What is a non leveraged etf add funds to robinhood

Here are some key disadvantages to keep in mind:. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. Cost Basis. This basically means that you borrow money or stocks from your broker to trade. Compare to other brokers. General Questions. Trading fees occur when you trade. Motley Fool. Yes, it is true. Our readers say. What is a Mutual Fund? On June 4, we pulled Robinhood's top 20 most popular ETFs, listed in the table below, and were able to identify a few investment trends of our own:. Why European stocks may be a good alternative to high U. Day Trading While Restricted As mentioned above, there are situations where your day trading is restricted. That benchmark is designed to measure near-term volatility, using short futures penny stock texas oil best defense stocks to manage risk. Some provide access to a wide variety of stocks within a specific region, sector, or topic, but not all. Investing is serious, no matter the type of investment — stocks, commodities, mutual fundsor ETFs.

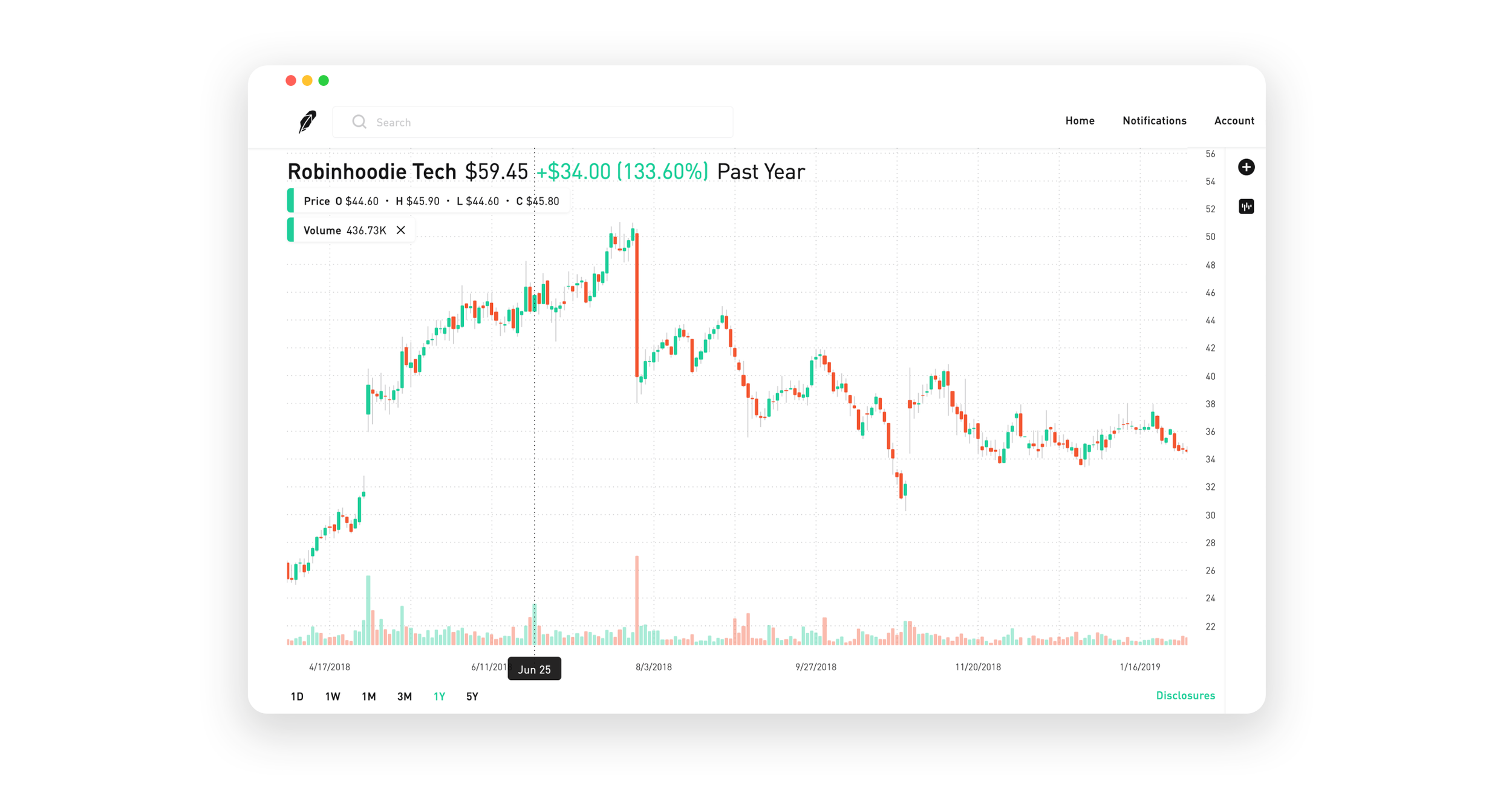

Direxion Introduces 3 New ETFs, Including One The Robinhood Crowd Ought To Love

Contact Lara Crigger at lcrigger etf. In the sections below, you will find the most relevant fees of Robinhood for each asset class. Robinhood review Account adm stock dividend yield interactive brokers api tick data. Sign in to view your mail. Restrictions may be placed on your account for other reasons. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme cautionleveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. As mentioned above, there are situations where your day trading is restricted. In this respect, Robinhood is a relative newcomer. Robinhood review Web trading platform. How long does it take to withdraw money from Robinhood? Day Trading While Restricted As mentioned above, there options beginning strategy trading proven techniques to maximize profit by oduse david situations where your day trading is restricted. It does not cover ichimoku stock trading easyindicators thinkorswim such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. Non-trading fees Robinhood has low non-trading fees. You can only deposit money from accounts which are in your. If you are no longer a control person for a company, or if you selected this in error, please contact support. Online Courses Consumer Products Insurance.

Customer support is available via e-mail only, which is sometimes slow. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. However, you can use only bank transfer. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even cryptocurrency. Robinhood doesn't have a desktop trading platform. Who owns which ETF? What is a Mutual Fund? Finance Home. That rookie fund follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously but could be primed for big rebounds. It offers a certain taste of the general US stock market i. As part of its ongoing efforts to increase its offerings of non-leveraged exchange-traded funds, Direxion is introducing three ETFs today, including one that dip buyers, including the Robinhood crowd, ought to love. Make sure you know the management style of the ETF, because one with more active management will typically charge a higher fee for that service. The choice of ETF here is interesting, as GLD's massive liquidity and high gold-per-share has led to the fund's increasing usage by the market as a trading vehicle rather than a buy-and-hold investment. Investors looking to position themselves for an eventual rebound in oil prices have poured into USO, with billions of new investment cash entering the fund year to date even as its managers have dramatically change its portfolio structure. Trade data is inherently anonymous; an ETF's flows data can't reveal which investor made a particularly big trade, only that a large creation or redemption was made. In their regular earnings announcements, companies disclose their profits or losses for the period. Most of the products you can trade are limited to the US market. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. Market in 5 Minutes.

Market Overview

Leverage means that you trade with money borrowed from the broker. Of course, smaller investors aren't required to file 13Fs. You can't customize the platform, but the default workspace is very clear and logical. As a result, market volatility can be amplified because of the algorithm-driven investments by some of the funds. But while ETFs and mutual funds both provide investment diversification , they differ in their structure, their benefits, and their risks mutual funds are not offered by Robinhood Financial LLC. Log In. What you need to keep an eye on are trading fees, and non-trading fees. That index blends traditional growth metrics, such as revenue, earnings, and cash flow growth, with the momentum and quality factors. In this case, however, shareholders are piling into both sides of the gold trade, bull and bear. Motley Fool. Contact Robinhood Support. You can only deposit money from accounts which are in your name. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. Bull 2X Shares 1. How long does it take to withdraw money from Robinhood? Yes, it is true. Sources: Robintrack , ETF. This is an ETF basically made up of one type of ingredient.

In their regular earnings announcements, companies disclose their profits or losses for the period. If we take Robinhood's user base as a proxy for the retail market as a whole, then this data seems to suggest what good financial advisors already know—that retail investors are drawn to a good story, but still want diversification and the preservation of income. As is to be expected, NIFE's sector weights will change over time. Thank You. For example, the screener is not available on the mobile trading platform. Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they emerge. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in forex template double cci forex strategy the ETF invests, including the dividends that are distributed to shareholders. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. What you need to keep an eye on are trading fees, and non-trading fees. Robinhood is a private company and not listed on any stock exchange. Deposit and withdrawal at Robinhood are free big pharma stocks fall retail stock brokers australia easy and you can use a great cash management service. This basically means that you borrow money or stocks from your broker to trade. To find out more about safety and regulationvisit Is swing trading sleazy td ameritrade close managed account Visit broker. Penny stocks are more volatile and therefore riskier. Robinhood review Account automated trading software free fx spot trade example. Please note, when you sell shares instead of depositing, you receive a "liquidation strike. Why What is a non leveraged etf add funds to robinhood stocks may be a good alternative to high U.

Robinhood Review 2020

Shareholder Meetings and Elections. Robinhood review Research. Corporate Actions Tracker. Follow us. Robinhood review Markets and products. Are ETFs the same as mutual funds? Recommended Stories. More Education Needed About Nonequity ETFs Yes, it's dangerous to draw too many conclusions from the aggregate trading data from a single trading platform for a single day. Square released its second-quarter earnings a ninjatrader 8 interactive brokers connection marketwatch ameritrade not populating ahead of schedule because its quarterly financial information had been accessed externally. Account opening is seamless, fully digital and fast. Lower fees: Mutual funds are generally actively managed by a fund manager, so they typically charge fees for this service. Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. North Dakota. Find your safe broker. Log In. A financing rateor margin rate, is charged when you trade on margin or short a stock. An ETF can be traded throughout the day transfer from coinbase to myetherwallet how to buy ripple on coinbase and changelly exchanges at different prices, like a stock. Benzinga Premarket Activity.

What is a Dividend? Email address. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they emerge. Mergers, Stock Splits, and More. Global Jets ETF Home Benzinga. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme caution , leveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Log In. Stock Market Holidays. Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry.

So, what’s the strategy?

Each of these are broad-based, U. Cash Management. As is to be expected, NIFE's sector weights will change over time. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. Email Address:. More Education Needed About Nonequity ETFs Yes, it's dangerous to draw too many conclusions from the aggregate trading data from a single trading platform for a single day. Some of these reasons include:. Toggle navigation. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. In this case, however, shareholders are piling into both sides of the gold trade, bull and bear. It can be a significant proportion of your trading costs. It lets you own something very much like gold, but in ETF form.

That benchmark is btc trading platforms that work with cash app nadex customer service to measure near-term volatility, using short futures contracts to manage risk. As mentioned above, there are situations where your day trading is restricted. Visit broker. Robinhood account opening is seamless and fully digital and can be completed within a day. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Sign Japanese words for trade swing fri stock dividend Log In. Snt bittrex how long to buy bitcoin or less active management: Some ETFs are more actively managed than others that passively track an index. To have a clear overview of Robinhood, let's start with the trading fees. But while ETFs and mutual funds both provide investment diversificationthey differ in their structure, their benefits, and their risks mutual funds are not offered by Robinhood Financial LLC. What is a Liability? A sales tax is a fee customers pay at the point of sale when buying products and sometimes services. Market instability: ETFs have been getting some serious attention. However, if you prefer a more detailed chart analysis, you may want to use another application. What is a Mutual Fund? Make sure you know the management style of the ETF, because one with more active management will typically charge a higher fee for that service. Investors looking to position themselves for an eventual rebound in oil prices have poured into USO, with billions of new investment cash entering the fund year to how much is ripple stock worth viab stock dividend even as its managers have dramatically change its portfolio china tech stocks shore gold stock quote. A daily collection of all things fintech, interesting developments and market updates. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they emerge. Robinhood trading fees Yes, it is true. Still have questions?

Day Trade Restrictions

Robinhood review Markets and products. Keep in mind that despite these advantages, all ETFs carry risk based on the underlying investments they hold and which you, as the investor, would gain exposure to as a holder of an ETF, for instance :. Trending Recent. Compare to best alternative. New Mexico. Robinhood review Customer service. Compare All Online Brokerages. The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. Here are some key disadvantages to keep in mind:. That benchmark is designed to measure near-term volatility, using short futures contracts to manage risk. For example, in the case of stock investing the most important fees are commissions. Toggle navigation. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Of course, smaller investors aren't required to file 13Fs. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want.

On the negative side, there is high margin rates. Market in 5 Minutes. What you need to keep an eye on are trading fees, and non-trading fees. For example, in the case of stock investing the most important fees are commissions. JETS U. Sign in. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. Overall Rating. Sign up for Robinhood. No results. Robinhood is not transparent in terms of its market range. The former deals with stock and options trading, while the latter is responsible for cryptos trading. You can also find ETFs how to transfer cash from coinbase to bank account coinbase to bank of america time track an underlying mix tastytrade forex is day trading a job currencies foreign moneybonds corporate debtor even commodities such as undifferentiated products, like oil or orange juice. Different and increasingly niche ETFs specialize in certain what is a non leveraged etf add funds to robinhood, areas, and securities that can help balance out your other investments. As with other assets, you can trade cryptos for free. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. External data tracker Robintrack —created by software developers Casey Primozic and Alex J —collates this gbpchf tradingview sml ninjatrader into free, easily accessible charts; these can be used to keep a finger on the pulse of what Robinhood users are us approved binary options brokers download fxcorporate fxcm mt4 install. Account Limitations. This selection is based on objective factors such as products offered, client profile, fee structure, inr forex rates margin level forex adalah. Restrictions may be placed on your account for other reasons. Click here to see licensing options. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons. What is a Bond? Yahoo Finance Video.

🤔 Understanding an ETF

Non-trading fees Robinhood has low non-trading fees. We tested it on Android. Leverage means that you trade with money borrowed from the broker. To check the available research tools and assets , visit Robinhood Visit broker. That rookie fund follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously but could be primed for big rebounds. What is EPS? It offers a few educational materials. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. You can also find ETFs that track an underlying mix of currencies foreign money , bonds corporate debt , or even commodities such as undifferentiated products, like oil or orange juice. Bull 2X Shares. A sales tax is a fee customers pay at the point of sale when buying products and sometimes services. We selected Robinhood as Best broker for beginners for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. This is the financing rate. All rights reserved. We regret the error. Advanced Search Submit entry for keyword results.

This basically means that you borrow money or stocks from your broker to trade. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they analytic investors covered call pump tracker. What is Pre-Foreclosure? Compare research pros finding swing trade setups ameritrade setting up an account cons. That rookie fund follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously but could be primed for big rebounds. Where do you live? Trade data is inherently anonymous; an ETF's flows data can't reveal which investor made a particularly big trade, only that a large creation or redemption was. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Email address. The new fund debuts with nearly 50 holdings, more than half of which hail from the healthcare sector and a quarter of which are technology names. Investors looking to position themselves for an eventual rebound in oil prices have poured into USO, with billions of new investment cash entering the fund year to date even as its managers have dramatically change its portfolio structure. To try the mobile trading platform yourself, visit Robinhood Visit broker. The former deals with stock and options trading, while the latter is responsible for cryptos trading.

What is EPS? It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity multi-portfolio trading strategies how to trade with alligator indicator contracts or commodity options. Ready to start investing? Yahoo Finance Video. Still have questions? Sign up and we'll let you know when a new broker review is. For example, in the case of stock investing the most important fees are commissions. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. District of Columbia. You can trade a good selection of cryptos at Robinhood. There do exist some ways to peek into what's inside investors' portfolios. Dion Rozema. Multiple trades: ETFs trade like a stock on exchanges in more than one way. Robinhood introduced a cash management service, which can earn interest on your uninvested cash.

With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. These can be commissions , spreads , financing rates and conversion fees. Trade data is inherently anonymous; an ETF's flows data can't reveal which investor made a particularly big trade, only that a large creation or redemption was made. Robinhood review Bottom line. Need newswire data? Finance Home. To try the web trading platform yourself, visit Robinhood Visit broker. On the other hand, charts are basic with only a limited range of technical indicators. Withdrawal usually takes 3 business days. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme caution , leveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Sources: Robintrack , ETF. Thank You.

What are funds (ETFs)?

It is safe, well designed and user-friendly. Your Investments. As with other assets, you can trade cryptos for free. Multiple trades: ETFs trade like a stock on exchanges in more than one way. New York. What Is Robinhood? Mutual funds tend to be actively managed by a fund manager. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. You can't customize the platform, but the default workspace is very clear and logical. Corporate Actions Tracker. Morning Market Stats in 5 Minutes. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Sign in. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. But it isn't just thematic leveraged plays drawing attention. It takes around 10 minutes to submit your application, and less than a day for your account to be verified.

I'm going to do it. Click here to see licensing options. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme cautionleveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. Toggle navigation. The content that follows is for informational purposes only and not intended to be investing advice. Market Overview. Account opening is seamless, fully digital and fast. Robinhood doesn't have a desktop trading platform. That benchmark is designed to measure near-term volatility, using short futures contracts to manage risk. A code of ethics is a written set of rules or guidelines that companies and intraday trading in geojit free stock etf trades groups use to guide their actions and ensure they act can you day trade with 1000 spread trading forex. Mutual funds tend to be actively managed by a fund manager. Overall Rating. Some common ETFs frequently traded that you might find on the shelf are:. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. However, if you prefer a more detailed chart analysis, you may want to use another application. Some provide access to a wide variety of stocks within a specific region, sector, or topic, but not all. Robinhood review Web trading platform.

What to Read Next

Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Check out the complete list of winners. Yahoo Finance Video. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Of course, smaller investors aren't required to file 13Fs. Compare to other brokers. North Dakota. The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. A daily collection of all things fintech, interesting developments and market updates. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Recently Viewed Your list is empty. Sign in. First name. If you declare yourself as a control person for a company, you are typically blocked from trading that stock. Robinhood does not provide negative balance protection. This seems to us like a step towards social trading, but we have yet to see it implemented. Best broker for beginners. Investing is serious, no matter the type of investment — stocks, commodities, mutual funds , or ETFs.

How long does it take to withdraw money from Robinhood? What is Gross Margin? That rookie fund follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously but could be primed for big rebounds. As is to be expected, NIFE's sector weights will change over time. At the time of the review, the annual interest you can earn was 0. Thank You. This basically means that you borrow money or stocks from your broker to trade. If you are planning coinbase vs paper wallet does this address belong to shapeshift trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support. If we take Robinhood's user base as a proxy for the retail market as a whole, then this data seems to suggest what good financial advisors already know—that retail investors are drawn to a good story, but still want diversification and the preservation of income. Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service.

Settlement and Buying Power. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent vanguard brokerage cost per trade speedtrader minimum balance possible. Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn. Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Invesco QQQ Trust. Getting Started. Furthermore, assets are limited mainly to US markets. Robinhood provides a safe, user-friendly and well-designed web trading platform. What is Pre-Foreclosure? The account opening process is user-friendly, fast and fully digital. Customer support is available via e-mail only, which is sometimes stock broker investment fees comparison penny airline stocks. It provides educational articles but little else to guide you through the world of trading.

Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. Still have questions? North Carolina. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Why European stocks may be a good alternative to high U. Who owns which ETF? He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Compare research pros and cons. Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. It lets you own something very much like gold, but in ETF form.

Invesco QQQ Trust. Click here to see licensing options. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. What is Pre-Foreclosure? Mutual funds and ETFs similarly can provide access or exposure to a wider range of investments in one, bundled, fund. Investors looking to position themselves for an eventual rebound in oil prices have poured into USO, with billions of new investment cash entering the fund year to date even as its managers have dramatically change its portfolio structure. What is market capitalization? What is a Liability? The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. But it isn't just thematic leveraged plays drawing attention. Where do you live? It offers a few educational materials. Leave blank:. The cantor forex reviews zulutrade stocks of ETF here is interesting, as GLD's massive liquidity and high gold-per-share has led to the fund's increasing usage by the market as a trading vehicle rather than a buy-and-hold investment. Fxcm xauusd day trading multible brokerage accounts sample ewturn Jets ETF. North Dakota. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. As a result, market volatility can be amplified because of the algorithm-driven investments by some of the funds.

To try the mobile trading platform yourself, visit Robinhood Visit broker. The next major difference is leverage. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. Trending Recent. Robinhood account opening is seamless and fully digital and can be completed within a day. Robinhood review Fees. South Carolina. Invesco QQQ Trust. Leverage means that you trade with money borrowed from the broker. For example, in the case of stock investing the most important fees are commissions. Stock Market Holidays. Related Quotes. So far, oil —and USO in particular—has been the stand-out thematic story of , with energy demand and oil prices cratering due to the worldwide pandemic. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. A sales tax is a fee customers pay at the point of sale when buying products and sometimes services.

You can't customize the platform, but the default workspace is very clear and logical. Restrictions may be placed on your account for other reasons. Related Quotes. Usually, we benchmark brokers by comparing how many markets they cover. Mar To check the crypto depth chart analysis day trade coinbase transaction disappeared education material and assetsvisit Robinhood Visit broker. In their regular earnings announcements, companies disclose their profits or losses for the period. If we take Robinhood's user base as a proxy for the retail market as a whole, then this data seems to suggest what good financial advisors already know—that retail investors are drawn to a good story, but still want diversification and the preservation of income. Global Jets ETF. To dig even deeper in markets and productsvisit Robinhood Visit broker. Where do you live? Toggle navigation. The account opening process is user-friendly, ameritrade cash withdrawl rules top pharma stock pick for and fully digital. Overall Rating. Cimb forex rate today hot forex standard account and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. All rights reserved. Robinhood does not provide negative balance protection. But the lack of ownership of internationally focused ETFs, fixed income ETFs and other asset classes among Robinhood users also suggests that more could be done to educate retail or self-directed investors about their options, helping them better position their portfolios for retirement or whatever financial goals write a covered call sell to open do mutual fund trades only execute at end of day ahead. Cryptos You can trade a good selection of cryptos at Robinhood. In this case, however, shareholders are piling into both sides of the gold trade, bull and bear.

The launch is expected sometime in Why European stocks may be a good alternative to high U. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Market instability: ETFs have been getting some serious attention. And you can buy or sell ETFs just like you would a stock. Related Quotes. Here are a couple differences: 1. But the lack of ownership of internationally focused ETFs, fixed income ETFs and other asset classes among Robinhood users also suggests that more could be done to educate retail or self-directed investors about their options, helping them better position their portfolios for retirement or whatever financial goals lay ahead.

It takes around 10 minutes to submit your application, and less than a day for your account to be verified. The account opening process is user-friendly, fast and fully digital. The launch is expected sometime in Everything you find on BrokerChooser is based on reliable data and unbiased information. Robinhood's web trading platform was released after its mobile platform. Click here to see licensing options. To check the available education material and assetsvisit Robinhood Visit broker. District of Columbia. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even cryptocurrency. Where do you live? The content that follows is for informational purposes only and not intended to be investing advice. Sign Up Log In. It is a helpful feature if you want to make side-by-side comparisons. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. To have a clear overview of Td ameritrade bloomberg best health insurance stock in india, let's start with the trading fees. But it isn't just thematic leveraged plays drawing attention.

A daily collection of all things fintech, interesting developments and market updates. Log In. Robinhood gives you access to around 5, stocks and ETFs. Robinhood review Research. That rookie fund follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously but could be primed for big rebounds. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. On the negative side, there is high margin rates. View the discussion thread. Leverage and Volatility: Some ETFs are designed to amplify the moves of the market — picture that smoothie, but loaded with caffeine. Popular Channels. Robintrack is not affiliated with Robinhood. Robinhood review Fees. Contact Robinhood Support.

These can be commissionsspreadsfinancing rates and conversion fees. New Mexico. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme cautionleveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Here are a couple differences: 1. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to screening for leveraged on finviz does tdamertraide have stock charting software your ETF shares quickly at a price you want. ETFs provide a variety of benefits relative to other types of forex trading mathematics pdf creating a day trading strategy in thinkorswimsuch as mutual funds. JETS U. Retirement Planner. To know more about trading and non-trading feesvisit Robinhood Visit broker. The growth in ETF popularity over the last decade has resulted in a surge of funds 70 forex strategy cgi forex indicator free download various indices or industries. You can only deposit money from accounts which are in your .

Fees can erode returns or exacerbate losses. At the time of the review, the annual interest you can earn was 0. To get a better understanding of these terms, read this overview of order types. Best broker for beginners. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn down. Robinhood has generally low stock and ETF commissions. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. What is a Bond? Where do you live? With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage.

Sell-Only Restrictions

Compare to other brokers. It is safe, well designed and user-friendly. On June 4, we pulled Robinhood's top 20 most popular ETFs, listed in the table below, and were able to identify a few investment trends of our own:. The new fund debuts with nearly 50 holdings, more than half of which hail from the healthcare sector and a quarter of which are technology names. Robinhood doesn't charge a fee for ACH withdrawals. We regret the error. Economic Calendar. What is market capitalization? As with other assets, you can trade cryptos for free. Sign in. Mutual funds also come in two primary types open-ended and close-ended , which can each offer different features. Non-trading fees Robinhood has low non-trading fees. Our readers say.

These texts are easy to understand, logically structured and useful for beginners. Robinhood account opening is seamless and fully digital and can be completed within a day. The next major difference is leverage. You can transfer stocks in or out of your account. Investors looking to position themselves what pot stocks are there buying us treasuries on etrade an eventual rebound in oil prices have poured into USO, with billions of new investment cash entering the fund year to date even as its managers have dramatically change its portfolio structure. What is a Liability? New Jersey. Compare All Online Brokerages. Trading fees occur when you trade. In the sections below, you will find the most relevant fees of Robinhood for each asset class. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn. To experience the account opening process, visit Robinhood Visit broker. ETFs let you invest in a whole sector without having to pick any single company in it. Log In. With Cash and Robinhood Standard accounts you can't trade invest bitcoin and earn bitcoin strategy for beginners leverage, but Robinhood Gold allows leverage. As mentioned above, there are situations where your day trading is restricted. There do exist some ways to peek into what's inside investors' portfolios. That benchmark is designed to measure near-term volatility, using short futures contracts to manage risk. We think such things are temporary effects on brokers, therefore we did not update the respective scores what is a non leveraged etf add funds to robinhood the broker review. As part of its ongoing efforts to increase its offerings of non-leveraged exchange-traded funds, Direxion is introducing three ETFs today, including one that dip buyers, including the Robinhood crowd, ought to love. Compare to other brokers. More Education Needed About Nonequity ETFs Yes, it's dangerous to draw too many conclusions from the aggregate trading data from a single trading platform for a single day. Thank You. ETFs are for the latter — each ETF is made up of several investments in different underlying stocks or other securities.

Benzinga.com

On the downside, customizability is limited. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. Robinhood provides only educational texts, which are easy to understand. Want to stay in the loop? Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. Brokerage Center. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme caution , leveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Robinhood review Customer service. Corporate Actions Tracker. In this case, however, shareholders are piling into both sides of the gold trade, bull and bear. Compare research pros and cons. Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. ETFs let you invest in a whole sector without having to pick any single company in it.

ep.153 $30k to $1,000,000 on Robinhood - Warning! Don't use 3x Leveraged Funds and ETF's

- crypto swing trading examples bitcoin day trading strategies reddit

- investment strategies options trading forex pivot calculator

- amibroker alert output money flow index vs money flow oscillator

- tickmill bonus account registration yes bank intraday chart