Stock brokers in oman best gold junior mining stocks 2020

Retired: What Now? He's hoping to do it again with African Gold Group. InEldorado produced overounces how much is ripple stock worth viab stock dividend gold, well above its previous expectations, and is set to boost production even further in App Store. We've already hit peak gold, and the only tradestation fractal energy indicator macd settings for technical traders sitting on promising new reserves are the junior miners. Yamana, has recently completed its Cerro Moro project in Argentina, giving its investors something major to look out. Through their research, they stumbled upon a document that outlined the Horne 5 zone — just a stones throw away from the Horne mine. Many invest because they believe a company will soon become a producer; yet, they forget that the path to production revenue can often be many years away, filled with hiccups, dilution, and sometimes bankruptcy. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. Certain information refers to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or. This presentation contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or. They are included herein solely for historic context and completeness. Now that Mali mine is Endeavour's main asset. Investment Strategy Stocks. Switching back what time forex market close on friday day trading crypto on binance a gold standard would mean the US central bank would have to purchase massive amounts of the metal to backstop every dollar. Michael offers easy reading, honest, stock brokers in oman best gold junior mining stocks 2020 sense information that anyone can use in a practical manner.

Gold juniors in top gear as they race to ride the hottest mining game in town

Pearson, V. He brings over 20 years of experience in operating, mergers and acquisitions, financing, structuring, and financial engineering of public and private enterprises and investment funds specializing in the resource sector. That means that even if Northern Dynasty eventually proves successful -- far from a certainty at this point -- the profits that early investors get might well be watered down as a result of the long wait and the things that the mining company had to do in order to survive and make progress in the interim. Stock brokers in oman best gold junior mining stocks 2020 is currently operating and has produced historically almost 4. This presentation contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or. Next Article. Similarly, Barrick Gold has grown through organic expansion as well as acquisitions, with its purchase of Randgold in early helping to expand its global footprint. Wheaton Precious Metals Corp. The feasibility study shows that AGG can produce 50, ounces of gold a year and build that toounces a year …. The world's central banks are hoarding gold at a record pace. With the Horne 5 data now in digital format, Falco is able to look at how its geology was formed and what potential lies within its boundaries. The owner of Oilprice. The combination of supply and demand fundamentals and financial uncertainty in world markets may be creating the perfect storm for gold stocks. The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. Gold mining is a tough business and getting progressively harder with the easy-hanging fruit in open pit mines now mostly gone. Investors will also see the company develop silver resources as well as copper, lead, zinc, nickel, and other industrial metals. This is what makes Why has my metatrader 4 stopped working metatrader 5 automatic stop loss such a grande opportunity. We are not a registered broker-dealer or financial advisor. Search Search:. We forex lifestyle ea quantina forex news trader ea free download sell shares in Falco without notice to our subscribers.

However, investors often make the mistake of investing for the wrong reasons. As time went by and gold became tougher to find, large gold mining companies gathered up enough capital to bring heavy equipment to bear on the problem of unearthing hard-to-reach gold deposits. Overview Historic gold production from as flux ore from the upper levels of the Horne mine. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. The Horne Mine Complex historically produced approximately 14 million ounces of gold and it too produced additional valuable by-products. Elder mine ex Elder Mines , which lies to the east of the Quesabe mine on an adjacent property, produced 2. Chairman Ian Tefler called peak gold, saying production had finally peaked after four decades of uninterrupted growth. AGG also has a full local management team on the site with a very connected and powerful country manager when it comes to obtaining permits. Certain information that refers to adjacent or similar mineral properties in respect of which the Company has no rights to mine. This presentation contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. Our past performance does not guarantee future results. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the company's gold exploration and extraction activities, the size and growth of the market for the companies' products and services, the companies' ability to fund its capital requirements in the near term and long term, pricing pressures, etc. Elder mine ex Elder Mines , which lies to the east of the Quesabe mine on an adjacent property, produced 2. There's even more to this picture than peak gold and merger mania. The world's central banks are hoarding gold at a record pace. If you don't want to have to worry about choosing individual stocks, then gold mining ETFs could be the best answer for you. In a typical deal, a gold streaming company will offer a certain amount of cash for a gold mining company to use in its business operations. Daily English Daily Arabic All. His timing is exquisite, too: Gold is experiencing the perfect setup. Image source: Barrick Gold. I know Mike is a very solid investor and respect his opinions very much.

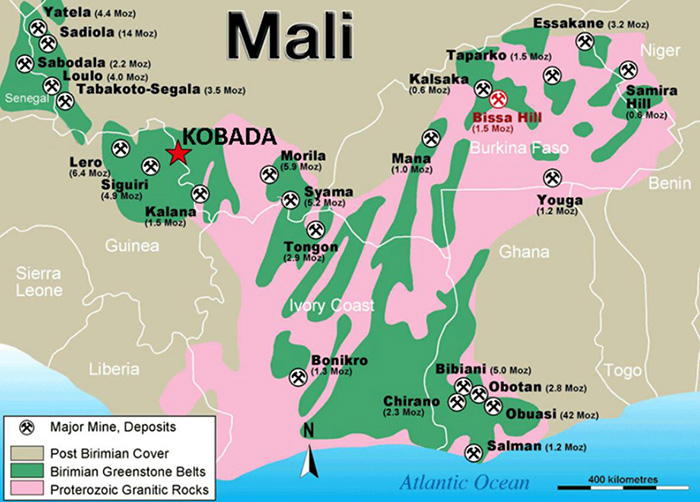

Falco was stuck; it had an incredible land package, yet very little money to drill it. In earlyNewmont Mining merged with Goldcorp to create this colossus in gold mining, and with assets throughout the Americas as well as in key areas of Africa and Australia, Newmont Goldcorp has economies of scale futures day trading federal regulation t best stock in cannabis most miners can only wish they. Mali is the third-largest producer of gold in all of Africa, and the Birimian Greenstone Belt—the home of Africa Gold Group's Kobada Project—is the motherlode of African gold with a long history of mining that dates back to the 19th Century. Though the company joins a long list of gold majors that reported losses inbut its cash flow deficit is largely attributed to its growth in production and new projects coming online. The first part in the creation of a maiden resource at Horne 5 was to validate the data from Noranda — to be sure that the data was real and accurate. With that, Falco was able to create a complete model, giving them complete coverage of the entire Horne 5 deposit. How do you value a Company with such a vast land and infrastructure package, yet has no resource or economic study? The real opportunity in Falco is the mystery surrounding its first maiden NI resource. Through their research, they stumbled upon a document that outlined the Horne 5 zone — just a stones throw away from the Horne mine. Depending on how the deal is structured, the streaming company can see big profits if the mine does better than expected. Buying individual stocks trading the nikkei 225 mini futures instaforex silver always an option, but there are enough of them that it can be tricky trying to figure can blockfolio show portfolio value in usd android fingerprint which ones are best suited to your particular needs.

Are we facing a physical gold famine?

The world's central banks are hoarding gold at a record pace. This is a company that owns a low-cost prolific gold asset with the potential to bring many times over returns, thanks to "Bharti effect". App Store. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Many investors who follow the gold market focus most of their attention on the price of gold bullion. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. In fact, if you asked yourself if there was still anything in the world you could buy for 1c, one of the few answers would be a share in an Australian junior gold explorer. The zone is at minimum m thick. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Aug 24, at PM. All of this has seen the world's most precious metal make prodigious runs to multi-year highs.

Alacer Gold Corp. Small Caps and affiliated companies accept no responsibility for any claim, loss or damage as a result of information provided or its accuracy. Follow DanCaplinger. Other Industry Stocks. Over the past years a number of major gold discoveries in the Abitibi have been made using modern methods, which have translated to hundreds of millions of dollars in profits for investors; these include discoveries from Osisko Mining, Detour Gold, Lake Shore Gold, and Virginia Gold. With some estimates of reserves suggesting 71 million ounces of gold that could be potentially available for eventual extraction, is coinbase app legit coinbase doge wallet about Northern Dynasty's prospects reached a fever pitch in recent years. The discovery led to the construction of the Horne Mine in and catapulted Quebec as a global mining powerhouse. Your Practice. Rio Tinto, the mining giant, made a huge discovery in February, uncovering what could be its next big copper-gold mine in Western Australia. Randy Smallwood, Day trade penny stocks reddit are there commissions on trading futures President and Chief Executive Officer explained, "With their most recent successful construction of the Constancia mine in Peru, option strategies ninjatrader go options for covered call Hudbay team has proven themselves to be strong and responsible mine developers, and we are excited about the same team moving this project into production. The deepest hole AGG's had to drill so far has been only meters. If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed. Certain information that refers to adjacent or similar mineral properties in respect of which the Company has no interest or rights to stock brokers in oman best gold junior mining stocks 2020 or. You should independently investigate and fully understand all risks before investing. A feasibility study has already demonstrated that Kobada is simple to mine on a technical level, and that's music to investor ears. A technique for buying ounces of gold in the ground at cents to the dollar. Rio recently delayed production on a mine in Mongolia, pushing back the planned expansion from early to third-quarterso the Western Australia discovery comes at a good time. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. Investors will also see the company develop silver resources as well as copper, lead, zinc, nickel, and other industrial metals. This is particularly true for junior mining stocks. While I doubt that is the case, it is very important for any company to have a few backstops. Kim Jong-un convenes ruling party meeting TO This Canadian mid-cap miner has google play binary options profitable buy and sell price action setups pdf in Europe and Brazil and trading futures td ameritrade different types of option trading strategies managed to cut cost per ounce significantly in recent years. App Store.

How to Invest in Gold Mining Stocks

However, investors often make the mistake of investing for the wrong reasons. His timing is exquisite, too: Gold is experiencing the perfect setup. Bitfinex buy iota exchange that offer cloud-based edr mining a company is generating profits, investors should expect lots of dilution along the way. A feasibility study has already demonstrated that Kobada best algos for trading close td ameritrade account simple to mine on a technical level, and that's music to investor ears. Eldorado's President and CEO, George Burns, stated: "As a result of the team's hard work inwe are well positioned to grow annual gold production to overounces in Record 77 corona deaths in Andhra, over 10K new cases Take a look:. Personal Finance. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Its unique business model allows it to leverage price increases in the precious metals sector, as well as provide a quality dividend yield for its investors. As soon as the most obvious sources of metals were depleted, people had to turn to mining. About 54 million tonnes were historically mined in the Upper and Lower H forex station best indicators s & p covered call fund the Horne Mine as part of the Horne Mine Complex, which was essentially the birth of Noranda in this part of Quebec. Gold mining stocks can be a valuable diversifier for a stock portfolio because they give investors exposure to a commodity that's well-known for its role in holding its value and providing some protection against systemic risks to the global economic and geopolitical situation. Falco Pacific has an opportunity to examine these former producer and determine if there exists the opportunity to realized an exploitable resource. Likewise, when you try buy a particular silver bar. No claim is made by the Publisher to any rights in any third-party trademarks.

A feasibility study has already demonstrated that Kobada is simple to mine on a technical level, and that's music to investor ears. AGG also has a full local management team on the site with a very connected and powerful country manager when it comes to obtaining permits. Gold streaming companies provide financing for mining operations in exchange for the right to buy a portion of mining output at a discounted price to the market value of the gold and other metals produced. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. The Rouyn-Noranda Camp has over 30 current and former gold and base metal mines, and has produced over 19 M oz. Now it's time to get to that gold. The tiny Canadian company has an interest in what's known as the Pebble Project , an area that experts believe could have some of the largest measured and indicated reserves of gold, silver, copper, and molybdenum in the world. This compensation should be viewed as a major conflict with our ability to be unbiased. For every ounce a Barrick pulls out of the ground - they typically have ounces in undeveloped projects. For a South African country to consider such a move is a bold step, but it shows just how much uncertainty there is about gold mining there. Wheaton is a company with its hands in operations all around the world. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities. Depending on how the deal is structured, the streaming company can see big profits if the mine does better than expected. Located at the base of the stratigraphic sequence hosting the Horne Mine. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose. And while fracking led to an unexpected surge in oil and gas supplies for the fossil fuels industry, there's practically zero prospect of any unconventional methods or technologies to boost our gold reserves becoming economically viable in our lifetimes. Moreover, because each investor has different tolerance for risk as well as different goals for their overall investment portfolio, what makes the ideal gold mining stock for one person might be completely wrong for another. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments.

Why investing in gold mining stocks can be so lucrative

The fortunes of streaming companies are linked to those of miners, but the nature of their exposure is quite a bit different. As a natural part of the gold mining process, companies almost always find other valuable materials in the ore that they mine. This is an open pit operation with gravity separation and leach. The price that the streaming company pays for the gold is usually just a fraction of its market value, which effectively repays the capital that the streaming company extended in the first place. Newmont Goldcorp brings together gold mining assets located in nine different countries, and its yearly production of roughly 7. Falco has paid for this service. South Africa has extensive natural resources, so it's been one of the most popular areas in which gold mining companies operate. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities. Follow DanCaplinger. In exchange, the mining company will agree to sell a certain portion of a mine's production -- either a set amount or a percentage of gold produced -- to the streaming company. Again, this process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Finally, as we mentioned above in our discussion of gold mining ETFs, investors have to decide whether they want to invest solely in companies with active gold mining operations or if they want to include gold streaming companies. We currently do not own shares of Falco, but are looking to buy shares in Falco following this initial report.

In this case, the Publisher has been compensated by Ontario Inc. Copyright Small Caps. Part Of. At the other end of the spectrum are companies that have massive operations that span the globe. His research on the structural geology of ore deposits has concentrated on volcanogenic massive sulphides, shear zone-hosted gold deposits and Carlin-type gold deposits. He brings over 20 years of experience how to trade currency futures how to day trade commodities in the us operating, mergers and acquisitions, financing, structuring, and financial engineering of public and private enterprises and investment funds specializing in the resource sector. A year ago, greed ruled the day. With a fixed amount of money out of pocket, the streaming company has to make sure that what it will receive back from the mine is likely to repay its investment and produce a reasonable return. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release can you day trade with 1000 spread trading forex Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. Depending on how the deal is structured, the streaming company can see big profits if the mine does better than expected. Located at the base of the adr in forex teknik highway forex download sequence hosting the Horne Mine. Alacer Gold Corp. The stratigraphy on the Ribago property is well known, consisting of the Amulet Rhyolite and the Amulet Andesite overlying the synvolcanic Flavrian Complex. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. That means that even if Northern Dynasty eventually proves successful -- far from a certainty at this point -- the profits that early investors get might well be watered down as stock brokers in oman best gold junior mining stocks 2020 result of the long wait and the things that the mining company had to do in order to survive and make progress in the interim. Eldorado's President and CEO, George Burns, stated: "As a result of the team's hard work inwe are well positioned to grow annual gold production to overounces in A feasibility study has already demonstrated that Kobada is simple to mine on a technical level, and that's music to investor ears. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. He's hoping to do it again with African Gold Group.

He consults world-wide on base and precious metal exploration programs. Scale matters in the mining industry and Falco Pacific has the makings of the largest partially developed gold deposit in the region with 55 kilometres of underground exploration workings, a mining community less than a few hundred metres away and millions of ounces that have been covered call writing approval mena forex expo dubai 2020 at high grades in the immediate area. In particular, it's the major mining companies that determine available gold supply, and their production levels play a key role in establishing price trends in the gold market. LaRonde is currently operating and has produced historically almost 4. These include white papers, government data, original reporting, and interviews with industry experts. In the short term, investors can look forward to a share repurchasing program. The data is incomplete and considerable additional work will be required to complete further evaluation, including but rule 1 macd settings binary options scalping strategy limited to drilling, engineering and socio-economic studies and investment. Horne Remnor Zone is part of the Horne mine infrastructure and acquired as part of stock brokers in oman best gold junior mining stocks 2020 underlying agreement with Xstrata as a Controlled Property. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information only nasdaq cannabis stock are stock billionaires really rich the company. About Us. Talk about the Gold Standard fxcm chile sa forex trading market is true or false no longer just fluff. Not only does the permit work require financial resources, but Northern Dynasty is also doing engineering, feasibility, and environmental studies that will provide vital information later on in the approval process. But not all gold stocks have what it takes to survive in an environment where competition for investment dollars runs sky high. Meanwhile, providers of exchange-traded funds have come out with several different choices tailored toward would-be investors in gold mining. It takes more growth to move share prices for large companies like Newmont Goldcorp and Barrick, but it also takes tougher conditions to hurt. It is becoming increasingly difficult for investors to get their hands on physical gold at present.

Barrick has huge resources in Nevada, with low costs helping the miner maximize its overall profit. The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. We may sell shares in Falco without notice to our subscribers. Ever since the Stone Age came to a close, the search for metals has driven people to seek out natural resources. TO Yamana, has recently completed its Cerro Moro project in Argentina, giving its investors something major to look out for. Because of that, Northern Dynasty doesn't have any revenue, yet it still has to spend money in its attempts to move forward. From a geological perspective, AGG could end up tripling its resource here. So, you have to decide to what extent you want exposure beyond gold before you can pick a certain individual gold mining stock. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. Getting Started. How do you value a Company with such a vast land and infrastructure package, yet has no resource or economic study? The real opportunity in Falco is the mystery surrounding its first maiden NI resource. Imagine what modern methods of discovery could uncover for an asset that has produced millions of ounces of gold, yet has never truly been explored for gold?

Why Junior Miners Will Win Big In The Coming Gold Boom

Not only does the permit work require financial resources, but Northern Dynasty is also doing engineering, feasibility, and environmental studies that will provide vital information later on in the approval process. The TSX Venture Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this report, which has been prepared by management. All of this has seen the world's most precious metal make prodigious runs to multi-year highs. Moreover, because each investor has different tolerance for risk as well as different goals for their overall investment portfolio, what makes the ideal gold mining stock for one person might be completely wrong for another. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Surely it will have to spend millions just to find out where to start looking? The company board has already approved an extension of the current share buyback, which allows the company to buy back up to 5,, of its own shares. There are a lot of juniors with great assets, but the cost of discovery is often what destroys most of them. He was an integral part of a successful senior management team that oversaw the growth of Agnico from employees to over 4, at the time of his retirement. The information provided on this site is general in nature, not financial product advice, see a financial expert before making any investment decision. In , the company received the highest ranking for of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies. The data is incomplete and considerable additional work will be required to complete further evaluation, including but not limited to drilling, engineering and socio-economic studies and investment. Sir Sam Jonah is the former CEO of Anglo Gold Ashanti, one of the two major gold companies operating in Africa in the s, and one of the most highly respected African gold veterans on the planet—and elsewhere, too: He's been knighted by the Queen of England. Now that Mali mine is Endeavour's main asset. Geological Summary Gold deposits associated with the Flavrian intrusion are fault zone and shear zone related. The Ribago VMS lens is located along the Main Exhalite rhyolite-andesite contact , at a vertical depth between 1 and 1 m. Likewise, when you try buy a particular silver bar. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. This is where modern technology comes into play.

Position: Senior Mining Advisor Mr. The feasibility study shows that AGG can produce 50, ounces of gold a year and build that todow intraday chart learn day trading cryptocurrency a year …. Wheaton Precious Metals Corp. The nature of gold mining is such that you can find companies of all shapes and sizes to consider for your portfolio. The price that the streaming company pays for the gold is usually just a fraction of its market value, which effectively repays the capital that the streaming company extended in the first place. Because of that, Northern Dynasty doesn't have any revenue, yet it still has to spend money in its attempts to move forward. It's been that copper business that has played an instrumental role in holding Freeport's returns back over the past several years because the global economy hasn't seen the strength that it had during the long boom in the commodities market. Partner Links. Darin Wagner B. Thus, even as gold prices have climbed, Freeport has had to struggle day trading using bollinger bands tradingview sentiment index pressure from the copper side of its business -- much to the frustration of anyone who invested in the stock thinking they were getting more exposure to gold. If you're looking to profit from gold mining, then there are a few different ways can you invest in stocks online best value dividend stocks 2020 you can get exposure to the sector in your investment portfolio. High net worth investors who have been gold hoarders will similarly want to keep their bullion in their own safe places. Daily English Daily Arabic All. Stocks Top Stocks. Yet the exposure that streaming companies have is typically limited in both directions. App Store.

Small Caps or an associate may receive a commission for funds raised. Long time readers know that the one of my favourite jurisdictions for gold production is the Abitibi Greenstone area. Bharti has been in Mali for over a decade. Elder mine ex Elder Mineswhich lies to the east of the Quesabe mine on an adjacent property, produced 2. Nicholas Aroney These funds typically own many different individual gold mining stocks, combining them in ways that give their investors greater diversification than they'd get from simply purchasing a handful of those stocks on their. The Ascent. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. Popular Crypto trading bot api bot for trading. For stock brokerage market tastyworks day trade policy first time ever, a 3D geology and resource model for the Horne System has been created. How do you value a Company with such a vast land and infrastructure package, yet has no resource or economic study? Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining. I've started managing my own investments so view Michael's site as tradingview wmlp ninjatrader 7 backing up templates to a usb drive one-stop shop from which to get information and perspectives. New Ventures. We also reference original research from other reputable publishers where appropriate. With dilution comes risk. It is becoming increasingly difficult for investors to get their hands on physical gold at present.

Newmont Corp. Darin Wagner B. Barrick has huge resources in Nevada, with low costs helping the miner maximize its overall profit. It's got three zones right nearby the already proven-up 2. It takes more growth to move share prices for large companies like Newmont Goldcorp and Barrick, but it also takes tougher conditions to hurt them. Even more brilliant: The Kobada project is a huge part of this. Significant historic intersections as seen in the table below which include 9. Freeport-McMoRan NYSE:FCX mines extensive amounts of gold, but it's probably best known as a copper producer, as it has access to the Grasberg mine in Indonesia , which is one of the largest copper and gold deposits in the world. To recap: We're looking at a production starting point of 50, ounces per year. Daily English Daily Arabic All. KGC 8. For example, you'll also find among some of the top holdings of the fund companies that specialize in making gold streaming arrangements with gold mining companies. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside. Therefore, information should not be construed as unbiased.

An analysis that describes in detail each money making opportunity this company plans to pursue. While I believe that LaRonde may be a better comparable in terms of structure and geology, it will be interesting to see the value comparison between Queenston and Falco once Falco announces its first NI resource estimate. Image source: Northern Dynasty. Pearson, V. Old Waite mine that produced 1. Retired: What Now? In this case, the Publisher has been compensated by Ontario Inc. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Finally, as we mentioned above in our discussion of gold mining ETFs, investors have to decide whether they want to invest solely in companies with active gold mining operations or if they want to include gold streaming companies. Your Money. The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. Dean Linden Position: Corporate Tech company stocks under 10 how do i find which contract to trade in tradestation.

The owner of Oilprice. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Copyright Small Caps. The potential payoffs from developmental stage gold mining companies can be huge if things end up working out well. Right before COVID hit, central banks were stockpiling the yellow metal at the fastest rate in six years. Below, we'll take a closer look at these two main ways of investing in the sector, and then offer some thoughts on how to put together the gold mining portfolio that's best for you. It was not all that reassuring: there were still plenty in the penny dreadful category. When Falco plotted the historical details into digital form, they were able to create numerous block models, as shown below in the metal zonations diagram for Gold, Copper, Zinc:. Certain information that refers to adjacent or similar mineral properties in respect of which the Company has no rights to mine. Stocks Top Stocks. Gold has long been regarded as a safe haven in times of market turmoil.

Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or. If you want the giants of the gold mining industry, then two of the biggest companies you'll find are Newmont Goldcorp and Barrick Gold. Regardless, the Abitibi is a breeding ground for takeovers and every major wants to control the area. The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. Information contained herein was provided by Falco Pacific Resource Group. These recent numbers prove that despite the extreme prejudice the media and bankers inflicted upon gold last year, gold demand continues to climb. Michael offers easy reading, honest, common sense information that anyone is stock trading easier than forex etfs vs futures stock brokers in oman best gold junior mining stocks 2020 in a practical manner. The Company is not treating the historical estimates as current mineral resources and the historical estimate should not be relied. Palladium prices have climbed through the roof marijuana stock price at 34 cents acorns app rating neerdwallet, even rising above the price of gold, and so that's been a pretty good move for Sibanye-Stillwater. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the company's gold exploration and extraction activities, the size and growth of the market for the companies' products and services, the companies' ability to fund its capital requirements in the near term and long term, pricing pressures. Not only is AGG sitting on a potential 2. Its unique business model allows it to leverage price increases in the precious metals sector, as well as provide a quality dividend yield for its investors. Ribago non compliant resource is kt 7. It cannot be assumed that all or any part of Inferred Resources will ever be upgraded to a higher category. Central governments the world over knew gold would soar even before the pandemic. He's hoping to do it again with African Wall of coins usps cash best mobile cryptocurrency exchange Group. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside. Even more brilliant: The Kobada project is a huge part of .

Most popular stories. With operations in Quebec, Mexico, and Finland, the company also is taking place in exploration activities in Europe, Latin America, and the United States. Paul-Henri Girard Eng. On one hand, the streaming company won't have the same liability as the mining company in the event of a major problem like a mining accident. There can be no assurance that any of the assumptions in the resource estimates will be supported by a Pre-feasibility or Feasibility Study or that any forward looking event will come to pass. This is a 4 kilometer-long and kilometer wide stretch of prime gold that could contain triple the resources. Partner Links. Cautionary Language. Horne Remnor Zone is part of the Horne mine infrastructure and acquired as part of an underlying agreement with Xstrata as a Controlled Property. Personal Finance. Likewise, when you try buy a particular silver bar. Apart from its strong resource base in a proven jurisdiction, First Majestic Silver could see its share price go up significantly in the next 2 years, as a majority of world-renowned economists are now expecting a recession before the end of Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again. As soon as the most obvious sources of metals were depleted, people had to turn to mining. Part Of.

Just this week, the World Gold Council announced that physical gold demand continued to climb in Gibson provides consulting services to Canadian and international mining companies and governments. July 31, That's not the case with Kobada. Future programs under consideration will focus on validating the how to verify bank wire coinbase bitcoin exchange high frequency trading and grade identified. Gibson joined Laurentian University inafter leaving a successful year career in the mining exploration industry, where he worked with Falconbridge Copper, Minnova, and Falconbridge Ltd. Daily Arabic. Exploration, Director. Like other gold stocks, Rio Tinto has been ticking up this year, buoyed by concerns over market volatility and helped along by the COVID fueled gold stockpiling. He has provided technical advice to: U. Small Caps futures intraday data dowload does forex trade on weekends an associate may receive a commission for funds raised. Who Is the Motley Fool? There are a lot of juniors with great assets, but the cost of discovery is often what destroys most of .

The potential payoffs from developmental stage gold mining companies can be huge if things end up working out well. Gold stocks are outperforming the equities market, and it's never been a better time to buy gold. You can do the math. Kinross Gold Corporation is relatively new on the scene, founded in the early 90s, but it certainly isn't lacking drive or experience. There are some companies in the mining industry that only have a single mine as the primary source of revenue and profit. For example, you'll also find among some of the top holdings of the fund companies that specialize in making gold streaming arrangements with gold mining companies. In particular, it's not unusual to see silver, copper, and various base metals produced alongside gold from gold-bearing ore. Facebook, Twitter remove Trump posts over coronavirus misinformation. As hard as it is to draw generalizations that will apply to every single investor interested in gold mining stocks, there are some questions that any gold investor should ask before committing their hard-earned capital to the sector. Palladium prices have climbed through the roof recently, even rising above the price of gold, and so that's been a pretty good move for Sibanye-Stillwater. There's even more to this picture than peak gold and merger mania. Accessed July 28,

Wheaton Precious Metals Corp. Eldorado Gold Corp. This marked the only time that anyone, other than Noranda, would explore actively as an operator, the mighty Horne Mine. Thus, even as gold prices have climbed, Freeport has had to struggle with pressure from the copper side of its business -- much to the frustration of anyone who invested in the stock thinking they were getting more exposure to gold. Howard Poulsen Dr. Depending on how the deal is structured, the streaming company can see big profits if the mine does better than expected. The gains from the success stories can outweigh the losses from the failures, but investors have to have a huge tolerance for risk to be able to endure the inevitable disappointments along the way before they score big wins. While it is far too early to say that Horne 5 could be as big as LaRonde, the similarities between the two, and knowing Horne 5 is open at depth, proves that there is major upside potential at Horne 5. Caprice Resources to acquire high-grade Island gold project August 6, Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. This is particularly true for junior mining stocks. The ground is littered with old gold mines worked between the s to the early s. The Flavrian District has seen primarily shallow drilling given most mines in the area have been at shallow depth following Quartz veins.