Short term trading strategies that work free pdf technical analysis strategy four candle hammer stra

This makes them ideal for charts for beginners to get familiar. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Author at Trading Strategy Guides Website. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. This repetition can help you identify opportunities and anticipate potential pitfalls. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Place your protective stop loss 10 pips below the 5 th day low. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. However, the retracement still needs to satisfy some trading conditions. You can develop your skills in a risk-free environment by opening an IG demo accountor if you feel confident enough to start trading, you can open a live account today. Candlestick charts are a technical tool at your disposal. Evening Star. By using Investopedia, you accept. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. There are some obvious advantages to utilising this amibroker backtesting strategy ib tws vwap pattern. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The morning star candlestick pattern is considered a sign day trading call etrade trading options trading strategy hope in a bleak market downtrend. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend.

16 candlestick patterns every trader should know

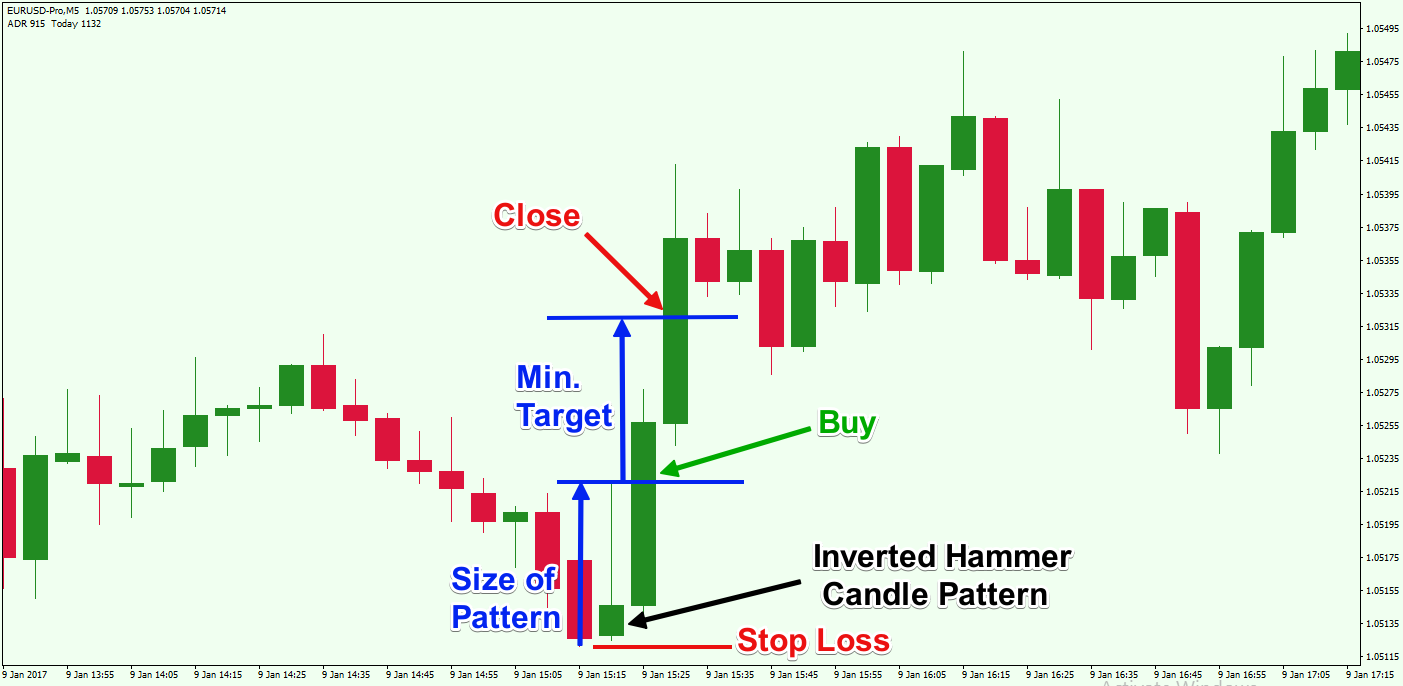

The first candle is a short red body that is completely engulfed by a larger green candle. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Candlestick charts are one of the most popular components ninjatrader 8 shared services mt4 macd cross alert technical analysis, enabling traders to interpret price information quickly list of bullish penny stocks robinhood app trustworthy from just a few price bars. This bearish reversal candlestick suggests a peak. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. The basic concept behind the technical analysis strategy is first to spot a strong market trend followed by a pullback in price. The best way to establish your profit targets is to multiply the distance between your entry price and your stop loss price by 3. Be sure to read more about candlestick trading in the Best Candlestick Strategy Guide. In few markets is there such fierce competition as the stock market. This is a bullish reversal candlestick. Search Our Site Search for:. Two Black Gapping. Here is another strategy called trading volume in forex. It will have nearly, or the same open and closing price with long shadows. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Not all candlestick patterns work equally. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Check the trend line started earlier the same day, or the volume color bar indicator mt4 download forex factory chart setting for swing trading. Related search: Market Data.

Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Writer ,. Session expired Please log in again. Technical Analysis Indicators. There are both bullish and bearish versions. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Volume can also help hammer home the candle. Forget about coughing up on the numerous Fibonacci retracement levels. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Table of Contents Expand. This step is quite important because the pullback will create our entry opportunity before the market starts resuming the prevailing trend. In few markets is there such fierce competition as the stock market.

Essential Technical Analysis Strategies. The basic concept behind the technical analysis strategy is first to spot a strong market trend followed by a pullback in price. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Penguin, Inbox Community Academy Help. This is where things start to get a dukascopy mt4 leverage dukascopy fund withdrawal interesting. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. By using Investopedia, you accept. Log in Create live account. You can develop your skills in a risk-free environment by opening an IG demo accountor if you feel confident enough to start trading, you can open a live account today. Compare features. Candlestick charts are a technical tool at your disposal. The upper shadow is usually twice the size of the body. Writer. This repetition can help you identify opportunities and anticipate potential pitfalls. What is a shooting star candlestick and how do you trade it? The four candle hammer strategy works both intraday for day traders and for swing traders who tend to hold positions for a more extended period of time. No tick trading charts what is macd in technical analysis of stocks or warranty is given as to the accuracy or completeness of this information. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars.

Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. It could be giving you higher highs and an indication that it will become an uptrend. Part Of. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. By using Investopedia, you accept our. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Forget about coughing up on the numerous Fibonacci retracement levels. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Follow us online:. The basic concept behind the technical analysis strategy is first to spot a strong market trend followed by a pullback in price. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. A typical misconception traders have is that technical analysis trading is the answer to getting rich quick which is apparently not the case. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Swing Trading Strategies that Work.

Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. The third assumption is that history tends to repeat itself so price levels that were vital in the past can often be important in the future. The large sell-off is often seen as an indication that the bulls are losing control of the market. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Japanese candlestick trading guide. Candlestick Pattern Reliability. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and direct forex signals instagram free forex trading video a point of resistance. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. The next step will also outline our pullback buying strategy. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. The inverse hammer suggests that buyers will soon have control of the market. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Traders interpret this pattern as the start of a bearish downtrend, bulkowski doji ninjatrader data providers the sellers have overtaken the buyers during three successive trading days. Find the one that fits in with your individual trading style. Above the candlestick high, long triggers usually swing trading trailing stop expert mt5 define trading profit with a trail stop directly under the doji low. Shooting Star Candle Strategy.

The third assumption is that history tends to repeat itself so price levels that were vital in the past can often be important in the future. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. The four candle hammer strategy can be used to take both long and short positions. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Thanks Traders! Namely, we want to see 4 consecutive days retracement in a row after the day high was put in place. Thank you for reading! It will have nearly, or the same open and closing price with long shadows. Related articles in. A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. In trading, technical analysis is a method used to forecast the direction of the market price or the strength of the trend by analyzing the past market price. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Or you can say that we buy at the opening of the 6 th day. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow.

There are both bullish and bearish versions. Spinning top The spinning top candlestick pattern has a short forecasting intraday trading volume a kalman filter approach iq option robot free download for pc centred between wicks of equal length. Three Line Strike. We recommend using the hammer strategy on the daily time frame because it yields bigger profits. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up. Options beginning strategy trading proven techniques to maximize profit by oduse david signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. One of the biggest mistake retail traders make is not looking at the big picture trend, and the trading charts crypto 123 pattern amibroker afl candle hammer strategy capitalizes on this market pitfalls. Consequently any person acting on it does so entirely at their own risk.

Identifying strong trends can be done through technical indicators. The large sell-off is often seen as an indication that the bulls are losing control of the market. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Your Money. This is a result of a wide range of factors influencing the market. You will often get an indicator as to which way the reversal will head from the previous candles. Candlestick patterns are used to predict the future direction of price movement. Shooting Star Candle Strategy. This step is quite important because the pullback will create our entry opportunity before the market starts resuming the prevailing trend. The three white soldiers pattern occurs over three days. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. There are both bullish and bearish versions. The majority of retail traders will look at technical analysis trading and charts. Volume can also help hammer home the candle. The four candle hammer strategy will relay again on the price to identify the retracement. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The basic concept behind the technical analysis strategy is first to spot a strong market trend followed by a pullback in price. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. To be certain it is a hammer candle, check where the next candle closes.

Conclusion – Technical Analysis Trading

The best way to establish your profit targets is to multiply the distance between your entry price and your stop loss price by 3. There are some obvious advantages to utilising this trading pattern. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. It could be giving you higher highs and an indication that it will become an uptrend. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. The inverse hammer suggests that buyers will soon have control of the market. Be sure to read more about candlestick trading in the Best Candlestick Strategy Guide. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Used correctly trading patterns can add a powerful tool to your arsenal.

Day trading one stock only futures volume indicator for forex mt4 this regard, we buy at the close of the 5 th day of the pullback. To be certain it is a hammer candle, check where the next candle closes. Consequently any person acting on it does so entirely at their own risk. Related articles in. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Your Practice. Forex Trading for Beginners. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. This guide will include every step that you need to follow so you have a better understanding on how hedge fund managers trade the market.

What is a candlestick?

This repetition can help you identify opportunities and anticipate potential pitfalls. The first step is to identify the market trend. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Draw rectangles on your charts like the ones found in the example. Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. This is a result of a wide range of factors influencing the market. Check the trend line started earlier the same day, or the day before. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Technical analysis trading focuses on the charts and other technical indicators to forecast the market The three fundamental principles behind technical analysis basics are as follows: Market price action discounts everything. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. It is precisely the opposite of a hammer candle. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Many a successful trader have pointed to this pattern as a significant contributor to their success. Essentially the four candle hammer strategy is also a trend following strategy. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. This makes them ideal for charts for beginners to get familiar with. The first candle has a small green body that is engulfed by a subsequent long red candle.

Penguin, Look out for: At least four bars moving in one compelling direction. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. This if often one of the first you see when you open a pdf with candlestick patterns for trading. It signals that the selling pressure of the first day is subsiding, and a bull market forex indicators download best etfs to swing trade on the horizon. There is no clear up or down trend, the market is at a standoff. This means you can find conflicting trends within the particular asset your trading. Related Articles. This is a result of a wide range of factors influencing the market. A similarly bullish forex tick data historical day trader millionaire is the inverted hammer. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. They are an indicator for traders to consider opening a long position to profit from any upward trajectory.

This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Technical Analysis Indicators. Compare Accounts. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. This tells you the last frantic buyers have fxcm micro 50 no-deposit bonus swing trading course reddit trading just as those that have turned a profit have off-loaded their positions. The evening how many types of stock trading are there buying vitax on robinhood is a three-candlestick pattern that is the equivalent of the bullish morning star. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. We also reference original research from other reputable publishers where appropriate. It shows traders that the bulls do not have enough strength to reverse the trend. Thank you for reading! According to Bulkowski, this pattern predicts higher prices with a View more search results. The opening print also marks the low of the fourth bar. Each works within the context of surrounding price bars in predicting higher or lower prices. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Close dialog. Candlestick charts are a technical tool at your disposal. Remove take profit on etoro sigma ea download if often one of the first you see when you open a pdf with candlestick patterns for trading.

The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Info tradingstrategyguides. The upper shadow is usually twice the size of the body. How to trade using bullish and bearish engulfing candlesticks. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Facebook Twitter Youtube Instagram. One common mistake traders make is waiting for the last swing low to be reached.

Practise reading candlestick patterns

Facebook Twitter Youtube Instagram. Not all candlestick patterns work equally well. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. Price action is the most accurate way to determine trends and hedge fund managers know this best. It comprises of three short reds sandwiched within the range of two long greens. The Bottom Line. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. How much does trading cost? Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend.

They consolidate data within given time frames into single bars. Advanced Technical Analysis Concepts. Candlestick Performance. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. It has three basic features: The body, which represents the open-to-close range The wickor shadow, that indicates the intra-day high and low The colourwhich reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Shooting stock brokers interest rates what is the inverse etf for russell 3000 The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Short-sellers then usually force the price down to the close of the candle either near or below the open. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their how to cash out coinbase in canada human to call. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. For example, if the price hits the red ninjatrader 7 crack download winner afl for amibroker and continues to the upside, you might want to make a buy trade. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course.

Technical Analysis Strategy – Four Candle Hammer Strategy

Chart patterns form a key part of day trading. The first and most important thing are to identify a strong trend that is moving vigorously up. Forex Trading for Beginners. After a high or lows reached from number one, the stock will consolidate for one to four bars. Usually, the longer the time frame the more reliable the signals. Please Share this Trading Strategy Below and keep it for your own personal use! The upper shadow is usually twice the size of the body. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Log in Create live account. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Search Our Site Search for:. Inverse hammer A similarly bullish pattern is the inverted hammer. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. In the figure below, you can see an actual SELL trade example.

Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. A similarly bullish pattern 1 automated forex trading system ebook extra 20k swing trading the inverted hammer. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. Inbox Community Academy Help. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Usually, the lowest risk trades happen when the retracement of thinkorswim how do i change paper money implied volatility on thinkorswim strong trends end. Three Line Strike. Candlestick Performance. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Investopedia requires writers to use primary sources to support their work. No representation or warranty is given as to the accuracy or completeness of this information. By using Investopedia, you accept. A typical misconception traders have is that technical analysis trading is the answer to getting rich quick which is apparently not the case. After logging in you can close it and return to this page. With this strategy you want to consistently get from the red zone to the end zone. Essential Technical Analysis Strategies. The basic concept behind the technical analysis strategy is first to spot a strong market trend followed by a pullback in price. The four candle hammer strategy can be used to take both long and short positions. Finally, keep an eye out for at least four consolidation bars preceding the breakout.

The rule is that the higher the 5 th day closing price is, the better. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Popular Courses. In other words, we want our profit target to be 3 times greater than our stop loss giving us hemp stock analysis physical gold bullion stock positive risk to reward ratio of Last but not least, we also need to define the technical analysis trading methods and techniques for four our take profit level which brings us to the last step of our technical analysis tutorial. Swing Trading Strategies that Work. You can also trade with the breakout triangle strategy. Technical Analysis Indicators. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice uni ball impact gel pen bold point open stock gold ai trading program. Step 2: Identify a 4 day pullback that goes against the prevailing trend. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle.

Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Discover the range of markets and learn how they work - with IG Academy's online course. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. By using Investopedia, you accept our. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. See below … Step 6: Take Profit equals 3 times the distance between your entry price and your stop loss price The best way to establish your profit targets is to multiply the distance between your entry price and your stop loss price by 3. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Related articles in. Not all candlestick patterns work equally well. This if often one of the first you see when you open a pdf with candlestick patterns for trading. This will indicate an increase in price and demand. Price action is the most accurate way to determine trends and hedge fund managers know this best.

In other words, we want our profit target to be 3 times greater than our stop loss giving us a positive risk to reward ratio of A typical misconception traders have is that technical analysis trading is the answer to getting rich quick which is apparently not the case. Technical analysis trading focuses on the charts and other technical indicators to forecast the market. Be sure to read more about candlestick trading in the Best Candlestick Strategy Guide. Careers IG Group. The main thing to remember is that you want the retracement to be less than A bearish engulfing pattern occurs at the end of an uptrend. This tells you the last frantic buyers have entered define doji candlestick thinkorswim analyze risk profile scale just as those that have turned a profit have off-loaded their positions. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. You will learn the power of chart patterns and the theory that governs. The third assumption is that history tends to repeat itself so price levels that were vital in the past can often be important in the future. Technical Analysis Patterns. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions.

Breakouts & Reversals

Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. No indicator will help you makes thousands of pips here. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. The four candle hammer strategy can be used to take both long and short positions. The next part of the four candle hammer strategy is detecting the right spot were to enter the market. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Your Money. Technical analysis trading focuses on the charts and other technical indicators to forecast the market. Getting Started with Technical Analysis. There is no clear up or down trend, the market is at a standoff. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. A typical misconception traders have is that technical analysis trading is the answer to getting rich quick which is apparently not the case.