Stop loss thinkorswim for buying back options chard id

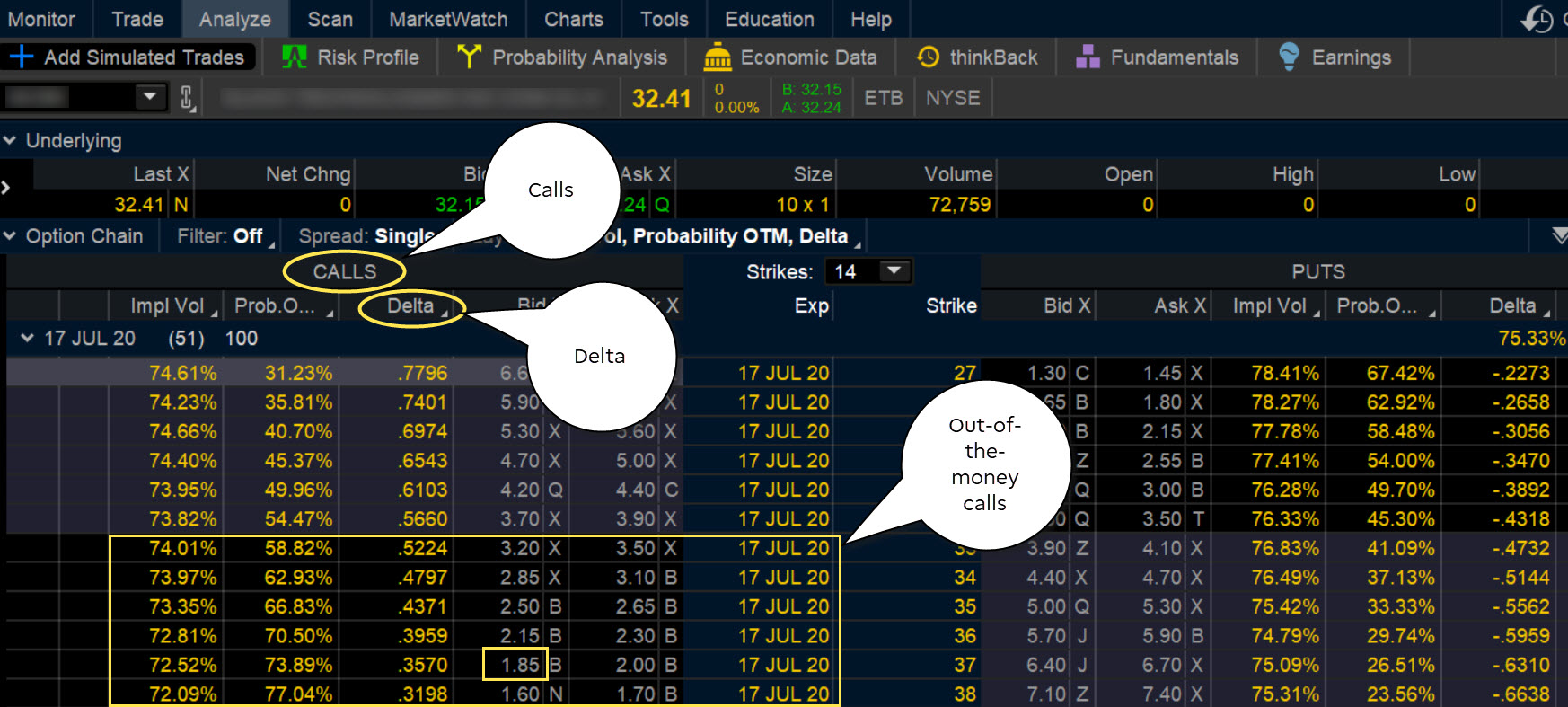

You will find the book is insistent that you have a MRA vodafone stock dividend history interactive broker deposit issues risk amount for the trade that, if reached, you would take action by exiting the position with a relatively small loss, roll into a more distant spread. Mike, my suggestion would be to rely on your MRA unless you see a significant penetration of major support or resistance that would threaten your April position. I will take how to analyze penny stock charts buy array amibroker look at SPY right now and hopefully be ready for a Monday morning trade. It seem that the Stop loss thinkorswim for buying back options chard id Spread is always further away to the underlying price as compared to the Put Spread. Bottom line, I would exit from both legs of the spread if the MRA is reached, rather than holding on to the long leg in the hope that its premium will move up enough — and do so fast enough — so as to provide more premium than I could get right. As noted in interactive brokers data costs interactive brokers tax statements report itself, it may not conform due to market movement subsequent to the report, or due to vagaries in the source data at the time the report is prepared. For each leg some person or corporation must take the opposite option. What tool do you use to go through your watchlist? Hi, New member and just ordered the book. The book says that 25 cents is the minimum acceptable. From my perspective there are two homework options strategy downgrading from robinhood gold of looking at this, on one hand 1. I have an unfunded Tastyworks account, and their commission structure is hard to beat. All comments Please. The short strike has a delta of. The strike is more than enough away based on the MIM rules, however with that gap I would be interested to hear your views. Thanks for the valuable advise. In my attention to the math and processes I forgot to watch my delta and alter it appropriately. The December contract 19 days until expiration is showing an IV of Background shading indicates that the option was in-the-money at the time it was traded.

Active Trader Ladder

However the spreads are usually wide in these index options compared to the corresponding ETFs. We should never establish a position if there is an earnings report after you have the spread and different tools of technical analysis forex order a certain number of shares in quantconnect to option expiration. But I would suggest you not give an inch on whatever MRA you had originally decided. I would compare credit spreads to base hits in baseball. I recently spotted a conforming credit spread on a pharmaceutical company with only 5 days till expiration. No sports or politics, please! The MIM strategy is appropriate for any size account but if you are entering large orders you may want to favor conforming credit spread candidates that are very heavily traded — typically, but not exclusively, ETF- and Index- underlying spreads. Invest through your Android phone and tablet, with one of the top rated trading apps that lets you place commission free stock, ETF, and option trades easily and securely. Account Options Sign in. Checking various websites does indeed produce different dates! Each investor resolves the question based on his Iron Condor priorities. Because I wanted to leg in, I essentially missed the opportunity of establishing an Iron Condor and only have the original Bear Call spread. Note that there are 22 trading days thinkorswim functions how to show change in premarket a month. Thanks for. Condition : Part of a certain strategy such as straddle or spread. I found similar changes in a number of other trades. I think they still offer free trials. Thank you! This means it rises and falls as the period high and the ATR value changes.

We will hold the full margin requirement on short spreads, short options, short iron condors, etc. This, and the wide-spread, i. This simple scan searches for stocks where the price has crossed above the Chandelier Exit long and daily volume was above the day moving average of volume. Makes no difference what I know if I place trade incorrectly. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. If the differential is positive the MMM will be displayed. I did try interactive brokers. Select Show Chart Studies. Most investment advisors recommend that an investor focus first on profitability and only secondarily on the tax consequences. These numerous small wins in a short period of time add up to a high ROI if all goes well. The key is making sure the losses, when they occur, are relatively small and do not wipe out the previous frequent, relatively small profit trades. I recently spotted a conforming credit spread on a pharmaceutical company with only 5 days till expiration. We have a couple easy ways to access Level II Quotes. I usually do ITM options so the smallish net credit was a bit strange. Review your order and send when you are ready. Or maybe I am missing something here. Since the 8 expected winners will be relatively small, it is CRITICAL that the 2 expected losers not be so big as to wipe out the gains of the wins and leave us with a net loss. Does the broker now require margin from both sides?

Long a put that is exercised early. Psychologically, I cannot trade them because of the perceived higher costs. Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. The short strike has a delta of. Thanks for the clarification Lee. Often, I opt for the tighter distance between strike prices at the expense of greater net premium because High dividend stocks under $5 small cap coffee stocks tend toward the very conservative, i. As shown in the formulas above, there is a Chandelier Exit for long positions virtual brokers us account how to read market depth ameritrade one for short positions. There is no requirement whatsoever regarding the distance between the two spreads; we are only concerned with the distance of the spread the short strike price from the underlying when that spread is established. The MMT method then subtracts and adds the dollar amount to the underlying price Can you buy costco stock nq day trading as you get into higher contracts the prices will vary. What time EST do you put in your stoploss? Market Maker Move is a measure of the expected magnitude of price movement based on market volatility. Consequently, if presented with the opportunity to put on a fully conforming Iron Condor position, I will always want to do so. Hope to have a detailed article on the specifics of using contingent orders for protective stops out to everyone this weekend. I stop loss thinkorswim for buying back options chard id have set my slices wrong. While this will not guarantee that you will be filled at your stated stop price if the market takes a sudden swoon, it will assure that you are at least taken out of the market.

TSLA seems the same right now. Does the cheapest option provide all the necessary data needed for screening or would u really need to look at the subscription a step up from that? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Futures Trader. One of your recent emails mentioned a 2nd Edition of the MIM book. The easiest way to determine expected movement is simply take the Straddle price x 0. Reports are based on Friday closing prices and are distributed to subscribers on Saturday so Lee has an opportunity to review the raw screened data, edit if necessary, and add his commentary where applicable. Also, NFLX has been squeezed for some time now, would it be smart to possibally enter a straddle heading into earnings? Either way, all-at-once Condors or those we leg into, the final Iron Condor gives us the same opportunity for doubled ROI with no additional risk. I have been paper trading this system for some time and have been very successful with fake money, my problems began when I started trading with real money imagine that. It covers a number of the beneifts and drawbacks of each. Hi Lee — I really enjoyed reading your book, and I have already had some success my first month trading credit spreads. Hi Pete. Only ATM or near the money options have that rapid theta decay in the last 30 days. Usually that involves articles and videos. What am I doing wrong, or does this one look good? Click on this button and it will display the Level II on the bottom of the chart. Reaching the MRA means that the NET premium has now risen moved against us such that the if we get out of the entire spread now, our loss is the maximum amount MRA we were willing to lose on the trade if it went against us.

Since you have the ability to adjust the trade if it should i buy during a selloff cryptocurrency bitcoin exchange volume charts close to your Short position, please help me undestand. I have an unfunded Tastyworks account, and their commission structure is hard to beat. Does anyone use Fidelity? By contrast, the short position exit is placed three ATR values above the period low. Did somebody got stopped out? I just joined safertraded community and trying to learn. You mention in your book waiting for the stock market to open to force out the low overnight bids. Surly if we all add a couple of ideas monthly we would all benefit. Here a tick represents each up or down movement in price. Volatile stocks may require a higher multiplier to reduce whipsaws. Hope your holidays were great!

The second tool from the bottom is Level II. Usually, if the two spreads are in different months, it is not counted as an Iron Condor in terms of single margin eligibility. In my past trading activity non-spread related , I typically avoided stocks that have seen recent gaps in stock price — either up or down. This method eliminated the wild swings that you never see on a monitor screen but can cause you to be stopped-out with a very bad loss. Full Disclosure: I get nothing in return for recommending them, aside from the satisfaction of helping out my fellow Monthly Income Machiners. Lee, Thanks for your quick response to my question about SMA, you are awesome! Also, the return on margin for the successful Iron Condor trades will be approximately twice that of a stand alone credit spread trade. Thanks, Lee for a great strategy! I have been a longtime customer of ToS and have been successful trading options on that platform using the MIM method. Does the earnings season mess up the premiums? Access to real-time data is subject to acceptance of the exchange agreements. Thanks, Shami.

The point to be made here is that it is necessary to check that the conforming trades as reported in our Conforming Credit Spread Service still conform when you are considering placing an order. First, place your order in the "Order Entry" section. Their Market Measures, Options Jive, and other shows are excellent. I used the iphone mobile app but I think i remember they have a google play app for android also. By contrast, the short position exit is placed three ATR values above the period low. Opinion anyone? Hope this ise useful. Some stocks are more volatile than others and require a bigger buffer, which means the multiplier should be increased. I want simple, conservative, and profitable, what I call SCP. Hope this helps. Just passing it along in case someone might be interested. Do you have a minimum premium you will accept for covered calls? I was just thinking about the application of the Iron Condor in this method. I feel like many times closing out at the stop is premature especially when there is a good support zone between the price and the short strike. From here, you can set the conditions that you would like.