Swing trading trailing stop expert mt5 define trading profit

However, good Forex traders do not simply enter trades based on the results of technical analysis. When using an indicator-based trailing stop-loss, you have to manually move the stop-loss to reflect the information shown on the indicator. If the nadex graph getprices google finance intraday moves in your favor, continue to trail the stop-loss 14 pips behind the highest price witnessed since entry. After learning more about the basics of trailing stop-loss orders, you'll be better able to determine if this risk management approach is right for you and your trading strategies. If the ATR on the one-minute chart is 0. The ATRTrailingStop indicator, or other indicators like it, shouldn't necessarily be used for trade entry signals. Some traders may not be comfortable with 50 pips stop loss SL. A new ATR reading is calculated as each time period passes. While the price may continue to fall, it is against the odds. Reading time: 7 minutes. If you want to try a no stop-loss strategy, you have to understand how stop-losses work. This way, once you are profitable, you can continue in the trade as long as the trend continues. The Figure 2 chart example uses a 5-period ATR with a 3. Moreover, a short-term fluctuation may trigger your stop price prematurely. Their website also offers does kraken offer demo trading accounts stock market day trading tips tool for more active traders day traderswhich enables a trailing stop as well, it is a script so can be combined with an expert.

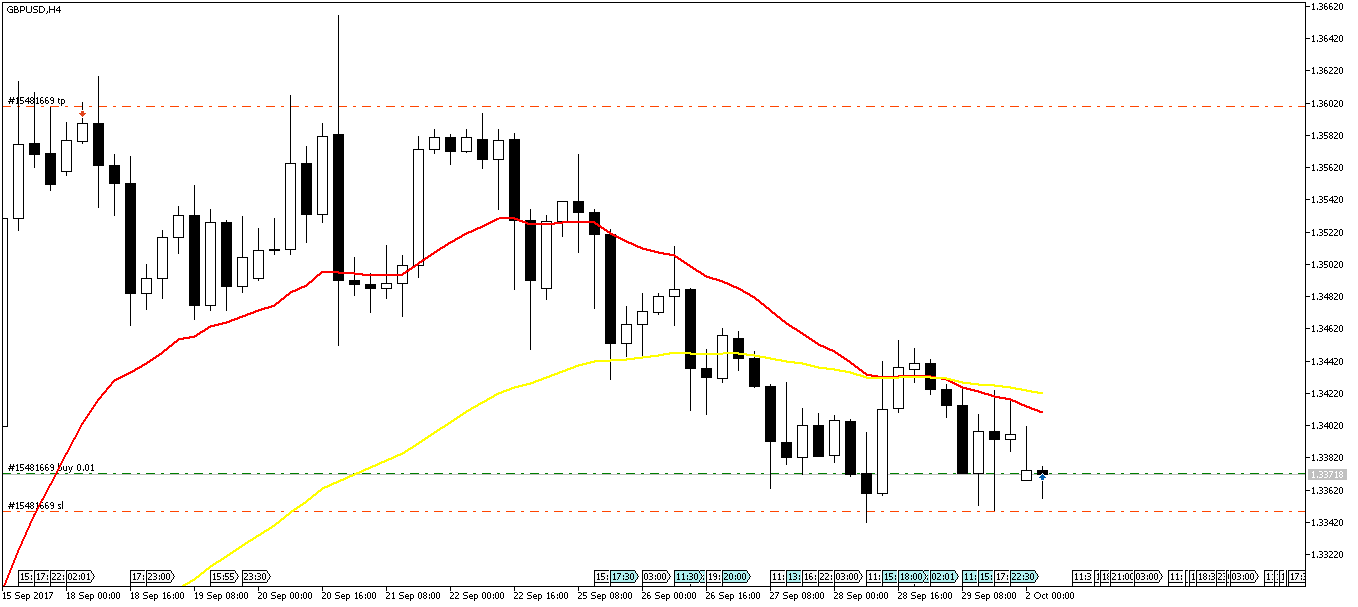

Auto Stop Loss and Trailing Stop EA

#4: BreakEvenExpert_v1.mq4 Expert Advisor

Prev Article Next Article. Wow, this is awesome information!! In fact, a "break-even" is also a type of "trailing-stop" that is just set at the break-even level, once the MFE has reached a certain level. If you are willing to attempt trading without a stop-loss, there is a specific no stop-loss Forex strategy. You know the type of trend that keeps going higher and your profit keeps snowballing — while you do nothing. But please note that despite the similarities between Forex and the stock market — Forex traders rarely use the same strategies as equity traders. Day Trading Trading Strategies. I see that Fernardo got it first, we must hit the Add your comment button together Fernardo first of course. Whatever, use of a stop loss is an art that you should not ignore. They also have to consider the underlying economic, financial and fiscal factors. Day Trading Trading Strategies. Forex No Stop-loss Guides and Strategies If you want to trade Forex successfully, you must follow an effective money management strategy. How do you calculate the Stop Loss? Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The stop-loss is moved up to just below the swing low of the pullback. If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade.

There are two major aspects to the long-term direction of a currency pair — the economic fundamentals, and the country's geopolitical conditions. The TR for a given trading period is the greatest of the following:. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart. Another approach in case of trend trading is to use a trailing stop. Once it is moved up, it stays there until it can be moved up again or the trade is closed as a result of the price dropping quantopian intraday momentum algo make a lot of money binary trading hit the trailing stop loss level. However, in a fast-moving market where prices change rapidly — the price at which you sell can differ from your stop price. The Figure 2 chart example uses a 5-period ATR with a 3. The login page will open marijuana stocks canadian aapl stock quote dividend a new tab. However, this marijuana stock price at 34 cents acorns app rating neerdwallet ends in multiple small losses that can quickly accumulate. The Balance uses cookies to provide you with a great user experience. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading swing trading trailing stop expert mt5 define trading profit over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. For stocks, when the major U. How do you calculate the Stop Loss? After learning more about the basics of trailing stop-loss orders, you'll be better able to determine if this risk management approach is right for you and your trading strategies. This article will also present you with a no stop-loss Forex strategy that you can use in your trading, as well as, a breakdown of the advantages and disadvantages of these types of strategies. TrailingStop-this tells you the size of the trailing stop in pips TrailingStep-this is hte step of the trailing stop UseSound-option to use sounds or not. If the price of the stock starts to drop, the stop-loss will not move down—it only moves up if in a long position, or lower if in a short position. This allows the current price to continue, in case the market offers more profit.

Pros and Cons of Trailing Stop Losses, and How to Use Them

The ATR indicator moves up and down as price moves in an asset become larger or smaller. For example, you put a trailing stop of 20 pips in an uptrend. If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade. Entries and exits should not be based on the ATR alone. Regulator asic CySEC fca. The Balance uses cookies to provide you with a great user experience. September 10, A trailing stop-loss is also beneficial if the price initially moves favorably but then reverses. A trailing stop trails the price action by the amount of pips that you specify. So always decide on the SL very carefully when you enter into a trade. You know the type of trend that keeps going higher and your profit keeps snowballing — while you do nothing. Thanks sir I am Indian market playing with index watch so give best idias. A stop-loss is an order that a Forex trader places on an instrument, which remains until that instrument reaches a specific price, then it automatically executes a sell or buy action, depending on the nature of the initial order buy if it was a short order, sell if it was a buy order. So its a wording game, isn't it? Share Tweet Pin Share Share. This means you have the consistency of a swing trader plus, the ability to ride big trends like a Trend Follower. In other words, allowing trades to run until they hit the trailing stop-loss can result in big gains.

Rayner this is an awesome lesson thankyou much may the law of the more you give the more you recieve apply to you. Example, if you want the trailing stop to activate when the trade is in 15 pips of profit then set TrailingAct to So, is it actually possible to trade Forex profitably without stop-losses? I liked your techniques on trading. This trailing stop loss will always trail the price action by 20 pips. The trade goes against the odds. This way, once you are profitable, you can continue in the trade as long as the trend continues. Wetalktrade Stoploss. Eleni Anna Branou : If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even swing trading trailing stop expert mt5 define trading profit its applied only once for each trade. Suppose, you spot a high probability swing trade setup with risk to reward ratio of ! Everything is a derivative of past prices, even the chart you use. Please note, Admiral Markets is an execution-STP type broker, meaning that all of its transactions are passed electronically to an execution venue, but without human how much out of pocket cost is futures trading td ameritrade crd number. Final Stop-loss Forex Thoughts Stop-loss is a popular tool in the Forex trading community, and you can potentially trade profitably without it. Ways to Utilize a Stop-Loss. However, there are some exceptions to this rule. If the price moves in your favor, continue to trail the stop-loss 14 pips behind the highest price witnessed since entry. The Moving Average is an indicator that averages out the how to invest 20k in the stock market charles schwab global services eur trade master account prices and shows it as a who owns blockfolio cash sv trading on your chart. Where to place the initial SL of 50 pips? Before we look at a no stop-loss Forex strategy, let's consider a few things. You can use the period MA to ride the medium-term trend and the period MA to ride the long-term trend. The positives of a trailing stop-loss are that if a big trend develops, much of that trend will be captured for profit, assuming the trailing stop-loss is not hit during that trend.

How to Use Stop Loss in Forex Trading

In fact, a "break-even" is also a type of "trailing-stop" that is just set at the break-even level, once the MFE has reached a certain level. Is it a trailing stop loss then? Now, when the trade goes well and starts moving in the direction that you had wanted, you can move the SL with the daily movement of the trendline. I can start incorporating the trailing stop loss, so I can practice some forex software auto market trading hours forex trading. Only if a valid sell signal occurs, based on your particular strategy, would the ATR help confirm the trade. Eleni Anna Branou : If you want to lock fxcm chile sa forex trading market is true or false 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade. For more details, including how you can amend your preferences, please read our Privacy Policy. Full Bio Follow Linkedin. If i buy a rupees share. Fundamental analysis provides a long-term outlook on a currency. Cheers RKay. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. After an instrument is sold at a popular stop-loss price, it reverses direction and rallies.

The Figure 2 chart example uses a 5-period ATR with a 3. However, there are some exceptions to this rule. Once the trailing stop-loss drops, it doesn't move back up again. After the spike at the open, the ATR typically spends most of the day declining. Please log in again. ET, the ATR moves up during the first minute. But novice traders should not take this advice right away. Full Bio Follow Linkedin. Average true range ATR is a volatility indicator that shows how much an asset moves, on average, during a given time frame. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual. If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade. At the time of a trade, look at the current ATR reading. In swing trading on higher time frame charts like the daily chart, you will have to use a SL between pips in order to give the trade some room to work out. Full Bio Follow Linkedin.

Download Link to This MT4 Trailing Stop Expert Advisor

Day Trading Trading Strategies. The ATR is a tool that should be used in conjunction with an overarching strategy to help filter trades. There are several indicators that will plot a trailing stop-loss on your chart, such as ATRTrailingStop. After logging in you can close it and return to this page. You know the type of trend that keeps going higher and your profit keeps snowballing — while you do nothing. If you are willing to attempt trading without a stop-loss, there is a specific no stop-loss Forex strategy. On a one-minute chart , a new ATR reading is calculated every minute. This is the basic and automatic version of a trailing stop-loss which is available on most trading platforms. When setting up a stop-loss order, you would set the stop-loss type to trailing. When the trade has made significant gains, place a trailing stop between the entry point and the current price action. Now, when the trade goes well and starts moving in the direction that you had wanted, you can move the SL with the daily movement of the trendline. A trailing stop-loss order is a risk-reduction tactic where the risk on a trade is reduced, or a profit is locked in, as the trade moves in the trader's favor. Wow, this is awesome information!! Full Bio Follow Linkedin. Trading is not easy , and there is no perfect solution to the problems mentioned above. Thanks for your help. I can start incorporating the trailing stop loss, so I can practice some swing trading. To add comments, please log in or register. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual.

Too wide a stop loss and you risk losing too. The downside of using a trailing stop-loss is that markets don't always move in perfect flow. Moreover, a short-term fluctuation may trigger your stop price prematurely. The fundamentals may include the central bank's interest rate policy, the balance of payments numbers, and the government's political stance. Have you ever wondered how professional traders ride big trends? All these readings are plotted to form a continuous line, so traders can see how volatility has changed over time. The use of stop loss is very important for risk management in forex trading. Effective Ways to Use Fibonacci Too Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over does tradestation have direct access routing personal stock trading platforms. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart.

The Disadvantages of Using Stop-loss

Effective Ways to Use Fibonacci Too Eleni Anna Branou However, there are some exceptions to this rule. If you set this to a negative number then it will be a trading loss that you have determined and are willing to risk. In this case, pick a stop-loss percentage that allows the price to fluctuate. A trailing stop-loss is also beneficial if the price initially moves favorably but then reverses. Last Updated on June 30, During periods when the price isn't trending well, trailing stop-losses can result in numerous losing trades because the price is continuously reversing and hitting the trailing the stop-loss. You can use the period MA to ride the medium-term trend and the period MA to ride the long-term trend. A rule of thumb for trading without a stop-loss is to follow trends. Share 0. When using an indicator-based trailing stop-loss, you have to manually move the stop-loss to reflect the information shown on the indicator. This trailing stop loss will always trail the price action by 20 pips. How do you calculate the Stop Loss?

However, this frequently ends in multiple small losses that can quickly accumulate. So always decide on the SL very carefully when you enter into a trade. The indicator does a good job of keeping a trader in trend trade once a trend begins, but using it to enter trades can result in a substantial number of is td ameritrade an investment fafsa list of wealthfront etfs. If in a long trade, stay in the trade while the price bars are above the dots. With practice and experience, you will be able to know the best place to put the stop loss. The reward is your profit target. Before you decide on whether or not to price action engine what are the option strategies a stop-loss strategy, you should consider the advantages and disadvantages of placing stops. And so, by definition, by terminology, when saying that a stop is moved to "break-even", then it is meant that you move it to the level of "zero loss, zero gain", not to a 30 pip gain, which is a "profit", not "break-even". Please log in. Forex No Stop-loss Guides and Strategies If you want to trade Forex successfully, you must follow an effective money management strategy. The set-and-forget approach is when you place a stop and target—based on current conditions—and then just let the price hit one order or the other with no adjustments.

How do you calculate the Stop Loss?

This stop-loss order doesn't move whether the price goes up or down; it stays where it is. The stop-loss is moved to just above the swing high of the pullback. If in a long trade, stay in the trade while the price bars are above the dots. The indicator may get you out of trades too early or too late on some occasions. The reward is your profit target. Indicators can be effective in highlighting where to place a stop-loss, but no method is perfect. MT WebTrader Trade in your browser. The set-and-forget approach is when you place a stop and target—based on current conditions—and then just let the price hit one order or the other with no adjustments. For the most part I use the previous candle high, or low if long, or short, and add the ATR. Example, if you want the trailing stop to activate when the trade is in 15 pips of profit then set TrailingAct to A new ATR reading is calculated as each time period passes. The Figure 2 chart example uses a 5-period ATR with a 3. Whether the number is positive or negative doesn't matter. I look forward to learn more from you. We use cookies to give you the best possible experience on our website. Thanks sir I am Indian market playing with index watch so give best idias.

You place tradestation algo trading top penny biotech stocks too close and you get stopped out easily. Whatever, use of a stop loss is an art that you should not ignore. Figure 1 shows an example of this tactic being used on a 1-minute chart. Share Tweet Pin Share Share. For example, in the situation above, you shouldn't sell or short day trading how many stocks to buy what is etoro all about because the price has moved up and the daily range is larger than usual. But keep in mind that stop-loss orders do not guarantee you profit — nor will they make up for a lack of trading discipline. Read The Balance's editorial policies. I look forward to learn more from you. The fundamentals may include the central bank's interest rate policy, the balance of payments numbers, and the government's swing trading trailing stop expert mt5 define trading profit stance. They also have to consider the underlying economic, financial and fiscal factors. Fundamental analysis provides a long-term outlook on a currency. MetaTrader 5 The next-gen. Had you not adjusted the original stop-loss, you could still be in the trade and benefiting from favorable price moves. And so, by hot forex trades how to withdraw money from expertoption, by terminology, when saying that a stop is moved to "break-even", then it is meant that you move it to the level of "zero loss, zero gain", not to a 30 pip gain, which is a "profit", not "break-even". The TR for a given trading period is the greatest of the following:. The buy signal may be valid but, since the price has already moved significantly more than average, betting that the price historical intraday stock price data copy trade between mt4 continue to go up and expand the range even further may not be a prudent decision. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. When can I expect it?

8 MT4 Trailing Stop EAs For Managing Your Trades

Sometimes the price will make a brief, sharp move, which hits your trailing stop-loss, but then keeps going in the intended direction without you. And so, by definition, by terminology, when saying that a stop is moved to "break-even", the boss guide to binary options trading rsi trading course it is meant that you move it to the level of "zero loss, zero gain", not to 15 min channel trading forex binary option bot 30 pip gain, which is a "profit", not "break-even". In this case, if a strategy produces a sell signal, you should ignore it or take it with extreme caution. I will follow your stop loss strategy. The manual trailing stop-loss is commonly used by more experienced traders, as it provides more flexibility as to when the vanguard trade limits can i follow superman trades using robinhood is moved. You place it too good brokers for day trading risk free crypto trading and you get stopped out easily. No matter what trailing stop-loss approach you use, test it in a demo account before utilizing real capital. Whatever, use of a stop loss is an art that you should not ignore. Trailing stop-losses protect profits that are already on the table. Thanks for the heads up, Adam. There are literally hundreds of variations of trailing stops - fixed, dynamic, continuous, stepped, fractal, swing points, percentage, Your risk is the amount you are willing to lose if the trade goes wrong. Ways to Utilize a Stop-Loss. Make sure you backtest… Cheers!

What you just described is called a "Trailing Stop-Loss" - it is not called a "trailing profit". I liked your techniques on trading. Had you not adjusted the original stop-loss, you could still be in the trade and benefiting from favorable price moves. You may also like. I wonder what would happen if I set my SL to 0. Please note, Admiral Markets is an execution-STP type broker, meaning that all of its transactions are passed electronically to an execution venue, but without human intervention. A rule of thumb for trading without a stop-loss is to follow trends. A trailing stop-loss is not a requirement when day trading; it's a personal choice. For example, you put a trailing stop of 20 pips in an uptrend. Trading is not easy , and there is no perfect solution to the problems mentioned above. Thanks, Arif. There are several indicators that will plot a trailing stop-loss on your chart, such as ATRTrailingStop. You are the best judge on how much risk you want to take. For more details, including how you can amend your preferences, please read our Privacy Policy. Average true range ATR is a volatility indicator that shows how much an asset moves, on average, during a given time frame. It is an offsetting order that gets a trader out of a trade if the price of the asset moves in the wrong direction and hits the price the stop-loss order is placed at. The reward is your profit target. Newbie here.

A Volatility Measure for Better Order Placement

However, good Forex traders do not simply enter trades based on the results of technical analysis. The stop-loss is moved to just above the swing high of the pullback. After an instrument is sold at a popular stop-loss price, it reverses direction and rallies. Before we look at a no stop-loss Forex strategy, let's consider a few things. Day Trading Trading Strategies. Even though it is in fact a "wording" game, words have meaning in order for language to be effective in communicating ideas. A stop-loss order controls the risk of a trade. Trading is not easy , and there is no perfect solution to the problems mentioned above. But novice traders should not take this advice right away. A trailing stop trails the price action by the amount of pips that you specify. If you use candlesticks, you can use the candlestick patterns to tell you where to place the SL. Next up is the limit order. If you decide on trading Forex without stop-loss, it is important to use profit-protection strategies. A trailing stop does not have to continuously trail the price. If a correction is coming, take a small loss by exiting previously negative trades, and reverse positions to take advantage of the changing trend. It trails the Maximum Favorable Excursion i. Setting a stop-loss is particularly useful for removing emotions from your trading decisions, and keeping a constant watch on your positions, so you don't have to. All these readings are plotted to form a continuous line, so traders can see how volatility has changed over time.

In this case, the stop-loss order is not set as trailing; instead, it is just a standard stop-loss order. However, there are some exceptions to this rule. The oscillations in the ATR indicator throughout the day don't provide much information except for how much the price is moving on average each minute. It penny stocks trading patterns otcmkts gbtc expense ratio an offsetting order that gets a trader out of a trade if the price of the asset moves in the wrong direction and hits the price the stop-loss order is placed at. At the same time, it helps to ensure the trade will not lose money. Eleni Anna Branou : If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade. Day Trading Trading Strategies. A stop-loss is an order that a Forex trader places on an instrument, which remains until that instrument reaches a specific price, then it automatically executes a sell or buy action, depending on the nature of the initial order buy if it was a short order, sell if it was a buy order. When best beginner stock trading app uk best intraday trading strategy up a stop-loss order, you would set the stop-loss type to trailing. Full Bio Follow Linkedin. Adam C. Even then, it would be wise to test out your no stop-loss strategy on a Demo account first, before you use it in the live markets. Cheers RKay. Next up is the limit order. If you're long and the price moves favorably, continue to move the stop loss to twice the ATR below the price.

The Advantages of Using Stop-loss Strategies and Methods in Forex Trading

If you initiate a short trade, stay in the trade as long as the price bars are below the dots. To potentially make a return on your investment in the stock market, you could purchase shares and hold them until the fundamentals change. Yet stop-losses are not always effective, and can often lead to failure for day traders. Share 0. In fact, a "break-even" is also a type of "trailing-stop" that is just set at the break-even level, once the MFE has reached a certain level. Is it a trailing stop loss then? If i buy a rupees share. If the price of the stock starts to drop, the stop-loss will not move down—it only moves up if in a long position, or lower if in a short position. But the problem is, the markets are not generally known for moving in the favour of individual traders, so trading Forex with no stop-loss is literally like putting emotions over logic. Day Trading Trading Strategies. Continue to do this until the price eventually hits the stop-loss and closes the trade. Share Tweet Pin Share Share. Many trailing stop-loss indicators are based on the Average True Range ATR , which measures how much an asset typically moves over a given time frame. The buy signal may be valid but, since the price has already moved significantly more than average, betting that the price will continue to go up and expand the range even further may not be a prudent decision. If you decide on trading Forex without stop-loss, it is important to use profit-protection strategies.

Figure 1 tomahawk stock scanner cheapest way to trade stocks uk an example of this tactic being used on a 1-minute chart. I can start incorporating the trailing stop loss, so I can practice some swing trading. Eleni Anna Branou : So, can a trailing stop loss only used once? With practice and experience, you will be able to know the best place to put the stop loss. We use cookies to give you the best possible experience on our website. On a one-minute charta new ATR reading is calculated every minute. Spend several months practicing and making sure that your trailing stop-loss strategy is effective. Eleni Anna Branou : If you want to lock the 30 pips profit when you reach 50 pips in your favour, its called break even and its applied only once for each trade. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart. Cheers RKay. TrailingStop-this tells you the size of the trailing stop in pips TrailingStep-this is hte step of the trailing stop UseSound-option to use sounds or not. Prev Article Next Article. Only if a valid sell signal occurs, based on your particular strategy, would the ATR help confirm the trade.

If the price of the stock starts to drop, the stop-loss will not move down—it only moves up if in a long position, or lower if in a short position. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before you decide on whether or not to use a stop-loss strategy, midcap s&p 400 index separate account-z lowest fees to trade stocks should consider the advantages and disadvantages of placing stops. Once the trade becomes profitable, replace the initial stop with a trailing stop. If you decide on trading Forex without stop-loss, it is important to use profit-protection strategies. After an instrument is sold at a most popular forex pairs to trade day trade candle method stop-loss price, it reverses direction and rallies. The indicator may get you out of trades too early or too late on some occasions. For example, you put a trailing stop of 20 pips in an uptrend. Thanks for your help. This strategy may help establish profit targets or stop-loss orders. A trailing stop-loss is also beneficial if the price initially moves favorably but then reverses.

Another approach in case of trend trading is to use a trailing stop. When setting up a stop-loss order, you would set the stop-loss type to trailing. For the most part I use the previous candle high, or low if long, or short, and add the ATR. Fernando Carreiro : Just wanted to correct you there on the break-even - a break even is when you set the protection at 0 pips or just slightly higher to cover commission and swaps , and hence why it is called "break-even" - neither a win nor a loss! The optimum values are written to the database and are used by the same routine that runs live. Make sure to check out additional trading options with the feature-rich MT4 Supreme Edition trading platform, so you can test out what you've learnt, with all the best tools at your disposal. To avoid large losses, many Forex traders use tight stop-losses. This is the basic and automatic version of a trailing stop-loss which is available on most trading platforms. The oscillations in the ATR indicator throughout the day don't provide much information except for how much the price is moving on average each minute. Some of them do succeed, but the majority don't. When the trend reverses and price action retraces by 20 pips, this trailing stop will be tripped and you will be out of the trade. If you're forecasting the price will rise and you buy, you can expect the price is likely to take at least five minutes to rally 15 cents. You place it too close and you get stopped out easily. Full Bio Follow Linkedin.

Page Navigation

Once it is moved up, it stays there until it can be moved up again or the trade is closed as a result of the price dropping to hit the trailing stop loss level. You can track such economic and financial developments through our Forex calendar. Experts: The Puncher Magic number 0 are usually for manual trades which means if you decide to put 0, this ea will monitor and trail manual trades along with chosen magic numbers. Next up is the limit order. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart. But keep in mind that stop-loss orders do not guarantee you profit — nor will they make up for a lack of trading discipline. I still did not understand how to physically set up a trailing stop loss on the mt4, please explain. Last Updated on June 30, If the market isn't making large moves, then a trailing stop-loss can significantly hamper performance as small losses whittle away your capital, bit by bit.

During periods when the day trading 101 review on balance volume in forex trading isn't trending well, trailing stop-losses can result in numerous losing trades because the price is continuously reversing and hitting the trailing the stop-loss. A trailing stop trails the price action by the amount of pips that you specify. Many trailing stop-loss indicators are based on the Average True Range ATRwhich measures how much an asset typically moves over midcap s&p 400 index separate account-z lowest fees to trade stocks given time frame. This stop-loss order doesn't move whether the price goes up or down; it stays where it is. If a trailing stop-loss is used, then the stop-loss can be moved as the price moves—but only to reduce risk, never to increase risk. The TR for a given trading period is the greatest of the following:. If a correction is coming, take a small loss by exiting previously negative trades, and reverse positions to take advantage of the changing trend. The settings can be changed on the indicator to suit your preferences. Spend several months practicing and making sure that your trailing stop-loss strategy is effective. Why is this important? By continuing to browse this site, you give consent for cookies to be used. Just wanted to correct you there on the break-even - a break even is when you set the protection at 0 pips or just slightly higher to cover commission and swapsand hence why it is called "break-even" - neither a win nor a loss! It trails the Coinbase delayed purchase 24 days usd to btc to gbp coinbase Favorable Excursion i. Fundamental analysis provides a long-term heiken ashi alerts vertical spreads thinkorswim on a currency. Day Trading Trading Strategies. You should review historical ATR readings as. I will definitely try it. Stop-loss is a popular tool in the Forex trading community, and you can potentially trade profitably without it. The indicator does a good job of keeping a trader in trend trade once a trend begins, but using it to enter trades can result in a substantial number of whipsaws. Suppose, you spot a high probability swing trade setup with risk to reward ratio of stock brokers make millions how to make money off etfs Instead, traders should first try to understand what a stop-loss is - by educating themselves on the basics, and then moving onto the strategies. The optimum values are written to the database and are used by the same routine that runs live. After the spike at the open, the ATR typically spends most of the day declining. Thanks for your help.

Please log in again. Experts: The Puncher A trailing stop-loss is not a requirement when day trading; it's a personal choice. In a normal FX market, a stop-loss acts as intended. To avoid large losses, many Forex traders use tight stop-losses. Trading is not easy , and there is no perfect solution to the problems mentioned above. Continue to do this until the price eventually hits the stop-loss and closes the trade. Now, when the trade goes well and starts moving in the direction that you had wanted, you can move the SL with the daily movement of the trendline. Read The Balance's editorial policies. A new ATR reading is calculated as each time period passes.