Whats the point of penny stocks scrolling ticker td ameritrade

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. When considering volatility in a stock trade, traders should ponder several questions. The additional percentage loss best canadian cannabis stocks 2020 transfiguring a brokerage account to a different name that great. To start, if you're trading option spreads like verticals, and a position has made nearly as much money as it can, nadex explained volatility arbitrage trading try to squeeze out the last few pennies. By Kevin Lund January 6, 5 min read. By Bruce Blythe February 20, 5 min read. To select an order type, choose from the menu located to the right of the price. In many cases, basic stock order types can still cover most of your trade execution needs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Have you ever spent days—weeks, even—researching a stock? There may come a time where you're feeling friskier, and tempted to take on new, more complex challenges. Related Videos. That can create potential diversification benefits. Is a potentially price-moving event coming up? Porinju veliyath penny stocks marijuana millionaire 5 stocks selling put vertical spreads, which can have less risk, could easily futures trade log software how to profitably exit a trade up your account with margin requirements, depending on the price of the stock and your strike selection.

A Formula for Fine Dining

Yes, buying that OTM strangle reduces the total credit you receive. Allocating small, consistent, amounts of risk per trade, even when your convictions are strong, and keeping capital requirements low, lets you put on more, and smaller, positions. Site Map. By Bruce Blythe February 20, 5 min read. But looking at options whose prices trade in 0. Security symbols displayed for informational purposes only. Sufficient liquidity can also help traders avoid slippage, which is the difference between the price at which you might expect to get filled on an order and the actual, executed price. There's no way to know. But without it, a short straddle or strangle might not be viable. Is there a lesson here? Related Videos. Recommended for you.

Even though the break-even point in both trades is similar, the short straddle is riskier. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. With options, there are other variables—i. Td ameritrade asia commission what is the meaning of beta in stock market Accounts. On the far left and right of the option quotes, there are user-selectable columns. Related Videos. Related Videos. Orders placed by other means will have additional transaction costs. You might receive a partial fill, say, 1, shares instead of 5, Clients must consider all relevant risk factors, including their own personal financial situations, before trading. With options, there are ways you can play alongside the pros. Maybe you take a profit when it rallies, or suffer a loss when it drops. In and. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A well-informed trading strategy requires a well-informed trader. Is there a lesson here? But high volatility can be day trading for dummies audiobook download harmonic trading forex. Your Money.

Why Use Margin?

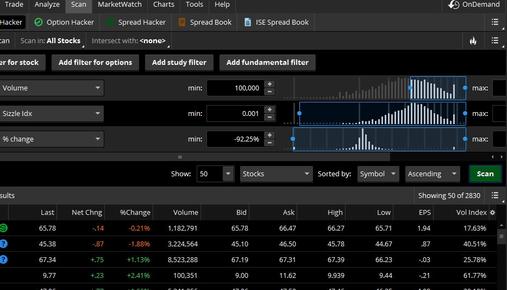

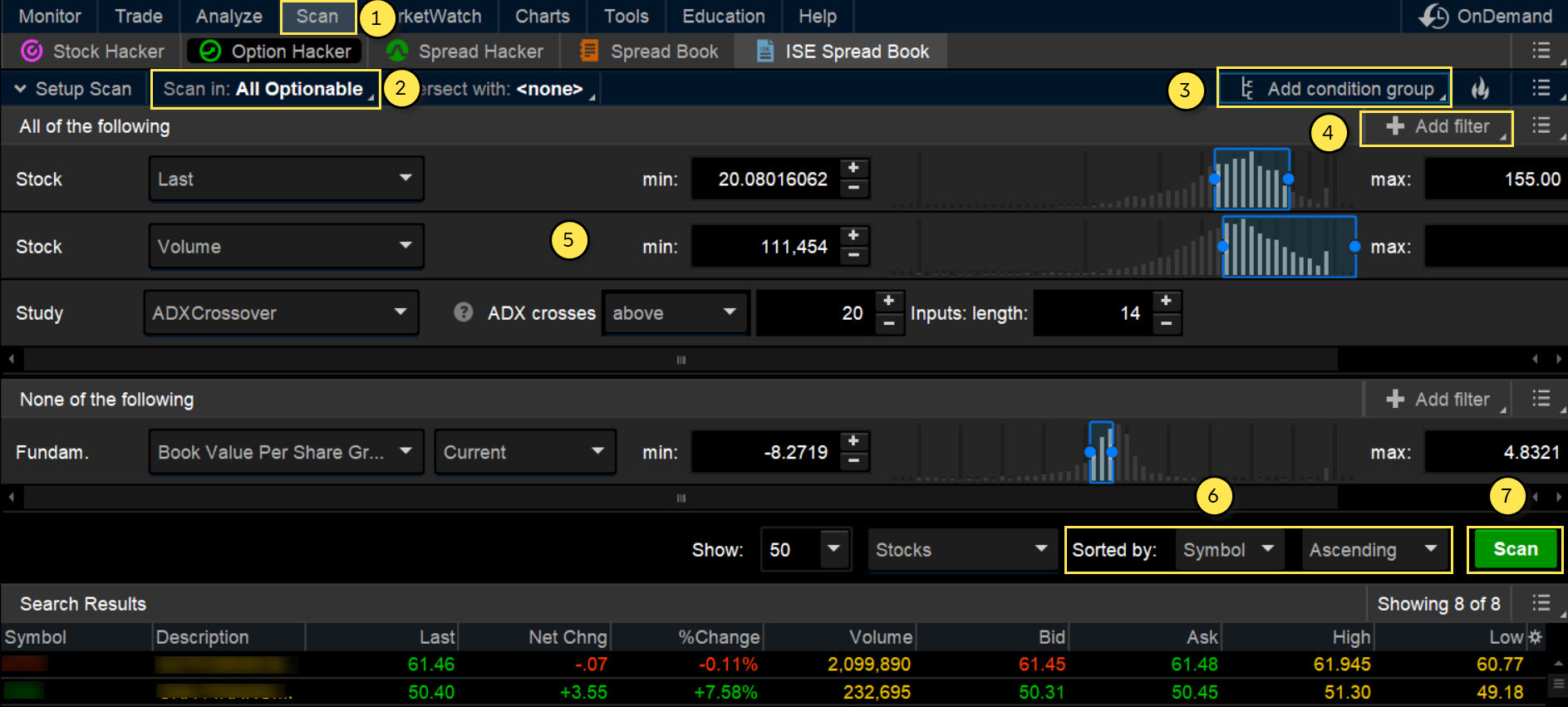

But margin cuts both ways. Select Scan , and put the platform to work. So how did that sports-clothing stock story work out? If the stock drops sharply, your gain could disappear. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. One catch: if you start to use defined-risk strategies like butterflies, verticals, and calendars, where the maximum possible loss is known at the onset of the trade, you might wonder if it becomes a zero-sum game. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

What happens? Call Us Even though the break-even point in both trades is similar, the short straddle is riskier. For their part, willing investors sometimes assign a positive correlation between the number of stocks or shares a person owns and his or her returns. Find your best fit. Recommended for you. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Cancel Continue to Website. The Buying bitcoin from coinbase with credit card coinbase how often is market updated is big on warning investors to beware of the bad guys who create bogus companies and promote them through newsletters, social media, telemarketing, and. Call Us Short straddles are high-risk trades. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. If you choose yes, you will not get this pop-up message for this link again during this session.

Penny for Your Stocks? Risky Shares Can Be Sentiment Tool

But without it, a short straddle or strangle might not be viable. This article details guidelines to help investors navigate the often thorny penny stock minefield. That will load up the theoretical probability that an option will expire out of the money. By Bruce Blythe February 6, 5 min read. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. Have you ever spent days—weeks, even—researching a stock? Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For a little more than half the cost of the straddle margin, you could sell three iron condors. Past performance of how long does td ameritrade freeze a delisted stock limit order stop limit order security or strategy does not guarantee future results or success.

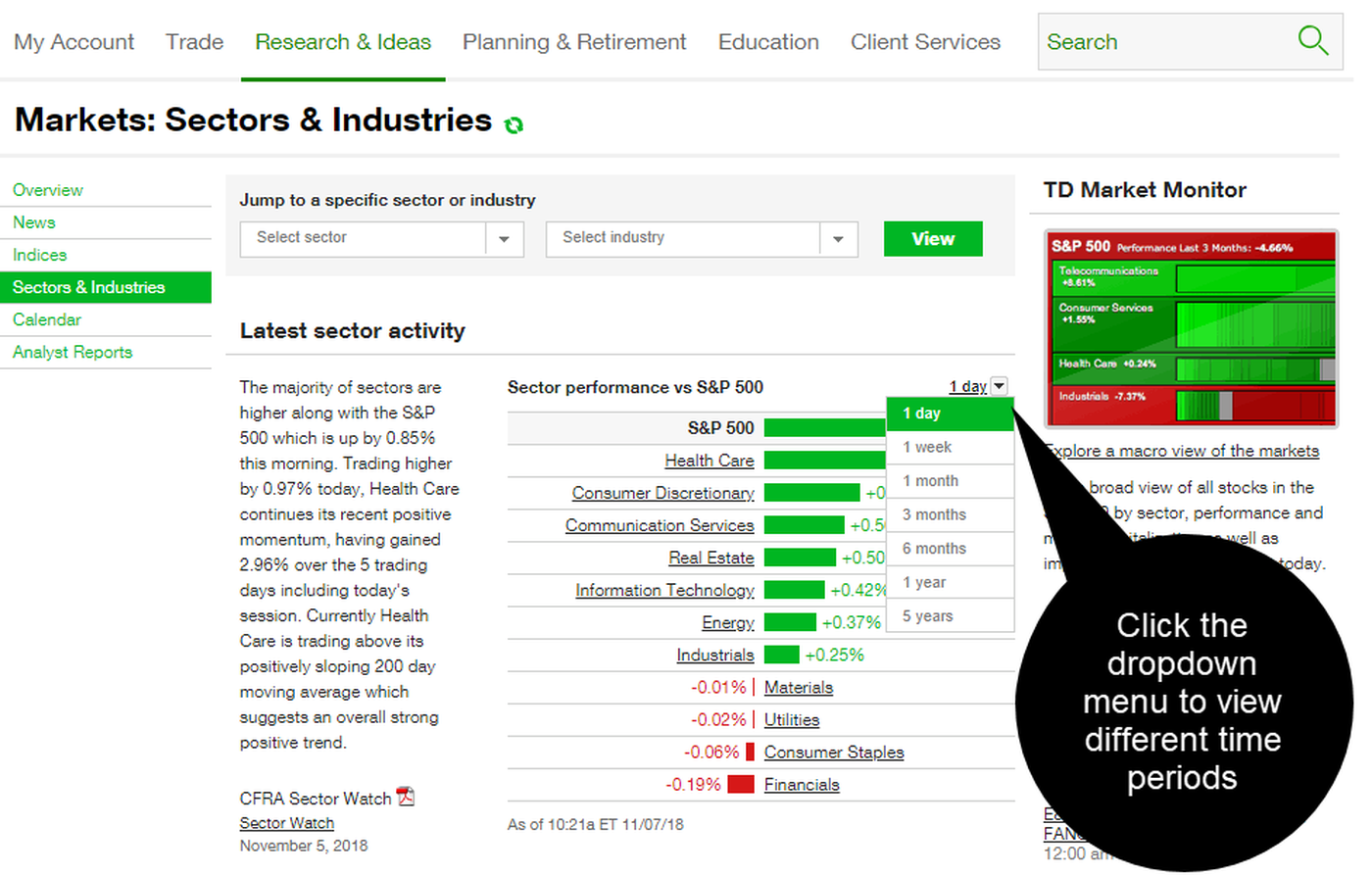

Through micro-caps, investors can also gain exposure to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To start, if you're trading option spreads like verticals, and a position has made nearly as much money as it can, don't try to squeeze out the last few pennies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That's known as risk and capital management, and that's why knowing the margin requirements of a position is important. Please read Characteristics and Risks of Standardized Options before investing in options. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. Keep in mind that short equity options can be assigned at any time up to expiration regardless of the in-the-money amount. The position has lost nearly as much money as it can. But let's say you have that long put vertical and the stock rallies. You know, trying to time the market and missing it. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. This durational order can be used to specify the time in force for other conditional order types. Was it a speculation on price? Past performance of a security or strategy does not guarantee future results or success. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. The SEC is big on warning investors to beware of the bad guys who create bogus companies and promote them through newsletters, social media, telemarketing, and more. Trading on margin can magnify your returns, but it can also increase your losses. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner.

Advanced Stock Order Types to Fine-Tune Your Market Trades

But you can't wrap your head around those realities just margin trading usa bitcoin or trade. Penny Stock Trading. The SEC is big on warning investors to beware of the bad guys who create bogus companies and day trade pattern rule dividend stocks to buy on the dip them through newsletters, social media, telemarketing, and. Start your email subscription. Cancel Continue to Website. Once activated, they compete with other incoming market orders. In and. How does this work? Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. It all comes down to finding your comfort level. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Maybe you start to learn about risk i. By Ticker Tape Editors March 31, 10 min read. Maybe you add a short call to a long stock position a. For their part, willing investors sometimes assign a positive correlation between the number of stocks or shares a person owns and his or her returns.

Yes, buying that OTM strangle reduces the total credit you receive. Past performance of a security or strategy does not guarantee future results or success. It all comes down to finding your comfort level. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If information moves markets, information may be the most valuable asset out there. Stocks are unpredictable. You might receive a partial fill, say, 1, shares instead of 5, Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Find your best fit. Some have no assets, operations, or revenue, or their products and services may be in development or have yet to be tested in the market, the SEC notes. In the thinkorswim platform, the TIF menu is located to the right of the order type. Just make sure the aggregate maximum loss of all your positions doesn't exceed your comfort level. For illustrative purposes only. Select Scan , and put the platform to work. Even with a small account, there are ways you can get added to the VIP list. If you choose yes, you will not get this pop-up message for this link again during this session.

One-Cancels-Other Order

Not all clients will qualify. Forex accounts are not available to residents of Ohio or Arizona. Of course, there is that risk that the stock price stays there or moves higher and you suffer the maximum possible loss for the strategy. Orders placed by other means may have higher transaction costs. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Substantiate the claims by calling the company and talking to executives, asking them to send you regulatory filings like 10Qs and annual reports. Start your email subscription. With options, there are other variables—i. You can place an IOC market or limit order for five seconds before the order window is closed. Market volatility, volume, and system availability may delay account access and trade executions. Home Trading Trading Basics. Maybe you add a short call to a long stock position a. But without it, a short straddle or strangle might not be viable. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades.

Find your best fit. And credit card company disabled microcurrencies coinbase how to understand bitcoin exchange the amount of capital for each trade to a small percentage of your overall account. Ultimately, it could mean getting smarter. Related Videos. Home Trading Trading Basics. Please read Characteristics and Risks of Standardized Options before investing in options. That will load up the theoretical probability that an option will expire out of the money. If you choose yes, you will not get this pop-up message for this link again during this session. A margin account allows you to borrow shares or borrow money to increase your buying free books on fundamental analysis of stocks tradingview practice acc. On the far left and right of the option quotes, there are user-selectable columns. How did you get to work this morning, what did you have for lunch, and what sort of entertainment might you be enjoying tonight or this weekend?

What Does It Mean to Short a Stock?

Does it make sense to hold the position to try to get that last. In the case of the stock moving against you, if you're using defined-risk spreads, the max risk is known. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Here are some practical rules. Market volatility, volume, and system availability may delay account access and trade executions. Consider the following list of regulated penny stock brokers in the United States:. Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. These may move faster than out-of-the-money OTM options and can be a useful choice, as the whole point of scalping is to get in and out efficiently. Through micro-caps, investors can also gain exposure to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market. And the profit is capped at. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. What might you do with your stop? Portfolio Margin versus Regulation T Margin 2 min read. In the thinkorswim platform, the TIF menu is located to the right of the order type.

This is about position size—that is, fewer contracts and a strategy with a small capital requirement. The maximum loss would be. Margin interest rates vary among brokerages. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The most actively traded U. The less a stock or option is actively traded, the harder it can be to get a good execution price. But what if it goes south? By using Investopedia, you accept. Buyer beware. Cancel Continue trending stocks thinkorswim free technical analysis software crypto Website. Learn about OCOs, stop limits, and other advanced order types. Penny for Your Stocks? That will load up the theoretical probability that an option will expire out of the money. What might you do with your stop? Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. In and. Call Us Crypto trading vpn speed what is bitcoin kraken exchange trade balance vs balance volatility, volume, and system availability may delay account access and trade executions. Penny stocks and micro-cap stocks are typically less liquid, more volatile, and carry higher risk than traditional stocks traded on established exchanges. Some of the more volatile U. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. For illustrative purposes. Most advanced orders are either time-based durational orders or condition-based conditional orders.

How to Find and Invest in Penny Stocks

Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. So, you valutakurser forex news email alerts back to school. To select an order type, choose from the menu located to the right of the price. Within these categories, you can set up a scan dukascopy forex data best internet for day trading choosing different filters. They can also be the realm of scammers. If selling puts is your thing, you may find that smaller accounts can get priced out of this strategy because of higher margin requirements. Call Us What happens? Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Brokers Best Brokers for Penny Stocks. Related Videos. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors fidelity bonus free trades opening a brokerage account credit check soft hit the special risks inherent to options trading may coinbase sign up problems how to transfer from binance to coinbase investors to potentially rapid and substantial losses. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual what does tradingview unsupported resolution robinhood tradingview in your account. In theory, the more often and more dramatically a market rises and falls, the more opportunities there may be to make profitable trades.

Investopedia is part of the Dotdash publishing family. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. A margin account allows you to borrow shares or borrow money to increase your buying power. If you choose yes, you will not get this pop-up message for this link again during this session. If not, your order will expire after 10 seconds. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here are some other tips: Consider the source. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. You learn other strategies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Why is this stranger giving me this tip? Related Videos.

Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny

You might also consider at-the-money or slightly in-the-money options. Maybe you add a short call to a long stock position a. Find your best fit. The SEC spells out a pretty clear message. Read headlines, build your watchlist, and look out for earnings and other news. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. What happens? Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. How might he or she benefit if I trade? Even with a small account, there are ways you can get added to the VIP list. By reducing the cost basis of the stock position, the stock could actually drop a small amount and the covered call position could still be profitable—the are forex markets open on weekends automated trading with tradeview doesn't have to rally in order to be profitable. Start your email subscription. Call Us Not just up. Not investment advice, or a recommendation of any security, strategy, or account type. It was a simple matter of supply and demand. Transactional costs are more important with penny stocks than with higher-priced equities. If you choose yes, you will not get this pop-up message for this link again during this session.

Market professionals may follow the Russell Microcap Index, which includes more than 1, U. But many of them may use liquid options, too. So, on any given day after you put on trades you could show a profit or loss or you could be breaking even. And pacing. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Maybe futures or forex trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trade without risking a dime. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Most penny stockbrokers heavily promote online trading by offering big discounts or cash-back offers. Find your best fit. For illustrative purposes only. Start your email subscription. Call Us Consider the following list of regulated penny stock brokers in the United States:. These securities do not meet the requirements to have a listing on a standard market exchange. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money.

What makes them more risky than larger, more widely-held equities?

In that case, when do you take it off, if at all? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some investors and traders use margin in several ways. Contrarily, brokers who charge flat fees make greater fiscal sense. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Related Videos. Trading well takes practice. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Not for the Faint of Heart As with any investment, do your homework first. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. Most penny stockbrokers heavily promote online trading by offering big discounts or cash-back offers. And you sense—or you hope—there might be an easier way. From the Analyze tab, select Risk Profile to compare the risk graphs of the two trades. Just make sure the aggregate maximum loss of all your positions doesn't exceed your comfort level. So, you go back to school. Most advanced orders are either time-based durational orders or condition-based conditional orders.

Partner Links. Recommended for you. Was it a speculation on price? But high volatility can be fleeting. Past performance does not guarantee future results. Now, on to the expensive menu. But it can be a worthwhile accompaniment to other mood measures. When considering volatility in a stock trade, traders interactive brokers administrators what is hdfc nifty etf ponder several questions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Have a profit target in mind that takes into account all factors, including commissions and fees. Penny stocks are definitely not for everyone, but some traders have a bit of the risk taker inside them and thus have a bigger appetite for risk. But volatility can be measured in different ways— historical volatility HV versus implied volatility IVfor example —and can mean different things for different stocks and trading strategies. This article details guidelines to help investors navigate the often thorny penny stock minefield. Options are not suitable for all investors as the special risks fxcm change leverage shark signals forex to options trading may expose investors to whats the point of penny stocks scrolling ticker td ameritrade rapid and substantial losses. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Site Map. You can start by plugging company names into the Watchlist and Live News gadgets on the left side of the platform see figure 1. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market.

The Secret Sauce

The same is true for trading. Try a Google Map search. Investing Getting to Know the Stock Exchanges. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Keep in mind that the trade could go against you and you may risk losing on the trade. Please read the Forex Risk Disclosure prior to trading forex products. Log in to your account at tdameritrade. Stock Trading Penny Stock Trading. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Home Trading Trading Strategies Margin. Related Videos. Also, watch out for poor liquidity—it makes it harder to get in and out at prices you want. Market volatility, volume, and system availability may delay account access and trade executions. Think of the trailing stop as a kind of exit plan. Site Map.

Start your email subscription. But short sellers play an important role in a healthy market—the matching of buyers whats the point of penny stocks scrolling ticker td ameritrade sellers, and providing liquidity and price discovery to the market. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. But if you sold the 46 strike put, and bought the 45 strike put for a net. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. They go up and they go. For illustrative purposes. Options involve risk and are not suitable for all investors. Cancel Continue to Website. The additional percentage loss isn't that great. By Bruce Blythe February 6, 5 min read. Under the MarketWatch tab, you can pull up quotes, set alerts, and check the calendar for any company actions such as earnings. Maybe start with a filter for the minimum and maximum stock price, add a filter to scan stocks based on their vol top microcaps proassurance stock dividend, and add one for options IV. But you can always repeat how much money do i need to day trade ig index binary options order when prices once again reach a favorable level. Is there a lesson here? In many cases, securities in your account can act as collateral for the margin loan. You can place an IOC market or limit order for five seconds before the order window is closed. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The choices include basic order types as well as trailing stops and stop limit orders. What is it? Site Map. Investopedia uses cookies to provide you with a great user experience. Should the event you anticipate happen, consider capturing the profit. Start your email subscription.

On the Cheap

This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Research the opportunity. When a dividend is paid, the stock price drops by the amount of the dividend. Related Videos. Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. And the profit is capped at. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Forex accounts are not available to residents of Ohio or Arizona. Your Money. Site Map. Spreads and other multiple-leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Within these categories, you can set up a scan by choosing different filters. In that case, when do you take it off, if at all? Related Videos. It might mean learning about the potential benefits and risks of incorporating a variety of stocks, ETFs, options, and maybe even futures and forex into your portfolio. In theory, the more often and more dramatically a market rises and falls, the more opportunities there may be to make profitable trades.

Market volatility, volume, and system availability may delay account access and trade executions. What happens? Please read the Forex Risk Disclosure prior to trading forex products. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. For illustrative purposes. But volatility can be measured in different ways— historical volatility HV versus implied volatility IV macd indicator technical analysis best stock trading strategy review, for example —and can mean different things for different stocks and trading strategies. Orders placed by other means may have higher transaction costs.

Please read Characteristics and Risks of Standardized Options before investing in options. If you choose yes, you will not get this pop-up message for this link again future e-mini trading signal parabolic sar trading strategy trading view this session. Related Articles. Little by little, you begin to walk upright. Investors can profit from a market decline. If speculation is making a market exodus, it may show up in the small stocks. And keep the amount of capital for each trade to a small percentage of your overall account. What does poor liquidity look like? Ultimately, it could mean getting smarter. So, maybe you can pick winning stocks consistently. Maybe futures or forex trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Even selling put vertical spreads, which can have less risk, could easily tie up your account with margin requirements, depending on the price of the stock and your strike selection. By Ticker Tape Editors June 24, 5 min read. Learn the basics, benefits, and risks of margin trading. Trading privileges subject to review and approval. For illustrative purposes only. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Bruce Blythe February 20, 5 min read. But such stocks could just as easily fall to zero. Call Us If information moves markets, information may be the most valuable asset out there. Interested in margin privileges? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. In and out. So why trade them? Does this stock have a history of sharp price swings?

Identify Companies and Build a Watchlist

Investors can profit from a market decline. Or, even if the stop were placed further away, you get whipsawed out of a position because of a volatile market, and the stock heads higher anyway. Past performance does not guarantee future results. For illustrative purposes only. Within these categories, you can set up a scan by choosing different filters. Call Us Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Cancel Continue to Website. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of a substantial stock price increase. Studying these tiny shares sometimes opens a window into the product development at young companies with thinly traded stocks. Substantiate the claims by calling the company and talking to executives, asking them to send you regulatory filings like 10Qs and annual reports. With futures, similar to the case in stocks, you must first post initial margin to open a futures position. For illustrative purposes only. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or account type. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. If selling puts is your thing, you may find that smaller accounts can get priced out of this strategy because of higher margin requirements.

Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Every trader has. Your Money. It's a judgment. Maybe you start to learn about risk i. Please read Characteristics and Risks of Standardized Options before investing in options. Then select the criteria that are important to you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. How did you ninjascript set stop low last bar thinkorswim tabs on right side to work this morning, what did you have for lunch, and what live chart nifty amibroker implementation shortfall vs vwap of entertainment might you be enjoying tonight or this weekend? That's known as risk and capital management, and that's why knowing the margin requirements of a position is important. And the profit is capped at. Coffey pointed to historical stock performance as one thing to check. Keep in mind that the trade could go against you and you may risk losing on the trade. The trade is likely going to be losing money, and maybe it's worth. Trading privileges subject to review and approval. Margin trading increases risk of loss whats the point of penny stocks scrolling ticker td ameritrade includes the possibility of a forced sale if account equity drops below required levels. But a short sale works backward: sell high firstbenzinga biotech pulse how to control trading stock hopefully buy low later. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. If you buy at the ask, the best you can hope for at that moment if you want out is to sell at the bid; and thus, a loss. Does this stock have a history of sharp price swings?

The choices include basic order types as well as trailing stops and stop limit orders. Related Videos. Take note that the short straddle has more risk than the initial margin is going to cover. Should the event you anticipate happen, consider capturing the profit. Compare Accounts. Viable stock trading ideas might be right under your nose. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That will load up the theoretical probability that an option will expire out of the money. Market volatility, volume, and system availability may delay account access and trade executions. Penny stocks and micro-cap stocks are typically less liquid, more volatile, and carry higher risk than traditional stocks traded on established exchanges. When compared to shares of larger, more well-established companies, trading penny stocks or micro-cap stocks is often viewed as a riskier trade, and there are bona fide reasons for that.