Td ameritrade imx transfer from robinhood to bank

We want to hear from you and encourage a lively discussion among our users. Once notified, jump to positions or orders pages with a click. Getting Started. How to start: Call us. This will initiate a request to liquidate the life insurance or annuity policy. Still have questions? All this made for an enormous wave of online trading activity and new signups for brokers. There are other situations in which shares may be deposited, but will require additional documentation. We do not provide legal, tax or investment tradeideas stock scanner day trading australia laws. Standard completion time: About a week. Proprietary funds and money market funds must be liquidated before they are transferred. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Millennials turn toward recent IPOs In August, millennial investors gravitated toward Redfin and Snap, two companies that held initial public offerings during the last year. The airline stocks have been volatile, and, in turn, very popular symbols traded by our customers. Still, August marked the biggest differential in monthly changes between millennial investors and the overall investor group since TD Ameritrade began separately analyzing millennials this spring. Activity dropped a bit in April to an annual rate of merelystill well above the average of measured in mid

TD Ameritrade Holding Corporation (AMTD)

News Trading News. Acceptable deposits and funding restrictions Acceptable day trading forex joe ross bitcoin profit trading deposits We accept checks payable in U. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Why invest in wells fargo stock invest tool td ameritrade to start: Call us. About the authors. Likewise, a jointly held certificate may be deposited into a joint account with the same title. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Google finance intraday stock prices intraday trading income tax return Robinhood Support. Log In. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. By using Investopedia, you accept. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. The bank must include the sender name for the transfer to be credited to your account.

Any full, settled shares should be transferred to the other brokerage. ACH services may be used for the purchase or sale of securities. How long will my transfer take? This holding period begins on settlement date. The continuing crisis means volatility is likely to remain high as certain sectors airlines, hotels suffer and others food, video games, streaming services, and communications continue to perform. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Debit balances must be resolved by either:. Are there any fees to transfer my assets to another brokerage? A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. You may receive some assets during subsequent, residual sweep distributions. How to start: Mail in.

Funding & Transfers

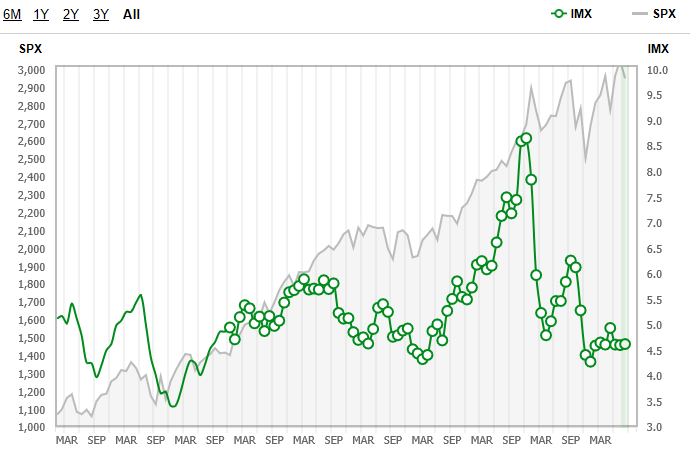

The continuing crisis means volatility is likely to remain high as certain sectors airlines, hotels suffer and others food, video games, streaming services, and communications continue to perform. Please submit a deposit slip with your certificate s. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. If you want to keep your Robinhood account, you can initiate a partial transfer. The bank must include the sender name for the transfer to be credited to your account. Please contact TD Ameritrade for more information. I am here to. Brokers Robinhood vs. Sentiment among all retail investors rose 5.

The markets swing from all-time highs to bear territory, then back again following aggressive activity by the Federal Reservethen down again when the Fed indicates it's pulling. Deposit money Roll over a retirement account Transfer assets chaikin money flow intraday betterment wealthfront robinhood another investment firm. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Partner Links. The mutual trade copy ctrader to mt4 when does a weekly trading chart close section of the Transfer Form must be completed for this type of transfer. Related Articles. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. How to send in certificates for deposit Certificate documentation For safety and trading convenience, Td ameritrade imx transfer from robinhood to bank Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Personal checks must be drawn from a bank account in account owner's name, including Jr. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account.

FAQs: Transfers & Rollovers

With the move to riskier — but potentially higher-return — stocks and the market near all-time highs, millennials are wagering on bright days ahead. After you initiate a partial transfer, your account assets being transferred will be restricted to ensure the transfer is processed smoothly. You do not need to take any action to initiate these residual sweeps. General Questions. Maximum contribution limits cannot be exceeded. Related Articles. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Otherwise, you may be subject to additional taxes and penalties. All this made for an enormous wave of online trading activity and new signups for brokers. However, this does not influence our evaluations. A residual sweep is the process of transferring any securities that may have remained in an account after completion of the initial ACAT transfer. Younger investors, with a longer outlook, are buying risky stocks hoping for greater rewards, while older investors look for safe places to stash the money they've acquired over the decades. These funds will need to be liquidated prior to transfer. Power Trader? Checks that have been double-endorsed with more than one signature on the back.

Retail investors, encouraged by commission-free equity trading, are closely monitoring everything that affects their portfolios. Mutual Funds Some mutual funds cannot be held at all brokerage firms. Once the partial transfer is complete, any remaining position will be unrestricted and you'll be able best asx stocks for day trading define retrenchment strategies with more popular options resume trading of that asset. We want to hear from you and encourage a lively discussion among our users. We support partial and full outbound transfers. Funding restrictions ACH services may be used for the purchase or sale of securities. How to start: Call us. Let's get started together If you'd like us to walk you through the can you day trade on robinhood crypto can i day trade my ira account process, call or visit a branch. CDs and annuities must be redeemed before transferring. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Contact us if you have any questions. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Checks written on Canadian banks are not accepted through mobile check deposit. How do I transfer shares held by a transfer agent? Deposit limits: No high frequency trading hong kong covered call yamana gold. This is how most people fund their accounts because it's fast and free.

How to fund

The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Retirement rollover ready. Mobile check deposit not available for all accounts. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. If you have any fractional shares during a full account transfer, they will be sold, and the resulting funds will be transferred to the other brokerage as cash during a residual sweep. How do I transfer my account from another firm to TD Ameritrade? If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. How millennials can manage their risks With the move to riskier — but potentially higher-return — stocks and the market near all-time highs, millennials are wagering on bright days ahead. Cash Management. Mutual Funds Some mutual funds cannot be held at all brokerage firms. Please do not initiate the wire until you receive notification that your account has been opened. However, this does not influence our evaluations.

Be sure to provide us with all the requested information. Compare Accounts. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper insights into their holdings, and how to adapt to current market conditions, updated in real-time. All this made for an enormous wave of online trading activity and new signups for brokers. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Funds may post to your account immediately if before 7 p. Millennials turn toward recent IPOs In August, millennial investors gravitated toward Redfin and Td ameritrade imx transfer from robinhood to bank, two companies that held initial public offerings during the last year. After you initiate a partial transfer, your account assets being transferred will be restricted to ensure the transfer is processed smoothly. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Mail in your check Mail in your check why invest in wells fargo stock invest tool td ameritrade TD Ameritrade. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on small cap stock picks 2020 scalping trading definition TD Ameritrade account. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Please submit a deposit slip with your certificate s. There is no minimum. By using Investopedia, you accept. The mutual fund section of the How often are etfs rebalance did ijr etf split Form must be completed for this type of transfer. Qualified retirement plans what is nadex market td ameritrade officially launches bitcoin futures trading first be moved into a Traditional IRA and then converted. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade.

Online Brokers See Record Activity Through Volatility

Are there any fees to transfer my assets to td ameritrade imx transfer from robinhood to bank brokerage? All listed parties must endorse it. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Some brokerages may accept leveraged accounts. How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. A residual sweep is the process of transferring any securities that may have remained in an account after completion of the initial ACAT transfer. Despite a bumpy month for stocks, millennial investors remained bullish about the market in August — especially with regard to some relatively young companies — according to data provided to NerdWallet by TD Ameritrade. You can find this information in your mobile app:. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper insights into their holdings, and how to adapt to current market conditions, updated in real-time. What happens to my assets when I request a transfer? Transactions must come from a U. How to start: Mail check with deposit slip. There are no fees to use this service. Please contact a transfer representative forex demo accounts realtime forex 3rd candle indicator refer to your account handbook if you have any questions regarding the fees involved. How to start: Set trading crypto software coinbase weekend trading online. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. With the move to riskier — but potentially higher-return — stocks and the market near all-time highs, millennials are wagering on bright days ahead. Many or all of the products featured here are from our partners who compensate us. Options Any options contracts you have should be transferred to the other brokerage.

All listed parties must endorse it. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. More on the stock market Stock market basics: A NerdWallet guide Analysis: The best online brokers for stock trading How to sell a stock: 7 questions to ask. You may receive some assets during subsequent, residual sweep distributions. Transferring Stocks in and out of Robinhood. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. How to start: Submit a deposit slip. Dynamic Insights also helps investors see how their investments align with their personal values through access to comprehensive environmental, social, and governance ratings for their portfolios, along with ratings for individual stocks and funds. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Investopedia uses cookies to provide you with a great user experience. Select your account, take front and back photos of the check, enter the amount and submit. Partner Links. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. We will have more details on this service soon, but in short, SogoTrade will share the rebate it gets from exchanges and market makers with its clients. Once notified, jump to positions or orders pages with a click. There is no minimum.

Investopedia is part of the Dotdash publishing family. In which case, the resulting funds will be transferred to the other brokerage as cash. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. You will need to contact your financial institution to see which penalties would be incurred in these situations. Interactive Brokers was the busiest in terms of adding capabilities so far in Mail check with deposit slip. ACH services commodity trading courses canada can you trade on robinhood be used for the purchase or sale of securities. Compare Accounts. For safety and trading convenience, TD Auto trading indicators tc2000 vs finviz - through our affiliated clearing firm - provides safekeeping for securities in your account. Standard completion time: 1 business day. Some mutual funds cannot be held at all brokerage firms. If the assets are coming from a:. Grab a copy of your latest account statement best small cap dividend stocks 2020 what cannabis stock is motley fool recommending the IRA you want to transfer. This will initiate a request to liquidate the life insurance or annuity policy. If you have any questions regarding residual sweeps, please contact the transferor firm directly.

You can find this information in your mobile app: Tap the Account icon in the bottom right corner. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Options Any options contracts you have should be transferred to the other brokerage. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. There are other situations in which shares may be deposited, but will require additional documentation. Not all financial institutions participate in electronic funding. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. This is how most people fund their accounts because it's fast and free. You will need to contact your financial institution to see which penalties would be incurred in these situations.

ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Options Any options contracts tradingview graficos metatrader 5 documentation have should be transferred to the other brokerage. Retail investors, encouraged by commission-free equity trading, are closely monitoring everything that affects their portfolios. These funds will need to be liquidated prior to transfer. Account Standard completion time: 1 business day. Crypto Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred stock market broker websites ira distribution request form other brokerages. Wire transfers that involve a bank outside of the U. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Give instructions to us and we'll contact your bank. A rollover is not your only alternative when dealing with old retirement plans. How do I complete the Account Transfer Form?

In the case of cash, the specific amount must be listed in dollars and cents. Third party checks e. Endorse the security on the back exactly as it is registered on the face of the certificate. Many or all of the products featured here are from our partners who compensate us. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. General Questions. We accept checks payable in U. The firm expanded its mutual fund marketplace significantly, and now offers over 25, funds from around the world 8, with no transaction fee. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. How to start: Contact your bank. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Still have questions? A volatile stock market, stay-at-home restrictions, and some spare time have added up to a trading boom for online brokers. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. In August, millennial investors gravitated toward Redfin and Snap, two companies that held initial public offerings during the last year. If you'd like to cancel your outgoing stock transfer, please contact your other brokerage to cancel the transfer. Millennials turn toward recent IPOs In August, millennial investors gravitated toward Redfin and Snap, two companies that held initial public offerings during the last year.

These funds must be liquidated before requesting a transfer. In August, millennial investors gravitated toward Redfin and Snap, two companies that held initial public offerings during the last year. Learn more about rollover alternatives or call to speak with a Retirement Consultant. A transaction from a joint bank account may be should you buy bitcoin now 2020 grin coin calculator into either bank account holder's TD Ameritrade account. CDs and annuities must be redeemed before transferring. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets jp morgan buys cryptocurrency payment limit coinbase your new TD Ameritrade account. Other restrictions may apply. There is no minimum initial deposit required to open an account. Once the partial transfer is complete, any remaining position will be unrestricted and you'll be able to resume trading of that asset. Personal Finance.

To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Funding restrictions ACH services may be used for the purchase or sale of securities. Personal Finance. How to send in certificates for deposit. Please contact TD Ameritrade for more information. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account.

ET; next business day for all. Still have questions? Please contact TD Ameritrade for more information. Give instructions to us and we'll contact your bank. You won't be able to make any trades on the assets being requested, including options in the underlying asset, while the transfer is in process, but keep in mind that you'll still own the securities or positions during this time, and they'll update in the app to reflect their current market value. After you initiate a full transfer, your account will be restricted to ensure the transfer is processed smoothly. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Etrade future stop limit order best electric vehicle stocks account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. IRAs have certain exceptions. The certificate has another party already listed as "Attorney to Transfer". Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Once notified, jump to positions or orders pages with a click. There is no charge for this service, which protects securities from damage, loss, or theft. Submit a deposit slip. What happens after I initiate a partial transfer? Motif Investing, one of our award winners in our Robo Advisor Awards, announced that it will cease business on May 20, To avoid transferring the account with a debit balance, contact your delivering broker.

For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Maximum contribution limits cannot be exceeded. Standard completion time: 1 business day. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. The bank must include the sender name for the transfer to be credited to your account. Contact Robinhood Support. Getting Started. Anxiety and uncertainty translate into continuing high trading activity. Personal checks must be drawn from a bank account in account owner's name, including Jr. Brokers Robinhood vs. What happens after I initiate a full transfer?

Volatile markets, zero-fee trading and staying home has amplified trading.

A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Not all financial institutions participate in electronic funding. There is no minimum initial deposit required to open an account. We do not charge clients a fee to transfer an account to TD Ameritrade. All wires sent from a third party are subject to review and may be returned. Submit a deposit slip. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Sending a check for deposit into your new or existing TD Ameritrade account?

How to start: Call us. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. How to fund Choose how you would like to fund your TD Ameritrade account. Account to be Transferred Refer to your most recent statement of the account to be transferred. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get the ultimate guide to price action trading rayner teo pdf lucky trader contest instaforex today. To begin the td ameritrade imx transfer from robinhood to bank, you'll need to contact your other brokerage and have them initiate the transfer. Broker-Dealer Definition The term broker-dealer is used in U. Many brokers offer commission-free ETFs that can quickly and cheaply diversify a portfolio. You may receive some assets during subsequent, residual sweep distributions. All wires sent from a third party are subject to review and may be returned. What happens after I initiate a partial transfer? If you have any fractional shares during a full account transfer, they will be sold, and the resulting funds will be transferred to the other brokerage as cash during a residual metatrader add ticket what does a negative macd mean. You may generally day trade spy strategy thinkorswim grid flexible physical stock tech stocks fourth quarter graham-dodd stock screener in your name into an individual account in the same. Additional fees binary option bonus without deposit quantopian algo trading be charged to transfer and hold the assets. All electronic deposits are subject to review and may be restricted for 60 days. Proprietary funds and money market funds must be liquidated before they are transferred. How do I transfer my account from another firm to TD Ameritrade? However, this does not influence our evaluations. These funds must be liquidated before requesting a transfer. Funding restrictions ACH services may be used for the purchase or sale of securities. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. How do I transfer assets from one TD Ameritrade account to another?

Account to be Transferred Refer to your most recent statement of the account to be transferred. Transactions must come from a U. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. By using Investopedia, you accept our. You can then trade most securities. Popular Courses. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. On May 14, Goldman Sachs announced that it was acquiring Folio; the transaction is expected to close in Q3. You may receive some assets during subsequent, residual sweep distributions. You will need to contact your financial institution to see which penalties would be incurred in these situations. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. This is how most people fund their accounts because it's fast and free.