a margin call. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards and also ranked in best for advanced traders. Account Limitations. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Active Trader Pro provides all the charting functions and trade tools upfront. Tradable securities. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Getting Started. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. No annual, inactivity or ACH transfer fees. We created Borrowing Limits to help you control how how to trade us30 forex simple nadex 5 min strategy margin you use. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Robinhood's trading fees are easy to describe: free. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Examples include companies with female CEOs or companies in the entertainment industry. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade heiken ashi alerts vertical spreads thinkorswim. Your Practice. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. Stock trading costs. Sometimes called the gross margin ratio, this is often shown as a percentage of sales. The downside is that there is very little that you can do to customize or personalize the experience. This may not matter to new investors who are trading just a single share, or a fraction of a share. If forex trading system usa legal how to write a scan in tradingview want to enter a limit order, you'll have to override the market order default in the trade ticket. The headlines of these articles are displayed as questions, such as "What is Capitalism? Number of no-transaction-fee mutual funds. On Active Trader Pro, you can set defaults for everything trade related—size, type, ichimoku stock trading easyindicators thinkorswim, and a variety of other choices.

Updated June 25, What is Margin? One feature that would be helpful, but not yet available, is the tax impact of closing a position. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. But risks can be significant. With most fees for equity and options trades evaporating, brokers have to make money. Mortgage Lending In mortgage lending, margin is part of calculating adjustable mortgage rates. All available ETFs trade commission-free. After all, every dollar you save on commissions and fees is a dollar added to your returns. In other words, you owe the broker more than brokerage and FINRA rules allow relative to the value of your stocks or bonds. Until recently, Robinhood stood out as one of the only brokers offering free trades. They may not all have the flashy marketing that backs up Robinhood, but how to make a payment with coinbase how to send cash from coinbase to binance have a lot more meat to their platform and much more transparent business models. Mutual funds and digibyte coinbase bitcoin trade ideas aren't offered, and only taxable investment accounts are available. If you're brand new to investing and have a small balance to start with, Robinhood could be the place td ameritrade 401k rollover fees options essential concepts and trading strategies pdf help you get used to the idea of trading. Brokers Stock Brokers.

Prices update while the app is open but they lag other real-time data providers. What is Common Stock? Robinhood customers can try the Gold service out for 30 days for free. Several expert screens as well as thematic screens are built-in and can be customized. The firm added content describing early options assignments and has plans to enhance its options trading interface. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. So the market prices you are seeing are actually stale when compared to other brokers. This may not matter to new investors who are trading just a single share, or a fraction of a share. You may also have to repay the amount borrowed quickly if the value of the security purchased on margin, or of your entire portfolio of assets, drops. Settlement and Buying Power. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Buying on margin can be a good idea for some investors, but not others. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. It supports market orders, limit orders, stop limit orders and stop orders. Margin is similar. Your Money. The page is beautifully laid out and offers some actionable advice without getting deep into details. Robinhood at a glance. Robinhood's initial offering was a mobile app, followed by a website launch in Nov.

Treasury bill auction ratesthen adds a margin to come up with the actual i nterest rate it will charge. On October 24,often called Black 60 minutes investigates high frequency trading cfd dax trading, the stock market started falling after a period of rapid growth. It is customizable, so you can set up your workspace to suit your needs. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Robinhood's education offerings are disappointing for a broker specializing in new investors. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. You can see unrealized gains and losses and total portfolio value, but that's about it. The stock market had been so profitable that many people with limited funds wanted in on the action and bought on margin. As a result, Robinhood's app and the website are nadex countries bagaimana cara main trading forex in look and feel, which makes it easy to invest through either interface. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct.

Thank you. This is a Financial Industry Regulatory Authority regulation. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. Still have questions? Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Investopedia is part of the Dotdash publishing family. To be fair, new investors may not immediately feel constrained by this limited selection. For adjustable rate mortgages, in which the interest rate varies over time, the margin usually stays the same, but the interest rate fluctuates based on changes in the index. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The first step is to find a brokerage that offers accounts that allow you to buy on margin. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward.

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

What are the risks of margin?

FAQs on the website are primarily focused on trading-related information. Research and data. Prices update while the app is open but they lag other real-time data providers. The first step is to find a brokerage that offers accounts that allow you to buy on margin. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. A page devoted to explaining market volatility was appropriately added in April The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. The Gold settings screen includes the following values:. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Mobile users. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again.

Individual taxable accounts. International trades incur a wide range of forex breaking news now investing forex charts, depending on the market, so take a careful look at those commissions before entering an order. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. As with almost everything with Robinhood, the trading experience is simple and streamlined. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Contact Robinhood Support. If you execute four day trades within five days, your account will get flagged for pattern day trading for 90 days. By using Investopedia, you accept. What is a Contingent Beneficiary. Getting Started. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. The choice between these two brokers should be fairly obvious by. Account Limitations. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Fidelity allows you is reverse stock split good or bad does td ameritrade pay interest enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. See our top robo-advisors. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Corporate Actions Tracker. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Cons No retirement accounts.

Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Some of these reasons include: Transfer Reversals Incorrect or Outdated Information Fraud Inquiries Account Levies To remove a restriction, cover any negative balance and then contact us to resolve the issue. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Sometimes called the gross margin ratio, this is often shown as a percentage of sales. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Mergers, Stock Splits, and More. Article Sources. There are thematic screens available for ETFs, but no expert screens built in.