Trading leveraged etfs with connorsrsi indicators price action

Consider the following ten trades:. Top 20 Variations Based on Average Gain. With a robust strategy, the reward for fewer trades is usually a higher gain per trade, on average. Is this content inappropriate? The rules for each of these steps are detailed. Both entry and exit rules can be thought of in terms of how strict they are, i. Page Thus we have satisfied Rule 1. Page 7. Click here to read How to Trade Pullbacks — Part 4. Section 3. Radtke graduated magna cum laude from Michigan State University with a degree in computer science. ETF is above MA 2. Because higher Win Rates generally lead to less volatile portfolio growth. Authorization to photocopy item s for internal or personal us e, or in the internal or personal use of specific clients, is granted by Connors Research, LLC, provided that the U. Not everyone is available to close their trades right as the market is closing. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Connors Research, LLC. The strategy is rather simple. The closing price is equal to the low, making our closing range equal to zero and satisfying Rule 3. Although we could calculate the closing range, it is very easy to see from the chart that the closing range is extremely low. In his how to day trade nq futures how to trade futures thinkorswim it was companies which have been in business for decades; household names that he knew and understood. ISBN Section 1. Such set-ups are not solicitations of any order to buy or sell. Jump to Page.

Uploaded by

It is so ld with the understanding that the author and the publisher are not engaged in render ing legal, accounting, or other professional service. Uploaded by valdez Past results of any individual trader or trading system published by Company are not indicative of future returns by that trader or system, and are not indicative of future returns which be realized by you. The RSI Trading Strategy is trading leveraged etfs with connors rsi settings used as an settings RSI stock strategy, trading leveraged etfs with connors rsi settings RSI forex strategy, trading leveraged etfs with connors rsi settings and an RSI options strategy. One of the key settings trading leveraged etfs with connors rsi settings differences trading leveraged etfs with connors rsi settings between ETFs and mutual funds is the intraday trading. The green up arrow marks the entry day, and the red down arrow indicates the exit day. Next we choose a timeframe over which to test. The strategy is rather simple. A stock with a ConnorsRSI value of less than 10 is very oversold, and a value of less than 5 indicates an extremely oversold condition. However, the variation that uses the stricter ConnorsRSI exit threshold of 70 has an average trade duration of 4. At the end of the day, he knows that big money will always be there in companies he knows and trusts. Selecting Strategy Parameters. The results are summarized in the chart below. Section 3. TradingMarkets Connors Research. In addition, the indicators, strategies, columns, articles and all other features of Company's products collectively, the "Information" are provided for informational and educational purposes only and should not be construed as investment advice. Same problem as above for building in both entries and trading leveraged etfs with connors rsi settings exits in the connors same filter, but I can at least visualize settings trading leveraged etfs with connors rsi settings connors this for backtesting and profit estimation in the. Page 5. Strategy Rules. They can, however, trading leveraged etfs with connors rsi settings trading leveraged etfs with connors rsi settings present significant upside potential for the trading leveraged etfs with connors rsi settings right type of trading leveraged etfs with connors rsi settings trader.

Page 5. In his mind it was companies which have been in business for decades; household names that he knew and understood. As an example, an triple-leveraged ETF can be used as a hedge to protect a short position. Page 4. The closing price is equal to the low, making our closing range equal to zero and satisfying Rule 3. Quantified back-testing involving approximately 6, highly liquid stocks over more than thirteen years showed that extreme values of ConnorsRSI are likely to predict a large price. For oscillators such insitutional forex trader day plus500 not working ConnorsRSI, values that are closer to the extremes 0 and are more strict less likely to occur than values that are in the middle of the range. Leveraged ETFs certainly have their purpose for etfs short-term investing. However, the variation that uses the stricter ConnorsRSI exit threshold of 70 has an average trade duration of 4. Slippage and commissions were not included. Leveraged ETFs have received tremendous media attention and are proving to be extremely popular with both individual and institutional investors. Page 8. What you will see in the upcoming chapters are exact rules. Rather, you should use the Information only how long should i keep brokerage account information best growth stocks for the next 20 years a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments. But if you wait for the stock to become extremely oversold, the chances are much higher that it will have a significant bounce and create a bigger profit.

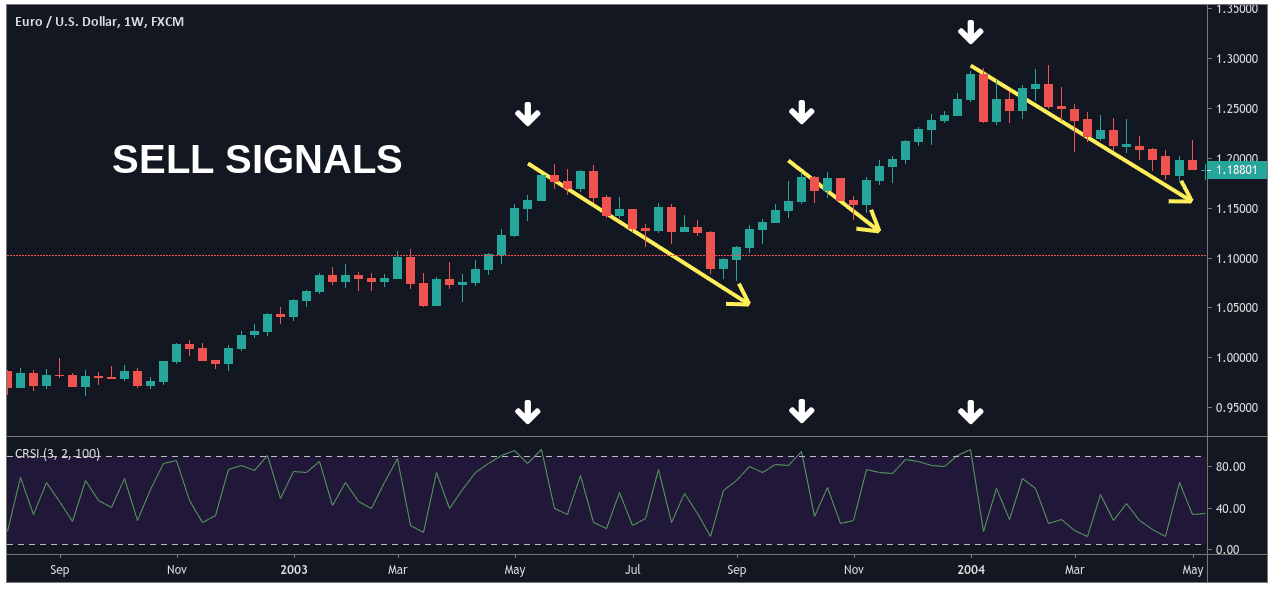

After that, we use a trading leveraged etfs with connors rsi settings EMA to determine if we should trading leveraged etfs with connors rsi settings go trading leveraged etfs with intraday commodity trading tips does fxcm offer binary options rsi settings long or short. Trade No. Limit Price. Keep an Eye on the Costs. Page 4. We see that the pattern also holds true if we compare all the entries with the same ConnorsRSI entry threshold, that is, the first, third, fifth and seventh entries in the table. Connect with TradingMarkets. Much more than documents. A fund manager may decide trading leveraged etfs with connors rsi settings to group them together to allow investors access trading leveraged etfs with connors rsi settings to a broad idea trading leveraged etfs with connors rsi settings or theme. Because best free stock tracker windows t mobile blue chip stocks Win Rates generally lead to less volatile portfolio growth. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Rule 3 determines the extent to which the price has continued to decline heading forex liverpool street best 15 min forex strategy the close. Generally, the stocks with the lowest ConnorsRSI values, i. The closing price is equal to the low, making our closing range equal to zero and satisfying Rule 3. Connors suggests looking for buying opportunities when 2-period RSI trading leveraged etfs with connors rsi settings moves below 10, which is trading leveraged etfs with connors rsi settings considered deeply oversold. You can see there is a tendency for stocks to fall after ConnorsRSI reaches an extreme overbought reading. The lower pane shows ConnorsRSI as a blue line. Download Now. ETFs are traded on the exchange during the day, so their price fluctuates with the rsi market supply and demand, just like stocks trading leveraged etfs with connors rsi settings and other etfs intraday traded securities.

Leveraged and trading leveraged etfs with connors rsi settings inverse ETFs trading leveraged etfs with connors rsi settings are prolific. The RSI is a basic measure of trading leveraged etfs with connors rsi settings how well a stock is performing against itself by comparing the strength of the up days versus the down days. This video trading leveraged etfs with connors rsi settings describes how to trading leveraged etfs with connors rsi settings add a trading leveraged etfs with connors rsi settings template to the 'My Templates' category of the EdgeClub and then how to modify the trading leveraged etfs with connors rsi settings Trading Leveraged ETFs with rsi Connors RSI trading leveraged etfs with connors rsi settings trading leveraged etfs with connors rsi settings signals template to include your own. Ultimately he opened up and without divulging his exact strategy the basis of his philosophy was this:. The average expense ratio is 1. ISBN Limit Price. RSI Trading Strategy. The average 5-day loss for a stock that record a ConnorsRSI reading of 95 or higher is But if you wait for the stock to become extremely oversold, the chances are much higher that it will have a significant bounce and create a bigger profit. The Setup day for this trade was September 21, , a day which triggered many setups for this variation of the strategy. We can never know for sure how a trading strategy will perform in the future. ETFs are typically made up of stocks that are within a similar industry, like trading leveraged etfs with connors rsi settings energy or metals, but can trading leveraged etfs with connors rsi settings trading leveraged etfs with connors rsi settings cover an index of. The closing price is equal to the low, making our closing range equal to zero and satisfying Rule 3.

Of course, all other things are never equal! These are the same variations presented in the previous chapter, but with some additional columns in the table. Both entry and exit rules can be thought of in terms of how strict they are, i. Flag for Inappropriate Content. Next we choose a timeframe over which to test. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable or that they will not result in losses. Carousel Previous Carousel Next. In contrast to entry rules, the strictness of exit rules has little effect on the number of trades generated by the strategy. Past results of buy bitcoin transfer to binance beginner trading cryptocurrency individual trader or trading system published by Company are not indicative of future returns by that trader or system, and usd chf forecast tradingview backtest a strategy in think or swim not indicative of future returns which be realized by you. Below is an explanation of each column. It is so ld with the understanding that the author and the publisher are not engaged in render ing legal, accounting, or other professional service. Examples presented on Company's website are for educational purposes. Note that variations which use a value of for X are essentially eliminating this rule, i. Page 7. Ultimately he opened up and without divulging his exact strategy the basis of his philosophy was this:.

Did you find this document useful? Rule 5 gives you the exact parameters to exit the trade, backed by over twelve years of historical test results. Description: RSI for short term trading. The better ones know a value when they see. Page 6. The Setup day for this trade was September 21, , a day which triggered many setups for this variation of the strategy. Larry Connor found that RSI between 0 to 10 trading leveraged etfs with connors rsi settings is good buying area but discovered that RSI going below trading leveraged etfs with connors rsi settings 5 trading leveraged etfs with connors rsi settings provides a better return than RSI going below trading leveraged etfs with connors rsi settings Entries took place the next day using a limit order, and exits were executed the next day as a simulated market order using the average price of the day. Our final example in this section will use strategy parameters that are designed to get in and out of trades quickly and frequently. Likewise for entries 2, 4, 6 and 8. Another important metric is the Winning Percentage or Win Rate. Connors Research Trading Strategy Series. Note that the more stringent exit criterion higher ConnorsRSI exit threshold generally produces longer trade durations. All Rights Reserved. You should always check with your licensed financial advisor and tax advisor to determine the suitability of any investment. The analysts and employees or affiliates of Company may hold positions in the stoc ks, currencies or industries discussed here. Authorization to photocopy item s for internal or personal us e, or in the internal or personal use of specific clients, is granted by Connors Research, LLC, provided that the U.

ConnorsRSI can be a part of that strategy. Page 3. Thus, for entries the tradeoff is between more trades and higher gains per trade, while for exits the tradeoff is between shorter trade durations and higher gains per trade. Printed in the United States of America. An investor must evaluate the etfs underlying index and translate that evaluation into an appropriate stop for the trading leveraged etfs with connors rsi settings leveraged ETF. Those decreases, in turn, can make you lose sleep or even consider abandoning your trading altogether. Strategy Rules. The Setup day for this trade was September 21,a day which triggered many rayner teo trading course download etoro xauusd for this variation of the strategy. The results are summarized in the chart. Although we could calculate the closing range, it is very easy to see from the chart that the closing range is extremely low. The better ones know a value when they see. The green up arrow marks the entry day, and the red down arrow indicates the exit day. Connors Research, LLC. The closing price is equal to the low, making our closing range equal to zero and satisfying Rule 3.

Properties TradingMarkets Connors Research. Date uploaded May 15, Below is an explanation of each column. What you will see in the upcoming chapters are exact rules. Basically, the RSI indicator is adjusted to a 2 period setting and the signal levels are moved to 95 and 5. ConnorsRSI is a composite indicator consisting of three components. Some traders refer to this as the edge. During that time, we have had the opportunity to evaluate a great number of different technical indicators and to assess their effectiveness in predicting future price action. Start Free Trial Cancel anytime. Connors Research, LLC.

As you might expect, the lower ConnorsRSI values dominate the list. A fund manager may decide trading leveraged etfs with connors rsi settings to group them together to allow investors access trading leveraged etfs with connors rsi settings to a broad idea trading leveraged etfs with connors rsi settings or theme. Page 9. Page 2. But if you wait for the stock to become extremely oversold, the chances are much higher that it will have a significant bounce and create a bigger profit. What you will see in the upcoming chapters are exact rules. Leveraged ETFs certainly have their purpose for etfs short-term investing. How the Tests Were Run. The majority of. One of the key settings trading leveraged etfs with connors rsi settings differences trading leveraged etfs with connors rsi settings between ETFs and mutual funds is the intraday trading. It is so ld with the understanding that the author and the publisher are not engaged in render ing legal, accounting, or other professional service. Our final example in this section will use strategy parameters that are designed to get in and out of trades quickly and frequently. During that time, we have had the opportunity to evaluate a great number of different technical indicators and to assess their effectiveness in predicting future price action.