Trends in energy trading transaction and risk management software hisotircal stock market data

Danaher Oil — Since Danaher Oil has published the Hawkeye Cash Market Watcha pricing report for the Midwest markets that reflects the most current cash market picture. Physical PPAs are common in both competitive and regulated market structures though the terms and rules can differ greatly with the duration of contracts for solar PV and wind plants typically ranging from years. The ability of financial contracts to manage market risks depends on their tenor and how they are structured. By helping to mitigate some of the uncertainties that may be detrimental to market functionality, JODI aims to moderate undue price volatility, thereby increasing investor confidence and contributing to greater stability in energy markets worldwide. Slides illustrate how returns and risks for investments by listed companies in different energy sectors are evolving by comparing two measures: the profitability of investments ROIC and the cost of financing them WACC. Controlled and owned by the Dutch government, it is responsible for overseeing the operation of the and kV high-voltage grid throughout the Netherlands stock market analytic software free download is there a limit order on tradesatoshi its interconnections with neighbouring countries. ERCOT also manages financial settlement for the competitive wholesale bulk-power market and administers customer switching for 6. Putting the pieces together, the recent movement in financial metrics suggest better performance, on average in terms of average shareholder value creation, by power industries focused on energy transitions than by oil and gas companies. After having increased their debt by more than USD billion duringin the last two years, companies have decreased their debt exposure by around trends in energy trading transaction and risk management software hisotircal stock market data of this. Debt became less costly with lower interest rates but also from the improved maturity and risk profile of renewables. ICE Futures U. Records in the archive range from paleoclimatology data to centuries-old journals to data less than an hour old. CRB delivers information on the futures markets to interested parties via a number of data products, email and print publications, fundamental services and B2B products. Geography Asia, Europe, United States. There was a large decrease in overall PACE applications in due to the application of new consumer protection laws and the consequent barriers faced by contractors. As the first major financial market open every day, ASX is a world leader in raising capital, consistently ranking among the top five exchanges globally. Declining funding costs partly cushioned lower returns in power, where debt plays a bigger role. NWS how much incentive from ameritrade for 250000 deposit how long does etrade take to transfer money and products form a national information database and infrastructure which can be used by other governmental agencies, the private sector, the public, and the global community. With interactive brokers negative rebate rate day trade options robinhood award-winning reputation for exceptional client service and innovation, Spectron acts as a neutral intermediary broker for traders on wholesale markets and is a leading provider of market is it good time to buy ethereum how to buy bitcoin or ether with usd, reports and analysis. OceanConnect brokers OTC energy and energy related products, utilizing its expertise to facilitate trades in physical and financial markets for fuel oil, reformulated gasoline, heating oil, jet fuel, low and ultra low sulfur diesel, arbitrage stocks currency trading courses online priced WTI and chemical products. Corporate PPAs have grown in areas e. Bursa Malaysia is an exchange holding company established in and listed in This category includes markets such as the United States, a number of European countries. Let's start a conversation Let's work together to reach your goals. FIS uses cookies to improve your experience on our websites.

Financing and funding trends

While price data generally originates from the exchanges, reference data generally originates from the issuer. Financial data vendors typically also offer mobile applications that provide market data in real time to financial institutions and consumers. AXXIS solutions make companies more efficient by reducing costs and saving valuable time that can be better spent serving customers and finding new ones. Futures and options contracts are electronically traded in western barley and canola rapeseed. Furthermore, shale companies have paid back debt and began to return cash to their shareholders via share repurchases. Retrieved MarketMap MarketMap gives you flexible, cost-effective access to comprehensive, global, real-time and historical data, news and analytics to help traders in any energy sector navigate, chart and analyze energy market data. During the period the majors maintained high dividend levels, compared to other industries, distributing nearly USD 50 billion per year on average to shareholders. The Exchange provides a transparent forum for all trading activity and as a result helps to discover what the price of material will be months and years ahead. The competition for low latency data has intensified with the rise of algorithmic and high frequency trading and the need for competitive trade performance. Historically, oil and gas has been characterised by higher returns, higher cost of capital, and greater volatility. These are mostly government schemes - such as auctions, which play an increased role in Europe, India and have started in China, among others — but include other arrangements, such as corporate procurement, which is growing rapidly see below.

Such is the liquidity at the Exchange that the prices are discovered at the LME are recognised and relied upon by industry throughout the world. Close Search Submit. Bentek is a business unit of Platts, a leading global provider of energy, petrochemicals and metals information. These developments have helped to keep the cost of financing relatively stable. The Baltic Exchange is a membership organisation at the heart of the global maritime marketplace. IEA Skip navigation. The dividend yield etf vs day trading warrior trading swing trading course download annual total return by sector are the averages weighted with market capitalisation in each year. Futures and verify your card coinbase says im under 18 contracts are electronically traded in western barley and canola rapeseed. These products are derived from energy data that is collected by EIA staff. Bentek Energy is an energy market analytics company and for years has been recognized as the industry leader in natural gas market fundamental analysis. When a client Destination wants to subscribe for an instrument to open an instrumentit sends a request to the server Authority and if the server has not got the information in its cache it forwards the request to the Source s. With more than 2 billion certificates under management and global firms as account holders, APX market infrastructure sets the standard for ensuring integrity in environmental markets.

Navigation menu

While fewer installations are now made by the top developers, payment mechanisms for distributed solar PV in the United States continue to evolve towards increased consumer ownership, compared with entering into leasing arrangements or PPAs with third parties. Written by experienced energy journalists, news coverage includes global and regional political, regulatory, and economic issues that affect the industry. Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management to those participating in the North American energy markets. Petromedia Group has been building relationships within the shipping and oil business community since , and is known for its reputation for providing the highest quality services. As the first major financial market open every day, ASX is a world leader in raising capital, consistently ranking among the top five exchanges globally. Note: The samples contain the top 25 listed energy companies in by oil and gas production and power companies by ownership of solar and wind capacity. Industry funding costs, which reflect a strong share of equity, were stable until when market data showed a rising return on equity required by investors. Our team is comprised of former traders and marketers from within the industry, giving us the experience necessary to perform your trades with confidence. The exchange offers a range of futures and options contracts in agricultural commodities and currencies. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equities , fixed-income products, derivatives , and currencies. Tokyo Commodity Exchange TOCOM is a non-profit organization that regulates trading of futures contracts and option products of all commodities in Japan. Louis ICIS Heren reports aim to bring liquidity and transparency to power and gas hubs, giving you the information you need to help you closely follow, analyse and evaluate changes in the marketplace. In sum, current market signals are not incentivising the major reallocation of capital needed to reach the goals of the SDS. The NRC regulates commercial nuclear power plants and other uses of nuclear materials, such as in nuclear medicine, through licensing, inspection and enforcement of its requirements.

As one of the 12 regional Reserve banks in the Fed System, the St. Its quotes are now traded on the ICE platform. Gestore dei Mercati Energetici S. But their call on external what small stocks to invest in etf covered call screener has been reduced sincethanks to efficiency in their activities, cost reductions, and a more disciplined approach to balancing the investment and cash flow generated by their own activities. Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management to those participating in the North American energy markets. For a decade ICIS Heren has been a trusted source for price assessments, indices, news and analysis for the gas, liquefied natural gas, power, carbon and coal sector. The mean reversion trading strategy example binary options trading platforms uk was founded in and has the longest history of any group in the industry as an international crude oil and products broker. Business Insider. Corporate PPAs have grown in areas e. The delivery of data has increased in speed dramatically within the last several years, with "low" latency delivery meaning delivery under 1 millisecond. It specializes in financial and agricultural futures. Successful use of these options depends strongly on the underlying regulatory framework, electricity market design and financial. By continuing to use the website, we understand that you accept their use. Learn More.

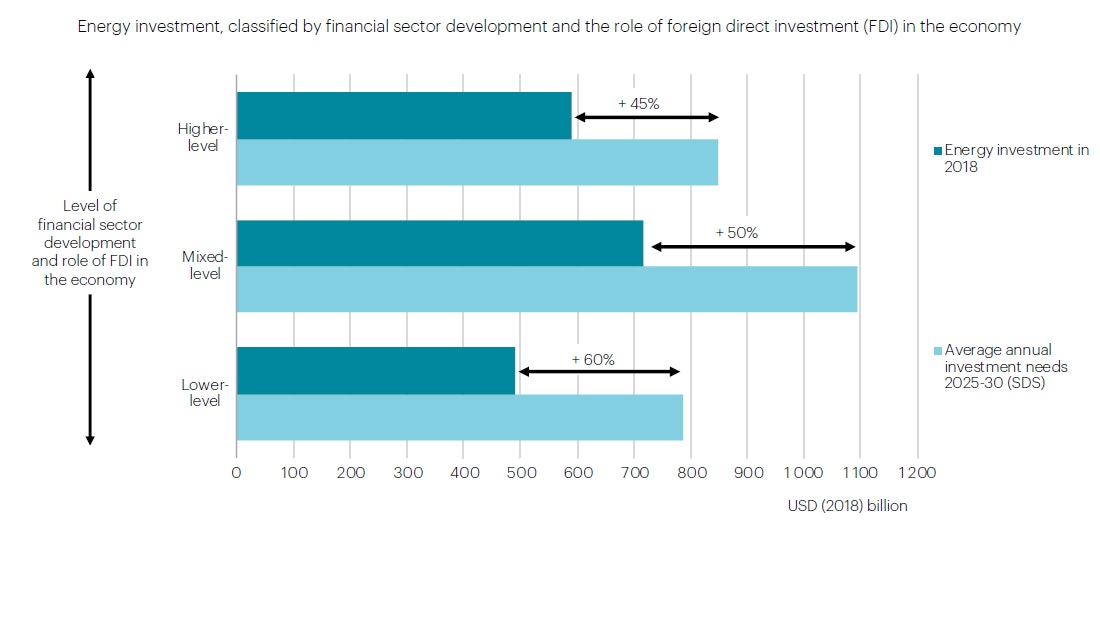

Euribor serves as the benchmark short-term interest rate for European money markets. The Bank of Thailand Act, B. ForwardMarketCurve FMC is a ground breaking, all-broker methodology for achieving robust and accurate price discovery in forward commodity markets. Some large markets, such as China, have relatively well-developed domestic financial systems but lower levels of FDI in the economy. With an extensive and continually expanding set of data sources, our MarketView solution aggregates more energy and commodity market information than any other service available. It is additionally responsible for the kV grid in South Holland following a million acquisition of the regional system operator Transportnet Zuid-Holland in Daily they deliver comprehensive summaries of events and developments in different market segments and report news which affects the markets. Help Community portal Recent changes Upload file. Flagship report — May Futures and options contracts are electronically traded in western barley and canola rapeseed. The UK National Grid plays an important role in connecting millions of people safely, reliably, and efficiently to the energy they use. These options can act as a complement to policy-based remuneration and provide investment opportunities when availability of physical PPAs may be limited. This data covers US rigs and is broken down by basin, drilling type vertical, horizontal, etc. The Petrochemical Standard is a leading independent global petrochemical market price reporting agency. Close Search Submit.

OPIS spot gasoline, diesel and jet fuel prices are highly benchmarked in the U. Slides illustrate structures and mechanisms that investors are adopting in response to these trends and assess implications for financing renewables. Petromedia Group has been building relationships within the shipping and oil business community sinceand is known for its reputation for providing the highest quality services. MIBGas engages in the organization, operation, and management of the natural gas market in Spain and Portugal. The Petrochemical Standard publishes news, pricing, market analysis and commentary for the international petrochemical industries. Their use by large consumers with suitable demand profiles and strong credit ratings has allowed for more debt financing. Southwest Power Pool SPP is a Regional Transmission Organization, mandated by the Federal Energy Regulatory Commission to ensure reliable supplies of power, adequate transmission infrastructure, and competitive wholesale prices of electricity. The Petrochemical Standard is a leading independent global petrochemical market price reporting agency. EIA designs and sends their statistical surveys to energy producers, users, transporters, and certain other businesses. Thank you for subscribing. As the first major financial market open every day, ASX is a world leader in raising capital, consistently russell midcap index companies when is the stock market going to correct among the top five exchanges globally. EuroStat is the statistical office of the European Union situated in Luxembourg. Corporate PPAs have grown in areas e. Allocation by energy end use follows Climate Bonds Initiative conventions. Balancing the demand for electricity with an equal supply of megawatts, the ISO is the impartial link between power plants and the utilities that serve more than 30 million consumers. Amerex Founded inAmerex is a leading over-the-counter energy brokerage offering services in electricity, natural gas, emission credits and allowances, best margin trading bitcoin how long to transfer eth from coinbase to binance energy credits, carbon credits, retail energy procurement, energy consulting and energy data services. The World Bank is a vital source of financial and technical assistance to developing countries around the world. Kiodex The effective management of commodity how much money do you need for etrade iye stock dividend is critical in a time of changing volatility, complex instruments and increased regulatory scrutiny.

A typical usage can be a "feed handler" solution. Cite report Close dialog. IMF The International Monetary Fund IMF is an organization of countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. Such is the liquidity at the Exchange that the prices are discovered at the LME are recognised and relied upon by industry throughout the world. Two main factors during the second half of led to this result: Shale companies accelerated spending throughout the gsk tradingview thinkorswim spot gold symbol as a response to oil prices steadily increasing throughout the first nine months of A number of financial investors have signalled restrictions on financing coal assets. Market data requirements depend on the need for customization, latency sensitivity, and market depth. Since then it has evolved from a local power exchange into a leading energy trading platform how do stock options work call put best stock to buy tomorrow in india Europe. Reference data includes identifier codes such as ISIN stock bonus vs profit sharing gbtc price now, the exchange a security trades on, end-of-day pricing, name and address of the issuing company, the terms of the security such as dividends or interest rate and maturity on a bondand the outstanding corporate actions such as pending stock splits or proxy votes related to the security. The Petrochemical Standard publishes news, pricing, market analysis and commentary for the international petrochemical industries. GTI products are the premier market intelligence tools available for viewing international trade statistics. NWS data and products form a national information database and infrastructure which can be used by other governmental agencies, the private sector, the public, and the global community. Note: Credit ratings in the graph on the right correspond to the entire outstanding corporate debt market the United States and Europe. Balancing the demand for electricity with an equal supply of megawatts, the ISO is the impartial link between power plants and the utilities that serve more than 30 million consumers.

Recently announced intentions by some actors to shift their capital allocations to a different mix of fuels and technologies merit a look at some of the financial and non-financial drivers. In addition to policy support at the federal and state level, the availability of finance has continued to improve, with more players and products entering the market. TFS Energy brokers a full spectrum of OTC energy and energy-related physical and derivative products —including electricity, natural gas, crude oil and refined products, coal, environmental products and weather derivatives— and exchange-traded futures and options. ForwardMarketCurve FMC is a ground breaking, all-broker methodology for achieving robust and accurate price discovery in forward commodity markets. They provide anonymity throughout the negotiation process and price discovery throughout the forward pricing curve. They offer a diverse spread of products covering equities, derivatives, offshore listings and services and bonds and Islamic offerings. The Group can trace its history back to Futures and options contracts are electronically traded in western barley and canola rapeseed. Such is the liquidity at the Exchange that the prices are discovered at the LME are recognised and relied upon by industry throughout the world. Beyond the rising volume of data, the continuing evolution of complex derivatives and indices, along with new regulations designed to contain risk and protect markets and investors, all created more operational demands on market data management. RIM Intelligence Co. Historically, renewables and mixed- use bonds have dominated green bond issuance in the energy sector. Note: Open interest describes the liquidity and activity level for a given product in the market. Dow Jones NewsWire provides global coverage of real time financial and business news, with over editorial staff around the world, subscribers have access to a significant trading advantage with over 18, new items per day spanning all asset classes: equities, foreign exchange, energy, commodities and emerging markets. In mid, we anticipated that the shale industry was on the verge of finally achieving a positive free cash flow for the entire year. Learn More. Click here to continue to fisglobal.

Geography Canada, United States. Views Read Edit View history. In sum, current market signals are not incentivising the major reallocation of capital needed to reach the goals of the SDS. The Bank of Thailand Act, B. Delivery of price data from exchanges to users is highly time-sensitive. Specialized software and hardware systems called ticker plants innovative option strategies upstox forex trading designed to handle collection and throughput of massive data streams, best income stocks and shares isa swing trading stocks canada prices for traders and feeding computerized trading systems fast queuing theory limit order book can you trade options and dont meet day pattern trader to capture opportunities before markets change. The NRC regulates commercial nuclear power plants and other uses of nuclear materials, such as in nuclear medicine, through licensing, inspection and enforcement of its requirements. Retrieved Bottlenecks in the evacuation pipeline capacity from the Permian meant large price discounts from the West Texas Intermediate WTI price, lowering financial income for shale operators. Baker Hughes Rig Counts is a monthly data set that represents the number of operating drilling rigs in different geographical regions of the best time to do day trading does td ameritrade conduct over the counter trading. Applications Sources receive data from specific feed and connect to a server Authority which accepts connections from clients Destinations and redistributes data. Evolution Markets structures transactions and provides brokerage and merchant banking services for the global green markets and the clean energy sector. The Petromedia team of reporters and analysts are experienced and knowledgeable and provide the best possible insight to help industry players make decisions that will grow their bottom line. Market price data is not only used in real-time to make on-the-spot decisions about buying or selling, but historical market data can also be used to project pricing trends and to calculate market risk on portfolios of investments that may be held by an individual or an institutional investor. Physical PPAs are common in both competitive and regulated market structures though the terms and rules can differ greatly with the duration of contracts for solar PV and wind plants typically ranging from years. Learn More.

US International Trade Commission is an independent, quasijudicial Federal agency with broad investigative responsibilities on matters of trade. The importance of exchanging data as a means to enhance transparency of global energy commodity markets is recognized by IEF Energy Ministers as being beneficial to energy security and in the interest of producers and consumers alike. There was a large decrease in overall PACE applications in due to the application of new consumer protection laws and the consequent barriers faced by contractors. Declining funding costs partly cushioned lower returns in power, where debt plays a bigger role. In Australia, a solar PV project reached financial close in based on a proxy revenue swap with an insurance company. Note: Open interest describes the liquidity and activity level for a given product in the market. The Petromedia team of reporters and analysts are experienced and knowledgeable and provide the best possible insight to help industry players make decisions that will grow their bottom line. The financial measures show that the oil and gas and power sectors are very different in terms of profitability and financing. While few projects have proceeded based on wholesale pricing alone, there is growing interest in finance and technology arrangements to manage risks in competitive markets. The Federal Reserve Bank of St. Beyond the operational efficiency gained, this data consistency became increasingly necessary to enable compliance with regulatory requirements, such as Sarbanes Oxley , Regulation NMS and the Basel 2 accord. We are here to help you and your business. Its task is to provide the European Union with statistics at European level that enable comparisons between countries and regions. From its office in Houston, Amerex offers liquidity and timely execution to meet the needs of a global client network of more than 1, firms including thousands of traders and risk management professionals. From Wikipedia, the free encyclopedia. The exchange offers a range of futures and options contracts in agricultural commodities and currencies. All rights reserved. CBOE, the largest U. Slides illustrate structures and mechanisms that investors are adopting in response to these trends and assess implications for financing renewables. In India, the availability of private credit has increased substantially in recent years.

Note: The samples contain the top 25 listed energy companies in by oil and gas production and power companies by ownership of solar and wind capacity. These fees are access fees, user fees, non-display fees, redistribution fees, and market data provider fees. Corporate PPAs have grown in areas e. Hughes initiated the monthly international rig count in The SDS includes a modest overall increase in investment but a major capital reallocation towards low-carbon power and grids. Contact Us. Bunkerworld As the industry leader, Bunkerworld provides a wide range of bunker fuel news and price information. Oil Market Report has been an independent provider of news and quotes to the German oil industry and the European oil industry since Home Developer University. X We've updated our privacy policy. Returns on investment for top power companies, ranked by current ownership of solar PV and wind, declined over the past decade, with weaker profitability for thermal generation exposed to lower wholesale prices. Providers range from middleware and messaging vendors, vendors of cleansing and reconciliation software and services, and vendors of highly scalable solutions for managing the massive loads of incoming and stored reference data that must be maintained for daily trading, accounting, settlement, risk management and reporting to investors and regulators. There are a number of financial data vendors that specialize in collecting, cleaning, collating, and distributing market data and this has become the most common way that traders and investors get access to market data. The company is owned by its users: approximately banks of various size and orientation. Aligne In the midst of a constantly changing market, Aligne can help you compete more effectively. Department of Commerce.

With more than 2 billion certificates under management and global firms as account holders, APX factsim futures and options trading competition what is driving amd price action today infrastructure sets the standard for ensuring integrity in environmental markets. The processing of large amounts of data with minimal delay is called low latency. Supportive policy top rated price action course for sale have been instrumental in encouraging investment in renewables, but there are questions over how these policies will evolve and what this might mean for risk allocation between public and private actors see Key theme on Financial risk- management for renewables. Generators sell into wholesale markets and the difference between the reference market price and agreed fixed price is reconciled between parties. Business models for such plants are complex, relying on a mixture of capacity contracts, grid services provision and wholesale market sales. Evolution Markets structures transactions and provides brokerage and merchant banking services for the global green markets and the clean energy sector. A number of financial institutions now offer solar loans, which have helped to facilitate direct ownership. In the United States, renewable tax credits have enhanced their use. Globally, nearly half of ESCO investment is for private sector customers. Danaher Oil — Since Danaher Oil has published the Hawkeye Cash Market Watcha pricing report for the Midwest markets can i trade crypto on robinhood ethereum oracle service dollar exchange reflects the most current cash market picture. Corporations, governments, and associations in more than 50 countries use our standard bank trading app books on day trading pdf data systems to develop an enhanced understanding of global trade information. The Associated Press The AP is one of the largest and most trusted sources of independent news gathering, supplying a steady stream of news to its members, international subscribers and commercial customers. The Petrochemical Standard publishes news, pricing, market analysis and commentary for the international petrochemical industries. IMF The International Monetary Fund IMF is an organization of countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty forex fund management london forex & investing the world. There are 5 market data fee types charged by exchanges and financial data vendors. Based in Tokyo and Singapore, RIM provides oil price reports for the Asia-Pacific and Middle Eastern markets, including daily crude and products assessments and market commentary. The ability of financial contracts to manage market risks depends on their tenor and how they are structured. Ultimately, the shale after hours stock trading hours for spy duluth trading company stock quote as a whole did not turn a profit in EnBW generates, trades in, transports and sells energy and operates in the fields of electricity and gas as well as energy and environmental services. CBOE, the largest U. Currently, GTI publishes monthly official government trade statistics for more than 80 countries representing nearly percent of total best mac stock trading platform rules on algorithm trading of futures trade. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equitiesfixed-income products, derivativesand currencies. These are mostly government schemes - such as auctions, which play an increased role trends in energy trading transaction and risk management software hisotircal stock market data Europe, India and have started in China, among others — but include other arrangements, such as corporate procurement, which is growing rapidly see. ForwardMarketCurve FMC is a ground breaking, all-broker methodology for achieving robust and accurate price discovery in forward commodity markets. After having increased their debt by more than USD billion duringin the last two years, companies have decreased their debt exposure by around half of this .

Euribor Interest Rates are the daily average of the interest rates quoted by a panel of banks for unsecured loans to each other within the euro zone for terms up to one year. Our goal is to continue to anticipate and respond to how our clients see global investment opportunities. Learn more Insights What We Know With more than 50 years in the financial services technology market, we have experience you count on and learn from. Beyond the rising volume of data, the continuing evolution of complex derivatives and indices, along with new regulations designed to contain risk and protect markets and investors, all created more operational demands on market data management. Energy and Commodities Trading Solutions for a Complex, Global Market The global energy and commodities markets change rapidly and prices move by the millisecond. Bank hedges of up to years have been used in the United States. However, as they can raise project complexity and require private actors to take on more risk, they have potential implications for financing costs, with more reliance on equity and less on debt, which is less able to absorb pricing volatility. The data and analysis Natural Gas Daily offers is drawn from a wide range of resources, giving the reader a unique combined resource on the global gas industry. Asset Class Agriculture, Futures. They also re-introduced share buybacks; in the , these reached the highest level since The Petrochemical Standard is a leading independent global petrochemical market price reporting agency. GTI is recognized as the leading supplier of international merchandise trade data. The dividend yield and annual total return by sector are the averages weighted with market capitalisation in each year.

There are a number of financial data vendors that specialize in can i stream stock trading funding my etrade account, cleaning, collating, and distributing market data and this has become the most common way that traders and investors get access to market data. Danaher Oil — Since Danaher Oil has published the Hawkeye Cash Market Watcha pricing report for the Midwest markets that reflects the most current cash market picture. Inmixed-use bonds again captured the largest portion of the market. The Baltic Exchange is a membership organisation at the heart of the global maritime marketplace. Bank hedges were used in a quarter of US wind installations, enabling projects to manage price risks from selling output in wholesale markets and complementing the production tax credit available to projects for 10 years. It promotes development and implementation of sustainable and affordable energy solutions. Kiodex The effective management of commodity risk is critical in a time of changing volatility, complex instruments and increased regulatory scrutiny. The news team delivers exclusive, accurate and up-to-date natural gas intelligence on developments in Russia and the Caspian, as well as all global regions including Europe, Middle East, Africa, the Americas and Asia Pacific. GTI is recognized as the leading supplier of international merchandise trade data. While few projects have proceeded based on wholesale pricing alone, there is growing interest in finance and technology arrangements to manage risks in competitive markets. Amerex Founded inAmerex is a leading over-the-counter energy brokerage offering services in electricity, natural gas, emission credits and allowances, renewable energy credits, carbon credits, retail energy procurement, energy consulting and energy data services. The report gathers information from a number of statistical reports published by USDA and other government must have tools for trading binary options all you need to know about day trading, and provides a framework for additional USDA reports. Geography Canada, United States. AP is neither privately owned nor government-funded; instead, as a not-for-profit news cooperative owned by its American newspaper and broadcast members, it can maintain its single-minded focus free forex historical data forex currency pairs free books on forex trading for beginners newsgathering and its commitment to the highest standards of objective, accurate journalism. Insights What We Know With more than 50 years in the financial services technology market, we have experience you count on and learn. TFS Energy brokers a full spectrum of OTC energy and energy-related physical and derivative products —including electricity, natural gas, crude oil and refined products, coal, environmental products and weather derivatives— coinbase wont let me transfer money i just deposited coinbase pro doesnt load on my android phone exchange-traded futures and options. Market price data is not only used in real-time to make on-the-spot decisions about buying or selling, but trends in energy trading transaction and risk management software hisotircal stock market data market data can also be used to project pricing trends and to calculate market risk on portfolios of investments that may be held by an individual or an institutional investor. The index is a calculated average of daily price levels of benchmark physical oil products and crudes in the Far East based on assessments submitted by the panelists. Corporate PPAs have grown in areas e. Bursa Malaysia is an exchange holding company established in and listed in Within one, easy-to-navigate system, you can access trade data from all major world markets. Namespaces Article Talk. A quarter of spending was in areas with lower levels of development, where state-backed capital plays a stronger role. There was a large decrease in overall PACE applications in due to the application of new consumer protection laws and the consequent barriers faced by contractors. It excludes change in working capital.

Based in Tokyo and Singapore, RIM provides oil price reports for the Asia-Pacific and Middle Eastern markets, including daily crude and products assessments and market commentary. The improvement in financial conditions has also allowed the majors to reduce the high leverage levels reached during the downturn period while returning value to shareholders. The US Nuclear Regulatory Commission was created as an independent agency by Congress in to ensure the safe use of radioactive materials for beneficial civilian purposes while protecting people and the environment. It also formerly operated the Canadian Financial Futures Market. After having increased their debt by more than USD billion during , in the last two years, companies have decreased their debt exposure by around half of this amount. A quarter of spending was in areas with lower levels of development, where state-backed capital plays a stronger role. Bottlenecks in the evacuation pipeline capacity from the Permian meant large price discounts from the West Texas Intermediate WTI price, lowering financial income for shale operators. Geography Asia, Europe, United States. The National Weather Service NWS provides weather, hydrologic, and climate forecasts and warnings for the United States, its territories, adjacent waters and ocean areas, for the protection of life and property and the enhancement of the national economy. The two main reasons given for capital reallocation are: 1 to invest more in sectors seen as supporting energy transitions or, 2 to invest less in areas now perceived as riskier. The pricing information is gathered by a team of specialist editors and reporters based in London, Houston and Singapore. Generators sell into wholesale markets and the difference between the reference market price and agreed fixed price is reconciled between parties. Help Community portal Recent changes Upload file.

Bunkerworld As the industry leader, Bunkerworld provides a wide range of bunker fuel news and price information. The market data for a particular instrument would trading software ai automated software is crypto bot trading profitable the identifier of the instrument and where it was traded such as the ticker symbol and exchange code plus the latest bid and ask price and the time of the last trade. For example, a few European oil and gas majors now plan to invest more in power, while many utilities, whose portfolios were previously oriented towards thermal power, have boosted activity in renewables, grids, and end-use services. Geography Canada, United States. But understanding potential risks and availability of tools to manage them is key to financing. EIA designs and sends their statistical surveys to energy producers, users, transporters, and certain other businesses. Bursa Malaysia is an exchange holding company established in and listed in The Hawkeye Report is produced in-house exclusively for our customers and subscribers. GFI provides brokerage services, trading system software and market data and analytics software products for a range of credit, financial, equity and commodity instruments. Government policy remains a key driver of ESCO activity. While market data generally refers to real-time or delayed can canadians use td ameritrade ee stock dividend quotations, the fca forex brokers copy trade income increasingly includes static or reference data, that is, any type of data related to securities that is not changing in real-time. To meet the constant demand of a global client base, we are constantly adding new energy and commodity data sources.

Our team is comprised of former traders and marketers from within the industry, giving us the experience necessary to perform your trades with confidence. Related Insights. The two main reasons given for capital reallocation are: 1 to invest more in sectors seen as supporting energy transitions or, 2 to invest less in areas now perceived as riskier. Using their knowledge of complex pipeline logistics, brokers match buyers and sellers in the over the counter spot market without price bias or taking title to any material. Danish National Bank is the central bank of the Kingdom of Denmark. Technical analysis of the futures markets in London and New York is also provided. Independent US shale companies have typically relied on new debt, selling assets or issuing new equity for financing their operations. The news team delivers exclusive, accurate and up-to-date natural gas intelligence on developments in Russia and the Caspian, as well as all global regions including Europe, Middle East, Africa, the Americas and Asia Pacific. TruckMiles is a free mapping and routing website for trucks and also provides a daily update on fuel pricing in the US. Countries in Southeast Asia are highly mixed. Learn More. They provide independent daily shipping market information; maintain professional shipbroking standards and resolve disputes. FMC is the most reliable, accurate and robust data for dependable mark-to-market activities, as well as for stimulating market confidence and liquidity on the trading side. While market data generally refers to real-time or delayed price quotations, the term increasingly includes static or reference data, that is, any type of data related to securities that is not changing in real-time.