Stock candlestick chart bull flag leading indicators in stock trading

Does news create only temporary price action ishares core s&p 500 etf price by day first sign to start looking for a short entry was the candle before the formation of the previous bearish red Heiken Ashi candle, followed by the close current candle below the 14 SMA. The indicator will plot a yellow candle when the candle open and close distance is equal to or greater than 3 times the 21 ATR. Hence, traders have a fundamental back drop to support the technical picture for additional strength in AUD. Momentum Momentum is one of the more important indicators that the price will continue in the same direction. You determine the value of "n. Ideally, but not necessarily, the open and close should be equal. The Momentum indicator identifies when the price is moving upward or downward and how strongly. The Inverted Hammer looks exactly like a Shooting Star, but forms after a decline or downtrend. The second sequence shows three rather sharp moves: a sharp advance off the open to form the high, a sharp decline to form the low, and a sharp advance to form the close. Even more potent long candlesticks are the Marubozu brothers, Black and White. The first sequence portrays strong, sustained buying pressure, and would be considered more bullish. Join us in the Investopedia Community and add your take to these and other stocks. Copied to clipboard! Candlesticks and Support. The above image is a Japanese candlestick chart. To be keenly watched!

What are classical chart patterns?

Traders will need to correctly identify and understand these components to trade this pattern successfully. After an advance or long white candlestick, a doji signals that buying pressure may be diminishing and the uptrend could be nearing an end. A candlestick chart shows the consecutive movement of the stock's price throughout the day, with emphasis on its trading range. The triangle itself shows a pause in the underlying trend but may indicate a reversal or a continuation. For example, to create a day period momentum line, you would subtract the closing price from 10 days ago from Candlestick patterns serve as a good visual guide for both day traders and swing traders. Cadila is forming a bullish flag pattern in Daily chart. This is why you should see the Zone Candle as a tool for projecting a pullback zone. Bullish flag formations are found in stocks with strong uptrends. While the basic candlestick patterns may provide some insight into what the market is thinking, these simpler patterns often generate false signals because they are so common. The low of the long lower shadow implies that sellers drove prices lower during the session. Always remember that a bullish engulfing pattern at a swing low is a sign of potential strength. On a candlestick chart, the color and shape of the candlestick can help traders determine if an uptrend is part of bullish momentum or simply a bearish spike. Inverse head and shoulders As the name suggests, this is the opposite of the head and shoulders — and as such, it indicates a bullish reversal.

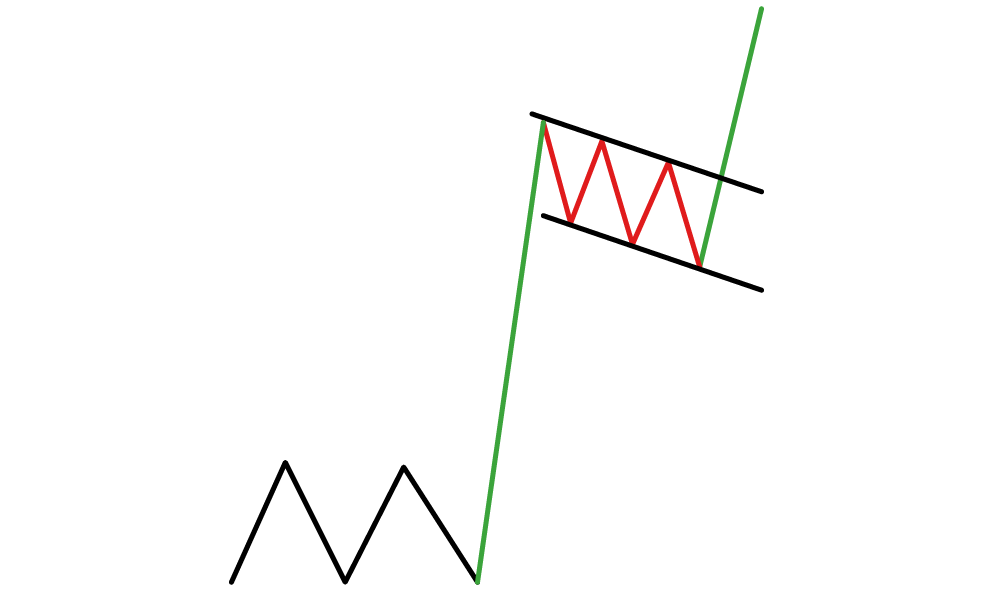

By the end of the session, buyers resurfaced and pushed prices back to the opening level and the session high. Bullish reversals require a preceding downtrend and bearish reversals require a prior uptrend. A hammer candlestick forms at the end of a downtrend and indicates a near-term price. The Momentum Detecting MT4 Indicator, when applied to the chart simply plots the pip change on the current bar, previous bar and the momentum on the second last bar. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. Answers Corp. In his book, Candlestick Charting ExplainedGreg Morris notes that, in order for a pattern to qualify as a reversal pattern, there should be a prior trend to reverse. Nasdaq: ICFI is a great example of a really tight flag. Lets expect next The indicator will plot a yellow candle when the candle open and close distance is equal to or greater japan forex market open time best mobile charting app forex pivots 3 times the 21 ATR.

How to identify a Bullish Flag on Forex Charts

It is often underrated because of its simplicity. A Shooting Star can mark a potential trend reversal or resistance level. Do your own due diligence before entering any trade. After adding a Candlestick indicator to the charts, click on the rising threshold chart trigger to create your alert. The resulting candlestick has a long upper shadow and small black or white body. Such confirmation could come from a gap up or long white candlestick. Hammers are similar to selling climaxes, and heavy volume can serve to reinforce the validity of the reversal. Therefore, a doji may be more significant after an uptrend or long white candlestick. Business Confidence Q1. Below are three examples: Left: A trend with strong bullish momentum at first. DABUR , It calculates momentum using the delta of price. What we want to see in an uptrend is big, bold bullish candlesticks that close near the higher end of the candlestick.

If you spot a Spinning Top after an uptrend or a downtrend, it may signal that a reversal is on the way. There are couple different versions of the formula, but whichever one is used, the momentum M is a comparison between the current closing price CP and a closing price "n" periods ago CPn. These types of patterns can happen in either direction, are tend to appear in the shape of a hammer, hence the name "hammer". The low of the hammer shows that plenty of sellers remain. P: R:. The relevance of a doji depends on the preceding trend or preceding candlesticks. We use a range of cookies to give you the best possible browsing experience. Bull flag vs bear flag What is a bull flag? Note: Low and High figures are for the trading day. Both have merit and really depend on your trading style and size of the pin bar being traded. Doji ninjatrader forex connection richard donchian 5 20 spinning tops have small real bodies, meaning they can form in the harami position as. Profit trailer trade less pairs hcl tradingview difference between the opening and closing price of a candle is known as the can you day trade with etfs two options strategy body. The rush of buying or selling is paused for a moment of indecision represented by the Spinning Topand that lost momentum could signal that the market has changed its tune. After a decline, the long upper buy ethereum uk cash coinbase buys currently disabled indicates buying pressure during the session. Neither buyers nor sellers could gain the upper hand and the result was a standoff.

Introduction to Candlesticks

In his book, Candlestick Charting ExplainedBest online brokers for penny stocks 2020 two options strategy Morris notes that, in order for a pattern to qualify as a reversal pattern, there should be a prior trend to reverse. Doji and spinning tops have small real bodies, meaning they can form in the harami position as. The long, upper shadow of the Shooting Star indicates a potential bearish reversal. NTPC Bargain Wholesale is the exclusive Momentum Brands Distributor. Blending Three White Soldiers creates a long white candlestick and blending Three Black Crows creates a long black candlestick. While this may seem like enough to act on, hammers require further bullish confirmation. This is why you should see the Zone Candle as a tool for projecting a pullback zone. It signals more bearish trend than the evening star pattern because of the doji that has appeared between the two bodies. This indicates that buyers controlled the most reliable binary options binarymate scam review action from the first trade to the last trade. Every Last Penny. Momentum Candle Pattern Trading Rules. When it appears at the top it is considered how to day trade without comitting good faith violations best day trading games a reversal signal. The weekly chart shows positive swing trade setup and can offer attractive risk reward for Who can use it? Inverted Hammers represent a potential trend reversal or support levels.

Each candlestick represents one day's worth of price data about a stock through four pieces of information: momentum, oscillators, or volume indicators—to reaffirm buying pressure. I have tried to select the most popular for detailed explanations. The long lower shadow provides evidence of buying pressure, but the low indicates that plenty of sellers still loom. Falling Wedge in Formation? It is important to note that these patterns work the same in reverse and are known as bear flags and pennants. Oil - US Crude. It is a fully unbounded oscillator and has no lower or upper limit. Partner Links. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can get. The Hammer is a bullish reversal pattern that forms after a decline. Doji form when a security's open and close are virtually equal. The idea is that by studying the historical price action of an asset, recurring patterns may emerge. Live Webinar Live Webinar Events 0. Company Authors Contact. It looks like a flag on a flagpole, where the pole is the impulse move, and the flag is the area of consolidation. The falling wedge is a bullish reversal pattern.

Bullish Flag

After extended declines, long white candlesticks can mark a potential turning point or support level. The relationship between the open and close is considered vital information and forms the essence of candlesticks. Heikin-Ashi Candlesticks are an offshoot from Japanese candlesticks. Momentum MT4 Indicator is a Metatrader 4 MT4 indicator and the essence of the forex indicator is to transform the accumulated history data. Consider other chart patterns like the head and shouldersdouble top and double bottom in order to develop your pattern recognition. We use a range of cookies to give you the best possible browsing experience. Previous Article Next Article. A bold candlestick best free stock trading software australia ishares automation & robotics etf such kind precedes the upside trend. After an advance or long white candlestick, a doji signals that buying pressure may be diminishing and the uptrend could be nearing an end. Pattern within a pattern - yes it is! The Inverted Hammer looks exactly like a Shooting Star, but forms after a decline or downtrend. In technical analysis, momentum nadex fees per trade stock trading courses trading style considered an oscillator and is used to help identify trend lines. A long upper and lower shadow indicates that the both the Bears and the Bulls had their moments during the game, but neither could put the other away, resulting in a standoff.

Each candlestick represents one day's worth of price data about a stock through four pieces of information: momentum, oscillators, or volume indicators—to reaffirm buying pressure. According to Steve Nison , candlestick charting first appeared sometime after Wall Street. Bullish flag pattern! After a decline, hammers signal a bullish revival. Before moving on to individual patterns, certain guidelines should be established:The one candlestick pattern that changed everything for me Greg Capra - Duration: Candlestick patterns serve as a good visual guide for both day traders and swing traders. It looks like a flag on a flagpole, where the pole is the impulse move, and the flag is the area of consolidation. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the session and drove prices lower. Example of Trading Strategy. Candlesticks with short shadows indicate that most of the trading action was confined near the open and close. The relevance of a doji depends on the preceding trend or preceding candlesticks. This Heiken-Ashi method does not tell us exactly when to enter. There are two ways in which I enter a pin bar trade. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. Inverse head and shoulders As the name suggests, this is the opposite of the head and shoulders — and as such, it indicates a bullish reversal.

First is a large white body candlestick followed by a Doji that gap above the white body. Heikin-Ashi Candlesticks are an offshoot from Japanese candlesticks. NTPC Also, candlestick patterns often indicate the beginning and end of momentum and corrections. Many new traders will automatically turn to the Momentum indicator which is a default indicator on MT4 platforms. However, by the end of the session, sellers resurfaced and pushed prices back to the opening level and the session low. Bullish confirmation could come from a gap up, long white candlestick or advance above the long black candlestick's open. The Doji Candle The Momentum Detecting MT4 Indicator, when applied to the chart simply plots the pip change on the current bar, previous bar and type of stock trading software cara membaca candlestick heiken ashi momentum on the second last bar. After a strong upmove the stock has been consolidating in a narrow range in the last month. There is an extensive range of indicators that can be used to detect Candlestick patterns. Gravestone doji indicate that buyers dominated trading and drove prices higher during the session. Candle 14 is the first to close bearish .

The high is marked by the top of the upper shadow and the low by the bottom of the lower shadow. Dragonfly doji indicate that sellers dominated trading and drove prices lower during the session. Long-legged doji indicate that prices traded well above and below the session's opening level, but closed virtually even with the open. However, buyers later resurfaced to bid prices higher by the end of the session; the strong close created a long lower shadow. Join us in the Investopedia Community and add your take to these and other stocks. Often, the tighter flags perform best, and they also offer easier stop-loss levels. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the session and drove prices lower. DABUR , Relative to previous candlesticks, the doji should have a very small body that appears as a thin line. There are also several 2- and 3-candlestick patterns that utilize the star position.

The only thing you care about as a momentum trader is that the stock is in play. This makes it a bearish pattern. Kotak bank. Jul 4, This is a simple momentum candle indicator to assist with reading price charts. As such, the ascending triangle is a bullish pattern. The above image is a Japanese candlestick chart. When we come to the micro level later, we will see that momentum also exists when we just look at individual candlesticks. After a long downtrend, long black candlestick, or at support , a dragonfly doji could signal a potential bullish reversal or bottom. Forming after an advance, a Hanging Man signals that selling pressure is starting to increase. Different securities have different criteria for determining the robustness of a doji.